Home/Trade/VAT on services and transactions

Value added tax is imposed on a wide range of transactions and services, but there is also a list of those that are not subject to this tax. The possibility of refusing to pay VAT is associated with social expediency - it is on this basis that the exemption from payment is formed. Minimization or the possibility of refusing payments are relevant as support measures for start-up businesses, for domestic manufacturers in general, competing with foreign suppliers.

For your information

Medicine, education and other socially significant areas are also exempt from payments, which is quite natural.

Normative base

Within the framework of VAT legislation, Art. 149 of the Tax Code of the Russian Federation, which provides not only basic explanations, but also regulates the list of services and areas that are exempt from payments. This list is indicated in paragraph 3 of Art. 149 of the Tax Code of the Russian Federation, after reading it, the taxpayer can clarify whether there is a need to pay tax in his case.

Attention! If you have any questions, you can chat for free with a lawyer at the bottom of the screen or call Moscow; Saint Petersburg; Free call for all of Russia.

Educational services

There is no need to pay VAT on the sale (Section 14, Clause 2, Article 149 of the Tax Code of the Russian Federation) of services in the field of education.

It should be borne in mind that such activities are exempt from this tax only if they are carried out on a non-commercial basis in the areas of basic and additional education.

In this case, the institution or entrepreneur must have the appropriate license.

Tax payments are not provided for when working with minor students in clubs, sections, studios and preschool institutions (subparagraph 4, paragraph 2, article 149 of the Tax Code of the Russian Federation).

Detail. The benefit is provided exclusively for non-profit educational institutions. Educational services performed by commercial enterprises and individual entrepreneurs require a tax. You cannot refuse the benefit.

A deposit agreement when purchasing a land plot should not be confused with an advance payment agreement. Is it possible to be discharged to nowhere? Find out about this from our article.

Are alcoholic neighbors causing a lot of trouble? Find out in what cases they can be evicted by reading our material.

What is VAT?

VAT is an indirect tax that is levied on both goods and services. It is calculated as an additional cost, paid from the cost of the service or operation by the end consumer in favor of the country's budget. The peculiarity of this tax is the fact that tax receipt is possible even at the production stages. If we talk about services, it is formed from those operations that are provided in the process of producing the final result, remaining relevant at all stages. The basic rate for VAT is 18 percent, and Russian legislation also provides for the possibility of using a reduced rate of 10 percent, or a zero rate, as well as a complete exemption.

Additional Information

VAT has some similarities with turnover or sales tax and is also added to the total cost of the service. However, there are significant differences in this regard. Thus, the seller of services for which the buyer pays VAT included in the total price can deduct from the amount paid by the buyer those figures that were paid the same tax to the supplier.

The tax remains indirect; it is paid by the buyer. Payment papers require separate registration of VAT on services and transactions; a special line is allocated for this. In general, this version of the tax system is formed to achieve several goals at once:

- Distribution of the tax payment process between the stages of production and commerce, while eliminating the risk of multiple collections and overpayments, which can become very serious.

- Distribution of responsibilities between several payers, eliminating the risk of non-payment. The specifics of taxation in this regard are such that the required amount will still be withdrawn for the budget, even if one of the participants in the process evades taxes. Care is possible only when using the most complex schemes.

- Receiving an indirect tax excludes national ones; this is convenient within the current economic situation.

Accounting entries for VAT accounting

Let's take a closer look at the accounting entries for VAT accounting.

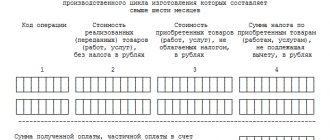

| Debit | Credit | Description |

| 19 | 60, 76 | Accounting for tax when purchasing goods or services |

| 68 | 19 | Acceptance of tax deduction |

| 41 | 19 | The tax is included in the price of the goods (in case the transaction is not subject to VAT) |

| 90 | 68 | Tax accrued on the sale of goods and services |

| 91 | 68 | Tax accrued for other types of activities |

What services are subject to VAT?

VAT is levied on a wide range of services provided on the territory of the Russian Federation, and this issue is regulated by Chapter No. 21 of the Tax Code of the Russian Federation. Almost all services are taxable, however, there is a list of exceptions approved by law in accordance with Articles No. 145, No. 149 and No. 150 of the Tax Code of the Russian Federation. Among the exceptions that are not subject to the fee, it should be noted:

- Licensed medical services except veterinary and cosmetology, not sponsored by the budget.

- Child care in specialized preschool institutions.

- Sections and clubs for children.

- Care for the elderly and disabled.

- Collection of duties and fees, related services.

- Funeral services.

- Renting premises to foreigners.

- Working with deposits and securities.

- Maintenance of vessels - river, sea, air.

- Non-profit services in the spheres of culture and art.

- Pharmacy services - manufacturing medicines, frames, repairing hearing aids, and so on.

- Transportation of people subject to a single tariff.

- Extinguishing fires in forests.

- Lawyer services.

- Guaranteed repair services at no additional charge.

Transactions not subject to VAT

List of non-taxable transactions. A closed list of transactions exempt from VAT is given in paragraphs. 1-2 tbsp. 149 of the Tax Code of the Russian Federation. True, experts call only some of the operations listed in it preferential, because any enterprise, and not specific categories of taxpayers, can receive VAT exemption from this list. But this does not change the essence; you do not need to pay VAT on transactions in this list.

The list includes rental operations to non-residents, sales of medical goods and medical services, transportation by passenger transport, funeral services, sale of goods of religious significance and others - more than 70 items in total.

Required documents. In order to receive a benefit and not pay VAT on these transactions, you must have permits - first of all, a license, since most transactions exempt from VAT are related to licensed activities. Another document that will be needed to apply the benefit is registration certificates for medical products. Both the license and registration certificates must not be expired. The tax office may also request invoices without the allocated part of VAT, agreements with counterparties and other documents (clauses 2 and 6 of Article 88 of the Tax Code of the Russian Federation).

Important! Exemption from VAT for transactions from the list in Art. 149 of the Tax Code of the Russian Federation in most cases does not apply to intermediaries who work in the interests of third parties under an agency agreement or a commission agreement. Such agents pay full tax on their fees. For more details, see paragraph 7 of Art. 1149 Tax Code of the Russian Federation.

Separate accounting. If a company pays VAT for part of its operations and applies benefits for another part, it will have to keep separate tax records (clause 4 of Article 149 of the Tax Code of the Russian Federation). Input VAT on purchased goods and services is also taken into account separately for preferential and taxable transactions. In this case, the amount of tax for preferential transactions that you have designated for the supplier must be taken into account in the cost of goods or services, and VAT on non-taxable goods and services is not deductible. Otherwise, the Tax Code does not provide clear instructions for maintaining such accounting, so the company will have to prescribe the methodology itself in its accounting policy.

Voluntary use of benefits. Sometimes VAT benefits are unfavorable for the company, and then some unnecessary “relaxations” can be abandoned. The taxpayer does not have the right to pay VAT on transactions in paragraphs. 1-2 tbsp. 149 of the Tax Code of the Russian Federation. But for transactions from clause 3, he may not benefit from the tax waiver provided. To do this, you must renounce your right to the benefit for a period of at least a year (Article 56 of the Tax Code of the Russian Federation) and submit a tax application about this before the start of the new quarter.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

What transactions are subject to VAT?

Regarding transactions, the situation is similar - almost all of them require payment of VAT, but there is a list of exceptions that are not subject to additional taxes. Exceptions established by law are worth listing. Thus, the following transactions are not subject to tax:

- Licensed banking activities except for collection, loans other than in kind (through the use of goods), operations with stones and precious metals.

- Transfer of infrastructure facilities to self-government bodies and authorities.

- Privatization of enterprises.

- Insurance, provision of pensioners of a non-state nature.

- Sale of land.

Attention

All other transactions require payment of tax.

What types of activities are not subject to VAT?

There is a list of activities that are not subject to VAT. First of all, these are socially significant areas, the cost of services within which should not increase. It is worth listing the following types of activities that are not subject to VAT in this case:

- Sphere of investment.

- Construction of any facilities for military personnel, including housing and infrastructure.

- When operating an organization whose staff consists of 80 percent or more disabled people, or if up to 80 percent of the authorized capital is formed by contributions from organizations of disabled people.

- The work of the International Olympic Committee.

- Charity.

- Budgetary research activities.

- Restoration of historical and cultural monuments.

- Cinema.

When working in any of these areas, there is no need to pay VAT.

Which goods are not subject to VAT upon import?

Tax must also be paid when importing products into the country for commercial purposes. In this sector there are also categories exempt from payment, and their full list can be seen in Art. 150 Tax Code of the Russian Federation. As an example of goods exempt from payment, one can cite technological equipment and spare parts that are not produced in Russia even within the framework of analogues. The following goods are also completely exempt from VAT when imported:

- Medicines that have no analogues, materials for their production.

- Consumables for scientific purposes that have no domestic analogues.

- Life-saving medical supplies.

- Any cultural values.

- Breeding agricultural animals, embryos.

- Items within the scope of gratuitous assistance.

- Seafood produced by domestic companies.

- Currency, securities - with the exception of collecting purposes.

- Rough diamonds.

- Objects of space activities.

- Printed products for exchange between museums and libraries.

- Goods produced by Russian companies operating abroad.

- Vessels for registration in Russia.

Who is exempt from paying VAT?

VAT is also exempt in other situations. Thus, there is no need to pay this tax if the organization or individual entrepreneur belongs to the sphere of small business, and a simplified taxation system is used. In this case, it becomes necessary to pay tax according to the developed “Income” or “Income minus expenses” schemes, and payment of VAT is not required. In addition, VAT does not need to be paid to those organizations that work under the agricultural tax regime.

IMPORTANT

It is worth knowing that the list of conditions for VAT exemption, as well as the list of services and goods subject to exemption, is revised from time to time, and innovations arise periodically in this area. Exemption is a regulated phenomenon and exempt companies are subject to supervision and control.

BASIC

All organizations and entrepreneurs that apply the general taxation system are VAT payers. Foreign organizations operating in Russia are also recognized as VAT payers. This follows from Article 143 and paragraph 2 of paragraph 2 of Article 11 of the Tax Code of the Russian Federation.

Foreign organizations registered with the tax office pay tax on their own. This follows from the provisions of paragraph 1 of Article 143, Article 83, paragraph 7 of Article 174 of the Tax Code of the Russian Federation. If they are not registered for tax purposes in Russia, then VAT for them is transferred by organizations acting as tax agents for:

- purchasing goods (works, services) from them (clause 2 of article 161 of the Tax Code of the Russian Federation);

- sales in Russia of their goods (works, services, property rights) on the basis of agency agreements, agency or commission agreements (clause 5 of Article 161 of the Tax Code of the Russian Federation).

VAT is charged when performing the following transactions:

- sale of goods (work, services) and property rights on the territory of Russia (in this case, the gratuitous transfer of goods, work and services is also considered a sale);

- transfer of goods on the territory of Russia (performance of work, provision of services) for one’s own needs, the costs of which are not taken into account when calculating income tax;

- performing construction and installation work for own consumption;

- import of goods.

This is stated in paragraph 1 of Article 146 of the Tax Code.

When carrying out transactions that are subject to VAT, issue an invoice (clause 5 of Article 168, subclause 1 of clause 3 of Article 169 of the Tax Code of the Russian Federation).

There is no need to charge VAT on transactions that:

- are not recognized as subject to VAT (clause 2 of Article 146 of the Tax Code of the Russian Federation);

- exempt from taxation (Article 149 of the Tax Code of the Russian Federation).

Value added tax calculation

Calculating VAT is quite easy; for this purpose there is a formula NB × Nst / 100 ,

Where NB is the total amount, that is, the tax base, and the rate can be equal to 10 or 18 percent.

When isolating the tax from the total amount, you can apply the following formula: C / 1.18 × 0.18 (or × 0.10)

C/1.10 —rate 10%,

C - total amount including VAT.

If you need to find the amount including tax without calculating it in advance, you can use the formula C = NB × 1.18 (or 1.10)

NB - total amount without tax, base.

Possible errors in calculations

An error can creep into any calculation, but mathematical inaccuracies are not the main problem area for VAT. They happen rarely, and if we talk about errors in formation and payment, then first of all it is necessary to note other factors.

For your information

Sometimes, by mistake or intentionally, they use a low interest rate in a situation where it would be legal to use the main one. Sometimes they are late with the calculation and payment of VAT, or do not take into account partial payment already received for a service or product. Sometimes VAT is deducted without transferring it to the supplier, and errors often occur due to the fact that incorrectly drawn up and completed invoices are received.

Since VAT on services and transactions is one of the most important, and fines for violations and non-payment of tax can be very serious, it is worth paying the necessary attention to calculations, and hiring only competent specialists for accounting work who can confidently cope with all the nuances of the issue.

Residential maintenance

Situation: can an organization use a VAT benefit when selling maintenance services for residential premises (garbage removal, cleaning staircases, heating services, elevator maintenance, etc.)?

Only homeowners' associations (HOAs), housing cooperatives or other specialized consumer cooperatives, as well as management organizations can apply VAT benefits for the sale of maintenance services for residential premises (subclauses 29, 30, clause 3, article 149 of the Tax Code of the Russian Federation). However, this benefit can be used subject to the following conditions:

- utilities were purchased directly from resource supply organizations specified in paragraph 1 of Article 2 of Law No. 210-FZ of December 30, 2004. It should be taken into account that utility services include payments for cold and hot water supply, sewerage, electricity supply, gas supply and heating (Part 4 of Article 154 of the Housing Code of the Russian Federation);

- utilities are sold at a cost corresponding to the cost of their acquisition from the resource supplying organization (including input VAT).

In the same manner, the performance of work (provision of services) for maintenance (maintenance and repair) of common property in apartment buildings is also exempt from VAT. That is, you can take advantage of the VAT benefit if:

- works (services) were purchased from contractors (organizations and entrepreneurs) who perform (provide) them, including with the involvement of subcontractors. It should be taken into account that the maintenance of property in apartment buildings includes the work (services) listed in paragraph 11 of the Rules, approved by Decree of the Government of the Russian Federation of August 13, 2006 No. 491;

- works (services) are sold at a cost corresponding to the cost of their acquisition (including input VAT).

If homeowners' associations, cooperatives or management organizations sell work (services) performed (provided) on their own or at a price higher than the cost of their acquisition, the benefits provided for in subparagraphs 29 and 30 of paragraph 3 of Article 149 of the Tax Code of the Russian Federation do not apply.

Similar clarifications are contained in letters of the Ministry of Finance of Russia dated August 6, 2010 No. 03-07-11/345, dated April 27, 2010 No. 03-07-07/18, dated March 12, 2010 No. 03-07-14/ December 18 and December 23, 2009 No. 03-07-15/169 (the last letter was addressed to the Federal Tax Service of Russia for use in the work of tax inspectorates).

An additional condition for using the benefit is the performance of maintenance (maintenance and repair) work on common property in apartment buildings under the apartment building management agreement. The requirements for such an agreement are established by Article 162 of the Housing Code of the Russian Federation. If such work (services) are performed (provided) within the framework of an agreement that does not comply with the requirements of Article 162 of the Housing Code of the Russian Federation, the benefit provided for by subparagraph 30 of paragraph 3 of Article 149 of the Tax Code of the Russian Federation does not apply. This conclusion is confirmed by the Ministry of Finance of Russia in a letter dated August 6, 2010 No. 03-07-11/345.

VAT benefits for the sale of utility services and for the performance of maintenance (maintenance and repair) work on common property in apartment buildings are provided regardless of to whom these services (work) are provided (performed): the population or organizations (letter from the Ministry of Finance of Russia dated April 30, 2010 No. 03-07-07/21), owners or tenants (users) of premises (letter of the Federal Tax Service of Russia dated May 28, 2010 No. ShS-37-3/2791).

Accounting entries

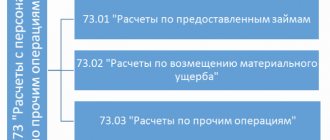

Value added tax and the correct execution of papers associated with it are assigned to tasks that must be solved mainly by an accountant. Modern systems greatly simplify this activity, and there are two points under VAT. First of all, account 19 is used, where you can open sub-accounts - the column is reserved for VAT on purchased values. There is also account 68 called Tax calculations, where a subaccount is allocated for VAT.

Additional Information

Using specialized accounting tools, you can successfully calculate value added tax with a minimum of effort and avoid breaking the rules.

Taxable and non-taxable VAT transactions

Art. 146 of the Tax Code of the Russian Federation strictly delineates operations according to their belonging to objects of VAT taxation. Thus, transactions not subject to VAT in 2019, as in previous periods, include transactions:

- for the sale of goods/services, transfer of property rights, as well as the provision of gratuitous services (equal to sales) in the country;

- for the transfer of goods and materials/services for one’s own needs, the costs of which were not reimbursed when calculating income tax;

- to carry out construction and installation work for one’s own use;

- on the import of goods.

In paragraph 2 of Art. 146 of the Tax Code of the Russian Federation defines transactions that fall into the category of non-taxable VAT. First of all, these are transactions that are not sales. To understand in what situations the term “implementation” is not applicable, you should refer to clause 3 of Art. 39 of the Tax Code of the Russian Federation - it explains transactions that are not defined as sales. For example, the following are not taxed:

- transfer of property during the reorganization of companies to legal successors;

- transfer of assets as part of a contribution to the management company upon withdrawal of a participant or liquidation of the company;

- transactions involving the circulation of foreign currency, except numismatic ones;

- transfer of property in investment transactions.

In addition to such transactions, transactions not subject to VAT include:

- free transfer of housing, kindergartens, electrical networks, roads, and other social and cultural facilities to state or local authorities;

- sale of plots of land or shares in them;

- transfer of the company's property rights to the legal successor;

- sale of goods/services related to the FIFA 2021, UEFA 2020 championships;

- free transfer of real estate objects to the State Treasury of the Russian Federation, including property for scientific research in Antarctica.

There are a number of transactions that are exempt from VAT. They are characterized mainly by a clearly oriented social orientation. Their list is indicated in Art. 149 of the Tax Code of the Russian Federation. This list is closed, but quite extensive and includes many positions - in this article we present only a few of them. The following transactions are exempt from taxation:

- provision of premises for rent on the territory of the Russian Federation to foreigners and foreign companies accredited in the Russian Federation;

- sale of medical goods included in the closed list, approved. Government of the Russian Federation on September 30, 2015, by Resolution No. 1042, as well as a number of medical products and services provided under compulsory medical insurance, ambulance services, etc.;

- sale to canteens of medical and educational institutions of food products produced by catering enterprises, as well as products produced by these canteens themselves;

- gratuitous transfer of goods/property rights to charity;

- issuance of sureties and guarantees by non-banking institutions;

- provision of residential premises for use in the housing stock of any form of ownership;

- transfer of goods for advertising purposes, the cost of purchase or production of which does not exceed 100 rubles. per unit, etc.

Thus, the current legislation contains a very impressive list of sales transactions that are not subject to VAT.

Read also: VAT rate “0” and “Without VAT”: what is the difference?