Deadlines for submitting the UTII declaration

Individual entrepreneurs' tax reporting on UTII is submitted quarterly - no later than the 20th day of the month following the quarter (Article 346.32 of the Tax Code of the Russian Federation).

Due dates (including postponements due to weekends):

January 20, 2021 - for the 4th quarter of 2019;

April 20, 2021 - for the 1st quarter of 2020;

July 20, 2021 - for the 2nd quarter of 2020;

October 20, 2021 - for the 3rd quarter of 2021.

If the specified deadlines fall on a weekend or holiday, then the last day for submitting reports is considered to be the next closest working day.

Individual entrepreneur on UTII: How to reduce the tax on insurance premiums without employees?

Individual entrepreneurs who do not use hired labor have the right to reduce the UTII tax by 100% by the amount of fixed payments paid for themselves in the quarter.

Please note that insurance premiums can be paid on any convenient schedule, subject to full payment before the end of the current year. Letter of the Ministry of Finance dated October 26, 2016 No. 03-11-09/2852 allowed UTII payers to reduce the tax base by the amount of contributions that the individual entrepreneur paid in another quarter, subject to the condition that a declaration has not yet been filed with the tax authority.

This means that if you pay contributions in the 1st quarter before the deadline for filing the declaration for the 1st quarter (April 20), this amount can be taken into account when calculating UTII for the 2nd quarter.

Example . Let's consider a situation where in 2021 an individual entrepreneur provides veterinary services. For this type of activity, the basic profitability is set at 7,500 rubles. The physical indicator is 1, since the individual entrepreneur himself is considered, K1 = 1.915, K2 = 1. Quarterly, he paid insurance premiums of 9059.5 per quarter (total for the year 36,238 rubles).

Taxable base: 7500 × 1 × 1.915 × 1 = 14362.5 rubles. per month or 43087.5 rubles. per quarter.

Tax amount for the quarter: 43087.5 × 15% = 6463 rubles.

Reduce tax: 6463 - 9059.5 = 0

The amount of insurance premiums paid in the quarter exceeds the calculated amount of UTII, therefore, individual entrepreneurs have the right to completely reduce the tax on the amount of contributions. At the end of the quarter, he will not have to pay tax.

What other reporting is submitted?

The reporting of individual entrepreneurs to UTII depends on the availability of employees.

Individual entrepreneurs and employees submit to the Federal Tax Service Form 6-NDFL and 2-NDFL, calculation of insurance premiums (if there are employees). All individual entrepreneurs on UTII, except those who work without employees, submit reports to the Pension Fund and the Social Insurance Fund. To the FSS, individual entrepreneurs submit a calculation form for accrued and paid insurance premiums (4-FSS) to the UTII. The calculation is submitted on paper no later than the 20th day of the month following the reporting period. Form 4-FSS can be submitted electronically no later than the 25th day of the month following the reporting month.

Individual entrepreneurs and employees report to the Pension Fund on a monthly basis using the SZV-M form. Also, starting from 2021, a new SZV-TD report on the work activity of each employee has been introduced. Submit it when hiring, transferring, dismissing an employee, or when choosing the type of work record book - electronic or paper. The deadline is similar to SZV-M - no later than the 15th day of the month following the reporting month.

The reporting of individual entrepreneurs on UTII without employees does not include forms 4-FSS, SZV-M, SZV-TD, calculation of insurance premiums and personal income tax certificates.

If an entrepreneur is engaged in several types of activities and some of them do not fall under UTII, then the individual entrepreneur must submit reports under two tax regimes at once and keep separate records for the correct payment of taxes.

Where are reporting documents submitted?

Individual entrepreneur UTII reports without employees only to the tax office.

If there are personnel - in the Pension Fund and in the Social Insurance Fund.

List of documents for submission:

- To the Federal Tax Service (tax service). Tax reporting of UTII individual entrepreneurs consists of providing: a declaration; income certificates; report on the number of employees.

- In the Pension Fund of the Russian Federation (for individual entrepreneurs with staff) - individual information about employees.

- FSS (not taken by individual entrepreneurs working without hired personnel).

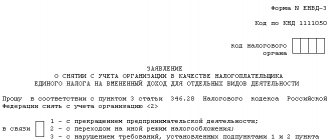

Cancellation of UTII in 2021

From January 1, 2021, UTII will be abolished. This is evidenced by Federal Law No. 97-FZ of June 29, 2012, which introduced appropriate amendments to the Tax Code.

The reason for the abolition of imputation is the fight against tax evasion and concealment of income. The imputed tax is calculated based on physical indicators, without taking into account the real revenue of companies and entrepreneurs. Because of this, the tax office loses control over the income of LLCs and individual entrepreneurs and believes that the budget is not receiving enough money.

No replacement for UTII is expected. For LLCs, the only option will be the simplified taxation system, with the exception of agricultural producers - they have the right to the unified agricultural tax. The individual entrepreneur remains content with the simplified tax system and a patent.

Other individual entrepreneur reporting

If there is a taxable object, individual entrepreneurs are required to report in any case. It doesn’t matter what special mode they use. Such cases include payment of mineral extraction tax, excise taxes, water tax and others like them. When paying land and transport taxes based on notifications from the tax office, entrepreneurs do not submit a declaration.

It’s easy to submit reports in the New Astral Report. The service will help you fill out forms quickly and without errors. The exchange of information with regulatory authorities is carried out instantly, and not a single tax demand will go unanswered.

Astral

October 30, 2021 5436

Was the article helpful?

33% of readers find the article useful

Thanks for your feedback!

Comments for the site

Cackl e

Products by direction

UTII restrictions in 2021

From January 2021, UTII will no longer be applicable to LLCs and individual entrepreneurs that sell labeled goods: medicines and fur clothing. Amendments to the Tax Code were introduced by Law No. 325-FZ of September 29, 2021. And from March 1, 2021, the UTII regime will be prohibited when selling shoes. The Ministry of Finance clarified this in letter No. 03-11-09/92662 dated November 28, 2021.

In addition, from January 1, 2021, UTII is completely abolished in Perm (approved by decision of the Perm City Duma dated September 24, 2019 No. 204).

The rest can continue to work on imputation until 2021.

For more information about individual entrepreneurs’ reports on UTII, read the article “UTI Declaration: procedure for submission and rules for filling out.”

How is UTII calculated in 2021?

The essence of the tax regime, called UTII, or more simply - imputation, is that the individual entrepreneur who has chosen this path calculates the amount of tax not from the actual income received, but from the planned (imputed) income.

The principle of determining the tax amount is described by the following algorithm:

- From the Tax Code of the Russian Federation, we select the type of occupation that gives the right to use UTII, using the list specified in Art. 346.26.

- Let's find out what the basic income for this type of occupation is (Bd). The data is given in paragraph 3 of Art. 346.29 of the Code and, for example, for a car service it equals 12,000 rubles/month.

- The physical indicator (Fp) is also taken from the table. For example, for the same car service, this will be the number of employees, including the individual entrepreneur himself, and for retail, this will be the area where trade is carried out.

- We count the number of months worked (Mm) or, if the activity in this mode is completed, the number of days.

- We are looking for the values of the coefficient K1 (deflation), which is set at the government level, and K2 (adjustments), which is approved by regional legislators and depends on the type of occupation of the entrepreneur.

- We determine the tax base (Nb) using the following mathematical expression: Bd*K1*K2*Fp*Chm

- We calculate the imputed tax (Vn) that must be paid for this period using the following formula: Nb * 15% (value 15 is the tax rate for UTII).

Let's give an example of calculating UTII in Voronezh for an automobile repair shop.

Given:

- staff of employees with an entrepreneur, also known as a physical indicator – 4 people;

- monthly basic profitability for a car service – 12 thousand rubles/month;

- deflator coefficient 2021 – 1.868;

- adjustment factor – 0.7;

- number of months – 3 (second quarter).

The procedure for calculating the tax amount consists of several stages.

First, let's find the value of the tax base:

Nb = Bd x K1 x K2 x Fp x Chm = 12,000 x 1.868 x 0.7 x 3 = 47,073.6 rubles;

We recommend you study! Follow the link:

Calculation and payment of insurance contributions of individual entrepreneurs to the Pension Fund

Now let’s determine how much you need to pay for the quarter:

Bn = Nb x 15% = 47,073.6 x 15% = 7,061.04 rub.

The tax service has made it easier for tax collectors to calculate the amount required for payment. When registering a type of occupation, an individual entrepreneur immediately receives information about how much and where to pay imputed tax, which he can later use in the entrepreneur’s reports. All that remains is to monitor changes in the coefficients annually, but this information is also provided on the taxpayer’s personal account page.

In such conditions, the reporting of individual entrepreneurs on UTII without employees comes down to recording the data received from tax authorities in the declaration and timely submitting them to the inspectorate.

An individual entrepreneur who has chosen this form of taxation pays their own insurance premiums. Subsequently, they are sent to his pension account and health insurance. If he transfers such amounts at the end of the quarter and before filing the report, he can reduce the amount of tax on the amount transferred to the fund.

Accounting for UTII

Organizations using the taxation system in the form of imputed income are required to comply with accounting rules, the objects of which are all transactions related to income or expenses of the enterprise. In accordance with PBU 9/99 “Income of the organization” and PBU 10/99 “Expenses of the organization”, accounting is carried out using the accrual method. But small businesses are allowed to use the cash method, in which income and expenses are taken into account after they are paid.

Information from the Ministry of Finance “On a simplified accounting system and financial reporting for small businesses” dated 02/20/2013 No. PZ-3/2012 allows you to use the chart of accounts in an abbreviated form, created on the basis of the usual one. A simplified version of the plan suggests replacing some accounts with one common one.

So, you can use account 20, combining on it the data of accounts 23, 25, 26, 28, 29. Account 76 for the “imputed” ones can replace accounts 62, 71, 73, 75 and 79.

Accounting for UTII also implies the adoption of an accounting policy. In addition, it is mandatory to use unified or independently developed forms of primary accounting documents.

But we should not forget that preferential tax regimes (including UTII) were created to support small businesses. Provisions of paragraph 4 of Art. 6 of Law No. 402-FZ simplifies record keeping for organizations falling under the categories of small enterprises, including “imputed” ones.

Small businesses have the right not to use standard accounting registers that require double entry. This rule is recommended for companies whose business transactions are no more than 30 per month, and where there is no production with large material costs.

An alternative for them is to keep a book for recording and reflecting actions that arise in the course of daily activities, or a journal of business transactions, from which the sources of receipt of material goods and cash balances should be visible, thanks to which financial statements can be generated. For ease of accounting, manufacturing companies have the right to fill out simplified statements of the status of their accounting accounts.

Law No. 402-FZ requires the use of mandatory details in various forms of independently developed registers and in primary documentation. According to Art. 9 of the said law, this includes the name of the document, its date, the contents of the business operation, etc.

The list of all simplified registers and statements used must be reflected in the accounting policies of the organization.

Read more about accounting options for small businesses in the article “Procedure for maintaining accounting records under the simplified tax system (2020).”

Features of UTII accounting

A company operating under UTII can keep records of indicators in 2 modes:

- for each type of activity for which a single tax is paid;

- by type of activity subject to UTII, as well as by those carried out under other taxation schemes.

Legal entities also need to keep accounting records and submit appropriate reports to the Federal Tax Service.