Accounting

A fully depreciated asset actually used in production continues to be listed in accounting (as follows from paragraph 2 of clause 29 of the Accounting Regulations “Accounting for Fixed Assets” PBU 6/01, approved by Order of the Ministry of Finance of Russia dated March 30, 2001 N 26n) .

Costs incurred in connection with the modernization of an OS asset, as a result of which the initially adopted standard indicators of its functioning (useful life, power, quality of use, etc.) are improved (increased), increase the initial cost of the OS asset (as follows from paragraph. clauses 14, 26, 27 PBU 6/01).

Accounting for modernization costs is carried out in the manner established for accounting for capital investments (clause 70 of the Guidelines for the accounting of fixed assets, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 N 91n (hereinafter referred to as the Guidelines)).

In this case, upon completion of the modernization of the OS object, the organization on the basis of paragraph. 6 clause 20 of PBU 6/01 revised and increased its useful life. Since the fixed asset is fully depreciated, that is, its previously established useful life expired before the modernization, the new useful life is 12 months.

The cost of an asset is repaid by calculating depreciation (clause 17 of PBU 6/01). With the linear method, the annual amount of depreciation is determined based on the original cost or current (replacement) cost (in case of revaluation) of the fixed asset and the depreciation rate calculated based on the useful life of this object (paragraph 2 of clause 19 of PBU 6/01) . During the reporting year, depreciation charges for fixed assets are accrued monthly, regardless of the accrual method used, in the amount of 1/12 of the annual amount (paragraph 5 of clause 19 of PBU 6/01).

The amount of monthly depreciation charges for a modernized fixed asset is calculated based on its residual value (which is zero, since the fixed asset was completely depreciated), increased by the amount of modernization costs, and the new useful life of the fixed asset (paragraph 2 of clause 60 of the Guidelines ).

Depreciation for a modernized fixed asset is accrued starting from the month following the month of completion of work on modernizing the fixed asset (which, in our opinion, follows from clause 21 of PBU 6/01).

Due to the fact that the fixed asset is used for the production of products, the amounts of monthly depreciation accrued on it are related to expenses for ordinary activities and participate in the formation of the actual cost of finished products (clauses 5, 9, 16 of the Accounting Regulations “Expenses of the organization » PBU 10/99, approved by Order of the Ministry of Finance of Russia dated May 6, 1999 N 33n).

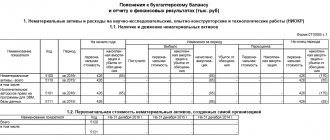

Accounting records for the transactions under consideration are made in accordance with the Instructions for the application of the Chart of Accounts for accounting the financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n, taking into account clause 42 of the Methodological Instructions and are shown below in the table of transactions.

Depreciation. OS object after modernization / reconstruction

Let's consider the issues of calculating depreciation on an item of fixed assets (FPE) after modernization or reconstruction, how to reflect these operations in tax accounting, apply the provisions of PBU 18/02, etc.

Basics

Starting from the month following the month of putting the modernized fixed asset into operation, depreciation on it is accrued in the amount calculated according to the formula (clause 60 of the Methodological Instructions for Accounting for Fixed Assets, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n “On approval of Methodological guidelines for accounting of fixed assets"):

| Sum monthly depreciation | = | Initial cost of OS + OS upgrade costs – amount of depreciation accrued before the introduction of the modernized OS object into operation |

| SPI installed during OS commissioning + The period for which the OS SPI is increased after modernization is The period during which depreciation was calculated putting the modernized OS object into operation |

If the period of work to modernize the fixed assets is more than 12 months, then for the entire period, depreciation on the fixed assets in both accounting and tax accounting is suspended.

There is one exception - when the upgraded OS continues to be used in activities aimed at generating income.

For such an asset, depreciation in tax accounting continues to be accrued in the usual manner and during the period of modernization work (clause 3 of article 256 of the Tax Code of the Russian Federation, clause 23 of PBU 6/01).

This is possible, for example, when part of the building is under reconstruction for more than 12 months, and the other part continues to be used during this period.

Then, during the entire period of reconstruction work in tax accounting, depreciation is accrued for the entire building.

Depreciation in tax accounting

An organization has the right to increase the useful life (USL) of an asset after its commissioning if, after the modernization of such an object, its USI has increased.

At the same time, an increase in SPI for fixed assets can be carried out within the time limits established for the depreciation group in which such an object was previously included (clause 1 of Article 258 of the Tax Code of the Russian Federation).

Chapter 25 of the Tax Code of the Russian Federation does not contain a direct indication of what depreciation rate should be applied after modernization of an asset in the event of revision of the SPI: initially determined when putting the asset into operation or recalculated taking into account the increased SPI of the asset.

There are clarifications from the Ministry of Finance of Russia, according to which, if the SPI was increased after modernization, the organization has the right to charge depreciation at the new rate, calculated based on the new SPI of the fixed asset (letter dated 08/04/2016 No. 03-03-06/1/45862) .

Then, from the month following the month of putting the modernized OS into operation, depreciation on it is accrued in the amount calculated according to the following formula (clause 1 of Article 258 of the Tax Code of the Russian Federation):

| Sum monthly depreciation | = | Initial cost of OS + OS upgrade costs – Depreciation bonus to costs for OS upgrade |

| SPI installed during OS commissioning + The period for which the OS SPI is increased after modernization is The period during which depreciation was calculated putting the modernized OS object into operation |

At the same time, according to the explanations of the Ministry of Finance, after the modernization, the fixed asset continues to be depreciated at the rate established during its commissioning, since its change after the putting into operation of the fixed asset is not provided for by the Tax Code of the Russian Federation (letter dated July 10, 2015 No. 03-03-06/ 39775).

In addition, there are court decisions that indicate that in such situations the organization has the right to accrue depreciation based on the residual value of the fixed assets, increased by the amount of modernization costs, and the remaining SPI.

The period for which the SPI of an OS object increases after its modernization must be determined by technical specialists.

Information about the increase in private equity must be indicated in the asset accounting inventory card (form OS-6).

If the SPI of the OS has not increased after its modernization, then depreciation will be charged on the OS even after the end of the SPI (until the cost of the OS is completely written off) (letters of the Ministry of Finance dated 01/11/2016 No. 03-03-06/40, dated 02/11/2014 No. 03-03 -06/1/5446).

In the same order, the costs of modernizing a fully depreciated OS are taken into account (letters of the Ministry of Finance dated March 25, 2015 No. 03-03-06/1/16234, dated November 18, 2013 No. 03-03-06/4/49459, dated June 9, 2012 No. 03 -03-10/66).

Example 1 Let's look at an example of a situation where the SPI does not change. The modernization was carried out by a contractor. The cost of modernization was 94,400 rubles. (including VAT RUB 14,400).

According to the accounting and tax records of the organization, the initial cost of the fixed asset is 720,000 rubles.

The equipment is assigned to the fourth depreciation group, SPI - 72 months.

At the time of completion of the work, the remaining life expectancy of the fixed asset was 20 months, its residual value was 200,000 rubles. (RUB 720,000 - RUB 720,000: 72 months x 52 months)

As a result of upgrading the SPI of an object, the OS does not change.

In accounting and tax accounting, depreciation on fixed assets is calculated using the linear method (method).

For income tax purposes, income and expenses are determined using the accrual method.

The depreciation bonus for the fixed asset was not applied.

We will make the necessary calculations.

The amount of monthly depreciation charges for the modernized operating system in accounting will be 14,000 rubles. ((RUB 200,000 + (RUB 94,400 – RUB 14,400)) : 20 months).

In tax accounting, the amount of depreciation accrued per month in relation to fixed assets is determined based on its original cost and the depreciation rate determined based on the full SPI of the fixed assets object.

The depreciation rate established upon commissioning of the operating system is 1.3889% (1/72 months x 100%).

In this case, the amount of depreciation charges for the modernized OS, monthly included in the costs associated with production and sales, will be 11,111.11 rubles. ((RUB 720,000 + (RUB 94,400 - RUB 14,400)) x 1.3889%) (subclause 3, clause 2, article 253, clause 3, article 272 of the Tax Code of the Russian Federation).

Thus, depreciation on the modernized OS will be accrued in tax accounting for 25 months ((200,000 rubles + (94,400 rubles - 14,400 rubles)) : 11,111.11 rubles).

In the 26th month, depreciation will be accrued in the amount of 2222.25 rubles. (RUB 280,000 – RUB 11,111.11 x 25 months)

Application of PBU 18/02 in this case

The amount of depreciation accrued in tax accounting during the remaining SPI of the modernized fixed asset is less than the amount of depreciation recognized in accounting. However, depreciation for profit tax purposes continues to be accrued for another 6 months after it ceases to be accrued in accounting (26 months - 20 months).

Thus, during the remaining STI (20 months), deductible temporary differences (DTD) in the amount of the excess of the amount of accounting depreciation over tax and the corresponding deferred tax assets (DTA) are reflected in the accounting records on a monthly basis.

The specified VVR and ONA are reduced (repaid) during the remaining seven months of depreciation in tax accounting (clauses 11, 14, 17 PBU 18/02 “Accounting for calculations of corporate income tax”, approved by order of the Ministry of Finance of Russia dated November 19. 2002 No. 114n).

| Contents of operations | Debit | Credit | Amount, rub. | Primary document |

| In the month of modernization of the OS object | ||||

| The costs of upgrading the OS object are reflected (236 000 — 36 000) | 08 | 60 | 80 000 | Acceptance certificate for completed work |

| The VAT presented by the contractor for the modernization of the OS facility is reflected | 19 | 60 | 14 400 | Invoice |

| VAT claimed by the contractor is accepted for deduction | 68-VAT | 19 | 14 400 | Invoice |

| The costs of upgrading an OS object are included in the increase in the cost of this object | 01 | 08 | 80 000 | Certificate of acceptance and transfer of fixed assets, Inventory card for recording a fixed asset item |

| Payment transferred to the contractor | 60 | 51 | 94 400 | Bank account statement |

| Monthly starting from the month following the month of modernization of the OS facility and its commissioning, for 20 months | ||||

| Depreciation accrued | 20 (26, 44 and etc.) | 02 | 14 000 | Accounting certificate-calculation |

| SHE is reflected ((14,000 - 11,111.11) x 20%) | 09 | 68/ONA | 577,78 | Accounting certificate-calculation |

| Monthly for 5 months of depreciation in tax accounting | ||||

| SHE reduced (11,111.11 x 20%) | 68/ONA | 09 | 2 222,22 | Accounting certificate-calculation |

| During the 6th month of depreciation in tax accounting | ||||

| SHE reduced (2,222.25 x 20%) | 68/ONA | 09 | 444,45 | Accounting certificate-calculation |

Example 2 Modernization was carried out by a contractor. The cost of modernization was 236,000 rubles. (including VAT RUB 36,000).

According to the accounting and tax records of the organization, the initial cost of the fixed asset is 800,000 rubles.

The equipment was assigned to the fourth depreciation group, the SPI was set by the organization at 72 months.

At the time of completion of the work, the remaining life expectancy of the fixed asset was 36 months, its residual value was 400,000 rubles.

As a result of modernization, the SPI of the OS object increased.

The organization decided, based on the results of the modernization, to increase the SPI of the OS facility by 12 months.

In accounting and tax accounting, depreciation on fixed assets is calculated using the linear method (method).

For income tax purposes, income and expenses are determined using the accrual method.

The depreciation bonus for the fixed asset was not applied.

The organization calculates depreciation in tax accounting for the modernized fixed asset based on the original cost increased by the cost of modernization, using the depreciation rate calculated based on the new SPI of the fixed asset.

We will make the necessary calculations.

In accounting, the amount of monthly depreciation charges for production equipment after modernization will be 12,500 rubles. ((400,000 rub. + 236,000 rub. - 36,000 rub.) : 48 months).

In tax accounting, the initial cost of an asset after modernization will be 1,000,000 rubles. (RUB 800,000 + RUB 236,000 - RUB 36,000).

The organization calculates depreciation for the modernized fixed asset based on the original cost, increased by the cost of modernization, using the depreciation rate calculated based on the new SPI of the fixed asset.

With this approach to tax accounting, the organization, on a monthly basis, starting from the month following the month of completion of the modernization work and commissioning of the OS facility, includes accrued depreciation in the amount of 11,905 rubles as expenses associated with production and sales. (RUB 1,000,000: (72 months + 12 months) x 100%).

In this case, after the expiration of the SPI (48 months), the asset will not be fully depreciated in tax accounting.

Therefore, the organization will continue to charge depreciation until the cost of the fixed asset is completely written off.

Tax depreciation on the modernized fixed asset will be accrued over 51 months in the amount of ((800,000 rubles - 400,000 rubles + 236,000 rubles - 36,000 rubles) : 11,905 rubles).

In the last month, the amount of depreciation will be 4,750 rubles. (RUB 800,000 - RUB 400,000 + RUB 236,000 - RUB 36,000 - RUB 11,905 x 50 months).

How to apply PBU 18/02 in this case

The amount of depreciation accrued in tax accounting during the industrial development of a modernized fixed asset is less than the amount of depreciation recognized in accounting. Depreciation for income tax purposes is calculated over 51 months, and for accounting purposes - 48 months.

Consequently, during these 48 months, deductible temporary differences (DTD) in the amount of the excess of accounting depreciation over tax and the corresponding deferred tax assets (DTA) are reflected in the accounting records on a monthly basis (clauses 11, 14 of PBU 18/02).

The specified VVR and ONA are reduced (repaid) during the remaining three months of depreciation in tax accounting (clause 17 of PBU 18/02).

In accounting, the modernization of an asset should be reflected in the following entries:

| Contents of operations | Debit | Credit | Amount, rub. | Primary document |

| In the month of modernization of the OS object | ||||

| The costs of upgrading the OS object are reflected (236 000 — 36 000) | 08 | 60 | 200 000 | Acceptance certificate for completed work |

| The VAT presented by the contractor for the modernization of the OS facility is reflected | 19 | 60 | 36 000 | Invoice |

| VAT claimed by the contractor is accepted for deduction | 68-VAT | 19 | 36 000 | Invoice |

| The costs of upgrading an OS object are included in the increase in the cost of this object | 01 | 08 | 200 000 | Certificate of acceptance and transfer of fixed assets, Inventory card for recording a fixed asset item |

| Payment transferred to the contractor | 60 | 51 | 236 000 | Bank account statement |

| Monthly starting from the month following the month of modernization of the OS facility and its commissioning, for 48 months | ||||

| Depreciation accrued | 20 (26, 44 and etc.) | 02 | 12 500 | Accounting certificate-calculation |

| SHE is reflected ((12,500 - 11,905) x 20%) | 09 | 68/ONA | 119 | Accounting certificate-calculation |

| Monthly for two months of depreciation in tax accounting | ||||

| SHE reduced (11,905 x 20%) | 68/ONA | 09 | 2 381 | Accounting certificate-calculation |

| In the last month of depreciation in tax accounting | ||||

| ONA extinguished (RUB 4,750 x 20%) | 68/ONA | 09 | 950 | Accounting certificate-calculation |

Example 3 Modernization was carried out by a contractor. The cost of modernization was 236,000 rubles. (including VAT RUB 36,000).

According to the accounting and tax records of the organization, the initial cost of the fixed asset is 800,000 rubles.

The equipment was assigned to the fourth depreciation group, the SPI was set by the organization at 72 months.

At the time of completion of the work, the remaining life expectancy of the fixed asset was 36 months, its residual value was 400,000 rubles.

As a result of modernization, the SPI of the OS object increased.

The organization decided, based on the results of the modernization, to increase the SPI of the OS facility by 12 months.

In accounting and tax accounting, depreciation on fixed assets is calculated using the linear method (method).

For income tax purposes, income and expenses are determined using the accrual method.

The depreciation bonus for the fixed asset was not applied.

The organization calculates depreciation for the modernized fixed asset based on the residual value of the fixed asset, increased by the amount of modernization costs, and the remaining fixed income.

We will make the necessary calculations.

In accounting, the amount of monthly depreciation charges for production equipment after modernization will be 12,500 rubles. ((400,000 rub. + 236,000 rub. - 36,000 rub.) : 48 months).

The organization calculates depreciation for the modernized fixed asset based on the residual value of the fixed asset, increased by the amount of modernization costs, and the remaining fixed income.

With this approach to tax accounting, the organization, on a monthly basis, starting from the month following the month of completion of the modernization work and commissioning of the OS facility, includes accrued depreciation in the amount of 16,667 rubles as expenses associated with production and sales. ((400,000 rub. + 236,000 rub. - 36,000 rub.) : 36 months) x 100%).

Tax depreciation on the modernized fixed asset will be accrued over 36 months ((800,000 rubles - 400,000 rubles + 236,000 rubles - 36,000 rubles): 16,667 rubles).

Application of PBU 18/02 in this case

It turns out that within 48 months. depreciation is recognized monthly in accounting in the amount of 12,500 rubles, and in tax accounting - for 36 months. in the amount of 16,667 rubles.

As a result, within 36 months. Taxable temporary differences in the amount of RUB 4,167 arise monthly in the company’s accounting records. (16,667 rubles – 12,500 rubles) and corresponding deferred tax liabilities (DTL) in the amount of 833 rubles. (RUB 4,167 x 20%).

The specified NVR and IT are reduced (repaid) during the remaining 12 months of depreciation in accounting (clause 17 of PBU 18/02).

In accounting, the modernization of an asset should be reflected in the following entries:

| Contents of operations | Debit | Credit | Amount, rub. | Primary document |

| In the month of modernization of the OS object | ||||

| The costs of upgrading the OS object are reflected (236 000 — 36 000) | 08 | 60 | 200 000 | Acceptance certificate for completed work |

| The VAT presented by the contractor for the modernization of the OS facility is reflected | 19 | 60 | 36 000 | Invoice |

| VAT claimed by the contractor is accepted for deduction | 68-VAT | 19 | 36 000 | Invoice |

| The costs of upgrading an OS object are included in the increase in the cost of this object | 01 | 08 | 200 000 | Certificate of acceptance and transfer of fixed assets, Inventory card for recording a fixed asset item |

| Payment transferred to the contractor | 60 | 51 | 236 000 | Bank account statement |

| Monthly starting from the month following the month of modernization of the OS facility and its commissioning, for 36 months | ||||

| Depreciation accrued | 20 (26, 44 and etc.) | 02 | 12 500 | Accounting certificate-calculation |

| IT is reflected ((16,667-12,500) x 20%) | 68/ONO | 77 | 833,4 | Accounting certificate-calculation |

| Monthly for 12 months of depreciation in accounting | ||||

| Depreciation accrued | 20 (26, 44 and etc.) | 02 | 12 500 | Accounting certificate-calculation |

| IT has been reduced (12,500 x 20%) | 77 | 68/ONO | 2 500 | Accounting certificate-calculation |

Accounting for a building with an initial cost of up to 100 thousand rubles. during reconstruction in the amount of 1 million rubles.

Consider the following situation. The organization purchased the building at an initial cost of 90,000 rubles. and put it into operation.

The building will be used for the production needs of the organization

The building is classified in the fifth depreciation group (property with a depreciation period of more than seven years up to ten years inclusive).

The SPI was set at 90 months.

5 months after the building was put into operation, the building was reconstructed in the amount of 1,000,000 rubles.

The period of work to reconstruct the building was 10 months.

In accounting and tax accounting, depreciation on fixed assets is calculated using the linear method (method).

For income tax purposes, income and expenses are determined using the accrual method.

Let's consider the procedure for reflecting reconstruction operations in the case when the SPI remains unchanged after reconstruction.

Accounting: acquisition and commissioning of a building before reconstruction

The building is used for the production needs of the organization for a long time (more than 12 months) and its cost is more than 40,000 rubles.

Consequently, this equipment meets the criteria established by paragraph 4 of the Accounting Regulations “Accounting for Fixed Assets” PBU 6/01, approved by Order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n, and must be included in the operating system.

The monthly amount of accounting depreciation starting from February 2017 for 15 months is 1000 rubles. (RUR 90,000: 90 months).

Income tax

In the letter of the Ministry of Finance of Russia dated 02/07/2017 No. 03-03-06/1/7342, financiers indicated that paragraph 1 of Article 256 of the Tax Code of the Russian Federation determines that depreciable property for the purposes of Chapter 25 of the Tax Code of the Russian Federation includes property, results of intellectual activity and other objects intellectual property that is owned by the taxpayer (unless otherwise provided by Chapter 25 of the Tax Code of the Russian Federation), is used by him to generate income and the cost of which is repaid by depreciation. Depreciable property is property with a fixed income of more than 12 months and an original cost of more than 100,000 rubles.

Depreciable property is taken into account at its original cost, determined in accordance with Article 257 of the Tax Code of the Russian Federation, unless otherwise provided by Chapter 25 of the Tax Code of the Russian Federation (clause 9 of Article 258 of the Tax Code of the Russian Federation).

Based on subparagraph 3 of paragraph 1 of Article 254 of the Code, the cost of property that is not depreciable is written off for tax accounting purposes at a time when it is put into operation.

The initial cost of fixed assets changes in cases of completion, additional equipment, reconstruction, modernization, technical re-equipment, partial liquidation of relevant facilities and for other similar reasons (clause 2 of Article 257 of the Tax Code of the Russian Federation).

Thus, if the initial cost of property after reconstruction exceeds 100,000 rubles, such property should be classified as depreciable and its value taken into account as expenses by calculating depreciation.

Application of PBU 18/02 in this case

Since the cost of the building is less than 100,000 rubles. is taken into account in tax expenses at a time, then when putting the building into operation there is a need to apply PBU 18/02. The monthly amount of accounting depreciation starting from February 2017 is 1000 rubles. (90,000 rubles / 90 months).

Tax accounting in January 2021 will take into account the entire cost of the building in the amount of 90,000 rubles.

Thus, in accounting in January 2021 there will be no expenses, and in tax accounting the entire cost of the building will be written off.

In this regard, according to the organization’s accounting, a taxable temporary difference (TDT) and a corresponding deferred tax liability (DTL) arise, which is reflected as a credit to account 77 “Deferred tax liabilities” in correspondence with the debit of account 68 “Calculations for taxes and fees” ( clauses 12, 15 PBU 18/02).

Further, as depreciation is accrued, the resulting NVR and the corresponding IT are reduced, since the amount of monthly depreciation deductions is recognized in accounting, and there will be no expenses in tax accounting (clause 18 of PBU 18/02). That is, on the last day of each month IT decreases, which is reflected by an entry in the debit of account 77 and the credit of account 68.

Accounting for operations after reconstruction

We will make the necessary calculations.

At the time of completion of the work, the remaining useful life of the asset was 75 months. (90 months - 5 months - 10 months), its residual value was 75,000 rubles. (90,000 rub. - 90,000 rub./90 months X 15 months)

The amount of monthly depreciation charges for the modernized operating system in accounting will be 14,333.33 rubles. ((RUB 75,000 +RUB 1,000,000))/ 75 months).

In tax accounting, the amount of depreciation accrued per month in relation to fixed assets is determined based on its original cost and the depreciation rate determined based on the full useful life of the fixed asset.

The depreciation rate established upon commissioning of the building is 1.1111% (1/90 month x 100%).

In this case, the amount of depreciation charges for the modernized OS, monthly included in the costs associated with production and sales, will be 11,111.11 rubles. ((RUB 1,000,000) x 1.1111%) (clause 3, clause 2, article 253, clause 3, article 272 of the Tax Code of the Russian Federation).

Thus, depreciation on the modernized OS will be accrued over 90 months ((RUB 1,000,000) / RUB 11,111.11).

Application of PBU 18/02

The amount of depreciation accrued in tax accounting over the remaining useful life of the upgraded asset is less than the amount of depreciation recognized in accounting.

However, depreciation for profit tax purposes continues to be accrued for another 15 months after it ceases to be accrued in accounting (90 months - 75 months).

Consequently, during the remaining useful life (75 months), deductible temporary differences (TDD) in the amount of the excess of accounting depreciation over tax and the corresponding deferred tax assets (DTA) are reflected in the accounting records on a monthly basis.

At the same time, since accounting continues to accrue depreciation in the amount of 1,000 rubles. (this is necessary to repay ONO), then the deductible temporary difference over 75 months will be reflected in the amount of RUB 2,222.22. (RUB 14,333.33 - RUB 1,000 -RUB 11,111.11).

And the deferred tax asset (DTA) will be equal to 444.44 rubles. (RUB 2,222.22 x 20%).

The specified VVR and ONA are reduced (repaid) during the remaining 15 months of depreciation in tax accounting (clauses 11, 14, 17 PBU 18/02).

Taking into account the above, transactions for the acquisition, commissioning and reconstruction of a building must be reflected as follows:

| Contents of operations | Debit | Credit | Amount, rub. | Primary document |

| In the month of commissioning of the OS object | ||||

| The building was put into operation | 01 | 08 | 90 000 | Certificate of acceptance and transfer of fixed assets in form OS-1 |

| ONO formed (90,000 x 20%) | 77 | 68/ONO | 18 000 | Accounting certificate-calculation |

| Monthly from February 2021 for 14 months | ||||

| Depreciation accrued on building | 20 (26, 44 and etc.) | 02 | 1000 | Accounting reference-calculation |

| Reduced IT (1000 X 20%) | 77 “Deferred tax liability” | 68/ONO | 200 | Accounting certificate-calculation |

| In the month of modernization of the OS object | ||||

| The costs of upgrading the OS object are reflected | 08 | 60 | 1 000 000 | Acceptance certificate for completed work |

| The costs of upgrading an OS object are included in the increase in the cost of this object | 01 | 08 | 1 000 000 | Certificate of acceptance and transfer of fixed assets, Inventory card for recording a fixed asset item |

| Depreciation accrued on building | 20 (26, 44 and etc.) | 02 | 1000 | Accounting reference-calculation |

| Reduced IT (1000 X 20%) | 77 “Deferred tax liability” | 68/ONO | 200 | Accounting certificate-calculation |

| Monthly starting from the month following the month of modernization of the OS facility and its commissioning, for 75 months | ||||

| Depreciation accrued | 20 (26, 44 and etc.) | 02 | 14 333,33 | Accounting certificate-calculation |

| SHE is reflected ((14,333.33 – 1000 – 11,111.11) x 20%) | 09 | 68/ONA | 444,44 | Accounting certificate-calculation |

| Reduced IT (1000 X 20%) | 77 “Deferred tax liability” | 68/ONO | 200 | Accounting certificate-calculation |

| Monthly for 15 months of depreciation in tax accounting | ||||

| SHE reduced (11,111.11 x 20%) | 68/ONA | 09 | 2222,22 | Accounting certificate-calculation |

Value added tax (VAT)

The organization has the right to deduct the amount of VAT presented by the contractor when carrying out work to modernize an OS facility if there is an invoice issued by the contractor and drawn up in accordance with the requirements of the law, and relevant primary documents after taking into account the results of the work performed, provided that the modernized the fixed asset will be used when carrying out transactions subject to VAT (clause 1, clause 2, article 171, clause 1, article 172, clause 2, article 169 of the Tax Code of the Russian Federation).

Corporate income tax

When modernizing an asset (including a fully depreciated one), its initial cost is increased (clause 2 of Article 257 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of Russia dated July 25, 2016 N 03-03-06/1/43374). The initial cost of the modernized OS object will be 720,000 rubles. (576,000 rub. + 172,800 rub. - 28,800 rub.).

In the situation under consideration, after modernization, the useful life of an asset has increased, and therefore the organization has the right to increase the useful life of this object in tax accounting, on the basis of which depreciation is calculated, but within the period established for the depreciation group in which this item is included OS object (Clause 1, Article 258 of the Tax Code of the Russian Federation).

In accordance with the Classification of fixed assets included in depreciation groups, approved by Decree of the Government of the Russian Federation dated January 1, 2002 N 1, equipment is classified in the third depreciation group (property with a useful life of over three years to five years inclusive), its useful life was established equal to 48 months (clause 1 of article 258 of the Tax Code of the Russian Federation). After modernization, the useful life increased by 12 months, therefore, the organization has the right to set a new useful life of 60 months (48 months + 12 months).

Depreciation after modernization of an asset is calculated based on the increased initial cost of the asset and its extended (new) useful life. Similar explanations are given in Letter of the Ministry of Finance of Russia dated 08/04/2016 N 03-03-06/1/45862.

With this approach, the amount of depreciation on the modernized fixed asset, monthly included in the costs associated with production and sales, starting from the month following the month of completion of the modernization of the fixed asset, will be 12,000 rubles. (RUB 720,000 / 60 months x 100%) (clause 3, clause 2, article 253, clause 4, article 259, clause 2, article 259.1, clause 3, article 272 of the Tax Code of the Russian Federation). Thus, after 12 months following the month of completion of modernization, the asset will be fully depreciated in tax accounting (576,000 rubles + 12,000 rubles x 12 months = 720,000 rubles).

Note that there are also other points of view on the issue of calculating depreciation on modernized fixed assets. Detailed information on positions on this issue is provided in the Encyclopedia of Disputes on Income Tax.

The amounts of accrued depreciation on a fixed asset, in accordance with the accounting policy, relate to direct expenses, which meets the requirements of paragraphs. 1, para. 8, 10 p. 1 art. 318 Tax Code of the Russian Federation. Direct expenses relate to the expenses of the current reporting (tax) period as products are sold, in the cost of which they are taken into account in accordance with Art. 319 of the Tax Code of the Russian Federation (clause 2 of Article 318 of the Tax Code of the Russian Federation).

If the OS is completely deprecated

There is no procedure for depreciation of depreciated fixed assets in tax legislation . The commented Letter of September 23, 2011 N 03-03-06/2/146 explains that when modernizing a fully depreciated fixed asset, the cost of the modernization increases the initial cost of such property. In this case, the cost of the modernization performed is subject to depreciation according to the standards that were initially determined when this fixed asset was put into operation. This opinion was repeatedly expressed by the Finance Ministry earlier in Letters of the Ministry of Finance of Russia dated December 27, 2010 N 03-03-06/1/813, dated September 10, 2009 N 03-03-06/2/167. The courts express a similar point of view on this issue (see Resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated February 17, 2011 in case No. A29-6272/2007).

Example. The organization, using a contracting company, is modernizing a fully depreciated OS facility (production equipment). In accounting and tax accounting, the linear method (method) of depreciation is used. Upon commissioning, the useful life of the fixed assets was set to five years (in accordance with the Classification of fixed assets). The cost of modernization was 118,000 rubles. (including VAT RUB 18,000).

Account correspondence

Table of accounting entries

| Contents of operations | Debit | Credit | Sum | Primary document |

| The costs of modernizing the OS facility are reflected (172,800 - 28,800) | 08 | 60 | 144 000 | Acceptance certificate for completed work |

| The VAT presented by the contractor for the modernization of the OS facility is reflected | 19 | 60 | 28 800 | Invoice |

| VAT claimed by the contractor is accepted for deduction | 68 | 19 | 28 800 | Invoice |

| The costs of upgrading an OS object are included in the increase in the cost of this object | 01 | 08 | 144 000 | Certificate of acceptance and delivery of fixed assets, Inventory card for accounting of fixed assets |

| Payment transferred to the contractor | 60 | 51 | 172 800 | Bank account statement |

| Monthly, starting from the month following the month of increase in the value of the fixed asset, for 12 months | ||||

| Depreciation accrued (144,000 / 12) | 20 | 02 | 12 000 | Accounting certificate-calculation |

Depreciation calculation

In the accounting system, depreciation according to the new rate is accrued from the month following its end (clause 21 of PBU 6/01, clause 61 of the Guidelines for accounting for fixed assets).

In NU, regulatory authorities recognize the possibility of calculating depreciation according to new standards from the month of completion of work (Decision of the Federal Tax Service of the Russian Federation dated January 26, 2017 N SA-4-9 / [email protected] ).

The program implements a depreciation calculation method similar to the accounting system - from the next month (clause 5, clause 7 of Article 259.1 of the Tax Code of the Russian Federation).

Accrue depreciation according to the new rate in the month following the modernization, in the procedure Closing the month using the routine operation Depreciation and depreciation of fixed assets in the Operations - Closing the month section.

Let's check the calculation performed by the program. The program uses SPI and residual value attributable to the month of depreciation.

In BU, depreciation is calculated (clause 60 of the Guidelines for accounting for fixed assets):

The residual value and self-reporting index are indicated in the Depreciation Calculation Certificate for June (section Operations - Month Closing - Calculation Certificates - Depreciation). PDF

- (262,500 + 36,000) / 50= 5,970 rub.

In NU, depreciation is calculated (clause 2 of Article 259.1 of the Tax Code of the Russian Federation, Letters of the Ministry of Finance of the Russian Federation dated March 22, 2019 N 03-03-06/1/19397, dated October 23, 2018 N 03-03-06/1/76004):

- (300,000 + 36,000) / 56= 6,000 rub. PDF

The calculation in the program coincides with our calculation.

See also:

- Accounting for fixed assets in 1C 8.3: step-by-step instructions

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Should I file a property tax return if my fixed asset is being conserved? ...

- Why is depreciation not calculated in 1C 8.3 at the end of the month? ...

- How to determine the SPI of fixed assets The Ministry of Finance reminded how to correctly determine the useful life (SPI) of fixed assets...

- How can I change the way fixed assets are reflected in depreciation expenses in 1C? ...