What is this in simple words

Officially employed workers can confirm their solvency using a 2-NDFL certificate. The document is drawn up at the workplace at the employee’s request and contains data on accrued income, as well as sick pay and financial assistance for a certain period of time. There is also information about withheld personal income tax (NDFL). The certificate is generated for a period of 1 year on a cumulative basis from the beginning of the year or from the month when the employee started working. Data on accruals and deductions must match the information that will subsequently be provided to the tax office.

How can people who are retired or unemployed get a 2-NDFL certificate?

Unemployed people registered with the Employment Center can obtain a certificate of income by submitting a written application directly to the Employment Center.

If a citizen did not work, was not registered as unemployed at the Employment Center, you should not count on receiving a certificate of income for one simple reason - there was no income and, accordingly, personal income tax was not calculated and paid.

Citizens receiving state pensions cannot apply for a 2-NDFL certificate, because Pension benefits are not subject to personal income tax.

Where they may require

The 2-NDFL certificate is generated in 2 cases: at the request of the employee or for submission to the tax authorities. In the first case, the document is issued at any time, as a rule, upon a written application from the employee for the specified periods, taking into account the actual time worked. That is, if an employee needed a certificate in July for personal needs, the accounting department will generate data on earnings and withheld tax from January (or from the month of starting work) to June.

In addition, certificates for all employees are submitted to the Federal Tax Service annually at the end of the working year. Based on them, the tax office checks the completeness of accrued and paid income tax for the enterprise as a whole. Both documents are identical to each other. Why does the employee need a certificate? The need arises when it is necessary to show the level of income, including to confirm the status of the poor. Also, 2-NDFL can serve as proof of a sufficient level of solvency of a citizen. In some cases, the purpose of the receipt is to show the amount of income tax transferred from earnings.

Who can request a 2-NDFL certificate? The document is generated to provide:

- To banks and other credit institutions to obtain borrowed funds.

- To government bodies (social protection and others) to register a number of benefits and payments in favor of the poor.

- In stores and shopping centers when making an expensive purchase on credit.

- To receive tax deductions (refund of previously paid tax).

- To confirm previously received income at a new place of work.

When to submit cancellation certificates

Most often, when the report was sent to the wrong tax office. If the 2-NDFL simply needs to be adjusted, submit the adjustment immediately - do not submit a cancellation certificate before that.

In the cancellation certificate, code 99 is entered in the “attribute” field. And in the fields “Amount of income”, “Amount of calculated tax”, “Amount of withheld tax”, “Amount of transferred tax” - zeros.

Submit reports in three clicks

Elba will help you work without an accountant. She will prepare reports, calculate taxes and will not require any special knowledge from you.

Try 30 days free Gift for new entrepreneurs A year on “Premium” for individual entrepreneurs under 3 months

Why is it necessary?

Certificate 2-NDFL serves as confirmation of an individual’s earnings. From time to time, a document is required to be submitted to a number of organizations and institutions.

To an individual

An ordinary employee, using a 2-NDFL certificate, can receive a loan, apply for benefits for himself and his minor children, and take advantage of a tax deduction. A complete list of situations in which a document may be required is given above. It is also worth noting that the certificate will help you understand the correct accrual of income, its completeness and volume in the workplace. The indicated income is the taxable base for calculating taxes. In addition, when calculating insurance premiums to the Pension Fund and the Social Insurance Fund, almost the same data are taken as a basis, with some minor nuances.

For an individual entrepreneur

A certificate of income in form 2-NDFL can be drawn up only if it is possible to calculate income tax, which is withheld from employee salaries. In this case, the document is generated not by the employee himself, but by the employer, who is a tax agent. The peculiarities of the work activity of an individual entrepreneur do not imply the presence of an employer. But drawing up a certificate for yourself personally will not be the correct decision. An individual entrepreneur can receive 2-NDFL only if, in parallel with running his own business, he is also employed by another employer.

However, entrepreneurs are often faced with the need to present a certificate in form 2-NDFL, for example, when applying for loans. It is worth understanding that this is just a standard requirement of banks. Usually, other forms of documents on income in any form are developed for individual entrepreneurs. You can also confirm the availability of income using tax returns or a special ledger of income and expenses.

Tax agent

Employers with hired employees are considered tax agents. This means that they are responsible for withholding personal income tax from employees’ wages and transferring the tax to the budget. Penalties for late payments or incomplete withholding are also at the expense of the enterprise. Employers, as tax agents, are required to annually report tax withholdings on employee income. For these purposes, 2-NDFL certificates are provided. As a rule, the amounts of tax calculated, withheld and transferred to the budget at the end of the year coincide. But in some situations it is not possible to retain personal income tax in full. In such cases, the employee develops a debt to the budget, which also needs to be reported to the tax office.

For pensioners

Pension payments are not subject to income tax. Therefore, generating a personal income tax certificate under these conditions is impossible. Just as in the case of entrepreneurs, pensioners can provide income certificates only if they are officially employed and receive wages. Separately, it should be said about people receiving payments from non-state pension funds.

Such types of pensions are subject to personal income tax. People receiving pensions from NPF funds can receive a 2-NDFL certificate at the location of the local NPF branch. The Tax Code of the Russian Federation does not consider pensions as a taxable base only if they are accrued at the expense of the state pension fund. You can confirm the income of people of retirement age using certificates from the Pension Fund. Other sources of income may also be taken into account, for example, entrepreneurial activity, renting out apartments.

Help on form 2-NDFL in 2021

Home / Reporting for employees

| Download form 2-NDFL (valid until the end of 2021) View a sample of filling out the certificate Below are detailed instructions for filling out | The following situations are considered: 1. Income was taxed at different rates 2. Salary for December was paid in January |

ATTENTION!

From January 1, 2021, the 2-NDFL form will be updated again.

What has changed + new forms can be found in this article.

2-NDFL is an official document about the income of an individual received from a specific source (usually an organization or individual entrepreneur) and the personal income tax withheld from this income.

Organizations and individual entrepreneurs submit certificates only in case of payment of income to employees and other individuals. But individual entrepreneurs do not draw up form 2-NDFL for themselves.

You are required to submit certificates both to the tax office and to your employees.

2-NDFL employees are issued within three working days from submitting an application for a certificate. A certificate may be needed when leaving a job and moving to another job, filing tax deductions, applying to a bank for a loan, applying for a visa to a significant number of countries, applying for a pension, adopting a child, submitting documents for various benefits, etc. .

Due dates

Tax certificates are submitted once a year:

- no later than April 1 (until April 2, 2021, since the 1st is a day off);

- until March 1, if it is impossible to withhold personal income tax (certificates with sign 2).

Information about the income of non-employees in the company

In the following common cases, we must file income information for individuals not employed by the company:

- The company paid for the work/services under the contract;

- The LLC paid dividends to participants;

- Property was rented from an individual (for example, premises or a car);

- Gifts worth more than 4,000 rubles were presented;

- Financial assistance was provided to those not working in the organization/individual entrepreneur.

When not to submit 2-NDFL

There is no obligation to file 2-NDFL when:

- purchased real estate, a car, goods from an individual;

- the cost of gifts given by the company is less than RUB 4,000. (in the absence of other paid income);

- damage to health was compensated;

- financial assistance was provided to close relatives of a deceased employee/employee who retired from the organization or to the employee/retired employee himself in connection with the death of his family members.

In what format to submit 2-NDFL

1) If the number of completed tax certificates is 25 or more, you need to transmit 2-NDFL via telecommunication channels (via the Internet), for which an agreement must be concluded with a specialized organization (operator of electronic document flow between taxpayers and inspectorates).

The list of operators can be viewed on the tax service website. You can also use the Federal Tax Service website to submit certificates.

2) If the number is smaller, you can submit certificates on paper - bring them in person or send them by mail.

When submitting 2-NDFL in paper form, a register of information on income is also compiled - a consolidated document with data about the employer, the total number of certificates and a table of three columns, the first of which contains the numbers of the tax certificates submitted, the second indicates the full name of the employees, the third their dates of birth are indicated.

The register also reflects the date of submission of the certificates to the tax authority, the date of acceptance and the data of the tax officer who accepted the documents. The register is always filled out in 2 copies.

The current form of the register is given in the order of the Federal Tax Service of Russia dated September 16, 2011 No. ММВ-7-3/ [email protected] When submitting via the Internet, the register will be generated automatically and there is no need to create a separate document.

When accounting is carried out in a special program (for example, various versions of 1C Accounting), personal income tax reporting is generated automatically; all that remains is to double-check the correctness of filling out. Also, some developers offer separate programs for filling out personal income tax reporting (for example, the resource 2ndfl.ru).

Instructions for filling out the 2-NDFL certificate

Cap part

We indicate:

- The year for which 2-NDFL was compiled;

- Serial number of the certificate;

- Date of compilation.

Column "sign"

Specify the value:

- “1” – in all cases where personal income tax was withheld, if the certificate is submitted by a tax agent (“3” – if the form is submitted by the legal successor of the organization or its OP on the same grounds);

- “2” – when it was not possible to withhold personal income tax if the document is submitted by a tax agent (“4” – if the form is submitted by the legal successor on the same basis).

The need to provide 2-personal income tax with sign 2 may arise in such common cases as:

- Presenting a non-monetary gift worth more than 4,000 rubles to a person who is not an employee of the company;

- Payment of travel and accommodation for representatives of counterparties;

- Forgiveness of debt for a resigned employee.

It should be borne in mind that submitting a certificate with feature 2 does not cancel the obligation to submit a certificate with feature 1 for the same income recipient.

Column "Adjustment number"

When the certificate is submitted for the first time, “00” is entered. If we want to correct the information from the previously provided certificate, the column indicates a value greater than the previous one by one - 01.02, etc.

If a cancellation certificate is submitted to replace the one submitted earlier, “99” is indicated.

Note: when filling out the corrective document, the successor of the tax agent must indicate the number of the certificate submitted by the previously reorganized company and the new date of preparation.

Code of the tax office with which the organization or individual entrepreneur is registered

You can find out on the Federal Tax Service website through this service).

Section 1

OKTMO code

OKTMO is the All-Russian Classifier of Municipal Territories. The code can be viewed on the tax service website in this service).

Individual entrepreneurs on UTII and PSN indicate OKTMO at the place of business in relation to their employees employed in these types of business.

The legal successor of the tax agent fills out OKTMO at the location of the reorganized company (RP).

TIN and checkpoint

Extracted from the tax registration certificate. In 2-NDFL for employees of separate divisions, OKTMO and KPP of these divisions are indicated. Individual entrepreneurs do not indicate checkpoints.

If the certificate is submitted by the successor of the tax agent, the TIN/KPP of the legal successor is filled in.

Tax agent

The abbreviated (if absent, full) name of the organization (full name of the entrepreneur) is indicated.

If the certificate is submitted by the legal successor, the name of the reorganized company (RP) should be indicated.

Reorganization (liquidation) codes

In the “Form of reorganization” field, the codes of reorganization (liquidation) of the legal entity (LP) are indicated:

| Code | Name |

| 1 | Conversion |

| 2 | Merger |

| 3 | Separation |

| 5 | Accession |

| 6 | Division with simultaneous accession |

| 0 | Liquidation |

The codes of the reorganized company (OP) are entered in the TIN/KPP field.

If the certificate is not submitted for a reorganized legal entity (LE), these fields are not filled in.

If the title of the certificate contains the sign “3” or “4”, these fields must be filled in in the prescribed manner.

Section 2

Taxpayer status

Indicated by code from 1 to 6:

Code 1 - for all tax residents of the Russian Federation (persons staying in the territory of the Russian Federation for 183 or more calendar days within 12 consecutive months), and for those who stayed less than 183 days, the following codes are indicated:

- 2 – when the recipient of the income is not a resident and does not fall under other codes;

- 3 – if we invited a highly qualified specialist to work;

- 4 – if our employee is a participant in the program for the resettlement of compatriots;

- 5 – if the employee brought a certificate of recognition as a refugee or provision of temporary asylum in the Russian Federation;

- 6 – when our employee is accepted on the basis of a patent (foreign workers from countries whose citizens do not require entry visas to the Russian Federation, with the exception of those included in the Customs Union. For example, citizens of Azerbaijan, Tajikistan, Uzbekistan, Ukraine , temporarily staying in Russia, for the right to work for legal entities and individual entrepreneurs are required to obtain patents).

We determine the status at the end of the year for which information is submitted. Those. if the employee became a resident during the year, in the “Taxpayer Status” column we enter the number 1. This does not apply only to filling out certificates for those working on the basis of a patent (for them, code is always 6).

If the 2-NDFL is issued before the end of the year, the status is indicated as of the date the document was drawn up.

Country of citizenship code

Indicated in accordance with OKSM (All-Russian Classifier of Countries of the World). For example, for Russian citizens this is code 643. For codes for other countries, see this link.

Identity document code

Indicated according to the directory “Codes of types of documents proving the identity of the taxpayer” (see table below). Usually these are codes 21 (passport of a citizen of the Russian Federation) and 10 (passport of a foreign citizen). Next, indicate the series and number of the document.

| Code | Title of the document |

| 21 | Passport of a citizen of the Russian Federation |

| 03 | Birth certificate |

| 07 | Military ID |

| 08 | Temporary certificate issued in lieu of a military ID |

| 10 | Foreign citizen's passport |

| 11 | Certificate of consideration of an application for recognition of a person as a refugee on the territory of the Russian Federation on its merits |

| 12 | Residence permit in the Russian Federation |

| 13 | Refugee ID |

| 14 | Temporary identity card of a citizen of the Russian Federation |

| 15 | Temporary residence permit in the Russian Federation |

| 18 | Certificate of temporary asylum on the territory of the Russian Federation |

| 23 | Birth certificate issued by an authorized body of a foreign state |

| 24 | Identity card of a military personnel of the Russian Federation |

| 91 | Other documents |

Sections 3-5

Indicators (except for personal income tax) are reflected in rubles and kopecks. The tax amount is rounded according to arithmetic rules.

If we paid income that was not subject to personal income tax in full (the list of such income is given in Article 217 of the Tax Code of the Russian Federation), we do not include the amount of such income in 2-personal income tax. For example, 2-NDFL does not reflect:

- benefits for pregnancy and childbirth and child care up to 1.5 years;

- payment to the dismissed employee of severance pay in the amount of no more than three monthly salaries;

- one-time payment at the birth of a child in the amount of up to 50,000 rubles.

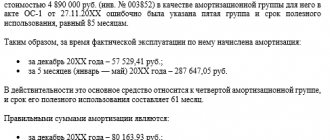

Section 3

It includes data:

- about income taxed at one of the rates (13, 15, 30, 35%);

- about tax deductions applicable to these types of income (in particular, amounts not subject to personal income tax).

Income received is reflected in chronological order, broken down by month and income code.

Employee income was taxed at different rates - how to fill it out?

If during the year one person received income subject to taxation at different rates, one certificate is filled out containing sections 3 - 5 for each rate. Those. all employee income, regardless of the type of income, must be included in one certificate.

If all the data does not fit on one sheet, fill out the second page of the certificate (in fact, we will have 2 completed 2-NDFL forms with the same number).

On the second page, indicate the page number of the certificate, fill in the heading “Certificate of income of an individual for ______ year No. ___ dated ___.___.___” (data in the header, including the number, are the same as on the first page), enter data in sections 3 and 5 (sections 1 and 2 are not filled in), the “Tax Agent” field (at the bottom of the document) is filled in. Each completed page is signed.

An example of such a situation is an organization issuing an interest-free loan to its employee. The recipient of the loan will have both income taxed at a rate of 13% (salary) and income subject to a rate of 35% (material benefit).

If dividends to a participant who works in the organization, they are reflected along with other income. There is no need to fill out separate sections 3 and 5 for dividends.

For example, on June 5, 2021, participant Nikiforov, who also works as Deputy General Director, was paid dividends of 450,000 rubles. In the data for June (see sample above), we will reflect wage income with code 2000 and dividend income with code 1010.

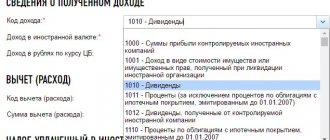

Income and deduction codes

Income and deduction codes are established by orders of the Federal Tax Service (the latest changes were approved by order dated October 24, 2017 No. ММВ-7-11/ [email protected] ). See the full list of income codes here.

But most often you will have to indicate the following:

| The most used deductions for this section:

|

See the full list of deduction codes here.

If there are no total indicators, a zero is entered in the certificate columns.

Salary for December was paid in January – how to reflect it?

In the certificate, income is reflected in the month in which such income is considered actually received according to the norms of the Tax Code. For example:

1) Our employee’s salary for December 2021 was paid on January 12, 2021 - we will reflect its amount in the certificate for 2021 as part of income for December (since, in accordance with paragraph 2 of Article 223 of the Tax Code, the date of receipt income in the form of wages is recognized as the last day of the month for which income is accrued in accordance with the employment contract).

2) For a craftsman working for us under a contract, payment for work completed in December 2021 was made on January 12, 2018 - this amount will be included in 2-NDFL for 2021 (since there are separate standards for payment for contracts of a civil law nature are not provided for by the Tax Code, therefore, we apply the general rule, according to which the date of actual receipt of income is defined as the day of its payment - clause 1 of Article 223 of the Tax Code of the Russian Federation).

Vacation pay is reflected in the certificate as part of the income of the month in which they were paid (Letter of the Ministry of Finance of the Russian Federation dated 06.06.2012 No. 03-04-08/8-139).

For example, our employee Nikiforov was on vacation from January 9 to January 21, 2021. Vacation pay was paid to him on December 29, 2021. In 2-NDFL for 2021 (see example of filling), we include the amount of vacation pay in income for December with code 2012.

Some types of income are not taxed up to certain limits. In 2-NDFL, opposite such income, you need to indicate the code and deduction amount in the amount of the non-taxable amount.

For example, for his birthday (September 10), employee Nikiforov was given a phone worth 18,000 rubles by the company. Because The cost of gifts for the year is not subject to personal income tax in an amount not exceeding 4,000 rubles. In the 2-NDFL certificate in the data for September (see example of filling) we will reflect:

- income 18,000 rub. with code 2720 (price of gifts);

- deduction 4000 rub. with code 501.

Section 4

The most commonly used deduction codes:

- 126, 127, 128 – deductions for the first, second, third and subsequent children;

- 311 – for expenses for the purchase of housing;

- 312 – for mortgage interest paid;

- 324 – for treatment expenses.

See the full list of codes here. Deductions are received exclusively by tax residents in respect of income taxed at a rate of 13% (except for dividends).

We can provide a social or property deduction at the place of work if the employee has brought a notification from the tax office about the right to such a deduction. Notification details are indicated at the bottom of section 4.

Section 5 states:

- Total amount of income from section 3 (add up the indicators in the “Amount of Income” column);

- Tax base (from the total amount of income we subtract the amount of deductions from the columns “Amount of deductions” of sections 3 and 4);

- The amount of tax calculated and withheld from this income (indicator in the column “tax base” * tax rate; in certificates with the attribute “2” (“4”), the amounts of calculated and withheld tax will differ);

- The amount transferred to the personal income tax budget.

The columns for information on fixed advance payments for a patent are filled out in certificates for those working on the basis of a patent based on information from the notice of confirmation of the right to a tax reduction received from the tax office.

In the “Tax Agent” column the following is indicated:

1 – when the certificate is presented by the head of the organization (successor company) in person or the certificate is sent with a digital signature of the head;

2 – in other cases (for example, when submitting 2-NDFL on paper by the chief accountant or courier).

Below are the details of the person who submitted the certificate and his signature.

The representative also indicates the power of attorney data.

Did you like the article? Share on social media networks:

- Related Posts

- Unified calculation of insurance premiums to the Federal Tax Service

- 6-NDFL for 9 months 2021 (3rd quarter)

- 6-NDFL for the 2nd quarter of 2021 (half year)

- Sample of filling out certificate 2-NDFL

- Form 6-NDFL in 2021

- 6-NDFL for the whole year

- Form SZV-STAZH - new reporting 2021

- Form SZV-K – reporting to the Pension Fund for employers

Discussion: 17 comments

- Elena:

02/01/2018 at 12:24Good afternoon. Please tell me, in section 5 on “tax amount transferred”, it is necessary to indicate the actual personal income tax transfers and salary payments in January for the accrued December salary, or will “calculated tax amount”, “withheld” and “transferred” be the same?

Answer

Alexei:

02/03/2018 at 04:04

Hello. If on the date of filing the 2-NDFL certificate the tax had already been withheld and paid to the budget, then it should be indicated as calculated, as withheld, and as transferred.

The fact of tax withholding and payment in 2021, and not in 2021, does not matter (letters of the Federal Tax Service of the Russian Federation dated 03/02/2015 No. BS-4-11/3283, dated 02/03/2012 No. ED-4-3/ [email protected] and No. ED-4-3/ [email protected] , dated 01/12/2012 No. ED-4-3/74). Thus, all Section 5 tax amounts will be the same.

Answer

02/13/2018 at 15:56

tell. An employee of mine purchased an apartment in 2021. He needs to submit a 2nd personal income tax certificate

Answer

- Alexei:

02/14/2018 at 16:45

Hello. If an employee was paid income during 2017, a 2-NDFL certificate must be submitted. Apparently, your question concerns how property deductions for purchased housing are reflected in the certificate.

The deduction is provided on the basis of a notification from the Federal Tax Service submitted by the employee and is reflected in 2-NDFL in the following order:

In section 4 you enter: deduction code “311” and the deduction amount.

Below you provide the details of the Federal Tax Service notification confirming your right to a property deduction.

The “Tax Base” column of Section 5 is filled out taking into account the amount of the deduction provided. If its size exceeds income, then the tax base is recognized as equal to 0.

Answer

03/24/2018 at 16:11

How to fill out section 5 in 2-NDFL, if the organization calculates salary monthly, pays with a delay of 9 months (in cash), and has never transferred personal income tax to the budget for the year (the account is blocked)? For example, the amount of tax calculated is 50,000 the amount of tax withheld is 20,000 the amount of tax transferred is 0

Answer

- Alexei:

03/25/2018 at 18:51

Hello. The following point is important here: whether the salary was issued and, accordingly, personal income tax was transferred before the submission of 2-NDFL certificates, that is, already in 2021. If you have paid off your obligations before submitting the certificate, fill out the form as usual.

If at the time of submitting the certificate there is a debt to employees and the tax has not been received into the budget, then in section 5 the indicators for the amount of tax calculated, withheld and transferred will differ, and the line “Amount of tax not withheld by the tax agent” will be filled in. In this case, after paying off obligations to employees and the budget, you will need to submit corrective certificates to the Federal Tax Service in Form 2-NDFL with the same number, but with a new date.

Answer

03/27/2018 at 21:11

Please tell me in form 2-NDFL for 2021 in the column “Tax amount transferred”:

1) Indicate the amount transferred for 2021 accruals? After all, the tax for December 2021 was also transferred in 2021.

2) How to distribute the tax among people if for November 2017 the tax amount calculated for all employees was 10,000 rubles, and 7,000 was paid to the budget? And the remaining 3,000 tax for November and tax for December have not yet been transferred.

Answer

- Alexei:

03/28/2018 at 00:54

Hello. If the tax for the past tax period was transferred to the budget before the date of submission of certificates in Form 2-NDFL to the Federal Tax Service, then such tax should have been included in these reports. Thus, the tax for December 2021 paid in Q1. 2021 should have been included in the primary reporting for 2021.

In cases where, on the date of submission of certificates in Form 2-NDFL, the tax has not been repaid in full, the amounts of calculated, withheld and transferred tax in Section 5 of the primary certificates will differ. After transferring personal income tax to the budget, the tax agent is required to submit corrective certificates, in section 5 of which the above amounts coincide.

Therefore, personal income tax for 2021 should not appear in certificates for 2021 (letter of the Federal Tax Service dated March 2, 2015 No. BS-4-11/3283).

As for the distribution of the amount of personal income tax not transferred, there are no official explanations on this issue, but there is the following opinion: since in this case the tax agent is clearly at fault, it is more logical for the personal income tax transferred from employee remuneration to be reflected in full, and the amount of the debt to be included in the manager’s certificates and founders.

Whether to follow this recommendation or distribute the amounts in proportion to the number of employees is up to you.

Answer

12/15/2018 at 19:02

Good evening! Can you please tell me that the 2-NDFL certificate must have the employer’s stamp?

Answer

01/15/2019 at 12:01

Good afternoon. How to generate (print) a 2-NDFL certificate for an employee? When printing from the program, it issues Appendix No. 1 to the order ММВ-7-11/566 dated 10/02/2018. Is this form suitable for issuing to employees? They will take it to the Federal Tax Service for reimbursement of costs.

Answer

01/24/2019 at 09:54

Good afternoon. Please tell me this is the situation. A husband and wife in an official marriage purchased an apartment, but the husband refused his share, but now he wants to receive a deduction for the purchase of this apartment, since his income is much higher than that of his wife. Does he have the right to make a deduction in 3-NDFL? We purchased the apartment in 2017, but never rented it out for 3-personal income tax.

Answer

02/05/2019 at 13:36

Good afternoon. If the accountant did not take into account the deduction of 4,000 rubles. from the gift and in the personal income tax report 2, this deduction is not indicated; will this be considered an error?

Answer

02/26/2019 at 20:28

Good evening. I don’t quite understand the answer to the question: Should the employer’s signature be stamped on the Form 2 personal income tax certificate?

Answer

01/23/2020 at 21:30

Please tell me, the amount of tax calculated is 54,000, withheld and transferred 9,600, and not withheld by the tax agent 44,600, what should I indicate in the 3NDFL certificate?

Answer

01/29/2020 at 16:35

Hello! My husband works in the Ministry of Internal Affairs. Recently he took out a certificate of 2nd personal income tax. In my opinion, paragraph 4 is filled in incorrectly. If 1400 per child, then it should be 16800 for each child. Deductions for two children. You can check and comment.

Answer

01/29/2020 at 16:37

I wanted to attach a scan, but it seems it’s not possible here. Now in the certificate in the deductions line it is 126-8400 and 127-8400. Certificate for 2021 for 12 months

Answer

02/04/2020 at 16:43

For which last months should 3 and 6 months be indicated in the certificate? A certificate must be submitted to the tax office for a package of documents for purchasing a home for a tax refund.

Answer

Leave a comment Cancel reply

Help during sick leave and maternity leave

Most non-employment income is not subject to income tax. These include:

- state benefits, including maternity and child care benefits

- pensions

- payments related to damage

- provision of free housing or compensation amounts

- payments in connection with the dismissal of an employee (except for compensation for unused vacation)

- reimbursed expenses for employee training

- travel allowances within the established norms

- other payments

The above charges are not reflected in 2-NDFL certificates.

If a woman is on maternity leave to care for children, the payments due to her are not taxed, therefore, there is no reason to draw up a 2-NDFL certificate. The document can only contain income from employment. For example, an employee, while on maternity leave, continues to work part-time.

In such cases, a certificate is issued indicating the accrued wages. Also, the document is issued if during this period a bonus was accrued, the amount of which exceeds 4,000 rubles per year (the maximum non-taxable amount of financial assistance). Sickness benefits, including those for caring for a sick child, are taxed. Their amounts are fully taken into account in the 2-NDFL certificate.

What is indicated

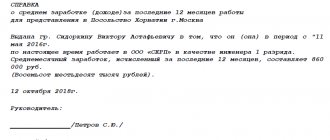

A certificate in form 2-NDFL gives an idea of the employee’s earnings during the year and the withheld personal income tax. Information on income is generated monthly, indicating income items (salary, vacation pay, sick leave, financial assistance, etc.). In addition, the document contains the following information:

- Information about the employer: name, TIN, contact phone number

- Employee details: Full name, Taxpayer Identification Number, date of birth

- Taxable income by month

- Availability of tax deductions, their amounts

- Information on the total amount of income, accrued, withheld and transferred tax to the budget

How to fill out the form

The current form of income certificate - 2-NDFL - is approved by Appendix No. 1 to the order of the Federal Tax Service of Russia dated October 2, 2018 No. ММВ-7-11/566. The same document approved:

- the procedure for filling out this certificate (Appendix No. 2, hereinafter referred to as the Procedure);

- electronic format 2-NDFL (Appendix No. 3).

The official name of the document in question is “Certificate of income and tax amounts of an individual” (form 2-NDFL).

How to fill it out correctly

A certificate in form 2-NDFL is filled out either at the request of the employee for his personal needs, or to the Federal Tax Service as an annual report. When forming, annual data on earnings received, subject to personal income tax, are taken into account. If the document is drawn up at the request of an employee, then the filling period is from the beginning of the current year (or the month of hiring) until the current moment.

The new requirements for filling out the certificate do not provide for indicating the address of the employee whose details are indicated in the document. Previously, this was considered a mandatory requirement. There is also no need to indicate the employee’s TIN if there are doubts about its authenticity or it is unknown. When preparing a 2-NDFL certificate, it is worth paying attention that some income and deduction codes have changed. Information with incorrect data makes the document invalid.

An employee's income is indicated monthly, separately for each type of income. So, if wages and vacation pay were accrued in the same month, then 2 lines appear with the coding 2000 and 2012, respectively, where the amounts received are reflected. Deductions are also taken into account separately for each type.

The summary data in the document (section 5) should be as follows:

- Total income, including all taxable payments (salaries, sick leave, compensation and others)

- Tax base, defined as the difference between total income and deductions

- Tax calculated, withheld from the employee’s salary and transferred to the budget. All 3 indicators must take the same value.

The certificate is signed by the tax agent - the employer responsible for the correctness of the accrual. There is no need to use a seal.

Common mistakes when filling out

If the 2-NDFL certificate is filled out using software, the risk of making errors is minimal. But provided that the accruals are carried out correctly.

The most common mistakes when generating certificates are the following:

- Incorrect personal information of the employee. The TIN and date of birth of the employee may be incorrectly indicated. The employee's address is no longer included.

- TIN of the organization. When filling out the certificate manually, it is important not to confuse the TIN of the employee and the employer, especially if the tax agent is an individual entrepreneur.

- Income and deduction codes. When completing a document, it is important to make sure that the codes used are current at the time of completion.

- Tax-free income, for example, maternity payments, is not reflected in the certificate. Therefore, if an employee has been on maternity leave for the entire year, a certificate for her is not provided to the tax authorities for this period.

- The total amount of all income should be the result of monthly receipts.

- In Section 5, the columns for calculated, withheld and transferred to the budget tax must contain the same amount.

- When filling out the certificate, you must pay attention to the organization codes (OKTMO, KPP, etc.).

Inaccurate information in certificates may lead to incorrect calculations. If an error is discovered, it is necessary to submit corrective documents before the tax office discovers the deficiencies. Otherwise, the tax agent may receive a fine of 500 rubles for each incorrect certificate.

What is the difference between 2-NDFL and 3-NDFL

Many individuals have heard about documents reflecting the income of individuals. Certain categories of citizens must report their income independently. We are talking about documents in the form 2-NDFL and 3-NDFL. What is the difference between them?

2-NDFL - is a certificate of earnings received from the employer. The document is prepared by the employer himself as a tax agent. The certificate is submitted annually to the tax authorities as reporting, and is also generated at the request of employees for personal purposes. If during the year individuals had income that was not related to entrepreneurial activity, then the recipients are required to independently declare the amounts received, calculate the tax and transfer it to the budget. For these purposes, a declaration is drawn up in form 3-NDFL.

In addition, the document will be required to confirm tax deductions when selling property (cars, housing) or obtaining other material benefits. In most cases, when generating 3-NDFL reporting, it becomes necessary to indicate all income received, including using data from the 2-NDFL certificate.

The main difference between 2-NDFL and 3-NDFL is as follows. 2-NDFL certificates reflect the income received by the employee from the employer. Declaration 3-NDFL contains other information about additional income, as well as applied tax deductions.

Where is a 2-NDFL certificate required?

A 2-NDFL certificate must be submitted to the tax office in 2 cases:

- The tax agent paid income from which he must withhold and transfer income tax to the budget (clause 2 of Article 230 of the Tax Code of the Russian Federation). This is a certificate with attribute 1. From 2021, it is submitted to the Federal Tax Service by March 1 of the year following the expiration (for 2021 - until 03/02/2020).

- The tax agent paid income from which it was not possible to withhold tax. In such a situation, the tax agent needs to notify the inspectorate and the taxpayer about the impossibility of withholding tax using a certificate with sign 2 - also no later than March 1 (clause 5 of Article 226 of the Tax Code of the Russian Federation). Also, for such taxpayers, officials require a certificate with attribute 1 to be submitted (see, for example, letter of the Federal Tax Service dated March 30, 2016 No. BS-4-11/544). Please note that these requirements relate to periods when there were different deadlines for submitting certificates with features 1 and 2. Now the deadlines are the same. I wonder whether the position of the controllers will change or whether they will still continue to demand both options.

If an individual approaches a tax agent with an application to issue a 2-NDFL certificate, then most likely he needs it:

- for transfer to a new place of work in order to receive standard tax deductions, since in order to provide such deductions, all income from the beginning of the year is taken into account, including income received from the previous employer (paragraph 2, paragraph 3, article 218 of the Tax Code of the Russian Federation);

- drawing up a 3-NDFL declaration, filled out on the basis of information from the 2-NDFL certificate;

- submissions at another place of demand (for example, when applying for a loan at a banking institution).

It should be noted that the taxpayer is not obliged to report for what purposes he needed or where he needed the 2-NDFL certificate. The tax agent cannot refuse to issue a 2-NDFL certificate. The certificate must be issued no later than 3 business days from the moment the tax agent receives an application from an individual (Article 62 of the Labor Code of the Russian Federation). Otherwise, liability measures may be applied to the tax agent under Art. 5.27 Code of Administrative Offenses of the Russian Federation.

If a taxpayer requests a 2-NDFL certificate in the middle of the year, the tax agent fills it out based on the data available to him at that time.

How to fill out a certificate with sign “2”? What to do if an employee from a closed, separate unit asks for a certificate? How to apply for 2-NDFL during reorganization? Find answers to these and other questions in the Ready-made solution from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.