Dividends are part of the profit remaining after taxation, which is distributed among participants, shareholders. The amount of dividends is calculated and paid in a certain order and within strictly established periods. For more information, see How to determine the amount and procedure for paying dividends.

Dividends can be issued in cash or in kind, that is, other property. Moreover, shareholders can only be paid in cash. For LLC participants - both through the cash register and to a bank account. This procedure follows from Article 28 of the Law of February 8, 1998 No. 14-FZ and Article 42 of the Law of December 26, 1995 No. 208-FZ.

Accounting and taxation of dividends also have their own peculiarities. Read about them in detail in this recommendation.

Situation: is it possible to transfer dividends to an account that does not belong to the shareholder or participant

Yes, you can, but only in limited liability companies.

In joint stock companies, dividends in cash are paid only by bank transfer and only to the shareholder’s account. If the recipient does not have an account, then the money is sent by postal order. This is stated in Part 8 of Article 42 of the Law of December 26, 1995 No. 208-FZ.

But for limited liability companies there are no restrictions in the Law of February 8, 1998 No. 14-FZ. Therefore, an LLC may transfer dividends at the direction of a member to the accounts of third parties, such as a spouse, relative, or organization. To do this, the participant must write a statement. In it, indicate the recipient and his account details.

Accounting

How to calculate dividends

In accounting, calculations for the payment of dividends should be reflected in a separate subaccount 75-2 “Settlements with founders for the payment of income.” Do this when making payments to shareholders and participants who are not on the staff of the organization. That is, in relation to those people with whom an employment contract has not been concluded, as well as in relation to other organizations.

On the date when the general meeting of shareholders and participants decided to pay dividends, make the following entry:

Debit 84 Credit 75-2 – dividends were accrued to participants, shareholders who are not on the staff of the organization.

If you are paying dividends to employee participants, use account 70:

Debit 84 Credit 70 - dividends were accrued to participants, shareholders - employees of the organization.

This follows from paragraph 10 of PBU 7/98 and the Instructions for the chart of accounts (accounts 70, 75 and 84).

An example of how dividends accrued to people are reflected in accounting

At the end of 2015, non-public Alpha JSC received a net profit of 266,000 rubles. On March 5, 2021, the general meeting of shareholders decided to use this amount to pay dividends.

The authorized capital of the company is divided into 100 ordinary shares:

- 60 shares belong to Alpha director A.V. Lvov;

- 40 shares are owned by Iraqi citizen R. Smith, who does not work for Alpha.

On March 5, 2021, Alpha’s accountant made the following entries in the accounting records:

Debit 84 Credit 70 – 159,600 rub. (RUB 266,000: 100 shares * 60 shares) – dividends were accrued to Lvov;

Debit 84 Credit 75-2 – 106,400 rub. (RUB 266,000: 100 shares * 40 shares) – dividends were accrued to Smith.

Russian organizations, when paying dividends, often must fulfill the duties of a tax agent. That is, calculate taxes, withhold them from payments and transfer them to the budget. This also needs to be reflected in accounting.

When you withhold personal income tax from dividends paid to individuals, you must also take into account whether they work for the organization or not. Depending on this, the entries will be as follows:

Debit 75-2 Credit 68 subaccount “Calculations for personal income tax” - personal income tax is withheld from dividends of a participant, shareholder who does not work in the organization;

Debit 70 Credit 68 subaccount “Calculations for personal income tax” - personal income tax is withheld from dividends of a participant, shareholder - employee of the organization.

If you pay dividends to a participant, shareholder - organization, then withhold income tax from them and document it with the following entry:

Debit 75-2 Credit 68 subaccount “Calculations for income tax” - income tax is withheld from dividends of a participant, shareholder - organization.

This procedure follows from the Instructions for the chart of accounts (accounts 68, 70, 75).

An example of reflecting personal income tax on dividends accrued to people in accounting

At the end of 2015, Alfa JSC received a net profit of RUB 266,000. Alpha did not receive income from equity participation in other organizations.

On March 5, 2021, the general meeting of shareholders decided to use all net profit to pay dividends.

The authorized capital of the company is divided into 100 ordinary shares:

- 60 shares belong to Alpha director A.V. Lvov;

- 40 shares are owned by a non-resident - Iraqi citizen R. Smith, who does not work for Alpha.

Dividends to the founders were transferred to their bank accounts on March 26, 2021.

Alpha's accountant made the following entries in the accounts.

March 5, 2021:

Debit 84 Credit 70 – 159,600 rub. (RUB 266,000: 100 shares * 60 shares) – dividends were accrued to Lvov;

Debit 84 Credit 75-2 – 106,400 rub. (RUB 266,000: 100 shares * 40 shares) – dividends were accrued to Smith.

March 26, 2021:

Debit 70 Credit 68 subaccount “Personal Income Tax Payments” – 20,748 rubles. (RUB 159,600 * 13%) – personal income tax is withheld from Lvov income;

Debit 75-2 Credit 68 subaccount “Personal Income Tax Payments” – 15,960 rubles. (RUB 106,400 * 15%) – personal income tax is withheld from Smith’s income (there is no agreement concluded between Russia and Iraq on the avoidance of double taxation on personal income tax);

Debit 70 Credit 51 – 138,852 rub. (159,600 rubles – 20,748 rubles) – dividends were transferred to Lvov;

Debit 75-2 Credit 51 – 90,440 rub. (106,400 rubles – 15,960 rubles) – dividends were transferred to Smith.

How to record dividend payments

The method of payment of dividends also determines how to reflect this operation in accounting.

If dividends are paid in cash , then make the following entry in accounting:

Debit 75-2 (70) Credit 51 (50) – dividends were paid in cash.

When property is transferred to pay dividends , the accounting procedure depends on the type of these assets:

| Operation | Type of property | Debit | Credit | Base | |

| Calculation of dividends | Doesn't matter | 84 | 75-2 (70) | Clause 10 of PBU 7/98, Instructions for the chart of accounts (accounts 70, 75 and 84) | |

| Payment of dividends in kind | Doesn't matter | 75-2 (70) | 91 | Clauses 5, 6.3 and 12 PBU 9/99, Instructions for the chart of accounts (accounts 70, 75 and 91) | |

| Write-off of property transferred to pay dividends | Finished products and goods | 90-2 | 43 (41) | Clauses 5, 7 and 9 PBU 10/99, Instructions for the chart of accounts (accounts 41, 43 and 90) | |

| Materials | 91-2 | 10 | Clause 11 of PBU 10/99, Instructions for the chart of accounts (accounts 10 and 91) | ||

| Fixed assets | depreciation | 02 | 01 | Instructions for the chart of accounts (accounts 01 and 02) | |

| residual value | 91-2 | 01 | Clauses 11, 16 and 19 PBU 10/99, clause 29 PBU 6/01, Instructions for the chart of accounts (accounts 01 and 91) | ||

As you can see, the postings are due to the following. First, the amount of dividends is determined. Having transferred property against them, they determine the proceeds as if they were sold and take them into account to offset obligations to the participants. And, as when selling, the value of the property is written off.

Line 630 “Debt to participants (founders) for payment of income”

Home/ Accounting statements/ Line 630

Line 630 of the financial statements refers to the balance sheet until 2011.

This line reflects the balance of account 75 “Settlements with founders” subaccount 75-2 “Settlements for payment of income”. This is the amount of the organization's outstanding debt for dividends due for payment.

When compiling the balance sheet for 2009, this line shows the amount of dividends accrued for payment if in the specified period a general meeting of shareholders (participants) of the company was held to distribute dividends and an appropriate decision was made.

The distribution of net profit for the payment of dividends is reflected by the accounting entry:

Debit 84 subaccount “Net profit of the reporting year” Credit 75 subaccount “Calculations for dividends” - reflects the amount of net profit allocated for the payment of dividends.

If the founder (participant) of the company is also its employee, the dividends due to him and other similar payments are accrued on account 70 “Settlements with personnel for wages” subaccount “Income from participation in capital”. The credit balance of this subaccount should be reflected on line 630.

Please note: a loan received by an organization from the founder is reflected in accounting in the same way as any other loan - on account 66 “Settlements for short-term loans and borrowings” or 67 “Settlements for long-term loans and borrowings”. In the balance sheet, the unrepaid amount of such a loan is shown as part of accounts payable: on line 510 (if the loan is long-term) or line 610 (if the loan is short-term) together with the interest accrued under the agreement. Line 630 is intended only to reflect debt to the founders for income from participation in the authorized capital.

Insurance premiums

When paying dividends, do not accrue:

- contributions for compulsory pension, social or health insurance (Part 1, Article 7 of Law No. 212-FZ of July 24, 2009);

- contributions for insurance against accidents and occupational diseases (clause 1 of article 20.1 of the Law of July 24, 1998 No. 125-FZ).

The fact is that dividends are not remuneration for fulfilled duties under employment or civil law contracts. This means that there is no need to pay insurance premiums on them.

This procedure follows from the provisions of Part 1 of Article 7 of the Law of July 24, 2009 No. 212-FZ, paragraph 2 of Part 1 of Article 7 of the Law of December 15, 2001 No. 167-FZ, subparagraph 1 of Paragraph 1 of Article 2 of the Law of December 29, 2006 No. 255-FZ, subparagraph 1 of part 1 of Article 10 of the Law of November 29, 2010 No. 326-FZ and paragraph 2 of the Explanations approved by order of the Ministry of Health and Social Development of Russia of June 8, 2010 No. 428n.

Personal income tax

Personal income tax on dividends is paid by:

- residents, always;

- non-residents only when dividends are paid by Russian organizations.

In this case, the tax agent usually calculates, withholds and transfers personal income tax to the budget. And only when the income is received by a resident from sources abroad, the person himself must calculate and remit the tax.

Situation: which period should be taken into account when determining a person’s tax status when calculating personal income tax – the year for which dividends were accrued to him, or the year when they were paid to him?

Determine tax status based on the 12 months preceding the payment of dividends.

After all, a person’s tax status must be checked every time income is paid to him. Including dividends. At the same time, it is determined whether the person spent 183 calendar days or more on the territory of Russia over the next 12 consecutive months. This procedure follows from paragraph 2 of Article 207 and subparagraph 1 of paragraph 1 of Article 223 of the Tax Code of the Russian Federation. A similar point of view is expressed in the letter of the Ministry of Finance of Russia dated October 9, 2007 No. 03-04-05-01/326.

An example of determining the tax rate for calculating personal income tax on dividends

At the end of 2015, Alfa JSC received a net profit. On March 4, 2016, the general meeting of shareholders decided to use the entire amount of net profit received to pay dividends. Dividends were paid in the same month (March 24).

During the 12 consecutive months preceding the payment of dividends (from March 24, 2015 to March 25, 2021), one of the shareholders - A.S. Kondratiev - went on business trips abroad.

The period when Kondratiev was abroad was:

- in April – 13 days;

- in May – 16 days;

- in June – 19 days;

- in July – 20 days;

- in August – 18 days;

- in September – 24 days;

- in October – 15 days;

- in November – 17 days;

- in December – 22 days.

In January 2015, Kondratiev left Russia for an international conference for 16 days.

In February 2015, Kondratiev left Russia for treatment for 24 days.

In total, over the last 12 months preceding the payment of dividends, Kondratiev spent 180 days abroad (13 days + 16 days + 19 days + 20 days + 18 days + 24 days + 15 days + 17 days. + 22 days + 16 days). The period of Kondratiev’s stay in Russia is not interrupted by periods of his traveling abroad for treatment.

Kondratiev spent 186 calendar days in Russia over the past 12 months (365 days - 180 days). This period is more than 183 calendar days, therefore Kondratiev is a tax resident of Russia. From the dividends accrued to him for 2015, the Alpha accountant calculated personal income tax at a rate of 13 percent.

Personal income tax is paid by the person himself

Residents must calculate and pay personal income tax on their own only on dividends received from sources abroad. He will calculate the tax at a rate of 13 percent. He has the right to reduce personal income tax by the tax paid on income in the country of location of the foreign organization. True, he can use this right only if he has concluded an agreement with this country on the avoidance of double taxation. In this case, he will calculate the tax as follows:

| Personal income tax on dividends that a resident received from a foreign organization | = | Dividends that a resident received from a foreign organization | x | 13% | – | The tax that the resident paid at the location of the foreign organization in the country with which a double taxation agreement has been concluded (if there is one) |

If the calculation results in a negative value, then the resident has no right to reimburse the difference from the budget.

This procedure is established by the provisions of subparagraph 1 of paragraph 3 of Article 208, paragraph 1 of Article 209, paragraphs 1 and 2 of Article 214 of the Tax Code of the Russian Federation.

In all other cases, the tax agent must calculate, withhold and pay personal income tax.

Dividends: taxation issues and reflection in financial statements

284 Tax Code of the Russian Federation. The total amount of dividends subject to distribution does not include the amount of dividends payable to a foreign organization and (or) a non-resident individual of the Russian Federation (clause 6 of article 275 of the Tax Code of the Russian Federation, clause 3 of clause 3 of article 284 and clause 3 of article 224 dividend amounts due:

- Russian organizations (including those using the simplified tax system, unified agricultural tax and UTII) are subject to income tax at a rate of 9 percent;

- Russian organizations that for at least 365 consecutive calendar days own at least half of the authorized capital of the dividend-paying organization are subject to income tax at a rate of 0 percent;

- foreign organizations are subject to income tax at a rate of 15 percent (taking into account the specifics provided for in Article 275 of the Tax Code of the Russian Federation);

- individuals who are tax residents of the Russian Federation are subject to personal income tax at a rate of 9 percent;

- Individuals - non-residents of the Russian Federation are subject to personal income tax at a rate of 15 percent.

Income tax on dividends, including those received from foreign organizations, is paid to the federal budget (clause 2 p.

Personal income tax transfers by tax agent

The tax agent must determine personal income tax on dividends separately for each taxpayer and for any payment. This is established in paragraphs 2 and 3 of Article 214 of the Tax Code of the Russian Federation.

When calculating personal income tax, tax agents apply the following rates:

- 13 percent – when paying dividends to a resident;

- 15 percent – when paying dividends to a non-resident. This rate is applied if international treaties on the avoidance of double taxation do not establish a different rate.

This is established by the provisions of Article 7, paragraphs 2 and 3 of Article 214, paragraph 1 and paragraph 2 of paragraph 3 of Article 224 of the Tax Code of the Russian Federation.

For information about who acts as a tax agent when paying dividends, see the reference table.

Situation: is it necessary to withhold personal income tax when paying dividends to a participant (shareholder) of a company who is an entrepreneur?

Yes need.

After all, the legislation does not provide for any exceptions in relation to the recipient of dividends - an entrepreneur. When paying dividends, the organization must fulfill the duties of a tax agent. Including withholding personal income tax. Therefore, when paying dividends to an entrepreneur, personal income tax must be withheld from him. This follows from paragraph 3 of Article 214, paragraph 2 of paragraph 3 of Article 224 of the Tax Code of the Russian Federation.

A similar position is reflected in letters of the Ministry of Finance of Russia dated April 10, 2008 No. 03-04-06-01/79 and dated July 13, 2007 No. 03-04-06-01/238.

Situation: is it necessary to withhold personal income tax when paying dividends to the heir of a shareholder (participant)?

Yes need.

This is explained by the fact that it is not the money itself that is inherited, but only the right to receive it. This means that the general rule according to which income received by inheritance is not subject to personal income tax does not apply. Therefore, when paying dividends to the heir of a participant or shareholder, personal income tax must be withheld. This conclusion follows from paragraphs 18 and 58 of Article 217, paragraphs 3 and 4 of Article 214 of the Tax Code of the Russian Federation.

A similar position is reflected in the letter of the Ministry of Finance of Russia dated October 29, 2007 No. 03-04-06-01/363.

Situation: is it necessary to withhold personal income tax if a participant refuses to pay dividends (for example, in favor of an organization)?

Yes need.

After all, despite the fact that the participant did not formally receive the money, he disposed of it - transferred it to the organization. These amounts must be taken into account when determining the tax base, as well as those that were paid. This is directly indicated in paragraph 1 of Article 210 of the Tax Code of the Russian Federation.

In this case, it is considered that the income was actually received on the date when the money was transferred to the accounts of third parties by order of the participant. But in this situation the money is not transferred anywhere. Therefore, the day when the participant refused dividends in favor of the organization is considered the date of receipt of this income (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation).

At the same time, on a general basis, withhold personal income tax from these amounts (clause 4 of Article 226 of the Tax Code of the Russian Federation).

A similar point of view is reflected in the letter of the Ministry of Finance of Russia dated October 4, 2010 No. 03-04-06/2-233.

Decision to pay dividends

The decision to pay dividends is made at a general meeting of participants or shareholders of a business entity, which is subject to formalization by minutes. Such a decision will be illegal when:

- the authorized capital of the company has not been finally formed;

- shares to be sold are not fully sold;

- bankruptcy proceedings have been initiated against the organization;

- According to the balance sheet data, the authorized capital of the company exceeds the value of its net assets.

How can a tax agent calculate personal income tax at a rate of 13 percent?

When calculating personal income tax on resident dividends, apply a rate of 13 percent. When calculating your tax, consider whether your organization received dividends from other companies or not.

When the organization does not have such income, calculate the tax using the formula:

| Personal income tax on dividends (to be withheld) = Dividends accrued to a resident x 13% |

This procedure follows from the provisions of paragraph 3 of Article 214 of the Tax Code of the Russian Federation.

An example of calculating personal income tax on dividends accrued to the founders. The organization did not receive income from equity participation in other organizations

At the end of 2015, Alfa JSC received a net profit of RUB 266,000. On March 5, 2021, the general meeting of shareholders decided to use this amount to pay dividends. Alpha did not receive income from equity participation in other organizations.

Alpha's authorized capital is divided into 100 ordinary shares. Of these, 60 shares belong to Alpha director A.V. Lvov, and 40 shares - to Iraqi citizen R. Smith, who is not a tax resident of Russia and an employee of Alpha.

On March 5, 2021, Alpha’s accountant made the following entries in the accounting records:

Debit 84 Credit 70 – 159,600 rub. (RUB 266,000: 100 shares * 60 shares) – dividends were accrued to Lvov;

Debit 84 Credit 75-2 – 106,400 rub. (RUB 266,000: 100 shares * 40 shares) – dividends were accrued to Smith.

The amount of personal income tax on dividends accrued to Lvov is: RUB 159,600. * 13% = 20,748 rub.

There is no agreement concluded between Russia and Iraq on the avoidance of double taxation on personal income tax. Therefore, the amount of personal income tax on income accrued to Smith is equal to: 106,400 rubles. * 15% = 15,960 rub.

If the company received dividends from participation in other organizations in the current or previous years, the procedure for calculating personal income tax will be different. It depends on whether dividends received from participation in other organizations are taken into account when paying participants. If taken into account, then calculate personal income tax in the usual manner.

Well, if, having received income from participation in other organizations, you have not yet paid dividends, then calculate your personal income tax as follows:

| Personal income tax on dividends (to be withheld) | = | Dividends accrued to a resident | : | Dividends to be distributed to all recipients | x | Dividends to be distributed to all recipients | – | Dividends received by the tax agent | x | 13% |

There is no need to withhold personal income tax only if the dividends your organization received are greater than or equal to those paid to the participant.

This procedure is provided for in paragraph 2 of paragraph 2 of Article 210 and paragraph 5 of Article 275 of the Tax Code of the Russian Federation.

When determining the indicator “dividends received by the tax agent,” take into account such income minus previously withheld tax (letter of the Ministry of Finance of Russia dated February 6, 2008 No. 03-03-06/1/82).

Take into account receipts from both Russian organizations and foreign ones. And don’t take into account only dividends that are taxed at a rate of 0 percent (letters of the Ministry of Finance of Russia dated October 31, 2012 No. 03-08-05 and dated February 19, 2008 No. 03-03-06/1/114).

Situation: at what rate (9 or 13%) should personal income tax be withheld from dividends paid in 2021, but distributed in previous years?

For dividends paid on January 1, 2021 and later, personal income tax is withheld at a rate of 13 percent. That is, according to the one that has been in effect since 2021. It does not matter for what period these dividends are for.

You can distribute profits for 2015 or earlier periods at any time. There are no legal restrictions for this. This conclusion follows from the provisions of Article 43 of the Tax Code of the Russian Federation, Article 28 of the Law of February 8, 1998 No. 14-FZ and Article 42 of the Law of December 26, 1995 No. 208-FZ and is confirmed by letters of the Ministry of Finance of Russia dated March 20, 2012 No. 03-03-06/1/133, dated April 6, 2010 No. 03-03-06/1/235.

In any case, the tax rate must be applied to the one in effect on the date the income was received. And in the situation under consideration, such a date is considered to be the day when dividends were paid to the participant (founder). That is, this is the day when the money was transferred to the participant’s bank account, or the day when you issued dividends from the cash register. The date of dividend distribution does not matter here. Therefore, if the payment is dated 2021, then personal income tax will have to be calculated, withheld and transferred to the budget at a rate of 13 percent.

This procedure follows from the provisions established by subparagraph 1 of paragraph 1 of Article 208, paragraph 2 of paragraph 2 of Article 210, paragraph 3 of Article 214, subparagraphs 1 and 2 of paragraph 1 of Article 223 and paragraph 1 of Article 224 of the Tax Code of the Russian Federation. Similar clarifications are contained in the letter of the Ministry of Finance of Russia dated March 16, 2015 No. 03-04-06/13962.

How can a tax agent calculate personal income tax at a rate of 15 percent?

When calculating personal income tax on non-resident dividends, apply a rate of 15 percent. Do this only if the double tax treaty with the foreign country does not specify different rates. The list of such agreements can be found in the table.

Calculate personal income tax on non-resident dividends using the formula:

| Personal income tax on non-resident dividends (to be withheld) | = | Dividends accrued to a non-resident | x | 15% (tax rate), unless otherwise provided by international treaties |

Such rules are provided for in paragraphs 3 and 4 of Article 214, paragraph 3 of Article 224, paragraph 6 of Article 275 of the Tax Code of the Russian Federation.

An example of calculating personal income tax on dividends accrued to citizens. The organization received income from equity participation in other organizations

At the end of 2015, Alfa JSC received a net profit of RUB 266,000. It includes income from equity participation in other organizations in the amount of 150,000 rubles.

In March 2021, the general meeting of shareholders decided to use the entire amount of net profit received (RUB 266,000) to pay dividends. The authorized capital of the organization is divided into 100 shares. Of these, 60 shares belong to Alpha director A.V. Lvov, and 40 shares - to Iraqi citizen R. Smith (not a tax resident of Russia and an employee of Alpha).

Alpha's accountant made the following entries in the accounting records:

Debit 84 Credit 70 – 159,600 rub. (RUB 266,000: 100 shares * 60 shares) – dividends were accrued to Lvov;

Debit 84 Credit 75-2 – 106,400 rub. (RUB 266,000: 100 shares * 40 shares) – dividends were accrued to Smith.

The Alpha accountant calculated the personal income tax on the founders’ income as follows:

– from Smith’s income (non-resident): 106,400 rubles. * 15% = 15,960 rub. (there is no agreement concluded between Russia and Iraq on the avoidance of double taxation on personal income tax);

– from the income of Lviv (resident): (266,000 rubles * 60%: 266,000 rubles) * (266,000 rubles – 150,000 rubles) * 13% = 9048 rubles.

Consultations: Corporate income tax

- Income tax. If we are talking about legal entities, the rate is fifteen percent, or the rates specified in the Double Taxation Agreements are provided.

- In the case of payment of dividends to a Russian organization: subsection 1.3 of section 1 of the income tax declaration contains the calculation of tax on certain types of income, while Sheet 03 (calculation of income tax, which is withheld by the tax agent - the source of payment of income) includes certain types of income. Information on tax calculation is given in paragraph 2 of Art. 275 of the Tax Code of the Russian Federation, and the rules for filling out sheet 03 are indicated within the framework of Order of the Federal Tax Service of Russia dated November 26, 2014 No. MMV-7-3/

- When receiving dividends from a Russian or foreign enterprise: sheet 04 (calculation of corporate income tax on income, which is calculated according to rates that differ from the rate presented in paragraph 1 of Article 284 of the Tax Code of the Russian Federation) contains information on dividend income from their participation in other organizations.

The transfer of personal income tax must be made on the day of payment of dividends to shareholders (participants) or within the next day after withdrawal of funds from the current account for payment of dividends. The transfer of income tax is made no later than the next day after the dividends were transferred.

Russian enterprises that are tax agents (organizations that are the source of receipt and payment of income) are required to provide income tax reporting.

Income from dividends received and issued, as well as the calculation of income tax, are indicated in the income tax return as follows:

If you require more detailed explanations about the application of the zero percent income tax rate, about dividends that are received and issued in kind, or about how dividends and their calculations are reflected in tax and accounting reports, please contact us for a free consultation by calling 8(812) 425- 24-05.

Was the article useful? Share on social networks!

Do you want to receive new information in a timely manner?

Subscribe to our newsletter

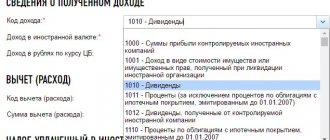

Tax Code of the Russian Federation), and income tax on dividends - no later than the day following the day of transfer of dividends (clause 4 of Article 287 of the Tax Code of the Russian Federation). The amounts of accrued taxes on dividends are not reflected in tax accounting. How to reflect personal income tax on dividends in tax accounting "1C: Accounting 8" Income of individuals from equity participation in the activities of an organization received in the form of dividends and the amount of calculated tax on this income for the purpose of reporting personal income tax are registered in the program for each individual using the document Tax accounting operation for personal income tax, which is available from the journal All documents for personal income tax in the Employees and salary section (Fig. 4). Rice. 4.