Home / Taxes / What is VAT and when does it increase to 20 percent? / VAT payers

Back

Published: 07/11/2017

Reading time: 4 min

0

431

In some circumstances, a company may require a certificate of the applicable taxation system and whether it is a VAT payer[/anchor]. How to draw up this certificate and what information should it contain?

- Why you may need a certificate of a reconciled tax system

- Requested by the counterparty: what is the certificate form for?

Document types

It must be said that there are many different types of primary documents . But first of all, the individual entrepreneur needs to remember the following:

- Agreement.

- An invoice for payment.

- Cash receipt or other payment document (BSO, sales receipt).

- Packing list.

- Certificate of work performed, services provided.

- Invoice.

It is not at all necessary that an entrepreneur will use all these documents in his work. For example, if an individual entrepreneur provides services to legal entities and other entrepreneurs using the simplified tax system, then he will enter into contracts, issue invoices for payment, and sign certificates of services rendered . But he will not deal with documents such as invoices and cash receipts.

Let's look at each of these documents in more detail.

Confirmation of the right to VAT exemption

Ekaterina Samodurova answers,

senior expert The institution has the right to receive an exemption from VAT if the revenue without VAT from the sale of goods (work, services) for the three previous consecutive calendar months did not exceed 2,000,000 rubles. (clause 1 of article 145 of the Tax Code of the Russian Federation). The maximum amount of income that allows you to take advantage of the VAT exemption is determined based on the proceeds from the sale of goods (work, services) for the three previous consecutive calendar months. Determine the amount of revenue without VAT according to accounting rules. When calculating the limit, include revenue only from those transactions that are subject to VAT (including at a zero tax rate). Do not take into account revenue from tax-exempt transactions. In addition, there is no need to take into account revenue from the sale of excisable goods (clause 1 of Article 145 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of Russia dated May 12, 2021 No. GD-4-3/8911, clauses 3 and 4 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated May 30, 2021 No. 33). Having submitted (sent) a package of documents to the tax inspectorate for exemption from VAT, the institution will not be able to independently refuse it within 12 calendar months (clause 4 of Article 145 of the Tax Code of the Russian Federation). At the same time, there is no need to confirm the right to use the VAT exemption every three months. The institution is required to confirm the validity of using the VAT exemption after 12 months of its application. To do this, submit or mail the following documents to the tax office:

Submit the specified documents and notifications to the tax office no later than the 20th day of the month following the last month of using the right to exemption (paragraph 2, paragraph 4, article 145 of the Tax Code of the Russian Federation). An institution using the VAT exemption is required to issue invoices. In such invoices, do not highlight the VAT amount, but make a note or stamp “Without tax (VAT)” (clause 5 of Article 168 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated May 26, 2021 No. 03-07-14/30264 and the Federal Tax Service of Russia dated February 4, 2021 No. ШС-22-3/85). Therefore, in the extract from the sales book provided to the tax office, the institution must reflect all issued invoices.

What you need to know about the contract

An agreement is the first document signed by the parties to a transaction. The agreement in its classic form is drawn up on paper in 2 copies and signed by both parties indicating their details. In the contract, the parties stipulate important points of their cooperation :

- The subject, that is, the thing in relation to which the transaction is concluded. For example, an agreement for the sale of a certain product or for the provision of a service.

- The cost of the subject of the contract and the payment procedure.

- Rights, obligations and responsibilities of the seller and buyer.

- The procedure according to which the parties can make changes to the contract, terminate it and resolve any disagreements that have arisen.

The contract does not necessarily have to be in writing. For example, if an individual entrepreneur is engaged in the retail sale of goods, then he, in fact, enters into an oral agreement with each of his customers. The object of this contract is the offered product, the price is its value on the price tag. If the buyer pays for this product, it means he accepts the proposed conditions. The fact of concluding such an agreement is confirmed by issuing to the buyer a cash receipt or a document replacing it.

One of the forms of agreement is an offer - this is a proposal to conclude a transaction sent to an unlimited number of persons. The offer is most often posted publicly, for example, on a website. The fact of payment is considered acceptance of the terms of the contract - acceptance of the offer.

This video is unavailable

Read more. Export is a customs procedure in which goods are exported outside the customs territory (Article 212 of the Labor Code of the Customs Union). When exporting, goods are exempt from taxation or the taxes paid are subject to refund in accordance with the tax legislation of the Russian Federation (Article 84 of the Labor Code of the Customs Union). For exporting enterprises, the Tax Code of the Russian Federation introduced the concept of “zero VAT rate”. When exporting, taxation is carried out at a tax rate of 0% (Article 164 of the Tax Code of the Russian Federation). Exporters must confirm the validity of applying the zero rate no later than 180 calendar days.

VAT amounts paid by an enterprise when importing goods into the territory of the Russian Federation can be accepted for reimbursement. The procedure for refunding VAT from the budget, documents for VAT refund - we will briefly talk about this in our material using the example of Belarus. 1. When is a VAT refund service required?

An invoice for payment

In fact an invoice for payment is more of a convenience document than a document necessary for accounting. It contains information about the quantity/volume and cost of goods or services to be paid. Typically, an invoice is sent to the buyer - a legal entity or individual entrepreneur - for payment by “non-cash” payment, that is, through a bank.

The invoice form can be developed by the entrepreneur independently. Below is one of the possible forms, which is quite often used by business entities.

Sample invoice

By the way, there is a document that combines an agreement and an invoice for payment. That's what it's called - an invoice agreement . In essence, this is an account in which the mandatory terms of the contract are entered (they are called essential). A sample of it is presented below.

Sample invoice agreement

Documents confirming payment of VAT

As a standard for all counterparties, I require managers to prepare a package of the following documents, certified by the seal of the legal entity and the signature of the General Director (or signature of the Individual Entrepreneur): 1) card of the counterparty with details, signatures of the General Director and the Executive Director (or Individual Entrepreneur); 3) certificate of state registration; 4) certificate of tax registration; 6) copy of the passport of the State Duma (or individual entrepreneur)*; 7) copies of orders for persons who have the right to sign the SChF (if they exist in addition to the State Duma or Individual Entrepreneur); balance sheet with tax mark as of the last reporting date (if any)*; 9) a certificate about the status of settlements with the budget*; 10) VAT declaration with a tax mark as of the last reporting date*; 11) payment slip for payment of VAT on this declaration*. (documents marked * are not required, but are highly desirable. Their absence reduces the supplier’s rating).

3) certificate of state registration; 4) certificate of tax registration; 6) copy of the passport of the State Duma (or individual entrepreneur)*; 7) copies of orders for persons who have the right to sign the SChF (if they exist in addition to the State Duma or Individual Entrepreneur); balance sheet with tax mark as of the last reporting date (if any)*; 9) a certificate about the status of settlements with the budget*; 10) VAT declaration with a tax mark as of the last reporting date*; 11) payment slip for payment of VAT on this declaration*. (documents marked * are not required, but are highly desirable. Their absence reduces the supplier’s rating).

The organization must provide the same documents to the tax office when extending the period of exemption from the obligation to pay VAT. When exporting goods within the Customs Union, a zero VAT rate is applied.

27 Jul 2021 jurist7sib 83

Share this post

- Related Posts

- Vacation without pay Disabled people 3 Groups

- Social Scholarship for Students Over 18 Years of Age

- Agricultural land for summer cottage construction

- Revenues Receiving from Transport Tax Nnovgorod

Payment acceptance documents

There are several such documents, and the choice is made not at will, but depending on the working conditions.

Important! The only case when an individual entrepreneur should not give anything to the buyer when receiving funds from him is when he receives payment directly to a bank account . In this case, the buyer remains in possession of a document from the bank, which will confirm that he has made the payment.

Typically, legal entities and entrepreneurs pay each other through a bank. But settlements with buyers—individuals—must be supported by business entities with documents. This is necessary when accepting payment in cash, bank cards or electronic means of payment (Qiwi wallets, Yandex.Money and others). The document remains with the buyer and serves as confirmation of payment.

In most cases, an individual entrepreneur is deprived of the right to choose which document to draw up - everything is regulated by law. So, if an entrepreneur uses OSNO or the simplified tax system and trades at retail, then he is required to use a cash register. Accordingly, the buyer must be issued a cash receipt . If an individual entrepreneur applies UTII or buys a patent and at the same time is engaged in retail trade or works in the catering industry, the issue with the cash register is resolved as follows:

- if there are employees, CCP is mandatory from July 1, 2018 ;

- when working independently, CCP may not be used until July 1, 2021 .

As for the provision of services to the population, regardless of the availability of employees and the applied taxation system, you can work without a cash register until July 1, 2021. However, instead of a cash receipt, the buyer must be given a strictly reporting form (SSR). And always, and not just on demand. BSO can be ordered/purchased at a printing house, generated through an automated system, including online through a special service.

Attention! It is impossible to generate BSOs on a regular computer - they will not be valid.

Free legal assistance

2. During the audit of the company, it turns out that its counterparty, who issued a properly executed invoice containing reliable information, no longer exists. Is it legal to accept the corresponding VAT for deduction?A. No, it needs to be restored.B.

Documents confirming the right to exemption from VAT Article 145 of the Code establishes a notification procedure for using the right to exemption from VAT. Payers claiming this right must send the relevant notification and documents confirming the right to exemption to the tax authorities. This article establishes a list of such documents. Thus, the following documents must be provided to the tax authorities: The organization must provide the same documents to the tax office when extending the period of exemption from the obligation to pay VAT. If documents confirming the zero VAT rate are not collected When exporting products, including to Belarus, the enterprise can apply a zero VAT rate. But if the documents confirming export transactions are not collected within the prescribed period, then the tax will have to be assessed (letter of the Ministry of Finance of the Russian Federation dated July 11, 2021.

We recommend reading: According to P3st226 of the Code of Civil Procedure of the Russian Federation, a Report of a Crime Is a Private Definition or Just a Report

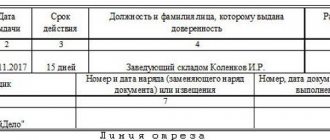

Packing list

An invoice is used if an individual entrepreneur sells goods to another entrepreneur or legal entity. When selling to ordinary individuals (not individual entrepreneurs), this document is not issued. A consignment note is drawn up in 2 copies:

- one for the supplier as confirmation of the fact of shipment of the goods ;

- another for the buyer - through it he will receive this product.

Most often, the consignment note is drawn up in the form TORG-12 .

Sample invoice TORG-12

How to submit primary documents for VAT to the tax office?

In Kontur.Extern, for VAT returns, it is now possible to submit primary (supporting) documents to the tax office. For example, send documents confirming the VAT rate, VAT refund information, etc.

This opportunity does not entail any new obligations to provide primary documents for taxpayers. If there is no need to provide primary documents along with the declaration, then this functionality does not need to be used.

In the future, all declarations will be able to send an inventory with attached primary documents.

Sending primary documents for VAT

- On the main page of the Kontur.Extern system, go to the F NS section and select the Sent reports (see Fig. 1).

Rice. 1. Go to the list of sent reports

- A list of reports sent to the Federal Tax Service will open. You should click on the desired VAT report (see Fig. 2).

The opportunity to send primary documents for VAT appears after the status of the declaration changes to “Delivered”.

Rice. 2. Selecting the desired declaration

- Click the Prepare documents under the sent report (see Fig. 3).

Rice. 3. Proceed to preparing documents

- In the next window, you should select how documents will be added. You can add ready-made files by clicking on the Upload files from your computer (you can also drag and drop the required files into the field that appears) (see Fig. 2).

If Diadoc is used to exchange documents between counterparties, then in the window that appears, you can click the link Select documents in Diadoc .

Rice. 4. Page for selecting a method for downloading documents

- After clicking on the Upload documents , select the files to upload and click Open (see Fig. 5).

You can add documents to the inventory in the form of scanned copies (files with the extension jpg, tif, pdf , etc.), as well as documents in the form of xml files (files with the xml ).

According to the format, scanned copy files must be sent in jpg or tif format. When loading files of other formats into the system (for example, pdf , doc, rtf, xls, docx, xslx, txt., etc.), they are automatically converted into files with the jpg extension.

You can add the missing files in the next step.

Rice. 5. Selecting documents to upload

According to the inventory format approved by order dated June 29, 2012 N ММВ-7-6/ [email protected] (as amended by the Order of the Federal Tax Service of Russia dated 08/31/2012 N ММВ-7-6/ [email protected] ), in the inventory you can submit the following types of documents:

In the form of scanned images:

- 0924 – Invoice

- 1665 — Consignment note

- 2181 — Certificate of acceptance and delivery of works (services)

- 2215 – Cargo customs declaration / transit declaration

- 2216 — Additional sheet to the cargo customs declaration/transit declaration

- 2330 — Specification (costing, calculation) of price (cost)

- 2234 — Consignment note (TORG-12)

- 2745 — Addendum to the contract

- 2766 - Agreement (agreement, contract)

- 2772 - adjustment invoice

As an xml file:

- 0924 - Invoice,

- 0925 — Purchase book,

- 0926 — Sales book,

- 1004 — Journal of received and issued invoices,

- 2181 — Certificate of acceptance and delivery of works (services),

- 2232 — Additional sheet of the Purchase Book,

- 2233 — Additional sheet of the Sales Book,

- 2234 — Consignment note (TORG-12),

- 2772 - adjustment invoice

Also, by agreement with the inspection, you can attach any document, choosing the most suitable type of document.

- The downloading and recognition of the selected files will begin. At the end of the process, a list of downloaded documents will be displayed on the screen (see Fig. 6).

- Required to be completed appears next to the document , then you should click on the name of the downloaded file and begin editing.

- If the status Ready to send , then there is no need to edit the document.

Rice. 6. Uploaded files

If necessary, you can add missing documents using the Upload from Computer button.

To delete unnecessary files, hover your mouse over the line with the unnecessary document and click on the trash can icon on the right side of the line.

- Editing documents in the form of scanned images.

In the editing window, you should select the type of loaded document. Depending on the selected type, fields will appear that must be filled out. Required items will be highlighted in pink (see Fig. 7).

Rice. 7. Entering data about the downloaded scanned copy

If the downloaded document consists of several pages, you should combine them by clicking

Conversely, extra pages should be selected into a new document by clicking

After filling out all the items, click the Save button and move on to the next one (if you are editing the last document in the list, the button will be called Save and close ) (see Fig. 7).

Documents in the form of xml files

Unlike scanned copies, documents in the form of xml files do not require editing.

Together with the xml files of the invoice, adjustment invoice, work (services) acceptance certificate, as well as the delivery note (TORG-12), sgn signature files must also be transferred. Xml files and the corresponding sgn signature files should be downloaded from the program in which electronic document management with counterparties is carried out (for example, Diadoc).

The remaining documents that can be transferred to the inventory in the form of xml files (purchase book, sales book, journal of received and issued invoices, additional sheet of the Purchase Book, additional sheet of the Sales Book) are transferred without signature files.

For example, to transfer a delivery note in xml form, you should add 4 files - two of them must have the xml extension (seller title and buyer title) and the corresponding two signature files with the sgn extension.

If errors are found in the xml file (for example, “Buyer’s title is not loaded”, “Buyer’s title signature is not loaded” - see Fig. 8), then you should upload the missing documents. You can also delete such a document and re-upload it from the program in which it was generated. After this, repeat the download to Kontur.Extern.

Rice. 8. Xml file with errors

7. Once all the necessary documents have been edited, go to the list and click the Proceed to Send (see Fig. 9).

Rice. 9. Sending an inventory

The button will be inactive until the Ready to send .

- A window with the test results will open, in which you should click Next (see Fig. 10).

Next button does not appear if there are errors in the form or the representation message. In this case, you should correct the errors found and resend.

Rice. 10. Control page

If the inventory is signed by a certificate of an authorized representative, then together with it a message about representation (CoP) is sent to the tax office (menu Settings / Message about representation ).

If the form is signed with a certificate from the legal representative (manager), then the message of representation is not transmitted.

- In the next window, you must click on the Sign and Send .

- Inventory sent. The list of documents submitted for the inventory and the status of their processing by the Federal Tax Service will be contained under the VAT report sent to the tax office (see Fig. 11).

Rice. 11. Documents submitted to the Federal Tax Service in response to the request

Processing statuses of primary documents sent for the declaration:

- Sent - documents have been sent to the tax authority. Shipping date confirmed. The system will display the date and time the inventory was sent.

- Delivered - documents have been delivered to the tax authority, a Notice of Receipt ;

- Accepted - the documents have been accepted by the tax authority, an Acceptance Receipt . The system will display the date and time of receipt of the receipt from the Federal Tax Service.

- Rejected - the documents were not accepted by the tax authority, a Notification of Refusal . The system will display the date and time of receipt of the notification from the Federal Tax Service.

Back to list of articles

Acceptance certificate

Acceptance certificates for work performed or services provided are important primary documents. They confirm the fact that the service was performed (the work was completed), as well as the fact that the customer accepted them and has no claims against the contractor.

The act is drawn up in two copies and signed by both parties. From the name it is clear that this document is drawn up based on the results of the performer’s work . If the cooperation is long-term and services are provided frequently, the act can be drawn up periodically. For example, the contract is concluded for a year, the service is provided once a week - in this case, the act can be drawn up once a month.

VAT on exports in 2021

The total period of refusal is no less than a year. Payers need this right if they want to accept tax deductible at rates of 20% or 10% from suppliers who, having the right to a zero rate, do not want to confirm it, highlighting the regular tax in invoices as a result. Indeed, in order to apply this benefit, the company must collect documents to confirm it and submit it to the Federal Tax Service.

We recommend reading: Is sick leave included in vacation calculations?

The tax rate for the export of goods from Russia is 0% (subclause 1, clause 1, article 164 of the Tax Code of the Russian Federation). In other words, exporters are not exempt from value added tax: they are its payers, must submit declarations, and have the right to deduct incoming amounts. In order to take advantage of the preferences, export transactions must be confirmed. They must be confirmed by documents provided for in Article 165 of the Tax Code of the Russian Federation:

Invoice

An invoice is an important document for VAT payers. This tax is paid by individual entrepreneurs (and companies) that apply the main tax regime. When applying the simplified tax system, UTII, unified agricultural tax (until 2019) and the patent system, VAT is not paid (although there are exceptions to this rule). Therefore, if an individual entrepreneur uses one of the special modes, he should not generate an invoice. Moreover, if, at the buyer’s request, he issues an invoice and allocates the amount of VAT in it, he will be obliged to pay this tax to the budget and file a declaration .

Individual entrepreneurs - VAT payers are required to issue an invoice. This must be done no later than 5 days after shipment of the goods. The document is drawn up in 2 copies - one each for the buyer and the seller.

If an individual entrepreneur is a VAT payer, it is also important for him to receive invoices from his suppliers in a timely manner, since this document is the basis for his application of VAT deduction .

What documents confirm payment of VAT by the supplier?

N 8688/08, the review of the case was denied). But tax authorities can also cite as an example court decisions in their favor (Resolution of the Federal Antimonopoly Service of the Moscow District dated December 30, 2021 N KA-A40/13429-09 in case N A40-32839/09- 142-126, dated December 22, 2021 N KA-A40/13955-09 in case N A40-23173/09-108-115). They are based on the fact that: - the primary documents contain unreliable information; - the buyer (customer of works, services) acted without due diligence and caution, since he did not identify and did not check the authority of the person who signed the relevant documents on behalf of the counterparty. To collect or not collecting a “dossier” for VAT deduction is up to you. And in conclusion, we suggest taking a test. Test 1. In the invoice from the counterparty, decryption of the signature “Ivanov I.I.” clearly does not coincide with the signature of “Naryshkin-Romanov”.

As a standard for all counterparties, I require managers to prepare a package of the following documents, certified by the seal of the legal entity and the signature of the General Director (or signature of the Individual Entrepreneur): 1) card of the counterparty with details, signatures of the General Director and the Executive Director (or Individual Entrepreneur); 2) Charter (for legal entities); 3) certificate of state registration; 4) certificate of tax registration; 5) extract from the Unified State Register of Legal Entities (USRIP); 6) copy of the passport of the State Duma (or individual entrepreneur)*; 7) copies of orders for persons who have the right to sign the SChF (if they exist in addition to the State Duma or Individual Entrepreneur); balance sheet with tax mark as of the last reporting date (if any)*; 9) a certificate about the status of settlements with the budget*; 10) VAT declaration with a tax mark as of the last reporting date*; 11) payment slip for payment of VAT on this declaration*. (documents marked * are not required, but are highly desirable. Their absence reduces the supplier’s rating). Actually, points 10 and 11 will be more than enough for the topicstrater, which is what I wrote to him about.

2) Charter (for legal entities); 3) certificate of state registration; 4) certificate of tax registration; 5) extract from the Unified State Register of Legal Entities (USRIP); 6) copy of the passport of the State Duma (or individual entrepreneur)*; 7) copies of orders for persons who have the right to sign the SChF (if they exist in addition to the State Duma or Individual Entrepreneur); balance sheet with tax mark as of the last reporting date (if any)*; 9) a certificate about the status of settlements with the budget*; 10) VAT declaration with a tax mark as of the last reporting date*; 11) payment slip for payment of VAT on this declaration*. (documents marked * are not required, but are highly desirable. Their absence reduces the supplier’s rating). Actually, points 10 and 11 will be more than enough for the topicstrater, which is what I wrote to him about.