Home / News and changes

Back

Published: 07/10/2019

Reading time: 3 min

2

562

The FSS pilot project called “Direct Payments” was launched on the territory of the Russian Federation back in 2011. In accordance with the program, insurance payments due to the insured under compulsory social insurance are transferred directly by the territorial branches of the Federal Social Insurance Fund of the Russian Federation.

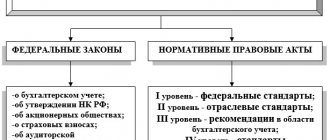

- Legal standards

- FSS pilot project

- Participating regions

- Required documents and their submission to the FSS

The project was created in order to maximally protect the insured from incorrect and untimely transfer of benefits and payments.

FSS pilot project

“Direct payments” is a modernization of compulsory insurance in the Russian Federation. All employers are required to participate in the project, if it is launched in the region, since the legislation does not provide for the possibility of choice in this case.

An employer participating in the project transfers funds to employees only for the first three days of sick leave, and payment for the remaining days of sick leave, as well as full maternity payments and child benefits, are accrued directly from the Fund.

Sample application for payment of sick leave

Employees of companies from regions where the Social Insurance Fund pilot project is taking place have the right to receive sick leave benefits from the Fund directly. To do this, they need to fill out an application for paid sick leave and prepare the necessary documents. Let's figure out what the company should do in this case.

Guest, get free access to the BukhSoft program

Full access for a month! – Generate documents, test reports, use the unique expert support service of the Glavbukh System.

Call us at 8 (toll-free).

Attention! You can use the links below for a free sample application:

The pilot project is that the Fund directly, without the participation of employer companies, pays social benefits to insured persons. These are sick leave, maternity benefits, childbirth benefits, child care benefits up to 1.5 years old, etc. The Fund also pays for the costs of preventing injuries and occupational diseases.

Currently, 39 regions are already involved in the FSS pilot project.

Consider sick leave in the BukhSoft program. You can easily determine the employee’s insurance length, all the amounts included in the calculation, and find the amount of benefits online. The program will separately calculate the amount of benefits paid by the employer and the Social Insurance Fund. Try it for free:

Calculate sick leave online

Submit the application for sick leave and other documents to the Social Insurance Fund

To receive benefits for illness not related to an accident, the employee submits to the company:

The company is obliged to submit an application for payment of sick leave and other specified documents, as well as an inventory of them, no later than 5 calendar days to the territorial office of the Fund at the place of registration.

The inventory form was approved by order of the Social Insurance Fund dated November 24, 2017 No. 578.

The employer submits the collected package of documents to the Social Insurance Fund in paper or electronic form. The method depends on the average headcount of the company.

Submit documents in electronic or paper form. If the average headcount of your company is 26 or more people, use the electronic method. Submit documents in the form of an electronic register. If the average number of employees is less than 25 people, then you can use the paper method.

The register form was approved by order of the Social Insurance Fund dated November 24, 2017 No. 579.

- registry

- filling out the register

The application for sick leave will be considered by the Social Insurance Fund

After the documents are received, the Fund’s division will check them within 10 calendar days and decide whether to pay sick leave or refuse.

If the company did not know about the pilot project and accrued sick leave itself, in the usual way, the Social Insurance Fund will not reimburse such expenses.

The money will be sent to the employee’s bank account according to the details specified in the sick leave application.

The Hospital Fund will pay as usual. He will accrue it starting from the 4th day of illness. The employer company will pay for the first 3 days at its own expense.

If there was an accident at work or an employee received an occupational disease, documents for the Fund are drawn up and transferred in the same order. But in expanded quantities. You must also submit a report on an industrial accident or a report on an occupational disease with copies of the investigation materials.

It is important to indicate the correct bank details in the sick leave application. Otherwise, the payment amount may be lost.

After the documents are received, the Fund will check the insured event within 10 calendar days and make a decision.

Filling out an application for sick leave

The Fund approved the application form for sick leave on November 24, 2017 by Order No. 578.

Read the sample form and show it to the employee:

If the length of sick leave is underestimated

In this case, the company should prepare an application for additional payment, attach supporting documents and submit the collected package to its territorial office of the Fund. He will pay the employee the amount of sick leave due.

Calculation of sick leave for pregnancy and childbirth in 2021 using an example, see the link

If the length of sick leave is too high

In this situation, it is believed that the company is to blame for the overpayment, since it was the company that submitted the documents.

The company is obliged to pay the costs incurred by it to the Social Insurance Fund. The employee has the right to return the money to her only voluntarily.

You can collect money only in two cases:

- The employee himself is to blame for the overpayment (brought documents with incorrect data; hid important information, etc.);

- There was a counting error (for example, double transfer of the amount).

Example

The company overestimated the employee's length of sick leave. She reflected the costs of reimbursement of the Social Insurance Fund as other expenses (clause 11 of PBU 10/99):

Debit 91-2 Credit 76 subaccount “Settlements with the Social Insurance Fund”

– costs of reimbursement to the Social Insurance Fund for overpayments for sick leave;

Debit 76 subaccount “Settlements with the Social Insurance Fund” Credit 51

– the amount of compensation was transferred to the FSS.

Example of filling out Appendix 6 to Order 578

» Citizen's rights No. 294 (Collection of Legislation of the Russian Federation 2011, No. 18, Art.

2633, 2012, N 1, art. 100; N 52, art. 7500; 2013, N 13, art. 1559; N 52, art. 7183; 2015, N 1, art. 274; N 52, art.

7614; 2021, N 52, art. 7680), I order: 1. Approve: the application form for payment (recalculation) of benefits (vacation pay) in accordance with; a form of inventory of applications and documents necessary for the appointment and payment of relevant types of benefits to insured persons, according to; application form for reimbursement of expenses for temporary disability benefits in accordance with Appendix No. 3; form of notification of the submission of missing documents or information in accordance with Appendix No. 4; form of the decision to refuse to assign and pay temporary disability benefits in accordance with Appendix No. 5; application form for reimbursement of expenses for payment of social benefits for funerals in accordance with; application form for reimbursement of expenses 2. Application for payment of benefits (vacation) (Appendix No. 1 to the Order of the Federal Social Insurance Fund of the Russian Federation dated November 24, 2021

No. 578). Download.

- Sample of filling out an application for payment of temporary disability benefits.

Order of the Ministry of Health and Social Development of Russia dated July 11, 2011.

No. 709n)

- A sample of filling out an application for reimbursement in 2021 to an insured registered with the territorial bodies of the Social Insurance Fund of the Russian Federation located on the territory of the constituent entities of the Russian Federation participating in the implementation of the pilot project for payment expenses incurred

Instructions: fill out the list of documents in the Social Insurance Fund

Not a day without instructions × Not a day without instructions

- Services:

A list of documents for the Social Insurance Fund is a list of all papers certified by the head that are sent to the Social Insurance Fund for the purpose of assigning and paying benefits to employees.

September 7, 2021 Author: Alexandra Zadorozhneva When submitting documentation to the territorial Social Insurance Fund (abbreviated as FSS) for assigning various benefits and payments to employees, the accountant must draw up and fill out an inventory of the relevant papers. A list of applications and documents necessary for the appointment and payment of relevant types of benefits to insured persons is a mandatory register.

It is filled out strictly according to the form approved by Order of the Social Insurance Fund No. 578 of November 24, 2017.

The list of documents in the Social Insurance Fund (the 2021 form can be downloaded below) is used in an updated form, starting from December 29, 2017.

In the water part, or header, organizational information about the institution is filled in:

- subordination code by registration number (in strict accordance with the notice of registration with the social insurance authorities);

- TIN and KPP of the insured organization;

- full and short name of the reporting enterprise;

- policyholder registration number;

Order of the Federal Insurance Service of the Russian Federation dated November 24, 2017 No. 578

In accordance with paragraphs 2, 3, 6, 7, 8, 10, 11, 12, 14 of the Regulations on the specifics of the appointment and payment in 2012 - 2021 to insured persons of insurance coverage for compulsory social insurance in case of temporary disability and in connection with maternity and other payments in the constituent entities of the Russian Federation participating in the implementation of the pilot project, clauses 2, 3, 6, 11, 13 of the Regulations on the specifics of the appointment and payment in 2012 - 2021 of temporary disability benefits to insured persons in connection with an industrial accident or occupational disease , as well as payment for the insured person’s vacation (in excess of the annual paid leave established by the legislation of the Russian Federation) for the entire period of treatment and travel to the place of treatment and back, in the constituent entities of the Russian Federation participating in the implementation of the pilot project, approved (Collection of Legislation of the Russian Federation 2011, No. 18, art.

The format and rules by which the FSS inventory is filled out (form 2021, a sample of which we are considering in the article) are given in Appendix No. 2 to Order No. 587. The register consists of two parts: introductory and tabular.

Approve: application form for payment (recalculation) of benefits (vacation pay) in accordance with Appendix No. 1; a form of inventory of applications and documents necessary for the appointment and payment of relevant types of benefits to insured persons, in accordance with Appendix No. 2; application form for reimbursement of expenses for temporary disability benefits in accordance with Appendix No. 3; submission notice form

Application form for payment of benefits (vacation pay) and samples of filling out the application

Application form for payment of benefits (vacation pay)

Download (Appendix No. 1 to the Order of the Social Insurance Fund of the Russian Federation dated November 24, 2017

2633, 2012, No. 1, art. 100; No. 52, art. 7500; 2013, No. 13, art. 1559; No. 52, art. 7183; 2015, No. 1, art. 274; No. 52, art. 7614; 2021, No. 52, art. 7680), I order: 1.

№ 578

“On approval of the forms of documents used for the payment of insurance coverage and other payments in 2012-2021 in the constituent entities of the Russian Federation participating in the implementation of a pilot project providing for the appointment and payment of insurance coverage to insured persons for compulsory social insurance in case of temporary disability and in connection with maternity and compulsory social insurance against accidents at work and occupational diseases, other payments and expenses by territorial bodies of the Social Insurance Fund of the Russian Federation"

) comes into force on December 29, 2017.

Forms: Download Download Samples of filling out an application for types of benefits: 1) for temporary disability Download 2) for pregnancy and childbirth and a one-time benefit when registering with medical organizations in the early stages of pregnancy Download 3) a lump sum benefit for the birth of a child Download 4) a monthly benefit for child care Download 5) a certificate calculating the amount of vacation pay (in addition to annual paid leave) for the entire period of treatment and travel to and from the place of treatment (Appendix No. 10) Download

Inventory of applications to the FSS order 578 example of filling

Regulatory framework and form When submitting documentation to the territorial Social Insurance Fund (abbreviated as FSS) for assigning various benefits and payments to employees, the accountant must draw up and fill out an inventory of the relevant papers.

A list of applications and documents necessary for the appointment and payment of relevant types of benefits to insured persons is a mandatory register. It is filled out strictly according to the form approved by Order of the Social Insurance Fund No. 578 of November 24, 2017. The list of documents in the Social Insurance Fund (the 2021 form can be downloaded below) is used in an updated form, starting from December 29, 2017.

Download How to fill out an inventory in the Social Insurance Fund The format and rules by which the Social Insurance Inventory is filled out (form 2021, a sample of which we are considering in the article) are given in Appendix No. 2 to Order No. 587. The register consists of two parts: introductory and tabular.

- Sample of filling out an application for reimbursement of expenses for paying four additional days off to one of the parents (guardian, trustee) to care for disabled children (Appendix No. 7 to Order of the Federal Social Insurance Fund of the Russian Federation dated November 24, 2017 No. 578)

Form of a certificate calculating the amount of vacation pay (in addition to annual paid leave) for the entire period of treatment and travel to the place of treatment and back (Appendix No. 10 to the Order of the Federal Social Insurance Fund of the Russian Federation dated November 24, 2017 No. 578)

- A sample of filling out a certificate calculating the amount of vacation pay (in addition to annual paid leave) for the entire period of treatment and travel to the place of treatment and back (Appendix No. 10 to the Order of the Federal Social Insurance Fund of the Russian Federation dated November 24, 2017.

Application form for reimbursement of expenses for payment of temporary disability benefits (Appendix No. 3 to Order of the Federal Social Insurance Fund of the Russian Federation dated November 24, 2017 No. 578)

Order for payment of benefits for the funeral of an employee: sample

An order to pay funeral benefits for an employee implies that the company can develop a sample. There is no single approved form for such a document in the legislation. This indicates the possibility of using a free form of the act.

Why do you need an order for payment of funeral benefits?

After the death of a citizen, his relatives have the right to apply for social benefits. In this regard, the provisions of Federal Law No. 8 of 1996 “On burial and funeral business” apply.

The issuance of an order indicates that the company where the person worked agrees with the payment of compensation for the funeral. This document determines the sequence of further actions of the company employees who are responsible for issuing funds . For example, these are employees of the financial department.

To make a payment, you must comply with the condition that the organization had the status of an insurer of the deceased citizen under the compulsory social insurance system. The contract must be valid at the time of the employee’s death.

Important! If the employment relationship between the company and the citizen was terminated before death, the relatives of the deceased cannot receive benefits. Similar rules apply to situations where a dismissed person applies for financial support in the event of the death of a family member.

Registration of an order for the issuance of burial benefits

In 2021, a single form has not been developed for drawing up an order for the provision of benefits intended for organizing a funeral. When drawing up the act, you will need to take into account the established rules. This concerns the reflection of mandatory elements and data in the document.

Including:

- Title of the document;

- the name of the company where the citizen worked;

- indication of the place of issue of the act;

- date of signing the order;

- details of the deceased employee. You must indicate your last name, first name and passport details;

- information about the citizen who issues a payment for the organization of the burial;

- a list of documentation confirming the possibility of receiving benefits;

- sum;

- data of employees who are responsible for the execution of the issued order. This could be an employee of the financial department or the chief accountant;

- information about the head of the enterprise. His last name, first name and position are indicated.

Depending on whether the employee himself or his relative died, the content of the order changes.

What documents are needed to draw up an order for payment of benefits?

It is necessary to consider what documents are needed to formulate an order for the payment of benefits for the burial of a person. First of all, an application must be received from the citizen organizing the funeral.

Attached to it:

- death certificate of an employee of the enterprise;

- a document through which the identity of the applicant is verified;

- account details for transferring funds;

- acts confirming funeral expenses incurred.

A payment order is issued only after a complete package of documentation has been submitted.

Who draws up an order for payment of benefits if death occurs after retirement?

In this case, you need to contact the Pension Fund. Compensation is provided when funds from the specified organization are used.

The amount has a fixed expression. The benefit changes every year due to indexation. In 2021, the size is 5686.25 rubles.

The documents for receiving compensation for the funeral of a pensioner are presented in a similar list as reflected above.

Nuances of forming an order to receive payment for burial

The order is necessary for posting certain amounts in the accounting department aimed at compensating for funeral expenses incurred. In a situation where a company employee who was insured died, several categories of citizens can receive funds.

Including:

- spouse;

- family members;

- the person organizing the burial procedure.

Regardless of who applied for the money, you will need to collect documents to receive a funeral benefit. It will be possible to confirm the expenses incurred for the funeral by sending the management of the enterprise an agreement on the provision of funeral services, as well as checks and receipts.

Note! Until the order is signed, the working relationship with the deceased must be terminated. Due to the fact that it is not permissible to use the wording “Dismiss” in relation to the deceased, it is necessary to write in the order “Terminate the employment relationship”.

An example of an order to provide benefits for the burial of an employee

To avoid mistakes when drawing up an act, you need to use an example.

Sample order for payment of funeral benefits at the place of work:

Iskra LLC

Order No. 54

Moscow August 01, 2021

Order to provide funeral benefits

Based on the provisions of Article 10 of Federal Law No. 8 of 1996, as well as the application submitted by Ivanova I.R.

I ORDER:

Source: https://ProPensiu.ru/pensioneram/lgoty/prikaz-o-vyplate-posobiya-na-pogrebenie-rabotnika-obrazets