In accordance with Russian legislation, organizations, both private and government-funded, must have accounting policies. In this article, we will consider what accounting policy should be in 2015 using the example of educational institutions. Thus, paragraph 6 of Instruction 157n (meaning Order of the Ministry of Finance of Russia No. 157n dated December 1, 2010) establishes that educational institutions acting as subjects of accounting are required to formulate accounting policies.

According to the Law on Accounting (Federal Law No. 402 of December 6, 2011), namely paragraph 2 of Article 8 of this document, the accounting policy of an organization or institution today is formed by the subject independently. In this case, one should be guided by federal and specific industry standards. Today, such standards have not been established for state institutions, including municipal institutions, which means that educational organizations can formulate this policy on the basis of instructions No. 157n, 162n, 183n and 174n.

At the end of the year, organizations analyze financial and economic activities for the past period and draw up plans for the upcoming 2015. In this light, the organization’s accounting policy for 2015 is also being reviewed, and it is also determined how accurately its provisions reflect information about a given educational institution and aspects of its economic activity. At this stage, it is important to take into account the changes in Russian legislation that have occurred over the past year, including those acts that will come into force only in 2015.

Accounting Policies Sections

The specialist must definitely pay attention to the structure of the accounting policy disclosed in the sixth paragraph of Instruction 157n. The accounting policy in an educational organization is established by the internal acts of this accounting entity, and the following are approved as such:

- an up-to-date working accounting plan, including, among other things, accounts used for maintaining analytical and synthetic accounting;

- methods used to comprehensively evaluate certain types of an institution's assets and liabilities;

- rules for document flow in the institution, as well as the existing procedure for submitting primary documentation that corresponds to the approved schedule;

- the introduced procedure for conducting inventory activities;

- technological methods for processing documentation to reflect this information in accounting;

- forms of primary and consolidated accounting documentation not unified by law and used in the institution, intended for the proper registration of business transactions. In this case, such forms must contain the details of the primary accounting document, which is provided for in paragraph No. 7 of Instruction 157n;

- the procedure for maintaining internal financial control by the organization;

- other acts and decisions, without which the organization and maintenance of financial records in an institution would be impossible.

Approved on August 29, 2014 by Order of the Ministry of Finance of the Russian Federation No. 89n, some changes were made to Instruction No. 157n. From now on, paragraph 6 stipulates not only the inclusion of the already listed sections in the accounting policy, but also the “Procedure for reflecting events noted after the reporting date in the organization’s accounting.” This concept, in accordance with existing international requirements, is used for accounting in commercial enterprises, but for government agencies this item is completely new. The accounting policy for 2015 should be formed taking into account all ongoing changes and innovations.

The corresponding PBU “Events after the reporting date” was approved in 1998, and by virtue of paragraph 3 of the regulation, such an event is recognized as an economic activity that has already had or may affect the financial condition, results of the operation of the institution or the existing cash flow. This fact must occur in the period of time between the reporting date and when the annual financial statements are signed.

The third paragraph of this PBU describes events that:

- confirm the economic and financial conditions as of the reporting date in which the organization operated;

- indicate the business conditions that arose after the reporting date and in which the organization is currently operating.

The appendix to the PBU contains an approximate list of relevant events and facts of economic activity. It is expected that, by analogy with the recommendations for commercial organizations, PBUs will be developed that apply to state as well as municipal institutions.

In accordance with the Order of the Ministry of Finance of the Russian Federation numbered 89n, the sixth paragraph also contains information that accounting forms developed and used by educational institutions that are not unified by the legislation of the Russian Federation must be included in the accounting policy. This is a significant difference from the previously existing practice, when the 2014 accounting policy was developed on the basis of only primary documentation.

If autonomous and budgetary institutions:

then when forming an accounting policy that takes into account all the nuances of the activity, the peculiarities of the functioning of such organizations and the maintenance of accounting or financial records are necessarily provided for, as prescribed by Instruction No. 157n.

Accounting policy for tax purposes. Production, services. BASIC

Limited Liability Company "Beta" LLC "Beta"

ORDER

12.12.2016 № 102

Moscow

On approval of the organization’s accounting policy for tax purposes when applying the general taxation system (OSNO)

I ORDER:

1. Approve the Accounting Policy for tax purposes under OSNO in accordance with the Appendix.

2. Entrust control over the execution of this order to the chief accountant Yu.V. Serebryakova.

Appendix: Accounting policies for tax purposes according to OSNO (on four sheets).

General Director _________________________ A.I. Petrov

M.P.

I have read the order:

| 12.12.2016 | ____________________ | Yu.V. Serebryakova |

| … | ____________________ | … |

Appendix to the Order of Beta LLC No. 102 dated December 12, 2016

APPROVED by Order of Beta LLC No. 102 dated December 12, 2016

M.P.

Accounting policies for tax purposes according to OSNO

The accounting policy of Beta LLC (hereinafter referred to as the Organization) was developed in accordance with Chapter. 25 of the Tax Code of the Russian Federation “Tax on profit of organizations”, Ch. 21 of the Tax Code of the Russian Federation “Value Added Tax”, Federal Law No. 402-FZ of December 6, 2011 “On Accounting”, Instructions for the Chart of Accounts.

Elements and principles of accounting policies:

1. General Provisions

1.1. The chief accountant of the Organization is responsible for maintaining tax records, generating declaration indicators, signing it and timely submitting it to the tax office.

2. Organization of tax accounting

2.1. Documents drawn up in paper and (or) electronic form (subject to their certification by a qualified electronic signature) are accepted for registration.

2.2. Tax accounting is carried out separately from accounting - in tax accounting registers developed by the organization independently. The list of tax accounting registers and their forms are given in Appendix No. 1 to the Accounting Policy for tax purposes.

2.3. If errors (distortions) relating to previous tax (reporting) periods are identified, which led to excessive payment of tax, the tax base and tax amount are recalculated for the tax (reporting) period in which they were identified.

2.4.Accounting for income and expenses is carried out using the accrual method based on Art. 271 and 272 of the Tax Code of the Russian Federation.

3. Accounting for depreciable property

3.1. The useful life of each fixed asset is determined by a commission appointed by order of the manager, within the time limits established for the depreciation group in which the fixed asset should be included on the basis of the Classification of fixed assets, approved. By Decree of the Government of the Russian Federation No. 1 of January 1, 2002, after reconstruction, modernization or technical re-equipment of fixed assets, the useful life can be increased within the limits established for the depreciation group.

3.2. The useful life of fixed assets that have been in operation is determined equal to the period established by the previous owner, reduced by the number of years (months) of operation of these fixed assets by the previous owner.

3.3. For the following intangible assets, the useful life is set equal to three years: – the exclusive right of the patent holder to an invention, industrial design, utility model; – the exclusive right of the author and other copyright holder to use a computer program, database; – the exclusive right of the author or other copyright holder to use the topology of integrated circuits; – the exclusive right of the patent holder to selection achievements; – possession of know-how, secret formula or process, information regarding industrial, commercial or scientific experience; – exclusive right to audiovisual works.

For all other intangible assets, the useful life is determined based on the validity period of the patent, certificate (other document protecting the right to intellectual property).

For intangible assets for which the useful life cannot be determined, a period of 10 years is applied.

3.4. Depreciation is calculated using the straight-line method for all items of depreciable property (fixed assets and intangible assets).

3.5. The depreciation bonus for all fixed assets is applied in the amount of 10 percent of the original cost and (or) expenses for completion, additional equipment, modernization, technical re-equipment or partial liquidation of the fixed asset and is included in the expenses of the reporting period.

3.6. The depreciation rate for fixed assets that are the subject of a leasing agreement is determined taking into account an increasing factor of 3 (with the exception of fixed assets belonging to the first, second or third depreciation groups).

3.7. For other fixed assets, depreciation is calculated at the basic depreciation rate without the use of increasing or decreasing factors.

3.8. A reserve for repairs of fixed assets is not created. Expenses for the repair of fixed assets are recognized for tax purposes as part of other expenses in the reporting period in which they were incurred, in the amount of actual expenses.

4. Accounting for inventories

4.1. When writing off raw materials and materials used in production, valuation is carried out using the average cost method calculated per month.

4.2. The cost of property that is not recognized as depreciable, for the purpose of calculating income tax, is taken into account as expenses at a time at the time of commissioning.

5. Accounting for income and expenses

5.1. Direct costs for production include: – all material costs for the purchase of raw materials and supplies used in the production of products, except for general business and general production material costs; – expenses for remuneration of personnel of workshops and divisions of the main production; – the amount of insurance contributions to extra-budgetary funds accrued to the salaries of personnel involved in the production process; – the amount of accrued depreciation on fixed assets directly used in production.

5.2. The amount of direct expenses incurred in the reporting (tax) period is fully attributed to the reduction of income from production and sales of this reporting (tax) period without distributing them to the balances of work in progress.

5.3. If the direct costs named in paragraph 5.1 of the Accounting Policy cannot be attributed to the manufacture of a specific type of product, then they are subject to distribution in proportion to the direct costs directly related to the production of each type of product.

5.4. Direct costs, named in paragraph 5.1 of the Accounting Policy, are distributed between work in progress and finished products in proportion to the share of direct costs in the planned (normative, estimated) cost of products.

5.5. Deductions to the reserve for doubtful debts are made quarterly. Inventory of receivables for the purpose of creating a reserve is carried out as of the last day of the reporting quarter.

5.6. A reserve for warranty repairs and warranty service is not created.

5.7. A reserve for future R&D expenses is not created. Expenses directly related to the implementation of scientific research and (or) development (R&D) are included in other expenses in the reporting (tax) period in which such research or development (individual stages of work) were completed, in full, regardless of R&D results.

5.8. If, as a result of R&D, an organization receives exclusive rights to the results of intellectual activity that meet the criteria for recognizing intangible assets in tax accounting, these intangible assets are not recognized, and the R&D expenses incurred are taken into account as part of other expenses associated with production and sales, within two years.

5.9. All types of R&D costs are included in other expenses without applying a multiplying factor.

5.10. In order to evenly account for costs, a reserve is created for future expenses to pay for employee vacations.

5.11. In order to evenly account for costs, a reserve is created for future expenses for the payment of annual remunerations for length of service and based on the results of work for the year.

5.12. Technological losses (irrecoverable waste) are taken into account as expenses in accordance with the standards approved in the technological map by the responsible person.

5.13. Income and expenses relating to several reporting periods are distributed evenly over the term of the contract to which they relate. If the completion date of work (provision of services) under the contract cannot be determined, the period for distribution of income and expenses is established by order of the head of the organization.

5.14. Income from contracts with a long (more than one tax period) production cycle that does not provide for stage-by-stage delivery of work (services) is recognized evenly over the term of the contract.

5.15. Costs that can be equally taken into account for different reasons (items, groups) of expenses are recognized according to one of them in a manner that is determined each time individually based on the characteristics of the transaction performed.

6. Accounting for losses

6.1. The amount of loss from the assignment of the right of claim under an agreement, the repayment period of obligations under which has not yet expired, is determined based on the maximum interest rate established for the corresponding type of currency, clause 1.2 of Art. 269 of the Tax Code of the Russian Federation.

6.2. The base at the end of the tax period is reduced by losses received based on the results of previous tax periods. Such losses are transferred in the manner provided for in Art. 283 of the Tax Code of the Russian Federation.

7.Procedure for calculating advance payments

7.1. Payment of monthly advance payments for income tax is made based on the profit received in the previous quarter.

7.2. To determine the amounts of advance payments and taxes payable at the location of separate divisions, indicators of the share of the residual value of depreciable property and the average number of employees are used.

8. VAT

8.1. When drawing up an invoice by a separate division, the serial number of such a document is supplemented through a dividing line with the digital index of the separate division - “2”.

8.2. To differentiate the amounts of input VAT between transactions subject to and not subject to VAT, the following additional sub-accounts are opened to account 19 “Value added tax on acquired assets”: – for goods (works, services, property rights) that the organization uses in taxable VAT transactions, – subaccount “For deduction”; – for goods (works, services, property rights) that the organization uses in VAT-free transactions – subaccount “In cost”; – for goods (works, services, property rights) that the organization uses in both taxable and tax-exempt transactions – subaccount “For distribution”.

8.3. The subaccount “For deduction” of account 19 takes into account the tax amounts presented by suppliers for goods (works, services) used in activities subject to VAT. Tax amounts recorded in this subaccount are accepted for deduction in the manner established by Art. 172 of the Tax Code of the Russian Federation, without restrictions.

8.4. Amounts of input VAT presented by suppliers when purchasing materials (work, services) classified as expenses for non-taxable activities are taken into account in the “In cost” subaccount of account 19.

8.5. The moment of determining the tax base for the sale of goods (work, services), the duration of the production cycle of which is more than six months, is established as the day of shipment (transfer of goods, performance of work, provision of services).

<…></…>

Adjustment of accounting policies

Based on existing sections of the accounting policy, it is possible to determine the lack of any information, or identify outdated or unreliable data. The procedure for making changes to existing accounting policies is strictly regulated. Clause No. 5 of Article No. 8 of the Accounting Law states that the current accounting policy for 2015 is based on data from previous years, maintained and applied consistently from year to year. That is, it is formed once when an organization is created. But according to paragraph No. 6 of the same law, its change is provided for and allowed in the following cases:

- in accordance with Russian legislation, exercise powers to fulfill their obligations in monetary form to an individual;

- on the basis of agreements, exercise the powers of a state customer concluding and executing government contracts on behalf of state bodies or local authorities,

- when existing standards and requirements established by law change;

- if a new method of accounting has been developed or chosen, which will improve the quality of information about the accounting object itself;

- if the conditions of the organization’s activities as an accounting entity have changed dramatically.

The last condition is especially important. The decision to change the accounting policy can be justified during the reorganization of an entity associated with a merger, division or accession, separation or transformation of a legal entity, carried out in accordance with Russian laws.

It is important to note that changes in the accounting policies of an educational institution are possible if Russian legislation in the field of accounting changes. And there are many such amendments at the moment.

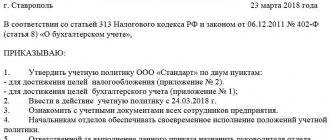

Example of an accounting policy order

Limited Liability Company "Project Organization "Sistema"

Accounting Policy Order No. 17

Kemerovo 01/20/2022

In accordance with Art. 8 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”,

I order:

- Approve the accounting policy of Project Organization Sistema LLC for 2022 for accounting and taxation purposes in accordance with Appendix No. 1 to this order.

- The provisions of the accounting policy are mandatory for execution by all employees of Project Organization Sistema LLC, responsible for maintaining accounting and tax records and preparing primary accounting documents.

- Responsibility for organizing the execution of this order is assigned to the chief accountant.

Director Ponomarev Ponomarev K.S.

I have read the order:

Chief accountant Ozheredova Ozheredova I.L.

Changes in the application of accounts

As new accounts are introduced, the order of their use is added. It is also envisaged that changes will be made to the existing correspondence of the institution's accounts and taxation.

As noted, the account 401 60 is introduced, which helps to summarize information about the amounts reserved for the even distribution of expenses. If we consider it as a sample, then the educational institution, in accordance with the instructions, will have the right to create reserves necessary to pay for vacations or compensation, repair of fixed assets or scientific research.

This means that this account will accumulate deductions for items of an uneven nature. Within the framework of the approved accounting policy of the institution, the procedure for creating such reserves is established. That is, in this situation, the organization can independently determine whether the reservation principle will be used or not.

There is another important change in the text of Instruction 157n. An example of this is paragraph No. 25 of the new edition of the applicable instructions, which states that land plots used by organizations on the right of perpetual use are in this case taken into account in the “Non-produced assets” account of analytical accounting. Such registration is carried out on the basis of a document confirming the right to use and the cadastral value of the site.

Until now, based on paragraph 333 of the above instructions, these plots were accounted for in off-balance sheet account 01. Since the plots are transferred to the balance sheet, it is necessary to make changes to the established accounting policy of the educational institution accordingly, and the taxation procedure also changes.

Changes to Internal Controls

The procedure for implementing internal control is highlighted in a special section of the accounting policy. As stated in paragraph 3 of the new edition of Instruction 157n, it is assumed that before the adoption of primary accounting documents, internal control measures will necessarily be carried out in relation to them. That is, in the accounting department of an educational institution, it is important to establish a strict distribution of responsibilities to ensure the proper quality of such control.

In order to be able to correlate and compare financial statements for several years, adjustments to accounting policies are made at the beginning of the reporting year, unless there are compelling reasons for another option.

Additions to accounting policies

There are no specific references and indications of what causes additions to the accounting policy of an educational institution, since such organizations do not use PBU in their activities.

But all situations when a new type of activity, new operations or, for example, a new type of assets appear in the activities of an educational institution, additions to the accounting policy are required. Adjustments to accounting policies can be carried out by an organization several times during the year, and there are no restrictions on the number of such additions.

An addition to the accounting policy can be considered the addition of correspondence accounts for activities that have been carried out for a long time, or a comprehensive description of a situation that often occurs in the work of the organization.

An example of this can be situations where the employer does not issue accountable funds on account, while an employee of the organization, due to production needs, is forced to pay any expenses of the institution from his own funds. Instruction 157n does not describe the reflection of such transactions in the account intended for recording settlements with accountable persons, but the situation can be described as the fulfillment of undertaken obligations. Since the formation of the current accounting policy is based on the specific structure of the institution, the characteristics of the industry and taxation, the organization has the right to independently choose the account used in this case.

In Letter of the Ministry of Finance of Russia No. 02-06-05/4406 dated September 30, 2011. it is indicated that the use of account 302 00 in this case is not a violation of accounting in an educational organization. If the described operation to reimburse expenses incurred by an employee is not uncommon, then the institution reasonably supplements its own accounting policies with provisions deciphering the procedure for reimbursement of such expenses.

Sample order on adoption of accounting policies for 2014

This page provides as an example a sample order for the adoption of an organization's accounting policy for 2014. For any organization, we can draw up an individual package of documents on the adoption of accounting policies for 2014. Order No. __ dated “___”_________________2014

on the adoption of accounting policies at the enterprise for accounting and tax purposes

I order:

In accordance with the Law of the Russian Federation dated December 6, 2011 No. 402-FZ “On Accounting”, the Accounting Regulations “Accounting Policy of the Organization” (PBU 1/2008), approved by Order of the Ministry of Finance of the Russian Federation dated October 6, 2008 No. 106n, and the Regulation on accounting and financial reporting in the Russian Federation, approved by Order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n, I order the approval of the accounting policy for 2014, I establish the following:

- Maintain accounting records in full in connection with the application of the simplified taxation system in accordance with the Law of the Russian Federation of December 6, 2011 No. 402-FZ “On Accounting”.

- When assessing the items in the financial statements, ensure compliance with the assumptions and requirements stipulated by the Accounting Regulations “Accounting Policy of the Organization”, approved by Order of the Ministry of Finance of the Russian Federation dated October 6, 2008 No. 106n.

- The facts of economic activity are reflected using the principle of temporal certainty, which implies that the facts of economic activity relate to the reporting period in which they took place, regardless of the actual time of receipt or payment of funds associated with these facts.

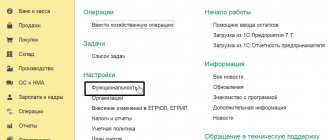

- Accounting in 2014 should be carried out using the Chart of Accounts for accounting the financial and economic activities of organizations and the Instructions for its application, approved by Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n.

- Accounting in 2014 should be carried out using the specialized accounting program 1C “Accounting” using a journal order form in electronic form. Analytical and synthetic accounting registers should be drawn up automatically (Article 10 of Law No. 129-FZ). Keep accounting documents at the enterprise in electronic form, ensuring their protection.

- The acquisition and procurement of materials in accounting is reflected using account 10 “Materials”, which forms the actual cost of materials and reflects their movement.

- When releasing inventories into production and otherwise disposing of them, they are assessed by the organization (except for goods accounted for at sales/retail cost) at the cost of each unit.

- When calculating depreciation of fixed assets in accounting, the linear method is used.

- For newly acquired fixed assets, apply the Classification of fixed assets included in depreciation groups, approved by the Decree of the Government of the Russian Federation “On the Classification of fixed assets included in depreciation groups” dated January 1, 2002 No. 1. For items acquired before 2002, depreciation is calculated in the order , provided for by Resolution of the Council of Ministers of the USSR of October 22, 1990 No. 1072 “On uniform standards of depreciation charges for the complete restoration of fixed assets of the national economy of the USSR.” If an item cannot be classified into any of the depreciation groups, the organization has the right to independently determine its useful life.

- Assets in respect of which the conditions are met that serve as the basis for their acceptance for accounting as fixed assets, costing no more than 40,000 (or a lesser limit) rubles per unit are reflected in accounting and reporting as part of inventories.

- Establish the following groups of homogeneous objects of fixed assets (buildings; structures; working and power machines and equipment; measuring and control instruments and devices; computer technology; vehicles; tools, production and household equipment; other objects).

- There is no revaluation of homogeneous fixed assets at the end of 2013.

- The costs of repairing fixed assets are included in the cost of products (works, services) of the reporting period.

- The useful life of intangible assets is determined based on the expected period of use of the asset, during which it is expected to receive economic benefits (or use them in activities aimed at achieving the goals of creating a non-profit organization).

- Depreciation of intangible assets is carried out using the following method of calculating depreciation charges in accounting: the straight-line method.

- Depreciation charges for intangible assets are reflected in accounting by accumulating the corresponding amounts in a separate account (05 - “Amortization of intangible assets”).

- Tourist vouchers purchased for sale should be accounted for in off-balance sheet account 004 as commission goods.

- When selling (dispensing) goods, their value (in the context of a particular group) is written off at the cost of each unit.

- Selling and administrative expenses are recognized in full in the reporting year as expenses for ordinary activities.

- Accounting for the output of finished products (works, services) should be carried out without using account 40 “Output of products (works, services).

- Goods shipped, work delivered and services rendered, for which revenue is not recognized, are reflected in the prepared annual balance sheet at actual full cost.

- Administrative expenses, accounted for in the debit of account 26 “General business expenses”, at the end of the reporting period are not distributed among the objects of calculation and, as conditional constants, are written off directly to the debit of account 90 “Sales”. Revenue from the sale of goods (work, services) is recognized in accounting in the usual manner.

- In accounting and tax accounting, revenue is recognized as the agent's remuneration from the sale of vouchers.

- Revenue from the performance of work, provision of services, and sale of products with a long manufacturing cycle is recognized as the work, service, or product is ready.

- Do not create reserves for upcoming expenses and payments.

- Do not create a reserve for doubtful debts.

- Transfer long-term accounts payable (for loans and borrowings) into short-term ones from the moment when, according to the terms of the agreement, 365 days remain until the repayment of the principal amount of the debt. (Clause 6 PBU 15/01).

- Recognize all borrowing costs as other expenses.

- The accounting regulation “Accounting for income tax calculations” (for an organization - a small business entity and a non-profit organization) should not be applied.

- The accounting provision “Information on related parties” does not apply.

- The consequences of changes in accounting policies that have had or are capable of having a significant impact on the financial position of the organization, the financial results of its activities and (or) cash flows are reflected in the financial statements (for an organization that is a small business entity, with the exception of issuers of publicly placed securities) prospectively, for except in cases where a different procedure is established by the legislation of the Russian Federation and (or) a regulatory legal act on accounting.

- Use in your work primary accounting documents that are presented in albums of unified forms of primary documentation developed by the State Statistics Committee of the Russian Federation.

- Responsibility for the organization and state of accounting at the enterprise should be assigned to the head of LLC "____________" full name.

- The manager personally maintains the accounting records of the organization LLC "_____________".

- An inventory of fixed assets, materials, and goods in the organization’s warehouse is carried out annually in December. In addition, carry out an inventory in cases provided for by law.

- Provide for changes to the accounting policy for 2014 in the event of changes in the legislation of the Russian Federation and (or) regulatory legal acts on accounting; development of new methods of accounting in order to more accurately represent the facts of economic activity in accounting and reporting or make the accounting process less labor intensive without reducing the degree of reliability of information; significant change in business conditions (reorganization, change in types of activities, etc.).

- Provide for the possibility of introducing clarifications into the organization’s accounting policy for 2014 in connection with the emergence of facts of economic activity that are essentially different from the facts that occurred previously, or arose for the first time in the organization’s activities.

- Tax accounting of the organization LLC "____________" is carried out in accordance with Chapter. 26.2 “Simplified taxation system” of the Tax Code of the Russian Federation.

Head _________ Full name

If for some reason the sample order for adoption of accounting policies for 2014 does not suit you, then you can order it from us.

Competent specialists of the accounting company will prepare the necessary set of documents within 1 business day.

For information:

Sample of a working chart of accounts for accounting policies for 2014 approved by the Order of the Ministry of Finance of the Russian Federation.