Large holdings and networks are developing an incentive system and often pursue an active social policy: they help employees financially, give gifts for holidays and birthdays.

The same thing happens in small businesses, just with a difference in scale and approach. The principles of accounting are the same everywhere. If you organize it correctly, the tax base will be reduced or at least it will be possible to avoid subsequent problems during the audit.

One-time payments include in particular:

- Prizes - any, incl. not related to work.

- Financial assistance - for an event upon application in connection with a difficult life situation and others.

- Gifts - in kind (even such as a car and real estate), cash and others.

We write accounting policies and regulations

Some specialists, especially in the creative field, high-quality professionals who have a choice of offers, are attracted by the social package.

In order for employees to see what they will get from working for the company, in addition to salary, it is worth clearly describing the incentive options and determining what you are willing to spend on. Then collect the data in a separate statement, which will become part of the accounting policy. It also specifies the nuances of accounting and tax accounting.

Note! Each employee must be familiarized with the document against signature.

If personal bonuses are established for someone (usually managers), they are prescribed in a separate clause of the employment contract. In other cases, the text simply refers to the provision (there is no need to bloat the document).

You can also provide general language. For example, “an organization has the right to reward an employee for work, achievement of professional results and for other reasons.” However, this option is not supported by the tax authorities; they require specifics and clear definitions of when and for what the employee receives incentives.

As an example of a bonus clause, you can use our sample.

How to reflect valuable gifts in accounting?

A gift given as a reward for work can be purchased by the employer from a supplier or produced in-house (including as a product of its own production). That is, until the moment of donation, it will be recorded as the debit of one of the accounts intended to reflect the material assets in stock: 10, 41 or 43.

The accrual of bonuses in the form of a gift occurs on the basis of an internal regulatory document (regulation) on bonuses and an order with the accrued amount being allocated to the employee’s regular payroll accounts:

Dt 20 (23, 25, 26, 29, 44) Kt 70.

The moment of donation will be recorded by the following posting:

Dt 70 Kt 10 (41, 43).

At the end of the month, insurance premiums will be calculated on the total amount of salary paid, which will include the bonus gift:

Dt 20 (23, 25, 26, 29, 44) Kt 69.

And from the total amount of payments (including the cost of the bonus-gift) personal income tax will be withheld:

Dt 70 Kt 68.

In terms of the composition of the entries (with the exception of the entry corresponding to the payment), the transactions reflected when issuing a gift are identical to those used when calculating regular wages.

What does tax accounting and the calculation of contributions from incentives look like?

When developing accounting policies and local regulations, remember the following principles:

- To accept cost amounts in tax accounting, indicate them as part of the payroll, tie them to work activity, but you will have to impose contributions on them. If, on the contrary, you reflect the costs of incentives as payments not related to work, then they will not fall into the base for contributions, but it will be impossible to accept them as expenses. We choose from two evils what is more profitable for you.

Note! Bonuses from targeted funds, at the expense of trade unions, remuneration to employees and managers beyond those mentioned in the concluded agreements will not be included in expenses. The basis is clauses 21 and 22 of Article 270 of the Tax Code.

- Holiday bonuses and other non-working payments to employees cannot be included in expenses. You can try to reformulate them in order to still include them in costs. For example, birthday bonuses should be correlated with length of service in the organization and a gradation should be created - the longer the period of work, the greater the incentive. True, there remains a possibility that the approach will not suit the tax authorities, and you will have to go to court for a solution. There is positive judicial practice for the employer.

- The calculated contributions, regardless of the payments themselves, will be fully included in the costs - paragraphs. 1 clause 1 art. 264 Tax Code of the Russian Federation.

- Financial aid, regardless of the size and purpose, will definitely not be included in tax expenses (clause 23 of Article 270 of the Tax Code). But for some of its types there will be no need to charge insurance premiums. For example, they do not tax assistance in the amount of up to 50,000 at the birth of a child (the main thing here is to meet the deadline - make the payment within the first year after birth). You can get by without charging contributions if you provide assistance of up to 4,000 rubles per year to your employees in other situations. Links - pp. 3 and 11 p. 1 p. 422 NK.

- Regardless of the form, any gifts require the execution of a gift agreement if the value of the gift is more than 3 thousand rubles (clause 2 of Article 574 of the Civil Code), but to document the transaction it is recommended to always draw it up, even when the amount is less.

- The Labor Code establishes that one of the reward options can be a valuable gift (Article 191). Having established this type of incentive in the company and designated it as part of the payroll, you will have to charge insurance premiums for it.

- When, in accordance with the GPC agreement, a transfer of ownership is carried out (for example, a company donates a car, an apartment), contributions will not be charged (clause 4 of Article 420 of the Tax Code).

- The donation transaction is subject to VAT (clause 1, clause 1, article 146 of the Tax Code). An exception is the gift of money (subclause 3, clause 1, article 39 of the Tax Code). Payers will be companies that work for OSNO. An organization (or individual entrepreneur) that uses UTII, does not conduct other activities and has not switched to the simplified tax system, is also required to pay VAT.

By the way! Some taxpayers and even judges have a different opinion regarding VAT. Alternatively, you can take into account gifts that are specified in the company’s internal documents as part of the Payroll Fund, and not calculate VAT. In practice, it is safer, of course, not to argue with inspection authorities, especially when it comes to rare and small gifts.

The line between rewarding for work achievements and the desire to please employees “just because” is thin, so you will have to defend yourself and firmly justify your own point of view (with documentation, of course). The Pension Fund and the Social Insurance Fund are also interested in non-taxable payments; they are especially attentive to them during an on-site inspection.

We reflect VAT

Experts from the Ministry of Finance have long held the position that the delivery of gifts is a gratuitous transfer subject to VAT on the basis of subparagraph 1 of paragraph 1 of Article 146 of the Tax Code of the Russian Federation.

This point of view is set out, in particular, in the letter of the Ministry of Finance of Russia dated January 22, 2009 No. 03-07-11/16 (see “The Ministry of Finance insists: a company that has made gifts to its employees must pay VAT”). With this approach, the organization that made gifts to employees charges VAT, and deducts the “input” tax. As a result, the accrual amount coincides with the deduction amount, and the amount payable for this operation is equal to zero.

Example 1

The company purchased a gift worth 2,360 rubles (including VAT at the rate of 18%, that is, 360 rubles) and presented it to the employee. The accountant made the following entries:

DEBIT 41 CREDIT 60 - 2,000 rub. (2,360 - 360) - reflects the purchase price of the gift; DEBIT 19 CREDIT 60 - 360 rub. — reflected “input” VAT; DEBIT 73 CREDIT 41 - 2,000 rub. — settlements with personnel are reflected; DEBIT 68 CREDIT 19 - 360 rub. — VAT is accepted for deduction; DEBIT 91 subaccount “Other expenses” CREDIT 73 - 2,000 rubles. — the purchase price of the gift is written off as expenses; DEBIT 91 subaccount “Expenses not accepted for tax purposes” CREDIT 68 - 360 rub. — VAT charged

However, it may happen that the supplier is not a VAT payer (for example, due to a transition to a special regime or due to exemption based on Article 145 of the Tax Code of the Russian Federation). Then there is no “input” tax, and it is impossible to apply a deduction. In such a situation, the company must not only charge VAT on the cost of gifts, but also pay tax to the budget.

To avoid this, some organizations present the matter as if gifts are an element of remuneration. For this purpose, a separate clause is included in the bonus regulations. It states that gift giving is used to reward and motivate employees, and the value of the gifts is charged to the wage fund. With this approach, the transfer of prizes is not considered a sale and is not subject to VAT.

However, this method has a significant drawback. There is a very high probability that during the inspection, inspectors will “reclassify” the operation and declare it a gratuitous transfer. True, in arbitration practice there are examples that are positive for taxpayers (see, for example, the resolution of the Federal Antimonopoly Service of the North-Western District dated November 20, 2008 No. A05-10210/2007). But there is no guarantee that other similar disputes will not end in victory for the inspectors.

Therefore, it seems to us that it is easier and safer to exclude the possibility of a dispute by charging VAT.

We understand the withholding and calculation of personal income tax

The bonuses will have to be taxed in full and there are no exceptions for them.

We list some exceptions from the taxable base, the list is incomplete, others can be found in Article 217 of the Tax Code, with references to items specifically from it in parentheses.

- Financial assistance paid to a working or former employee (if his dismissal is related to retirement) - in the amount of up to 4,000 per year (clause 28).

- Assistance provided by an organization to an employee at the birth (adoption, receipt of guardianship) of a child (up to a year after birth) - up to 50,000 rubles (clause 8).

- Any assistance to veterans and disabled people of the Great Patriotic War; for former prisoners (detailed list in paragraph 33) - up to 10,000 rubles during the year.

- Any other gifts from organizations and individual entrepreneurs received by the taxpayer during the year in a total amount not exceeding 4,000 rubles (clause 28).

By the way! You can give gifts to the child and another relative of the employee, not just himself. There will be a limit of 4,000 per year for each person. The main thing is to draw up a gift agreement in the name of the appropriate person.

Typical gift tax mistakes

Mistake #1. Stationery as gifts

We must not forget that so-called “useful” gifts for work (stationery, pens, notepads, books) can be written off as consumables, simplifying the work of the accountant and without exposing the organization to the risk of receiving unnecessary questions during a tax audit.

Mistake #2. Incorrect reflection of taxes

To prevent an administrative violation, you must be very careful about the purpose for which remuneration is given to employees, since this directly affects the tax accounting of the organization. Otherwise, during an audit, the tax inspector has the right to charge additional tax and also hold you accountable.

Mistake #3. Application of tax deduction

The tax deduction for gifts can be applied for a total amount of 4,000.00 rubles during the year; if the value of the reward is less, then the balance can be used again until the maximum value is reached. With the onset of the new year, the tax deduction amount can be used again to the maximum extent, just do not forget to check this amount with the current legislation adopted for this period.

Who will pay the tax?

We withhold personal income tax from the employee’s income. If we give out money, it is done directly from it. If the remuneration is in kind - payment for a spa, swimming pool, some goods, then from other income.

Let’s imagine a generous employer and a lucky employee who received something valuable as a gift: an apartment, a car, expensive jewelry. The cost of such things is high, which means that the tax will be rather large.

Despite the gratuitous basis of the gift agreement, do not forget to indicate the value of the gift, otherwise it is impossible to determine income. If the employee’s income does not allow personal income tax to be withheld until the end of the year, then the tax agent is not obliged to fulfill his duties indefinitely. You just need to inform the Federal Tax Service with a certificate 2-NDFL (sign “2”) before March 1 of the next year that there is a balance of uncollected tax, it will send the taxpayer a notification about the amount of the debt and the deadline for payment.

Explain to the employee the nuances of taxation to avoid disagreements in the future.

The timing of personal income tax transfer depends on the form in which the payment is made.

- we issue money - we deduct it directly from income and transfer it no later than the next day;

- we give an item, a certificate, pay for something - we transfer personal income tax to the budget no later than the day following the day of actual tax deduction.

Gifts for employees: registration, taxation, accounting

From the article you will learn:

1. What taxes and contributions and in what order must be calculated when giving gifts to employees.

2. How are gifts to employees taken into account for the purposes of calculating income tax under the simplified tax system.

3. In what order are gifts to employees reflected in accounting?

It's no secret that the most common way to express your gratitude or show your attention to another person is to give him a gift. Therefore, many employers practice “gifting” their employees as part of their corporate culture.

Fortunately, there are enough reasons for presenting gifts: these are official holidays, such as New Year, Defender of the Fatherland Day (February 23), International Women's Day (March 8), and individual ones, for example, a professional holiday or an employee's birthday.

However, despite all the solemnity of the moment, the presentation of gifts to employees from an accounting point of view is a business transaction that must be properly formalized, reflected in accounting, and taxes and contributions calculated.

We’ll look at how to do all this correctly and what an accountant should pay attention to in this article.

What is a gift

A gift to a gift is discord. In order to correctly formalize the transfer of a gift to an employee, and then correctly calculate taxes and contributions from this operation, it is necessary to determine how this gift qualifies from the point of view of civil and labor legislation.

1. A gift not related to the employee’s work activity (for anniversaries and holidays, etc.).

According to the Civil Code of the Russian Federation, a gift is a thing (including cash, gift certificates) that one party (the donor) transfers to the other party (the recipient) free of charge (clause 1 of Article 572 of the Civil Code of the Russian Federation). In the context of this article, the donor is the employer, and the recipient is the employee. The transfer of a gift is carried out on the basis of a gift agreement.

! Please note: the gift agreement must be concluded in writing if the value of the gift exceeds 3,000 rubles, and the donor is a legal entity (clause 2 of Art.

574 of the Civil Code of the Russian Federation). However, it is safer for the employer to enter into a written gift agreement with the employee in any case, regardless of the value of the gift, in order to avoid possible claims from tax authorities and funds.

Download Sample gift agreement between employer and employee

If the presentation of gifts occurs en masse, for example, to all employees by March 8, then there is no need to conclude separate agreements with each employee. In this case, it is advisable to draw up a multilateral gift agreement, in which each of the gift recipients will put his signature (Article 154 of the Civil Code of the Russian Federation).

2. A gift as a reward for work.

The Labor Code of the Russian Federation provides for the right of an employer to reward its employees with valuable gifts as incentives for work (Article 191 of the Labor Code of the Russian Federation). In this case, the cost of the gift acts as part of the salary, and the transfer of the gift occurs not on the basis of a gift agreement, but on the basis of an employment contract with the employee.

Gifts given to employees as incentives for their work are essentially production bonuses. You can read about the procedure for documenting and confirming bonuses to employees in one of the previous articles.

Personal income tax on gifts to employees

A gift given to an employee, either in cash or in kind, is recognized as his income and is subject to personal income tax. The responsibility for calculating and withholding personal income tax from an employee’s income lies with the employer, since he is a tax agent.

In this case, not the entire amount of the gift is taxed, but only over 4,000 rubles. (clause 28 of article 217 of the Tax Code of the Russian Federation).

When applying this limitation, you must take into account the total amount of gifts given to a specific employee in cash and in kind during the calendar year.

Example.

- During 2014, the employee received her first gift in March (for International Women's Day). The cost of the first gift is 2800 rubles. Since the value of the gift is less than 4,000 rubles, personal income tax is not charged on it.

- In September 2014, the employee was given a second birthday gift in the amount of 3,000 rubles. In this case, it is necessary to withhold personal income tax from the amount of the gift exceeding 4,000 from the beginning of the year, that is, from the amount of 1,800 rubles. (2800 + 3000 – 4000).

- Obviously, all subsequent gifts to this employee, issued in the current calendar year, for example, for the New Year, must be subject to personal income tax in full.

Personal income tax on the value of gifts is calculated in the general manner: at a rate of 13% if the employee is a resident, at a rate of 30% if the employee is not a tax resident of the Russian Federation. You can read more about who residents and non-residents are, as well as about the specifics of calculating personal income tax on non-resident income in this article.

! Please note: the moment of deduction of personal income tax and transfer to the budget depends on the form in which the gift was issued (Letter of the Federal Tax Service dated August 22, 2014 N SA-4-7/16692):

- if a gift is given to an employee in cash, then the tax must be withheld and transferred to the budget on the day the gift amount is issued from the cash register or transferred to the employee’s personal account;

- if the gift is given in kind, then personal income tax must be withheld and transferred on the nearest day of payment of funds to the employee, for example, on the next day of salary payment. If, after delivering a gift to an employee, no payments will be made until the end of the calendar year, then the employer must, no later than one month from the end of the tax period (year), notify the employee in writing, as well as the tax authority at the place of registration, about the impossibility of withholding personal income tax and the amount of tax not withheld. . In this case, a 2-NDFL certificate is filled out for the employee, in which the value “2” must be indicated in the “sign” field, and submitted to the Federal Tax Service no later than January 31 of the following year.

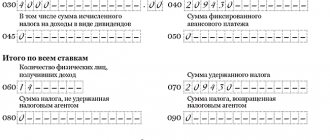

Income received by an employee in the form of gifts is reflected in the 2-NDFL certificate in the following order:

- the amount of each gift (including those not exceeding 4,000 rubles) is reflected in the certificate as income with code 2720;

- the amount of the gift that is not subject to personal income tax (i.e. up to 4,000 rubles) is reflected in the certificate as a deduction with code 501.

Insurance premiums from the amounts of gifts to employees

To determine whether insurance premiums are calculated on the amounts of gifts to employees or not, you need to clearly understand the nature of the payments these gifts relate to.

According to Law No. 212-FZ, insurance premiums are levied on payments and other remuneration to employees within the framework of labor relations (Part 1 of Art.

7) and payments and other remuneration under civil law contracts, the subject of which is the transfer of ownership of property (which includes a gift agreement), are not taxed (part 3 of article 7). This means the following:

- if gifts are given to employees on the basis of labor and collective agreements without drawing up gift agreements, the amounts of such gifts are subject to insurance contributions ;

- if gifts (including in cash) are given to employees on the basis of written donation agreements, the amounts of these gifts are not subject to insurance contributions to the Pension Fund, Federal Compulsory Medical Insurance Fund, Social Insurance Fund, incl. for insurance against industrial accidents and occupational diseases.

Source: https://buh-aktiv.ru/podarki-sotrudnikam-oformlenie-nalogooblozhenie-uchet/

Accounting entries

In different cases, accounting methods are similar, but there are differences in the types of payments and other incentives. We give gifts, give out financial assistance or bonuses not related to work, using the transactions below.

Option 1. Goods purchased from a supplier with VAT. Organization - VAT payer:

- D 10 K 60 – purchases received.

- D 19 K 60 – input VAT is taken into account.

- D 60 K 51 (71) – paid for the purchase to the supplier with a settlement account (or through an accountable person).

- D 68 VAT K 19 – VAT is accepted for deduction.

- D 73 (76) K 10 – issuing incentives to employees (other individuals).

- D 91.2 K 73 (76) - the cost of purchased items is written off as other expenses. Sometimes postings No. 5 and No. 6 combine D 91.2 K 10, but this is not correct.

- D 91.2 K 68 VAT – VAT charged.

- D 99 K 68 NP – reflects the permanent tax liability (PNO) for income tax (PBU 18/02), calculated by the formula (amount of incentive in the form of an item + VAT) * 20%.

- D 73 K 68 – personal income tax is charged.

- D 91.2 K 69 – contributions accrued.

- D 70 K 73 – personal income tax is withheld from wages.

Note! PBU 18/02 is not applied by those who do not pay income tax (for example, organizations using the simplified tax system, UTII, Unified Agricultural Tax) and is optionally applied by companies maintaining simplified accounting (for example, small businesses).

Similar entries are made when an organization “pays” with goods that it usually trades (account 10 will replace another - 41 “Goods”) or transfers its own products (instead of 10 “Materials” account 43 “Finished Products” and there are no first 4 entries).

Option 2. Certificates, tickets, gift cards and other monetary documents, which are used to subsequently provide services or purchase goods:

Here everything is exactly the same as in Option 1, only count 10 changes to 50.3 “Cash documents”.

Option 3. Money:

- D 73 (76) K 50 (51) – funds were issued from the cash register or transferred through the bank.

- D 91.2 K 73 (76) - writing off the amount as other expenses.

- D 99 K 68 Income tax - PNO.

- D 73 K 68 – personal income tax.

- D 91.2 K 69 – insurance premiums are charged.

Option 4. In-kind form of encouragement. We pay for the benefit of the employee for services or goods:

- D 73 K 76 – reflects the employee’s debt to the creditor.

- D 76 K 51 (50, 71) – services, work or goods paid for by the employer.

- D 91.2 K 73 – payment is written off.

- D 99 K 68 NP – PNO.

- D 73 K 68 – personal income tax.

- D 91.2 K 69 – contributions.

- D 70 K 73 – personal income tax is withheld from wages.

Insurance premiums for gifts for employees' children

On the eve of the New Year, many organizations give holiday gifts to the children of their employees. How to calculate insurance premiums on their cost? As the Ministry of Labor of the Russian Federation explained in its letter dated July 8, 2015 No. 17-3/B-335, there are two options here:

- if the cost of children's New Year's gifts is paid to employees personally, then such payments are subject to insurance contributions in accordance with the general procedure;

- if the employer independently purchases children's New Year's gifts, then there is no object for taxation of contributions, since the children of employees are not insured persons of the employer and no labor relations arise here.

So, are gifts to employees subject to insurance premiums? If gifts are given on the basis of local acts of the employer and employment contracts, then their value is subject to contributions, but if a written gift agreement is drawn up for the gift, and the reason for it is not related to the performance of work duties by the employee, then contributions should not be assessed.

Features of accounting for financial assistance

Various sources can be used for payment. Including the company's profit remaining after taxation and not previously distributed. Let's assume that the organization decided to issue financial assistance from retained earnings of previous years (account 84). How to carry out such a business transaction? I would like to emphasize that the Ministry of Finance is against such manipulations; in its opinion, the expression “retained earnings” implies that the founders have not yet made a decision on these funds.

In order not to irritate the Ministry of Finance, you need to hold a meeting and draw up a protocol with a decision on allocating part of retained earnings to such expenses. This will be easier to do if there is only one participant in the organization, then his sole decision is sufficient. The postings will be similar to the postings above, but count 91 will replace count 84.

What taxes are a gift to an employee subject to in 2021?

The employer gives gifts to employees. The 2020 taxation of this operation is of interest to the accountant. Details are in the material. By default, gifts are subject to personal income tax only if their value exceeds RUB 4,000. per year (clause 28, article 217, clause 2, art.

226 of the Tax Code of the Russian Federation). Moreover, for income tax purposes, it does not matter who the recipient of the gift is: a company employee or third parties.

There is an exception to this rule - these are gifts issued on the grounds provided for in paragraph 8 of Article 217 of the Tax Code of the Russian Federation (the birth of a child to an employee, etc.

) Please note: Prizes for participation in competitions or badges with corporate symbols are also gifts for personal income tax purposes.

In the case of gifts to employees, this is the first salary payment after the gift. Let us remind you that the amount of withholding tax cannot exceed 50% of the salary.

Continuing the topic of taxation of gifts to employees in 2021, let’s focus on insurance premiums from the cost of the gift.

There is no need to impose insurance contributions for compulsory pension, social, medical insurance, as well as contributions for insurance against accidents and occupational diseases.

This is explained as follows. A donation is a civil contract, and such transactions are not subject to contributions (clause

1 tbsp. 572, paragraph 2 of Art. 574, paragraph 4 of Art. 420 Tax Code of the Russian Federation, clause 1, art. 20.1 of the Federal Law of July 24, 1998 No. 125-FZ)

Accounting and taxes for New Year's gifts 2021

The New Year holidays are approaching - the time for gifts.

Most organizations give gifts to their employees and their children.

It is important to properly process the transfer of gifts and avoid taxation mistakes.

The basis for issuing gifts to employees is the order of the manager. Let us remind you that a gift agreement must be concluded in writing in cases where:

- the contract contains a promise of donation in the future (Article 574 of the Civil Code of the Russian Federation).

- the donor is a legal entity and the value of the gift exceeds 3,000 rubles;

If the value of the gift is below 3,000 rubles, then there is no obligation to conclude it in writing, but still, in order to avoid disputes with the tax office, it is better to have a written agreement.

Sometimes regulatory authorities equate gifts with payment for work in kind and try to charge additional contributions.

Here arbitration practice will come to the rescue - Resolution of the Arbitration Court of the North Caucasus District dated 08/06/2015 No. F08-4089/2015 in case No. A32-27379/2014, according to which the cost of gifts is not included in the taxable base.

Arbitration practice in 2021 within the framework of Chapter 34 of the Tax Code of the Russian Federation “Insurance contributions” has not yet developed.

In accounting, goods intended for gifts to employees are reflected in accounting entries: Dt 10 (41) Kt 60 - New Year's gifts are accepted for accounting; Dt 19 Kt 60 – “input” VAT is taken into account; Dt 68 Kt 19 – VAT accepted for deduction; When transferring a gift to an employee in connection with the New Year celebration: Dt 91 Kt 10 (41) - gifts are taken into account

The procedure for taxing gifts for employees with insurance premiums and personal income tax in 2020

Author of the articleNatalie Feofanova 7 minutes to read1 Many organizations, in order to motivate and maintain corporate culture, encourage their employees with gifts dedicated to certain state, personal or corporate holidays, as well as certain labor achievements of the employee.

But, despite all the pleasantness of this moment, for the organization this is a certain business transaction that must be correctly reflected in accounting so as not to lead to unpleasant consequences.

In the article we will tell you whether gifts to employees are subject to personal income tax and insurance contributions, and how such gifts are formalized at the enterprise. Several types of gifts can be classified, which, by their functional characteristics, can affect the way they are reflected in accounting: Gifts not related to the main job responsibilities of employees (for various holidays, anniversaries, etc.).

Gifts for employees: registration, taxation, accounting

From the article you will learn: 1. What taxes and contributions and in what order must be calculated when giving gifts to employees. 2. How are gifts to employees taken into account for the purposes of calculating income tax under the simplified tax system.

3. In what order are gifts to employees reflected in accounting?

It's no secret that the most common way to express your gratitude or show your attention to another person is to give him a gift. However, despite all the solemnity of the moment, the presentation of gifts to employees from an accounting point of view is a business transaction that must be properly formalized, reflected in accounting, and taxes and contributions calculated.

We’ll look at how to do all this correctly and what an accountant should pay attention to in this article.

A gift to a gift is discord. In order to correctly formalize the transfer of a gift to an employee, and then correctly calculate taxes and contributions from this operation, it is necessary to determine how this gift qualifies from the point of view of civil and labor legislation. 1. A gift not related to the employee’s work activity (for anniversaries and holidays, etc.). According to the Civil

Cash gift to employee taxation 2020

After congratulating the staff on a particular significant date, event and presenting gifts, the accounting department has to check whether personal income tax has arisen from gifts to employees.

Let's look at how not to miss anything.

Gifts are given in cash or in kind.

Gift certificates have become popular in recent years. But in each case the question arises: should personal income tax be assessed on gifts to employees? The answer to this is given by the Tax Code of the Russian Federation.

As follows from paragraph 1 of Art. 210 of the Tax Code of the Russian Federation, gifts should be included as income received in kind. Individual income tax must be taken from their value.

The same as with income received in the form of “real” money. If the value of all gifts that an employee received during the year exceeded 4,000 rubles, the amount in excess of this limit is subject to personal income tax.

If you draw up a gift agreement for gifts to employees in 2021, you can save on insurance premiums. But they cannot be written off in tax accounting. With gifts for work, the opposite is true.

And is tax required to be withheld when gifts are given to customers?

If a company gives gifts to employees, you need to carefully consider their value. New Year's holidays are not only about a Christmas tree, champagne and Olivier salad.

d.

Gift to employee tax 2020

Let us note that according to civil law (clause 2 of Article 574 of the Civil Code of the Russian Federation), the agreement for the gift of movable property must be made in writing if the value of the gift exceeds 3,000 rubles.

However, Law No. 212-FZ does not indicate this restriction, so the value of the gift in this case does not matter.

Regarding the taxation of gifts with insurance contributions to the Pension Fund of Russia, the Social Insurance Fund and the Federal Compulsory Medical Insurance Fund of Russia, the situation is ambiguous.

As a general rule, the object of taxation is payments and other remuneration accrued by companies in favor of individuals within the framework of labor relations and civil contracts, the subject of which is the performance of work or the provision of services (Article 7 of the Federal Law of July 24, 2009 No. 212-FZ ( hereinafter – Law No. 212-FZ)).

Accordingly, the amount of income from a valuable gift is fully subject to insurance premiums, including contributions for injuries.

- DT70 KT68. Withholding personal income tax.

- DT19 KT60. Fixation of “input” VAT.

- DT91-2 KT68. VAT accrual.

- DT68 KT19. Acceptance of “input” VAT for deduction.

- DT10 KT60 (76, 71). Capitalization of the gift excluding VAT.

- DT91-2 KT73-3. Write off the cost of the gift for other expenses.

- DT73-3 KT10. Presentation.

IMPORTANT! The transfer of gifts free of charge is considered a sale and is therefore subject to VAT.

VAT is not charged on gifts in cash.

It will be charged if the company uses the general taxation system or UTII. Gifts are not subject to VAT

How gifts to employees are subject to insurance premiums in 2021

How to properly formalize a gift, and also in what cases a gift should be subject to insurance premiums and in what cases not. According to the definition given by the Labor Code of the Russian Federation, a gift is understood as a form of incentive to an employee, within the framework of which the institution transfers property to the employee in material form, money or ownership of an object.

Gifts given to employees can be divided into two types:

- A gift that is not related to remuneration of an employee for his work merits.

The Civil Code provides for the giving of such gifts, but it must be taken into account that if the value of the gift is more than 3,000 rubles. and the donor is a legal entity, then in this case an agreement must be concluded in writing.

However, it is safer for the employer if the contract is concluded regardless of the value of the gift.

- A gift as a reward for work.

The Labor Code of the Russian Federation provides for remuneration of employees with valuable gifts for conscientious performance of their labor duties. In this case, the cost of the gift is considered as part of the salary, and the transfer of the gift occurs on the basis of an employment contract with the employee.

In addition to a written gift agreement, it is also necessary to issue an order to reward an employee with a gift in Form No. T-11 or an independently approved form. In order to correctly and correctly draw up a gift agreement, we indicate the following information in it: date and place of preparation; employer details (full name, legal address, bank account number);

Personal income tax on gifts in 2021

→ → Current as of: October 6, 2021 An organization or individual entrepreneur, when paying income to an employee, in general must withhold personal income tax.

After all, the employer is recognized in this case ().

Accordingly, as a general rule, gifts are subject to personal income tax.

The only question will be whether tax must be withheld from the entire value of the gift.

The Tax Code of the Russian Federation exempts from taxation gifts received by individuals from organizations and individual entrepreneurs if the total cost of such gifts during a calendar year does not exceed 4,000 rubles (). However, for certain categories of individuals, the cost of gifts per year can reach 10,000 rubles and still be exempt from taxation. We are talking, in particular, about such persons as ():

- WWII veterans or disabled people;

- home front workers;

- former prisoners of Nazi concentration camps.

- widows of military personnel who died during the Second World War;

- widows of deceased disabled veterans of the Second World War;

The employer must keep personalized records of income in the form of gifts received from such an employer by individuals.

After all, only if there is accounting in the context of individual recipients of income, the employer will be able to control the excess of the value of given gifts over the non-taxable amount. Personal income tax on a gift is calculated depending on whether the recipient is a recipient or not.

Expert: Gifts for Employees Taxation 2020

When determining the tax base for personal income tax, all income of the taxpayer that he received both in cash and in kind is taken into account (clause

1 tbsp. 210 of the Tax Code of the Russian Federation). Accordingly, as a general rule, gifts are subject to personal income tax. The only question will be whether tax must be withheld from the entire value of the gift. The non-taxable payment limit, calculated on an accrual basis for the year, should not exceed 4,000 rubles.

Amounts in excess of the established norm are subject to personal income tax on a general basis. Gifts to employees are part of the corporate culture and an element of employee motivation.

New Year's holidays, February 23, March 8, weddings, birth of a child, retirement - the most common reasons for which employers give gifts. Gifts can include, for example, sweets, flowers, souvenirs, and also amounts of money. We note that according to civil law (clause

2 tbsp. 574 of the Civil Code of the Russian Federation), the agreement for the donation of movable property must be made in writing if the value of the gift exceeds 3,000 rubles.

However, Law No. 212-FZ does not indicate this restriction, so the value of the gift in this case does not matter.

If the presentation of gifts occurs en masse, for example, to all employees by March 8, then there is no need to conclude separate agreements with each employee.

In this case, it is advisable to draw up a multilateral gift agreement, in which each of the gift recipients will put his signature (Art.

154 of the Civil Code of the Russian Federation). The accountable person receives funds from the cash register, draws up an act for the transfer of funds and transfers them to the employee (donee).

Gifts to Employees in Cash Taxation 2020

As is known, if there are hired employees, their employer must necessarily pay personal income tax on various payments in their favor.

At the same time, there is a certain list of payments from which it is not at all necessary to withhold taxes or even prohibited from doing so, and therefore employers or authorized accountants have to group all types and correctly prepare reports in order to avoid any errors and troubles.

In particular, many are asking questions about whether gifts to employees are subject to insurance premiums and how this issue is regulated by current legislation in 2021.

It is immediately worth noting that the current legislation provides for different options for gifts, and in order to correctly formalize the transfer and correctly calculate contributions and taxes from this transaction, you will need to decide how the order made is qualified from the point of view of the law.

First of all, there are gifts that are not related to the employee’s work, which recognize certain property transferred from one party to another free of charge.

In this case, the transfer should be carried out only if there is an appropriate gift agreement, and taxes will only need to be paid if the donor is an individual and the total value of the gift made exceeds the amount of 3,000 rubles.

In accordance with the Labor Code, it is possible for an employer to issue awards to its employees as a reward for fulfilled labor duties, and this is stated in Article 191.

Article 191.

Reporting

Sometimes confusion arises when reporting non-taxable payments. Some do not include them at all in reports and 2-NDFL certificates, others show them everywhere. How to correctly fill out reports in accordance with the rules and legislation?

First of all, look at the instructions for the forms, they are quite detailed, and you can find answers to most questions there. Secondly, note for yourself the difference between payments that are not taxable under the law and those that are not subject to tax or conditional contributions. For example, dividends are not taxable amounts and are not shown at all in the RSV-1 report. At the same time, financial assistance is generally subject to contributions and is exempt from them only in the form of certain exceptions, which means that it should appear in the report.