Meaning of 40 accounts for accounting

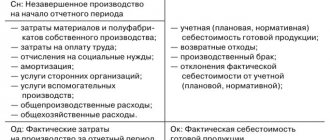

40 account is intended to summarize information about the goods released during the reporting period, as well as to assess the emerging deviations between the standard and actual cost of goods produced.

In order to estimate the real value of the cost, the following information is used:

- information about the semi-finished products and materials used;

- data on costs for services or work of third-party enterprises;

- data on wage costs for workers engaged in production;

- information on fuel costs;

- indicators on the costs of maintaining premises allocated for production activities.

The planned cost of manufactured products for a future period can be calculated using average consumption indicators or data on a similar product produced in the previous period as a basis.

Example of closing account 40 (Savings)

During the month, finished products were produced in the amount of 200,000 rubles at standard costs. The actual cost turned out to be 150,000 rubles. All finished products were sold for 400,000 rubles, + 20% VAT. Reflect in postings.

- Debit 43 Credit 40-200,000 rubles - Finished products were produced at standard prices.

- Debit 62 Credit 90-1-480,000 rubles (400,000*1.2) - Sales proceeds

- Debit 90 Credit 68/VAT-80,000 rubles (480,000-400,000) -VAT charged on sales.

- Debit 90 Credit 43- 200,000 rubles - Finished products written off at standard price

- Debit 51 Credit 62-480,000 rubles - The buyer paid for the products.

- Debit 40 Credit 20-150,000 rubles - The actual cost of manufactured finished products is written off.

- Debit 90 Credit 40-50,000 rubles (minus) (150,000-200,000) - Savings reversed (actual cost is less than accounting cost) posting is made on the last day of the month.

If you are in doubt about which entry to record savings or overexpenditure, then take the turnover on debit 40 of the account minus credit turnover, if the amount is plus then it will be an overexpenditure debit 90 credit 40, if the amount is minus then you need to write off the savings debit 90 Credit 40 Reversal with a minus

Standard accounting entries

Standard accounting entries for item 40 look like this:

— Dt 40

Kt 20 – write-off of actual costs to the initial cost of the finished product;

— Dt 40

Kt 20 – transfer of finished goods to the warehouse at standard or actual cost;

— Dt 40

Kt 23 – write-off of the actual cost of finished products;

— Dt 40

Kt 79 – production of finished products;

— Dt 43

Kt 40 – accounting of manufactured products at standard initial cost.

Example of closing account 40 (overspending)

During the month, finished products were produced in the amount of 200,000 rubles at standard costs. The actual cost turned out to be 250,000 rubles. All finished products were sold for 400,000 rubles, + 20% VAT. Reflect in postings.

- Debit 43 Credit 40-200,000 rubles - Finished products were produced at standard prices.

- Debit 62 Credit 90-1-480,000 rubles (400,000*1.2) - Sales proceeds

- Debit 90 Credit 68/VAT-80,000 rubles (480,000-400,000) -VAT charged on sales.

- Debit 90 Credit 43- 200,000 rubles - Finished products written off at standard price

- Debit 51 Credit 62-480,000 rubles - The buyer paid for the products.

- Debit 40 Credit 20-250,000 rubles - The actual cost of manufactured finished products is written off.

- Debit 90 Credit 40-50,000 (250,000-200,000) - At the end of the month, overspending is written off (the actual price is more than the standard price).

If you are in doubt about which entry to record savings or overexpenditure, then take the turnover on debit 40 of the account minus credit turnover, if the amount is plus then it will be an overexpenditure debit 90 credit 40, if the amount is minus then you need to write off the savings debit 90 Credit 40 Reversal with a minus

Analytical monitoring

The main purpose of using the 40th account in accounting is to evaluate data on the normative and actual SS, which is necessary for making appropriate management decisions designed to ensure the efficient use of the resources of any company.

Saved resources, when a credit balance remains on account 40 at the end of the reporting period, must be reversed by Dt 90 position. If there is a debit balance, i.e. there is an overexpenditure of resources, it is written off to the debit part 90 of the account.

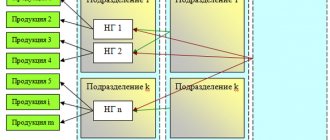

Such a comparison of data is observed, as a rule, in those companies where there are a huge number of product groups, and therefore the assessment of indicators is carried out in the context of structural divisions or product names.

Account 40 “Output of products (works, services)” in the new chart of accounts

In this material, which continues the series of publications devoted to the new chart of accounts, an analysis of account 40 “Output of products (works, Balt-Audit-Expert”) was carried out.

| [td] Account 40 “Output of products (works, Output of products (works, Main production”), 23 “Auxiliary productions”, 29 “Service productions and facilities”). According to the credit of account 40 “Product output (works, finished products”, 90 “Sales”, etc.). By comparing debit and credit turnover on account 40 “Product output (works, Product output (works, Sales”). Overexpenditure, i.e., the excess of actual cost over the standard (planned) cost, is written off from account 40 “Product output (works, Sales”) additional recording. Account 40 “Output of products (works, Output of finished products (works, Output of products (works, Main production)”) we saw that the accountant must make a choice:

|

Product cost accounting

The cost of a manufactured product is accounted for using the selling price, as well as planned and actual costs.

The following wiring can be used:

- Dt 43 Kt 40 - operations for the receipt of products in warehouses;

- Dt 40 Kt 20 - accounting for the actual total cost;

- Dt 62 Kt 90-1 - accounting for revenue from the sale of goods;

- Dt 90-2 Kt 43 - planned cost of products sold;

- Dt 90-3 Kt 68 VAT - calculation of value added tax on the sale of goods;

- Dt 51 Kt 62 - crediting funds from the consumer as payment for the sale of products;

- Dt 90-2 Kt 40 - a reflection of the difference between the actual cost and the planned cost;

- Dt 90-9 Kt 99 - accounting for income received at the end of the month.

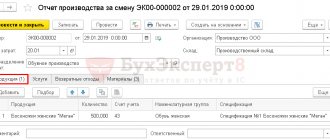

Transactions are reflected on the basis of the following documents:

- act on the release of manufactured products at the enterprise;

- waybill;

- invoices;

- bank statement;

- accounting settlement certificate;

- balance sheet.

Using account 40 for cost planning

The need for account 40 in accounting is associated with the need to determine the cost of finished products (hereinafter referred to as the CGP) in real time.

A significant part of the costs can be taken into account only at the end of the month. These are wages with accruals, costs for energy supply, various periodic services of third-party organizations (for example, information and consulting services, communication services), etc. Consequently, the actual SGP can be accurately determined only once a month. And if we are talking about production with a large range and a short production cycle (substantially less than a month), then taking into account costs only in fact can be very inconvenient. Indeed, in this case, finished products have to be released to the warehouse almost every day.

Therefore, the transferred products need to be evaluated somehow. In this situation, intermediate account 40 is used. During the month, the transferred products are accounted for there according to the planned SGP. Then, when complete data for the period is received, deviations between plan and actual are taken into account.

The use of this account, at first glance, complicates accounting, since the number of transactions increases. But in fact, its use allows you to establish the rhythmic work of accounting services and makes it possible to receive timely information about production and inventory. In order for this information to reflect the real state of affairs, it is necessary to plan costs as accurately as possible.

Accounting for sold products and warehouse balances

If at the beginning of the month there were balances of finished goods, then the following entries are indicated in the balance sheet:

- Dt 20 Kt 10.70, 69, 25, 26 - about the costs of production, according to limit cards, payroll statements, invoices, acts of services rendered.

- Dt 40 Kt 20 - on accounting for the real total cost of manufactured products, in accordance with cost calculation;

- Dt 43 Kt 40 - development of finished goods in warehouses on the basis of product release certificates;

- Dt 90-2 Kt 43 - on the planned cost of products sold, indicated in the general list of costs, using full cost calculation;

- Dt 90-2 Kt 40 - a reflection of the amount of the existing overexpenditure relative to the real and planned cost, referring to the accounting statement.