The procedure for paying insurance premiums has been changed

Since January 2021, the algorithm for transferring payments for compulsory insurance to working citizens has changed dramatically. Now, for a number of payments for compulsory insurance, the recipient is not only the Social Insurance Fund (in terms of compulsory insurance against accidents at work and occupational diseases, or, as they often say, “for injuries”), but also the Federal Tax Service, and the Pension Fund completely transferred the powers of the administrator to the Federal Tax Service. Now mandatory insurance payments are regulated by the Tax Code and Law dated July 24, 1998 No. 125-FZ.

The Social Insurance Fund retains the rights to administer payments for injuries. FSS details for payment of insurance premiums 2021 regarding FSS NS and PZ remained unchanged. Fill out the payment order in the same way as before.

The powers of Social Insurance as a regulatory body have not changed: employees also conduct desk and on-site inspections, monitoring the reimbursement of funds for insurance coverage and the correct calculation of payments.

Details for transferring contributions in 2021

In the current financial year, Social Insurance Fund details may be required in the following cases:

- Payment details for “injury” in 2021 have not changed.

- Calculations for 2021, if the organization has a debt for the previous period (identified during a desk audit, an error in the payment), we pay using the old details.

- Submission of reports submitted to Social Security.

- Receive reimbursement of insurance costs if your region is not included in the pilot project to directly finance these costs.

- Appeals to the Fund (complaints, clarifications, disagreements, etc.).

Until 2021, policyholders could transfer payments for compulsory social insurance in case of temporary disability and in connection with maternity (hereinafter referred to as VNIM) in the amount of the difference in calculated contributions and expenses incurred (benefits, sick leave).

In 2021, the authority to consider applications for the return of VNiM expenses has been retained by the Social Insurance Fund, but the administrator of income for contributions to VNiM has changed. To pay only the difference, you must confirm the expenses with the Social Insurance Fund by filling out a refund application with supporting documents.

IMPORTANT!

In 2021, to offset expenses incurred, confirmation of the Social Insurance Fund is required. Representatives of the Fund will independently notify the Federal Tax Service of the decision of offset (confirmation) or refusal of offset (clause 9 of Article 431 of the Tax Code of the Russian Federation).

Details for transferring contributions for injuries to the Social Insurance Fund in 2021

If you incorrectly indicate the details when paying insurance premiums to the Social Insurance Fund, Pension Fund and Federal Tax Service, the payments will fall into the unknown and then you will have to prove that you paid on time. Look at the details for transferring insurance premiums in 2021 so you don’t make mistakes when filling out payments.

Read in the article:

- Details for paying injury contributions in 2021

- Details for paying insurance premiums to the Federal Tax Service of Russia

- Details for transferring insurance premiums in 2021 to the Pension Fund of Russia

- Details for paying insurance premiums for individual entrepreneurs for themselves

Details for paying injury contributions in 2021

Employers (both organizations and individual entrepreneurs) pay two types of contributions for social insurance:

- In case of temporary disability and maternity;

- Contributions for injuries.

But the only contributions that are paid to the Federal Social Insurance Fund of the Russian Federation in 2018 are contributions for injuries. They are paid from the salaries of all workers, regardless of whether they are employed under hazardous working conditions or not. The payment tariff is determined according to OKVED for the main type of activity.

The details for transferring contributions for injuries in 2021 to the Social Insurance Fund are the same for both organizations and individual entrepreneurs. Check the correctness of the KBK data.

- Contributions for traumatism – 393 1 0200 160

- Penalties on contributions – 393 1 0200 160

- Penalty on contributions – 393 1 0200 160

View a sample payment form for paying contributions for industrial accidents and occupational diseases in 2021, and download this sample below.

payment order for payment of contributions for injuries in 2018 >>>

Details for paying insurance premiums to the Federal Tax Service of Russia

In 2021, all employers pay the following contributions to the Federal Tax Service of Russia:

- For pension insurance;

- For health insurance;

- For social insurance (in terms of contributions in case of disability and maternity).

Look at the details for paying insurance premiums in 2021 to avoid making a mistake and waste time checking with the tax office what kind of payment you transferred.

KBC for transfer of insurance premiums in 2021 (basic payments)

| For pension insurance | 182 1 0210 160 |

| For compulsory health insurance | 182 1 0213 160 |

| For social insurance | 182 1 0210 160 |

KBC for transferring penalties and fines on insurance premiums

OPS

| Penalty | 182 1 0210 160 |

| Fines | 182 1 0210 160 |

| Compulsory medical insurance | |

| Penalty | 182 1 0213 160 |

| Fines | 182 1 0213 160 |

| Social anxiety | |

| Penalty | 182 1 0210 160 |

| Fines | 182 1 0210 160 |

s filling out payment orders indicating all the details for paying insurance premiums in 2021 to the Federal Tax Service.

payment order for payment of pension contributions to the Federal Tax Service of Russia in 2021 >>>

payment order for payment of medical contributions to the Federal Tax Service of Russia in 2021 >>>

payment order for payment of social insurance contributions to the Federal Tax Service of Russia in 2021 >>>

There is a service on the website of the Federal Tax Service of Russia that allows you to fill out details for paying contributions in 2021 in a convenient form. You just need to indicate the type of payment and the details will be determined automatically.

This might be interesting:

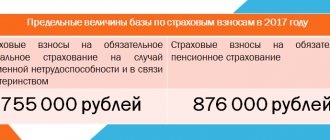

Details for transferring insurance premiums in 2021 to the Pension Fund of Russia

Some employers are required to pay additional insurance contributions for the funded part of their employees’ labor pensions.

IMPORTANT! On April 23, an order of the Ministry of Finance came into force, which introduced changes to the BCC for penalties and fines paid under additional tariffs. The tables below take these changes into account.

KBC for transferring penalties and fines at additional rates

The tariff depends on the results of the special assessment

| List 1 Penalties | 182 1 0200 160 |

| List 1 Fines | 182 1 0200 160 |

| List 2 Penalties | 182 1 0200 160 |

| List 2 Fines | 182 1 0200 160 |

| The tariff does not depend on the results of the special assessment | |

| List 1 Penalties | 182 1 0210 160 |

| List 1 Fines | 182 1 0210 160 |

| List 2 Penalties | 182 1 0210 160 |

| List 2 Fines | 182 1 0210 160 |

Details for paying insurance premiums for individual entrepreneurs for themselves

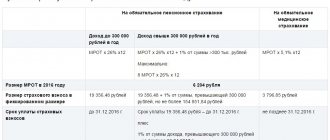

In addition to the fact that individual entrepreneurs must pay insurance premiums for their employees, they are also required to pay pension and health insurance contributions for themselves.

See which KBK individual entrepreneurs should use to pay contributions to compulsory health insurance and compulsory medical insurance in 2021.

KBC for transferring insurance premiums in 2021 for individual entrepreneurs for themselves (basic payments)

| Fixed payment for OPS | 182 1 0210 160 |

| Contributions to compulsory pension insurance from incomes above 300,000 rubles. | 182 1 0210 160 |

| On compulsory medical insurance | 182 1 0213 160 |

KBC for transferring penalties and fines on insurance premiums for individual entrepreneurs for themselves

OPS

| Penalty | 182 1 0210 160 |

| Fines | 182 1 0210 160 |

| Compulsory medical insurance | |

| Penalty | 182 1 0213 160 |

| Fines | 182 1 0213 160 |

Source: https://www.RNK.ru/article/215958-rekvizity-dlya-uplaty-strahovyh-vznosov-v-2018-godu-fss-pfr-fns

Where to find current details for paying insurance premiums in 2020

To avoid errors in payment orders, it is necessary to clarify information about the recipient of funds:

- Name;

- information about the recipient's bank details: personal account, bank name and other data.

You can obtain such information about the Social Insurance Fund in several ways:

- contact Social Insurance (in person, by phone or in writing), employees will definitely provide you with the current details for paying contributions in 2021;

- obtain information through the “State Services” portal, to do this, send a request through your personal account on the website, the information will be provided within 24 hours;

- check on the official website of the FSS on the Internet.

Transfer of insurance premiums in 2021, details for the Federal Tax Service and the Social Insurance Fund

Let’s look at the payment of insurance premiums “for injuries” and VNIM using examples.

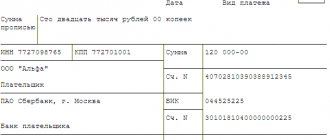

Example 1. An organization transfers VNiM contributions administered by the Federal Tax Service for June 2021 in the amount of 150,000.09 rubles. We issue a payment order, focusing on the following fields of the payment order:

Field 4. Date of payment. The tax must be paid within the established deadlines: no later than the 15th day of the month following the month in which contributions were calculated.

Cells 6 and 7 - fill in the amounts with kopecks in words and numbers = 150,000.09 rubles (one hundred fifty thousand rubles 09 kopecks).

In field 22 enter 0.

In field 101 (payer status), enter code “01” for the organization, since it is a direct payer of the contribution (tax, fee).

104 (KBK): 182 1 0210 160 (VNiM).

105 (OKTMO) - we check with the tax office or in a special reference book - the All-Russian Classifier of Municipal Territories (each federal district has its own volume approved).

106 (basis of payment): indicate the code “TP” (current period).

Field 107 (tax period) is coded in a special way: “MS.06.2019”.

In fields 108–110 we indicate “0”, since there is no data to fill in, 110 is empty.

Filling sample (VNIM)

Example 2. An organization transfers a payment “for injuries” to the Social Insurance Fund for June 2021 in the amount of 1,309.42 rubles.

The fields are filled in the same way as in the example above, except for fields 101 and 104.

IMPORTANT!

In field 101 (payer status), enter code “08” (payer making payments to the budget system of the Russian Federation, with the exception of taxes, fees, insurance premiums and other payments administered by tax authorities).

Important! KBK "injury": 393 1 0200 160 (FSS NS and PZ).

Sample form (“injury”)

FSS details for paying insurance premiums in 2017-2018

FSS details for paying insurance premiums in 2017-2018 will be required when paying “accident” contributions. how the rules for paying insurance premiums have changed since 2021 and which of these payments should be transferred to the Social Insurance Fund .

Payment details for paying “unfortunate” social taxes to the Social Insurance Fund

Transfer of VNIM contributions to the Federal Tax Service

Payment of insurance premiums for periods preceding 2017

Results

Payment details for paying “unfortunate” social taxes to the Social Insurance Fund

Since 2021, employers will transfer only “unfortunate” contributions directly to the Social Insurance Fund, using the following details:

| Payment line name | Regular payment | Fine | Penalty |

| Recipient | Name of the regional social insurance authority at the place of registration of the policyholder | ||

| payee's bank | Details of the treasury where the money is transferred | ||

| Recipient's TIN and checkpoint | Data from the regional social insurance office at the place of registration of the policyholder | ||

| KBK | 39310202050071000160 | 39310202050073000160 | 39310202050072100160 |

| OKTMO | The payer chooses according to his geographical location | ||

| Payer status | 08 | ||

| WIN | Fixed in field 22 only if there is a request for payment of arrears |

Lines 106–110 of the payment slip do not need to be filled out.

A sample payment form for paying contributions for injuries to the Social Insurance Fund can be downloaded from the link.

Read about the rules for calculating “accident” premiums in the material “Insurance premiums for injuries in 2021 - rate and BCC.”

Transfer of VNIM contributions to the Federal Tax Service

Since 2021, the functions of control over insurance premiums (except for “accidents”) have been transferred to the tax department, including social fees for temporary disability and maternity (VNiM) (Chapter 34 of the Tax Code of the Russian Federation).

In this regard, the payment details for paying VNIM contributions have changed and are as follows:

- TIN and KPP of the recipient - TIN and KPP of the Federal Tax Service at the place of registration of the payer of contributions (at the location of the separate legal entity or at the place of registration of the individual entrepreneur);

- recipient - the name of the Treasury and in brackets the abbreviated designation of the Federal Tax Service;

- KBK - since the payment administrator is the Federal Tax Service, the numbers with which the code begins are 182.

When filling out the remaining details for insurance premiums, tax officials recommend following the rules applied for tax payments (Order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n).

Find samples of payment orders for insurance premiums filled out according to the updated rules in this article.

Payment of insurance premiums for periods preceding 2017

Starting from January 2021, transfers of social taxes (except for “unfortunate” contributions) for periods preceding this year should no longer be made according to the details of the funds, but to the relevant tax office. Especially for this purpose, separate KBKs were opened in the Treasury:

The Federal Tax Service details depend on the location of the legal entity or the registration of the individual entrepreneur. If a separate division has the right to pay employees wages, then payments for social insurance of employees are transferred to the tax office at the location of this division.

ATTENTION! If, by mistake or ignorance, you sent a payment to the details of the Federal Tax Service or Pension Fund, indicating the previous BCC, then the Federal Tax Service will automatically recode the information and include the payment in the card corresponding to the contribution (letter of the Federal Tax Service dated January 17, 2017 No. 3N-4-1 / [email protected] ). But we still recommend that if you find errors in your payments, you check with the tax authorities and find out whether all your payments have reached them.

The KBK for “unfortunate” transfers has not undergone any changes due to the changes in 2021, and policyholders, when generating payment documents for these accruals, still indicate in them the details of the Social Insurance Fund and KBK 39310202050071000160.

How can the policyholder figure out which government agency is responsible for which social contributions? Here is a brief reminder of the interaction between the policyholder, the Social Insurance Fund and the Federal Tax Service:

Source: https://nalog-nalog.ru/strahovye_vznosy_2017/uplata_strahovyh_vznosov/rekvizity_fss_dlya_uplaty_strahovyh_vznosov/