When transitioning or initially choosing a simplified taxation system, the relevant business entities must immediately determine which simplified tax rates they will use in 2021. There are two options: applying a fixed tax rate to the total amount of income received or an increased rate to income, but reduced by expenses incurred. The amount of tax, the procedure for its calculation and the rules for accounting for costly transactions depend on the object of taxation. We'll tell you how much the simplified version will cost today.

Base rates

When a choice of taxation principle has been made, the question arises: according to the simplified tax system, which rate is more profitable and how to apply them in practice. Article 346.20 of the Tax Code of the Russian Federation fixes two base rates for simplifiers:

- 6% – if the taxable object is only a complex of income receipts;

- 15% – provided that the tax is levied on income minus expenses recognized as justified.

In the second option, only those costs that were aimed at obtaining material benefits and are included in the legally approved list are taken into account. It is enshrined in Art. 346.16 Tax Code of the Russian Federation. Moreover, for expenses, tax law provides for different dates for their recognition depending on the type of expenses incurred.

Individual entrepreneur and simplified tax

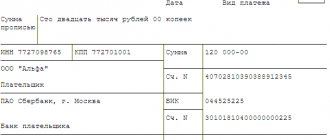

Tax under the simplified tax system is paid in advances, which are transferred to the budget no later than the 25th day of the month following the reporting quarter (Article 346.21 of the Tax Code of the Russian Federation). If the “deadline” falls on a weekend, it is moved to the next weekday date.

In practice, this means that the deadline for paying the simplified tax system for individual entrepreneurs for 2018 in advance fell on the following dates:

- 25.04.18;

- 25.07.18;

- 25.10.18.

The final settlement with the budget is made no later than the deadline established for submitting a tax return to the Federal Tax Service, namely: April 30 (Article 346.23 of the Tax Code of the Russian Federation). If the specified date is a weekend or public holiday, the “deadline” is shifted to the next weekday.

This year 30.04 is a working day. This means that the payment of the simplified tax system for 2021 by individual entrepreneurs is made precisely on this date - 04/30/2019..

Experts do not recommend that entrepreneurs delay the payment of taxes, since this violation entails the accrual of penalties.

Regional rates

In the constituent entities of the Russian Federation, according to the simplified tax system “Income minus Expenses”, the rate may be less than the base value. Thus, the current rules allow for legislative approval of rates of this type in the range of 5–15% at the level of an individual region. To reduce the tax burden in relation to the activities of simplifiers, the authorities of a constituent entity of the Russian Federation must issue a law changing the size of the rate under the simplified tax system. Regional authorities have also been granted the right to adjust the tax rate in relation to the simplified tax system rate in 2021 for the “Revenue” object. Fluctuations in this percentage tax rate are allowed within 1 – 6%. Each update of the value of this indicator must also be supported by legislation.

How to switch to simplified tax system

The transition to the simplified tax system in 2021, as before, is of a notification nature. The notification form was approved by Order of the Federal Tax Service of Russia dated November 2, 2012 N ММВ-7-3/ [email protected] , no changes were made to it.

The current application form and a sample for filling it out are published in the article “How to write a notice of transition to the simplified tax system.” In addition, when preparing documents for registration of individual entrepreneurs and LLCs in our service, the applicant receives an automatically completed form.

The timing of the transition to a simplified taxation system depends on whether the taxpayer is a newly created business entity or not.

- For newly registered organizations and individual entrepreneurs - within 30 days after state registration at any time of the year. In this case, the date of transition to the simplified system is the date of state registration, and not the actual submission of the application. For example, if an LLC was created on November 10, and the notification was submitted on November 30, then the organization is recognized as a simplified organization from November 10, and not from November 30.

- For already operating companies and individual entrepreneurs - from the beginning of the new year, provided that the notification is submitted no later than December 31 of the current year. However, you can switch to the simplified tax system in 2021 even later, because the last day of 2021 is a day off. In accordance with the rule for postponing the date under Article 6.1 of the Tax Code of the Russian Federation, the transition can be reported no later than January 9, 2021.

Submit a notification of the transition to a simplified taxation system in two copies to the tax office at the place of registration of the LLC or individual entrepreneur. In principle, a second copy with an acceptance mark from the Federal Tax Service is sufficient for the applicant to be recognized as a payer of the simplified tax system.

However, for greater confidence, as well as for working with counterparties, you can request confirmation that you actually submitted a notification about the transition to a preferential simplified regime. To do this, send a written request to the inspection in free form. In response, you should be sent an Information Letter in form No. 26.2-7.

Rates for individual entrepreneurs on the simplified tax system

Paragraph 4 of Article 346.20 of the Tax Code of the Russian Federation regulates special conditions for taxation of individual entrepreneurs:

- specializing in the production of products;

- conducting main activities in the social or scientific sphere;

- providing household services to the population.

Under the simplified tax system, tax rates for this category of payers may be zero. This benefit is allowed for use during the first 2 years after state registration, subject to a number of conditions:

- an individual registered for the first time as an individual entrepreneur;

- at the end of the tax period, at least 70% of income is allocated to preferential types of activities.

Minimum payments

If an enterprise applies the simplified tax system “Income – Expenses”, the tax rate must be at least 1%, regardless of the amount of income. An exception is made for situations where no income was recorded for the entire tax period.

When receiving even a small income that turns out to be less than or equal to the expenses incurred, the tax must be calculated at a minimum one percent rate.

For business entities that use a simplified taxation system, rates of 1% are relevant if the following conditions are met:

- tax liability is calculated according to the “Income minus Expenses” principle;

- during the reporting period, revenue receipts were recorded;

- the difference between cash receipts and production expenses turned out to be zero or negative.

In the described situation, according to the simplified tax system, the 2021 rates in the minimum amount are applied to the amount of income received during the reporting period of time.

For more information about this, see “Payment of the minimum tax under the simplified tax system.”

USN-2018: main changes

The income and expense accounting book and the new list of activities for which entrepreneurs pay reduced insurance premiums are the main changes in the simplified tax system, which came into force in January 2021.

USN in 2021: updated KUDiR form

In December 2021, a new form of KUDiR was adopted, which in 2017 could be used by simplifiers on a voluntary basis. After January 1, 2021, it became mandatory for everyone who applies the simplified tax system. Section V has appeared in KUDiR - “The amount of the trade fee, which reduces the amount of tax paid in connection with the application of the simplified tax system (advance payments for tax), calculated for the object of taxation from the type of business activity in respect of which the trade fee is established.” This section needs to be completed only by taxpayers with the simplified tax system for the object “income”, who pay a trade fee that reduces tax under the simplified tax system. Please note that only part of the tax under the simplified tax system, calculated from the taxable activity fee, can be reduced by the trade fee. We recommend that such simplifiers keep separate records by type of activity, indicating the one for which the trading fee is paid. Using income minus expenses, include the entire collection amount in tax expenses.

Simplified tax system in 2021: income limit for simplifiers

The deflator coefficient for the purpose of applying the simplified tax system has been re-approved, but the income limit for simplified people in 2021 does not change. This is due to the fact that Federal Law No. 243-FZ suspended the mechanism for indexing income limits by a deflator coefficient for the purposes of applying the simplified tax system until 2021. Thus, the deflator coefficient for the simplified tax system in 2021 for income limits is not applied.

Simplified tax system in 2021: list of income exempt from taxation under the simplified tax system

It included:

- dividends left by the management of the enterprise at the disposal of the company;

- property, shares, shares, etc., contributed as a contribution to the property of the enterprise.

Please note: if the property is to be sold, the income tax benefit disappears. The tax will need to be paid in full. However, this Federal Law does not contain information on the correct conduct of this operation. Usually it is necessary to draw up minutes of the meeting where the decision is proposed and assistance is provided to increase net assets.

Simplified tax system in 2021: corporate property tax

Companies using the simplified tax system pay property tax with cadastral value. Therefore, it is necessary to provide a declaration. From January 1, 2021, it must be filled out according to the new form adopted by the Order of the Federal Tax Service of the Russian Federation dated March 31, 2017. The deadline for submitting the declaration is March 30, 2021. According to the new form, the title page no longer contains the details “M.P.” and "OKVED". In Section 3 the following lines are adopted:

- Property code “001” - Appendix 5 to the Procedure for filling out the calculation. For cadastral objects - code 11; for apartments and residential buildings not accounted for as fixed assets - code 13.

- Share in the right of common ownership “030” – to be filled in if we have a share together with a legal entity or individual entrepreneur.

- Share of cadastral value - is indicated if the simplifier owns premises in a shopping or office center, and the cadastral value is determined for the entire building.

Simplified tax system in 2021: simplified minimum tax

The minimum tax is valid at the simplified tax system rate “income minus expenses” and arises only at the end of the year. Every quarter we calculate and pay the tax as usual: from the income from the beginning of the year, you need to subtract expenses, multiply by the tax rate of the simplified tax system “Income - Expenses” in the region - this will give you the tax that needs to be paid. After the tax period: calculate the tax as usual. Then you need to compare the amount received with the minimum tax - 1% of annual income. If the amount received is more than 1% of income or equal to this amount, you need to pay regular tax under the simplified tax system. If the tax is less than 1% of income, then we pay the minimum tax. Example. Entrepreneur Ivanov A.A. I decided to use the simplified tax system with the object “income minus expenses. During the tax period, he received income in the amount of 30 million rubles, while his expenses for the same period amounted to 29 million rubles. Let's calculate the tax base: 30 million – 29 million = 1 million rubles. The tax amount for such an object of taxation is: 1 million x 15% = 150,000 rubles. Let's calculate the minimum tax: 30 million x 1% = 300,000 rubles. The state needs to pay exactly the amount of 300,000 rubles, and not 150,000 rubles.

Have questions?

Contact us and we will answer them, +7 (343) 222-16-02

Best regards, e-office24 team!

Share with your friends!

Regional differences

In some regions of the Russian Federation, to improve the business climate, laws have been adopted to reduce rates under the simplified taxation regime.

Thus, for entrepreneurs registered in Moscow, the rate for the tax object “Income – Expenses” is 10%. The norm is provided for by the Law of the capital dated October 7, 2009, No. 41. The conditions for its application are as follows:

- the preferential line of activity must bring at least 75% of total revenue;

- a commercial structure specializes in the provision of social services, is engaged in the field of sports, manufacturing, agriculture (livestock or crop production).

For those who have switched to or chosen the simplified tax system, rates by region in 2018 will vary. Thus, in more than 70% of Russian regions, preferential conditions have been adopted for the “Income minus Costs” scheme, and in other regions, reduced rates are also applied to the amount of income.

It should be noted that the benefits established by regional authorities often extend only to certain areas of business. Typically, the allocation of benefits for areas of business is aimed at enhancing commercial and industrial activities in segments with a low level of popularity among entrepreneurs and small firms due to their low profitability (as a rule).

EXAMPLE

In the Lipetsk region, for simplified people under the “Income minus Expenses” system, a differentiated rate applies - 5% and 10%. These values are relevant for 31 and 42 activities, respectively. The minimum rate is applied to business entities engaged in agriculture, science, education, and information systems.

Also see “Changes to the simplified tax system in 2021”.

Read also

14.03.2018

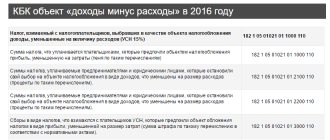

Taxes under the simplified tax system “income minus expenses”

Taxpayers using the simplified tax system are exempt from paying:

- property tax, except for real estate, the value of which is determined as cadastral (this, in particular, office, retail and service premises and buildings);

- VAT (with rare exceptions);

- income tax (for self-employed persons - personal income tax), except for income in the form of dividends and income taxed at special rates.

Other taxes, fees and contributions are paid on a general basis.

Read about what rules to follow when applying the simplified tax system in 2018-2019 in terms of insurance premiums.

If taxpayers have chosen a taxation system such as the simplified “income minus expenses” with a rate of 15%, then they must maintain KUDiR. You must have all documents confirming expenses and their payment. “Simplified” taxpayers are required to conduct cash transactions in accordance with the general procedure. And also submit tax and statistical reporting.

For information about the “simplified” option not to use online cash registers when providing services to the population (except for public catering services) until July 1, 2019, read the publication “A deferment for online cash registers has been introduced.”

Taxpayers who have chosen income-minus-expenses taxation are not exempt from performing the duties prescribed for tax agents. In addition, they must comply with all controlling person regulations if they hold relevant interests in controlled foreign companies.