From January 1, new KBK budget classification codes for 2021 will begin to be applied. The changes affected mainly insurance premiums, which companies transfer to extra-budgetary funds for their employees. In addition, changes have been made regarding self-employed persons. Read more about the changes in our article.

The main changes to the current order of the Ministry of Finance on budget classification codes No. 65 dated 07/01/2013 were introduced in the summer by another order of the ministry No. 90n dated 06/08/2015. In addition, another document should appear in the very near future that will clarify the amendments already made. All these changes under the KBK 2021 are related to insurance contributions to the Pension Fund, Social Insurance Fund and Federal Compulsory Medical Insurance Fund for both organizations and self-employed individuals.

KBK 2021 in the Pension Fund of Russia

The new BCC must begin to be applied from January 1, 2021, however, in payment documents for contributions to extra-budgetary funds that must be transferred for December 2015 until January 15, 2016, the new BCC must also be indicated.

It is important to note that when transferring contributions to compulsory pension insurance (OPI), you must indicate one BCC, regardless of whether the limit is exceeded or not (and not choose from two codes, as stated earlier):

• 392 1 0200 160.

Download table New BCCs for 2021

you can follow this link.

The BCC for self-employed persons who independently pay fixed contributions to the Pension Fund has also changed. These codes differ depending on the income for the year:

• more than 300 thousand rubles. – 392 1 0200 160;

• less than 300 thousand rubles. – 392 1 0200 160.

In addition, the KBK 2021 codes in the Pension Fund for penalties and interest were divided for self-employed workers making contributions in a fixed amount:

- 392 1 0200160 – penalties for compulsory pension insurance on the insurance part of the pension;

- 392 1 0200160 – interest on compulsory pension insurance on the insurance part of the pension;

- 392 1 0200160 – penalties for mandatory pension insurance on the funded part of the pension;

- 392 1 0200160 – interest on compulsory pension insurance on the funded part of the pension.

New BCCs for 2021 for payment of insurance premiums

Order of the Ministry of Finance of Russia dated 06/08/2015 N 90n - amended by the KBK on the payment of insurance premiums.

In 2015, individual entrepreneurs paid insurance contributions to the Pension Fund for one KBK, but in 2021 there will already be two codes.

One KBK code for contributions within the established maximum base for calculating insurance premiums. The second BCC is for contributions exceeding the established limit.

In addition, instead of one code for individual entrepreneurs’ pension contributions, there will be two codes - one for the fixed part of fixed contributions, which does not depend on the individual entrepreneur’s income, and the second code for contributions calculated from income over 300 thousand rubles per year.

The FFOMS contribution code is also divided. Separate codes are allocated for fixed contributions of individual entrepreneurs.

There is also a general change for all contributions - the group of subtypes of budget income (14-17 digits of the code) when paying penalties will not be 2000, but 2100.

According to the established structure of budget classification codes in the subtype of budget revenues from the collection of taxes, fees, contributions, etc. payments (14-17 digits in KBK) indicate:

- 1000 - payment amount, arrears and debt for the corresponding payment, including canceled ones

- 2100 - penalties for the relevant tax

- 3000 - fines for the corresponding payment

KBK 2021 – insurance contributions of individual entrepreneurs to the Pension Fund

Insurance contributions for pension insurance of individual entrepreneurs for themselves in a fixed amount (based on the minimum wage) - 392 1 0200 160

Insurance premiums for pension insurance of individual entrepreneurs for themselves with income exceeding RUB 300,000 - 392 1 0200 160

Insurance premiums for medical insurance for individual entrepreneurs for themselves in a fixed amount (based on the minimum wage) - 392 1 0211 160

KBK of insurance contributions to the Pension Fund in 2021 for employees

Insurance contributions for pension insurance to the Pension Fund for employees within the established maximum base value for 2021 - 392 1 0200 160

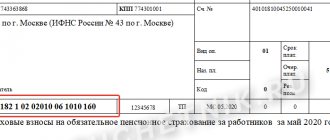

Insurance contributions for pension insurance to the Pension Fund for employees above the established maximum base for 2021 - 392 1 02 02010 06 1200 160

Insurance contributions to the Pension Fund at an additional rate for insured persons employed in the relevant types of work, according to list 1 - 392 1 0200 160

Insurance contributions to the Pension Fund at an additional rate for insured persons employed in the relevant types of work, according to list 2 - 392 1 0200 160

Insurance contributions to the FFOMS budget for employees - 392 1 02 02101 08 1011 160

Insurance contributions to the Social Insurance Fund for compulsory social insurance in case of temporary disability and in connection with maternity for employees - 393 1 0200 160

Insurance contributions to the Social Insurance Fund against industrial accidents and occupational diseases for employees - 393 1 0200 160

New KBK 2021 for paying taxes under the simplified tax system, UTII

KBK contributions 2021 to the Social Insurance Fund

In the new BCC for 2021, changes also affected contributions to compulsory social insurance (OSS) to the Social Insurance Fund. And if the codes for contributions did not change directly, then regarding penalties and interest, amendments were made and the codes were divided. So, employers need to pay attention that now penalties and interest are different BCC codes:

- 393 1 0200 160 – penalties for compulsory social insurance for temporary disability and maternity;

- 393 1 0200 160 – interest on OSS for temporary disability and maternity;

- 393 1 0200 160 – penalties for OSS from accidents and occupational diseases;

- 393 1 02 02050 072200 160 – interest on OSS from accidents and occupational diseases.

Introductory information

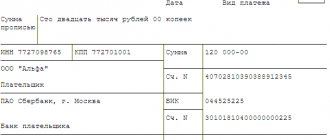

The budget classification code (BCC) is part of the group of details that allow you to determine the ownership of the payment.

Therefore, when transferring insurance premiums to extra-budgetary funds, it is important to fill out the payment order correctly, indicating the correct 20-digit code in the “104” field. If you make a mistake, the payment may be attributed to unknown receipts. In this case, you will need to clarify the payment and, possibly, go through a reconciliation with the funds (see “Instructions for filling out payment orders when paying taxes, penalties, fines, as well as contributions to extra-budgetary funds.”) Starting from January 2021, when filling out payment orders for transfer of insurance premiums must be applied to the KBK approved by the commented order of the Ministry of Finance. In addition, the codes for paying penalties and interest on contributions will change.

Insurance contributions to the Social Insurance Fund of the Pension Fund and the Compulsory Medical Insurance Fund changes from January 1, 2021

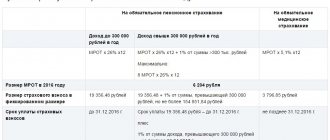

First of all, from January the maximum base was increased to 796 thousand rubles. This is due to the fact that wages have increased due to inflation.

The Pension Fund of the Russian Federation now needs to pay monthly, before the 10th. Otherwise, a FSS fine may be assessed. The employer is obliged to transfer the amount no later than the 15th of each month. You can transfer the amount of money electronically, but no later than the 20th. These conditions for making insurance contributions to various Fords will be in effect until 2021, further changes may follow, but for now the latest version of the law is as follows.

Reduction of UTII by the amount of insurance premiums in 2021 for individual entrepreneurs

A reduction in tariffs for fixed taxes is possible for both individual entrepreneurs and LLCs. But the amount will not be more than what was paid last quarter for the same taxes. The type of activity the company is engaged in also influences. Such payment is made by transmitting a payment order. You can calculate it yourself.

The minimum rate payable is 22,261.38 rubles. During the year it must be paid until December inclusive. This can be done in one payment, or quarterly. If there is hired labor, the amount increases.

Pension contributions from payments to employees

Basic payments

Insurance contributions to the Pension Fund budget for payments to employees within the limit (for 2015 it is 711,000 rubles) are charged at a rate of 22%, and for payments above the limit - at a rate of 10%. Such tariffs are established for most insurers by Article 58.2 of the Federal Law of July 24, 2009 No. 212-FZ (hereinafter referred to as Law No. 212-FZ). To transfer contributions from payments within the limit and from payments accrued in excess of the maximum base value, the same BCC is used today.

From 2021, two codes will need to be used. One is for paying pension contributions from payments within the limit, the second is for paying pension contributions from payments exceeding the limit (see “Starting from 2021, the BCC for payment of insurance contributions to the Pension Fund will change”). Please note that the commented order does not specify which BCC to use to transfer contributions for December 2015 in 2021. In our opinion, in this case there is no reason to use new codes. Official clarification on this matter will likely appear towards the end of this year.

Let us also recall that pension contributions accrued for periods from January 1, 2014 are transferred to the Pension Fund of the Russian Federation in a single payment, without dividing into the insurance and funded parts of the pension. When filling out the payment form, you must indicate the BCC for contributions credited to the insurance pension. This is stated in Article 22.2 of the Federal Law of December 15, 2001 No. 167-FZ “On Compulsory Pension Insurance in the Russian Federation” (hereinafter referred to as Law No. 167-FZ). Starting from 2021, if the maximum base for calculating pension contributions is exceeded, you will need to issue two payments, while you still need to use the KBK to transfer contributions to the insurance pension (see Table 1).

From the editor

Please note: at the end of 2015, the Ministry of Finance abandoned the idea of distributing contributions to the Pension Fund for employees into two payments. According to the order of the Ministry of Finance of Russia dated December 1, 2015 No. 190n, in 2021, insurance contributions for compulsory pension insurance (both within the limit and above it), as well as in 2015, will need to be transferred to the same code (392 1 0200 160). See “The Ministry of Finance refused to introduce separate BCCs for paying contributions to the Pension Fund for payments within the limit and above the limit.” Thus, Table 1 of this article has lost its relevance.

Table 1. BCC for payment of pension contributions

| Payment type | 2015 | 2016 |

| Insurance contributions for compulsory pension insurance, credited to the Pension Fund for the payment of insurance pensions for employees (at a rate of 22%) | 392 1 0200 160 | 392 1 02 02010 06 1100 160 |

| Insurance contributions for compulsory pension insurance, credited to the Pension Fund for the payment of insurance pensions for employees (at a rate of 10%) | 392 1 0200 160 | 392 1 02 02010 06 1200 160 |

Please note that payers of insurance premiums who apply reduced rates established by Articles and 58.1 of Law No. 212-FZ do not charge contributions to the Pension Fund for payments exceeding the maximum base value. This follows from paragraph 1 of part 1.1 of Article 58.2 of Law No. 212-FZ. Thus, in 2021, beneficiaries must use the KBK to pay pension contributions, which is provided for transferring contributions from payments within the limit (that is, code 392 1 0200 160).

Penalties and interest

If insurance premiums are paid later than established by law, you will have to pay a fine (Part 1, Article 25 of Law No. 212-FZ). Also, payers of insurance premiums may be faced with the need to pay interest, for example, when receiving a deferment (installment plan) for paying premiums (Part 6, Article 18.1 of Law No. 212-FZ). Whether a payment belongs to penalties or interest is determined by the code of the subtype of income (14-17th categories of the KBK). Today, the values of 14-17 categories of the BCC for the payment of penalties and interest on taxes and insurance premiums differ (see “The BCC for the payment of interest and penalties on taxes has changed” and table 2).

Table 2. Comparison of 14-17 categories of the BCC for taxes and contributions (2015)

| Payment type | 14-17 categories of the KBK for taxes | 14-17 categories of the KBK for insurance premiums |

| Basic payment of tax or insurance premium | 1000 | 1000 |

| Penalty | 2100 | 2000 |

| Interest | 2200 | 2000 |

| Fines | 3000 | 3000 |

As can be seen from the table, in order to list penalties and interest on tax payments, different codes of the subtype of income are indicated (different values of 14-17 KBK categories), and to list penalties and interest on insurance premiums, the same code is used. The commented order changes this situation. From 2021, payments for penalties and interest on insurance contributions to the Pension Fund will need to be distributed (see Table 3).

Table 3. BCC for payment of penalties and interest on pension contributions

| Payment type | 2015 | 2016 |

| Penalties and interest on insurance contributions for compulsory pension insurance, credited to the Pension Fund for payment of the insurance pension | 392 1 0200 160 | 392 1 02 02010 06 2100 160 - fine 392 1 02 02010 06 2200 160 - percent |

| Penalties and interest on insurance contributions for compulsory pension insurance, credited to the Pension Fund for the payment of a funded pension | 392 1 0200 160 | 392 1 02 02020 06 2100 160 - fine 392 1 02 02020 06 2200 160 - percent |

| Penalties and interest on contributions from organizations employing the labor of flight crew members of civil aviation aircraft, credited to the Pension Fund for the payment of additional payments to pensions | 392 1 0200 160 | 392 1 02 02080 06 2100 160 - fine 392 1 02 02080 06 2200 160 - percent |

| Penalties and interest on contributions paid by coal industry organizations to the Pension Fund for payment of pension supplements | 392 1 0200 160 | 392 1 02 02120 06 2100 160 - fine 392 1 02 02120 06 2200 160 - percent |

| Penalties and interest on insurance premiums at an additional tariff for employees engaged in the types of work specified in clause 1, part 1, art. 30 of the Federal Law of December 28, 2013 No. 400-FZ, credited to the Pension Fund for the payment of an insurance pension | 392 1 0200 160 | 392 1 02 02131 06 2100 160 - fine 392 1 02 02131 06 2200 160 - percent |

| Penalties and interest on insurance premiums at an additional tariff for employees engaged in the types of work specified in paragraphs. 2-18 hours 1 tbsp. 30 of the Federal Law of December 28, 2013 No. 400-FZ, credited to the Pension Fund for the payment of an insurance pension | 392 1 0200 160 | 392 1 02 02132 06 2100 160 - fine 392 1 02 02132 06 2200 160 - percent |

| Penalties and interest on insurance premiums credited to the Pension Fund for the payment of insurance pensions (for billing periods from 2002 to 2009 inclusive) | 392 1 0200 160 | 392 1 02 02031 06 2100 160 - fine 392 1 02 02031 06 2200 160 - percent |

| Penalties and interest on insurance contributions credited to the Pension Fund for the payment of funded pensions (for billing periods from 2002 to 2009 inclusive) | 392 1 0200 160 | 392 1 02 02032 06 2100 160 - fine 392 1 02 02032 06 2200 160 - percent |