Organizations offering insurance services are required to maintain accounting records. Their activities are controlled by the insurance market department that exists under the Central Bank.

Question: How are the costs of insuring property (including leasing and rented property) reflected in accounting and tax accounting? The organization entered into a property insurance contract for a period of 12 months (365 days) and paid a lump sum insurance premium in the amount of 146,000 rubles. The insurance contract is valid from March 1 of the current year (the date of payment of the insurance premium) to February 28 of the next year inclusive. For tax purposes, income and expenses are accounted for on an accrual basis. Reporting periods for income tax are the first quarter, half a year, and nine months of the calendar year. Interim financial statements are prepared on the last day of each quarter. View answer

Primary documents

Primary documentation is the papers on the basis of which accounting is carried out. Primary information for an insurance organization:

- Founding papers: charter, license.

- Insurance contracts.

- Papers confirming the occurrence of the event (application, insurance certificate).

- Papers confirming coverage of losses.

- Tax accounting registers.

The insurance company needs to approve the document flow schedule and document forms that are necessary for accounting needs.

the insurance premium reflected in accounting when terminating a compulsory motor liability insurance contract ?

Accounting in insurance organizations

The activities of any organization are reflected in the accounting documentation. The basic principles of accounting are the same for all enterprises and organizations, regardless of legal form and industry. This is the reliability of information, continuous continuous documentation, inventory, double entry, the relationship of forms of generalization of information and its reflection in periodic reporting.

One of the main, officially established functions of accounting is serving the information needs of external and internal users. Managers in the process of managing an insurance organization must have reliable and most complete accounting reports.

This is necessary both to solve current problems and to develop an overall development strategy for the organization. In addition, the owners and co-owners of the company are directly interested in information about the financial condition of the insurance organization.

The most important internal provision regulating the organization and procedure for maintaining accounting is the company's accounting policy. The accounting policy establishes accounting methods and methods, the application of which directly affects the formation of the organization’s final financial results. When forming an accounting policy, the insurer is guided by the Accounting Regulations currently in force.

There are two options for organizing tax accounting:

– tax accounting as an autonomous system that exists separately from the accounting system;

– construction of an integrated accounting and tax accounting system.

In the first option, to generate data on the preparation of tax calculations (tax reporting), along with the accounting policy, the taxpayer must develop and approve the organization’s independent tax policy.

In the second option, in addition to the accounting policy adopted by the organization, provisions must be introduced to systematize tax accounting data, grouped in accordance with the requirements of tax legislation.

The choice by an insurance organization of the option of harmonizing accounting systems depends on the volume of its activities, the ratio of short-term and long-term contracts in the insurance portfolio, and the coincidence of taxable objects with accounting indicators.

Did not you find what you were looking for?

Teachers rush to help

Diploma

Tests

Coursework

Abstracts

Accounting reporting in Russia has undergone significant changes due to the gradual unification of reporting in accordance with international financial reporting standards (IFRS). Approaching international standards ensures comparability of reporting and equivalence of financial indicators of insurance organizations around the world.

Due to the specifics of insurance activities, the accounting system in the insurance sector differs significantly from other sectors of the economy. The accounting statements of insurance organizations are a unified system of data on the property and financial position of the organization and the results of its financial and economic activities, compiled on the basis of accounting indicators.

The balance sheet of an insurance organization is the main final document of the insurer's financial statements. The balance sheet contains basic information about the amount and structure of the insurance organization's funds and sources of their financing: assets, equity and borrowed capital, liabilities.

The balance sheet is drawn up as of the end of the reporting period and contains data as of the beginning of the reporting period. The balance sheet shows how the organization's resources are provided by its own and attracted capital. Traditionally, the balance sheet is divided into two parts: assets and liabilities, which should be equal to each other.

Assets are resources owned or controlled by an organization that are expected to produce economic benefit. Asset items represent the insurer's investments, which include intangible assets, investments, property, plant and equipment, cash and accounts receivable.

The specifics of insurance activities are reflected in the composition of the items on the active part of the balance sheet, which include depot premiums for risks accepted for reinsurance, the share of reinsurers in insurance reserves, accounts receivable for insurance and co-insurance operations and other items.

When an insurance organization is actively investing, the majority of its assets are made up of financial investments in securities, subsidiaries, dependent companies and other organizations, bank deposits, real estate and other investments.

The liability side of the balance sheet shows the insurance company's sources of funds, including its own and borrowed funds. Own funds are represented by authorized capital, additional capital, reserve capital, and retained earnings.

In the passive part of the balance sheet, an element reflecting the industry specifics of insurance activities is the section “Insurance reserves”, which represents funds set aside by the insurance organization in reserve for the fulfillment of future obligations to policyholders.

With a significant, constantly replenished and relatively break-even insurance portfolio, this liability section is the largest. The mechanism for generating income and expenses of an insurance company is shown in the figure

Accounting for payments under basic agreements with policyholders

The organization makes insurance payments when insured events occur. They may relate to various areas:

- Property (payments are made in cases of theft, flooding and other damage).

- Medicine (payments in case of illness).

- Auto (payments in case of car theft).

How is accounting carried out when insuring the leased asset by the lessee (sublessee)?

Insurance payments are formed from the totality of all proceeds from people who have entered into an insurance agreement with the organization. Payments are recorded on account 22. Information about them is collected in registers. Analytical accounting is carried out in the context of agreement forms and policyholders. Information is recorded in accounting on the date of occurrence of insurance rights.

Accounting for bonuses

Insurance premiums are payments made by a person to an organization. The insurance agreement comes into force either from the date specified in it or from the date of payment of the first premium.

How is accounting carried out when insuring cargo by the shipper ?

Compensation in the event of an insurance event is paid only when the person has no arrears on premiums. All amounts for the past period must be paid.

The compensation paid to the insured may be counted towards the following insurance premiums.

Let's look at an example. The insured person was awarded compensation in the amount of 50,000 rubles. Additional expenses associated with the insured event were also confirmed. The person decided to use half of this amount towards future insurance payments. In this case, these postings are used:

- DT22/1 KT51. Payment of insurance compensation.

- DT22/1 KT51. Payment of additional expenses.

- DT22/1 KT77/1. Crediting part of the indemnity amount against the following insurance premiums.

The legality of all payments is confirmed by the primary source.

Insurance premium in accounting postings - what is it

An insurance premium is the payment for insurance services made by the policyholder in favor of the insurer within the framework of a concluded agreement between the parties. The accounting entry of the specified payment is a record entered into the computer database and displays changes in the state of accounting objects.

The execution of these operations begins from the moment the contract begins. The domestic legislative framework does not provide for a uniform procedure for entering transactions. It is allowed to make them once for the past calendar period or constantly adjust them during the validity of the insurance policy.

Postings for insurance premiums

Postings of insurance premiums in accounting are divided into two components, attributed to the following items:

- debit;

- credit.

Each of these types is characterized by discrepancies between accounting and tax data:

- in accounting, write-offs are made one-time within the expiration of the insurance period, and in tax accounting - no more than once under an insurance agreement valid for the period of time when income tax is required to be paid;

- in accounting, costs are taken into account in full, in tax accounting, boundaries are established for tariff rates for each specific insurance product;

- according to accounting, expenses begin to be reflected from the moment the policy begins, in tax reporting - after the first payment by the policyholder.

The debit part of the transactions is drawn up as a subaccount in Form 76-1, and the credit part includes accounts for basic and additional expenses, which require a one-time write-off.

Related article: What is a professional association of insurers

Accounting for reinsurance

Reinsurance is the transfer of obligations to protect against risks. It is assumed that these obligations are transferred from one organization to another. That is, a person enters into an agreement with one organization. She will be considered the primary insured. It is she who is responsible to clients. She also accepts various insurance claims.

If reinsurance is carried out, these transactions become relevant:

- DT92/4 KT77/4. Premium aimed at reinsurance.

- DT77/4 KT91/1. Money received from the reinsurer.

- DT77/4 KT77/6. Money deposited under agreements submitted to reinsurance.

The reinsurance agreement is a separate contract. The reinsurer makes payments only in the amounts established by the contract. Amounts above the limit are paid by the primary insurer.

Accounting for payments under coinsurance agreements

A person may enter into insurance agreements with several organizations. In this case, the companies will be jointly and severally liable to the person in the event of an insured event. That is, each organization contributes a certain share. There are 2 options for drawing up an agreement:

- The person enters into separate agreements with each company. Calculations are carried out by each organization separately.

- All operations are carried out by one organization, which acts on behalf of others.

If agreements are concluded with each organization separately, these postings are used:

- DT77/1 KT92/1. Calculation of insurance premium.

- DT51 KT77/1. Payment of the premium.

- DT22/1 KT77/1. Calculation of payment upon the occurrence of an insured event.

- DT77/1 KT51. Transfer of payment.

If settlements are carried out by one organization, accounting is carried out by each insurance company. Accounting reflects amounts proportional to the organization's share.

Accounting for liability insurance

Liability insurance involves compensation for damage caused by the insurer to a third party. For example, a person received insurance in case of apartment flooding. And then he flooded his neighbor's apartment. In this case, the insurance company compensates for the damage caused to this neighbor. Let's look at other common cases of liability insurance:

- Damage caused to someone else's vehicle during its operation.

- Damage caused to the environment or people due to potentially hazardous activities.

- Damage caused to third parties in connection with the performance of legal or medical activities.

Let's look at the entries made for liability insurance (example):

- DT22/1 KT51. Payment of damages to a person injured in a car accident.

- DT91/2 KT22/1. The payment is included in the spending structure.

- DT50 KT91/1. Receipt of money from a person found guilty of an accident.

FOR YOUR INFORMATION! You can insure business risks. In this case, the insurance agreement ends early upon termination of business activity.

Features of VHI accounting

VHI is one of the types of personal insurance. As a rule, it is included in the “social package” provided by the employer. Contributions for voluntary health insurance are included in expenses if there are circumstances specified in subparagraph 16 of article 255 of the Tax Code of the Russian Federation. Consider these circumstances:

- The VHI agreement is signed for a period of more than a year.

- The insurance company has a license to conduct insurance activities.

- Expenses are fixed at no more than 6% of total labor costs.

In accounting, expenses for voluntary health insurance relate to the period in which they arose. Insurance payments are recorded on the DT of expense accounts (for example, account 20, 26, 44). The company may make insurance payments for persons with whom labor relations have not been formalized. Related expenses will be recorded on DT 91. A subaccount 02 will be opened for it.

Features of cost accounting under compulsory motor liability insurance

Regulatory regulation

Payment of the insurance premium to the accounting department should be taken into account as part of advances issued (clause 3, 16 of PBU 10/99). Costs for paying premiums are not recognized as deferred expenses, since this is a “continuing” service (clause 3, 16 of PBU 10/99). The organization has the right to terminate the contractual relationship early and return part of the funds paid in proportion to the remaining period of insurance.

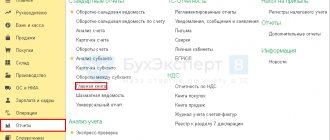

In the 1C program, a special account 76.01.9 “Payments (contributions) for other types of insurance” is provided for calculations of insurance premiums. Despite the fact that the premium paid cannot be attributed to deferred expenses, account 76.01.9 has a sub-account Deferred Expenses PDF for automatic even recognition of expenses when performing the Month Closing procedure. Therefore, there is no need to create an additional cost accounting document, for example, a Receipt document (act, invoice) .

Insurance costs are recognized as expenses for ordinary activities evenly in the reporting period in cost accounts (clause 5 of PBU 10/99).

In NU, the costs of paying insurance premiums for compulsory insurance (including compulsory motor liability insurance) are included in indirect costs, like other costs associated with production and (or) sales (clause 5, clause 1, article 253 of the Tax Code of the Russian Federation, p. 2, paragraph 3 of Article 263 of the Tax Code of the Russian Federation).

Under insurance contracts valid for more than one reporting period, the insurance premium paid at a time is taken into account in expenses evenly during the term of the contract, in proportion to the number of calendar days (clause 6 of article 272 of the Tax Code of the Russian Federation, clause 1, clause 2 of article 263 Tax Code of the Russian Federation):

- within the limits of insurance rates, if they are provided for by law;

- in the amount of actual expenses, if limits on insurance rates are not provided.

Analytics for insurance premiums account

In the 1C program, you need to enter analytics for account 76.01.9 subconto Deferred Expenses - this is the name of the reference book for accounting for expenses subject to straight-line write-off. The procedure for filling it out for insurance premiums is as follows:

- Type for NU - Other types of insurance ;

- Type of asset in the balance sheet - Accounts receivable ;

- Amount - the paid amount of the insurance premium, written off evenly over the term of the contract;

- Recognition of expenses - By calendar days ;

- Write-off period —insurance period;

- Cost account - account for accounting costs for insurance;

- Cost item is a cost item for which the insurance premium is reflected in expenses.

Features of creating insurance reserves

The formation of insurance reserves is an event considered mandatory for an insurance company. The mandatory creation of such reserves is stipulated in Article 26 of Federal Law No. 4015-1 “On the Insurance Business” of November 27, 1992. The sequence of formation of reserves is specified in the order of the Ministry of Finance No. 51 n dated June 11, 2002.

Let's consider the sequence of formation of reserves:

- Establishing the required type of reserve. Orders of the Ministry of Finance 32n and 51n will help with this. You also need to focus on the local regulations of the company.

- Establishing a method for determining the reserve.

- Determination of the reserve for each insurance agreement.

The reserve is needed to ensure that the organization always has the amount of funds that is needed in the event of an insured event.

How to account for insurance costs in tax accounting

Tax accounting differs from accounting in the following features:

- expenses begin to be taken into account only after the premium is received by the insurer;

- a one-time write-off of costs is possible if the term of the agreement does not extend beyond the reporting period for paying income tax, otherwise the costs are distributed over the duration of the agreement;

- In tax accounting, prohibitions on expenses are applied for compulsory types of insurance - according to insurance tariffs; for voluntary ones, expenses are taken into account in full.

Article on the topic: Accounting entries for deductions and accruals to the Social Insurance Fund

The task of accountants at an insurance company is to minimize these discrepancies. This can be achieved by using account 97. If the limits are respected, the difference can be avoided.