Happy owners of apartments, rooms, country houses, garages and outbuildings are required to pay property tax for individuals. From 2021 it is calculated according to new rules. In addition to apartments, residential buildings, country houses and garages, the list of taxable objects will be supplemented with parking spaces registered as property, as well as objects whose construction has not been completed.

In accordance with Chapter 32 of the Tax Code of the Russian Federation, from 2021 the formation and calculation of property tax for individuals will be based on the cadastral, and not on the inventory value of the property. It is the one that is as close as possible to the market price.

Who is obliged to pay and who is not?

Property tax for individuals is levied on holders of ownership rights to property recognized as an object of taxation. Even minors are not exempt from the mandatory payment if they own this or that real estate. Payments for those under 18 years of age are made by guardians or parents until they reach adulthood.

The following are exempt from tax:

- pensioners or persons receiving a pension;

- payers discharged from military service or serving under conscription for military training in other countries where military operations took place;

- payers who are parents or spouses of military personnel who died while performing military duties;

- arts payers who use their premises as a museum, library or other public space;

- payers who own a building, outbuilding, commercial building, the area of which does not exceed 50 sq.m.

What is subject to tax?

The new list of objects subject to property tax for individuals includes:

- House;

- living space (apartment, room);

- garage, parking place;

- single real estate complex;

- unfinished construction project;

- other buildings, structures, structures, premises.

At the same time, residential buildings located on plots provided for personal subsidiary farming, dacha farming, vegetable gardening, horticulture, and individual housing construction are now classified as residential buildings.

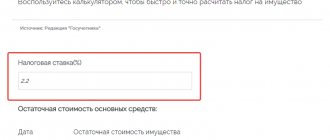

We calculate the tax ourselves

If for some reason you do not want to use a calculator and want your real estate tax

- cadastral value of taxable property. Fortunately, you can calculate it yourself, and it is not at all necessary to visit any government agencies to find out the necessary information. We go to the official Internet resource of Rosreestr, after which we look for the “electronic services” tab there and click on it. A page opens where you can receive online help. There is only one condition: you will be required to have the cadastral number of the real estate on which the tax is calculated;

- Next, we reduce the cost of the cadastre of our home (or garage) by the total amount of tax-free areas. These may be certain benefits and so on;

- the last step is to multiply the received amount by 0.1% (or 0.001), after which you will find out what tax you need to pay to the state budget.

As you can see, everything is extremely simple, and most importantly transparent - every citizen of the country knows what the property tax for individuals is based on and can even calculate it independently to make sure of this.

Tax deductions for property

| Property | Reduction of cadastral value taking into account tax deductions |

| Apartment | 20 sq m area |

| Room | 10 sq m area |

| House | 50 sq m area |

It should be noted that if you own several objects, then a tax deduction is due for each of them. If the property is owned by several people, then the deduction is made for everyone.

Property tax for individuals

Compared to the previous procedure, according to which the tax was calculated on the basis of the inventory price of real estate, the cadastral value is slightly higher. To find out the inventory price, you need to contact the BTI . Do you know why this price is lower? Its calculation took place taking into account the initial cash payment. As for the freshly baked project, there is actually nothing to be happy about here; the legislation provides for an annual tax increase . Moreover, this trend will continue until the twentieth year. Imagine, for four whole years the tax will increase by twenty percent.

There is one positive aspect here, thanks to which the rates will increase virtually insignificantly for the average citizen of Russia. Not subject to taxation : 10 sq. meters from the area of the room and 20 sq. meters from the area of the apartment. In the case of a house - 50 sq. meters. And no, such conditions are provided not only to beneficiaries, but in general to every honest taxpayer, which also cannot but rejoice!

By the way, regarding benefits . They are all in place. Only the conditions have changed. Now the benefit recipient has the right not to pay tax for only one apartment if he owns two or more. They did this in view of the fact that relatives registered their housing in their names and thus did not pay tax.

As soon as the innovations come into full force, the tax amount for all regions of the country will be equal. The basic rate is 0.1% (0.001 for a simpler calculation) of the cadastre value. The value is the maximum for all bet types. The following objects are subject to taxation:

- residential buildings and apartments;

- newly built real estate with residential premises;

- car owners' garages.

To calculate the approximate tax , you should use the so-called tax calculator. It takes into account almost all factors, including restrictions and benefits. For example, there is a benefit that provides for the following conditions: there is a residential complex worth no more than three hundred thousand rubles, it is not used to obtain monetary benefits, that is, there is no need to pay taxes on the complex. As you can see, everything is extremely simple.

What benefits are there?

All existing tax benefits have been retained in the amended law. Thus, the tax will not be levied on disabled people from birth, as well as on disabled people of groups I and II. True, these categories of citizens can take advantage of the preferential right only in relation to one of the objects of each type, that is, in relation to one apartment, one garage, residential building, etc.

Benefits do not apply to:

- objects used in business activities;

- objects worth more than 300 million rubles.

In order to take advantage of the benefit, you must contact the tax authority with a corresponding application. This should be done before January 1 of the year, which is the tax period. If you are late, the tax authority, having finally calculated the amount of due payments, will independently provide the benefit.

Tax base

This is the average annual price of the property, which is formed taking into account the residual value, excluding depreciation:

SGS = (OstK + OstN): (KM + 1),

Where: Residual price as of the last date of tax payment; OstN – residual price on the first day of the month; KM – the number of months of the fact of ownership of property during the tax period; 1 – coefficient increasing the number of months during which ownership of the property is confirmed.

How to count?

Chapter 32 of the Tax Code of the Russian Federation provides basic values that are applied if the tax is calculated at the cadastral value.

Rates for calculating tax on cadastral value

| Property | Maximum bet |

| Residential buildings, apartments, rooms, unfinished housing construction, garages, parking space, outbuildings on land intended for dacha farming | 0,1% |

| Property of shopping or office complexes; property worth more than 300 million rubles | 2% |

| Other objects | 0,5% |

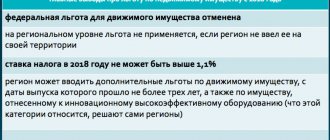

Regional authorities will be able to reduce base rates to 0 percent or increase them, but not more than three times.

An example of calculating tax based on cadastral value:

Owned by Ivanov I.L. there is an apartment of 54 sq. meters. The cadastral value of housing as of January 1, 2015 was 4 million rubles. We reduce the area of the apartment by the amount of the tax deduction:

54 - 20 = 34 sq. meters.

4,000,000 rub. : 54 sq. meters x 34 sq. m = 2,518,519 rub.

It is on this amount that tax will be charged.

We multiply it by the rate and get the amount of payments due from the owner: 2,518,519 × 0.1% = 2,519 rubles.

Property tax for individuals in 2021

Since the beginning of 2015, real estate tax for individuals has been calculated not according to the book value of the BTI, but according to the cadastral value, which is close to the market price. According to the new rules, it will be necessary to pay from 2021 for the past 2015, according to notifications that will be sent to all owners.

How much will you have to pay?

The new tax obliges people who own apartments and other real estate to pay annually in the following amounts:

- 1. For apartments, houses, unfinished houses, garages - 0.1% of the cadastral value.

- 2. For a cost over 300 million rubles - 2%.

- 3. For all other premises - 0.5%.

The amount that will have to be paid will increase significantly, so people have been given a transition period - the full amount of this tax will have to be paid for the first time only in 2021. In 2021, for the past 2015, you will need to pay 20% more than before. Then there will be an annual increase of 0.4; 0.6; 0.8, that is, until 2021 the tax amount will increase by 20%, and in 2021 it will be calculated in full.

Property tax for pensioners from 2021 latest news

Who will pay less?

Payment benefits are preserved for all categories of people who are entitled to them. But if there are several apartments or houses, preferential taxation can only be used when calculating for one object. All others will be paid on a general basis. If the owner of several objects does not make a choice himself, the tax service will determine the most expensive of them for the purpose of preferential taxation.

Tax deduction

Also, to reduce pressure, tax deductions have been introduced, that is, 50 square meters will not be taxed. m in the house, 20 sq. m in an apartment, 10 sq. m in the room. For example, if an apartment with a total area of 30 sq. m, then you need to subtract the provided deduction and 10 sq. m. will remain. m for which you will have to pay.

Having a problem? Call a lawyer: +7

— Moscow, Moscow region

+7

— St. Petersburg, Leningrad region

The call is free!

Differences by region

Each region has the right to change the tax deduction in any direction, but at the moment none of them has exercised this right. Regional authorities also have broad rights to provide benefits.

When to pay?

Payment must be made no later than October 1 of the year following the expired tax period. For example, before October 1, 2016, you need to pay tax for the past year 2015.

How to calculate?

To calculate the amount of tax yourself, you need to find out the cadastral value of your property on the Rosreestr website or at its territorial branch, for example, the cost of an apartment is 6 million rubles, with an area of 30 square meters. m. First you need to find out the price of 1 sq. m. m of object. In this case, it is equal to 200 thousand rubles, this figure should be multiplied by the taxable area.

That is, from 30 sq. m subtract 20 sq. m, 10 sq.m. left. m, which are taxed. After multiplying the cost per square meter - 200 thousand rubles per 10 square meters. m taxable, we get 2 million rubles, an amount that is taxed. It needs to be multiplied by the current rate of 0.1% for you - 2 million rubles multiplied by 0.001 will equal 2000 rubles, this is the amount of the annual tax.

Controversial issues

If some error has occurred that has led to an increase in the cadastral value, then this can be disputed by contacting the MFC or Rosreestr, which has created a commission to consider disputes, about 70% of which are resolved before the courts, for example, in the case of a technical error and etc. If you think that the cadastral value is unreasonably inflated, then you need to go to court.

For any questions, please contact our lawyers through this form!

What will happen in regions that are late with innovations?

Nizhny Novgorod residents will begin paying property taxes according to the new rules in 2016, based on the results of 2015. But this will not be the case in all regions. It is planned to completely switch to the new calculation system within five years, by 2021. If the old principle is still in effect in your region, the tax will be calculated based on the inventory value of the property. To do this, the inventory cost must be multiplied by the rate.

Rates for calculating tax on inventory value

| Property value increased by deflator coefficient | Maximum bet |

| Up to RUB 300,000 inclusive | Up to 01% inclusive |

| Over 300,000 rubles up to 500,000 rubles inclusive | Over 0.1% to 0.3% inclusive |

| Over 500,000 rub. | Over 0.3% up to 2% inclusive |

The rates listed in Chapter 32 of the Tax Code of the Russian Federation are set by regional authorities. So far they have not changed, but regional authorities have the right to revise them.

For regions that have not switched to the new taxation system, a special transitional formula has been developed. The tax service will determine the difference between the cadastral and inventory value of the property, and then multiply it by a special coefficient (Article 408 of the new Tax Code of the Russian Federation). The coefficient values will gradually increase over four years as follows: 0.2; 0.4; 0.6 and 0.8.

You can familiarize yourself with the regulatory legal acts on the establishment of tax rates, additional deductions and benefits adopted in a particular region (locality) on the website of the Federal Tax Service of Russia “Reference information on rates and benefits for property taxes”

Read the next article “How to get a tax deduction when buying real estate?”

Tax rate on property of individuals

The basic rate of property tax for individuals for apartments remained the same, that is, equal to 0.1% (clause 2, article 406 of the Tax Code of the Russian Federation). Only the tax base itself has changed.

At the same time, the law allows local authorities in municipalities of the constituent entities of the Russian Federation to independently set tax rates for their subordinate territories, but within the framework specified by the Tax Code. If local authorities have not made any decision regarding local tax rates the basic tax rate specified in the code (see above) applies

For Moscow, for example, tax rates for apartments are determined by local authorities as follows:

- if the cadastral value of the apartment does not exceed 10 million rubles. (inclusive), then the tax rate applies 0,1%;

- from 10 to 20 million rubles. (inclusive) – tax rate 0,15%;

- from 20 to 50 million rubles. (inclusive) – tax rate 0,2%;

- over 50 million rubles – tax rate 0,3%.

Current real estate tax rates personal property tax benefits

For other constituent entities of the Russian Federation and municipalities within them, property tax rates for individuals established by the local executive authority, as well as local tax benefits can be found in a special reference book on the website of the Federal Tax Service of Russia - here.

Calculator for calculating property tax for individuals (apartment) - see below in the article, follow the link.

In what cases you can avoid paying tax when selling an apartment - see here.