The tax on expensive cars has become lower

In fact, new vehicle tax rates in 2021 will affect expensive cars. Thus, Law No. 335-FZ of November 27, 2021, with amendments to the Tax Code of the Russian Federation, reduced the increasing coefficient for calculating the tax on cars worth from 3 to 5,000,000 rubles to a minimum value of 1.1 from 01/01/2018. Note that until 2021, such a coefficient could be used in calculations only for cars from 2 to 3 years from the year of manufacture, and according to the new rules - simply up to 3 years from removal from the assembly line (new edition of clause 2 of Article 362 of the Tax Code RF).

In addition, for other expensive cars costing from 3 to 5 million rubles, there will no longer be increasing factors of 1.3 (when 1-2 years have passed since the year of manufacture) and 1.5 (if the car is less than a year old). In fact, the coefficient of 1.1 swallowed them up.

That is, as a result, the tax for these vehicles will be 20-40 percent less from 2018. It is necessary to take into account changes when calculating transport tax from 2021.

For your convenience, here is an explanatory table of changes in transport tax from 2021:

| Average cost of a car, million rubles. | Number of years since the year of issue | Coefficient in 2021 | Coefficient from 2021 |

| From 3 to 5 inclusive | From 2 to 3 years | 1,1 | 1,1 |

| From 1 year to 2 years | 1,3 | ||

| No more than 1 year | 1,5 | ||

| From 5 to 10 inclusive | No more than 5 years | 2 | 2 |

| From 10 to 15 inclusive | No more than 10 years | 3 | 3 |

| From 15 | No more than 20 years | 3 | 3 |

Let us remind you that I apply these increasing factors only to those passenger cars that are included in a special list. It is maintained and posted on its website by the Russian Ministry of Industry and Trade. Here is the exact link for the 2021 tax season:

https://minpromtorg.gov.ru/common/upload/files/docs/Perechen_2017_dlya_publikatsii.pdf

Also see “List of the Ministry of Industry and Trade of expensive cars in 2021.”

The general transport tax rates were not affected by changes in 2021 (clause 1 of Article 361 of the Tax Code of the Russian Federation). Meanwhile, regional authorities can correct them. Therefore, you need to refer to the law of your constituent entity of the Russian Federation on transport tax.

Chapter 28. Transport tax

Article 356. General provisions

Contents of the Tax Code of the Russian Federation Part I Part II

Transport tax (hereinafter in this chapter - tax) is established by this Code and the laws of the constituent entities of the Russian Federation on tax, is put into effect in accordance with this Code by the laws of the constituent entities of the Russian Federation on tax and is obligatory for payment on the territory of the corresponding constituent entity of the Russian Federation.

When establishing a tax, the legislative (representative) bodies of the constituent entities of the Russian Federation determine the tax rate within the limits established by this chapter. In relation to taxpayer organizations, the legislative (representative) bodies of the constituent entities of the Russian Federation, when establishing a tax, also determine the procedure and deadlines for paying the tax.

When establishing a tax, the laws of the constituent entities of the Russian Federation may also provide for tax benefits and grounds for their use by the taxpayer.

Article 357. Taxpayers

Contents of the Tax Code of the Russian Federation Part I Part II

Taxpayers (hereinafter in this chapter - taxpayers) are persons who, in accordance with the legislation of the Russian Federation, are registered with vehicles recognized as an object of taxation in accordance with Article 358 of this Code, unless otherwise provided by this article.

For vehicles registered in the name of individuals, acquired and transferred by them on the basis of a power of attorney for the right to own and dispose of the vehicle before the official publication of this Federal Law, the taxpayer is the person specified in such a power of attorney. In this case, the persons on whom the specified vehicles are registered notify the tax authority at their place of residence about the transfer of the specified vehicles on the basis of a power of attorney.

UEFA (Union of European Football Associations) and subsidiaries of UEFA for the period up to December 31, 2021 inclusive, FIFA (Federation Internationale de Football Association) and subsidiaries of FIFA specified in the Federal Law “On the preparation and holding of the championship in the Russian Federation” are not recognized as taxpayers FIFA World Cup 2021, FIFA Confederations Cup 2021, UEFA European Football Championship 2020 and amendments to certain legislative acts of the Russian Federation.”

Confederations, national football associations (including the Russian Football Union), the Organizing Committee "Russia-2018", subsidiaries of the Organizing Committee "Russia-2018", producers of FIFA media information, suppliers of goods (works, services) of FIFA, determined by the Federal Law “On the preparation and holding in the Russian Federation of the 2021 FIFA World Cup, the 2021 FIFA Confederations Cup, the 2021 UEFA European Football Championship and amendments to certain legislative acts of the Russian Federation”, in relation to vehicles legally owned by them property and used only for the purposes of carrying out activities provided for by the said Federal Law, as well as during the period up to and including December 31, 2021, the Russian Football Union, the local organizational structure, UEFA commercial partners, suppliers of UEFA goods (works, services) and UEFA broadcasters determined by the specified Federal Law, in relation to vehicles owned by them and used only for the purpose of carrying out activities for the preparation and holding of the 2021 UEFA European Football Championship in the Russian Federation, provided for by the said Federal Law.

Article 358. Object of taxation

Contents of the Tax Code of the Russian Federation Part I Part II

1. The objects of taxation are cars, motorcycles, scooters, buses and other self-propelled machines and mechanisms on pneumatic and caterpillar tracks, airplanes, helicopters, motor ships, yachts, sailing ships, boats, snowmobiles, motor sleighs, motor boats, jet skis, non-self-propelled (towed vessels) ) and other water and air vehicles (hereinafter in this chapter - vehicles) registered in the prescribed manner in accordance with the legislation of the Russian Federation.

2. The following are not subject to taxation:

1) lost force in accordance with Federal Law dated April 15, 2019 No. 63-FZ;

2) passenger cars specially equipped for use by disabled people, as well as passenger cars with an engine power of up to 100 horsepower (up to 73.55 kW), received (purchased) through social welfare authorities in the manner prescribed by law;

3) fishing sea and river vessels;

4) passenger and cargo sea, river and aircraft owned (by the right of economic management or operational management) of organizations and individual entrepreneurs whose main activity is passenger and (or) cargo transportation;

5) tractors, self-propelled combines of all brands, special vehicles (milk tankers, livestock trucks, special vehicles for transporting poultry, machines for transporting and applying mineral fertilizers, veterinary care, maintenance), registered to agricultural producers and used in agricultural work for the production of agricultural products ;

6) vehicles owned by the right of operational management to federal executive authorities and federal state bodies in which the legislation of the Russian Federation provides for military and (or) equivalent service;

7) vehicles that are wanted, as well as vehicles the search for which has been stopped, from the month the search for the relevant vehicle began until the month it was returned to the person for whom it was registered. Facts of theft (theft), return of a vehicle are confirmed by a document issued by an authorized body, or information received by tax authorities in accordance with Article 85 of this Code;

airplanes and helicopters of air ambulance and medical services;

airplanes and helicopters of air ambulance and medical services;

9) ships registered in the Russian International Register of Ships;

10) offshore fixed and floating platforms, offshore mobile drilling rigs and drilling ships;

11) vessels registered in the Russian Open Register of Vessels by persons who have received the status of a participant in a special administrative region in accordance with Federal Law of August 3, 2021 N 291-FZ “On Special Administrative Districts in the Territories of the Kaliningrad Region and Primorsky Territory”;

12) aircraft registered in the State Register of Civil Aircraft by persons who have received the status of a participant in a special administrative region in accordance with Federal Law of August 3, 2021 N 291-FZ “On special administrative regions in the territories of the Kaliningrad Region and Primorsky Territory.”

Article 359. Tax base

Contents of the Tax Code of the Russian Federation Part I Part II

1. The tax base is determined:

1) in relation to vehicles with engines (except for vehicles specified in subclause 1.1 of this paragraph) - as the vehicle engine power in horsepower;

1.1) in relation to air vehicles for which the thrust of a jet engine is determined - as the nameplate static thrust of the jet engine (the total nameplate static thrust of all jet engines) of the aircraft at take-off mode in terrestrial conditions in kilograms of force;

2) in relation to non-self-propelled (towed) water vehicles for which gross tonnage is determined - as gross tonnage;

3) in relation to water and air vehicles not specified in subparagraphs 1, 1.1 and 2 of this paragraph - as a unit of vehicle.

2. In relation to vehicles specified in subparagraphs 1, 1.1 and 2 of paragraph 1 of this article, the tax base is determined separately for each vehicle.

In relation to vehicles specified in subparagraph 3 of paragraph 1 of this article, the tax base is determined separately.

Article 360. Tax period. Reporting period

Contents of the Tax Code of the Russian Federation Part I Part II

1. The tax period is a calendar year.

2. Reporting periods for taxpayer organizations are the first quarter, second quarter, and third quarter.

3. When establishing a tax, the legislative (representative) bodies of the constituent entities of the Russian Federation have the right not to establish reporting periods.

Article 361. Tax rates

Contents of the Tax Code of the Russian Federation Part I Part II

1. Tax rates are established by the laws of the constituent entities of the Russian Federation, respectively, depending on the engine power, jet engine thrust or gross tonnage of the vehicle per one horsepower of the vehicle engine, one kilogram of jet engine thrust, one register ton, one unit of gross tonnage vehicle or one unit of vehicle in the following sizes:

| Name of taxable object | Tax rate (in rubles) |

| Passenger cars with engine power (per horsepower): | |

| up to 100 hp (up to 73.55 kW) inclusive | 2,5 |

| over 100 hp up to 150 hp (over 73.55 kW to 110.33 kW) inclusive | 3,5 |

| over 150 hp up to 200 hp (over 110.33 kW to 147.1 kW) inclusive | 5 |

| over 200 hp up to 250 hp (over 147.1 kW to 183.9 kW) inclusive | 7,5 |

| over 250 hp (over 183.9 kW) | 15 |

| Motorcycles and scooters with engine power (per horsepower): | |

| up to 20 hp (up to 14.7 kW) inclusive | 1 |

| over 20 hp up to 35 hp (over 14.7 kW to 25.74 kW) inclusive | 2 |

| over 35 hp (over 25.74 kW) | 5 |

| Buses with engine power (per horsepower): | |

| up to 200 hp (up to 147.1 kW) inclusive | 5 |

| over 200 hp (over 147.1 kW) | 10 |

| Trucks with engine power (per horsepower): | |

| up to 100 hp (up to 73.55 kW) inclusive | 2,5 |

| over 100 hp up to 150 hp (over 73.55 kW to 110.33 kW) inclusive | 4 |

| over 150 hp up to 200 hp (over 110.33 kW to 147.1 kW) inclusive | 5 |

| over 200 hp up to 250 hp (over 147.1 kW to 183.9 kW) inclusive | 6,5 |

| over 250 hp (over 183.9 kW) | 8,5 |

| Other self-propelled vehicles, pneumatic and tracked machines and mechanisms (per horsepower) | 2,5 |

| Snowmobiles, motor sleighs with engine power (per horsepower): | |

| up to 50 hp (up to 36.77 kW) inclusive | 2,5 |

| over 50 hp (over 36.77 kW) | 5 |

| Boats, motor boats and other water vehicles with engine power (per horsepower): | |

| up to 100 hp (up to 73.55 kW) inclusive | 10 |

| over 100 hp (over 73.55 kW) | 20 |

| Yachts and other sailing-motor vessels with engine power (per horsepower): | |

| up to 100 hp (up to 73.55 kW) inclusive | 20 |

| over 100 hp (over 73.55 kW) | 40 |

| Jet skis with engine power (per horsepower): | |

| up to 100 hp (up to 73.55 kW) inclusive | 25 |

| over 100 hp (over 73.55 kW) | 50 |

| Non-self-propelled (towed) ships for which the gross tonnage is determined (for each registered ton or gross tonnage unit if the gross tonnage is determined without specifying the dimension) | 20 |

| Airplanes, helicopters and other aircraft with engines (per horsepower) | 25 |

| Airplanes with jet engines (per kilogram of thrust) | 20 |

| Other water and air vehicles without engines (per vehicle unit) | 200 |

2. The tax rates specified in paragraph 1 of this article may be increased (decreased) by the laws of the constituent entities of the Russian Federation, but not more than ten times.

The specified limitation on the amount of reduction in tax rates by the laws of the constituent entities of the Russian Federation does not apply to passenger cars with an engine power (per horsepower) of up to 150 hp. (up to 110.33 kW) inclusive.

3. It is allowed to establish differentiated tax rates for each category of vehicles, as well as taking into account the number of years that have passed since the year of production of the vehicles and (or) their environmental class.

The number of years that have passed since the year of manufacture of the vehicle is determined as of January 1 of the current year in calendar years from the year following the year of manufacture of the vehicle.

4. If tax rates are not determined by the laws of the constituent entities of the Russian Federation, taxation is carried out at the tax rates specified in paragraph 1 of this article.

Article 361.1. Tax benefits

Contents of the Tax Code of the Russian Federation Part I Part II

1 - 2. Lost force in accordance with Federal Law dated July 3, 2016 No. 249-FZ.

3. Taxpayers entitled to tax benefits established by the legislation on taxes and fees shall submit an application for a tax benefit to the tax authority of their choice, and also have the right to submit documents confirming the taxpayer’s right to a tax benefit. The specified application and documents can be submitted to the tax authority through the multifunctional center for the provision of state and municipal services.

If documents confirming the taxpayer’s right to a tax benefit are not available to the tax authority, including those not submitted by the taxpayer independently, the tax authority, based on the information specified in the taxpayer’s application for a tax benefit, requests information confirming the taxpayer’s right to a tax benefit, from authorities and other persons who have this information.

An authority or other person that has received a request from a tax authority to provide information confirming the taxpayer’s right to a tax benefit fulfills it within seven days from the date of receipt or, within the same period, informs the tax authority about the reasons for non-fulfillment of the request.

The tax authority, within three days from the date of receipt of the specified message, is obliged to inform the taxpayer about the failure to receive, upon request, information confirming the right of this taxpayer to a tax benefit, and about the need for the taxpayer to submit supporting documents to the tax authority.

An application for a tax benefit is considered by the tax authority within 30 days from the date of its receipt. If the tax authority sends a request provided for in this paragraph, the head (deputy head) of the tax authority has the right to extend the period for consideration of the application for a tax benefit by no more than 30 days, notifying the taxpayer about this.

Based on the results of consideration of an application for a tax benefit, the tax authority sends to the taxpayer in the manner specified in this application a notice of the provision of a tax benefit or a message of refusal to provide a tax benefit.

The notice of granting a tax benefit must indicate the grounds for granting the tax benefit, the objects of taxation and the periods for which the tax benefit is provided. The notice of refusal to provide a tax benefit must indicate the grounds for refusal to provide a tax benefit, the objects of taxation, as well as the period from which the tax benefit is not provided.

Forms of applications from taxpayers - organizations and individuals for the provision of tax benefits, the procedure for filling them out, formats for submitting such applications in electronic form, forms of notification of the provision of tax benefits, messages about refusal to provide tax benefits are approved by the federal executive body authorized for control and supervision in the field of taxes and fees.

If a taxpayer, an individual entitled to a tax benefit, has not submitted an application for a tax benefit to the tax authority or has not reported a refusal to apply a tax benefit, the tax benefit is provided on the basis of information received by the tax authority in accordance with this Code and other federal laws, starting from the tax period in which the taxpayer - an individual arose the right to a tax benefit.

Article 362. Procedure for calculating the amount of tax and amounts of advance payments for tax

Contents of the Tax Code of the Russian Federation Part I Part II

1. Taxpaying organizations shall calculate the amount of tax and the amount of advance tax payment independently. The amount of tax payable by individual taxpayers is calculated by tax authorities on the basis of information submitted to tax authorities by bodies (organizations, officials) carrying out state registration of vehicles on the territory of the Russian Federation, unless otherwise provided by paragraph 3.1 of this article.

2. The amount of tax payable to the budget at the end of the tax period is calculated for each vehicle as the product of the corresponding tax base and tax rate, unless otherwise provided by this article.

The amount of tax payable to the budget by taxpayer organizations is determined as the difference between the calculated amount of tax and the amounts of advance tax payments payable during the tax period.

The tax amount is calculated taking into account the increasing coefficient:

1.1 - in relation to passenger cars with an average cost of 3 million to 5 million rubles inclusive, from the year of manufacture of which no more than 3 years have passed;

2 - in relation to passenger cars with an average cost of 5 million to 10 million rubles inclusive, no more than 5 years have passed since the year of manufacture;

3 - in relation to passenger cars with an average cost of 10 million to 15 million rubles inclusive, from the year of manufacture of which no more than 10 years have passed;

3 - for passenger cars with an average cost of 15 million rubles, the year of which no more than 20 years have passed.

In this case, the calculation of the periods specified in this paragraph begins with the year of manufacture of the corresponding passenger car.

The procedure for calculating the average cost of passenger cars for the purposes of this chapter is determined by the federal executive body exercising the functions of developing state policy and legal regulation in the field of trade. The list of passenger cars with an average cost of 3 million rubles, subject to use in the next tax period, is posted no later than March 1 of the next tax period on the official website of the specified body on the Internet information and telecommunications network.

2.1. Taxpaying organizations calculate the amount of advance tax payments at the end of each reporting period in the amount of one-fourth of the product of the corresponding tax base and the tax rate, taking into account the increasing coefficient specified in paragraph 2 of this article.

3. In the case of registration of a vehicle and (or) deregistration of a vehicle (deregistration, exclusion from the state ship register, etc.) during the tax (reporting) period, the amount of tax (the amount of advance payment for tax) is calculated taking into account the coefficient defined as the ratio of the number of full months during which the vehicle was registered to the taxpayer to the number of calendar months in the tax (reporting) period.

If the registration of a vehicle occurred before the 15th day of the corresponding month inclusive, or the deregistration of the vehicle (deregistration, exclusion from the state ship register, etc.) occurred after the 15th day of the corresponding month, the month of registration (removal) is taken as the full month from registration) of the vehicle.

If the registration of the vehicle occurred after the 15th day of the corresponding month or the deregistration of the vehicle (deregistration, exclusion from the state ship register, etc.) occurred before the 15th day of the corresponding month inclusive, the month of registration (deregistration) of the vehicle funds are not taken into account when determining the coefficient specified in this paragraph.

3.1. In relation to a taxable object that has ceased to exist due to its destruction or destruction, tax calculation ceases on the 1st day of the month of the destruction or destruction of such an object on the basis of an application for its destruction or destruction submitted by the taxpayer to the tax authority of his choice. With this application, the taxpayer has the right to submit documents confirming the fact of death or destruction of the taxable object. The specified application and documents can be submitted to the tax authority by individual taxpayers through the multifunctional center for the provision of state and municipal services.

If documents confirming the death or destruction of a taxable object are not available to the tax authority, including those not submitted by the taxpayer independently, the tax authority, based on the information specified in the taxpayer’s application for the death or destruction of a taxable object, requests information confirming the fact of death or destruction of the taxable object. destruction of the taxable object, from authorities and other persons who have this information.

An authority or other person that has received a request from a tax authority to provide information confirming the fact of the death or destruction of a taxable object shall execute the said request within seven days from the date of its receipt or, within the same period, notify the tax authority of the reasons for non-fulfillment of the request.

The tax authority, within three days from the date of receipt of the specified message, is obliged to inform the taxpayer about the failure to receive upon request information confirming the death or destruction of the taxable object, and about the need for the taxpayer to submit supporting documents to the tax authority.

An application for the death or destruction of a taxable object is considered by the tax authority within 30 days from the date of its receipt. If the tax authority sends a request provided for in this paragraph, the head (deputy head) of the tax authority has the right to extend the period for consideration of such an application by no more than 30 days, notifying the taxpayer about this.

Based on the results of consideration of the application for the death or destruction of a taxable object, the tax authority sends to the taxpayer in the manner specified in this application a notice of termination of tax calculation in connection with the death or destruction of a taxable object or a message about the absence of grounds for termination of tax calculation in connection with the death or destruction of the object taxation.

The notice of termination of tax calculation due to the loss or destruction of a taxable object must indicate the grounds for termination of tax calculation, the objects of taxation and the period from which tax calculation ceases. The message about the absence of grounds for stopping the calculation of tax due to the death or destruction of an object of taxation must indicate the grounds for refusal to terminate the calculation of tax and the objects of taxation.

Form of application for the death or destruction of a taxable object, the procedure for filling it out, the format for submitting such an application in electronic form, forms of notification of termination of tax calculation in connection with the death or destruction of a taxable object, notification of the absence of grounds for termination of tax calculation in connection with death or destruction objects of taxation are approved by the federal executive body authorized for control and supervision in the field of taxes and fees.

4 - 5. Lost force in accordance with Federal Law dated July 23, 2013 No. 248-FZ.

6. The legislative (representative) body of a constituent entity of the Russian Federation, when establishing a tax, has the right to provide for certain categories of taxpayers the right not to calculate or pay advance tax payments during the tax period.

Article 363. Procedure and terms for payment of tax and advance payments of tax

Contents of the Tax Code of the Russian Federation Part I Part II

1. Payment of tax and advance payments of tax is made by taxpayers to the budget at the location of the vehicles.

The procedure and deadlines for payment of tax and advance payments of tax for taxpayer organizations are established by the laws of the constituent entities of the Russian Federation. In this case, the deadline for paying the tax cannot be set earlier than the deadline provided for in paragraph 3 of Article 363.1 of this Code.

The tax is payable by individual taxpayers no later than December 1 of the year following the expired tax period.

2. During the tax period, taxpayers-organizations pay advance tax payments, unless otherwise provided by the laws of the constituent entities of the Russian Federation. At the end of the tax period, taxpayers-organizations pay the amount of tax calculated in the manner prescribed by paragraph 2 of Article 362 of this Code.

3. Taxpayers - individuals pay transport tax on the basis of a tax notice sent by the tax authority.

Sending a tax notice is allowed no more than three tax periods preceding the calendar year of its sending.

Taxpayers specified in paragraph one of this paragraph pay tax for no more than three tax periods preceding the calendar year of sending the tax notice specified in paragraph two of this paragraph.

Refund (credit) of the amount of overpaid (collected) tax in connection with the recalculation of the tax amount is carried out for the period of such recalculation in the manner established by Articles 78 and this Code.

Article 363.1./b> Lost force as of January 1, 2021 (Federal Law dated April 15, 2019 No. 63-FZ)

Contents of the Tax Code of the Russian Federation Part I Part II

Documents supporting the benefit do not need to be submitted.

There are significant changes to the transport tax from 2021 regarding the procedure for obtaining benefits for it. The bottom line is that from January 1, 2018, an application can be submitted to the Federal Tax Service without supporting documents. As a result, it is now easier to claim a benefit and without unnecessary paperwork (Law No. 286-FZ dated September 30, 2017, as amended by the Tax Code of the Russian Federation).

According to the new edition of paragraph 3 of Art. 361.1 of the Tax Code of the Russian Federation, if the owner of a vehicle has submitted an application for a benefit to the Federal Tax Service, indicated in it the relevant supporting documents, but did not submit them, the inspector is obliged to make a request to the bodies/organizations/officials that issued them. If they do not provide documents, the inspector will request them from the citizen himself. And then the individual will receive an answer about whether the benefit is approved or not.

According to the new rules, no more than 10 days can pass from the moment of filing an application for a transport tax benefit to receiving a response from the Federal Tax Service.

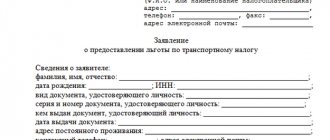

In connection with these changes, from 01/01/2018 a new application form for benefits on three taxes is in force - for land, transport and property. It was approved by order of the Federal Tax Service of Russia dated November 14, 2021 No. ММВ-7-21/897. This is what it looks like in terms of transport tax:

As you can see, from 2021 the form of this application is more similar to a tax return. In any case, the structure and filling principle have become similar.

The main thing is that from 2021 the owner of the vehicle can choose from two options:

1. Immediately submit to the Federal Tax Service, along with an application for a benefit, documents justifying the right to it.

2. Just provide the details of these documents in the application.

You can see how the consideration of an application for a transport tax benefit is progressing in your personal account on the website of the Federal Tax Service of Russia. If one is not connected, you can choose another method of notification:

• at the tax office;

• MFC (“My Documents”) through which the application was submitted;

• by mail.

You can apply for a transport tax benefit to any Federal Tax Service Inspectorate, as well as through an individual’s personal account on the website of the Federal Tax Service of Russia.

Deadlines for payment of transport tax by legal entities in 2021

Starting from 2021, a single payment deadline for transport tax has been approved. It no longer depends on the region and is the same for all of Russia.

Organizations are required to pay transport tax for the past year no later than March 1 of the following year. Thus, companies pay tax for 2020 until 03/01/2021.

Regions still have the right to establish their own procedure for transferring taxes and oblige organizations to make advance payments. At the same time, regions no longer set deadlines for paying advances; they are also the same for the entire Russian Federation:

- 04/30/2021 — advance payment for the 1st quarter;

- 08/02/2021 — advance payment for the 2nd quarter;

- 01.11.2021 — advance payment for the 3rd quarter.

New declaration form for 2017

Order of the Federal Tax Service of Russia dated December 5, 2021 No. ММВ-7-21/668 established a new form of transport declaration. In 2021, you need to report for 2017 on this form, which no longer needs to be stamped. The deadline remains the same - no later than February 1, 2018. It will be a working day - Thursday.

Among other things, Section 2 of the declaration has been adjusted. The following lines appeared in it:

- vehicle registration date;

- date of termination of vehicle registration (deregistration);

- year of manufacture of the vehicle;

- tax deduction code;

- the amount of tax deduction (in rubles).

In addition, the new form provides the opportunity to indicate a tax benefit and/or deduction for heavy cargo registered in the Platon system.

Another important innovation is the ability to indicate the total tax amount for all vehicles located in the same region (by prior agreement with the local Federal Tax Service).

The rules for filling out the declaration have also been clarified if the registration of a vehicle or deregistration occurred before or after the 15th day of the corresponding month.

Also see “What will change in 2021: taxes, insurance premiums, reporting, accounting and a new fee.”

Read also

08.10.2018