New limits for 2021

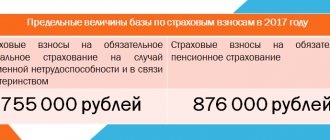

The maximum value of the base for calculating insurance premiums for 2018 was approved in accordance with paragraphs 3 and 6 of Article 421 of the Tax Code of the Russian Federation. The new values were approved by Decree of the Government of the Russian Federation dated November 15, 2017 No. 1378). This Resolution was published on the official legal information portal on November 17, 2017. From January 1, 2021, the size of the maximum base values for calculating insurance premiums is as follows:

- 815,000 rubles is the maximum base for calculating insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity;

- 1,021,000 rubles is the maximum value of the base for calculating insurance contributions for compulsory pension insurance.

Please note: the maximum amount of the base for calculating “medical” contributions is not approved. These contributions, regardless of the amount of income of an individual in 2021, must be paid at a rate of 5.1%. There is also no maximum base for contributions “for injuries”. Therefore, their size for 2021 is not given in the table.

In 2021, the maximum values of the base for insurance premiums increased compared to 2021. Let's compare the values in the table.

| Year | Maximum base for pension contributions | Maximum base for social contributions |

| 2017 | 876,000 rub. | RUB 755,000 |

| 2018 | RUR 1,021,000 | RUB 815,000 |

Examples of calculations for all types of insurance premiums in 2021

Let us give one example of calculation for all types of insurance premiums. Let’s assume that A.P. Sviridov works at the enterprise. with a monthly salary of 95,000 rubles under an employment contract.

Please note that as of 2021, the company applies regular rates (not reduced) for insurance premiums.

Thus, the Meteorit enterprise in 2021 must pay insurance premiums at the following rates:

1. For pension insurance:

- 22% - within 1,021,000 rubles;

- 10% - from amounts exceeding the limit of 1,021,000 rubles.

2. For social insurance FSS:

- 2.9% - contributions for maternity and in case of temporary disability;

- 0.2% - contributions for “injuries”.

3. For health insurance in the FFOMS - 5.1%.

Now we will consider in detail for each type of insurance in accordance with the new values of the maximum base for 2021.

Why exactly these amounts?

The maximum size of the base for calculating the insurance premiums indicated above was approved by Decree of the Government of the Russian Federation of November 15, 2017 No. 1378 “On the maximum size of the base for calculating insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity and for compulsory pension insurance from January 1, 2021 G.". Let us note that officials in the Government of the Russian Federation do not set the new size of the base for insurance premiums for the next year “out of the blue.” Legislation regulates the procedure for setting limits. Let us explain how the new values for 2021 were calculated.

New base for contributions for temporary disability and maternity

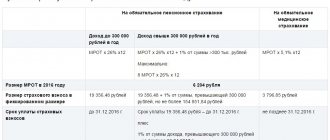

The provisions of paragraph 4 of Article 421 of the Tax Code of the Russian Federation establish that the maximum base for insurance premiums in case of temporary disability and in connection with maternity from January 1 of the year should be indexed based on the growth of average wages in the Russian Federation. Based on the parameters of the forecast indicators of the Ministry of Economic Development, the size of the nominal accrued average monthly wage per employee in 2021 compared to 2017 will increase by a factor of 1.08.

If we apply this coefficient to the maximum base that was set for 2021, we get 815,400 rubles (755,000 rubles × 1.08). In this case, the size of the maximum base for calculating insurance premiums must be rounded to the nearest thousand rubles. In this case, the amount of 500 rubles or more is rounded up to a full thousand rubles, and the amount less than 500 rubles is discarded (clause 6 of Article 421 of the Tax Code of the Russian Federation). Consequently, 815,400 rubles were rounded down - to 815,000 rubles.

New base for pension contributions

The maximum amount of the base for pension contributions is determined in accordance with paragraph 5 of Article 421 of the Tax Code of the Russian Federation. This norm stipulates that in 2021 the maximum value of the base for pension contributions should be determined using the following formula:

| Maximum base for pension contributions = Average salary in 2021 X 12 X 2 |

As a result of applying this formula, the size of the base for pension contributions for 2021 amounted to 1,021,000 rubles.

What is the basis for calculating insurance premiums?

Absolutely every employer is obliged, from the accrued amount of earnings of each employee, to calculate and pay insurance premiums for compulsory pension insurance (OPI), compulsory social insurance (OSI) for temporary disability and maternity (VNIM), as well as against accidents (AS) at work and compulsory health insurance (CHI).

Since January 2021, all of the above contributions, with the exception of payments from the Tax Service at production, have come under the control of the tax authorities. “Unfortunate” contributions, as before, are administered by the FSS. Tariffs for employers for 2017–2019 were approved by Art. 426 of the Tax Code of the Russian Federation and are:

| Contribution | Tariff, % |

| On OPS | 22 |

| At OSS for VNiM | 2,9 |

| On compulsory medical insurance | 5,1 |

Find out what changed for contributions when they were transferred under the control of tax authorities here.

The amount of employee income is the basis for calculating contributions. In this case, income can be received under the agreement:

- labor or civil law;

- author's order;

- on the alienation of the exclusive right to objects of art or literary works.

However, not all employee income is subject to insurance premiums. The list of such amounts is determined by Art. 422 of the Tax Code of the Russian Federation.

Read what employee income should not be subject to insurance premiums here .

How employers can apply the new values

Now we will explain how insurance premium payers in 2021 can use the new maximum values of the insurance premium base when calculating insurance premiums in 2021. Here's the basic rule:

In 2021, the basic tariffs are applied by calculating insurance premiums from payments, the cumulative total from the beginning of the year for each person does not exceed:

- RUB 1,021,000 – for compulsory pension insurance. Payments that exceed this amount are subject to pension contributions at a rate of 10 percent;

- 815,000 rub. – for compulsory social insurance in case of temporary disability and in connection with maternity. Payments exceeding this amount are no longer subject to insurance premiums.

The rate of contributions for compulsory health insurance does not depend on the amount of payments. Therefore, all payments without restrictions are subject to contributions at a rate of 5.1 percent.

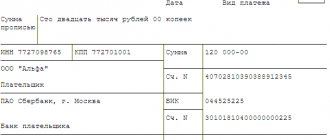

Let's give an example and calculations.

Petrov A.S. works in the organization under an employment contract. He receives a monthly salary of 94,000 rubles. In 2021, the Cosmos organization applies general insurance premium rates:

- pension contributions (PFR) – 22% and 10% (above the taxable base);

- contributions for temporary disability and maternity (FSS) – 2.9%;

- medical contributions (FFOMS) – 5.1%;

In the FSS of the Russian Federation, in case of injury, the organization pays insurance premiums at a rate of 0.2%.

Calculation of pension contributions in 2021

When calculating pension insurance contributions in 2021, you need to take into account that when the new base limit is reached (RUB 1,021,000), the tariff rate for insurance contributions will change:

- from accruals within 1,021,000 rubles, contributions must be calculated at a rate of 22 percent;

- from accruals on the amount exceeding 1,021,000 rubles - the rate of pension contributions is reduced to 10 percent.

This is what the calculation of pension insurance contributions will look like using the new base limits.

| Month | Growing base of pension contributions from the beginning of 2021, rub. | Amount of accrued pension contributions, rub. | ||

| Up to 1,021,000 rub. | Exceeding RUB 1,021,000 | tariff 22% | tariff 10% | |

| January | 94 000 | 20 680 | ||

| February | 188 888 | 20 680 | ||

| March | 282 000 | 20 680 | ||

| April | 376 000 | 20 680 | ||

| May | 470 000 | 20 680 | ||

| June | 564 000 | 20 680 | ||

| July | 658 000 | 20 680 | ||

| August | 752 000 | 20 680 | ||

| September | 846 000 | 20 680 | ||

| October | 940 000 | 20 680 | ||

| November | 1 021 000 | 13 000 | 17 820 | 1300 |

| December | 1 128 000 | 9400 | ||

If an organization or individual entrepreneur uses reduced insurance premium rates in 2021, then they should not accrue pension contributions from payments exceeding 1,021,000 rubles at all.

Calculation of social contributions in 2021

In 2021, insurance premiums for temporary disability and maternity are calculated at a rate of 2.9 percent. If in 2018 the accruals in favor of the employee exceed the new limit on the base (that is, 815,000 rubles), then contributions will stop accruing. In our example, monthly accruals in favor of the employee are 94,000 rubles. Therefore, the calculations will be as follows.

| Month | Base of insurance premiums for VNIM since the beginning of 2021, rub. | Amount of accrued contributions at the rate of 2.9%, rub. |

| January | 94 000 | 2726 |

| February | 188 888 | 2726 |

| March | 282 000 | 2726 |

| April | 376 000 | 2726 |

| May | 470 000 | 2726 |

| June | 564 000 | 2726 |

| July | 658 000 | 2726 |

| August | 752 000 | 2726 |

| September | 815 000 | 1827 |

| October | 815 000 | 0 |

| November | 815 000 | 0 |

| December | 815 000 | 0 |

As you can see, after accruals in favor of the employee in September 2021 exceeded 815,000 rubles, insurance premiums for temporary disability and in connection with maternity stop accruing.

Calculation of medical contributions

As we have already said, the maximum base for medical contributions is not established. Therefore, contributions to the FFOMS in 2021 are calculated from all payments subject to insurance contributions. That is, monthly for the employee from our example you need to transfer 4,794 rubles. (RUB 94,000 × 5.1%).

Calculation of contributions for injuries

Contribution rates for insurance against industrial accidents (injury premiums) in 2021 are determined depending on the occupational risk class of the organization’s main activity.

For the purposes of calculating contributions “for injuries”, the maximum base for insurance premiums is also not established. Therefore, these contributions in 2018 should be charged on all taxable payments in favor of individuals without any restrictions. That is, the monthly payment, based on the conditions of our example, will be 188 rubles (94,000 rubles × 0.2%).

Insurance contributions for pension insurance of Sviridov A.P. in 2021

| Month of 2021 | Growing base of insurance contributions for pension insurance from the beginning of 2021 (in rubles) | The amount of insurance premiums that were accrued (in rubles) | ||

| Up to 1,021,000 rubles | Over 1,021,000 rubles | At a rate of 22% | At a rate of 10% | |

| January | 95 000 | 20 900 | ||

| February | 190 000 | 20 900 | ||

| March | 285 000 | 20 900 | ||

| April | 380 000 | 20 900 | ||

| May | 475 000 | 20 900 | ||

| June | 570 000 | 20 900 | ||

| July | 665 000 | 20 900 | ||

| August | 760 000 | 20 900 | ||

| September | 855 000 | 20 900 | ||

| October | 950 000 | 20 900 | ||

| November | 1 021 000 | 24 000 | 15 620 | 2 400 |

| December | 1 140 000 | 9 500 | ||

Insurance contributions for social insurance for temporary disability and in connection with maternity Sviridova A.P. in 2018

We calculate social insurance contributions in 2018 at a rate of 2.9% (for temporary disability and in connection with maternity). The limit set for social insurance contributions is 815,000 rubles. If this amount is exceeded, insurance premiums are no longer charged.

Let's see what insurance premiums will look like for Sviridov with a salary of 95,000 rubles in 2021:

| Month of 2021 | Growing base of social insurance contributions from the beginning of 2021 (rub.) | The amount of insurance premiums that were accrued at a rate of 2.9% in 2018 (rub.) |

| January | 95 000 | 2 755 |

| February | 190 000 | 2 755 |

| March | 285 000 | 2 755 |

| April | 380 000 | 2 755 |

| May | 475 000 | 2 755 |

| June | 570 000 | 2 755 |

| July | 665 000 | 2 755 |

| August | 760 000 | 2 755 |

| September | 815000 | 1595 |

| October | 815000 | 0 |

| November | 815000 | 0 |

| December | 815000 | 0 |

Since September 2021, the employee’s insurance premiums have exceeded the established limit of 815,000 rubles, which means that from October there is no longer a need to accrue contributions for temporary disability and in connection with maternity.

Insurance premiums for “injuries” of Sviridov A.P. in 2018

Let us remind you that in order to calculate insurance premiums for “injuries” in 2018, the occupational risk classes of the main type of activity of the enterprise should be taken into account.

There is no maximum base for calculating this type of insurance premiums.

For the organization where Sviridov works, the risk class is 0.2%. Let's calculate how much you need to pay each month:

95,000 * 0.2% = 190 rubles.

That is, for the year you will need to pay 190 * 12 = 2,280 rubles.