Methods of recording working hours

This is the period during which the work team performs duties. At the same time, he complies with the PVTR, as well as the requirements of the Labor Code of the Russian Federation.

Traditionally, enterprises and organizations adhere to the 5/2 regime. The number of hours in 5 days does not exceed 40. In a number of areas of work activity, a shift schedule or working day (part-time) is established.

The employer has the right to independently establish the operating hours of a particular company. He takes into account the specifics of her work. All details are documented. This is the schedule, time and specifics of the work.

Working hours are recorded in the form of a daily report maintained by the enterprise. It indicates the number of working hours worked by the person, and also specifies unforeseen circumstances. For this purpose, an output schedule is generated. This is a special document that reflects the information:

- number of shifts at night;

- hours beyond normal;

- certificates of incapacity for work;

- days off for hired personnel;

- business trips of employees.

REFERENCE: employers have the right to independently choose a methodology related to monitoring the work process, but in such a way that this does not occur in violation of the provisions of the Labor Code of the Russian Federation.

How do you pay

With a salary system, the employee receives a fixed amount in hand every month.

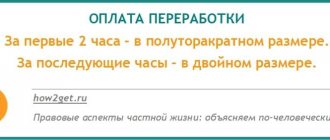

Overtime work with a salary is paid at an increased rate according to Art. 152 TK. It establishes the minimum sizes of increasing coefficients for payment. They are 1.5 in the first 2 hours and 2 for all subsequent hours. By agreement with employees, overtime pay may be higher, but not less than the legally established limits.

It is advisable to fix increased compensation in terms of overtime pay in a separate document, for example, a collective agreement.

To apply increasing coefficients, additional payment by hour is allowed according to the norm of working hours (in the production calendar) and according to the average number of working hours for the period (based on letter of the Ministry of Labor of Russia dated 2002 No. 1202-21).

The maximum working time that is paid overtime is 120 hours.

Article 152 of the Labor Code does not contain information about what amount should be taken into account. Therefore, employers first clarify whether they need to take into account only the salary or average earnings with bonuses and allowances. Often, when calculating overtime, managers take only double salary (tariff) without incentive payments and allowances. Overtime work is also determined taking into account bonuses, if the specified approach was adopted in the salary regulations.

With a shift schedule

Workers who are employed on a shift schedule can receive wages based on tariff rates or salary. Under a tariff system, the number of hours worked is multiplied by a certain rate. The overtime rate is determined separately.

The standard working day is 8 hours, and the weekly is 40 hours.

If a person works in shifts, then his working day can last 12 hours. A short day is being introduced for certain categories of workers. Then the length of their working week can be 24-36 hours. The employee will be able to find out the number of overtime days from the production calendar.

If, with daily accounting, overtime or overtime is recorded within one day, labor payment is calculated for each day of overtime, and overtime is transferred at the end of the month.

With piecework wages

Citizens on piecework pay receive a certain amount of earnings for each part produced. Payment in favor of such an employee depends on how many parts he produced during normal working hours , and how many during overtime work.

For example, an employee worked 5 hours overtime. In the first two hours she produced 20 parts, in the remaining three hours she produced another 33. For each part she was paid 200 rubles. The calculation taking into account one and a half and double rates will look like this:

- (200 * 1.5 * 20) +(200 * 2 * 33) = 6,000 + 13,200 = 19,200 rub.

When recording working hours in total

The employer is required to keep records of employees' working hours. Hours from the timesheet must be recalculated for the corresponding day. The exception is the summarized recording of working time, when calculations occur at the end of the accounting period.

Choosing a method for recording working time is a concern for managers. It is determined by the scope of the organization’s activities and must be enshrined in internal regulations. There are such forms of accounting as weekly, daily and summarized.

When recording working hours in aggregate, deviations from the norm can occur at the end of the day, week or month. The basic requirement is as follows: after the accounting period has expired, the employee must work a certain number of hours, according to the approved norm .

When recording working hours in aggregate, the overtime worked at the end of the accounting period must first be calculated, and then the amount of the additional payment must be determined. The first two hours will be paid at 1.5 times the rate, the rest of the time - at double rates.

When summarizing accounting for a period of more than a month, you need to determine the average cost of an hour for the period (for example, quarterly income for the quarter must be divided by the standard time). The calculation of overtime is based on the resulting cost of one hour.

Overtime payment for hourly wages depends on whether the organization has adopted summarized recording of working hours. The coefficients will be the same as for salary.

For example, an employee was given a tariff rate of 300 rubles per hour, subject to a five-day working week. In January 2021, the amount of overtime work was 6 hours. The organization has adopted a summarized accounting of working time with a monthly accounting period. The calculation will look like this:

(300 * 1.5 * 2) + (300 * 2 * 4) = 900 + 2,400 = 3,300 rub.

What is overtime work?

Overtime work according to the Labor Code of the Russian Federation is carried out at the initiative of the employer. It includes overtime in addition to the normal working hours and shifts.

Involvement of hired personnel in work is possible only with the consent of the person, in writing. In Art. 99, paragraph 3, the legislator listed cases when such a need arises:

- the work needs to be completed: the process was delayed due to technical problems;

- equipment restoration;

- replacing an employee: absent or ill.

Without the consent of employees, they can be involved in additional work, but only in extreme situations. For example, there was an accident at work, another emergency, a catastrophe, or circumstances of indefinable force.

Typically, overtime activities are performed before and after regular time. The condition for attracting a person to such work is the decision of his boss. If a citizen himself remains after a shift to finish his business, without proper registration, this is not considered activity beyond the norm. Delay at work for 2 or more hours is not paid. This provision follows from the Letter compiled by the Ministry of Labor in 2021 under N14-2/B-149.

Regular work without additional hours on a holiday or a day off also cannot be considered overtime. These days are paid according to Art. 152, part 3 of the Labor Code of the Russian Federation.

Overtime is limited by the Labor Code of the Russian Federation. For example, it cannot exceed four hours in total for 2 days in a row, or 120 hours over 12 months. For example, a person was late for 3 hours on Monday. On Tuesday he cannot work more than 1 hour after the end of the working day.

REFERENCE: Involvement in additional work beyond that established is legal and without the desire of the person. The provision of the Labor Code of the Russian Federation is established by Art. 99, part 3.

Payment of overtime hours for piecework wages.

The Labor Code does not contain the concept of “part-time work”

Labor Code of the Russian Federation, Article 99. Overtime work

“Overtime work is work performed by an employee at the initiative of the employer outside the working hours established for the employee: daily work (shift), and in the case of cumulative accounting of working hours - in excess of the normal number of working hours for the accounting period.

“”An employer’s involvement of an employee in overtime work is permitted with his written consent in the following cases:

""1) if necessary, perform (finish) work that has begun, which, due to an unforeseen delay due to technical production conditions, could not be completed (finished) during the working hours established for the employee, if failure to complete (unfinished) this work may lead to damage or destruction of the employer's property (including property of third parties located at the employer, if the employer is responsible for the safety of this property), state or municipal property, or create a threat to the life and health of people;

2) when carrying out temporary work on the repair and restoration of mechanisms or structures in cases where their malfunction may cause the cessation of work for a significant number of workers;

""3) to continue work if the replacement employee fails to appear, if the work does not allow a break. In these cases, the employer is obliged to immediately take measures to replace the shift worker with another employee.

“”Involving an employee in overtime work by an employer without his consent is permitted in the following cases:

""1) when carrying out work necessary to prevent a catastrophe, industrial accident or eliminate the consequences of a catastrophe, industrial accident or natural disaster;

2) when carrying out socially necessary work to eliminate unforeseen circumstances that disrupt the normal functioning of centralized hot water supply, cold water supply and (or) sewerage systems, gas supply systems, heat supply, lighting, transport, communications;

""3) when carrying out work the need for which is due to the introduction of a state of emergency or martial law, as well as urgent work in emergency circumstances, that is, in the event of a disaster or threat of disaster (fires, floods, famine, earthquakes, epidemics or epizootics) and in other cases that threaten the life or normal living conditions of the entire population or part of it.

“In other cases, involvement in overtime work is permitted with the written consent of the employee and taking into account the opinion of the elected body of the primary trade union organization.

“” It is not allowed to involve pregnant women, workers under the age of eighteen, and other categories of workers in overtime work in accordance with this Code and other federal laws. Involvement of disabled people and women with children under three years of age in overtime work is allowed only with their written consent and provided that this is not prohibited for them due to health reasons in accordance with a medical report issued in the manner established by federal laws and other regulations legal acts of the Russian Federation. At the same time, disabled people and women with children under three years of age must be informed of their right to refuse overtime work upon signature.

“The duration of overtime work should not exceed 4 hours for each employee for two consecutive days and 120 hours per year.

“The employer is obliged to ensure accurate recording of the duration of overtime work for each employee.

Labor Code of the Russian Federation, Article 152. Payment for overtime work

“Overtime work is paid for the first two hours of work at least one and a half times the rate, for subsequent hours - at least double the rate. Specific amounts of payment for overtime work may be determined by a collective agreement, local regulations or an employment contract. At the request of the employee, overtime work, instead of increased pay, can be compensated by providing additional rest time, but not less than the time worked overtime.

Overtime work with the consent of the employee

Processing according to the Labor Code occurs with the consent of the employee. It is important to document this fact. There are 2 options:

- The employee agrees by signing the order for overtime work.

- The citizen draws up a corresponding application and addresses it to the head of the company. There is no strict, unified application form: it is written randomly, by hand.

Overtime at work is established by the Labor Code. In particular, the law in Art. 99, part 2 defines situations when people are involved in working overtime:

- There is a need to perform, complete certain work that could not be done due to objective reasons (for example, technical). Failure to complete the work has adverse consequences for the company. For example, death, damage to property, threat to human life.

- Work of a temporary nature associated with the repair work of mechanisms, their restoration in cases where their downtime will cause workers to be unemployed.

- Production at the enterprise does not allow interruptions: a person who does not show up for work must be replaced.

REFERENCE: the boss is obliged to familiarize certain categories of employees who have the right to refuse such work against signature.

Important condition

The calculation of overtime 2021 should be carried out taking into account the key condition. Thus, any employee who was involved in work beyond the norm has the right to demand additional rest time. For example, work outside the norm is 3 hours, therefore, the employee can take these same hours in a future period for rest. For example, coming to work three hours late the next day after working extra hours.

If a specialist applies for additional rest, then the additional payment for overtime will have to be calculated differently; in this case, payment is made in a single amount. So, how to act in this situation:

| Condition for additional rest time | How to count, or recycling calculator |

| The employee decided to take time off from work, that is, the rest was provided. | Overtime work will be paid at a single rate. Calculate payment as if the employee worked during normal working hours. But rest time taken in exchange for overtime work does not need to be paid. |

| The employee refused to rest, that is, no rest was provided. | Overtime pay in this case is charged at an increased rate. So, for the first two hours of overtime, charge an additional payment in one and a half equivalent of the standard rate, official salary or tariff. For subsequent hours of work in excess of the standard, charge an increase of at least double the amount. Let us recall that the organization has the right to provide higher rates of additional payments for work above the norm. For example, the collective agreement states: payment for overtime 2021 for the first 2 hours is double, for subsequent hours of work - triple. |

It is worth noting that the institution sets increased surcharge rates for work above the norm, above the legal minimum, based on the economic potential and financial capabilities of the subject.

Please note that an application for rest must be received from the employee in the month in which overtime work occurred.

Overtime work without the employee's consent

Art. 88, part 3 establishes that in extreme cases an employee is required to work overtime:

- Prevention of accidents, disasters, elimination of their consequences.

- Elimination of the consequences of an accident at the enterprise.

- Elimination of circumstances under which engineering systems, transport, and communications stopped working.

- Martial law has been introduced throughout the country, cases that threaten the life and health of people (fires, tornadoes, floods, etc.).

What does overtime mean? These are a person’s working hours, which are summed up when he is at his place of work after the end of the day or shift.

REFERENCE: in these situations, the consent of the trade union body is not required. Refusal to perform work entails drawing up a special act. The employee is subject to disciplinary liability.

Who should not be required to work overtime?

According to the provisions of the Labor Code of the Russian Federation, certain categories of employees cannot be involved in overtime work:

- pregnant women (Article 99);

- minor citizens (under 18 years of age);

- certain categories of employees (Article 268, the list is prescribed by the Decree of the Russian Government in 2007, N252);

- Art. 348.8, part 3 of the Labor Code of the Russian Federation: athletes, if the provision on not involving this category is spelled out in the collective regulations, in local acts;

- employees of the enterprise, if a student agreement is in force (Article 203, Part 3);

- other workers whose restrictions are usually prescribed by medical requirements: for example, drivers due to health conditions.

Current standards

So, if an employee was involved in work in his free time, then for this period he is entitled to an increased payment.

In accordance with Article 152 of the Labor Code of the Russian Federation, overtime work is paid at one and a half times the rate if its duration is up to 2 hours, and at a rate of two times for the rest of the work time. In simple words, if an employee was asked to stay at the workplace after the end of the working day, then for the first two hours he will be paid 1.5 times the amount. And if a specialist has to work for more than two hours, then for the remaining time exceeding a two-hour interval, the employer is obliged to make payments twice as much.

IMPORTANT!

Legislation sets minimum values. Thus, overtime work and its payment are not limited by the provisions of the Labor Code of the Russian Federation. Consequently, employers have the right to set higher coefficients. Such a decision must be enshrined in the wage regulations, collective agreement, and labor agreement.

Please note that specialists with irregular work hours are not eligible for increased payments. For such categories of workers, a different type of compensation is provided: additional days to the next vacation.

Special procedure for recruitment

- The employee's consent in writing.

- There are no contraindications to overtime work due to medical requirements.

- Informing employees that they have the right to refuse an offer made by the employer regarding overtime work (Article 99, Part 5, 259, 264):

- single mothers or fathers with children under 5 years of age;

- persons with disabilities;

- employees raising children with disabilities, caring for family members for medical reasons;

- women with children under 3 years of age, guardians of children under 18 years of age.

How to determine the amount of overtime work?

What is the maximum duration of overtime work? According to Art. 91 of the Labor Code of the Russian Federation, working hours are 40 hours in 5 days. An employee may work beyond this time, but not more than 4 hours for two days in a row. 120 hours is the maximum for a year.

REFERENCE: the duration worked is reflected in a special document. This is an imperative requirement. The document is abbreviated as T-13.

With a shift schedule

Art. 103 of the Labor Code of the Russian Federation establishes that a shift schedule is work activity that is carried out in several shifts. The existence of the schedule is due to the continuity of the production process. If a shift worker works overtime, not on his shift, the day is paid double, or he is given a day off for this.

When recording working hours in total

Overtime work in accordance with the Code and with payment for cumulative working hours is calculated for the period established by the organization. This is a quarter, a year, and also a month.

Accounting is introduced to ensure that the length of time spent at work does not exceed the number of working hours. One week an employee may be at the workplace more than his normal hours, the next week - less. The employer will evaluate his working time after the end of the accounting period. This is a month, quarter or year.

With salary

Based on the provisions of Art. 153. According to the Labor Code of the Russian Federation, overtime work is paid according to the employee’s earnings per hour. For every 60 minutes of overtime, the employer pays one and a half or double the amount. For the calculation, the number of working hours per year is taken as an average. As a result, the average value for the year is displayed. But not the actual number of hours worked per month.

In addition, there is another payment option according to the salary. The actual working hours per month are taken into account. The salary is divided by a person’s work shift in a particular month.

What is included in overtime working time?

This depends on the form adopted by the enterprise for recording hours worked. She may be:

- daily - the standard hours of work are established for each working day;

- weekly - standard hours are considered as a week;

- summarized - to calculate the standard working time, a period of more than a week is taken - a month, a quarter, a maximum of a year (Article 104 of the Labor Code of the Russian Federation);

- shift - hours for a period are distributed into shifts that may exceed daily standards (Article 103 of the Labor Code of the Russian Federation).

Read more about working time tracking in the article “How to draw up a working time schedule?” .

IMPORTANT! The operating hours may not be standardized (Article 101 of the Labor Code of the Russian Federation). Then periodic involvement in work during hours when other employees are on rest is not considered overtime work.

Time worked in excess of the standard includes:

- daily - hours in excess of those set for the day;

- weekly - hours in excess of those established per week;

- summarized - hours in excess of the standard specified for the period; in this case, the calculation is made only at the end of the period;

- in shifts - the shift schedule is drawn up in such a way that it already includes processing in excess of the standard according to the production calendar.

Example 1

The cook works on a 2/2 schedule, 12 hour shift. According to the schedule, there are 15 shifts per month - 180 hours. There are 22 working days in a month, the standard hours according to the Labor Code are 176. That is, overtime is 4 hours.

Article 99 of the Labor Code of the Russian Federation: overtime work

Overtime work according to the Labor Code of the Russian Federation is performed only at the request of the employer. It includes overtime in addition to the traditional working day.

The involvement of hired personnel in work is possible only with their consent, expressed in writing. In Art. 99, paragraph 3, the legislator listed cases when there is a need to work overtime:

- the need to complete work that was delayed due to technical problems;

- work on the restoration of temporary equipment;

- replacing an employee.

REFERENCE: without a person’s consent, he can be required to work additional hours. Overtime work cannot exceed 4 hours on two consecutive days.

Working hours: what the labor code says about overtime

Labor legislation establishes such a concept as the normal duration of labor activity. It cannot exceed forty hours a week . Depending on the individual characteristics of each specific subject, daily norms are established. So, in some cases they are 8 hours.

Overtime work is all work that goes beyond the above limits both per day and per week.

It must be paid, otherwise the employee has the right to go to court for appropriate compensation and refuse overtime.