Home / Plaintiff

Back

Published: March 10, 2020

Reading time: 19 min

0

13

- 1 Formation and use of additional capital as a result of the formation of exchange rate differences on contributions from founders

- 2 Formation and use of additional capital (postings) as a result of the revaluation of fixed assets 2.1 Examples

- 8.1 Examples

BASIC: income tax

The procedure for tax accounting of transactions related to a decrease in the authorized capital depends on the reasons why the company reduces this indicator.

If an organization reduces its authorized capital voluntarily (at the initiative of the organization), the amount of this reduction must be included in non-operating income. The amount by which the authorized capital was reduced, regardless of the method used for calculating income tax, must be included in non-operating income as of the date of state registration of changes in the charter (clause 1 of Article 271, clause 2 of Article 273 of the Tax Code of the Russian Federation). But if the amounts by which the nominal value of the participants’ shares decreased were paid to them, then the reduction in the authorized capital does not affect the calculation of the income tax of the organization itself.

If an organization reduces its authorized capital in accordance with legal requirements, then the specified amount of reduction is not recognized as income of the organization. Even if the authorized capital is reduced below the net assets.

This follows from paragraph 16 of Article 250 and subparagraph 17 of paragraph 1 of Article 251 of the Tax Code of the Russian Federation and is confirmed by letters from the Ministry of Finance of Russia dated May 23, 2014 No. 03-03-RZ/24777, dated August 6, 2013 No. 03-03-10/ 31651 (brought to the attention of the tax inspectorates by letter of the Federal Tax Service of Russia dated August 15, 2013 No. AS-4-3/14908).

The amount of the state duty paid for amending the charter should be included in other expenses (subclause 1, clause 1, article 264 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of Russia for Moscow dated June 26, 2006 No. 20-12/56686). When using the accrual method, take into account the amount of the state duty at the time of its accrual (subclause 1, clause 7, article 272 of the Tax Code of the Russian Federation). With the cash method - as it is paid to the budget (subclause 3, clause 3, article 273 of the Tax Code of the Russian Federation).

An example of how to reflect in accounting and taxation a voluntary reduction of the authorized capital by reducing the nominal value of the shares of all participants in the company. The corresponding part of the deposits by which the organization has reduced the nominal value of the participants’ shares is not returned to them. The organization applies a general taxation system and calculates income tax using the accrual method

The participants of LLC “Trading Company “Hermes”” are JSC “Alfa” and JSC “Production Company “Master””. The authorized capital of Hermes is 800,000 rubles. The organization calculates income tax on a monthly accrual basis.

In February 2021, by the minutes of the general meeting of participants, it was decided to reduce the authorized capital by 300,000 rubles.

As of the date of the decision to reduce the authorized capital, Alpha’s share is 60 percent with a nominal value of RUB 480,000. (800,000 rubles × 60%), the share of the “Master” is 40 percent with a nominal value of 320,000 rubles. (RUB 800,000 × 40%).

When the authorized capital was reduced, the size of the participants' shares remained the same, and their nominal value decreased proportionally by:

- 180,000 rub. (RUB 300,000 × 60%) - from Alpha;

- 120,000 rub. (RUB 300,000 × 40%) – from “Master”.

There is no provision for a refund to participants of amounts by which the nominal value of their shares has decreased.

For state registration of changes in the charter, Hermes paid a state fee of 800 rubles.

In March 2021, a decrease in the authorized capital was registered.

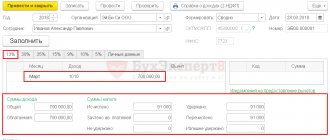

The Hermes accountant made the following entries in the accounting.

On the date of payment of the state duty:

Debit 68 subaccount “State duty” Credit 51 – 800 rub. – the state duty for registration of changes in the charter is transferred.

As of the date of state registration of changes in the charter:

Debit 80 Credit 75-1 – 300,000 rub. – a decrease in the authorized capital is reflected;

Debit 91-2 Credit 68 subaccount “State duty” - 800 rubles. – the state duty for registering changes in the charter was included in other expenses;

Debit 75-1 Credit 91-1 – 300,000 rubles. – the amount by which the authorized capital decreased was included in other income.

When calculating income tax for March 2021, the accountant took into account RUB 300,000 as non-operating income.

Reducing the capital of a company - tax consequences for participants

In this article I will allow myself to speculate more than to state facts and give answers. Because this topic (very controversial to this day) raises a number of questions in me.

I will consider several situations, from simple to more complex.

- Reduction of the authorized capital of the company.

To begin with, let’s define that the authorized capital in this case means the capital of the company registered and reflected in the constituent documents - the nominal value of the share (Article 14 of the Federal Law “On Limited Liability Companies”, Article 25 of the Federal Law “On Joint-Stock Companies”). The actual value of shares (including the company's net assets, additional capital) is not included in the concept of par value.

In this situation, there are no questions, because the law directly stipulates that payments received by participants (shareholders) as a result of a decrease in the nominal value of the authorized capital are exempt from taxation. For individuals, this is indicated in paragraph 1 of Art. 220 of the Tax Code of the Russian Federation, which provides for a tax deduction in the amount of expenses incurred when receiving profit in the form of funds from reducing the nominal authorized capital of the company. Clause 2 of the same article states that instead of receiving a property tax deduction, the taxpayer has the right to reduce the amount of his taxable income by the amount of expenses actually incurred and documented by him related to the acquisition of this property. Those. if a company participant can prove with documents that he contributed this amount independently to pay for the nominal value of his share in an LLC (shares in a joint-stock company) or purchased this share from a third party at a similar price, then he will not have to pay tax (similarly with shares).

Regarding legal entities, paragraphs. 4 clause 1 art. 251 of the Tax Code of the Russian Federation stipulates that when determining the tax base, income in the form of property, property rights that are received within the limits of the contribution of a participant in the organization is not taken into account when the authorized capital is reduced.

- Reducing the added value of a share (shares) of the company.

Here the situation is already ambiguous. Let us define that by additional capital we mean the assets of the company (in addition to the authorized capital), in particular financial assistance and contributions to property from participants (shareholders) (Article 27 of the Federal Law on LLCs and Article 32.2 of the Federal Law on Joint-Stock Companies). The situation under consideration: the participants invested certain funds in the company’s property (they are reflected in the statements as additional capital) and after a while decided to return these funds back by reducing the capital. The above articles of the Tax Code of the Russian Federation are applicable to the nominal authorized capital. Can their same logic be applied to other investments of participants in the capital of the company (in excess of the nominal authorized capital)?

In accordance with Art. 41 of the Tax Code of the Russian Federation, economic benefit is recognized as income. If the participant received back exactly as much as he invested, then there is no economic benefit, and therefore no income. But confusion is caused by the letter of the Ministry of Finance dated February 6, 2021 N 03-08-05/6035, which provides an answer to the situation where a Russian company pays funds to a Cypriot participant in connection with a decrease in additional capital. There is a reference to the already mentioned paragraph 4, paragraph 1 of Art. 251 of the Tax Code of the Russian Federation and then there is a clause literally as follows: “Since in the case under consideration there is neither a reduction in the authorized capital, nor the withdrawal of a participant from the company, nor the liquidation of the company, the payments received by the participant should be recognized as income... Thus, based on the above, the income paid to the participant of the Russian company - a resident of the Republic of Cyprus in connection with a decrease in the additional capital of the company, is recognized as the income of the specified participant.” Those. The Ministry of Finance asserts that the articles of the Tax Code applicable in terms of reducing the nominal value of the authorized capital do not apply to the case of reducing additional capital. But such payments cannot be recognized as income if they do not exceed the amount of the participant’s contribution, because the participant has no economic benefit.

Is it possible to apply by analogy the article regulating liquidation payments, which states that only the amount of payments exceeding the amount of the deposit is taxed? It would be logical. But this is not enshrined in law, if we interpret it literally.

In September 2021 in Art. 251 of the Tax Code of the Russian Federation clarified this issue by adding a type of income that is not taken into account when determining the tax base for taxation of organizations. Namely income:

"P. 11.1) in the form of funds received by an organization free of charge from a business company or partnership of which such organization is a shareholder (participant), within the amount of its contribution (contributions) to the property in the form of funds previously received by the business company or partnership from such an organization.” . It is important to keep documents confirming the amount of relevant contributions to the company. Moreover, this change applies to the period starting from 01/01/2019 (Federal Law of November 27, 2018 N 424-FZ).

I believe that this addition clarifies the situation and provides an answer to the question posed: payments in the form of a reduction in the company’s additional capital in favor of a participant (shareholder) are not taxed if there is documentary evidence of payment by this participant (shareholder) for this contribution. This position is also confirmed by the letter of the Ministry of Finance dated February 14, 2021 N 03-03-06/1/9345. But the question remains: if the participating organization did not itself make a contribution to the LLC, but bought a share of the LLC at a price equal to the amount of previously made contributions. Will the cost of acquiring a share be taken into account in this case? I suppose I should. But this will be discussed in more detail in the next example.

Also, I have not found a similar interpretation of exemption from taxation of any payments (and not just a reduction in the nominal authorized capital) when reducing the capital of the company in terms of taxation of individuals.

- Reduction of the premium of the Cyprus company and payment in favor of the Russian shareholder.

In Cyprus, the concept of authorized capital (paid and registered) and bonus (unregistered capital received in the form of contributions from shareholders in excess of the nominal value of shares) is also divided. Those. in Cyprus, a company can issue shares at a premium, while the amount of the authorized capital will be increased by the amount of the par value of the issued shares, and the amount of the premium on these shares will be reflected in the company’s accounting in a special section “Premium”. The size of the premium will affect the actual price of the shares. In my opinion, this situation in accounting and corporate understanding is identical to the authorized capital in the company and additional capital formed through contributions to property from participants (shareholders).

Situation: a Russian LLC, being the only participant in a Cyprus company, the shares of which it bought at the price of the company’s net assets (i.e. the price for the shares took into account the par value + premium paid by the previous shareholder), decided to return part of the capital previously paid by the previous shareholder Cyprus company by reducing the premium. How does the Russian tax authorities qualify these payments? This is not a reduction in the authorized capital. If we can draw an analogy with the Russian concept of additional capital, then the answer reflected in paragraph 2 of this article will be applicable to this situation. Provided that the shareholder can document the costs of purchasing shares in the amount of the premium received back. But this expense will be taken into account if, by analogy with the taxation of individuals, clause 2 of Art. 220 Tax Code of the Russian Federation. With regard to corporate income tax, there is no such clarification on expenses in the Tax Code of the Russian Federation.

Based on the presented materials, I draw the following conclusions regarding the tax consequences for individuals and legal entities when receiving payments from the company in the event of a decrease in capital:

- There is a discrepancy in the interpretation of tax consequences for participants when a company’s additional capital is reduced in terms of individuals and in terms of organizations. The Tax Code of the Russian Federation clearly indicated that this income for organizations is not taxable, but for individuals there is no clear position in the Code. Also with the question of confirming the costs of obtaining a share: will the cost of acquiring a share be taken into account when exempting from tax (for individuals there is a clear position on what will happen. For organizations it is not provided for, we are talking only about direct contributions to society).

- Individuals, in order to avoid unexpected taxes, must document all expenses (investments) associated with the company (in particular, for the acquisition of shares (shares) of the company). Then you can prove that there is no profit, and therefore there is nothing to tax.

- Legal entities must correctly reflect all investments in the company in their financial statements. So that in the future there will be no discrepancy between the item of expenditure on the society and the item of income from the society. Then you can justify that you are not receiving any profit from the payment received.

If any of your colleagues have encountered these issues in practice, please share your experience, I would be grateful.

Decrease in capital

The minimum amount of capital is regulated by law. Its value is calculated according to the minimum wage and depends on the form of ownership of the enterprise:

- LLC - 10 thousand rubles;

- CJSC - 100 minimum wage;

- OJSC - 1000 minimum wage;

- municipal enterprises - 1000 minimum wage;

- state enterprises - 5000 minimum wage.

The founders may decide to reduce the amount of their own funds by reducing the price of shares or repurchasing the Central Bank. As a result, the participant is paid a remuneration in the amount of the difference between the original and new costs. Income received as a result of reducing the capital capital by changing the value of the share is subject to personal income tax.

If the company has purchased the shares, they cannot be distributed among the owners. The Central Bank must be sold or canceled and, according to general rules, changes must be made to the constituent documents.

Never do this in church! If you are not sure whether you are behaving correctly in church or not, then you are probably not acting as you should. Here's a list of terrible ones.

Why are some babies born with an "angel's kiss"? Angels, as we all know, are kind to people and their health. If your child has the so-called angel's kiss, then you are out of luck.

10 charming celebrity children who look completely different today Time flies, and one day little celebrities become adults who are no longer recognizable. Pretty boys and girls turn into...

11 Weird Signs That You're Good in Bed Do you also want to believe that you please your romantic partner in bed? At least you don't want to blush and apologize.

Contrary to all stereotypes: a girl with a rare genetic disorder conquers the fashion world. This girl's name is Melanie Gaydos, and she burst into the fashion world quickly, shocking, inspiring and destroying stupid stereotypes.

Unforgivable Movie Mistakes You Probably Never Noticed There are probably very few people who don't enjoy watching movies. However, even in the best cinema there are mistakes that the viewer can notice.

When is the Criminal Code reduced?

Authorized capital (AC) is a concept inherent in commercial organizations: business entities (PJSC, JSC, LLC), business partnerships (HT), state unitary enterprises and municipal unitary enterprises (UP). The smallest amount of the Criminal Code is fixed by law (except for HT, which does not have such restrictions):

- for PJSC – 100,000 rubles;

- for JSC and LLC – 10,000 rubles;

- for state unitary enterprises – 5,000 minimum wages;

- for municipal unitary enterprises – 1,000 minimum wages.

In this case, the minimum wage is equal to the value established on the date of registration of the UE.

The owners of the listed legal entities have the right to reduce the capital on their own initiative, and in some situations this procedure is required by law. However, in any case, the charter capital cannot fall below its minimum value (as of the date of registration of changes in the constituent documents of the charter capital in the case of a voluntary reduction and on the date of registration of a legal entity in the case of a reduction due to obligation). If this happens, the legal entity will be liquidated. State unitary enterprises and municipal unitary enterprises that find themselves in a situation of mandatory reduction (when the capital capital is greater than the value of net assets (NA), but if reduced to NA, the capital capital will become less than required by law), they have 3 months from the end of the year to correct the situation, based on the results which this situation was created.

For information on how net assets are calculated, read the material “The procedure for calculating net assets on the balance sheet - formula 2015.”

According to the decision made by the owners, a reduction is possible when:

- The organizational and legal form of a legal entity is changing, and the new form allows for a lower value of the Criminal Code.

- The owners made this decision. Since with a voluntary reduction it is possible to pay them income, this procedure can be regarded as an analogue of the calculation of dividends.

The obligation to reduce the capital capital arises in the following situations:

- A PJSC, JSC or LLC has unpaid or undistributed shares (or unsold shares of the primary issue) or shares (shares) purchased by the business entity that could not be sold during the year.

- In a PJSC, JSC or LLC for 2 years, and in a unitary enterprise - at the end of the year, the value of the authorized capital turns out to be greater than the calculated value of the NA.

- A participant leaves the LLC, and he needs to pay his share at its real value, and the difference between the private equity and the charter capital is not enough for this.

Read about available ways to increase net assets in the article “Procedure for increasing net assets by founders (nuances).”

Regardless of the reason for reducing the capital, you need to do the following before doing so:

- Notify the Federal Tax Service.

- Twice a month publish a message about these intentions, intended for creditors who have the right to demand payment of their debts.

- Register the conversion of shares or redemption of their quantity in the SBRFR (for PJSC and JSC).

- Make sure that as a result of the reduction procedure at the initiative of the owners of the management capital there is no more than the NAV.

Reasons and methods for reducing the capital

Article 20 of Law No. 14-FZ “On LLC” allows you to reduce the size of the authorized capital, and sometimes obliges you to do so. The Criminal Code may be changed downward in the following cases:

- When the participants want it. This usually happens due to a change in plans or the occurrence of unfavorable circumstances (the business does not develop). At the same time, it is possible to reduce the criminal capital to 10,000 rubles - this is exactly the minimum amount enshrined in the law on LLCs (Article 14, paragraph 1). If, when registering a company, capital was contributed in a minimum amount, then the founders will not be able to reduce it.

- When the company ended the year with a loss, which led to a reduction in the value of net assets (NA) - they became cheaper than the charter capital. If such a result occurs after the first year of work, then there is no crime yet. However, if the capital capital <NA after the end of the second or subsequent years, then the amount of capital must be reduced (clause 4 of article 90 of the Civil Code of the Russian Federation). In this regard, owners sometimes have a question: what will happen if the company receives a large loss and the value of its net assets becomes less than 10,000 rubles? Is it possible to reduce such an authorized capital of an LLC? The answer is clear - you can’t! In such a situation, the Company will have to be liquidated.

- When the owner left the LLC, he transferred his share to him, but it was not claimed. As a result, after a year, the share remained with the Company. In this case, it is extinguished, that is, canceled, and the authorized capital is reduced by its nominal value (clause 5 of Article 24 of the Law “On LLC”).

Previously, there was another reason for reducing the capital capital - if in the first year of the Society’s operation the participants did not pay it in full. Now this provision is no longer valid.

The procedure for reducing the authorized capital of an LLC depends on its reason:

- If this happens voluntarily or due to a drop in net assets, then the par value of the shares should be reduced. But their ratio should remain unchanged. For example, 3 founders contributed 100 thousand rubles each to the management company. The capital is 300 thousand, and the share of each participant is 1/3. If they decide to reduce the authorized capital of the LLC to 150 thousand, then each share will still be equal to 1/3, but its nominal value will decrease from 100 to 50 thousand rubles.

- If the undistributed share is redeemed, then the nominal value, on the contrary, does not change. The authorized capital is reduced, after which the size of the shares is recalculated. Let's say one of the participants in the example above decided to leave the LLC. His share in the amount of 1/3 was transferred to the Company. If after a year it remains undistributed, the participants will have to repay it and reduce the authorized capital of the LLC. It will become equal to 300 - 100 = 200 thousand rubles. Since there will be two participants, each will own 1/2 of the company. But at the same time, the nominal value of the share of each of them will remain equal to 100 thousand rubles.

Reasons for making adjustments to the LLC's management company

The minimum amount of the authorized capital of an LLC is 10,000 rubles. It is within this amount that the company will be liable for its debts to counterparties in the event of problems arising.

In the process of carrying out activities, it may be necessary to increase the amount of capital, for example, by increasing the size of shares or introducing a new participant into the founders.

Also, the board of founders or the sole participant of the LLC may decide to reduce the amount of the authorized capital (if, of course, there is room for reduction). This may be due to the departure of one of the founders or other reasons.

That is, changes can be both positive and negative.

In general, the following reasons can be identified for increasing the size of the LLC's capital:

- introduction of a new participant;

- directing profits to increase the capital capital - how to increase the capital capital at the expense of the company’s property;

- change in the direction of activity for which a higher minimum amount of capital is established;

- increasing the size of the share of one or more founders - increasing the capital due to additional contributions;

- the desire to look more respectable in the eyes of counterparties, as well as the requirements put forward by partners and creditors (in order to increase the company’s reliability).

As for changes in the amount of capital downward, the reasons are usually:

- withdrawal of a participant from the company without distributing the size of his share among the remaining participants;

- reducing the size of the share of one or more founders;

- the total value of the LLC's assets is lower than the value of the authorized capital - the size of the capital must be reduced by force.

How to change the share value - step-by-step instructions

These articles of Law No. 14-FZ clearly define the sequence of actions when changing the size of the authorized capital.

If we summarize the information from the federal law, we can provide the following step-by-step instructions for an LLC whose capital value changes up or down:

- Step 1. A general meeting of founders is organized.

- Step 2. If the changes are initiated by one of the founders, then they write a statement.

- Step 3. A decision is made to change the amount of capital - at a general meeting, if there are several founders, or a single founder, the result is a Minutes or Resolution, which stipulates the need for an increase or decrease.

- Step 4. The value by which the size of the Criminal Code changes is set.

- Step 5. A decision is made to amend the charter of the LLC - it is necessary to register the new value of the capital or shares in it.

- Step 6. If the authorized capital increases, then contributions must be made within two months from the date of the decision.

- Step 7. Within a month after making contributions, a decision is made to approve the results.

- Step 8. Fill out an application for state registration of changes to the charter.

- Step 9. Additional documents necessary for state registration of the change procedure are collected.

- Step 10. Within a month from the date of the decision on the results, the documents are transferred to the state body that registers legal entities.

- Step 11. In case of a decrease in capital, the authority must be notified within three working days after the relevant decision is made. Also, the reduction must be reported twice to the press (once a month).

Accounting - postings

Changing the amount of capital requires reflecting the corresponding entries in the accounting records.

If the Criminal Code changes, then this should be taken into account in account 80.

When increasing, the following accounting entries are made:

- Dt 75 Kt 80 – increase in capital due to additional deposits;

- Dt 50, 51, 52, 10, 08, 41 Kt 75 – contribution of a share to the management company of the LLC;

- Dt 83/84 Kt 80 – increase in capital at the expense of the LLC’s own funds.

When decreasing, the following accounting entries are made:

- Dt 80 Kt 75 – reduction of the capital due to a decrease in the value of the founders’ shares;

- Dt 75 Kt 51, 50, 52 – payment to the founders of the amount by which the size of the charter capital was reduced;

- Dt 75 Kt 91 - inclusion in other income of the amount of reduction in the size of the capital (if money is not paid to participants);

- Dt 80 Kt 81 – reduction of the capital by paying off one’s own shares;

- Dt 80 Kt 84 – reduction of the Criminal Code as required by law.

General Audit Department on the issue of reflecting a decrease in the authorized capital (STS)

Answer In accordance with paragraph 1 of Article 20 of Law No. 14-FZ[1], the company has the right, and in cases provided for by this Federal Law, is obliged to reduce its authorized capital.

A decrease in the authorized capital of a company can be carried out by reducing the nominal value of the shares of all participants in the company in the authorized capital of the company and (or) redeeming shares owned by the company.

The company does not have the right to reduce its authorized capital if, as a result of such a reduction, its size becomes less than the minimum amount of authorized capital determined in accordance with this Federal Law on the date of submission of documents for state registration of the relevant changes in the company’s charter, and in cases where, in accordance with By this Federal Law, the company is obliged to reduce its authorized capital as of the date of state registration of the company.

Reducing the authorized capital of a company by reducing the nominal value of the shares of all participants in the company must be carried out while maintaining the size of the shares of all participants in the company.

According to paragraph 4 of Article 30 of Law No. 14-FZ, if the value of the company's net assets remains less than its authorized capital at the end of the financial year following the second financial year or each subsequent financial year, at the end of which the value of the company's net assets was less than its authorized capital, the company no later than six months after the end of the relevant financial year, it is obliged to make one of the following decisions:

1) on reducing the authorized capital of the company to an amount not exceeding the value of its net assets

;

2) on the liquidation of the company.

Thus, the current legislation provides for a case when an Organization (LLC) is obliged to reduce its authorized capital

- if after two years the value of the Organization’s net assets is less than the amount of its authorized capital. In this case, the authorized capital must be reduced to the amount of net assets.

At the same time, current legislation does not prohibit making a decision to reduce the authorized capital in other cases, including on a voluntary basis.

It is unclear from the question whether the reduction of the authorized capital of the Organization is carried out in connection with a legal requirement (clause 4 of Article 30 of Law No. 14-FZ) or on a voluntary basis. In this regard, consider the consequences for both cases.

Reduction of authorized capital due to the requirement of current legislation

As follows from your question, an organization whose authorized capital is being reduced applies the simplified taxation system (USNO).

At the same time, when reducing the authorized capital, situations are possible when:

— the participant will be paid cash in the amount of the difference between the amount of the authorized capital and net assets after reducing the authorized capital;

- the corresponding funds will not be paid.

Please note that, as stated earlier, the reduction of the authorized capital in connection with the requirements of current legislation is carried out to an amount not exceeding the value of net assets. Moreover, a reduction in the authorized capital in this case is usually accompanied by a refusal to pay the corresponding value of the share to the participant by which the reduction is made. This is due to the fact that when funds are transferred to a participant to pay for a share, the amount of net assets will automatically decrease.

In this regard, in this section of our answer we will consider the situation when the reduction of the authorized capital is carried out as required by law and is not accompanied by the transfer of funds to the participant.

Tax accounting

In accordance with paragraph 1 of Article 346.15 of the Tax Code of the Russian Federation, taxpayers using the simplified tax system take into account the following income when determining the object of taxation:

— income from sales determined in accordance with Article 249 of the Tax Code of the Russian Federation;

— non-operating income determined in accordance with Article 250 of the Tax Code of the Russian Federation.

At the same time, according to paragraph 1.1 of Article 346.15 of the Tax Code of the Russian Federation, when determining the object of taxation, the following are not taken into account:

1) income specified in Article 251 of the Tax Code of the Russian Federation;

2) income of an organization subject to corporate income tax at the tax rates provided for in paragraphs 3 and 4 of Article 284 of the Tax Code of the Russian Federation, in the manner established by Chapter 25 of the Tax Code of the Russian Federation;

3) income of an individual entrepreneur, subject to personal income tax at the tax rates provided for in paragraphs 2, 4 and 5 of Article 224 of the Tax Code of the Russian Federation, in the manner established by Chapter 23 of the Tax Code of the Russian Federation.

The list of expenses for which a taxpayer using the simplified tax system has the right to reduce income is given in Article 346.16 of the Tax Code of the Russian Federation.

In accordance with paragraph 16 of Article 250 of the Tax Code of the Russian Federation, non-operating income is recognized as income in the form of amounts by which in the reporting (tax) period there was a decrease in the authorized (share) capital (fund) of the organization

, if such a reduction was carried out with a simultaneous refusal to return the cost of the corresponding part of contributions (contributions) to the shareholders (participants) of the organization (except for the cases provided for in subparagraph 17 of paragraph 1 of Article 251 of the Tax Code of the Russian Federation).

At the same time, according to subparagraph 17 of paragraph 1 of Article 251 of the Tax Code of the Russian Federation, when determining the tax base, income in the form of amounts by which the authorized (share) capital of the organization was reduced in the reporting (tax) period in accordance with the requirements of the legislation of the Russian Federation.

Based on these standards, we can conclude that if the authorized capital of the Organization is reduced in accordance with the requirements of current legislation

(in particular, based on paragraph 4 of Article 30 of Law No. 14-FZ - reduction to the value of net assets), then the

Organization does not generate non-operating income

, despite the fact that the participant will not be paid the cost of the corresponding part of the share.

This conclusion is confirmed by Letters of the Ministry of Finance of the Russian Federation dated 08/06/13 No. 03-03-10/31651, Federal Tax Service of the Russian Federation dated 07/19/13 No. ED-4-3 / [email protected] [2].

In the Resolution of the Federal Antimonopoly Service of the Volga District dated 04/03/12 in case No. A65-12721/2011, the court indicated that the decision to reduce the authorized capital was made in accordance with the requirements of Article 35 of Law No. 208-FZ[3]. Consequently, the decision of the tax authority to include in income the difference between the amount of net assets and the amount of authorized capital is unlawful.

Accounting

In accordance with the Instructions for the Application of the Chart of Accounts[4], in the event of a decrease in the authorized capital of the Organization by reducing the nominal value of the shares of all participants, after making appropriate changes to the constituent documents, an accounting entry is made in its accounting:

D-account 80 “Authorized capital”

Account number 84 “Retained earnings (uncovered loss)”

Reducing the authorized capital on a voluntary basis

A voluntary reduction of the authorized capital can be carried out both to the level of net assets and below their value.

Reduction can be done by:

— reduction of the nominal value of participants’ shares;

— repurchase of a share from a participant and its subsequent redemption.

Tax accounting

As stated earlier, in accordance with paragraph 16 of Article 250 of the Tax Code of the Russian Federation, non-operating income is recognized as income in the form of amounts by which in the reporting (tax) period there was a decrease in the authorized (share) capital (fund) of the organization

, if such a reduction was carried out with a simultaneous refusal to return the cost of the corresponding part of contributions (contributions) to the shareholders (participants) of the organization (except for the cases provided for in subparagraph 17 of paragraph 1 of Article 251 of the Tax Code of the Russian Federation).

Thus, if, when reducing the authorized capital on a voluntary basis, a decision is made to refuse to return the cost of the corresponding part of the share to the participant, then the amount by which the authorized capital was reduced shall be included in the non-operating income of the Organization.

If the reduction of the authorized capital is accompanied by payment to the participant of the corresponding part of the share, then the Organization will not generate non-operating income.

This conclusion is confirmed by regulatory authorities.

Thus, the Letter of the Ministry of Finance of the Russian Federation dated March 28, 2007 No. 03-11-04/2/69 states the following:

“In accordance with paragraph 1 of Art. 346.15 of the Tax Code of the Russian Federation (hereinafter referred to as the Code), organizations applying the simplified taxation system, when determining the object of taxation, take into account income from the sale of goods (work, services), sale of property and property rights, determined in accordance with Art. 249 of the Code, and non-operating income determined in accordance with Art. 250 Code. When determining the object of taxation, organizations do not take into account the income provided for in Art. 251 Code.

The provisions of Art. 29 of the Federal Law of December 26, 1995 N 208-FZ “On Joint-Stock Companies” provides that the authorized capital of a company can be reduced by reducing the total number of shares, including by purchasing part of the shares.

Reducing the authorized capital of a company by acquiring and redeeming part of the shares is permitted if such a possibility is provided for by the company's charter.

The decision to reduce the authorized capital of the company by acquiring part of the shares in order to reduce their total number is made by the general meeting of shareholders.

According to paragraphs. 17 clause 1 art. 251 of the Code, when determining the tax base for income tax, the taxpayer’s income in the form of amounts by which the authorized (share) capital of the organization was reduced in the reporting (tax) period in accordance with the requirements of the legislation of the Russian Federation.

In accordance with paragraph 16 of Art. 250 of the Code, non-operating income of a taxpayer is recognized as income in the form of amounts by which in the reporting (tax) period there was a decrease in the authorized (share) capital (fund) of the organization, if such a decrease was carried out with a simultaneous refusal to return the cost of the corresponding part of contributions (contributions) to shareholders (participants ) organizations (except for the cases provided for in paragraph 17, paragraph 1, article 251 of the Code).

Thus, if the reduction of the authorized capital will be carried out together with the repayment of the corresponding value of shares to shareholders, then income in the form of amounts of reduction of the authorized capital for tax purposes with tax paid in connection with the application of the simplified taxation system is not taken into account

».

Also, in the Determination of the Supreme Arbitration Court of the Russian Federation dated October 13, 2009 No. VAS-11664/09, it is noted that the amount of reduction in the authorized capital will be considered non-operating income and taken into account for profit tax purposes[5] only if the authorized capital is reduced voluntarily

(that is, not on the basis of mandatory legal requirements) and at the same time,

the reduction of the authorized capital is not accompanied by a corresponding payment (return) of the cost of part of the contribution to the company’s participants

.

In this case, the amount paid when reducing the authorized capital of a participant is not taken into account in the expenses of the Organization

, since this type of expense is not named in Article 346.16 of the Tax Code of the Russian Federation.

Note that if payment for the cost of the deposit is made in an amount less than its nominal value, then the difference is subject to inclusion in non-operating income.

This conclusion follows from the Letter of the Ministry of Finance of the Russian Federation dated February 27, 2007 No. 03-11-04/2/45:

“In accordance with Art. 346.15 of the Tax Code of the Russian Federation (hereinafter referred to as the Code), taxpayers applying the simplified taxation system, when determining the object of taxation, take into account income from sales determined in accordance with Art. 249 of the Code, and non-operating income determined in accordance with Art. 250 Code.

When determining the object of taxation, income provided for in Art. 251 Code.

According to paragraph 16 of Art. 250 of the Code, non-operating income of an organization includes income in the form of amounts by which in the reporting (tax) period there was a decrease in the authorized (share) capital (fund) of the organization with a simultaneous refusal to return the cost of the corresponding part of contributions (contributions) to the shareholders (participants) of the organization.

In this regard, if, when transferring real estate to shareholders when purchasing shares from them in connection with a decrease in the authorized capital, the value of the transferred property is equal to or exceeds the value of the shares acquired from shareholders, non-operating income taken into account for taxation is not generated by the joint-stock company.

If the value of the transferred property is less than the value of the shares acquired from shareholders, then the resulting difference must be taken into account as part of the non-operating income of the joint-stock company

».

Accounting

1. Without payment of funds to the participant

A decrease in the authorized capital (as of the date of registration of the decrease in the authorized capital) is reflected:

Account length 80

Account set 84

2. With payment of funds to the participant

In accordance with the Instructions for using the Chart of Accounts, account 75 “Settlements with founders” is intended to summarize information on all types of settlements with founders (participants).

The debt to the participants of the organization for the payment of amounts by which the authorized capital was reduced is reflected:

Account length 80

Account set 75

This entry is made on the date of state registration of the decrease in the authorized capital.

Payment of funds to participants is reflected:

Account number 75

Set of accounts 50, 51

Based on the foregoing, the Organization may experience the following tax consequences from these transactions:

| The reason for the decrease in capital | Non-operating income |

| Reduction based on legal requirements (in strict accordance with paragraph 4 of Article 30 of Law No. 14-FZ) | — |

| Voluntary reduction without payment of funds to the participant | + (in the amount of reduction) |

| Voluntary reduction with full payment of the cost of the share | — |

| Voluntary reduction with partial payment of the cost of the share | + (from the difference between the cost of the share and the payment) |

[1] Federal Law No. 14-FZ dated 02/08/98 “On Limited Liability Companies”

[2] These letters discussed the situation regarding the payment of income tax. However, in our opinion, taxpayers using the simplified tax system have the right to be guided by these explanations.

[3] Federal Law No. 208-FZ dated December 26, 1995 “On Joint-Stock Companies” contains a requirement to reduce the authorized capital in a case similar to that provided for in paragraph 4 of Article 30 of Law No. 14-FZ

[4] Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n “On approval of the Chart of Accounts for accounting of financial and economic activities of organizations and Instructions for its application”

[5] In our opinion, this conclusion can also be used when applying the simplified tax system

Answers to the most interesting questions on our telegram channel knk_audit

Back to section

Reducing the authorized capital by shares (shares) owned by the enterprise

For a number of reasons established by law and constituent documents, shares (shares) can be placed at the disposal of the enterprise, and they are listed on account 81 “Own shares (shares)”. Within one year, the specified shares (shares) must be sold, otherwise the authorized capital of the enterprise is subject to reduction (clause 6 of article 76 of the Law on JSC, clauses 2 and 5 of article 24 of the Law on LLC).

The cancellation of shares (shares) is carried out by posting Debit 80 “Authorized capital” Credit 81 “Own shares (shares)”.

The difference arising in account 81 “Own shares (shares)” between the actual costs of repurchasing shares (shares) and their nominal value is charged to account 91 “Other income and expenses”.

Example 6. In accordance with the court decision, at the request of creditors, the share of Vesna LLC in the authorized capital of Hermes LLC was foreclosed. From the moment the creditors’ claims were satisfied (07/18/2012), the former share of Vesna LLC is listed in the records of Hermes LLC as redeemed in account 81 “Own shares (shares)” in the amount of 23,500 rubles. . The nominal value of the share is 15,000 rubles. None of the other participants in Hermes LLC expressed a desire to acquire this share. At the meeting of participants of Hermes LLC on August 14, 2013, it was decided to reduce the authorized capital by redeeming the share listed in account 81 “Own shares (shares)” in the amount of 15,000 rubles. Registration of changes in the charter was made on August 22, 2013.

In accordance with paragraph 2 of Art. 25 of the LLC Law, creditors are paid the actual value of the share.

The following entries were made in the accounting of Hermes LLC:

| Contents of operation | Debit | Credit | Amount, rub. |

| 22.08.2013 | |||

| Authorized capital has been reduced | 80 | 81 | 15 000 |

| The excess of the redemption price over the par value of the shares was expensed (23,500 – 15,000) rub. | 91-2 | 81 | 8500 |

Basic accounting entries for authorized capital

Accounting for the authorized capital is carried out using account 80. The loan balance must be equal to the volume of investments specified in the organization's charter. Any movements are possible only with additions or changes to the company’s charter.

The following analytics are used in accounting: founders, stages of formation and types of shares. The last two analysts are necessary for accounting in joint stock companies.

They plan to change the chart of accounts. The Ministry of Finance reported this to the UNP newspaper.

Contribution to the authorized capital: postings

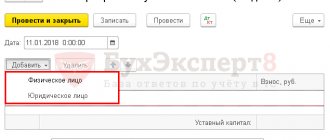

The first entry in a new organization is the accrual of debt for payment of the authorized capital:

The basis for making this entry is the charter, as well as an extract from the Unified State Register of Legal Entities. The entry on balance sheet accounts is reflected on the date of registration of the company with the Federal Tax Service.

- When forming an LLC, the posting amount is equal to the full value of capital specified in the articles of association.

- In joint-stock companies, the debt for payment of issued shares is initially shown.

On account 75 it is necessary to show transactions with investors for the transfer of funds and property to the initial capital, as well as for calculations related to the payment of net profit from the activities of a legal entity.

The debit balance must be equal to the amount of unpaid shares. Founders of legal entities can be both individuals and legal entities. The transfer of cash and other property is shown on the credit of account 75 in correspondence with the asset accounts. A very common form is cash to a current account or to a cash desk:

| Debit | Credit | Business transaction |

| 50 | 75 | depositing cash through a cash register |

| 51, 52, 55 | 75 | payment by bank transfer or special account |

Formation of authorized capital: accounting entries

The first operation after the creation of an enterprise is the formation of authorized capital in the BU. Its value must be determined before the company is registered, and then enshrined in the statutory documents. Let's take a closer look at how the authorized capital is formed on the balance sheet. Postings depend on the type of contribution. But each case has its own nuances.

The authorized capital is the amount that the founders contribute after registering the company. It is displayed in the liability side of the balance sheet, since it is the source of the formation of assets. The founders can make contributions in the form of cash, non-cash funds, materials, fixed assets. The activities of the enterprise are financed from the funds of the management company.

For lenders, this value is a kind of guarantee of return on investment in the event of bankruptcy of the borrower.

How is the formation of authorized capital reflected in accounting? Postings depend on the sources of funds. To account for the authorized capital, accounts 80 and 75 are used. Receipts of funds are reflected in credit 75, and write-offs are shown in debit 75. The entry drawn up when forming the authorized capital in joint-stock companies looks like this: DT75 KT80 - the debt of the founders is reflected in the Criminal Code. Each owner must contribute to the capital in accordance with his share. Profits will then be distributed in the same ratio.

Rules for accounting entries

The establishment of accounting begins with the registration of founding contributions. Information is reflected in debit and credit. The main accounting account becomes “Authorized capital” (No. 80). The balance on it is considered a liability and is reflected in the third section of the balance sheet. The final value of this account must correspond to the constituent documents of the company.

Before the actual payment of contributions by the owners, the debt is formed in account No. 75. Subsequently, operations on the fulfillment of their obligations by the participants are reflected here. If necessary, the accountant opens additional accounts. Thus, transactions involving the formation, increase or decrease of capital are classified as subgroup 75.1. The payment of dividends is recorded in subaccount 75.2.

The rules for registering founding contributions depend on the form of receipts.

| Contents of operation | Debit | Credit |

| Registration of a company with an authorized capital (debt of founders for contributions) | 75 | 80 |

| Making a monetary contribution by a participant to a current account | 51 | 75.1 and 75 |

| Payment of a contribution to the company's cash desk | 50 | 75.1 and 75 |

| Transfer of property (fixed assets, materials, other valuables) as a contribution | 08, 10, 11, 41, 21, 67, 58, 66, 97 | 75.1 and 75 |

Dt 01 Kt 83.

Dt 83 Kt 02.

Dt 83 Kt 01.

Dt 02 Kt 83.

Dt 91-2 Kt 01.

Dt 01 Kt 91-1.

Examples

Procedure for reducing the authorized capital

The following procedure for reducing the amount of capital is relevant:

- Convening a meeting of participants.

- Sending a notification of changes to the tax office. It must be sent within three days after the meeting at which the relevant decision was made. The notification is drawn up in form P14002. The director signs the application.

- Sending notices to creditors. The announcement of changes is published in the State Registration Bulletin.

- Submitting papers to the Federal Tax Service to register the reduction. The Inspectorate of the Federal Tax Service is provided with the minutes of the meeting, the new Charter of the organization, a receipt for payment of the fee, a statement of changes, and the journal “Bulletin” in which the corresponding announcement was published. In the event that the procedure is carried out due to the ratio of the capital and net assets, you must also submit a calculation of the value of the assets.

- Receiving documents on changes in capital. The new charter and extract from the Unified State Register of Legal Entities are provided by the tax office within 5 days.

The procedure is quite simple, but it is important to follow all the nuances. You cannot skip items, otherwise changes will be considered illegal

Notification of the Federal Tax Service regarding the reduction of capital

When making a decision to reduce the size of the capital capital, you must inform the Federal Tax Service of your intention within 3 days. An application form P14002 is provided for notification. If the organization abandons its intentions at the stage of the procedure, the same form is used to submit the refusal. The document is submitted on paper without blots, erasures or corrections. There is no stitching; the sheets are held together with a paper clip.

When submitting the form, you must attach the minutes of the meeting of founders with the decision to reduce the authorized capital. The application is submitted by a manager who has the right to represent the interests of the company without a power of attorney or another person whose right is confirmed by a power of attorney. The person must prove his identity with a passport.

Procedure and step-by-step instructions

A decrease in the authorized capital is always accompanied by a change in the Charter, so you will definitely need to contact the body registering legal entities (tax) for state registration of adjustments.

The value of shares is reduced in order to reduce the authorized capital without the founder leaving the company.

If one of the participants leaves the LLC, and his share is not redistributed among those remaining in the company, then a reduction is formalized by paying off the share without reducing the value of the shares of the remaining founders.

The algorithm of actions for the organization in these cases is prescribed in Article 20 of Law 14-FZ; below are explanations for both cases.

The founder can leave the company at his own request, and he writes a statement about this. Also, the departure of a participant can be carried out forcibly by a general decision of the remaining members of the company.

In any case, a general meeting is organized, at which the issue of what to do with the share of the departing person is decided - to redistribute its value between existing participants or to reduce the authorized capital by its value, paying off its value.

If the share is redistributed, then the value of the share of the remaining members of the LLC changes, while the value of the authorized capital does not change.

https://www.youtube.com/watch?v=ytcreatorsru

If the share is repaid without distribution, then the authorized capital is reduced by the amount of the repaid deposit, the value of the shares of the remaining participants does not change, but their size is adjusted. This event requires a number of actions:

- Step 1. Convening a general meeting.

- Step 2. Making a decision on the withdrawal of a participant from the LLC (voluntarily on the basis of an application or involuntarily), repaying his share and reducing the level of the authorized capital.

- Step 3. Drawing up minutes of the general meeting.

- Step 4. Payment of the state fee for amending the Charter - 800 rubles. for 2021.

- Step 5. Sending a message to the Federal Tax Service about making a decision within three working days from the date of execution of the protocol - by filling out an application form P14002 (on making changes to the Unified State Register of Legal Entities).

- Step 6. Publication in the press of a notice with information about the reduction of the capital.

List of documents for registration

The Federal Tax Service requires you to submit a package of documents to register a decrease in the capital capital. The state service is paid; a fee is paid for making changes. A package of documents is submitted to the Federal Tax Service:

- A new edition of the Charter or a list of changes made to the document. The forms indicate the reduced amount of the authorized capital. The document is submitted in 2 copies.

- Application form P13001.

- Original receipt with details of the duty paid.

- Minutes of the meeting or the decision of the sole participant. The documents remain in the organization's file.

- A copy of the notification to partners when publishing a message in the official gazette.

If the value of the capital is reduced to the value of net assets, the list includes the calculation of the net asset value. There are no rules for calculating NA. The calculation is presented in any order.

The duration of the registration procedure is 5 days, after which the representative or director of the company receives a new version of the Charter certified by the registrar and a sheet of entry into the register.

Functional purpose of the authorized capital and its minimum size

To carry out the subsequent activities of the enterprise, its founders form start-up capital in the form of their contributions. These may include inventories, securities, non-current assets, money and others. The size of the dividends received depends on the size of their deposits. In addition, the formed capital acts as a kind of guarantor for the credit obligations of the enterprise. Its size can either increase or decrease according to the decision of its founders:

Each type of ownership of a newly formed enterprise has its own amount of authorized capital, which is fixed at the legislative level.

Minimum permissible amounts of authorized capital:

- Limited liability companies (LLC) – RUB 10,000.00.

- Closed joint stock companies – 100 times the minimum wage for the corresponding year. This indicator is constantly indexed (prescribed in the budget of the corresponding year).

- Open joint stock companies – 1000 minimum wages.

- Municipal enterprises – 1000 minimum wages.

- State enterprises – 1000 minimum wages.

Get 267 video lessons on 1C for free:

Legal basis

The legal basis for reflecting business facts is Law 402-FZ “On Accounting” dated December 6, 2011. The normative act establishes the general principles of reporting. All participants in business transactions are required to follow its provisions. The nuances of registration related to the organizational structure are regulated by the provisions of Federal Law-14 “On LLC” dated 02/08/98.

Orders of the Ministry of Finance, letters from the tax service, instructions from Rosstat, the Pension Fund of the Russian Federation and the Federal Social Insurance Fund of the Russian Federation are of great importance. The same departments approve unified forms of documents. Basic accounting principles are listed in the fifth paragraph of PBU 1/2008:

- Property separation. The assets of the enterprise are not the property of the founders. The owners are liable for the obligations of the company to the extent of their contributions. Exceptions are cases of deliberately bringing a company to a state of financial insolvency (Article 3 of Law 14-FZ).

- Continuity of recording economic facts. Accounting is maintained from the moment of establishment of the company until its exclusion from the state register (official liquidation).

- Clear sequence. Transactions and business events are reflected by accrual (clause 5 of PBU 1/2008). What is key is the date the obligation arose, not the actual settlement. The cash method is used in tax accounting, but not in accounting.

We should not forget about precedents. The positions of the Supreme and Constitutional Courts of Russia are regularly published in open sources. The clarifications provide guidance in bridging legal gaps.

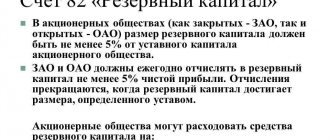

In what account is additional capital accounted for and how is it reflected in the statements?

This account is account 83. Credit transactions on account 83 mean that additional capital is growing. If the entry is made as a debit, then, on the contrary, this means that the operation reduces additional capital.

When preparing the company's financial statements for any specific date, the value of additional capital is also subject to reflection in the company's own funds. For this purpose, there is line 1350 in the balance sheet “Additional capital without revaluation.” It should indicate the amount of additional capital, excluding from it the amount of the identified positive revaluation (revaluation) of fixed assets.

How to do this in practice? It is necessary to subtract from the total balance on the credit of account 83 the amount attributable to the previously identified total revaluation of the company’s non-current assets.

Please pay attention! In accordance with clause 68 of Regulation No. 34n, each amount forming additional capital must be reflected in accounting separately

Consequently, when accounting for additional capital, companies conduct analytics of individual amounts that form additional capital in separate subaccounts in the context of account 83. Therefore, the company is able to identify the total amount of revaluation of fixed assets by looking at the credit balance in the corresponding subaccount of account 83.

The amount of revaluation of fixed assets, in turn, is recorded in another line of the balance sheet, namely in line 1340.

In practice, as stated above, there are several possible situations in which a company's additional capital can be formed or used. Moreover, some situations are “mirror”, i.e. under some circumstances they increase additional capital, and under others they decrease it.

Let's consider such situations.

Results

Accounting for transactions involving contributions to the capital company and its increase is generally simple. It may be quite labor-intensive to formalize the process of transferring property to the founder's contribution if the volume of this property is significant.

Thus, correct accounting of additional capital allows the company to smooth out such potentially negative situations as identifying a markdown of non-current assets, lack of funds to pay dividends to participants, etc. In addition, there are other areas for the possible use of the company’s additional capital.

According to accounting rules, the formation and increase in additional capital is reflected in the credit of account 83, and its decrease is reflected in the debit. It is important for the company’s accounting service to remember that correct accounting is only possible if detailed analytics are maintained for each component of additional capital (which includes amounts that are identical in their economic nature) in the corresponding subaccount of account 83.

We invite you to read: Is it possible to restore trust after betrayal? 7 signs that trust has been restored

Increase in capital

The increase in the authorized capital is carried out at the expense of net assets, additional and contributions from third parties. Multiple sources can be used simultaneously

Let's look at how the formation of the authorized capital is displayed; we won't ignore the entries in the accounting system either.

The new amount of own funds is approved at the meeting of shareholders. Then changes are made to the statutory documents, data is registered with the Federal Tax Service and postings are generated in the accounting department. An increase in own funds does not always occur through additional contributions. Sometimes retained earnings, the amount of asset revaluation, are used for this purpose:

- DT75 KT80 - by the amount of the increase in the authorized capital.

- DT84 KT75 - direction of profit into capital.

In accordance with Art. 217 of the Tax Code of the Russian Federation, income of joint-stock companies received in the form of shares, property shares or in the form of the difference between the new and original value of the Central Bank is not subject to personal income tax. The increase in the value of shares itself does not lead to real income, provided that the changes occurred due to the revaluation of fixed assets. But if the difference is formed as a result of adding part of retained earnings to capital, then such amounts are subject to personal income tax. In this case, the amount paid can be taken into account in future periods. The date of receipt of income is considered to be the day of registration of the new amount of the capital.

Let's look at how the formation of authorized capital is reflected in the accounting system. Postings with turnover according to KT80 mean that the funds came from internal sources:

- DT83 KT80 - due to share premium, revaluation of fixed assets;

- DT84 KT80 - at the expense of special purpose funds and retained earnings.

Additional shares can be issued only within the limits of the number of securities declared. In this case, by decision to increase the capital, the company must determine:

- number of placed ordinary and preferred securities;

- publication method;

- price;

- form of payment;

- other conditions.

Payment for additional securities is carried out at the market price, but above the nominal value. An exception is the purchase of securities by participants who already own ordinary shares. The placement price in this case can be a maximum of 10% below the market price. If professional market participants are involved in the publication, then the price of the securities can also be increased by an amount equal to the cost of intermediaries’ services. But the amount of their remuneration cannot exceed 10% of the placement price.

How to act when reducing the Criminal Code

So, for one reason or another, you need to reduce the authorized capital of the LLC. Our step-by-step instructions, relevant for 2021, will help you with this.

Step 1. Making and formalizing the decision

If the Company has several founders, a general meeting is held, the agenda of which includes the issue of reducing the capital. At least 2/3 of the participants must vote for this, but the charter may provide for a larger number of positive votes. If there is only one founder in the company, he alone makes a decision to reduce the capital.

The protocol or decision must indicate that:

- the authorized capital is reduced by the amount of XX rubles;

- its new size will be AU rubles;

- In this regard, changes are being made to the charter.

Step 2. Report to the Federal Tax Service

Next, the planned reduction of the authorized capital of the LLC must be reported to the registering Federal Tax Service. This must be done within 3 days from the date of the decision. To do this, submit form P14002, approved by order of the Federal Tax Service dated January 25, 2012 No. ММВ-7-6/ [email protected] You can send it:

- in electronic form, signing with an enhanced electronic digital signature of the head of the LLC;

- in the form of a paper document on which the manager’s signature is certified by a notary. This is mandatory even if the director of the LLC submits a message about the reduction of the capital capital to the tax office in person.

In addition to form P14002, the set of documents for informing the Federal Tax Service includes a copy of the director’s passport, a power of attorney (if an authorized person goes to the inspection), as well as a protocol or a decision to reduce the capital. Having received the documents, the tax authority must make an entry in the Unified State Register of Legal Entities stating that the organization is reducing its authorized capital. He must do this no later than 5 working days.

Step 3. Publishing notices to creditors

Sometimes owners have a question: is it possible to avoid fulfilling part of their obligations by reducing the authorized capital? Of course not, this is not a solution. The fact is that the Company’s creditors must be notified of the reduction in the capital. This is done precisely so that they have the opportunity to demand from the company the fulfillment of its obligations before the agreed date.

Creditors are notified through the official press organ - “Bulletin of State Registration”. It is necessary to publish information in it first when information about the beginning of the process of reducing the capital capital is entered into the Unified State Register of Legal Entities.

Step 4: Republish

At least a month after the initial publication, it must be re-posted in the same Bulletin. Within 30 days after the second notice is issued, creditors may require the LLC to fulfill its obligations ahead of schedule. If this is impossible, they have the right to demand termination of obligations, as well as compensation for losses associated with this. Within six months from the date of publication of the second notice, the creditor has the right to go to court.

Step 5. Register changes

The new amount of the authorized capital must be included in the charter, and then these changes must be registered. To do this, a set of documents is sent to the tax authority, which includes:

- a new version of the charter with a reduced amount of the capital or a separate sheet of changes - 2 copies;

- the document on the basis of which the capital is reduced - a decision or minutes of the meeting;

- application for amendments in form P13001 (approved by order of the Federal Tax Service No. ММВ-7-6/ [email protected] ). The signature on the application must be certified by a notary, except in cases where the documents are signed with an electronic signature and submitted electronically;

- receipt of payment of state duty in the amount of 800 rubles. If documents are sent electronically, then from the beginning of 2021 there is no need to pay state duty;

- a copy of the magazine with a published message about the reduction of the capital or a copy of the publication form, certified by the head of the LLC;

- if the capital is reduced due to losses, then a calculation of the net asset value is attached.

The tax office must register the changes within 5 business days. The applicant will be given a sheet of registration of the Unified State Register of Legal Entities, as well as a new version of the charter or a sheet of amendments, depending on what he submitted. At this point, the process of reducing the capital asset can be considered complete.

So, an LLC can reduce the size of its charter capital, and in certain situations it is even obliged to do so. This procedure does not cause serious difficulties, but it does require some time. We hope that our step-by-step instructions will help business owners go through this path without any problems.

basic information

There are two procedures for reducing capital:

Regardless of the order in which changes are made, they must not contradict the law. In particular, the minimum size of the authorized capital is at least 10 thousand rubles. The amount of capital should not be below this level.

Reducing the amount of capital on a voluntary basis is carried out by reducing the nominal value of the founders' shares. However, the ratio of shares does not change, since redistribution occurs.

IMPORTANT! Reducing the capital on a voluntary basis cannot be a method of avoiding the company's liability to creditors. In particular, an organization cannot avoid paying its debts in this way.

Creditors to whom there are early obligations must be notified of the changes being considered. The presence of the notification must be confirmed.

The amount of capital can be reduced both through money and property. For example, the organization’s capital is 10 thousand rubles. The new founder contributed to the company's assets in the form of a production building. However, the entrepreneurial project began to bring only losses. In this regard, the founder decided to withdraw his contribution. The accountant must deal with the registration of disposal of fixed assets. Then the cost of the building is written off from accounting. In this case, you need to draw up an act of acceptance and transfer of the OS object.

ATTENTION! Personal income tax is deducted from the amount of disposal of objects that are transferred to the founders. The founder, in turn, receives taxable income

This rule is specified in the letter of the Ministry of Finance dated August 26, 2016. However, the founder has the opportunity to provide a tax deduction for the amount of expenses associated with the acquisition of rights to property. The rule in question is stipulated by Article 220 of the Tax Code of the Russian Federation.

When is an organization obliged to reduce its authorized capital?

The company is obliged to reduce the amount of capital in the following circumstances:

- The size of the charter capital is greater than the size of net assets . This ratio of indicators indicates that the company is unprofitable. It is allowed in the first year of the company’s activity. Subsequently, when such a ratio is identified, the company is obliged to begin the process of reducing capital. For example, the net assets of an organization are 200 thousand rubles, and the amount of capital is 500 thousand rubles. In this case, the principle of providing capital with company property is violated. The interests of creditors are also not guaranteed. It is necessary to reduce the size of the capital to the size of net assets.

- Within 12 months there was no distribution or sale of the share that the company received . If such circumstances exist, the cost of the share must be repaid.

FOR YOUR INFORMATION! Previously, there was a law according to which a reduction of the capital was carried out in the absence of full payment of capital within 12 months from the date of registration of the organization.