Is optimization always necessary?

VAT exemption affects whether it is convenient to work with you.

If you, as the seller, do not charge VAT, then the buyer will not be able to recover the tax. Therefore, if you work mainly with large companies, then without VAT you are less competitive. Losing one or two key customers can be much worse than paying a large VAT. On the other hand, if you pay VAT, then it is beneficial for you to work with suppliers who pay this tax. It is worth working with non-payers if they give a discount comparable to the VAT rate.

One more point: in business there can be both VAT-taxable and non-VAT-taxable areas. Then, to apply tax benefits, you will have to keep separate records. But if the preferential direction is insignificant compared to the entire volume of business, separate accounting may cost more than saving on VAT.

Therefore, when applying optimization schemes, take into account the risks, benefits and reactions of counterparties.

Working in special mode

The last resort is not to pay VAT at all. This is possible if you apply a special tax regime: simplified tax system, PSN, unified agricultural tax or UTII (cancelled from 2021). Special regimes also exempt from taxes on property and profits. Instead of several taxes, you pay one and usually at a lower rate. Compare your tax burden across different taxation systems using our free calculator.

Each special regime has its own set of conditions that the business must meet: revenue, cost of fixed assets, participation of other companies in the authorized capital, number of employees.

Some special modes can be combined with OSNO: PSN, UST, UTII. They can also be combined with each other: simplified tax system + UTII, simplified tax system + PSN, simplified tax system + ESKHN. You will have to maintain separate accounting and reporting for each mode.

Sometimes a business is divided into several legal entities or individual entrepreneurs, so that each part operates under its own tax regime. But this method of optimization is dangerous: tax authorities may consider this a fragmentation of the business, recognize the entire direction as a single company operating on OSNO and charge additional taxes (and also impose fines and penalties). And if the arrears exceed 5 million rubles, the tax office may initiate a criminal case under Art. 199 of the Criminal Code of the Russian Federation.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

VAT exemption

Businesses can be exempt from paying VAT on certain transactions or types of activities (Article 145 of the Tax Code of the Russian Federation). This is a privilege; it is given for up to a year to companies without import operations. Also, you cannot trade excisable goods. To obtain this right, you must submit an application.

It is important that during this period the enterprise’s revenue excluding VAT for three consecutive calendar months does not exceed 2 million rubles. Otherwise, the right to the privilege is lost.

And for certain types of goods and services there is an exemption from VAT (Article 149 of the Tax Code of the Russian Federation). These are, for example, medicine, child and disabled care, arts services, financial services, and research.

Formally legal methods containing some risk

The main difficulty in applying subsequent techniques is that before their implementation, efforts will have to be made to collect evidence confirming that these techniques were used to streamline business and solve other problems caused by the current economic needs of the organization, and not to reduce the tax burden.

Note that here the probability of tax risks is quite high. At the same time, with a reasonable approach, the absence of excesses and excessive greed, the methods given below can be tried to be applied in practice. In any case, court decisions in many cases turned out to be in favor of taxpayers.

Use of loans

This method of evading VAT can be used in cases where the contract provides for partial or full prepayment for the supply.

As you know, the seller issues an invoice for the received advance payment for the products, which automatically obliges him to transfer VAT to the budget. This leads to a premature outflow of the company's cash supply, reducing opportunities for ongoing financing of activities.

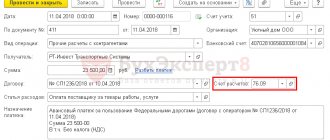

In order to delay the moment when the obligation to pay arises until the day of actual shipment of the goods, you can enter into an agreement with the buyer to provide the latter with a loan without paying interest. When the products are shipped, the seller will repay the debt and at the same time the actual payment for the goods will be made by the buyer.

IMPORTANT! The described option is based on the fact that, according to Art. 149 of the Tax Code of the Russian Federation, lending money is not subject to VAT.

The optimal way to implement this method would be a transaction under which the advance payment and shipment occur in different tax periods. In this case, the buyer should not care about accepting the tax for refund, otherwise the method is not suitable for use, since it contradicts the interests of the buyer.

As insurance against the claims of the inspectorate, various loan and advance amounts should be provided, since their complete coincidence will be a clear sign of a fictitious transaction. In addition, debt repayment and final payment for goods should not be made in one day.

Option with deposit

In the supply agreement, instead of the buyer’s obligation to make an advance payment, it is possible to provide for the payment of a deposit. The procedure for providing a deposit is described in Art. 380, 381 Civil Code of the Russian Federation.

The company that purchases the goods in such cases has its own interests, since if the contract fails, the seller will be obliged to pay the deposit back in a much larger amount. The literal interpretation of the concept of “deposit” by the Civil Code does not define it as an advance payment, and therefore the seller is not obligated to issue an invoice upon receipt and charge tax on it. In this case, the transferred funds are a guarantee of fulfillment of obligations under the contract.

Use of bills

A substitute for lending money can be issuing a bill of exchange. That is, the seller draws up a bill of exchange and transfers it as a loan to the buyer. The buyer, in turn, transfers funds under the bill and becomes the holder of the bill. Both transactions are exempt from VAT, and relations associated with the circulation of bills of exchange are regulated by the provisions of Art. 815 of the Civil Code of the Russian Federation. That is why tax is not calculated and paid in this case.

The maturity date of the bill must be different from the date of shipment. After the return of funds on the bill and shipment of the goods, the buyer pays for the goods as if the goods were purchased without prepayment.

Conclusion of a mediation agreement

This option is convenient for companies engaged in resale in situations where their partners are special regime agents. The latter are not required to calculate and pay VAT; therefore, the purchasing organization does not have the opportunity to deduct input VAT. According to the agency agreement, the transfer of ownership of the goods does not take place, and the income received is equal to the amount of the markup.

The agent calculates income tax and VAT from the amount of his income received - the markup, and not from the entire cost of the goods indicated in the documents to the end consumer. That is, the VAT calculated for payment will be equal to the difference between the amount of tax on the final cost and the amount of the expected deduction of input VAT. Thus, the agent organization manages to reduce the amount of tax payable.

This approach is not profitable for companies that sell goods at a rate of 10%, since intermediary transactions are subject to the standard rate of 18%.

Application of the discount system

One of the methods to stimulate the purchase of company products is the provision of discounts. One of the ways to implement this mechanism is to reduce the cost of products already supplied, work performed, or services provided.

Having decided to provide a discount, having previously discussed this in the contract, the seller draws up an adjustment invoice after delivery. Thus, the total sales amount is reduced, and therefore the amount of tax that must be paid. The buyer will need to restore the VAT deduction that he applied earlier in the amount of the discount.

Use of advances

In circumstances where the amount of VAT payable exceeds the current financial capabilities of the company, as well as in a situation where a significant amount of tax is expected to be accepted for reimbursement in the next period, there is another option for reducing the VAT payable. To do this, the taxpayer needs to discuss with his supplier the possibility of transferring an advance to the latter for a supply that is expected to occur in a future tax period.

Most likely, the shipment will never take place, and the supplier will eventually simply send back the prepayment received previously. In this case, the concluded contract must specify in advance the period after which the funds must be returned to the buyer.

Manipulations with fines

Including conditions for the application of financial sanctions in the supply contract also leads to a reduction in the tax burden. First, the contract specifies requirements for non-compliance with which the buyer will be required to pay an additional amount as a penalty. It is advisable to provide for such circumstances of the occurrence of fines that are likely to occur.

As a result, upon violation of contractual obligations by the buyer (most often intentionally), the supplier is paid a fine, which is practically a VAT-free alternative to prepayment.

At the same time, tax authorities, based on paragraph 1 of Art. 162 of the Tax Code of the Russian Federation, they are trying to charge additional VAT on fines. However, the courts do not support such a policy (for example, Resolution of the Supreme Arbitration Court of the Russian Federation dated 02/05/2008 No. 11144/07). The arbitrators also rely on Art. 162, however, they interpret its contents a little differently. Tax authorities proceed from the fact that penalty payments are inextricably linked with the sale of goods and therefore should be subject to taxation. Representatives of the courts, on the contrary, deny the connection between such sanction payments and the fact of implementation, and therefore fines, in their opinion, should not lead to additional payments to the budget.

Contribution of a share to the authorized capital

As Art. 39 of the Tax Code of the Russian Federation, the transfer of property as a contribution to the authorized capital of a company is not subject to taxation. The mechanism for using this provision to reduce VAT payments is as follows:

- The seller contributes goods or other property to the buyer’s authorized capital.

- After some time, the seller leaves the co-founders, taking his share in monetary terms.

Such an operation is quite suspicious from the position of the Federal Tax Service. At the same time, there are court decisions that recognize such actions as legal and justify companies. Most of the law enforcement practice on the described situation is accumulated in the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated November 11, 2003 No. 7473/03.

There is another unpleasant point: a company that has transferred its goods as a contribution to the authorized capital must restore the VAT that was previously accepted for reimbursement on transferred goods on the basis of Art. 170 Tax Code of the Russian Federation. For non-current assets, additional tax is charged on the amount of the residual value on the date of the transaction. In this regard, the use of property objects with zero residual value for these purposes will make it possible not to pay an additional amount of VAT.

Quite often, one of the options for implementing this method is used, which involves the transfer by a foreign company of goods and equipment as a contribution to the authorized capital of a domestic organization. In this case, the amount should be exempted from taxation on the basis of clause 7 of Art. 150 Tax Code of the Russian Federation.

Advance payments

Work with advances usually begins at the end of the quarter. The optimization scheme works if the company receives an advance for goods or services in one quarter and sells them in the next. It consists of the following: the organization receives an advance from the buyer and transfers funds to its supplier for another product, which receives an advance and transfers funds to its supplier, and so on. The tax is paid by the participant in the chain who did not manage to make an advance payment to their supplier.

Keep in mind that the tax office is well aware of this scheme and does not welcome it. If you regularly use advances to defer VAT payment, you may receive an unscheduled tax audit.

You must also pay VAT on advances received. And the seller can enter into a supply agreement at the end of the quarter, and, by agreement with the buyer, transfer the advance payment to the beginning of the next quarter. Then the seller will pay tax three months later.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

You can defer VAT payment by more than a quarter using borrowed funds. Then the seller takes a loan from the buyer in the amount of the advance. And after shipment, they offset the debts on the loan and for the goods sold. The issuance of a loan is not subject to VAT, so tax is charged only upon sale. Although this scheme does not violate the law, the tax authorities are displeased with it, so it is not suitable for regular use.

It is important to consider the interests of the buyer when working with advances. When the buyer makes an advance payment, but uses it to deduct VAT on this amount. So it is not profitable for him to postpone the payment deadline or work with the loan.

Point 5. Correct amounts

It’s good if the amounts for paper VAT are broken down in invoices up to 100 thousand rubles. It is clear that if you have a quarterly turnover of a billion, then accountants will be killed to do it themselves, with their own hands. Even copy-pasting in Excel won't help.

The solution is simple: you simply tell the VAT seller the total amount. And he already sends you a finished book with amounts up to 100 thousand. A professional VAT seller has specially written programs that do the breakdown almost automatically. In general, a VAT seller is a person who is aware of all the technical innovations of the tax office. And he manages to automate his processes faster than the tax authorities do.

Of course, if you, the client, strictly need to indicate your amounts, and they exceed 100 thousand, there are no questions, it will be so.

Include shipping costs in the product price

If you sell goods at a VAT rate of 10%, it is beneficial for you to include the costs of transporting goods to the buyer in the price of the goods and not allocate the delivery amount. In this case, you will pay 10% of the entire amount of the goods, and for the services of transport companies you will deduct 20%. To do this, write down in your accounting policy a provision that the cost of the goods includes delivery costs, and in the contract with the buyer indicate that the cost of the goods includes delivery.

Work with VAT in the Kontur.Accounting web service. The system makes it easy to keep records, pay salaries, and report online. The service will help you optimize VAT and tell you how to reduce your payment. The first two weeks of operation are free for all new users.

Is it possible to reduce the tax amount?

When they talk about reducing VAT, the first thing that comes to mind is illegal and less than legal methods of cashing out money through shell companies or offshore zones. There are quite reliable schemes, but they also pose a threat to such violators. But besides all this, there are also quite official ways to reduce VAT. They:

- Less effective than fraud.

- But if used systematically and correctly, they can significantly reduce payments to the budget.

A diagram of how you can legally reduce the accrued VAT payable to the budget (optimization) is discussed below.

Schemes for legal VAT reduction are reviewed by a specialist in this video: