The form of a standard employment contract was approved by Decree of the Government of the Russian Federation dated August 27, 2016 No. 858. See “A standard employment contract was approved.” For what purposes was the form of a standard employment contract approved? Who and in what situations can conclude agreements using the standard form? Is it necessary to use a standard form? When to switch to standard contracts? You will find answers to these and other questions in this article.

Waiver of regulations since 2017

Starting from 2021, employers (organizations and individual entrepreneurs) belonging to micro-enterprises have the right to fully or partially refuse to adopt local regulations containing labor law standards. Instead, from 2021, working conditions can be stipulated directly in employment contracts concluded with employees on the basis of a standard form. This is provided for in Article 309.2 of the Labor Code of the Russian Federation, which comes into force on January 1, 2021.

For more information about this, see “Local regulations from 2021: changes to the Labor Code of the Russian Federation.”

Microenterprises include organizations or individual entrepreneurs that meet the following criteria:

| Criterion | Limit value |

| Average number of employees. | For the previous calendar year, the average number of employees of an organization or individual entrepreneur does not exceed 15 people inclusive. |

| Income from the sale of goods (works or services). | Receipts for the last calendar year do not exceed 120 million rubles. The criterion is relevant for organizations and individual entrepreneurs. |

| Composition of founders (relevant for organizations). | Requirements for the shares of participants: - the total share of regions, municipalities, public, religious organizations, foundations cannot exceed 25%; — the total share of participation of third-party organizations (Russian or foreign) is no more than 49%. |

You can check whether, as of January 1, 2021, an organization or individual entrepreneur belongs to a microenterprise through the “Unified Register of Small and Medium-Sized Enterprises,” opened since August 2021 on the Federal Tax Service website at https://rmsp.nalog.ru/. You will need to enter the details of the company or individual entrepreneur and note that you are looking for yourself among micro-enterprises.

If you are on the register, then from 2021 you can switch to concluding employment contracts with employees on the basis of a standard form and refuse to adopt local regulations containing labor law standards.

Also see “Register of Small Entrepreneurs”.

Form and sample of an employment contract with an employee

Download a standard form of an employment contract with an employee, approved by the government, for free in Word format.

You might be interested in:

Order 302n dated 04/12/11 of the Ministry of Health and Social Development with amendments that came into force in 2021

Download an example of an employment agreement in Word format.

Download the employment contract form in Excel format.

Composition of a standard form of an employment contract

The form of a standard employment contract consists of a preamble (that is, an introductory part) and 11 sections:

| Sections of the employment contract | |

| 1 | General provisions. |

| 2 | Rights and obligations of the employee. |

| 3 | Rights and obligations of the employer. |

| 4 | Employee remuneration. |

| 5 | Working time and rest time of the employee. |

| 6 | Occupational Safety and Health. |

| 7 | Social insurance and other guarantees. |

| 8 | Other terms of the employment contract. |

| 9 | Changing the terms of the employment contract. |

| 10 | Responsibility of the parties to the employment contract. |

| 11 | Final provisions. |

The form of a standard contract already includes all the mandatory information and conditions that must be stipulated in the contract according to the rules of Chapters 10 and 11 of the Labor Code of the Russian Federation.

In particular, the standard form contains wording regarding information about salary, position, place of work, working hours, etc. Also, the standard form of the contract includes various wording regarding special working conditions, for example, remote and home workers who are not used in other cases. In other words, the form of a standard contract is, in fact, a universal contract “for all occasions”. In it, employers can find formulations for a variety of situations. And thanks to this, the standard form of an employment contract will help the manager enter into contracts with the requirements of labor legislation and take into account the features associated with the performance of specific work related to a specific employee. This conclusion was made on the website of the Government of the Russian Federation. https://government.ru/docs/24339/

But which local regulations can we refuse to adopt starting from 2021? All employers who wish to switch to standard contracts will certainly face this question. Let's look at this in more detail.

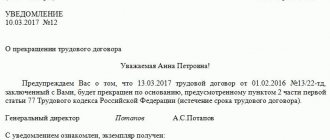

Drawing up an employment agreement according to a standard form, as an alternative to maintaining personnel documentation

If a micro-enterprise formalizes labor relations with employees using this document, it has the right not to adopt other local acts (regarding labor law), including internal regulations, regulations on wages, bonuses, etc. This is very convenient, as it reduces the documentary and administrative burden.

Requirements for an employee for a certain position, rights, responsibilities and other essential conditions must be specified in the text of the contract. In order for the introduction of such personnel document flow to have a legal basis, the head of a business entity must record the use of a standard form of an employment contract in the relevant order.

What personnel documents can you refuse?

Let us give examples of some personnel documents, which since 2017 can be fully or partially replaced by employment contracts concluded on the basis of a standard form.

Regulations on remuneration and bonuses

The regulation on wages is an internal normative act that defines the size, grounds, procedure and conditions for assigning payments for labor, taking into account state guarantees to employees and the employer’s own financial capabilities. This document often stipulates the conditions for paying bonuses to employees.

See “Terms for payment of bonuses under the new wage law: what has changed.”

However, the “Regulations on remuneration and bonuses” can be completely (or partially) replaced with the wording from section 4 of the standard form “Employee remuneration”. So, for example, in employment contracts concluded on the basis of a standard form, it will be necessary to specify wages (official salary or piece rates) and indicate the exact dates of its payment.

Also see “Salary and advance in 2021: how many days between payments.”

Tables are also provided to describe compensation and incentive payments:

You can also use standard formulations about the procedure for paying wages (through a cash register or through a bank), about the indexation of earnings, etc.

Internal labor regulations

Labor regulations may regulate, in particular, the time of work and rest (Part 4 of Article 189 of the Labor Code of the Russian Federation). However, these rules can be replaced by the language from section 5 of the standard contract form. Here is an excerpt from this section.

Regulations on irregular working hours

This document usually contains a list of workers with irregular working hours, if such a regime is established for them (101 Labor Code of the Russian Federation). A similar local act may not be applied from 2021 if the wording from clause 19 of the standard form is included in the employment contract.

Rules and instructions on labor protection

These documents are developed and approved in accordance with paragraph 23 of part 2 of article 212 of the Labor Code of the Russian Federation. The form of a standard employment contract contains section 6 “Occupational Safety and Health”. It contains language, for example, about the class of working conditions in the workplace, initial training, and the provision of personal protective equipment. In this part, you can switch to a standard contract.

However, rules and instructions on labor protection are usually much more informative. Therefore, most likely, not all employers will be able to completely abandon them.

Job Descriptions

The obligation to draw up job descriptions is established only for government agencies (Article 47 of the Federal Law of July 27, 2004 No. 79-FZ). Therefore, it is impossible to fine an ordinary employer for lack of instructions (letter of Rostrud dated 08/09/2007 No. 3042-6-0). However, many employers draw up job descriptions because their availability allows, for example:

- justify the dismissal of an employee due to inadequacy of the position;

- distribute responsibilities evenly between similar positions;

- prove in court the legality of imposing a disciplinary sanction on an employee;

- conduct personnel certification, etc.

The job description, in itself, is not a local regulatory act. In practice, job descriptions are quite often drawn up simply as an appendix to an employment contract or as an independent document (Rostrud letter No. 4412-6 dated October 31, 2007).

At the same time, the form of a standard employment contract allows that the employee’s labor (job) responsibilities can be established:

- or directly in the employment contract;

- or in the job description.

It turns out that the form of a standard employment contract allows the employer to decide what is more convenient for him to do. Either continue to approve job descriptions separately or specify all the functionality of employees in the employment contract.

Shift schedule

Shift schedules are drawn up based on the established norm of working time for the accounting period for a specific category of workers and contain information about the duration of working time during a shift, rest breaks between shifts and the order of their rotation. All this information, in principle, can be reflected in employment contracts. The necessary formulations for this are in a standard form:

What should an employment contract with an employee contain?

The contents of the employment contract are the terms and conditions that the parties agreed upon among themselves.

This document must certainly contain certain points in accordance with Art. 57 Labor Code of the Russian Federation. Some of them are legally decisive - without them, the employment contract may be declared invalid. Others complement the terms of the employment relationship.

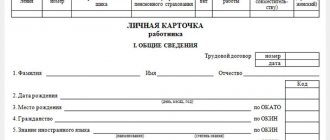

Non-contractual terms

The employment contract with the employee must include data that is not the subject of negotiations, but must be present in any title document, as required by current legislation.

Such data includes:

- Full name of the employee entering into an employment relationship;

- name of the organization or full name of the individual employer;

- data from the employee’s identity documents;

- employer details;

- TIN (if any);

- place of signing the contract;

- date of conclusion.

Attention! If the contract is signed by his authorized representative instead of the employer, the text must contain information about him and the grounds for replacing the manager with him.

Mandatory terms of the employment contract

Art. 57 of the Labor Code of the Russian Federation provides conditions developed through negotiations or agreements that are mandatory for this document:

- place of future work - indicate the actual location of the head office or branch of the organization where the employee will work; for remote workers, their home address or any other address, not under the control of the employer, where they perform their work is indicated;

- labor function - in other words, the name of the position, formulated according to the staffing table; it is necessary to note the qualifications or write what exactly the work will consist of;

- date of employment - the day the employee starts work (if this date is not specifically indicated, then work must begin the next day after the conclusion of the contract);

- duration of the contract - should be indicated only in fixed-term employment contracts (together with the reason determining the temporary nature of the work);

- Probation. The contract and employment order must indicate the probationary period and its duration. As a rule, it takes 3 months, after which the test can be considered to have been passed. Even if the employer did not notify about this;

- conditions for receiving labor remuneration - the amount according to the salary (tariff schedule) and the procedure for issuing wages, including additional payments, allowances, compensation and incentive payments (provisions for the payment of additional funds can be specified not in the contract itself, but in the local acts of the company, with reference to they should be in the text of the contract);

- work and rest schedule - must be described in the contract, if for a given position it differs from the generally accepted one at the company;

- working conditions - need to be reflected in detail in the contract, especially if their features affect compensation payments;

- production environment at the workplace - reflected as a separate item since 2014; you need to indicate the class and subclass of the workplace according to the special assessment made (Part 2 of Article 57 of the Labor Code of the Russian Federation);

- the norms of flushing agents necessary for an employee according to his working conditions are prescribed to be included in the employment contract, clause 9 of the Labor Safety Standard “Providing workers with flushing and (or) neutralizing agents”, approved by Order of the Ministry of Health and Social Development of December 17, 2010 No. 1122n); real standards are fixed by internal order;

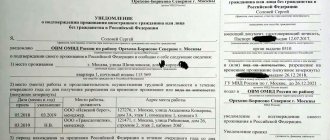

- the condition of compulsory social insurance is required, since all officially employed persons must be insured by the Pension Fund of the Russian Federation, as well as have social and medical insurance in accordance with federal legislation (Article 2 of Federal Law No. 255 “On compulsory social insurance in case of temporary disability and in connection with with motherhood" dated December 29, 2006; Article 5 of Federal Law No. 125 "On compulsory social insurance against accidents at work and occupational diseases" dated July 24, 1998, Article 10 Federal Law No. 326 "On compulsory health insurance in the Russian Federation" dated November 29, 2010, Article 7 of Federal Law No. 167 “On compulsory pension insurance in the Russian Federation” dated December 15, 2001.

Attention! The list of mandatory conditions is open by law, that is, if labor law norms change, it can be supplemented.

Additional terms of the employment contract

These conditions are for clarification only. They must not make the employee's situation worse or more difficult than the mandatory conditions.

You might be interested in:

Civil legal agreement: what is it, taxation features, procedure for conclusion

These items include:

- the procedure for passing the probationary period (if this clause is not present, the employee is considered accepted without probation);

- provisions on secrets protected by law (official, state, commercial, protection of personal data, etc.)

- about the conditions for providing training and work after it;

- on social and domestic assistance to the employee and his family from the organization;

- terms of additional insurance;

- clarifications regarding the place and conditions of work;

- other contractual terms.

Note! If the contract does not stipulate any conditions specified in labor legislation, for example, the rights and obligations of the employer and staff representative, this is not a reason for their non-fulfillment, since legislative acts have priority over contractual documents.

After signing, the terms of the agreement can only be changed bilaterally by drawing up a written agreement recorded by the signatures of the parties.

What documents should not be refused?

The commented form of a standard employment contract will not replace some personnel documents. Some documents will still need to be approved and applied. Let's give examples.

Staffing table

The staffing table is used to formalize the structure, staffing and staffing levels (Article 57 of the Labor Code of the Russian Federation). The staffing table is a local regulatory act (paragraph 6 of letter No. PG/4653-6-1 dated May 15, 2014). However, this document does not regulate the labor activities of employees. Therefore, the employer is not obliged to familiarize employees (including when hiring) with the staffing table.

At the same time, by virtue of paragraph 3 of part 2 of Article 57 of the Labor Code of the Russian Federation, the staffing table is a mandatory document. In this regard, an employment contract cannot in any way replace the staffing table. Accordingly, its approval in 2021 should not be abandoned.

Vacation schedule

The vacation schedule is drawn up for each calendar year. It must be prepared two weeks before the onset of this period. That is, for example, the vacation schedule for 2021 must be drawn up no later than December 17, 2021.

See “Make your vacation schedule for 2021 before December 17.”

The purpose of the schedule is to establish the order in which vacations are granted. In this case, the vacation schedule is required to be approved by the employer. This is directly stated in Part 1 of Article 123 of the Labor Code of the Russian Federation. Therefore, the employer does not have the right to refuse to approve and apply this document. Moreover, a reference to the vacation schedule as an independent document is provided for in clause 22 of the standard form of the employment contract. Therefore, it is impossible to refuse to use the vacation schedule.

Other documents

Some other personnel documents cannot be replaced by standard contracts due to the fact that the standard form approved by Decree of the Government of the Russian Federation of August 27, 2016 No. 858 simply does not provide suitable wording. Here are examples of such personnel documents.

| Statement on personal data. |

| Regulations on certification. |

| Regulations on the protection of trade secrets. |

| Regulations on business trips. |

Transition to standard employment contracts

The legislation does not oblige employers to switch to standard employment contracts. Article 309.2 of the Labor Code of the Russian Federation only allows that organizations and individual entrepreneurs have the right to fully or partially refuse to adopt local acts that they are required to approve.

Employers who have already approved local regulations until 2021 and apply them may not change anything in their work. In particular, you can hire new employees and, as before, introduce them to these local acts (and not pay attention to the standard form of the employment contract).

However, another option is possible: starting from 2021, you can hire new employees and conclude employment contracts with them based on a standard form. And then you may not apply (in whole or in part) some local regulations. Existing employees from 2017 can be transferred to standard employment contracts. To do this, additional agreements will need to be concluded with them.

See “Additional agreement to the employment contract: samples.”

Where is the completed copy of the agreement stored?

The employment contract form is usually filled out by HR employees, and the employee only has to sign, thereby confirming his familiarity with the sample standard employment contract and agreement with its terms. If the company accepts that the document is filled out by the employee himself, then the HR department will need a sample of filling out the employment contract.

The document is drawn up and signed in two copies (one copy for each party). The completed employment contract form is given to the HR employee, who, in turn, submits it to the head of the organization for signature (if this has not already been done).

After the signing procedure, one copy is kept by the employer, the other is given to the employee. Evasion from signing a contract by the employer or failure to provide a copy to an employee is an offense for which the manager bears responsibility under labor legislation.

This is important to know: Work under a fixed-term employment contract

Is it possible to change the wording

The form of a standard agreement, approved by Decree of the Government of the Russian Federation dated August 27, 2016 No. 858, is quite large and, as we have already said, includes various options for filling out individual paragraphs. Is it necessary for an employer to save the entire text of a standard contract? Or is it possible to take from the approved form only the wording necessary for a specific situation?

In our opinion, the form of a standard employment contract has been approved, among other things, so that only the necessary wording can be taken from it. And if the working conditions are not connected in any way, for example, with remote work, then words about remote work may not be included in the employment contract.

Is it possible to correct the approved wording? So, for example, paragraph 17 of the approved contract form states that “Payment of wages to an employee is made _____ once a month (but not less than every half month) on the following days (specify specific days of wage payment).” Is it possible to reformulate this condition in other words? In our opinion, if an employer decides to abandon the approval and application of local regulations and switch to concluding standard employment contracts, then the approved wording should not be changed. After all, it is the use of the approved form of a standard employment contract that gives the right to refuse local regulations. This is stated in Article 309.2 of the Labor Code of the Russian Federation. If you start changing the wording, it is not clear what the “use of the standard form” will be.

However, it is worth noting that there are no official clarifications on the procedure for concluding employment contracts based on the standard form. The Ministry of Labor of Russia has the right to give such explanations (clause 2 of the Decree of the Government of the Russian Federation dated August 27, 2016 No. 858).

Read also

02.06.2017