Allocation of VAT by calculation

As a general rule, the contract price is determined taking into account VAT. If the tax amount is allocated separately in the contract, then it is the seller who will present it to the buyer (clauses 1, 4, article 168 of the Tax Code of the Russian Federation).

If the amount of VAT is not allocated in the contract, then the seller must independently, by calculation, allocate the VAT from the contract price and present it to the buyer (clause 1 of Article 168, clause 1 of Article 173 of the Tax Code of the Russian Federation). This rule corresponds to the resolution of the Plenum of the Supreme Arbitration Court dated May 30, 2014 No. 33, in paragraph 17 of which the following is established: if the VAT amount is not allocated in the contract, then by default it is included in the contract price.

This rule does not apply to cases where, under the terms of the contract, VAT is not included in the price of goods, works, or services.

If the amount of VAT is not allocated in the contract, but the contract does not indicate that the tax is not included in the price, then such an agreement does not provide for the buyer’s obligation to pay the seller VAT in addition to the contract price. Therefore, the seller must extract VAT from the contract price when issuing an invoice. To do this, the amount specified in the contract must be multiplied by 20/120 or 10/110 - depending on the tax rate at which the goods, works, services sold, and transferred property rights are taxed (clause 4 of Article 164 of the Tax Code of the Russian Federation).

According to the purchase and sale agreement for the refrigerator, its cost is 24,000 rubles. The amount of VAT is not allocated in the contract, but the contract does not indicate that the cost of the refrigerator does not include VAT. The contract does not contain any conditions for paying VAT in addition to the price of the refrigerator. Since this sale is subject to VAT at a rate of 20%, the seller will calculate the tax as follows:

When issuing an invoice, the seller will include the following information:

- the cost of the refrigerator excluding VAT is 20,000 rubles;

- VAT amount – 4,000 rubles;

- the cost of the refrigerator including VAT is 24,000 rubles.

VAT on top of price

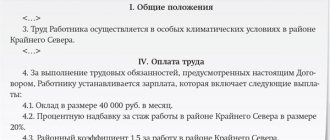

It happens that the VAT amount is not allocated in the contract, but the contract contains the following conditions:

In such circumstances, the seller issues an invoice to the buyer with the amount of VAT, which is calculated in excess of the contract price, namely: the amount specified in the contract is multiplied by 20% or 10% - depending on the rate at which the goods sold, work are taxed , services, transferred property rights (clause 1 of article 168 of the Tax Code of the Russian Federation).

The seller will include the following information on the invoice:

- the cost of the refrigerator excluding VAT is 24,000 rubles;

- VAT amount – 4,800 rubles;

- the cost of the refrigerator including VAT is RUB 28,800.

Safe formulation

According to the rules, when the existing VAT rate changes, the amount specified in the contract must be recalculated before the new amount is specified in the contract. In this case, the buyer must subsequently agree to the new wording and sign a new contract.

In reality, this almost never happens. Negotiating a change in the contract amount is often difficult and the buyer may not agree to it. There are still disputes between lawyers about who will be right - the seller or the buyer.

To avoid conflicts, you can divide the amount for goods and VAT in the contract. That is, indicate the cost excluding tax. It is separately stated that the buyer must pay the rate that will be in effect at the time of depositing funds.

Recommendations for drafting contracts

When concluding a contract, the conditions regarding the inclusion or non-inclusion of the VAT amount in the contract price should be clearly formulated at the stage of preparing its draft. This will allow you to avoid future misunderstandings in relations with the counterparty and claims from inspectors.

Practice shows that buyers do not always transfer additional VAT to sellers if, according to the terms of the contract, the price does not include the amount of VAT. But the buyer’s failure to pay VAT does not affect the seller’s obligation to pay tax to the budget. This means that the seller will have to pay the tax from his own funds.

Briefly about VAT: mechanism and rates

VAT is an indirect tax that is levied on the sale of most goods and services. It is usually included in the price and paid out of the buyer's pocket. In this case, the seller is formally the tax payer - he must take the tax from the amount received from the buyer and pay it to the budget. This is how the indirect taxation mechanism works.

The basic tax rate is 18%. It applies to most taxable objects. Along with it, there is a reduced rate of 10% for preferential categories of goods. It covers many types of food, children's products and certain medical products. Another preferential rate is 0%. It is used for export, for the provision of a whole range of services related to international transportation, as well as for individual sales objects. In addition, there are a number of transactions that are completely exempt from VAT.

The seller's right to claim VAT from the buyer

According to paragraphs. 1, 2 tbsp. 168 of the Tax Code of the Russian Federation, the buyer is obliged to transfer VAT to the supplier, even if the tax is not provided for in the contract or the supplier has not issued an invoice. Since the tax is imposed in addition to the price of the goods (works, services), the buyer must pay it taking into account the calculated tax. Therefore, the seller has the right to issue an additional invoice to the buyer for the amount of VAT accrued above the contract price, and if the buyer refuses to pay this amount, to recover it in court.

This is evidenced by many judicial acts: clause 15 of the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated January 24, 2000 No. 51, resolution of the Arbitration Court of the Volga-Vyatka District dated November 14, 2016 No. F01-4724/2016 in case No. A79-6711/2015, FAS Moscow district dated July 23, 2012 No. A40-68414/11-60-424, FAS Volga-Vyatka District dated March 11, 2012 No. A43-7468/2011, FAS Far Eastern District dated December 12, 2011 No. F03-6075/2011.

However, when claiming VAT from the buyer, one should take into account the three-year limitation period (resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated September 29, 2010 No. 7090/10, FAS North-Western District dated August 10, 2011 No. A05-5565/2010).

The contract indicated the amount excluding VAT by mistake

Let’s assume that the contract only specifies the cost of goods. There are no reservations regarding VAT. But it turns out that in reality there should be a tax amount. By the way, this happens if the seller is sure that he has the right to a benefit. And later it turns out that this is not so - say, the condition for the benefit is not met.

Have you ever encountered VAT errors in contracts?

What to do if your company is a supplier

So, you see that the contract with the buyer does not include VAT, although it should be. You will still have to charge this tax in addition to the price of the goods. The obligation prescribed in paragraph 1 of Article 168 of the Tax Code of the Russian Federation has not yet been canceled. Of course, the ideal option is to correct the agreement by increasing its amount by VAT. And if the buyer has already transferred money to you for the goods, ask him to pay additional tax.

Has the counterparty fulfilled your request? Great - that means you will be charged tax as usual. But the buyer may refuse to pay you the additional tax amount above the price of the goods. Then you can try to recover this amount from the counterparty through the court. This is confirmed by paragraph 15 of the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated January 24, 2000 No. 51. As well as the resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated September 29, 2010 No. 7090/10.

Important detail

If the contract forgot to indicate VAT, the supplier may demand this amount from the buyer in addition to the transaction price.

But if your company’s management does not want to argue with the buyer, you have two more options. One of them is to change the contract by separating the amount of VAT from the total cost of goods. Then the buyer will not have to pay anything extra. But the amount of your income from the transaction will, of course, decrease. That is, in essence, you will first find the tax amount at the estimated rate to determine the new price. And on the invoice, indicate the usual 18 percent.

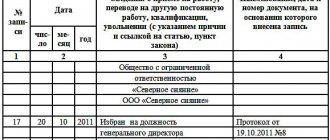

If the manager is satisfied with this option, then the price change must be recorded in the additional agreement. An example of this document is shown below.

But here is the second possible option - in case the counterparty does not want to sign any additional agreements at all. You charge VAT on the amount under the contract and pay it to the budget from your own funds.

Unfortunately, it is not possible to include the amount of such VAT in expenses. Officials emphasized this in a letter from the Russian Ministry of Finance dated June 7, 2008 No. 03-07-11/222.

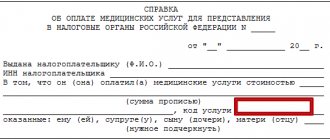

Example: How to take into account the amount of VAT that the supplier does not present to the buyer

Contractor LLC mistakenly indicated in the contract the cost of services in the amount of 152,000 rubles. excluding VAT. The director of the LLC decided not to collect the VAT amount from the customer and pay it at his own expense. Therefore, the accountant assessed tax in the amount of 27,360 rubles. (RUB 152,000 ? 18%). When calculating income tax, the accountant did not include this amount of VAT in expenses. He made the following entry in accounting:

DEBIT 91 subaccount “Other expenses” CREDIT 68 subaccount “VAT calculations”

— 27,360 rub. — VAT is charged on the sale of goods.

If the counterparty charges you VAT on top of the contract price and your management does not mind paying additional tax, you can easily deduct this amount. After all, the seller will issue you an invoice, in which the tax will be allocated according to all the rules.

Now let’s assume that you and the supplier change the terms of the contract, removing VAT from the cost of goods. But at this moment the counterparty has already shipped the products to you and you have managed to sell them. Then you will need to reduce the cost of goods, which was previously taken into account in expenses when calculating income tax.

Did you receive the goods after you signed the price change agreement? You don’t have to correct anything - you capitalize the goods and materials according to the documents as is.

Well, if the counterparty decided to pay VAT at the expense of its own funds, then you will not transfer this amount to him. And if so, then you do not have the right to deduct tax.

Wrongful presentation of VAT to the buyer

There are cases when the seller misleads a bona fide buyer by claiming to apply an exemption, the use of which is unlawful, and subsequently claims VAT for payment to the buyer. In this situation, the seller himself must be responsible for paying the tax. The judges came to this conclusion in the resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated June 14, 2011 No. 16970/10 regarding the performance of work under a government contract.

Similar conclusions are contained in the resolution of the Arbitration Court of the Ural District dated September 24, 2014 No. F09-5967/14 in case No. A76-26562/2013, which concluded that a lessor who has lost the right to use a simplified taxation system does not have the right to increase the amount of rent for the amount of VAT without concluding an additional agreement to the contract. Imposing on a bona fide participant in civil legal relations the obligation to pay VAT that has not been presented for payment is unlawful.

Conditions that will not allow the seller to revise the contract price in terms of VAT after the transaction is completed

Often a dispute arises between counterparties regarding the amount of the rate paid, if at the time of conclusion the rate was 18%, and later became 20%. According to the laws, the amount of the applied rate does not depend on the date of signing the contract. The new rate applies to goods and work that were shipped or completed starting from January 1, 2019.

The relevant question is whether there is a need to conclude additional agreements to existing contacts. This depends on the terms of the contract with the counterparty. There is no need to make changes if a condition has been agreed upon to unilaterally increase the price when the tax rate changes.

In addition, amendments are not made if the price is agreed upon in separate agreements, the contract specifies the size of the price and the wording “excluding VAT”. In this case, tax is charged on the excess cost of goods or work.

Results

The seller must calculate VAT if its amount is not allocated in the contract. There are 2 options here: VAT is already included in the price of the product. Then the specified amount is multiplied by 20 and divided by 120. Or the cost of the goods is indicated excluding tax, then the cost of material assets will increase by the amount of tax.

Value added tax (VAT) is indirect; it is included in the cost of goods, works, services, property rights and is presented for payment to the buyer. Is it necessary to include VAT in an agreement with a customer and how to avoid controversial situations with a counterparty, said Elena Vozhova, senior legal adviser at the Legal Services Center.

When forming the terms of a payment agreement, everything depends on the taxation system used by the parties to the agreement (STS, OSN, other special regime), the correctness of accounting records and the parties’ awareness of the rules and procedure for paying tax, as well as on a clear indication in the contract of the obligations of the parties in terms of payment of VAT. Based on this, the following contract options are found.

Option 1. VAT in the contract is calculated separately and is indicated in the text along with the cost of goods, work, services, property rights. VAT is highlighted in the contract. In this case, both parties apply a common taxation system. Accordingly, the buyer and seller agree in advance on all the conditions for payment, execution of the agreement and their obligations regarding taxation. In such a situation, the buyer knows the amount of VAT and will pay the tax based on the invoice presented to him.

Option 2. A situation where one of the parties to the agreement applies a special taxation regime, for example, the simplified tax system. Then the contract makes reference to this fact. In most cases, in such transactions there are no conflict or controversial issues, since initially everything is obvious: there is no obligation to calculate VAT, tax legislation does not provide for the requirement to allocate VAT as part of the contract price (see, for example, the letter of the Ministry of Finance of the Russian Federation dated June 1, 2021 No. 03-11-11/38624).

Option 3. The presence of one of the parties to the agreement has the right to receive a tax benefit (Article 145 of the Tax Code of the Russian Federation - exemption from fulfilling the duties of a taxpayer; Article 149 of the Tax Code of the Russian Federation - carrying out transactions not subject to taxation) also implies the legal consequences set out in option 2 The contracts also make reference to preferential circumstances, but indicate the price of the contract as a whole. Additionally, it is recommended to request from the party that has a preferential tax regime, documentary evidence (certificate of state registration of a legal entity, charter with the types of activities of the organization, other documents confirming the right to receive a tax benefit, tax exemption). However, it is not uncommon for contracts to lack a separate line indicating the calculation of VAT and its amount.

From the buyer's side

Buyers on the general tax system will most likely not be affected if the amount of VAT in the contract increases. They can deduct this VAT and reduce their own.

The problem arises when the supplier sells goods to the client on a simplified basis or on UTII.

It works on a simplified basis. For him, 2000 rubles is simply an increase in the cost of the goods he is buying.

In the example, the amounts are small, but the contracts can be worth millions. Then the company’s additional costs will also be significant.

Contract without VAT

It happens that VAT is not indicated in the contract at all. In this case, the seller is still obliged to present VAT to the buyer and pay it (clause 1 of Article 168, clause 1 of Article 173 of the Tax Code of the Russian Federation). However, here you need to correctly calculate the tax and find out whether the VAT amount is included in the contract or not. Depending on what the parties agree on, the tax calculation formula will be different.

If companies decide that tax is included in the contract price, then the formula will be as follows: Contract amount × 20/120 (or 10/110 - depending on the tax rate - Article 164 of the Tax Code of the Russian Federation) = VAT.

If the tax is considered above the cost of the agreement, then to calculate it you need to use another formula: Amount of the agreement × 20% (or 10% - depending on the tax rate - Article 164 of the Tax Code of the Russian Federation) = VAT.

Thus, when calculating and presenting VAT for payment, it is necessary to analyze the terms of a specific agreement. In order to avoid ambiguity in the interpretation of the contract, it is additionally recommended to clearly formulate the conditions for the inclusion or non-inclusion of VAT in the contract at the stage of preparing its draft. Initially, companies must clearly decide whether to include VAT in the contract price or to pay tax on top of the price, and also spell out these conditions in detail in the contract. Upon payment of VAT, the seller may issue an additional invoice to the buyer for the amount of VAT in excess of the contract price. Sometimes companies enter into an additional agreement, with the help of which it is possible to resolve controversial situations regarding the inclusion of VAT in the contract and its payment by the buyer.

In order to avoid ambiguity in the interpretation of the contract, it is additionally recommended to clearly formulate the conditions regarding the inclusion or non-inclusion of VAT in the price of the contract at the stage of preparing its draft.

An error when specifying VAT in a contract may result in additional tax charges.

Info

Clause 1 of Article 168 of the Tax Code of the Russian Federation provides that when selling goods (work, services), the taxpayer, in addition to the price (tariff) of the goods (work, services) sold, is obliged to present the corresponding amount of VAT for payment to the buyer of these goods (work, services). From the literal content of the above norm it directly follows that if the text of the contract does not indicate the condition that the price is formed taking into account VAT, this tax must be added to the price specified in the contract.

Negative tax consequences in this situation are possible for both the buyer and the seller. A seller who is not a VAT payer will pay the appropriate amount of this tax to the budget. This is directly provided for in paragraph 5 of Article 173 of the Tax Code of the Russian Federation and is confirmed by letters from the Ministry of Finance of Russia and. In addition, the seller: - submits a declaration on value added tax (and the Tax Code of the Russian Federation).

We note that until January 1, 2014, this issue was controversial due to the ambiguous interpretation of the norms of the Tax Code of the Russian Federation.

Moscow and)

Price circumstances

In this regard, if the contract does not directly indicate that the price established therein does not include the amount of tax, and otherwise does not follow from the circumstances preceding the conclusion of the agreement or other terms of the contract, the courts should proceed from the fact that the presented the seller allocates the tax amount to the buyer last of the price specified in the contract, for which it is determined by the calculation method

(clause 4 of article 164 of the Tax Code of the Russian Federation). Thus, according to the conclusions of the court, if, based on the terms of the contract and other circumstances related to the conclusion of the contract, it follows that the price indicated in it is formed without taking into account tax, the application of the estimated tax rate provided for in paragraph 4 of Article 164 of the Tax Code is unfounded.

The contract contains an incorrect VAT rate

Here's another situation. The contract contains the usual VAT rate of 18 percent. But in reality it should be 10 percent. Or vice versa. Let's see how to correctly charge tax to the supplier and how to deduct it for the buyer.

What to do if your company is a supplier

The VAT rate depends on the type of goods, works or services. And, of course, you cannot change it arbitrarily. Therefore, even if there is an error in the contract, indicate the correct VAT rate in the invoice.

It's better to make changes to the contract. Otherwise, you may owe taxes. If, say, instead of 18 percent, you calculate the tax at a rate of 10 percent.

Legal risks

The existing judicial practice is represented by complex and ambiguous examples. This is due, first of all, to the fact that the parties inattentively and frivolously approach the issue of drawing up contracts and the correct allocation and calculation of the amount of VAT. I will give an example of the most interesting and popular conclusions of the arbitrators.

Buyers do not always transfer VAT to sellers if, according to the terms of the contract, the price does not include the amount of tax. However, this does not affect the seller’s obligation to pay VAT to the budget. In such cases, the seller will have to transfer the tax from his own funds with subsequent recovery of the paid amount from the buyer in court (for example, the resolution of the FAS Moscow District dated July 23, 2012 in case No. A40-68414/11-60-424, FAS Volgo-Vyatka district dated March 11, 2012 in case No. A43-7468/2011, FAS Far Eastern District dated December 12, 2011 No. F03-6075/2011).

Incorrect indication by the parties of the VAT tax rate in the agreement cannot be the basis for exemption from the obligation to reimburse the seller for the tax, regardless of the agreement of this condition by the parties to the agreement.

Payment in addition to the cost of the contract of the corresponding amount of VAT is provided for by the Tax Code and is obligatory for the parties to the contract by virtue of paragraph 1 of Article 422 of the Civil Code (in confirmation of this, see, for example, the decision of the Third Arbitration Court of Appeal dated November 26, 2009 in case No. A33-10186/ 2009, resolution of the FAS North-Western District dated August 10, 2011 in case No. A05-5565/2010, resolution of the FAS North-Western District dated September 27, 2010 in case No. A05-1517/2010).

If the seller demands to recover from the seller VAT accrued on the contract price due to the seller’s unlawful actions, as a result of which the tax benefit was lost, then this demand is illegal, it is an abuse of law (see, for example, the resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 14 June 2011 No. 16970/10 in case No. 05-1486/2010).

In conclusion, I would like to say that the absence of tax provisions in the contract entails additional risks. And if an entrepreneur does this deliberately, then you need to be prepared not only for conflict situations with a partner, but also for arbitration disputes.

Practical encyclopedia of an accountant

All changes for 2021 have already been made to the berator by experts. In answer to any question, you have everything you need: an exact algorithm of actions, current examples from real accounting practice, postings and samples of filling out documents.

Organizations and individual entrepreneurs applying special tax regimes can take part in the procurement. Such companies do not pay VAT. The customer must correctly spell out the terms of the contract so as not to violate the rights of the participants. Imagine that the company won the simplified tax system. What about VAT? Let's look at examples of judicial practice under 44-FZ.

VAT in a contract under 44-FZ: analysis of errors

Law 44-FZ provides equal conditions for participation in procurement, regardless of the legal form and taxation system of participants.

A participant in government tenders can become:

- any legal entity or individual, including an individual entrepreneur (clause 4 of article 3 of the Federal Law of 04/05/2013 No. 44-FZ, Law No. 44-FZ);

- any participant, including those exempt from VAT and applying a special tax regime (for example, simplified tax system, UTII).

Controversial situations arise due to the fact that the customer takes a standard approach to the development of documentation and the draft contract and does not take into account the likely possibility of filing an application by a participant who is not a VAT payer.

Let's look at four typical customer mistakes in applying VAT at the stage of concluding and executing a contract with such participants.

Example: decision of the Federal Antimonopoly Service for the Omsk Region dated August 29, 2016 No. 03-10.1/220-2016.

The customer established in the contract (section III. Information card of the electronic auction, clause 14) the requirement:

OFAS considered that the customer’s actions contradicted the norms of Part 2 of Art. 34 and part 2 of Art. 70 of Law No. 44-FZ. The customer was given an order to exclude this item from the documentation.

Expert Stanislav Gruzin comments on the above standard contract formulation:

Example: decision of the Arbitration Court of the Republic of North Ossetia-Alania dated November 18, 2014 No. A61-2186/14.

The court noted that the customer concludes and pays for the contract at the price proposed by the winner, regardless of what taxation system the latter applies. During the execution of the contract, its price may be reduced by agreement of the parties without changing the quantity of goods, scope of work, services and other conditions. The customer’s actions to reduce the contract price by the amount of VAT before concluding the contract itself are a violation of Law No. 44-FZ.

The antimonopoly authority recognized the customer’s actions as violating Part 10 of Art. 70 of Law No. 44-FZ.

Stanislav Gruzin comments:

Example: Resolution of the Seventh Arbitration Court of Appeal dated March 28, 2016 No. 07AP-1505/2016 in case No. A67-7718/2015 and the Decision of the Arbitration Court of the Republic of Sakha (Yakutia) dated April 24, 2015 in case No. A58-182/2015.

The contract executor, using the simplified tax system, provided the customer with invoices for payment for services rendered in an amount equal to the contract price without VAT. The customer paid for the contract excluding VAT, citing the fact that the contractor is not a payer of such tax.

As the courts have indicated, the customer must pay for the work at the price established by the contract, according to the auction documentation, regardless of whether the supplier is a VAT payer or not.

A person who is not recognized as a VAT payer is obliged to independently transfer to the budget the amount of tax paid as part of the price of goods (work, services) (clause 5 of Article 173 of the Tax Code of the Russian Federation). It is the supplier's task to transfer VAT to the budget. If he does not do this, he faces claims from the tax authorities. But they won’t be available to the customer.

Example: Resolution of the Fifteenth Arbitration Court of Appeal dated August 27, 2015 No. 15AP-12729/2015 in case No. A53-10584/2015

The customer and the contractor entered into a contract using the simplified tax system, the price of which does not include VAT. The work performed was paid in full. Based on the decision of the financial control body that the cost of the work was too high, the customer demanded to recover unjust enrichment. The customer's request was denied. The fact is that the contract price is fixed and determined for the entire period of its execution. Changing the price is allowed only in cases provided for in Art. 34 and 95 of Law No. 44-FZ.

If the terms of the contract are fulfilled properly, the customer is obliged to pay the cost of the work in the amount established by the winner, regardless of the taxation system applied by the latter. The VAT amount is recognized as the profit of the winner who is not a payer of such tax. The parties did not enter into an agreement to change the price of the disputed contract. The customer must pay for the work in the amount provided for in the estimate.

VAT rate 20% during the transition period

Consider the following example, when the contract states: “price 118 rubles, including VAT 18 rubles.” However, as of January 1, 2019, invoices are issued at a new rate, that is, for 120 rubles, and an agreement to change the contract price has not been signed.

The seller, in addition to the price of goods (work, services), transferred property rights shipped starting from 01.01.2019, is obliged to present for payment to the buyer of these goods (work, services), property rights the amount of tax calculated at a tax rate of 20%.

Amendments to the agreement regarding changes in the VAT rate are not necessary. At the same time, the parties to the agreement have the right to clarify the payment procedure and the cost of goods sold (work, services), transferred property rights in connection with changes in the VAT tax rate (Letter of the Federal Tax Service of Russia dated October 23, 2018 N SD-4-3/).

Thus, according to the position of the department, the signing of an additional agreement is at the discretion of the parties and does not change the essence of the changes made by law in terms of the size of the tax rate. We also believe that the buyer has no legal grounds for refusing to pay the contract amount taking into account the new tax rate, since, as we discussed above, the price under the contract remained unchanged and in this case it is necessary to take all measures provided for under the contract related to non-payment or late payment payment for goods. In case of legal disputes under these circumstances, the court will be on the side of the seller of the goods. The only reason may be termination of the contract on the specified grounds.

Let us consider judicial practice, which can indirectly confirm the stated approach.

The Determination of the Judicial Collegium for Economic Disputes of the Supreme Court of the Russian Federation dated November 23, 2017 N 308-ES17-9467 in case N A32-4803/2015 states that the taxpayer, based on the results of a desk audit, was denied the application of a zero rate for services of international transportation of exported goods, in In connection with which the company went to court with the following demands - VAT was not included in the cost of services, in connection with additional tax assessment by the tax authority, it asks to recover the increased cost of services from the counterparty. In this case, the position of the counterparty was that the services provided by the plaintiff included VAT at a rate of 0%, that is, the tax was included in the cost of the service.

Thus, the amount of tax charged to the buyer when selling services must be taken into account when determining the final amount of the price specified in the contract and highlighted in settlement and primary accounting documents, invoices as a separate line. At the same time, the burden of ensuring compliance with these requirements lies with the contractor as a taxpayer, who is obliged to take into account such a sales operation when forming the tax base and calculating the tax payable to the budget based on the results of the corresponding tax period. If the contract does not directly indicate that the price established in it does not include the amount of tax, then the amount of tax presented to the customer by the contractor is allocated from the price specified in the contract, for which it is determined by the calculation method (clause 4 of Article 164 of the Tax Code of the Russian Federation).

Within the meaning of the above explanations, in civil legal relations between the customer and the contractor, the amount of VAT is part of the price of the contract binding them, which is separated from this price for tax purposes. In the court case under consideration, the parties to the contracts, when formulating the terms of the price, agreed to set the price for services at a fixed rate. The risk of misunderstanding of tax legislation when determining the final price falls on the person obligated under tax law - the taxpayer (performer), on the characteristics of whose economic activity in this case the application of one or another tax rate (0% or 18%) depended. Consequently, the amount of VAT was not subject to recovery from the organization that fulfilled the contractual obligation to pay the price in full.

The Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated September 22, 2009 N 5451/09 in case N A50-6981/2008-G-10 reflected the following conclusions. Thus, the party disputed the legality of collecting the amount of interest under Art. 395 of the Civil Code of the Russian Federation, accrued on the amount of VAT included in the principal debt. The court, refusing to satisfy the claims, proceeded from the following. Public legal relations regarding the payment of VAT to the budget are formed between the person selling goods (works, services) and the state. The buyer of goods (works, services) does not participate in these relations. The amount of VAT presented to the company for payment is for the company part of the price payable. Since revenue is recorded for VAT purposes from the date of shipment (transfer) of goods (work, services), and not from the moment of payment, the seller is obliged to pay this tax from his own funds, without waiting for payment to be received from the buyer.

Consequently, by delaying payment for services provided, the company actually unjustifiably used not the amount to be transferred to the budget in the form of VAT, but the funds of the service provider. In this connection, the calculation of interest for the use of other people's funds on that part of the debt amount that falls on the tax amount is legal.

Based on the above position, we can come to the conclusion that the concluded agreement in terms of setting the price as consideration under the agreement does not change. The amount of tax in the part not subject to regulation by the parties has been increased by law. The cost of the contract is divided into price (regulated by agreement of the parties) and the stipulated amount of VAT (regulated by law).