CCP for non-cash payments with individuals

In 2021, the vast majority of organizations and individual entrepreneurs are required to use cash register equipment when making payments to citizens, regardless of the method by which money is transferred. The use of a simplified taxation system does not relieve one from such an obligation. There are only a few exceptions listed in Art. 2 of Federal Law No. 54-FZ, when it is possible not to use a cash register.

For example, these are the services of nannies and caregivers, shoe repair, rental of apartments (but not offices), services of educational and sports organizations.

Failure to use cash register equipment in cases where it is mandatory is subject to a fine of up to 100 percent of the transaction amount (Part 2 of Article 14.5 of the Code of Administrative Offenses of the Russian Federation).

The seller of goods and services is obliged to use cash register systems for non-cash payments from citizens. Moreover, this applies to both payment via a bank card and payment via a payment order. According to the position of the financial department (letter of the Ministry of Finance of the Russian Federation dated June 21, 2018 No. 03-01-15/42668), when making non-cash payments without direct interaction between the buyer and the cash register user, the user is obliged to use cash register systems from the moment the bank confirms the execution of the order to transfer funds.

There is no need to punch a check for non-cash payment by an individual in only one case - if the buyer is an individual entrepreneur. But there is a nuance: if the individual entrepreneur paid for the goods with a bank card, then the cash register will still be needed.

If we talk about whether an organization needs to issue a check if it buys goods or services from citizens, then this situation is controversial. Even in official explanations you can find two positions.

The first position is based on letters of the Federal Tax Service of the Russian Federation dated April 13, 2020 No. AB-4-20/ [email protected] and dated August 14, 2018 No. AS-4-20/15707. According to this position, a check must be punched if an organization buys goods for resale from individuals (even if the goods are transferred by barter). According to the tax service, such an operation is considered a settlement from the point of view of Federal Law No. 54-FZ.

The second position is based on letters from the Ministry of Finance of the Russian Federation dated December 26, 2019 No. 03-01-15/102189 and dated October 10, 2019 No. 03-01-15/77953. According to the Ministry of Finance, a check does not need to be punched if the organization transfers rent, salaries, financial assistance and other similar payments to citizens.

It follows from this that if a product (service) is purchased for resale, then you will have to use cash register equipment. In all other cases, when transferring money to an individual, there is no need to punch a check.

Is a check required for acquiring?

The acquiring receipt is issued in two copies: one for the buyer, the other for the seller. According to current legislation (FZ-290), each organization is required to provide clients with a payment receipt, regardless of the type of activity.

That is, it is always issued when there are commodity relations between the seller and the buyer. Namely:

- when purchasing goods at a point of sale (TT);

- when paying in cafes, hairdressers;

- when ordering services;

- when purchasing online (including plane, train, theater tickets, etc.);

- when paying for subscriptions to paid content;

- when paying out lottery winnings.

If trade relations concern organizations (supply of equipment, goods in large quantities), then in addition to the payment document, you must provide the client’s company with an invoice.

It is worth noting that upon entry into force of 54-FZ, each TT is required to send data on monetary transactions to the tax authorities. This usually happens when an organization interacts with the Fiscal Data Operator (FDO).

Therefore, business owners need to have not only a payment terminal in their stores, but also an online cash register. With its help, information about each purchase is sent directly to the OFD, and then to the tax office. Then the question of whether and why it is necessary to store acquiring receipts arises by itself.

CCP for non-cash payments with legal entities

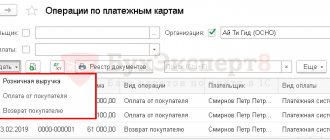

In general, if the buyer is a legal entity or individual entrepreneur, there is no need to use cash register equipment. However, even if the buyer is an organization, the check will have to be punched when paying:

- by bank card;

- through an electronic wallet;

- through online banking;

- from a mobile phone.

This also applies to situations when an organization purchases goods (work or services) through an accountable employee.

According to some clarifications of the Federal Tax Service, when offsetting prepayments or advances between organizations or individual entrepreneurs, it is not necessary to use cash registers (information from the Federal Tax Service of the Russian Federation dated June 10, 2020, letter of the Federal Tax Service of the Russian Federation dated August 21, 2019 No. AS-4-20 / [email protected] ).

At the same time, in the opinion of the Federal Tax Service of Russia for the city of Moscow, when providing or receiving counter provision (including when conducting offsets) for goods in the case of settlements between organizations or with individual entrepreneurs, cash register systems must be used (letters dated August 13, 2019 No. 17 -15/ [email protected] , dated 08/13/2019 No. 17-15/ [email protected] ).