SZV-K report to the Pension Fund of Russia

Back in 2021, the Pension Fund approved a reporting form on employee experience and explained what this form is and who submits the SZV-K. This reporting form is provided by the following categories of policyholders:

| Who submits the form | What information is included in the report? |

| Russian policyholders who received an individual request from representatives of the Pension Fund of Russia | Information that should be included in the form concerns the length of service of individuals for periods up to and including December 31, 2001 |

| Russian insurers operating in the territory of the Republic of Crimea or the city of Sevastopol | In the report, include information about the length of service of Russian citizens working for you who, as of March 18, 2014, permanently resided in the specified territories |

Many accountants and HR department employees are familiar with this form of reporting. Information was provided to the Pension Fund in 2003 and 2004 using a similar form. The reporting information reflected the length of service of employees until the end of 2001.

IMPORTANT!

From 02/11/2020, the new unified form SZV-K is used. The form and instructions for filling out are established by Resolution of the Board of the Pension Fund of the Russian Federation dated September 27, 2019 No. 485p. OKUD code is not provided.

Filling procedure

To correctly fill out the SZV-K form, follow the Instructions for filling out individual (personalized) accounting forms, approved by Resolution of the Board of the Pension Fund of the Russian Federation dated July 31, 2006 No. 192p.

Fill out the SZV-K form on the basis of the work book and other documents that confirm the employee’s insurance experience. For example, these are employment contracts, certificates from previous places of work, personal accounts and salary statements, certificates issued by the administration of a correctional labor institution, a military ID, a child’s birth certificate, and others.

This follows from the provisions of paragraph 59 of the Instructions, approved by Resolution of the Board of the Pension Fund of the Russian Federation dated July 31, 2006 No. 192p, and the Rules approved by Resolution of the Government of the Russian Federation dated October 2, 2014 No. 1015.

Due date in 2021

There are no uniform deadlines for submitting the report. The Pension Fund of Russia decides who submits the SZV-K report and when in 2021, sends requests to these organizations with the requirement and deadlines. In a standard situation, one month is allocated for the formation and provision of information. But there are urgent requests when several days are given to collect and send information. The letter from the Pension Fund always indicates a specific deadline for providing data, please adhere to it.

IMPORTANT!

There is one exception! If you operate in the territory of the Republic of Crimea or the city of Sevastopol, submit information no later than December 31, 2021 (Part 1, 2, Article 6.1 of the Federal Law of July 21, 2014 No. 208-FZ).

The SZV-K form can be submitted both electronically and on paper. But we recommend submitting information electronically via secure communication channels. Information about the length of service will quickly be transferred to the individual personal account of the insured person.

Personal data and insurance number of the employee

At the top of the SZV-K form (on the left), indicate the insurance number of the individual personal account of the insured person (SNILS). Take it from the person's insurance certificate. Enter the employee's last name, first name and patronymic in the nominative case in the fields of the same name. This procedure is provided for in paragraphs 37, 60 of the Instruction, approved by Resolution of the Board of the Pension Fund of the Russian Federation dated July 31, 2006 No. 192p.

Fill out the “Date of Birth” field as follows. Write the month of birth in words, and the date and year in numbers. That is, for example, September 15, 1985. This follows from the provisions of paragraphs 19, 60 of the Instruction, approved by Resolution of the Board of the Pension Fund of the Russian Federation dated July 31, 2006 No. 192p.

Fill out the field “Territorial conditions of residence as of December 31, 2001” in accordance with Appendix 1 to the Instructions, approved by Resolution of the Board of the Pension Fund of the Russian Federation dated July 31, 2006 No. 192p. In this case, only the following values are possible: empty field, “RKS”, “ISS”. For the values “RKS” or “MKS”, indicate the size of the regional coefficient as a number with a fractional part separated by a comma (for example, “MKS 1.7”).

How to fill out SZV-K

The form consists of the following sections:

- Information about the insured person. Includes: SNILS, full name, date of birth and place of residence. This information is filled in based on your passport and insurance certificate. For the “territorial living conditions” indicator, an empty value is acceptable in the absence of supporting documents.

- Type of reporting form. Select from the suggested types and check the box. Initial - when submitting information for the first time, corrective - when changing the information of the original SZV-K about the length of service or other information about the insured person, canceling - to cancel previously provided information.

- Periods of activity. The section includes information about the periods of work experience of the insured person until December 31, 2001, based on the work record book. Fill in the name of the organization, activity code (required). To determine it, we use Appendix No. 1 of the Pension Fund Resolution No. 485p.

Let's look at a clear example of filling out SZV-K. The conditions for filling out are as follows:

GBOU DOD SDYUSSHOR "ALLUR" received a notification from the Pension Fund of the Russian Federation about the provision of information on employee Sergeev Sergey Sergeevich. According to the work book records, there is information that Sergeev S.S. works at the GBOU DOD SDYUSSHOR "ALLUR" in the position of "building maintenance worker":

- the employment contract with GBOU "ALLUR" was concluded on August 21, 2014;

- from 03/23/1980 to 03/25/1985 - work as a “turner” at the Stroyka enterprise (an area equated to the regions of the Far North);

- from 03.03.1986 to 04.11.1988 - work as a “general worker” at the Chaika enterprise (region of the Far North);

- from 11/14/1988 to 04/01/1999 - work as a “gas cutter” at the enterprise “Plant No. 12” (the position is classified as work with difficult working conditions).

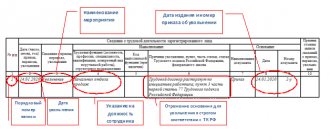

This is what a sample looks like on how to fill out the SZV-K according to these conditions:

SZV-K: what is this form and who takes it in 2021

Although the SZV-K form was approved in 2021 by Resolution of the Board of the Pension Fund of the Russian Federation dated January 11, 2017 No. 2p, it is familiar to accountants with experience, who in 2003–2004 submitted a similar form about experience until 2002 for “all their” employees on schedule, approved by the Pension Fund department. Then it was called “conversion”, since it was the transfer of information from work books into personalized records. If during the “conversion” an employee quit, he was required to receive a certificate indicating whether the conversion had been submitted to him or not. This was due to the fact that the pension system was switching to personalized accounting, accountants began to submit quarterly information about the length of service and earnings of employees, but in the period before 2002 there was no such accounting.

Form SZV-K is not a reporting document, since the information in it is submitted as of January 1, 2002. Why did the Pension Fund return to this form again in 2021? Most likely, in 2021, the Pension Fund of Russia began revising and updating information for each insured person. And in situations where there is no information in the PFR database as of 01/01/2002 for an employee of an organization or an individual entrepreneur (and we submit information about our employees to the Pension Fund on a monthly basis using the SZV-M form), then the Pension Fund sends a request (by letter or email ) to the head of an organization or individual entrepreneur to provide the SZV-K form for this employee or a number of employees, indicating the deadline for submitting the form to the Pension Fund (usually the Pension Fund gives four weeks to complete this order). This letter looks like this:

Sample letter

GU-UPF of the Russian Federation No. 15 for the city of Saratov reports that your organization employs insured persons, in whose personal accounts there is no information about periods of work and other activities before 01/01/2002 in the form SZV-K (f. SZV-K is a copy work book in electronic form for the period from the beginning of employment to December 31, 2001 inclusive).

A list of insured persons is attached. It is urgently necessary to provide SZV-K forms for employees from the attached list (given below) by March 30, 2018, who have entries in their work books before January 1, 2002.

For each insured person for whom the SZV-K form will not be submitted, it is necessary in the “Notes” column of the submitted list to indicate the reasons for the impossibility of providing information on him in the SZV-K form (for example: dismissed; there is no information in the work book about work, studies, military service until 01/01/2002; pension granted, died, etc.)

In the SZV-K form, for periods of work, the code “WORK” is indicated in the “type of activity” line; for military service - code “SERVICE”; for full-time study in educational institutions of primary secondary and higher education - code “DVSTO”.

You can submit information via electronic communication channels, or on purpose in room 13.

| Surname | Name | Surname | SNILS | Personal account opening date | Date of Birth | Policyholder registration number | Name of the insurer | Was on the 2014 list | NOTE |

Based on the information provided, the Pension Fund will calculate pension points earned by the employee before 2002. But now the size of the pension depends on the number of points earned. Therefore, it is so necessary to submit SZV-K for the required employees.

And a fine of 300–500 rubles. according to Art. 15.33.2 of the Code of Administrative Offenses of the Russian Federation, it will be unpleasant to pay for each employee for whom they forgot to submit information or submitted incorrect information. And there is also Art. 25 of Federal Law No. 173-FZ of December 17, 2001 “On Labor Pensions in the Russian Federation”, according to which, in the event of an incorrect calculation of a pension based on the information submitted by the organization, the Pension Fund has the full right to recover damages from the organization for this calculation.

Like all reports on personalized accounting, SZV-K is submitted to the Pension Fund:

- both on paper and electronically, if the organization’s staff does not exceed 24 people;

- only in electronic form if your staff exceeds 24 people.

In this case, the organization or individual entrepreneur must keep a copy of the submitted information (in paper or electronic form - this item should be in your accounting policy) in accordance with Art. 22.1 of the Federal Law of October 22, 2004 No. 125-FZ “On Archiving in the Russian Federation.” Shelf life - 75 years.

Based on what documents is the SZV-K form filled out?

According to paragraph 31 of Resolution No. 2p, the SZV-K form is filled out on the basis of a work book or other documents provided by the employee to confirm his work experience.

The list of such documents is given in the Decree of the Government of the Russian Federation dated October 2, 2014 No. 1015 “On approval of the Rules for calculating and confirming the insurance period for establishing insurance pensions.” A number of basic documents are given in Table No. 1.

Table No. 1

| № | What period is confirmed | Document | Code when filling out SZV-K |

| 1 | Work experience at enterprises or organizations | Employment history | JOB |

| 2 | Work experience of an individual entrepreneur (previously, individual entrepreneurs did not have the right to make an entry about hiring and dismissal in the employee’s work book, but were required to enter into an employment contract, which was registered with the Social Insurance Fund and the Pension Fund of the Russian Federation) | Employment contract with individual entrepreneur | JOB |

| 3 | Work experience at enterprises or organizations, in cases where there is no work book, or errors in filling out the work book (crossing out entries, unclear printing, errors in dates) | Extracts from orders, certificates from places of work, personal accounts or salary slips | JOB |

| 4 | Work experience on collective farms | Collective farmer's work book | JOB |

| 5 | Length of service in the army | Military ID, certificates from military commissariats or units | SERVICE, SLPRIZ |

| 6 | Service in internal affairs bodies and drug control agencies, fire service, Ministry of Emergency Situations, National Guard and penitentiary authorities | Certificates, certificates | SERVICE |

| 7 | The period of residence of spouses of military personnel, if in places of military service these spouses could not carry out their labor activities | Certificates from military commissariats or units | PROZHSUPR |

End of table. No. 1

| № | What period is confirmed | Document | Code when filling out SZV-K |

| 8 | The period of residence abroad for spouses of diplomats and members of diplomatic missions, embassies, etc. | Certificates from government agencies that send diplomats and other similar workers to work | PRZAGR |

| 9 | Work under a civil contract | Civil contracts | AGREEMENT |

| 10 | Work under copyright or license agreements | Copyright or licensing agreements | AGREEMENT |

| 11 | Periods of unemployment, public works, periods of moving in the direction of the employment service | Employment service certificate | BEZR |

| 12 | The period of caring for a disabled child, an incapacitated family member or a person who has turned 80 years old | Decision of the Pension Fund or social protection | CARE-INVD, WORK |

| 13 | Employment as a housekeeper, nanny, etc. among citizens | Agreement with an employer - a citizen | JOB |

| 14 | Period of work in a peasant farm (peasant farm) | Entry into the work book about work in a peasant farm is confirmed by local government bodies | JOB |

| 15 | Period of work as a shepherd | Agreement between the shepherd and the collective of citizens | JOB |

| 16 | Period of self-employment | Certificate or patent issued by the executive committee | JOB |

| 17 | Period of creative activity | Certificate from the organization that paid the reward for the work of art | JOB |

| 18 | The period of work in traditional industries in communities of indigenous peoples of the North, Siberia and the Far East | The work document is issued by the community | JOB |

| 19 | Detention and imprisonment of persons who have been rehabilitated or recognized as unreasonably repressed | Document on rehabilitation and document from the place of serving the sentence | REHABILIT, REVISION |

| 20 | Period of work as a notary, private detective or lawyer | Pension Fund document confirming payment of mandatory payments | JOB |

| 21 | Study in higher and secondary specialized institutions | Diploma, record book | DVSTO |

If an employee cannot provide a document in the event of its loss or loss due to force majeure (natural disaster: flood, fire, earthquake, hurricane, etc.), and there is no way to restore it, then such period of work can be confirmed by witnesses (not less than two witnesses) with whom this employee worked in a given place, in this case the code “RABSVPK” is entered in the SZV-K.

Features of filling for Crimea and Sevastopol

The updated instructions for filling out the SZV-K for Crimea provide a special procedure for filling out the report. For policyholders operating in the territory of the Republic of Crimea or the city of Sevastopol, include in the form information about the length of service for the periods:

- up to December 31, 2014 inclusive - if you brought the constituent documents into compliance with the legislation of the Russian Federation within the period established by law and submitted an application to enter information into the Unified State Register of Legal Entities;

- up to 12/31/2015 inclusive - in other cases.

Labor activity: total work experience

When filling out information as of January 1, 2002, to assess the pension rights of the insured person (conversion), consider the following.

Calculate the indicators “Total length of service” and “Experience giving the right to early assignment of a pension” taking into account the requirements of paragraph 61 of the Instructions, approved by Resolution of the Board of the Pension Fund of the Russian Federation dated July 31, 2006 No. 192p. In this case, the length of service giving the right to early assignment of a pension must be shown in the SZV-K form in the context of the relevant working conditions:

- territorial;

- special;

- determining the right to a pension for long service.

In the appropriate columns, indicate the total length of service under working conditions (years, months, days).

How to fill out SZV-K if you have no experience

If a request has been received from the territorial branch of the Pension Fund for a dismissed employee or for an employee who does not have entries in the work book for the required period, then there is no need to fill out information. In this case, prepare a letter of refusal, in which you describe in detail the reason why it is not possible to provide information. Let's look at the situation using an example.

An official request from the Pension Fund for Irina Yuryevna Pegova.

Pegova I.Yu. worked at the State Budget Educational Institution of Children's and Youth Sports School "ALLUR" in the position of "wardrobe attendant" in the period from 07/15/2013 to 06/22/2017. Dismissed at her own request by order of the director No. 102 dated 06/22/2017 based on a statement b/n dated 06/07/2017.

Procedure and deadline for passing SZV-STAZH in 2021

The SZV-STAZH report form, submitted in 2021 for 2021, was approved by Resolution of the Pension Fund of the Russian Federation Board of December 6, 2018 No. 507p. In comparison with the information previously included in the quarterly reports submitted to the Pension Fund, there is nothing fundamentally new in it. Even the tables reflecting data on experience are similar.

However, the Pension Fund considered it necessary to obtain, along with information on length of service, some information that would clarify certain issues regarding the reporting employer:

- on the number of persons for whom information on length of service was generated;

- on the summary amounts of contributions accrued and paid for the year (dividing them by type of payment) and the debt on them at the beginning and end of the year;

- on the existence of working conditions that give the employee the right to early retirement, and on the number of such persons.

To reflect this data, Resolution No. 507p approved another form - EDV-1, which must be submitted along with the SZV-STAZH report.

See also “What are the differences between the SZV-STAZH form and the EDV-1 form?” .

As the deadline for submitting a report on experience, the Law “On Individual (Personalized) Accounting...” dated 04/01/1996 No. 27-FZ (clause 2, Article 11) indicates March 1 of the year following the reporting year. Law No. 27-FZ does not contain rules on shifting it if it coincides with a weekend, so if March 1 is a general day off, the report will have to be submitted earlier.

At the same time, the law also provides for exceptions to the deadline for submitting the SZV-STAZH report.

So, if the insured person submits an application for a pension, then the report must be submitted within 3 calendar days from the date of receipt of such an application (Clause 2, Article 11 of the Law “On Persuance” dated 04/01/1996 No. 27-FZ).

How to fill out the SZV-STAZH when applying for a pension and what additional documents to prepare, find out in the ConsultantPlus Typical Situation, having received trial access to the system for free.

Also, the report is submitted ahead of schedule by the insured in the event of liquidation, reorganization, termination of the status of a lawyer, the powers of a notary engaged in private practice (Clause 3 of Article 11 of the Law “On Persuchet” dated 04/01/1996 No. 27-FZ). Information on when a report must be submitted in such situations is given in the table:

| Policyholder submitting a report early | In what situation is a report submitted early? | When is the report due? |

| Legal entity in liquidation | Upon liquidation | Within one month from the date of approval of the interim liquidation balance sheet |

| In case of bankruptcy | Before the bankruptcy trustee’s report on the results of the bankruptcy proceedings is submitted to the arbitration court | |

| Legal entity created during reorganization | When reorganizing by separating | Within one month from the date of approval of the transfer act (separation balance sheet), but no later than the day of submission of documents for its state registration |

| A legal entity merged with another legal entity during reorganization | Upon reorganization by merger | No later than the day of submission of documents for making an entry in the Unified State Register of Legal Entities on the termination of the activities of the affiliated legal entity |

| Individual entrepreneur | Upon termination of activity | Within one month from the date of the decision to terminate activities as an individual entrepreneur |

| In case of bankruptcy | Before the bankruptcy trustee’s report on the results of the bankruptcy proceedings is submitted to the arbitration court | |

| Lawyer, notary, private practice | Upon termination of the status of a lawyer or the powers of a notary | Simultaneously with the application for deregistration as an insured |

For employers submitting information about the length of service for a number of persons exceeding 24, there is an obligation to send reports to the Pension Fund of Russia electronically (clause 2 of Article 8 of Law No. 27-FZ). When the number of employees whose data is included in the report is less than 25, then the information can be submitted on paper.

Storage periods and responsibility

Documents containing individual information about experience must be stored for at least 75 years (Article 22.1 125-FZ and Article 905 of Order No. 558 of the Ministry of Culture). If reporting forms are prepared and submitted electronically, arrange for documentation to be stored in electronic format. Reflect the procedure in the accounting policy, familiarize the responsible persons with signature.

The official request from TOPFR indicates not only the latest deadlines for providing information, but also the responsibility provided for failure to provide or for indicating erroneous data. For example, refusal to provide, incomplete provision or distortion of information in the SZV-K form threatens officials of the institution with an administrative fine. Its size is 300-500 rubles. (note to Article 2.4, Article 15.33.2 of the Code of Administrative Offenses of the Russian Federation).

At the same time, the size of the pension is determined based on the data provided. If you provide incorrect data that will lead to the assignment of an inflated pension, the Pension Fund has the right to sue for compensation for material damage (Article 25 173-FZ), so it is important to provide reliable information.

Form type SZV-K

At the top of the SZV-K form (on the right), you need to indicate the type of adjustment: “initial”, “corrective” or “cancelling”. How to determine what to put? We'll tell you.

If you are submitting information about the length of service for an employee for the first time, then put an “X” in the “Original” field. The same mark will need to be made if you submit the corrected SZV-K form after the inspectors returned the primary one to you due to errors.

Check the “Corrective” field if you yourself have found an error in the SZV-K form previously submitted and accepted by the fund, and now you want to clarify or correct this information. In this case, in the SZV-K form, indicate not only the data that you are correcting, but also those that remain unchanged.

Do you want to completely cancel previously submitted information about a covered employee? Then put a mark in the “Cancelling” field. This form must be presented together with the “original” one. At the same time, in the form itself, fill in the details from “Insurance number” to “Category of insurance premium payer,” inclusive, and, if necessary, the details of a civil law agreement or an author’s agreement.

Rules for registration and sample of filling out SZV-STAZH in 2021

The list of information that must be reflected in reporting on length of service is provided by Law No. 27-FZ (clause 2 of Article 11), which requires the following indications for each employee:

- FULL NAME.;

- his personal account number;

- period of work during the reporting year;

- conditions giving the right to apply a special procedure for recording length of service or to early retirement.

Read about what these conditions are in the article “Special work experience - what is it?” .

Download our checklist for filling out the SZV-STAZH for 2021 and avoid making mistakes.

The main table of the SZV-STAZh form is intended for entering the above data. The form also contains fields for indicating the information necessary to identify the employer (its name, registration number, INN and KPP), data about the reporting period and the type of information (for the yearly report they will be initial, and in case of subsequent corrections - supplementary. In case of When submitting a report on employees applying for a pension before the end of the reporting year, the type of information will be indicated as “appointment of pension”).

Spaces are provided in the form for making notes on the presence (absence) of accrual and payment of contributions, but they are not filled out in the annual report, since they are intended for a report compiled in connection with the assignment of a pension.

The main part of the report is section 3 “Information on the period of work of the insured persons.”

In it, in order, you need to indicate the last names, first names, patronymics of the insured persons, SNILS, periods of work within the reporting year.

In this case, you need to indicate in a separate line for each employee the start and end dates of the period when he worked or did not work, for example, he was on vacation, on sick leave.

In this case, in column 11 you need to indicate additional information for each period of work. Additional information is reflected in the following codes:

| CHILDREN | Holiday to care for the child |

| DECREE | Maternity leave |

| AGREEMENT | Work under civil law contracts, including those beyond the reporting (calculation) period, payments for which were made during the reporting period |

| UVPERIOD | Working within an extended billing period |

| DLOTPUT | Staying on paid leave for employees who work under special conditions. Read more here. |

| NEOPL | Leave without pay |

| VRNETRUD | Period of temporary incapacity for work |

| WATCH | Shift rest time |

| MONTH | Transfer of an employee from a job that gives the right to early assignment of an old-age pension to another job that does not give the right to the specified pension, in the same organization due to production needs for a period of no more than one month during a calendar year |

| QUALIFY | Off-the-job training |

| SOCIETY | Performance of state or public duties |

| SDKROV | Days for donating blood and its components and rest days provided in connection with this |

| SUSPENDED | Suspension from work (preclusion from work) through no fault of the employee |

| SIMPLE | Downtime caused by the employer |

| ACCEPTANCE | Additional leave for employees combining work and study |

| MEDNETRUD | The period of work corresponding to the transfer, in accordance with the medical report of a pregnant woman at her request, from a job that gives the right to early assignment of an old-age labor pension to a job that excludes the impact of unfavorable production factors, as well as the period when the pregnant woman did not work until the issue of her employment in accordance with the medical report |

| NEOPLDOG | The period of work of the insured person under a civil contract, payments and other rewards for which are accrued in the following reporting periods |

| NEOPLAUT | The period of work of the insured person under the author's contract |

| DOPVIKH | Additional days off for persons caring for disabled children. |

| ZGDS | Information about a person holding a government position in a constituent entity of the Russian Federation on a permanent basis |

| DDG | Information about a person holding a government position in the Russian Federation |

| ZGGS | Information about a person holding a position in the state civil service of the Russian Federation |

| ZMS | Information about a person holding a municipal service position |

| PHI | Information about a person holding a municipal position on a permanent basis |

If the period was interrupted, for example, an employee quit during the year and was hired again, each period must also be indicated on a separate line.

If a report of the “Pension Assignment” type is submitted, then the end date of the period is indicated as the employee’s expected retirement date specified in the employee’s application.

If the employee’s dismissal date falls on December 31 of the year for which the SZV-STAGE form is being submitted, then in column 14 you must indicate the symbol “X”.

If an employee has the right to early retirement due to territorial conditions, then in column 8 “Territorial conditions (code)” you must indicate one of the following codes:

| Code | Name |

| RKS | Far North region |

| ISS | The area is equivalent to the regions of the Far North |

| RKSM | Far North region |

| ICSR | The area is equivalent to the regions of the Far North |

| VILLAGE | Work in agriculture |

| Ch31 | Work in the exclusion zone |

| Ch33 | Permanent residence (work) in the territory of the residence zone with the right to resettle |

| Ch34 | Permanent residence (work) in the territory of the residence zone with preferential socio-economic status |

| Ch35 | Permanent residence (work) in the resettlement zone before relocation to other areas |

| Ch36 | Work in the resettlement zone (according to actual duration) |

Note: The list of regions of the Far North and equivalent areas was approved by Resolution of the USSR Council of Ministers dated January 3, 1983 No. 12.

If an employee has the right to early retirement due to special working conditions and these conditions are documented, and insurance premiums at an additional rate or pension contributions have been paid in accordance with pension agreements for early non-state pension provision, then in column 9 “Special working conditions (code )" you must specify one of the following codes:

| 27-1 | Underground work, work in hazardous working conditions and in hot shops |

| 27-2 | Work with difficult working conditions |

| 27-3 | Work (women) as tractor drivers in agriculture and other sectors of the national economy, as well as drivers of construction, road and loading and unloading machines |

| 27-4 | Labor (women) in the textile industry in work with increased intensity and severity |

| 27-5 | Work as workers of locomotive crews and workers of certain categories who directly organize transportation and ensure traffic safety on railway transport and the subway, as well as truck drivers directly in the technological process in mines, mines, open-pit mines and ore quarries for the removal of coal, shale, ores, rocks |

| 27-6 | Work in expeditions, parties, detachments, on sites and in teams directly on field geological exploration, prospecting, topographic-geodetic, geophysical, hydrographic, hydrological, forest management and survey work |

| 27-7 | Work in logging and timber rafting, including maintenance of machinery and equipment |

| 27-8 | Work as machine operators (docker-mechanizers) of complex teams during loading and unloading operations in ports |

| 27-9 | Work as a crew member on ships of the sea, river fleet and fishing industry fleet (with the exception of port ships constantly operating in the port water area, service and auxiliary ships and crew ships, suburban and intracity ships) |

| 27-10 | Work as drivers of buses, trolleybuses, trams on regular city passenger routes |

| ZP12L | Working as a rescuer in professional emergency rescue services, professional emergency rescue teams and participation in emergency response |

| 27-OS | Working with convicts as workers and employees of institutions executing criminal penalties in the form of imprisonment |

| 27-PZh | Ministry of Internal Affairs of Russia and emergency rescue services of the Ministry of Emergency Situations of Russia |

| 28-SEV | Reindeer herders, fishermen, commercial hunters who live permanently in the Far North and equivalent areas |

The list of industries, works, professions, positions and indicators that give the right to preferential pension provision was approved by Resolution of the USSR Cabinet of Ministers dated January 26, 1991 No. 10.

Column 10 indicates the code of the basis for calculating the insurance period:

| SEASON | Work for a full navigation period on water transport, a full season at enterprises and organizations in seasonal industries |

| FIELD | Work in expeditions, parties, detachments, on sites and in teams during field work (geological exploration, search, topographic-geodetic, geophysical, hydrographic, hydrological, forest management and survey work) directly in the field |

| UIK104 | Work of convicts while they are serving a sentence of imprisonment |

| DIVER | Divers and other underwater workers |

| LEPRO | Work in leper colonies and anti-plague institutions |

IMPORTANT! Starting from the report for 2021, a new code “VIRUS” must be entered in column 10. It is indicated in relation to health workers who provide medical care to patients with coronavirus or suspected of it.

Column 12 “Base (code)” contains the code of the basis for the condition for early assignment of an insurance pension.

In column 13 “Additional information” you need to indicate additional information on the conditions for the early assignment of an insurance pension.

For a sample of filling out the SZV-STAZH form for 2021, see our website: