Compulsory and voluntary insurance for individual entrepreneurs

There are two types of social insurance for individual entrepreneurs:

- mandatory contributions - for employees;

- voluntary contributions - for yourself.

When an entrepreneur has employees, he must make contributions to payments included in the wage fund in the amount of 2.9%.

Important! If a person works for an individual entrepreneur, and not in an organization, then he will also receive payments from social insurance.

In the second case, the entrepreneur independently decides whether to register with the Social Insurance Fund and whether to pay voluntary contributions.

How do you pay

If a citizen wonders whether the sick leave is paid for by the individual entrepreneur, then the sick leave benefit is issued to all citizens registered with the Social Insurance Fund. And if an individual entrepreneur has employees, then it is the employer himself who makes contributions to the Social Insurance Fund for them. If a person has the status of an individual entrepreneur, then he makes contributions for himself. Moreover, a businessman can only decide for himself whether to contribute them or not.

Calculation of insurance premiums for individual entrepreneurs without employees - is it necessary to submit it?

And a woman who works for herself has the right to receive maternity benefits. But it is paid only to those women who have been registered with the Social Insurance Fund for more than 1 year. Moreover, the benefit is calculated based on the minimum wage. And if the minimum wage increased after the woman went on maternity leave, then the benefit will be calculated according to the new indicator.

Important! The benefit to a businessman is paid only after he concludes an agreement with the Social Insurance Fund.

Moreover, he is required to conclude a contract 2 years before the occurrence of the insured event. The calculation takes into account 720 days before the occurrence of the insured event.

If the businessman has not concluded an agreement with the Social Insurance Fund, then they will not pay him anything. FSS employees do not have insurance contributions received from the businessman, so they will not be able to pay the amount that needs to be paid.

Sick leave for individual entrepreneurs: registration with social insurance authorities

To make voluntary payments for social insurance, an individual entrepreneur must contact the social insurance department and submit:

- Statement.

- Passport.

- Certificate of state registration of an individual entrepreneur - OGRNIP.

- Document on registration with the tax service - TIN.

- Extract from the state register - USRIP.

The Social Insurance Fund registers an entrepreneur within five working days. He issues a notification to the individual entrepreneur that voluntary registration has taken place.

Important! An individual entrepreneur receives payments for temporary disability and when going on maternity leave if he pays voluntary contributions to the Social Insurance Fund.

How to receive temporary disability benefits for individual entrepreneurs

According to paragraph 1 of Art. 5 Federal Law No. 255

, sick leave is issued in the following situations:

- loss of ability to work due to illness

or

injury

, including in connection with an operation for artificial termination of pregnancy or in vitro fertilization (hereinafter referred to as illness or injury);- the need to care for a sick

family member;- quarantine

of the insured person, as well as quarantine of a child under 7 years of age attending a preschool educational organization, or another family member recognized as legally incompetent in accordance with the established procedure;- implementation of prosthetics

for medical reasons in a hospital specialized institution;- follow-up treatment

in the prescribed manner in sanatorium-resort organizations located on the territory of the Russian Federation, immediately after the provision of medical care in an inpatient setting.

A visit to a clinic or a private medical organization for an individual entrepreneur is absolutely no different, as if the hospital was visited by an ordinary employee working in a certain company under an employment contract. The attending doctor also diagnoses the entrepreneur’s disease and determines the necessary types of therapy for recovery. And then issues a certificate

, confirming the temporary disability of the person who applied to him.

Information about how sick leave is paid for as an individual entrepreneur, and what is needed for this, does not contain any extraordinary information. Everything is extremely simple - to receive insurance payment from the Social Insurance Fund

documents

to the Fund :

- Sick leave

from a medical institution that has state permission to issue certificates of incapacity for work. - Application

drawn up in free form, which contains a request to transfer the insurance payment to the current bank account of the individual entrepreneur. - Copies of receipts

indicating the timeliness of making insurance contributions to the Fund.

When it is the entrepreneur’s turn to fill out the form for temporary disability, he needs to adhere to some rules

:

- The form must be filled out exclusively with a black gel pen;

- You cannot enter information on the sick leave sheet in words: all letters must be capitalized and written in printed form;

- the form is divided into cells, and when filling it out, the entrepreneur must not make blots in the margins or go beyond the designated cells;

- you must be extremely careful, since it is prohibited to correct the text written on the sick leave.

You can apply to the Social Insurance Fund for sick leave payment within six months after receiving the appropriate certificate from the clinic. However, this period may be extended if the policyholder has valid reasons. These include Order of the Ministry of Social Development of January 31, 2007 No. 74

refers:

- Force majeure, that is, extraordinary, unpreventable circumstances (earthquake, hurricane, flood, fire, etc.).

- Long-term temporary disability of the insured person due to illness or injury lasting more than six months.

- Moving to a place of residence in another locality, change of location.

- Forced absenteeism due to illegal dismissal or suspension from work.

- Damage to health or death of a close relative.

- Other reasons recognized as valid in court when insured persons apply to court.

Transfer of funds to the individual entrepreneur's current account is carried out within 10 days after submitting an application to the Fund.

About the size and payment of contributions for individual entrepreneurs

The amount of insurance contributions of individual entrepreneurs to the Social Insurance Fund is calculated taking into account the cost of the insurance year.

| Year of payment of contributions | Minimum wage | Rate | Amount to be paid | Year of compensation received |

| 2016 | 6204,00 | 2,9% | 2158,99 | 2017 |

| 2017 | 7500,00 | 2,9% | 2610,00 | 2021 |

Calculation

7,500 rub. (minimum wage 2017) × 2.9% × 12 months. = 2610 rub.

Important! The table shows that in order to be able to receive compensation amounts in the current year, the individual entrepreneur is obliged to fully pay off the contributions in the previous year. This must be done before December 31st.

| Contributions can be paid | Payment method |

| – one time – once a month – once per quarter – once every six months | – in cash through a bank branch – non-cash via bank account – via postal service |

If an individual entrepreneur misses a payment deadline, the FSS terminates relations with the entrepreneur automatically, starting on January 1 of the following year. The decision to terminate insurance is sent to the individual entrepreneur no later than January 20. Contributions are refunded within one month.

Important! Starting from 2021, individual entrepreneurs who pay contributions to the Social Insurance Fund on a voluntary basis do not submit a report on them.

The procedure for calculating the insurance period of individual entrepreneurs and calculating pensions

It should be remembered once and for all that pension provision for individual entrepreneurs is fundamentally different from the calculation of pensions for employees. Differences can be seen in the accounting of insurance (work) experience (previously we talked about independent deductions by individual entrepreneurs), in the amount of insurance premiums and in the formulas on the basis of which future pensions for entrepreneurs are calculated. In the life of businessmen, the law provides for non-insurance periods. During such periods of time, state funds pay contributions instead of individual entrepreneurs. This time is also included in the length of service of businessmen. This is possible in the following situations:

- Military service;

- residence of spouses as military personnel in regions where they had no employment opportunities (no more than 5 years in total);

- when spouses, as employees of the diplomatic and consular departments of the Russian Federation, reside in the territory of a foreign state (no more than 5 years in total), if during this period they were not engaged in commercial activities;

- time to care for children, until each child is 1.5 years old (in total no more than 6 years);

- the period of care of an able-bodied individual entrepreneur for a disabled person of group 1, a disabled child or an aged relative over 80 years old.

Pensions for individual entrepreneurs are calculated in accordance with the norms of the Labor Code of the Russian Federation and the rules of pension legislation

As mentioned above, the amount of an individual entrepreneur’s pension is affected by the amount of his insurance contributions. The annual volume of these contributions is fixed by the legislative framework. In 2021 it is:

- for individual entrepreneurs whose average annual income is up to 300,000 rubles, the payment to the budget is 32,385 rubles;

- income over 300,000 rubles obliges the individual entrepreneur to transfer 1% of the amount of income that exceeds this amount in addition to the fixed amount. In this case, the amount will be limited to a maximum of 212,360 rubles.

Pension payments of those entrepreneurs who continue to work after retirement are not indexed. If an entrepreneur leaves work after retirement, he can count on an annual increase in pension.

Calculation of length of service for the northern regions of the Russian Federation

For the northern regions of our country, the legislation provides for special rules for calculating the length of service of the population. To receive a pension, men need to be 55 years old, women – 50 years old. In addition, they must work in the north for at least 20 and 15 years, respectively. In order for the activities of an individual entrepreneur to be included in the “northern” experience, entrepreneurs, in addition to paying insurance premiums, must provide evidence of conducting commercial activities in the relevant regions.

The northern regions of the Russian Federation have their own rules for calculating length of service and calculating pensions

The evidence is:

- tax statements about income and expenses in a given area;

- premises rental agreement;

- contracts with contractors, etc. (the evidence provided depends on the specific activities of the individual entrepreneur and may differ significantly).

What are the requirements for sick leave?

To be sure that the sick leave certificate is filled out correctly, you need to check its completion by an employee of the medical structure, taking into account the following requirements:

- Records should not be allowed to extend beyond the cells and borders.

- Filling out is done carefully and only in large block letters.

- The recording color can only be black.

- It is allowed to fill out the sick leave only with a fountain, gel or capillary pen. Ball type is not used.

- It is possible to print using a printing device.

- Entries cannot be corrected.

- If an error is found, you need to contact your doctors for a duplicate.

Important! The sick leave form has two sides and several sections. Some of them are filled out by doctors, others - by employers and individual entrepreneurs, in particular.

How to correctly calculate the insurance period for sick leave

For this purpose, you can either use special online programs or make the calculation yourself using a regular calculator. The main thing you need to focus your attention on is that you definitely need to convert days into months, and months into years. All you need is your work record and some rules:

- Initially, you need to write down all periods of activity, taking into account the dates of entry into position and dates of dismissal;

- Do not forget that the period of study at technical schools, colleges, and universities is not counted as experience;

- then add up all the periods, alternately counting the number of days, then months, years;

- if there are more than eleven months, you need to convert them to years. We do the same with days, only we convert them into months, provided that there are more than thirty of them.

Expert opinion

Novikov Oleg Tarasovich

Legal consultant with 7 years of experience. Specializes in criminal law. Member of the Bar Association.

It is important to consider that the last rule applies only to balances, more precisely, to partial months and years of each period. Otherwise, periods that have been fully worked out are already included in the calculation of length of service.

What amount of benefits can you count on, taking into account temporary disability?

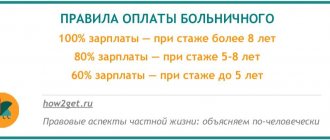

As already mentioned, previously the insurance period completely dictated the amount of this benefit. This year, depending on your situation, you may receive:

- in the case when you have worked for less than five years, then all you can count on when opening a sick leave is sixty percent of your salary;

- those whose experience already consists of five to eight years receive eighty percent;

- and only for people with more than eight years of experience, the law provides for benefits in the amount of their full salary, that is, 100 percent of it.

One of the extremely important points is the influence of average earnings, in addition to length of service. This size is taken for the last two years.

So, when you go on sick leave, you need to know how long your length of service is today, so that you can at least approximately independently determine the amount of benefits you will receive.

This is important to know: 7 years of experience, sick leave percentage

It is extremely important for all employees to take care of all documents related to their work activities. In addition, you should keep photocopies of all certificates and contracts. And then, when you go on sick leave, you will not have any problems applying for benefits due to disability.

How to fill out the “sick leave” part of the document

The sequence of filling out sick leave by doctors is indicated below.

- The topmost section must be filled out by an employee of the medical structure. The first line tells you whether the document is a primary document or a duplicate. In the duplicate, next to the tick mark, the number of the original copy is indicated.

- Then indicate the name, address of the organization and the date when the document was issued.

- The day on which the incapacity occurred is entered.

- The code indicating the type of disability consists of two numbers, and the one following it consists of three. The meaning of both is indicated on the reverse side of the sheet.

- The hospital institution is required to affix its OGRN.

- You should check that your gender and date of birth are correct.

- The purpose of the “date 1” column is to indicate in it the day when the cause of the illness changed. For example, the day on which childbirth is expected. Or the date of the voucher, then in the column “date 2” the final date of the voucher and its number are entered.

- In the “care” block there are two lines in which data about two relatives who are being cared for is entered. These are: their age, relationship code, full name;

- In the special cells below, the time of treatment in the hospital, violations of the regime, disability group, and ITU marks are noted.

- In the adjacent column, the duration of the disease, the name and signature of the attending physician are indicated. There is also a date indicating when you need to start work.

Calculating length of service for sick leave: main points

As mentioned above, to calculate sick leave payments, you need to take into account only those periods of the employee’s work for which payments were made to the relevant insurance funds. In particular, the periods of work for:

- contract agreements;

- work book;

- employment contracts;

- individual entrepreneurship;

- public service.

In addition, when calculating the insurance period, contract service in the army military service .

Articles on the topic (click to view)

- Is sick leave considered income?

- What to do if you have extended sick leave for pregnancy and childbirth

- What to do if your employer does not accept electronic sick leave

- What to do if you are not given sick leave

- How many days does it take for sick leave to arrive from the Social Insurance Fund?

- What to do if the place of work is not indicated on the sick leave

- Are sick leave taken into account when calculating maternity leave?

An example of calculating length of service (according to a work book):

- We take all periods of work according to labor dates, starting from hiring to dismissal;

- we add them up, counting days, months and years separately;

- Now we need to convert days into months, and months into years.

For example , the amount of insurance experience according to the work book turned out to be 8 years 14 months 35 days. We convert months into years, we get: 1 year and two months, we do the same with days, as a result we have: 1 month 5 days. Now we add everything up and have the following total: 8 years + 1 year 2 months + 1 month 5 days = 9 years 3 months and 5 days.

This is important to know: Sample of filling out the register of sick leave for the Social Insurance Fund

For your information! There is no need to include time spent studying at a university or other professional educational institutions in the calculation of sick pay.

When calculating length of service, only those periods of work are taken into account when the employer contributed all due payments to extra-budgetary funds for the employee.

Attention! If at the same time an employee worked in two places at once, then to calculate the length of service for sick leave you need to take only one of them.

Expert opinion

Novikov Oleg Tarasovich

Legal consultant with 7 years of experience. Specializes in criminal law. Member of the Bar Association.

Why is it important to know the total insurance experience? The fact is that the percentage of payment from the salary of a sick employee directly depends on it.

Filling out sick leave by an individual entrepreneur

An individual entrepreneur must provide the following information on sick leave:

- The name of the individual entrepreneur as an employer.

- A note about the type of income - main or part-time.

- An identification number.

- SNILS.

- The date of the report in form N1 is for a work-related injury.

- Time of insurance period and non-insurance periods. When the length of service is less than one month, then zeros are entered. Non-insurance periods include military service, work in the fire department or in the law enforcement system.

- Amounts of average and average daily earnings. For individual entrepreneurs, the first is equal to the minimum wage, the second is calculated based on the first.

- Signature and seal of the entrepreneur.

Important! Stamps should not obscure the filled cells. If sick leave is filled out incorrectly, the insurer may refuse to pay for it.

Next, the entrepreneur contacts the Social Insurance Fund and submits:

- An application requesting payment for sick leave indicating the details for transferring funds.

- Passport.

- Certificate of incapacity for work.

- Calculation of payments due.

Important! An application to the Social Insurance Fund must be submitted no later than 6 months after the closure of the sick leave.

Example of a completed sick leave form

How to determine the amount of length of service for accruing sick leave in 2021

The amount of sick leave payment depends on many factors. Including how much insurance experience a temporarily disabled citizen has, and whether he has any at all.

Also, some information about the periods of work for sick leave can be found in other legislative norms, in particular the Federal Law states how the percentage of payment of benefits depends on the duration of work:. There are situations when temporary disability will be paid in full regardless of whether you have length of service or not.

The most common case is sick leave issued in connection with pregnancy and childbirth.

The insurance period for sick leave is the time calculated on the basis of supporting documents during which employers transferred contributions to the Social Insurance Fund (SIF) for an employee.

Below we will tell you how to calculate the length of service for sick leave in 2021.

Use the experience calculator on our website.

The amount of sick leave payments for individual entrepreneurs

When calculating the temporary disability certificate for an individual entrepreneur, the following are taken into account:

- Minimum wage as average earnings.

- Length of work for which social security contributions have been paid.

| Experience | Percentage of average earnings (minimum wage) |

| 8 years + | 100% |

| 5-8 years | 80% |

| Up to 5 years | 60% |

Important! The amount of benefits is calculated taking into account the minimum salary on the date when the insured event occurred.

The insurance period consists of periods of time when an individual entrepreneur:

- Worked under an employment agreement.

- He was in the civil service - at the municipal or federal level.

- He was engaged in other types of work, during which contributions to the Social Insurance Fund were paid.

Important! The experience of an individual entrepreneur includes not only those periods of work when he carried out entrepreneurial activities and transferred contributions to the Social Insurance Fund, but also other periods that he is able to confirm with records in his employment record or an agreement with the employer.

Example

Entrepreneur V.N. Semenov started his working career in 2011. In 2021, he took sick leave and was ill for 6 days.

The amount of sick leave for an individual entrepreneur will be:

(minimum wage x 24/730) x percentage of length of service x number of days.

7500.00 (minimum wage 2017) x 24 months: 730) x 80% x 6 days. = 1183.56 rub.

Payments and settlement

When all the paperwork and formalities are settled, and the registration is successfully completed, the practical side becomes relevant - the procedure for paying insurance premiums, the amount of benefits. All insurance premiums must be paid by December 31, that is, by the end of the year in which the application was submitted.

Insurance premiums must be paid for all 12 months , even if registration was, for example, in July. If an individual entrepreneur has not made all the necessary contributions by December 31, then he will not be able to receive benefits.

Let's give an example - an individual entrepreneur took out insurance in 2014, the loss of disability occurs in 2015. In order to receive benefits, the individual entrepreneur had to make insurance contributions for the entire 2014. Contributions can be paid monthly, quarterly and annually - for the entire year at once.

The annual mandatory contribution in 2021 is about 2,100 rubles. Therefore, monthly deductions amount to 175 rubles. The size of the contribution depends on the level of the minimum wage and is constantly indexed/changed.

An individual entrepreneur also needs to submit quarterly reports using form 4-FSS. The form was approved by Order of the Ministry of Social Development N847.

The final amount of benefits for individual entrepreneurs, as in other cases, greatly depends on the length of insurance coverage. The more insurance deductions have been made, the greater the amount of payments will be. If an entrepreneur has paid contributions for 5 years or less, he can count on 60% of average earnings. With experience from 5 to 8 years - 80%.

For those who have made contributions for 8 years or more, full compensation of average earnings is due. Please note that the minimum wage is taken as the average earnings, not income from business activities.

Let's give an example of calculating sick leave for an individual entrepreneur for the following case - an entrepreneur gets sick with the flu and goes on sick leave. The number of days of incapacity for work will be 7 days. The minimum wage for 2021 is 6,204 rubles. The insurance period in this case is 10 years, therefore, the coefficient will be equal to 100%. Calculation formula:

(minimum wage x 24/730) x SN x KS, where:

- KS - Experience coefficient.

- SN - Duration of incapacity for work, number of days.

We substitute the values from the example:

- 6204 x 24/730 = 204 rubles - the amount of benefits for one day.

- 204 x 7 x 100% = 1428 - multiply the calculated amount by the CS and the number of days of incapacity.

Thus, for a week of sick leave, a payment of 1,428 rubles is due. It’s not difficult to calculate - you’ll have to be sick for at least 11 days in a year for the insurance to pay off and at least break even .

In the case of paid sick leave for pregnancy from an individual entrepreneur, the calculation occurs in a similar way. If for maternity leave (pregnancy and childbirth) we take a benefit amount of 204 rubles (8 or more years of insurance experience) and the sick leave period is 140 days, then the total amount of payments will be 28,560 rubles.

For a month it comes out to 30 x 204 = 6120 rubles. In addition, you can count on all other payments related to BiR (for example, a lump sum).

We also recommend reading the article “Rules for issuing sick leave for child care” so that you know what to do if your baby gets sick.

Confirmation of IP experience

The entrepreneur confirms his experience with the following evidence:

- Certificate of registration of an individual as an individual entrepreneur (until 2017) or the Unified State Register of Individual Entrepreneurs (from 01/01/2017).

- Certificate of state registration of termination by an individual of activities as an individual entrepreneur (issued after the entrepreneur ends his activities if the current account is closed and there are no debts to state regulatory authorities.

- If the individual entrepreneur’s activities were carried out before 1991, it is necessary to obtain from the archives a certificate confirming the payment of all insurance premiums. If the activity was carried out after 1991, this information is obtained from the FSS department.

To take into account the experience of individual entrepreneurs, legal evidence is required

In some cases, a businessman has the right to count on an increase in pension. Such hopes are justified if the individual entrepreneur:

- works in the State Duma of the Russian Federation or the Federation Council of the Russian Federation;

- is in state or municipal service;

- serves in internal affairs bodies or drug control agencies;

- is in military service;

- deprived of freedom, but at the same time involved in paid work;

- is on maternity leave or child care leave, if at the same time he voluntarily transfers contributions to the Federal Tax Service.

In these cases, supporting documentation will be as follows:

- employment history;

- certificate from the archive;

- military ID;

- document from places of detention;

- child's birth certificate.

Video: insurance premiums for individual entrepreneurs

Subject to compliance with the rules established by the Labor Code of the Russian Federation, insurance experience will be accrued for citizens engaged in commercial activities. In this regard, a businessman can count on pension payments from the state, and in some cases even an increase in cash payments. Work experience of at least 5 years, timely voluntary transfer of contributions to the tax office during the operation of the individual entrepreneur, reaching retirement age, having documents confirming the length of service - all this gives the right to receive a pension.

- Author: ozakone

Rate this article:

- 5

- 4

- 3

- 2

- 1

(0 votes, average: 0 out of 5)

Share with your friends!