What expenses are considered direct?

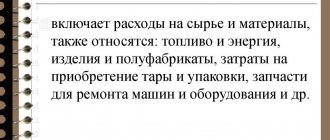

Art. 318 of the Tax Code classifies as direct expenses:

- Costs incurred by an enterprise in the acquisition of materials and raw materials that are used in the production of goods, as well as in the implementation of work or provision of services.

- Costs incurred by an enterprise when purchasing components for installation or semi-finished products for additional processing.

- Expenses for remuneration of employees of an enterprise involved in the production of goods, provision of services or performance of work. This category also includes expenses for compulsory pension insurance, insurance in case of temporary disability, medical insurance, social insurance against occupational diseases and accidents, and financing the funded part of the pension. The listed expenses must necessarily be accrued for the wages of workers involved in the production of goods (performance of work, provision of services). Only in this case can they be taken into account when determining income tax.

- Amounts accrued for depreciation of fixed assets, if they are used in the production of goods, performance of work or provision of services.

The list of direct expenses is open. The taxpayer has the right to independently determine his own list of direct expenses, which differs from the list from Art. 318 Tax Code of the Russian Federation. At the same time, the Ministry of Finance of the Russian Federation draws attention to the fact that the list of direct expenses determined by the taxpayer must be justified by the technological process. The judges of the Arbitration Court of the Far Eastern District share the same opinion (see resolution dated August 1, 2017 No. F03-2571/2017 in case No. A04-10568/2016. By decision of the Supreme Court of the Russian Federation dated November 24, 2017 No. 303-KG17-17016, transfer was denied case No. A04-10568/2016 to the judicial panel for economic disputes of the Supreme Court of the Russian Federation for review of this decision in cassation proceedings).

IMPORTANT! When accepting expenses to reduce the tax base for income tax, it is very important to comply with the provisions of Art. 252 of the Tax Code of the Russian Federation, according to which all expenses must be documented and economically justified.

At the same time, officials emphasize that indirect costs can include costs associated with the production of goods (works, services), only if there is no real possibility of classifying these costs as direct costs (letter of the Ministry of Finance of the Russian Federation dated March 13, 2017 No. 03-03-06/1 /13785). This point of view is shared by the arbitrators (see the decisions of the Arbitration Court of the Western Siberian District dated 08/21/2017 No. F04-3174/2017 in case No. A27-19836/2016, the Arbitration Court of the Far Eastern District dated 08/01/2017 No. F03-2571/2017 in case No. A04-10568/2016, Arbitration Court of the Moscow District dated 06/05/2017 No. F05-7067/2017 in case No. A40-136716/2016).

The list of direct expenses for tax purposes must be approved in the accounting policy for tax purposes (paragraph 10, clause 1, article 318 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated 02/21/2018 No. 03-07-07/11012, dated 03/13/2017 No. 03 -03-06/1/13785, dated 02/07/2011 No. 03-03-06/1/79 and Federal Tax Service of Russia for Moscow dated 02/02/2010 No. 16-12/ [email protected] ).

If you have access to ConsultantPlus, check whether you correctly divide costs into direct and indirect when calculating taxable profit. If you don't have access, get a free trial of online legal access.

See also the material “List of direct income tax expenses”.

Distribution of direct expenses. How to take into account “unfinished work”

What expenses need to be distributed?

| The list of direct expenses is in Article 318 of the Tax Code |

In order to calculate taxable profit, each accountant needs to divide all the company's expenses into direct and indirect.

Direct costs reduce profits only partially, indirect costs completely. Recently the list of these expenses has changed. Now direct costs include: - for the purchase of raw materials and supplies for production; — for the purchase of components; — for the purchase of semi-finished products; — for the salaries of production workers (including the unified social tax from their salaries); — for depreciation of production fixed assets. All other costs are indirect. Only the amount of direct expenses that relates to products sold reduces profit. To calculate this amount, you need to distribute direct costs between: - “unfinished” (that is, products that are unfinished); — products in stock; - products shipped but not sold to customers (for example, if the products were transferred to an intermediary for sale).

The easiest way is to determine the total amount of direct expenses. To do this, they need to be folded. The calculation of direct expenses that relate to “work in progress” depends on the type of activity of your company.

Depending on the type of activity, the Tax Code divides all firms into three groups: - those performing work or providing services; — processing raw materials; - conducting other activities.

The first group includes companies that perform work or provide services. These are construction, transport, consulting, auditing firms, consumer service enterprises, etc. The second group includes enterprises that use one or another raw material as the basis for finished products: oil refiners, metallurgists, woodworkers, etc. Who does what? then by others (other activities) - in the third group. For example, it produces radio equipment, instruments, cars, etc.

| The new procedure for the distribution of direct expenses is effective from January 1, 2002 |

Calculation of “work in progress”

Performance of work (provision of services)

If your company is included in the first group, then calculate the expenses that relate to “work in progress” as follows:

Total direct expenses for the month

x

Volume of unfinished work (services) at the end of the month

+

Volume of completed work (services) not accepted at the end of the month

:

Volume of work (services) performed per month

=

Amount of direct expenses that relates to “work in progress”

You only need to determine that the amount of direct expenses that relates to “work in progress”. The remaining amount of expenses reduces profit. The fact is that you do not have finished products in the warehouse and finished products shipped to customers. Calculate the amount of expenses that reduce profit as follows:

Amount of direct expenses per month

—

Amount of direct expenses that relates to “work in progress”

=

Amount of direct expenses that reduces profit

Example 1.

CJSC “Aktiv” transports cargo. In August, the total volume of transport traffic amounted to 500,000 t/km. Of these, transport services of 40,000 t/km were not accepted by customers. Direct costs for August - 200,000 rubles. “Unfinished projects” include direct expenses in the amount of 16,000 rubles. (RUB 200,000 x 40,000 t/km: 500,000 t/km). The Aktiva accountant can reduce the profit for August by 184,000 rubles.0).

Raw material processing

As the code says, if you process raw materials, you need to allocate direct costs “to work-in-process balances as a share of those balances in the feedstock (in quantitative terms), less process losses.” How to calculate this share and determine the amount of expenses that relates to “work in progress”? First of all, find out how much raw material went into production and how much was spent on “work in progress”. Take this data from primary documents on the movement of raw materials (for example, limit cards). Calculate the amount of direct expenses that relates to “work in progress” as follows:

Amount of direct expenses per month

x

Amount of raw materials spent on “work in progress”

:

Amount of raw materials transferred to production per month

-

Technological losses

=

Amount of direct costs that relate to “work in progress”

Example 2.

LLC “Passive” processes timber. In August, 4,000 cubic meters were released into production. m of forest. Of these, 1200 cubic meters. m was spent on the production of boards that did not undergo all the necessary processing (that is, “unfinished”). Technological losses of forest amounted to 65 cubic meters. m. The amount of direct costs for August is 8,000,000 rubles. “Unfinished” includes direct expenses in the amount of RUB 2,439,644. (RUB 8,000,000 x 1,200 cubic meters: (4,000 cubic meters - 65 cubic meters)).

Other activities

If your company belongs to the third group, you need to calculate direct costs related to “work in progress”, “in proportion to the share of direct costs in the planned (standard, estimated) cost of production.” Do this using the formula:

Amount of direct expenses per month

x

The amount of direct costs in the planned cost of finished products

:

Planned cost of finished products

=

The amount of direct costs that relates to “work in progress”

Example 3.

LLC “Reserve” produces radios.

The planned cost of one radio receiver is 2000 rubles/piece, including: — direct costs—1600 rubles/piece; — indirect costs — 400 rubles/piece. Direct expenses of the company for August - 1,500,000 rubles. Based on the amount of unfinished products, direct costs in the amount of 1,200,000 rubles are allocated to “work in progress”. (1,500,000 x 1600: 2000). Calculation of the cost of finished products in the warehouse

| Forms of primary documents for accounting of finished products were approved by Decree of the State Statistics Committee of August 9, 1999 No. 66 |

To determine this indicator, find out the total number of products produced per month and the quantity transferred to the warehouse.

Take all this data from primary documents on the movement of finished products (for example, a log of product receipts). First, calculate the amount of direct costs that relate to the products shipped. It needs to be done like this: The amount of direct costs that relates to finished products

—

Direct costs for “work in progress”

x

Total quantity of finished goods shipped to customers

:

Total quantity of finished goods

=

Direct costs for shipped products

Then calculate the direct costs that relate to the balance of finished goods in the warehouse. Do this using the formula:

The balance of direct expenses for finished products in the warehouse at the beginning of the month + Total amount of direct expenses - Direct expenses for “work in progress” - Direct expenses for shipped products = Direct expenses for finished products in the warehouse

Example 4.

CJSC Aktiv produces furniture.

1000 tables were made in August. Of these, 550 tables were shipped to customers. The balance of direct expenses that relate to finished products in the warehouse at the beginning of August is 360,000 rubles. The amount of direct expenses for August is RUB 4,500,000. Expenses that are classified as “unfinished” - 600,000 rubles. The amount of direct expenses that relates to shipped products will be: (RUB 4,500,000 - RUB 600,000) x 550 pcs. : 1000 pcs. = 2,145,000 rub. The amount of direct costs for finished products in the warehouse at the end of August will be:

360,000 rubles.

+ 4,500,000 rub. — 600,000 rub. — 2,145,000 rub. = 2,115,000 rub. Calculation of the cost of shipped but not sold products

Direct costs are allocated to shipped products only in two cases:

| The procedure for the distribution of direct expenses is contained in Article 319 of the Tax Code |

- if the ownership of the product has not been transferred to the buyer;

- if the products are transferred for sale under an intermediary agreement. It is impossible to understand from the text of the code how such expenses should be calculated. Therefore, we propose our own algorithm. It is closest to the code. First, determine the amount of direct expenses that will need to be distributed. Do it this way: Total amount of direct expenses - Expenses on “work in progress” - Direct expenses on finished goods in the warehouse = Amount of direct expenses that must be distributed

Secondly, calculate the amount of direct costs that relate to products shipped but not sold to customers using the formula:

Quantity of products shipped but not sold: Total quantity of products shipped x Amount of direct costs to be distributed = Direct costs for products shipped but not sold

Then, to the amount received, add the balance of direct costs for shipped but not sold products at the beginning of the month.

Example 5.

Let's use the data from the previous example.

Let’s assume that Aktiv has handed over 150 tables for sale. The balance of direct costs for shipped but not sold products at the beginning of August is 180,000 rubles. Direct costs for products in the warehouse (excluding balances at the beginning of the month) - RUB 1,755,000. The amount of direct expenses that must be distributed will be: RUB 4,500,000.

— 600,000 rub. — 1,755,000 rub.) = 2,145,000 rub. The amount of direct costs for shipped but not sold products will be:

150 pcs.

: 550 pcs. x 2,145,000 rub. = 585,000 rub. The total amount of direct costs for shipped but not sold products at the end of August will be:

180,000 rubles.

+ 585,000 rub. = 765,000 rub. M. ZHARKOVA, leading specialist of the income tax department of the Ministry of Finance The material was published in the 8th issue of the magazine “Practical Accounting”

General procedure for accounting for direct expenses

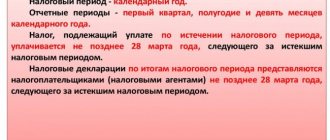

For direct income tax expenses, there is a special accounting procedure provided for by the Tax Code of the Russian Federation.

The essence of direct expenses is that they are taken into account only in the part attributable to goods, work, services or products after processing, sold in the current tax or reporting period (paragraph 2, paragraph 2, article 318 of the Tax Code of the Russian Federation). This statement is explained, in addition, in letters of the Ministry of Finance of Russia dated July 20, 2017 No. 03-03-06/1/46286, dated October 31, 2016 No. 03-02-07/1/63462, dated June 9, 2009 No. 03-03- 06/1/382, dated December 8, 2006 No. 03-03-04/1/821, as well as the Federal Tax Service of Russia for Moscow dated May 18, 2010 No. 16-15/ [email protected]

It is separately stated that such expenses must be written off in the period when the products are sold, even if the funds to pay for them were received in the next tax period. Confirmation of this can be found in the resolution of the Federal Antimonopoly Service of the West Siberian District dated June 15, 2011 No. A45-12953/2010.

Direct costs and service sector

If the organization’s activities are related to the provision of services, then, according to paragraph. 3 p. 2 art. 318 of the Tax Code of the Russian Federation, such taxpayers are allowed to reduce income from sales by the entire amount of direct costs of the tax or reporting period (letters of the Ministry of Finance of Russia dated June 15, 2011 No. 03-03-06/1/348, dated August 31, 2009 No. 03-03-06/ 1/557). There are also court decisions on this matter, for example, the resolution of the Federal Antimonopoly Service of the West Siberian District dated August 27, 2013 No. A27-19013/2012. It also states that it is not necessary to establish such an accounting procedure in the accounting policy, since it is provided for by the Tax Code of the Russian Federation. However, it is better to reflect this in the appropriate document, which will avoid unnecessary explanations.

Works in accordance with clause 4 of Art. 38 of the Tax Code of the Russian Federation, like goods and products, differ from services in that they have a material expression and can be sold in the literal sense (for example, a constructed building, a completed project, etc.). Services do not have a material appearance (Clause 5, Article 38 of the Tax Code of the Russian Federation).

Example

Development of design documentation in accordance with Art. 758 of the Civil Code of the Russian Federation, should be classified as activities related to the performance of contract work. This means that income cannot be reduced at a time by the entire amount of direct expenses, but such expenses must be distributed among work in progress. This is what the letter of the Russian Ministry of Finance dated February 22, 2007 No. 03-03-06/1/114 aims at.

General construction costs, which include the maintenance of the construction site, including security of the village, cleaning the territory, renting equipment, temporary power supply, design and construction of temporary roads, standard design of residential buildings, development and approval of documentation for planning and land surveying of the territory, and other work, are an integral part of the construction costs. They should be considered as direct expenses of the construction company.

This conclusion was reached by the Arbitration Court of the Moscow District in its ruling dated June 5, 2017 No. F05-7067/2017 in case No. A40-136716/2016. By ruling of the Supreme Court of the Russian Federation dated September 27, 2017 No. 305-KG17-13063, the transfer of case No. A40-136716/2016 to the judicial panel for economic disputes of the Supreme Court of the Russian Federation for review of this decision in cassation proceedings was refused. But the audit applies, according to clause 2 of Art. 779 of the Civil Code of the Russian Federation, at your service. Therefore, an organization operating in this area has the right to reduce the income of the reporting period at a time by the entire amount of direct expenses. Confirmation of this thesis can be found in the letter of the Ministry of Finance of Russia dated June 15, 2011 No. 03-03-06/1/348.

If the taxpayer combines the provision of services with production or performance of work, then in full he has the right to attribute only those related to services to expenses of the reporting period (letter of the Ministry of Finance of Russia dated September 11, 2009 No. 03-03-06/4/77).

We distribute direct production costs

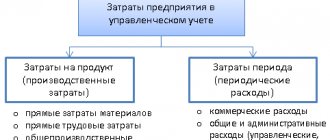

According to tax legislation, direct expenses can be taken into account when calculating income tax as goods are sold. And this obliges the enterprise to distribute them between sold finished products, stock balances and work in progress. How to do this is in the article. What is the difference between direct and indirect costs?

For the purpose of calculating income tax, expenses during the reporting (tax) period for the production and sale of products are divided into direct and indirect. An approximate list of direct expenses is given in Article 318 of the Tax Code of the Russian Federation. However, the enterprise determines their specific composition independently in its accounting policies. The amount of indirect expenses incurred in the reporting period is fully taken into account when calculating income tax for this period. And direct expenses reduce taxable profit as products, works and services are sold, in the cost of which they are taken into account (clause 2 of Article 318 of the Tax Code of the Russian Federation). That is, even if products are produced but not sold, the direct costs related to them are not taken into account when calculating income tax in a given reporting period.

Procedure for distribution of direct expenses

The following sequence should be followed in tax accounting. Direct costs are distributed between: 1) work in progress and finished products; 2) finished and shipped products; 3) shipped, but not sold and sold products.

First step

Currently, tax legislation provides taxpayers with the freedom to choose methods for assessing work in progress and released finished products. Each organization must determine for itself the most economically feasible procedure so that direct costs correspond to the size of products sold. What evaluation indicators can be used? In addition to raw materials, to evaluate work in progress, enterprises can use another type of resource, the costs of which constitute the largest part of direct costs. For example, for organizations with labor-intensive production (for example, microelectronics), the indicator will be labor force, and for organizations with capital-intensive production (for example, the oil and gas industry) - fixed assets. In addition, not only the quantity of a resource, but also the cost of spending on it can serve as evaluation indicators. In case of single production, estimates can be made based on actual costs. And in serial industrial production - according to the ratio of the standard cost of work in progress and the planned cost of costs of the current period. Currently, many organizations continue to use the procedure for distributing direct costs in proportion to the quantitative expression of raw materials and supplies. In a material-intensive process, the cost of production consists mainly of material costs, so this method, of course, is the most appropriate. Based on the data from the primary accounting documents, the amount of raw materials that was written off during the month for the production of various types of products is determined. This is stated in paragraph 1 of Article 319 of the Tax Code of the Russian Federation. Then, based on the results of the inventory in the workshops, the amount of raw materials remaining on the last day of the month that have already been processed is determined. Then the work-in-progress ratio (Knzp) is calculated: Knzp = Amount of raw materials in work-in-progress at the end of the reporting period: (Amount of written-off raw materials in the reporting period + Amount of raw materials in work-in-progress at the beginning of the reporting period).

Using this coefficient, the amount of direct costs attributable to work in progress is calculated:

Direct costs in work in progress at the end of the reporting period = (Direct costs in the reporting period + Direct costs in work in progress at the beginning of the reporting period) x KZP.

Then the accountant acts like this.

Calculates the amounts of direct costs that relate to finished products produced in the corresponding reporting period: Direct costs for manufactured products = Direct costs in work in progress at the beginning of the reporting period + Direct costs in the reporting period – Direct costs in work in progress at the end of the reporting period.

Most often, several types of raw materials are required to produce a product. In this case, the enterprise accountant has the right to select the main component of the manufactured product and evaluate work in progress based on the remainder of this type of raw material.

Second step

The amount of direct costs that falls on finished products manufactured per month must be distributed between its balances in the warehouse and the shipped batch. The quantity of goods in the warehouse and shipped products will be determined by the enterprise accountant based on data from primary accounting documents (clause 1 of Article 319 of the Tax Code of the Russian Federation). With this data, the appropriate coefficient can be determined. So, the coefficient of shipped products (Kop) is determined as follows: Kop = Number of products shipped in the reporting period: (Quantity of finished products at the beginning of the reporting period + Number of finished products released from production).

To distribute direct costs between shipped products and their balances in the warehouse, the following formulas are used.

To calculate costs for shipped products: Direct costs for finished products shipped in the reporting period = (Direct costs for the balance of products at the beginning of the reporting period + Direct costs for manufactured products in the reporting period) x Kop.

To determine the costs that relate to the balance of goods listed in the warehouse:

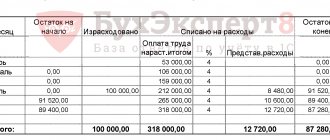

Direct costs for the balance of products at the end of the reporting period = Direct costs for the balance of products at the beginning of the reporting period + Direct costs for products released in the reporting period – Direct costs for those shipped in the reporting period finished products. Table 1 Distribution of direct costs between work in progress and finished products

| No. | Indicator name | Meaning |

| 1 | The amount of raw materials in work in progress at the beginning of the reporting period | 100 kg |

| 2 | Amount of written-off raw materials in the reporting period | 1900 kg |

| 3 | The amount of raw materials in work in progress at the end of the reporting period | 300 kg |

| 4 | Knzp | 0,15 (300 kg: (100 kg + 1900 kg)) |

| 5 | Direct costs in work in progress at the end of the reporting period | 162,000 rub. ((RUB 80,000 + RUB 1,000,000) x 0.15) |

| 6 | Direct costs for manufactured products | 918,000 rub. (80 000 + 1 000 000 – 162 000) |

Third step

Direct costs attributable to shipped products are distributed between its sold and unsold parts.

To do this, the product sales ratio (Kr) is calculated: Kr = Number of products sold in the reporting period: (Quantity of products shipped but not sold at the beginning of the reporting period + Number of products shipped in the reporting period).

And then, on its basis, direct costs are distributed between sold and shipped but not sold products.

Expenses on products sold are determined as follows: Direct expenses on products sold = (Direct expenses on products shipped but not sold at the beginning of the reporting period + Direct expenses on products shipped in the reporting period) x Cr.

And the amount of expenses for unsold goods is obtained based on the following formula:

Direct expenses for the balance of products shipped, but not sold = Direct expenses for products shipped, but not sold at the beginning of the reporting period + Direct expenses for products shipped in the reporting period – Direct expenses for products sold .

If all products shipped at the end of the month are sold, then the coefficient does not need to be calculated.

In this case, the amount of direct expenses attributable to shipped products and the amount of direct expenses related to sold products will coincide. At the end of the reporting period, the organization, having determined the cost of direct expenses attributable to finished products sold during the reporting period, includes this indicator in line 010 of Appendix No. 2 to sheet 02 of the income tax return. Table 2 Distribution of the amount of direct costs between products shipped and in warehouse

| No. | Indicator name | Meaning |

| 1 | Quantity of finished products at the beginning of the reporting period | 300 units |

| 2 | Quantity of finished products released from production | 3700 units |

| 3 | Quantity of products shipped in the reporting period | 3000 units |

| 4 | Coefficient of shipped (sold) products | 0,75 (3000 : (300 + 3700)) |

| 5 | Direct costs for finished products shipped in the reporting period | RUB 752,250 ((RUB 85,000 + RUB 918,000) x 0.75) |

| 6 | Direct costs for the balance of production at the end of the reporting period | RUB 250,750 (85 000 + 918 000 – 752 250) |

Example.

The company Rechitsa LLC produces porcelain products.

For the first half of 2010, the amount of direct costs for production, reflected in the debit of account 20, amounted to 1,000,000 rubles. The balance of work in progress as of January 1, 2010 is equal to 80,000 rubles. The accountant allocated direct costs to work in process and finished goods in proportion to the quantities of the main materials used in production (kaolin, feldspar, quartz and clay). The calculation of the work in progress ratio, as well as the distribution of direct costs between work in progress and finished products based on data on the amount of materials in work in progress as of January 1 and June 30, 2010, are shown in Table 1. Let us assume that as of January 1, 2010, the balance of finished products in the warehouse was 300 units worth 85,000 rubles. In the first half of 2010, 3,700 units of products were received at the warehouse, and 3,000 units were shipped. All products shipped in the first half of 2010 were sold. This means that the sales coefficient does not need to be calculated. It is only necessary to distribute the amount of direct costs between the products shipped and those in the warehouse. The calculation is presented in Table 2. Thus, the amount of direct expenses in the amount of 752,250 rubles is included in the income tax return. It is important to remember that

the enterprise chooses methods for assessing work in progress and released finished products independently, registering them in the accounting policy.

The article was published in the journal “Accounting in Production” No. 8, August 2010.

How to correctly distribute direct costs for products sold

To accurately determine the part of direct expenses that must be attributed to sold products, you should isolate the direct expenses for the month attributable to:

- For the remains of unfinished production.

- Remains of products shipped but not sold at the end of the month.

- Remaining products in warehouse.

The amounts of direct expenses that occurred in the current period on all these balances do not need to be taken into account in reducing the tax base for this period.

EXAMPLE of calculating WIP balances when producing products from ConsultantPlus: For tax purposes, the accounting policy of Legprom LLC states: “1. Direct costs are: the cost of raw materials and basic materials used in the production of products; remuneration of key production workers; insurance premiums from the wages of key production workers; depreciation of production equipment. The remaining costs are indirect. 2. To distribute direct costs to the balance of the work in progress, it is determined... view an example of the calculation in full in K+, having received trial access to the system for free.

If an organization decides to change the list of direct expenses, then it must make a change to the accounting policy from the beginning of the new tax period (paragraph 6 of Article 313, paragraph 10 of paragraph 1 of Article 318 of the Tax Code of the Russian Federation).

About the situation when the tax inspectorate may challenge the list of direct and indirect costs given in the accounting policy, read the material “Rent of industrial premises may not be recognized as an indirect expense .

As a result, from the beginning of a new reporting or tax period, certain income tax expenses will move from the category of direct to the category of indirect expenses.

However, at the end of the last tax period, direct costs attributable to unsold products and work in progress were not taken into account. The Ministry of Finance of Russia in letters dated 09.15.2010 No. 03-03-06/1/588, dated 05.20.2010 No. 03-03-06/1/336 recommends that they be taken into account in the new tax period as goods or work are sold. It will now be possible to recognize at a time only those expenses that have been incurred since the beginning of the new period.

However, in judicial practice there is also a different opinion. As an example, we can cite the situation that was considered by the FAS of the East Siberian District (resolution dated 02/03/2011 No. A78-901/2010). The essence of the matter is that in the first quarter, when calculating the income tax base, the organization took into account expenses that had previously been classified as direct in full.

Tax inspectors perceived this action as a violation, indicating in the inspection report that since the expenses were incurred in the previous tax period, they should be attributed to them. And the taxpayer had no right to write them off as indirect expenses at a time. Nevertheless, the arbitration court sided with the organization and recognized the one-time inclusion of these costs in the income tax base as legitimate. A similar position of the court is contained in the decisions of the Federal Antimonopoly Service of the Far Eastern District dated May 27, 2011 No. F03-1824/2011 and dated December 25, 2009 No. A27-671/2009.

The ratio of direct and indirect costs: the position of the Federal Tax Service and the courts

Why might similar precedents related to lawsuits against the Federal Tax Service arise? Most often, it is because tax authorities recognize the company’s inclusion of certain expenses as indirect as unreasonable.

In this case, the Federal Tax Service simply charges additional income tax, as if the corresponding costs were direct, and obliges the company to pay it. However, the taxpayer always has a chance to defend the legality of his actions and the wrongness of the Federal Tax Service in court.

Example 1

There is a known judicial precedent in which the Supreme Arbitration Court of the Russian Federation recognized as legitimate the negative assessment by the courts of previous instances of the approach of the Federal Tax Service to the classification of expenses of one of the companies that produces paper and cardboard (more information about this precedent can be found by reading the determination of the Supreme Arbitration Court of the Russian Federation dated October 19, 2011 No. VAS- 13628/11).

The tax authorities considered that the company did not have the right to include in the structure of indirect costs the costs associated with the production of packaging for the packs of paper it produced. These expenses, as the Federal Tax Service considered, should have been considered direct and could not be used to reduce the tax base in the corresponding period.

However, the arbitrators of the first instance did not agree with the opinion of the Federal Tax Service, since it was established that packaging is not a mandatory component of the production cycle within which the company produces paper. Packaging, as the courts have found, is more of an accompanying component of the delivery, which is not even taken into account when weighing the goods before placing them in the warehouse.

Let us note that in a number of cases the separation of the manufactured product from the packaging may be considered by the court to be not as obvious as in the case discussed above.

Example 2

The Presidium of the Supreme Arbitration Court of the Russian Federation, in resolution No. 8617/10 dated November 2, 2010, established that the costs of purchasing containers, labels, and lids of a plant for the production of alcoholic beverages and food products should be considered as direct expenses. The fact is that the relevant components, as the court considered, cannot be considered as related to the production technology of a particular product of the relevant categories.

Indirect income tax expenses: list

In accounting, indirect expenses include general production and general business expenses, i.e., expenses associated with the production of different types of products that support the activities of the organization as a whole. In this regard, when calculating the cost, they need to be distributed. The basis for the distribution of indirect costs in accounting is established by the organization independently in its accounting policies.

How to reflect indirect costs in accounting policies, see the article “Reflection of indirect costs in accounting policies - sample.”

Indirect expenses: what applies to them in tax accounting

In Art. 318 of the Tax Code, indirect expenses include all expenses except direct and non-operating ones. That is, if direct costs, the list of which must be given in the accounting policy, are excluded from production and sales costs, then indirect costs for income tax remain, the list of which is open. Indirect costs include costs for repairs, development of natural resources, R&D, property insurance, as well as other costs associated with production and sales. The composition of indirect costs for each organization will depend on the operations performed. Indirect expenses should be classified as expenses of the current tax or reporting period. This is the aim of the letter of the Ministry of Finance of Russia dated March 25, 2010 No. 03-03-06/1/182, based, in turn, on the provisions of paragraph 2 of Art. 318 Tax Code of the Russian Federation.

Example

The company has a confectionery shop, which allows it to produce and sell relevant products. If the products are not sold, then, according to the contract, they are returned and processed as raw materials. In such circumstances, direct costs of processing confectionery products should be recognized in the period in which the finished products made from processed raw materials are sold.

In tax accounting, indirect expenses are not distributed. But there is an exception to this rule: the distribution of indirect costs is made if they relate to several reporting periods. At the same time, there are indirect income tax expenses, the list of which is given below and which in tax accounting are attributed to the reduction of the tax base not at the time of occurrence, but according to a special algorithm. Such expenses, in particular, include:

- R&D expenses (Article 262 of the Tax Code of the Russian Federation);

- insurance costs (clause 6 of Article 272 of the Tax Code of the Russian Federation);

- entertainment expenses (clause 2 of article 264 of the Tax Code of the Russian Federation);

- advertising expenses (clause 4 of article 264 of the Tax Code of the Russian Federation).

ConsultantPlus has a test, by answering the questions of which you will refresh your knowledge on the topic and be able to reasonably defend the correctness of income tax calculations in the event of disputes with tax authorities. Get trial access to the K+ system and start testing for free.

What expenses are called indirect?

Indirect (related to servicing the main work of the company) are costs that are associated with the production process and the sale of goods (services, works), cannot be attributed to the direct production of products and are taken into account in the costs of the period in which they arose.

If resources were not classified as integral parts of the production cycle according to technical regulations, they can be safely taken into account in indirect costs (in this case, belonging to the production cycle is determined for each cycle separately).

The difference between direct and indirect costs is that the amount of the latter is fully attributed to the costs of the current period, while the former should be attributed to the costs of the current period as the products are sold (the balance of unfinished production is taken into account, if this is not is about the provision of services).

Results

The taxpayer determines the list of direct expenses independently based on the specifics of his technological process. Costs related to production and sales are classified as indirect costs only if there is no real possibility of classifying them as direct costs.

Errors in the distribution of expenses between direct and indirect lead to distortion (most often understatement) of the tax base, the accrual of fines and penalties.

Therefore, any expense for the purpose of calculating income tax must not only be tested for compliance with Art. 252 of the Tax Code of the Russian Federation, but also to classify correctly. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.