Employers must withhold personal income tax (PIT) from their employees' paychecks. Therefore, if an employee has a salary of 30,000 rubles, he will receive only 26,100 rubles in cash minus personal income tax of 13%, if without any difficulties.

In order for some groups of employees to receive more, tax deductions were invented. The deduction works like this: they take the employee’s income, reduce it by the amount of the deduction, and calculate the tax from this amount. That is, they reduce the tax base, and not the tax itself.

Example

Florist Katya has a salary of 30,000 ₽ and a deduction of 1,400 ₽ for her daughter, which means they will deduct from her salary:

- in January: (30,000 - 1,400) × 0.13 = 3,718 ₽

- in February: (60,000 - 2,800) × 0.13 - 3,718 = 3,718 ₽ and so on.

Remember, personal income tax is always considered an accrual total from the beginning of the year as in the example.

Deductions for personal income tax are different: standard, property, social and professional. Most often, employees come with standard tax deductions: for themselves or for a child.

Standard tax deductions reduce income, which is subject to personal income tax at a rate of 13%. Standard deductions are not applied to income at other rates and dividends. Non-residents cannot use deductions either. Let us remind you that a non-resident is an individual who stays on the territory of the Russian Federation for less than 183 days within one year.

Standard deductions for personal income tax in 2021

This type of deduction applies to certain categories of citizens, the list of which is defined in Art. 218 of the Tax Code of the Russian Federation, as well as for taxpayers with children. It includes deductions as a reduction in monthly taxable income:

- For 3000 rubles. for persons: liquidators of the Chernobyl accident who became disabled or suffered radiation sickness as a result of being in contaminated areas;

- disabled people from WWII and other military conflicts.

- participants of the Second World War, heroes of the USSR and the Russian Federation, holders of the Order of Glory of 3 degrees;

Personal income tax deductions for children apply to parents (including adopted ones), guardians, and reduce the base monthly:

- 1400 rub. per month for every 1st and 2nd child;

- 3000 rub. on the 3rd and subsequent ones.

For disabled children under 18 years of age or up to 24 years of age (if they are studying full-time), a deduction is provided for 12,000 rubles. parents, 6,000 rubles each. to guardians.

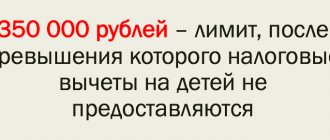

The monthly income of both parents is reduced by these amounts or, if there is only one parent, by double the amount. In addition, one of the parents may refuse the deduction in favor of the other. Standard tax deductions for personal income tax for children in 2021, as in the past, are provided to individuals from the beginning of the year until the month when their income reaches 350,000 rubles. It is important to remember that dividends are not included in this amount. The right to deduct continues until the child turns 18, and a full-time student until he turns 24.

Standard deductions for personal income tax are benefits of a declarative nature and are provided to an individual on the basis of a personal application submitted to the employer and supported by the necessary set of documents.

Documents for child support

First, the employee needs to write a free-form deduction application and attach supporting documents to it: a birth certificate or a certificate from an educational institution.

Deduction application template

If an employee has not been working since the beginning of the year or works part-time in another organization, ask him for a certificate in form 2-NDFL from other places of work. She will confirm that income since the beginning of the year has not exceeded 350,000 rubles.

Important: do not provide an employee with standard tax deductions that he did not receive from his previous employer or did not receive in full.

In some cases, other documents will be needed. For example, from a spouse who is not the child's parent or guardian, ask for a statement from the child's mother or father stating that the spouse is providing for the child.

Some documents need to be updated every year. The general rule: if a document confirms the right to deduction only in one period, then it needs to be updated in the next. For example, request a certificate from the university every year, because the situation may change next year.

Social deductions for personal income tax in 2021

Social deductions are regulated by Art. 219 of the Tax Code of the Russian Federation and allowing to reduce the actual costs of the payer for their needs. Circumstances that allow you to return the personal income tax amount are:

- donations to religious, non-profit or charitable organizations (in the amount of actual costs, but not more than 25% of the amount of taxable income received);

- payment for your own education (in the amount of expenses incurred, but not more than the limit of 120,000 rubles per year), as well as for full-time education of your children, sisters, brothers under 24 years of age (in the amount of no more than 50,000 rubles for each within the established limit);

- expenses incurred for your treatment or the treatment of your spouse, parents, children under 18 years of age (in the amount of actual costs, but not more than 120,000 rubles). Deductions for expensive treatment with drugs listed in list No. 201, approved. The Government of the Russian Federation dated March 19, 2001 is provided in the amount of real expenses. In particular, this applies to the implantation of dentures. A personal income tax refund can be made if the conditions are met - if the treatment was carried out at the applicant’s own expense, and the medical institution has the appropriate license;

- insurance costs (in the amount of expenses incurred, but not exceeding the limit of 120,000 rubles). These include the costs of non-state pension provision (NGPO), voluntary pension insurance (VPE) and life insurance (LI), concluded for a period of at least 5 years, as well as the payment of insurance premiums for a funded pension;

- conducting an independent assessment of qualifications (in the amount of actual costs, but not more than 120,000 rubles).

Agreement on shared participation in construction: features of deduction

When receiving a deduction for the purchase of housing under an equity participation agreement (EPA) in construction, there are nuances. Firstly, the right to deduct such property arises not from the moment of registration of ownership, but from the date of signing the acceptance certificate for the construction project (Letter of the Ministry of Finance of the Russian Federation dated December 14, 2017 No. 03-04-05/83678). Secondly, the price of an object in the DDU is not indicated in a single figure, but consists of several cost items. These may include developer services and reimbursement of construction costs. In practice, the tax authorities refused to provide a property deduction for expenses related to payment for developer services, that is, they only took into account reimbursement of construction costs. However, the Letter of the Federal Tax Service dated June 27, 2017 No. BS-4-11/12277 states that the entire amount of the taxpayer’s actual expenses in the amount of the contract price is taken into account as part of the property deduction for DDU, that is, the services of the developer are also taken into account.

Property deductions for personal income tax

Art. 220 of the Tax Code of the Russian Federation determines the conditions for providing deductions for transactions with movable or immovable property - sale or purchase.

You can return the amount of withheld tax:

- when purchasing an apartment, room, house (share in them) or other type of real estate, as well as during construction (participation in it) in the amount of actual costs, but not more than 2,000,000 rubles;

- when using borrowed mortgage funds to purchase housing in the amount of expenses on interest paid for using the loan, but not exceeding RUB 3,000,000.

Tax legislation establishes the obligation of property owners to pay tax upon its sale if it was in their possession for less than the established temporary minimum - 5 years. But, if the real estate being sold was received by inheritance, as a gift from a relative, or privatized, then the minimum tenure is 3 years. You can receive a tax deduction if the minimum period of ownership has not expired when selling:

- housing (in the amount of income received not exceeding 1,000,000 rubles);

- other property (in the amount of income not exceeding 250,000 rubles).

Period and limit for provision of standard deductions

Standard personal tax deductions have no limits and are provided until conditions change, and therefore are eligible for as long as the taxpayer works. As for deductions for children , they are allowed to be used only until the month until the taxpayer’s income exceeds 350 thousand rubles.

When a month comes in which earnings exceed the specified limit, the deduction automatically ceases to be provided. The tax deduction for children can be used only until the month in which the taxpayer exceeds the official income of 350,000 rubles!

You can start using the standard deduction for yourself from the month when you submit the document according to which it is allowed. The deduction for a child begins from the month when he was born , was adopted into a family or began education, and ends in December of the year when the child reached 18 or 24 years of age , and if he graduated before the age of 24, in the last month of study.

The two types of standard deductions - for yourself and for children - are not related to each other and are provided simultaneously if you are eligible for them. In addition, deductions for children are also not linked and are provided for each individual child.

Deductions that were not provided last year for any reason cannot be carried over to the current year . If an error related to not providing a deduction in the current year was also discovered in the same year, a deduction can be provided taking into account the identified violation. This is due to the fact that personal income tax is calculated on an accrual basis from the beginning of the year, that is, every month the tax is calculated taking into account the total tax base, deductions provided and previously calculated tax amounts.

Professional deductions for personal income tax

Similar deductions are provided for individuals (not entrepreneurs!) engaged in performing work (services) under GPC agreements, i.e.:

- providing services under contract agreements;

- inventors;

- authors of literary works, etc.

In order to take advantage of the deduction, an individual must submit an application to the tax agent who paid the income. If this is not possible, then at the end of the year you must submit an income tax return (3-NDFL) to the Federal Tax Service. Deductions provided for in Art. 221 of the Tax Code of the Russian Federation are determined in the amount of actual expenses, and if it is impossible to confirm expenses - according to standards from 20 to 40% of the amount of accrued income.

How and for what you can get a tax deduction

We all know that the economy of the Russian Federation is undergoing significant changes, and not for the better. There is a factor of rapid inflation, the number of unemployed is growing, wages are not increasing, and therefore, without financial incentives from the government, such important aspects as buying a home or studying become intractable. The main condition for receiving benefits is one.

A citizen must officially work and have a transparent income. If you receive your salary in an envelope, the employer does not transfer UTII, and therefore there is simply no right to deduction.

Formation of tax deduction

According to the current tax code, almost all income received by citizens is taxed at the approved rate, which in 2021 is at least 13 percent. Let’s take a closer look at what exactly this income is:

- Wages received by an employee at the employer's cash desk;

- Almost all financial income from private teaching, as well as any other type of paid consultations;

- The tax is levied on income received by the owner of residential or non-residential premises from renting it out. The same applies to movable property, such as cars and motorcycles;

- A person is obliged to pay tax after the sale of real estate owned for less than 3 years from the date of its acquisition, etc.

What you can get a tax deduction for: list in 2021

List of tax deductions in 2021

If we use a clear definition, then this deduction is an amount on which you can avoid paying a tax of 13 percent. Currently there are five types of tax deductions:

- The standard deduction in 2021 is a fixed amount calculated regardless of the person's income and can be provided monthly;

- Social deduction is provided only in certain cases. For example, if funds are required for education or for the education of children. Also, a benefit can be obtained if money is needed for treatment, not only for yourself, but also for close relatives. If you decide to engage in charity, also feel free to count on such a deduction. Do not think that the benefit has no limits on the amount. The maximum deduction, and for treatment and education cannot exceed more than 120,000 rubles. There are, of course, exceptions, but you will have to provide evidence that the treatment is expensive.

- Next comes the already familiar property deduction for many citizens. Since 2001, the government has made certain adjustments to the legislative framework, and now happy owners of real estate can take advantage of this type of tax deduction and get back a certain part of the money spent.

- The professional deduction is available only to certain categories of citizens, including individual entrepreneurs who paid taxes at a rate of 13 percent. Also, this type of deduction may be available to lawyers and teachers engaged in private practice on the basis of received permits. Authors of books who receive monetary compensation for their works, etc.

A property deduction is provided only if you have purchased a finished apartment, a private house, or a room in a communal apartment.

And also for those who use a bank mortgage, part of the interest paid can be returned. In order to receive a tax deduction in 2021, the applicant will have to submit to the tax office the main document or documents indicating what exactly the money was spent on. If this is the purchase of housing, you will need a certificate of its registration with the authorized body. Payment will be made exclusively to the owner of the real estate. Also, a citizen can prepare a list of receipts confirming monetary expenses for training or treatment.

Documents required to apply for benefits

To receive a deduction, you should prepare in advance for this rather complex and time-consuming process. You will need a significant number of documents, but getting them will not be difficult. Let's look at their main list:

- A document confirming the identity of the applicant. As a rule, this is a valid passport of a citizen of the Russian Federation with a mark of registration at the place of residence;

- You will need a certificate of income, which can be obtained from the human resources department of your organization;

- The main purchase and sale agreement, which records the fact of transfer of real estate, or a registration certificate;

- The statement itself is of a standard form stating that you are asking for the appropriate deduction.

When sending documents to the tax office by registered mail, the refund is delayed. In addition, if a flaw or error is found in the package, you will be notified about it in a few weeks, or even months.

Investment tax deduction for personal income tax in 2021

With this new type of deduction, the state stimulates the activity of citizens in investment activities. It is provided upon redemption of securities traded on the market that were owned by the payer for more than 3 years and on the profits from which he paid tax. The deduction can be issued by a tax agent or when submitting a tax return for 2021 to the Federal Tax Service.

Art. 219.1 provides for the conditions for receiving an annual deduction:

- possession of an IIS (individual investment account) for at least 3 years;

- funds were invested in the development of the domestic securities market;

- preferential profit does not exceed RUB 3,000,000.

This norm has been in effect since 01/01/2014, i.e. in 2021, investors received the right to issue a refund of the funds spent. The investment deduction is calculated taking into account the amount of funds contributed to the IIS for the year, but in an amount not exceeding 400,000 rubles.

It is important to remember that an individual has the right to own only one transaction account and must confirm this fact in writing to the broker.

Deduction for yourself

Some adults are entitled to a deduction of 500 ₽ or 3,000 ₽. The amount depends on which benefit category the employee belongs to. Among them are disabled people who suffered from the Chernobyl disaster, participants in military operations, heroes of Russia and many others. All categories can be viewed in paragraphs. 1 and 2 paragraphs 1 art. 218 Tax Code of the Russian Federation.

To receive a deduction, the employee brings an application and documents confirming his right to the deduction.

Such deductions cannot be added and used at the same time. If an employee is entitled to several standard deductions, provide one of them - the maximum. But there is no income limit - provide deductions for yourself regardless of the amount of income received.