Legislative framework for transport tax

The basics of the transport tax are established in Chapter.

28 Tax Code of the Russian Federation. But being a regional tax, it is largely dependent on decisions made regarding it at the regional level. Regions are given the right to establish:

- Benefits.

Tax benefits are established in different forms. ConsultanPlus experts spoke in detail about all the varieties, and also suggested where to look for information in your region. Get trial access to K+ for free and go to the Ready-made solution.

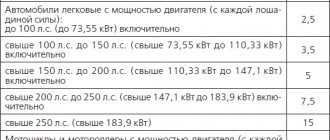

- Rates with the possibility of increasing or decreasing them, splitting them, or linking them to the year of manufacture or the environmental class of the vehicle. There is a limit for bets on cars with a power of more than 150 hp. pp.: they change no more than 10 times compared to those given in the Tax Code of the Russian Federation. If a region has not established rates, those specified in the Tax Code of the Russian Federation are subject to application there.

- Procedure and deadlines for tax payment by legal entities.

Find out how the procedure and terms for paying TN by companies have changed here.

Most regions of the Russian Federation have adopted corresponding laws. Each of them used their rights in their own way to clarify the procedure for applying transport tax, which is why there are significant differences in all 3 parameters in different regions. They are the largest in terms of bet values.

Important! Hint from ConsultantPlus If your region has not established its own rates, calculate the tax according to... (for more details, see K+).

From time to time, regions adjust their tax rates by amending the relevant laws. Changes can be of various kinds - from the introduction or cancellation of benefits to the replacement of rates (one, several or all existing ones).

Most regions of the Russian Federation adhere to the policy of maintaining rates. But changes in rates nevertheless occur.

Tables of transport tax rates for some regions in 2021, 2020 and 2021 related to passenger vehicles are given in the following sections of our article. They clearly reflect both the variety of bets and the changes that have occurred with the onset of 2021. Rates are indicated in rubles.

Regions with moderate transport taxes

Motorists in the Caucasus and Siberia also pay a relatively small transport tax. For example, in Chechnya, Dagestan, North Ossetia, Tomsk region, Khakassia, Tyva, Yakutia and Kemerovo, rates for low-power vehicles do not exceed 8 rubles, and for vehicles up to 150 horsepower they are no more than 15 rubles per force.

Transport tax in different regions of Russia (rubles per year)

| Dagestan | Chechnya | Yakutia | Altai | Kemerovo | |

| Lada Granta (87 hp) | 696 | 609 | 696 | 870 | 696 |

| Skoda Octavia 1.4 (150 hp) | 1500 | 1650 | 1950 | 2100 | 2100 |

| Toyota Camry 2.5 (181 hp) | 6335 | 4344 | 3077 | 3620 | 8145 |

| Audi A6 45TFSI (245 hp) | 12 250 | 11 760 | 7350 | 11 025 | 16 660 |

| Mercedes-Benz G63 AMG (585 hp) | 61 425 | 53 235 | 35 100 | 70 200 | 78 975 |

Transport tax rates by region in 2021

| Region name | Passenger cars with engine power | |||||||

| No more than 100 l. With. (up to 73.55 kW) | More than 100 l. s., but not higher than 125 l. With. (more than 73.55 kW, but not higher than 91.94 kW) | More than 125 l. s., but not higher than 150 l. With. (more than 91.94 kW, but not higher than 110.33 kW) | More than 150 l. s., but not higher than 175 l. With. (more than 110.33 kW, but not higher than 128 kW) | More than 175 l. s., but not higher than 200 l. With. (more than 128.7 kW, but not higher than 147.1 kW) | More than 200 l. s., but not higher than 225 l. With. (more than 147.1 kW, but not more than 165.5 kW) | More than 225 l. s., but not higher than 250 l. With. (more than 165.5 kW, but not more than 183.9 kW) | More than 250 l. With. (more than 183.9 kW) | |

| Moscow | 12 | 25 | 35 | 45 | 50 | 65 | 75 | 150 |

| Saint Petersburg | 24 | 35 | 35 | 50 | 50 | 75 | 75 | 150 |

| Sevastopol | 5 | 7 | 7 | 25 | 25 | 75 | 75 | 100 |

| Amur region | 15 | 21 | 21 | 30 | 30 | 75 | 75 | 150 |

| Magadan Region | 7 | 10 | 10 | 15 | 15 | 23 | 23 | 45 |

| Smolensk region | 10 | 20 | 20 | 40 | 40 | 66 | 66 | 110 |

| Kamchatka Krai | 10 | 32 | 32 | 45 | 45 | 75 | 75 | 150 |

| Perm region | 25 | 30 | 30 | 50 | 50 | 58 | 58 | 58 |

| Nenets Autonomous Okrug | 10 | 15 | 15 | 25 | 25 | 30 | 30 | 50 |

| Tyva Republic | 7,7 | 12,1 | 12,1 | 29,7 | 29,7 | 50,6 | 50,6 | 107,8 |

| The Republic of Khakassia | 6 | 15 | 15 | 29 | 29 | 50 | 50 | 104 |

| Udmurt republic | 8 | 20 | 20 | 50 | 50 | 75 | 75 | 100 |

Increasing factor

Transport tax (2020) is calculated taking into account several characteristics, such as environmental class and date of issue. And when it comes to passenger cars, the calculations also use a so-called increasing factor, depending on the cost of the car. It is this coefficient, which greatly influences the 2021 transport tax, that must be taken into account. According to Federal Law No. 335-FZ dated November 27, 2017, when calculating the amount of the fee for passenger cars worth from 3 to 5 million rubles inclusive and not older than three years, a coefficient of 1.1 must be used.

Let us recall that previously three different coefficients were in effect:

- if the car was produced 2-3 years ago, the coefficient was 1.1;

- if the car is from 1 to 2 years old, the indicator is already 1.3;

- owners of cars less than 12 months old paid taking into account a coefficient of 1.5.

As you can see, the amendments do not allow for an increase in transport tax in 2021. On the contrary, some owners even benefit from them.

Transport tax rates by region for 2021

| Region name | Passenger cars with engine power | |||||||

| No more than 100 l. With. (up to 73.55 kW) | More than 100 l. s., but not higher than 125 l. With. (more than 73.55 kW, but not higher than 91.94 kW) | More than 125 l. s., but not higher than 150 l. With. (more than 91.94 kW, but not higher than 110.33 kW) | More than 150 l. s., but not higher than 175 l. With. (more than 110.33 kW, but not higher than 128 kW) | More than 175 l. s., but not higher than 200 l. With. (more than 128.7 kW, but not higher than 147.1 kW) | More than 200 l. s., but not higher than 225 l. With. (more than 147.1 kW, but not more than 165.5 kW) | More than 225 l. s., but not higher than 250 l. With. (more than 165.5 kW, but not more than 183.9 kW) | More than 250 l. With. (more than 183.9 kW) | |

| Moscow | 12 | 25 | 35 | 45 | 50 | 65 | 75 | 150 |

| Saint Petersburg | 24 | 35 | 35 | 50 | 50 | 75 | 75 | 150 |

| Sevastopol | 5 | 7 | 7 | 25 | 25 | 75 | 75 | 100 |

| Amur region | 15 | 21 | 21 | 30 | 30 | 75 | 75 | 150 |

| Magadan Region | 7 | 10 | 10 | 15 | 15 | 23 | 23 | 45 |

| Smolensk region | 10 | 20 | 20 | 40 | 40 | 70 | 70 | 150 |

| Kamchatka Krai | 10 | 22 | 22 | 36 | 36 | 67 | 67 | 150 |

| Perm region | 25 | 30 | 30 | 50 | 50 | 58 | 58 | 58 |

| Nenets Autonomous Okrug | 10 | 15 | 15 | 25 | 25 | 30 | 30 | 50 |

| Tyva Republic | 7,7 | 12,1 | 12,1 | 29,7 | 29,7 | 50,6 | 50,6 | 107,8 |

| The Republic of Khakassia | 6 | 15 | 15 | 29 | 29 | 50 | 50 | 104 |

| Udmurt republic | 8 | 20 | 20 | 50 | 50 | 75 | 75 | 100 |

Example

In October 2021, Leonov, who lives in the Novosibirsk region, bought a Lada 21051 car. In September 2021, he received a notification from the Federal Tax Service to pay transport tax. How to calculate transport tax?

The initial data is presented in the table.

| Power, hp | Duration of possession | The rate established for Novosibirsk and NSO in 2015-2016 (for vehicles with a capacity of up to 100 hp), rub. |

| 59 | Less than 1 year | 6 |

Solution Leonov needs to determine the category to which the transport belongs and the power. The information received must be compared with the rates in force in the Novosibirsk region in 2017. The calculation will be as follows: 59 × 6 × (3 / 12) = 88.5 rubles. Based on NSO Laws No. 280-OZ, No. 281-OZ, No. 370 and others, Leonov must pay transport tax for last year in the amount of 89 rubles.

This must be done no later than December 1, 2017. Also see “Deadline for payment of transport tax by individuals: a reminder for motorists.”

Transport tax rates by region in 2021

| Region name | Passenger cars with engine power | |||||||

| No more than 100 l. With. (up to 73.55 kW) | More than 100 l. s., but not higher than 125 l. With. (more than 73.55 kW, but not higher than 91.94 kW) | More than 125 l. s., but not higher than 150 l. With. (more than 91.94 kW, but not higher than 110.33 kW) | More than 150 l. s., but not higher than 175 l. With. (more than 110.33 kW, but not higher than 128 kW) | More than 175 l. s., but not higher than 200 l. With. (more than 128.7 kW, but not higher than 147.1 kW) | More than 200 l. s., but not higher than 225 l. With. (more than 147.1 kW, but not more than 165.5 kW) | More than 225 l. s., but not higher than 250 l. With. (more than 165.5 kW, but not more than 183.9 kW) | More than 250 l. With. (more than 183.9 kW) | |

| Moscow | 12 | 25 | 35 | 45 | 50 | 65 | 75 | 150 |

| Saint Petersburg | 24 | 35 | 35 | 50 | 50 | 75 | 75 | 150 |

| Sevastopol | 5 | 7 | 7 | 25 | 25 | 75 | 75 | 100 |

| Amur region | 15 | 21 | 21 | 30 | 30 | 75 | 75 | 150 |

| Magadan Region | 7 | 10 | 10 | 15 | 15 | 23 | 23 | 45 |

| Smolensk region | 10 | 20 | 20 | 40 | 40 | 66 | 66 | 110 |

| Kamchatka Krai | 10 | 32 | 32 | 45 | 45 | 75 | 75 | 150 |

| Perm region | 25 | 30 | 30 | 50 | 50 | 58 | 58 | 58 |

| Nenets Autonomous Okrug | 10 | 15 | 15 | 25 | 25 | 30 | 30 | 50 |

| Tyva Republic | 7,7 | 12,1 | 12,1 | 29,7 | 29,7 | 50,6 | 50,6 | 107,8 |

| The Republic of Khakassia | 6 | 15 | 15 | 29 | 29 | 50 | 50 | 104 |

| Udmurt republic | 8 | 20 | 20 | 50 | 50 | 75 | 75 | 100 |

Read more about the transport tax declaration in this section .

Updated rates by region

Transport tax 2021 for legal entities and citizens is calculated based on regional rates. At the same time, a transport tax rate has been introduced at the federal level in 2021, which officials from the constituent entities of the Russian Federation are required to follow. Local authorities are allowed to increase or decrease such indicative indicators by 10 times.

Below are transport tax rates by region in 2020 (table) for various types of vehicles (TS). This is a sample of some subjects and types of vehicles where rates have changed.

| Transport tax for 2020 | Cars (min-max), in rubles per 1 liter. With. | Buses (min-max), in rubles per 1 liter. With. | Trucks (min-max), in rubles per 1 liter. With. | Reason: regional law |

| In the Yaroslavl region | 31,1–145 | 42–70 | 25–73 | Yaroslavl region dated 05.11.2002 No. 71-z |

| In the Saratov region | 16–150 | 42–82 | 22–85 | Saratov region dated November 25, 2002 No. 109-ZSO |

| In St. Petersburg | 24–150 | 50–65 | 25–85 | St. Petersburg dated November 4, 2002 No. 487-53 |

| In the Vologda region | 25–150 | 40–60 | 25–85 | Vologda region dated November 15, 2002 No. 842-OZ |

| In the Oryol region | 15–150 | 50–100 | 25–85 | Oryol region dated November 26, 2002 No. 289-OZ |

| To Mari El | 25–150 | 50–100 | 25–85 | Republic of Mari El dated October 27, 2011 No. 59-Z |

| In Tatarstan | 10–150 | 50–100 | 25–85 | Republic of Tatarstan dated November 29, 2002 No. 24-ZRT |

| In Voronezh | 20–150 | 50–100 | 25–85 | Voronezh region dated December 27, 2002 No. 80-OZ |

| In the Perm region | 25–58 | 48 | 25–58 | Perm region dated December 25, 2015 No. 589-PK |

| In the Novgorod region | 18–150 | 50–100 | 25–85 | Novgorod region dated September 30, 2008 No. 379-OZ |

| In the Astrakhan region | 14–150 | 27–44 | 14–68 | Astrakhan region dated November 22, 2002 No. 49/2002-OZ |

| In the Sverdlovsk region | 2,5–99,2 | 32,9–66,2 | 7,3–56,2 | Sverdlovsk region dated November 29, 2002 No. 43-OZ |

| In Karelia | 10–150 | 50–100 | 25–85 | Republic of Karelia 12/30/1999 No. 384-ZRK |

| In the Nizhny Novgorod region | 13,5–150 | 45–90 | 22,5–76,5 | Nizhny Novgorod region dated November 28, 2002 No. 71-З |

| In the Chelyabinsk region | 7,7–150 | 50–100 | 25–85 | Chelyabinsk region dated November 28, 2002 No. 114-ZO |

| In Krasnoyarsk | 5–102 | 25–44 | 15–85 | Krasnoyarsk Territory dated November 8, 2007 No. 3-676 |

| In Krasnodar region | 12–150 | 25–50 | 15–80 | Krasnodar Territory dated November 26, 2003 No. 639-KZ |

| In the Penza region | 21–150 | 42–85 | 25–85 | Penza region dated November 18, 2002 No. 397-ZPO |

| In Smolensk | 10–110 | 36–62 | 20–52 | Smolensk region dated November 27, 2002 No. 87-Z |

| In the Komi Republic | 10–150 | 40–80 | 20–85 | Republic of Komi dated November 26, 2002 No. 110-RZ |

| In Bashkiria | 25–150 | 50–100 | 25–85 | Republic of Bashkortostan dated November 27, 2002 No. 365-z |

| In the Tver region | 10–90 | 50–100 | 25–85 | Tver region dated 06.11.2002 No. 75-ZO |

Information on rates and benefits for all property taxes in any region can be found on the Tax Service website - you need to select the type of tax, tax period and your region.

Let us remind you that for organizations and individuals who pay transport tax 2021, payment deadlines are different. Legal entities independently calculate the amounts. In some regions, organizations pay advance payments 3 times a year (for each quarter), and at the end of the period they pay up to the full amount, in others they pay once for the entire year. Specific deadlines are set by regional authorities.

As for citizens, payment of transport tax in 2020 is carried out on the basis of notifications that come from the Federal Tax Service. Based on Art. 363 of the Tax Code of the Russian Federation, the deadline for payment for owners - individuals - is December 1 of the year following the expired tax period.

Another point that owners should be aware of. The vehicle ownership period does not always coincide with the calendar year. Sometimes a car or truck will be repossessed for a shorter period of time, such as six months. In this case, you will have to pay less, since the final amount directly depends on the length of ownership of the vehicle in months. And you need to know that if you bought a car after the 15th of the month, then the amount of the fee will be calculated only from the next month, and if before the 15th, then from the month of purchase. For those who sold the car, a different rule applies: if the car is sold after the 15th, the former owner pays a fee for the whole month, if the car is sold before the 15th, you will not have to pay anything.

If the car is stolen, the owner also has the right not to pay for it (Article 358 of the Tax Code of the Russian Federation). At the same time, as the Federal Tax Service explained in Letter No. BS-4-21/ [email protected] , the owner must present a certificate of theft or other documents from law enforcement agencies. In addition, it is permissible to provide a certificate or a resolution to initiate a criminal case, as well as refer to information about the theft of a vehicle from court orders, rulings or decisions that have entered into force.

If the car was not found, and the criminal case regarding the theft was closed, the owner must contact the traffic police with an application to deregister the vehicle. Otherwise, he will have to pay for his car again, the Federal Tax Service clarified.

Calculation

TN is calculated according to the rules of Article 362 of the Tax Code and regional laws.

Formula to calculate the HP of a car based on horsepower:

sum = number of l. With. * rate * t/y (t – number of months of ownership, y – number of months in a year) * k (increasing factor).

Examples

Example 1.

Let's take the general rate for a car with a 100 hp engine. With.

If you own the car for 11 months out of a full year, the calculation will be as follows:

100 l. With. * 2.5 * (11/12) = 229.16 rubles.

Example 2.

Let's say you live in the Krasnoyarsk Territory and own a BMW X5 x Drive 30 d diesel 2993 cm3 (cost 4,750,000) with an engine power of 235 hp. With. (173 kW), year of manufacture 2021 (tax paid in 2019). Holding period is 4 months out of the taxable period (1 year).

The machine is expensive, which means you need to multiply the result by a multiplying factor:

- 1.1 – coefficient for a car worth 3-5 million (year of manufacture from 2 to 3 years).

- 1.3 – 3-5 million (year of production from 1 to 2 years).

- 1.5 – 3-5 million (less than a year).

- 2 – 5-10 million (less than 5 years).

- 3 – 10-15 million (less than 10 years).

- 3 – more than 15 million (less than 20 years).

The calculation of the fuel pump for a car based on horsepower and with a multiplying factor will be as follows:

235 (number of hp) * 51 (rate in the Krasnoyarsk Territory) * (4 months / 12 months) = 3595.5.

3595.5 * 1.3 (increasing factor) = 4674.15.

What online calculators are it convenient to calculate this on?

On the Internet you can find several calculators that will automatically calculate the transport tax on a car by region, horsepower and other parameters. You just need to enter some information about the car into the fields.

- Nalog.ru.

You need to enter:- year of issue;

number of months of vehicle ownership;

- type of vehicle;

- engine power;

- right to benefits (read about transport tax benefits here);

- region.

- Calculat.ru.

You need to enter:- region;

the year for which the tax is calculated;

- type of vehicle;

- quantity l. With. TS;

- period (months).

Unfortunately, this online calculator cannot indicate the increase factor for the car.

You can learn more about calculating TN and using the calculator here.

Read our other materials about transport tax. Find out about the nuances of paying tax on importing cars into Russia, winning cars and on old cars.

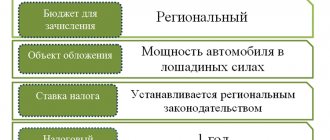

General characteristics of regional taxes

The key feature that characterizes this taxation group is the budget level. In other words, regional taxes and fees include all budget payments that are credited directly to the treasury of a constituent entity of the Russian Federation (region, autonomous district, federal city).

That is, regional taxes and fees are the main revenue part of the region’s budget. These proceeds are redirected to the implementation of socially significant programs and events. Also, some part of the funds received may be redirected to the treasury of the municipality in the form of subsidies, subventions and other transfers.

It is important to note that all regional taxes are established at the federal level, but the specifics of their application are detailed by the legislators of the constituent entities of the Russian Federation. Let's explain in simple words. Tax obligations at all levels are enshrined in the Tax Code of the Russian Federation. That is, the general rules for applying taxation are outlined at the federal level. For example, the maximum rates, calculation procedure, rules for applying deductions and benefits are approved by the Government of the Russian Federation. But categories of taxpayers, privileges and benefits for regional taxes are established and canceled at the level of a specific subject of Russia. For example, the regional government can introduce additional benefits for certain fees, introduce exemptions for certain categories of taxpayers, and reduce or increase the tax rate several times.