Home / Labor Law / Payment and benefits / Wages

Back

Published: March 16, 2016

Reading time: 8 min

1

3978

The business trip is related to the employee’s performance of labor functions, so it is subject to mandatory payment. Certain peculiarities arise in this case if any of its days coincide with weekends.

We will determine what the payment procedure is and how the employee can be compensated for his lost day off.

- Rules for paying for business trips on weekends and holidays

- Payment procedure and calculation example

- How to take payment into account when calculating income tax?

- How to compensate an employee for a lost day off

Where does it say about payment for a business trip?

The general rules for paying a posted employee for days off are regulated by the Labor Code and the Regulations on the specifics of sending employees on business trips, which was approved by Decree of the Government of the Russian Federation dated October 13, 2008 No. 749 (hereinafter referred to as the Regulations on Business Travel).

In particular, it says how to pay daily allowances and how to pay for work if the employee was at the place of business trip on a weekend or holiday. Compose HR documents using ready-made templates for free

Normative base

Important! Please keep in mind that:

- Each case is unique and individual.

- A thorough study of the issue does not always guarantee a positive outcome. It depends on many factors.

To get the most detailed advice on your issue, you just need to choose any of the options offered:

- Use the online chat in the lower corner of the screen.

- Call: Federal number: +7 (800) 511-86-74

An employer who sends his employee on a business trip for the first time should be guided, first of all, by Chapter 24 of the Labor Code of the Russian Federation. In it you can find clarification on most fundamental questions regarding:

- The procedure for sending employees to other cities on instructions from their superiors;

- Ways to pay for their efforts and reimburse costs;

- Whether the task needs to be formalized in an order, a report on its completion, and whether time off is allowed for a business trip, and most importantly, when.

In addition to the direct norm, the Labor Code contains references to other federal laws and government regulations. In particular, the details of sending ordinary workers on a business trip are described in Decree 749. But how to organize a trip and allow military personnel to take time off for a business trip in 2021, you need to look in Law 76 Federal Law on their status and Decree 1237 on issues of service.

The need to work on weekends that fall during the business trip must be voiced by the employer and agreed with the employee in writing, Art. 99 TK

Features of the term “business trip”

When many employees mention a possible business trip, they have light romantic associations about a pleasant trip to another city at the employer’s expense. Sometimes the flair of dreams takes an employee away from true understanding and essence.

In fact, business travel is one of the ways to solve pressing problems by sending one or more specialists to places located outside the home enterprise. To establish new contacts or support certain processes taking place remotely, an employee can be “sent” either to a neighboring locality or thousands of kilometers from home and work, including abroad.

Business trip on weekdays and weekends

The most productive time for fulfilling an employer’s assignment is during the daytime hours. After all, most Russian enterprises work eight hours a day from Monday to Friday, from 8 a.m. to 7 p.m.

That is why management tries to organize a business trip at the beginning or in the middle of the week in order to optimize the time spent and the financial costs of paying for it. It is quite logical that time off for a business trip on a weekday is only possible if the assigned employee completed the task assigned to him longer than a normal working day. A prerequisite for this is that the posted worker has a written instruction from his superiors about the need to work overtime, Art. 99 TK.

It's another matter when a business trip covers weekends or holidays. If it takes more than a week to achieve a positive result, then the number of days spent away from home will inevitably include non-working days. Since labor legislation fully applies to the work of business travelers, a person in another city has the right to rest on Saturday and Sunday. It is clear that then there cannot even be a reason to talk about getting time off for a business trip on a weekend.

In fairness, it should be noted that there are a number of situations when this point receives a slightly different interpretation. The right to time off for a business trip on weekends appears to those who:

- Leaves or returns back on his allotted day of weekly rest;

- By order of the business trip, he was obliged to carry out the assignment without taking into account the day of the week.

Working hours on business trips are the responsibility of the employer. It is the manager of the seconded specialist who must determine how, when and how much his subordinate should work. The main thing is that the production of hours and methods of compensating for overtime do not violate the norms of the Labor Code of the Russian Federation.

How to calculate daily allowance for weekends on a business trip

According to paragraph 11 of the Business Travel Regulations, per diem must be paid for each day of a business trip, including weekends and non-working holidays, as well as for days spent en route, including during a forced stop. Thus, the employee must receive daily allowance for each calendar day of the business trip, including the days he spent on the road when traveling to and from the business trip.

IMPORTANT. Each employer can set the amount of daily allowance that it considers necessary. In practice, the amount of daily allowance usually does not depend on what day it is paid for - a working day, a weekend or a holiday. This means that calculating daily allowances for weekends on a business trip is no different from calculating daily allowances for working days.

To determine how much the employee should receive, you need to multiply the amount of daily allowance established in the organization by the number of calendar days of the business trip, which starts from the day of departure and ends on the day of arrival.

The rules for determining the day of departure and day of arrival are established in paragraph 4 of the Regulations on Business Travel. The day of departure on a business trip is the date of departure of a train, plane, bus or other vehicle from the place of permanent work of the posted employee. The day of arrival from a business trip is the date of arrival of the specified vehicle at the place of permanent work. When a vehicle is sent before 24.00 inclusive, the day of departure for a business trip is considered the current day, and from 00.00 and later - the next day. The day the employee arrives at his place of permanent work is determined similarly.

Features of business trips on weekends

The provisions of the regulations define a business trip as the departure of an employee, with permission and on instructions from management, to complete production and other tasks assigned to the employee.

Such stay of an employee on company business in another location can be long-term. This includes weekends and holidays.

Quite often, non-working days fall either at the beginning of a business trip or at the end of it. In any case, the start and end dates should be fixed in the appropriate management order.

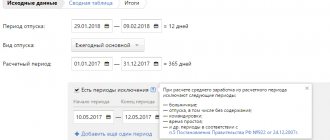

How to calculate average earnings for weekends on a business trip

The Regulations on Business Travel do not directly say whether it is necessary to pay the average salary for weekends or holidays on which the business trip occurred. It is only stipulated that payment for a seconded employee if he is involved in work on weekends or non-working holidays is made in accordance with the labor legislation of the Russian Federation.

Automatically calculate the salary of a posted worker according to current rules Calculate for free

However, from this general phrase we can draw the following conclusion: it is necessary to calculate average earnings for weekends and holidays only if the person was actually involved in work on these days. This means that if an employee, while on a business trip, rests on weekends and holidays, then the average salary for these days is not paid to him.

If the employer decides that the posted worker must work every day, including on weekends, then he will have to pay for work on those days that are intended for rest. Moreover, in an increased (at least double) size. Or the employee must be given a day off for each day he worked on his day off (subject to his written application). Then the work itself on a day off is paid at a single rate (Article 153 of the Labor Code of the Russian Federation).

REFERENCE. According to Article 153 of the Labor Code of the Russian Federation, work on a weekend or a non-working holiday is paid at least double the amount. Specific amounts of payment for work on a specified day can be established by a collective agreement, local regulations, or employment contract.

Taking into account the above, the rule for paying for days off on a business trip is as follows: if the employee is resting on these days, no payment is made (average earnings are not calculated). If, by decision of the management, a posted employee works on a weekend or holiday, then this day must be paid at least double the amount, or, at the request of the employee, be given a day off (then work on a day off is paid at a single rate). Please note that it is more correct to pay for “working weekends” during a business trip not according to average earnings, but based on the remuneration system established for the employee - salary, tariff rate, etc. (Article 153 of the Labor Code of the Russian Federation, clause 9 of the Regulations on business trips).

Calculate “complex” salaries with coefficients and bonuses for a large number of employees

How to take payment into account when calculating income tax?

Some of the nuances associated with compensation for a business trip on a day off also apply to the taxation of the enterprise. In particular, such an issue as taking these expenses into account when calculating income tax. An employer will be able to reduce the tax base by the amount paid to an employee in double the amount only in certain individual cases:

- The internal labor regulations officially provide for working hours on weekends and holidays.

- The employer will be able to prove that the expenses incurred by him are economically justified and were aimed at obtaining additional financial benefits for the enterprise.

In all other cases, payments to the employee will not be deductible from the general income tax calculation base.

You need to calculate maternity benefits correctly! We will help you with this! Correctly calculating your sick leave during pregnancy has its own characteristics. You can learn about them and understand their intricacies here.

You will find out what the maximum period of time you can count on when receiving sick leave is if you follow the link and read our material.

How to pay for days off while traveling

Accountants often have difficulty calculating average earnings for the weekends that a posted worker spent on the road. This situation can arise not only by the decision of management, who planned the employee’s trip in this way, but also unintentionally, for example, due to a flight delay or cancellation, employee illness, etc. Do days spent on the road count as work? Do I need to pay them double?

The Labor Code and the Regulations on Business Travel do not provide answers to these questions. Judges and officials believe that days of departure, arrival, as well as days en route during a business trip that fall on weekends or non-working holidays are paid in accordance with Article 153 of the Labor Code of the Russian Federation at least double the amount, unless the employee is given another day of rest. Such clarifications are contained in the decision of the Supreme Court of the Russian Federation dated June 20, 2002 No. GKPI2002-663, in letters of the Ministry of Labor of Russia dated October 13, 2017 No. 14-2/B-921, dated September 5, 2013 No. 14-2/3044898-4415 and dated December 25. 13 No. 14-2-337.

Thus, if an employee leaves for or arrives from a business trip, and is also on the road on a day off (according to the schedule of the sending organization), then this is regarded as being hired to work on a day off. This means that you need to pay for this day and provide time off, or pay double for work on this day. It is also more correct to pay for weekends on the road not according to average earnings, but based on the wage system established for the employee.

These provisions apply subject to the rules mentioned above for determining the day of departure and arrival. For example, if an employee left on a business trip on Friday and arrived at his destination no later than 24:00 on the same day, then the average earnings do not need to be calculated for Saturday and Sunday (unless, of course, he will work on these days as directed by management). But if a train (plane, bus) leaves the place of work or arrives at the place of business trip after 00.00 on Saturday, then you will have to pay for this day (with the provision of time off or at an increased rate).

ADVICE. If possible, plan your business trips so that your arrival and departure dates do not fall on weekends or holidays.

How to pay for the day of departure or return on a holiday

If a business trip takes place on a weekend, then each hour spent by the employee on the road should be paid in double (or more) or single with the provision of time off . Do the same if an employee returns from a business trip on a day off.

The stated position is supported by Rostrud and the Ministry of Labor (letters dated October 16, 2019 No. PG/26391-6-1 and dated July 9, 2019 No. 14-2/B-527).

Moreover, the type of compensation - double pay or time off - is chosen by the employee himself .

The employer has no right to dictate terms. An exception is an employee with whom a fixed-term employment contract has been concluded. They only get higher pay. They do not have .

Due to the fact that is not established , we recommend that you establish in an internal regulatory document how to pay for days off on a business trip. In this case, the calculation will be performed equally for all employees. You will avoid claims and questions from inspection authorities.

In addition to travel time (train or plane), it is also necessary to take into account the time an employee spends getting to the train station or origin/destination station, as well as for registration. After all, boarding the plane usually ends 1 hour before departure. In this case, time is required to check in luggage, go through customs control, etc. If the employer does not compensate for this time as work on a day off, a dispute is possible with the labor inspectorate, which will most likely side with the employee .

How to reflect weekends during a business trip in the report card

In the Timesheet, each calendar day of a business trip is marked with a special code (K or 06) without indicating the number of hours. This code is also indicated for the weekends on which the business trip occurred (remember that usually weekends are marked in the Timesheet with code B or 26).

ATTENTION. For a posted employee, codes B and 26 are not used in the Timesheet. If an employee worked on a business trip on a weekend or holiday, then for this day an additional code РВ or 03 is entered into the Timesheet. The number of hours of work is entered only if there is an order from the employer (at the main place of work) indicating the number of hours that this The employee must work on a specific weekend or holiday.

As for weekends (holidays) on which the employee was on the way to the place of business trip or back (including if the day of departure or arrival fell on a holiday or day off), they are marked in the Timesheet with the double code K/RV or 06/ 03 without specifying the number of hours.

Such explanations for filling out the Working Time Sheet are given in paragraph 2 of the letter of the Ministry of Labor of Russia dated February 14, 2013 No. 14-2-291.

Maintain timesheets and calculate salaries in the Vesti web service for free

The business traveler goes on a day off

When going on a trip on company business, the employee and management calculate its start so that the person is at the location for the official assignment from the beginning of the work week, so the travel period may include weekends.

Be sure to remember the following:

- A business trip on a weekend must be agreed upon with the administration of the business entity.

- At the same time, the director of the company needs to indicate that the start of the business trip falls on a weekend.

- It is also necessary, before going on a trip, to request written consent from the traveler to work on non-working days.

Also, the business trip order records the schedule according to which the employee will carry out his work duties, reflecting exactly what time he needs to go on a business trip. These points of management’s order will help determine exactly how payments should be made to the traveler for the time worked.

For example, the plane departs at 23-45 hours on Sunday. In order for an organization’s worker to get to the airport on time, he needs to hit the road at 10:00 pm on Sunday.

If the administration document indicates that the employee’s trip begins at the indicated hour, then the company can pay the employee not for the whole day, but only for 2 hours of the day off. And on the time sheet, the responsible person must only enter the hours when he was directly on the road.

Attention! If you do not do this, but indicate that the trip on company business begins on Sunday, then management will have to pay the business traveler for the entire day off.

In addition to what has been noted, one must not miss the point that a company employee, based on his own desire, chooses how to pay him for days off for the days of the trip. Either the salary is calculated in double amount, or as a standard with the provision of a day of rest according to the wishes of the individual. You will need to enter the codes “RV” or “03” on the report card.

You might be interested in:

Travel certificate: is it mandatory, how to fill it out correctly

The employer must remember that daily allowances on weekends on a business trip must be paid in the same way as on other days. There is no need to recalculate based on the hours actually worked on this day during the trip.

Attention! An employee can start a trip on a day off of his own free will, without notifying or receiving permission from the administration. Then these days are paid as standard. And in the time sheet, the responsible person enters the code “K” or “06”.

Accounting for travel expenses

The fact that the business trip “occupies” weekends or holidays does not in any way affect the accounting procedure for the corresponding expenses incurred by the employer. Daily allowances accrued for weekends (including days en route, including the day of departure and day of arrival) are not subject to personal income tax and insurance premiums according to the same rules as daily allowances accrued for working days. Namely: they are exempt from personal income tax and insurance contributions up to 700 rubles. for each day of a business trip in Russia, and within 2,500 rubles. for each day of being on a foreign business trip (clause 3 of article 217, clause 2 of article 422 of the Tax Code of the Russian Federation).

The average earnings accrued for the weekends on which the posted employee was involved in work or was on the road (including the day of departure or arrival) are subject to personal income tax and insurance contributions in the same way as the average earnings accrued for weekdays (letter of the Federal Tax Service of Russia dated April 17, 2018 No. BS-4-11/ [email protected] ).

ATTENTION. For tax accounting purposes, the average earnings paid to a posted employee on weekends are regarded as wages.

For personal income tax purposes, the date of actual receipt of income in the form of average earnings paid for a day off on a business trip will be considered the last day of the month for which this income was accrued. The date of actual receipt of income in the form of daily allowances paid in excess of the non-taxable rate is the last day of the month in which the business trip report is approved. Tax must be withheld when paying (transferring) the corresponding amounts (subclause 6, clause 1 and clause 2, article 223, clause 4, article 226 of the Tax Code of the Russian Federation). Insurance premiums must be calculated simultaneously with the calculation of average earnings and excess daily allowances in accounting (clause 1 of Article 424, clause 1 of Article 421 of the Tax Code of the Russian Federation). The entire amount of payment for a business trip in 2021 is taken into account as part of expenses both under the OSNO (clause 6 of Article 255, subclause 12 of clause 1 of Article 264 of the Tax Code of the Russian Federation) and under the simplified tax system (subclauses 6 and 13 of clause 1 of Art. 346.16 Tax Code of the Russian Federation). In particular, this amount includes daily allowances for all days of the business trip. It also includes the average earnings for work on a business trip on weekends and holidays and for the time spent on the road on these days. The basis for writing off costs will be the Time Sheet and business trip documents.

Decor

Today, travel arrangements for company business have been simplified and complicated at the same time. Resolution 749 determines that documentary support for a business trip consists of an order before its start and an advance report drawn up based on its results.

Since mention of a written assignment, a report on the work performed and a travel certificate has disappeared from the legislation, all significant moments of a particular trip must be spelled out in great detail in a single document - the order of the manager. It is important to remember that it is also necessary to outline the working hours and days of rest, the need to comply with the work schedule of the host party, and situations where an employee is guaranteed to receive time off for a business trip upon returning home.

List of documents based on the results of the business trip

After a specialist is given an order to be sent on a business trip to an unfamiliar city or friendly enterprise, the person receives a cash advance to pay for work needs during the trip and to cover his own daily expenses. He must bring a much larger number of documents from his business trip:

- Travel documents or receipts for fuel for personal transport, if the employer has permission to use it;

- Invoices for hotel accommodation or a document confirming payment for rented housing;

- Agreements, invoices, acts or other papers confirming the successful completion of assigned tasks;

- A detailed note, if the documents provided are not sufficient to reliably establish the period of stay, the reasons for unforeseen delays, or other unusual situations.

Despite the fact that the travel certificate has lost the status of a mandatory document, it continues to be used, securing this form in the list of forms for internal document flow. In particular, it is by the marks on the back of the certificate that one can reliably establish the fact of work on those days for which the employee can subsequently ask for time off for a business trip.

Applying for time off

Even if it was initially planned that there would be no need to rest during the trip, and the employee himself agreed with this need, HR officers will need a statement about how and when providing time off for a business trip will be useful to the person. It is better to write it before departure, and then record the date of rest in the order.

If you had to work on a day off spontaneously, then it would be acceptable to submit such a request after arrival. Those who have agreed on all the details at least over the telephone can apply for time off. If the business traveler does not have any confirmation of the employer’s consent, then one can only hope for the manager’s honesty. A sample application for a business trip can be found on our website.

The issue of going to work on the day of poisoning and returning from a business trip must be agreed upon in advance with the employer, clause 4 of Resolution 749.

Leave order

When the plan for carrying out activities on a business trip is known in advance, the employee’s consent to work overtime and his written request on the form of compensation for such work (rest or double average daily rate) have been received, the order to be sent on a business trip is drawn up taking into account the date of time off for work on a business trip. If everything did not happen according to the preliminary plan, then, after the specialist returns, an order is issued to compensate for labor in excess of the monthly norm with extra days of rest.

Briefly, what is a business trip?

This concept is disclosed by the legislator in the Labor Code of the Russian Federation (Article 166). To recognize any trip as a business trip, it must meet three mandatory criteria:

1. First of all, this is a trip by an employee to carry out one or another assignment outside the permanent place of work (populated area).

2. The employer’s order is required, which, as a rule, is drawn up in the form of an order.

3. A certain duration of such a trip.

These mandatory features allow you to distinguish a business trip from related legal relations:

- temporary transfer to another place of work (for example, when temporarily filling the position of a retired employee);

- work that has a permanent traveling nature or is carried out on the road (for example, a train conductor, a driver performing intercity transportation).

While there are some similarities between them, they also have significant differences, including how payments are made.

An employee, while on a business trip, including on the road, cannot at will set the departure (arrival) date or choose the time and place of execution of the assignment.

It must be taken into account that there is no legal limit on the period for which an employee can be sent to carry out an official assignment. The main thing is that it is defined. If necessary, this period can be extended. The period depends on many factors, primarily on production needs. Naturally, the longer the period, the more time there is on weekends.

Getting time off on a business trip

When going on a business trip, some citizens want to get time off to get to know a new place or take a short vacation in another city. But it will not be possible to legally obtain time off during a business trip, because a person is sent there to perform important duties. The only thing an employee can count on is to spend time at his own discretion on his day off. True, if he is asked to work on weekends, he will have to fulfill his duties. But then you can receive compensation.