General rules for calculating property tax advances

The procedure for calculating and paying property tax for organizations is regulated by Chapter 30 of the Tax Code of the Russian Federation.

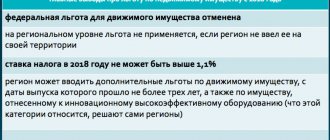

In general, the object of taxation is movable and immovable property, recorded on the balance sheet as fixed assets.

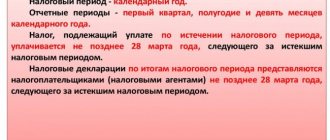

The tax period is the calendar year, and the reporting period is periods that are multiples of a quarter.

Before you begin calculating your advance property tax payment for the 3rd quarter of 2021, you should do the following:

- Check whether you need to make this calculation at all. The Tax Code gives the authorities of the constituent entities of the Russian Federation the right to cancel advance payments for property tax both in the region as a whole and for certain categories of taxpayers (clause 3 of Article 379, clause 6 of Article 382 of the Tax Code of the Russian Federation).

- Specify the category of property. For some types of objects, the tax base is determined in a special manner (based on cadastral value).

- Consider the location of objects. If they are located in territories under the jurisdiction of different Federal Tax Service Inspectors, then they should be “segregated” into different reports.

Also see “Calculation of advance payment on property for 2 sq.m. 2021."

Deadlines for transferring property taxes

By introducing unambiguous reporting deadlines for all regions without exception, the Tax Code of the Russian Federation nevertheless does not in any way limit the regions in determining payment deadlines. And the subject of the Russian Federation, when establishing them, can choose any landmarks (clause 1 of Article 6.1 of the Tax Code of the Russian Federation):

- specific date;

- a time period of a certain length, indicated either in calendar or working days and counted, for example, from the date of submission of reports or some other event.

The amounts of accrued advances will be taken into account when calculating the value of the tax due for payment at the end of the year. The deadlines for making payments on advances (as well as for paying taxes at the end of the year) in this case must be specified in the regulatory act of the region.

Check the deadlines for your region on the Federal Tax Service website. For companies affected by the coronavirus, the deadline for paying the advance payment for the 1st quarter has been extended, and the payment for the 2nd quarter has been cancelled.

Failure to divide the year into reporting periods leads to the fact that tax accrual in the subject is done only once per year at the end of the year in the final declaration. The amount of tax payable in this case will be formed in full without reduction for advances. For such a situation, the law of the region must necessarily contain a provision on the non-establishment of reporting periods. The payment deadline will be specified only for the final (annual) tax amount.

For information about the specifics of entering data into the current tax return form, see the material “Nuances of filling out a property tax return .

The article “BCC of property tax in 2020” will tell you which BCC you need to indicate when paying property tax.

Calculation of advance payments for property tax depending on the category of objects

The procedure for calculating property tax based on the cadastral value is determined by Art. 378.2 Tax Code of the Russian Federation. This method is used to calculate tax for the following objects:

- Business or shopping centers (complexes) and premises inside them. These objects must satisfy the following conditions:

– the permitted use of the land plot under the building involves the placement of office buildings or retail facilities;

– at least 20% of the building’s area must have permitted use as office or retail premises, public catering and consumer services, or actually be used for these purposes.

- Separate non-residential premises that are permitted to be used for offices, trade, consumer services or public catering, or that are actually used for these purposes.

- Real estate objects of foreign organizations not related to work through permanent representative offices.

- Residential buildings and premises that are not included on the balance sheet as fixed assets.

A specific list of “office” and “retail” objects for which property tax is calculated on the basis of cadastral value is determined by the regional authorities at the beginning of each tax period (clause 7 of Article 378.2 of the Tax Code of the Russian Federation).

The advance payment of property tax for the 3rd quarter of 2018 in relation to such objects is determined as 1/4 of their total cadastral value as of 01/01/2018, multiplied by the corresponding tax rate (clause 1, clause 12, article 378.2 of the Tax Code of the Russian Federation).

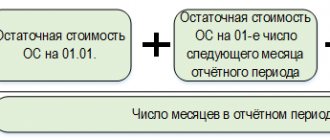

The tax base for all other taxable objects, except for “cadastral” ones, is determined on the basis of their value according to accounting data. The base for 9 months of 2021 is calculated as the sum of the values of the residual value at the beginning of each month, from January to October, divided by 10. The amount of the advance payment will be equal to ¼ of the product of the tax base by the rate established for this category of objects (clause 4 of Art. 382 of the Tax Code of the Russian Federation).

Example.

Alpha LLC owns office space. Its cadastral value at the beginning of 2021 is KS = 10,000 thousand rubles. The residual value of other objects subject to property tax for 9 months of 2021 was:

| date | Residual value, thousand rubles. |

| 01.01.18 | 5 000 |

| 01.02.18 | 4 900 |

| 01.03.18 | 4 800 |

| 01.04.18 | 4 700 |

| 01.05.18 | 4 600 |

| 01.06.18 | 4 500 |

| 01.07.18 | 4 400 |

| 01.08.18 | 4 300 |

| 01.09.18 | 4 200 |

| 01.10.18 | 4 100 |

The tax rate for objects taxed at cadastral value is C1 = 1.5%, for other taxable property – C2 = 2.2%. The company does not benefit from property tax benefits.

The advance payment for the 3rd quarter of 2021 for “cadastral” objects will be:

APk = ¼ x KS x C1 = ¼ x 10,000 x 1.5% = 37.5 thousand rubles.

Advance payment on objects taxed at average cost:

APs = ¼ x SS x C2,

where CC is the average residual value of objects for the period

CC = (5,000 + 4,900 + 4,800 + 4,700 + 4,600 + 4,500 + 4,400 + 4,300 + 4,200 + 4,100) /10 = 4,550 thousand rubles.

APs = ¼ x 4,550 x 2.2% = 25.025 thousand rubles.

The total amount of the advance payment of Alpha LLC for property tax for the 3rd quarter of 2021 will be:

AP = APk + APs = 37.5 + 25.025 = 62.525 thousand rubles.

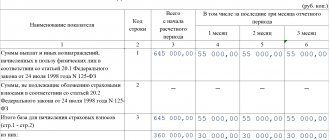

A sample of filling out the calculation based on the example data can be downloaded here.

Do I need to submit a report in 2021?

As of January 2021, the report in KND form 1152028 has been cancelled. The Federal Tax Service accepts only the annual property tax return - until March 30 of the next tax period (clause 3 of Article 386 of the Tax Code of the Russian Federation).

Regional authorities establish an obligation for taxpayers to pay a quarterly property advance. The rules for calculating advance payments in 2021 have changed: the contribution is calculated based on the changed cadastral value of the property.

IMPORTANT!

The property tax return for the 3rd quarter of 2020 has not been submitted. Taxpayers report to the territorial Federal Tax Service on other mandatory contributions.

Tax reporting deadlines for the 3rd quarter of 2021:

- VAT - until October 26, 2020. Details are in the article “VAT reporting in 2021”.

- Profit - until October 28, 2020. For details, see the article “Income Tax Declaration: Filling Out and Submitting.”

- Declaration on UTII - until 10.20.2020. The procedure for filling out is in the article “Tax return for UTII.”

- Simplified tax return - until October 20, 2020. The procedure for filling out is in the article “Unified (simplified) tax return: features of filling out.”

- 6-NDFL - until 02.11.2020. The rules are in the article “How to fill out form 6-NDFL. Complete Guide."

How not to miss important changes

Monitor changes in your work using ConsultantPlus. Set up a personalized profile and receive notifications about news and amendments as soon as they appear. Instructions in the system are updated immediately after changes and are always relevant. Try it free for 2 days!

Rules for filling out the calculation of the advance payment for property tax for the 3rd quarter of 2021.

The form for calculating advance payments for property tax and the Procedure for filling out (hereinafter referred to as the Procedure) were approved by order of the Federal Tax Service of the Russian Federation dated March 31, 2017 N MMV-7-21/

The calculation consists of the following sections:

- Title page.

- Section 1, containing information about the advance payment amounts to be transferred to the budget.

- Section 2, in which advance payments are calculated based on the average cost of objects.

- Section 2.1, which deciphers information about real estate objects subject to property tax based on their average value.

- Section 3, which provides information about objects taxed at cadastral value and the calculation of the advance payment for them.

Russian organizations and foreign companies operating through permanent missions must submit all calculation sheets. If there are no indicators, a dash is entered in the corresponding fields. In an abbreviated form (title page, section 1 and section 3), only foreign companies can submit calculations in relation to objects not related to activities through permanent establishments.

Let's look at the rules for filling out individual sheets in the order in which this happens in practice.

Results

The rules for applying property tax are largely influenced by the procedures established by each of the constituent entities of the Russian Federation. In particular, regions are given the right not to introduce reporting periods based on the results of which advances should be calculated and paid. If the reporting periods are not cancelled, then reports are submitted for them (within the deadline established by the Tax Code of the Russian Federation), containing the calculation of the advance payment to be paid.

About the features of paying property tax under the simplified tax system, read the material “How to pay property tax under the simplified tax system in 2019-2020?”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Title page

This section can be completed at the beginning of work on the report, with the exception of information on the number of sheets, because it depends on the number of objects whose data is included in the form.

The title page includes general information about the taxpayer:

- TIN and checkpoint codes. In the “KPP” field, you must indicate the code corresponding to the tax authority to which the report is being submitted. This may be a division of the Federal Tax Service at the place of registration of the organization itself, its separate division, or a taxable piece of real estate.

- Correction number. The number in this field indicates whether this report is the first “version” or contains updated data. For the primary form, “0 – -” is indicated in this field, then “1 – -”, “2 – -”, etc. The amended report must be submitted using the “old” form that was in force in the period for which the error was found.

- The reporting period code is indicated in accordance with Appendix 1 to the Procedure. For the 3rd quarter it is “18”.

- The reporting year is entered in a four-digit format, i.e. in this case – 2021.

- The tax authority code is indicated in accordance with the tax registration certificate.

- Calculation submission codes show why the form is submitted to this particular division of the Federal Tax Service. Codes are selected from Appendix 3 to the Procedure. In a “typical” situation, when a Russian organization provides a report at its location, code 214 is used.

- The full name of the organization is indicated in accordance with the constituent documents.

- The field “Reorganization form (code)” is filled in if the calculation is provided by the legal successor. Codes are selected from Appendix 2 to the Procedure. In this case, you must also fill in the “TIN/KPP of the reorganized organization” fields. They contain the codes that were originally assigned to the company.

- The contact phone number must include the country and city code and not contain spaces or other characters other than numbers.

- Number of pages of calculation and supporting documents.

- In the field “I confirm the accuracy and completeness of the information,” information about the responsible person who signed the calculation, his signature and the date of completion is entered. If the form is submitted by a representative, then the details of the power of attorney are indicated in the same field.

- The field “Information on provision of calculation” is filled in by an employee of the Federal Tax Service. It contains information about the method of submitting the form, the date of submission, the number of sheets, the registration number and the signature of the responsible person.

Section 2

This part of the form contains a calculation of the down payment on property for the 3rd quarter of 2021, for which the tax base is determined at the average cost.

Section 2 is filled out separately according to:

- Types of property in accordance with Appendix 5 to the Procedure.

- Separate divisions with a separate balance sheet.

- Locations of property according to OKTMO codes.

- Tax rates and tax benefits (except for benefits in the form of a reduction in the entire tax amount and a lower tax rate).

When completing section 2:

- Line 001 indicates the code of the type of property from Appendix 5 to the Procedure.

- Line 010 contains the OKTMO code by which the tax will be paid.

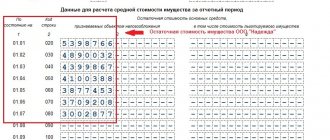

- Lines 020 – 110 include information about the residual value of the property as of the 1st day of each month from January to October 2018. In this case, column 3 contains the total cost of taxable objects, and column 4 – the cost of preferential property from column 3.

- Line 120 indicates the average cost of property for 9 months of 2021. It is determined by dividing by 10 the sum of the values of lines 020-110 in column 3.

- Line 130 has two parts. The first part contains a seven-digit tax benefit code in accordance with Appendix 6 to the Procedure. If the benefit is established by the law of a constituent entity of the Russian Federation in the form of a reduction in the tax rate (code 2012400) or a reduction in the total amount of tax (code 2012500), then line 130 is not filled in. For other regional tax benefits (code 2012000), the right side of the line is also filled in. It consistently indicates the article, paragraph and subparagraph of the relevant regional law. For each attribute, 4 positions are allocated; “extra” cells in each block are filled with zeros on the left. For example, pp. 3.3 clause 2 art. 11 of the law of the subject of the Russian Federation will be “coded” as follows: 0 0 1 1 0 0 0 2 0 3. 3

- Line 140 indicates the average value of non-taxable property for 9 months of 2021. It is calculated similarly to the average value of all property on page 120, only the data is taken not from column 3, but from column 4.

- Line 150 is filled in only if the taxable property is located on the territory of several constituent entities of the Russian Federation (property type code 02). This field contains the share of the book value of an object related to a given constituent entity of the Russian Federation.

- Line 160 is filled in if the law of a constituent entity of the Russian Federation establishes a tax benefit in the form of a rate reduction. The first part of the line indicates benefit code 2012400, and the second part contains data on the corresponding article of the regional law, similar to line 130.

- Line 170 indicates the tax rate taking into account the benefits provided

- Line 175 is filled in only if the object is public railway tracks or their integral parts (property type code - 09). In this case, the line will contain a reduction factor Kzd, which is determined in accordance with clause 2 of Art. 385.3 Tax Code of the Russian Federation.

- Line 180 contains the amount of the advance payment for property tax for the 3rd quarter of 2021. In the general case, the difference between the values of lines 120 and 140 is multiplied by the tax rate (line 170) and divided by 4. For railway facilities, the reduction coefficient Kzh from line 175 is additionally applied. For facilities located on the territory of several subjects, the tax amount is determined taking into account the share of the cost object (line 150).

- Line 190 is filled in only if the region has established a benefit in the form of a reduction in the amount of tax payable to the budget. First, the benefit code 2012500 is indicated, and then information about the norm of the regional law, similar to lines 130 and 160.

- Line 200 reflects the amount of this tax benefit.

- In line 210 you need to indicate the residual value of fixed assets as of 10/01/2018. The cost of objects not subject to tax on the basis of paragraphs. 1 – 7 p. 4 tbsp. 374 of the Tax Code of the Russian Federation, is not included in line 210.

Who submits the payment in the 3rd quarter of 2021

The rules for calculating and paying property tax and submitting reports on it are regulated by Chapter 30 of the Tax Code of the Russian Federation. Like the final reporting for the year, the declaration on advances on property for the 3rd quarter of 2019 is provided by those taxpayers who have property assets subject to mandatory taxation on their balance sheet (Article 374 of the Tax Code of the Russian Federation). Starting from 01/01/2019, only those legal entities that own real estate are reporting (letters of the Ministry of Finance No. 03-02-08/5904 dated 02/28/2013, No. 03-02-08/41 dated 04/17/2012). If there are no real estate assets on the balance sheet of the institution, then they do not provide reporting to the Federal Tax Service.

Individual entrepreneurs do not submit a report and do not transfer an advance payment on property to the budget for the 3rd quarter of 2021, since, as a general rule, payment of contributions for them is carried out on the basis of notifications from the territorial inspection.

Section 2.1

This section allows you to identify real estate objects that are taxed at their average cost. For each such object, a block of lines 010-050 is filled in, containing:

- Lines 010 and 020 indicate the cadastral and conditional number of the object, respectively (if any).

- Line 030 is filled in if there is no data on lines 010 and 020 and contains the inventory number of the object.

- Line 040 indicates the object code in accordance with the OKOF classifier.

- Line 050 contains information about the residual value of the object as of October 1, 2021.

If, as of 10/01/2018, the object was retired for any reason, then section 2.1 for it is not completed.

Objects of taxation for property tax

The object of taxation on the property of organizations is only the real estate of Russian enterprises, which is put on the balance sheet as fixed assets and accounted for in accounts 01 “Fixed assets” and 03 “Profitable investments in material assets” (clause 1 of article 374 of the Tax Code of the Russian Federation, clause 19 Article 2, paragraph 2 of Article 4 of the Law “On Amendments to Parts One and Two of the Tax Code of the Russian Federation” dated August 3, 2018 No. 302-FZ), with the exception of non-taxable and preferential property.

You can find out how an organization’s real estate is taxed with property tax in the ready-made solution “ConsultantPlus”. If you don't already have access to the system, get a free trial online.

Residential buildings and residential premises that are not registered as fixed assets are also subject to taxation. The list of real estate objects that are included in the tax base based on cadastral value is approved annually at the regional level.

An exception is property received under a concession agreement and taken into account on the balance sheet; property tax is paid on it (letter of the Ministry of Finance dated September 11, 2013 No. 03-05-05-01/37353).

Note! The tax on the above property is paid regardless of its use in business activities (letter of the Ministry of Finance dated December 17, 2015 No. 03-05-05-01/74010).

Section 3

This section contains both information about the “cadastral” objects themselves and the calculation of the amount of the advance payment for them.

- Line 001 contains the code of the type of property, in accordance with Appendix 5 to the Procedure.

- Line 010 contains the OKTMO code by which the tax is paid.

- Line 014 indicates the cadastral number of the building (structure).

- Line 015 contains the cadastral number of the premises, if cadastral registration has been carried out in respect of it.

- Line 020 indicates the cadastral value of the object. If we are talking about premises, the cost of which has not been determined, then the indicator of line 020 is calculated based on the cadastral value of the entire building and the share of the area of the premises given in line 035.

- Line 025 from line 020 separates out the tax-free cadastral value.

- Line 030 is filled in only if the object is in common ownership. It contains information about the taxpayer's share of the right to the object.

- Line 035 indicates the share of the premises' area in the total area of the building. It is filled in if the cadastral value of the premises has not been determined, but the value of the entire building is known.

- Line 040 consists of two parts. The first includes the tax benefit code from Appendix 6 to the Procedure. If the benefit is established by the law of a constituent entity of the Russian Federation in the form of a reduction in the tax rate (code 2012400) or a reduction in the total amount of tax (code 2012500), then line 130 is not filled in. For other regional tax benefits (code 2012000), the right side of the line is also filled in. An example of filling is given in paragraph 5 of the description of section 2.

- Line 050 is filled in if the taxable object is located on the territory of several constituent entities of the Russian Federation. Then the share of the cadastral value that relates to the part of the object located in a given region is entered in the field.

- Line 060 is filled in if the law of a constituent entity of the Russian Federation establishes a tax benefit in the form of a rate reduction. The left side of the field contains benefit code 2012400, and the right side contains details of the article of the regional law, similar to line 040.

- Line 070 contains the tax rate taking into account benefits (if any).

- Line 080 is used only if the object was owned by the taxpayer for part of the reporting period. The coefficient in this case is equal to the number of full months the object was owned, divided by 9.

- Line 90 indicates the amount of the advance payment. In general, this is ¼ of the difference between the values of lines 20 and 25, multiplied by the tax rate (line 070). If necessary, the payment amount is multiplied by additional adjustment factors from lines 030, 050 and 080.

- Line 100 is used if the law of the subject establishes a benefit in the form of a reduction in the amount of payment to the budget. First, the benefit code 2012500 is indicated, and then information about the norm of the regional law, similar to lines 040 and 060.

- Line 110 indicates the amount of the benefit.

Section 1

Completing this section completes the calculation. It contains information about the total amounts of advance payments for property tax payable to the budget.

A section consists of several blocks of lines. Each block indicates the amount of tax payable under a specific OKTMO code. In general, the section contains information about payments according to the codes of municipalities subordinate to the Federal Tax Service, to which the calculation is submitted.

- On line 010 the code OKTMO is indicated.

- Line 020 contains the BCC of the payment.

- Line 030 shows the amount of tax payable. It is calculated by summing the values from all sections 2 and 3 of the calculation for this OKTMO. From sections 2, the difference between lines 180 and 200 is taken, and from sections 3, the difference between lines 090 and 110. Thus, for each OKTMO, payments for all types of property minus benefits (if they are established in a given region) are grouped.

The information in section 1 is certified by the signature of the responsible person.

Where to submit an advance payment

Taxpayer organizations must provide an advance payment to the Federal Tax Service at the place of registration and location of property assets at the end of each reporting period. The largest organizations submit declarations and calculations strictly at the place of registration (Article 83 of the Tax Code of the Russian Federation).

The advance property tax report is sent electronically in specialized programs via telecommunication channels or submitted to the inspectorate on paper in person, through an authorized representative of the responsible person or by mail with a mandatory list of the package of documents sent. In electronic form, a report for advance payments of property tax for the 3rd quarter of 2021 is sent not only by enterprises classified as the largest, but also by taxpayers whose average number of employees is 100 people or more.