Payment of dividends to the owners of the organization occurs in accordance with the legally established procedure. Let's consider the features of reflecting in 1C the operations of accrual and payment of dividends to the founders.

You will learn:

- how to calculate dividends in 1C 8.3 accounting: to an individual resident of the Russian Federation, to an individual non-resident of the Russian Federation, to a Russian organization;

- how to pay dividends;

- what transactions in 1C 8.3 are generated when accounting for dividends.

Calculation of dividends: postings in 1C 8.3

Accrual of dividends in 1C 8.3 Accounting is documented in the document Accrual of dividends .

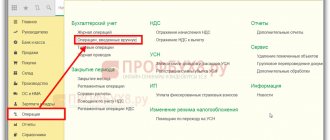

You can find it:

- Salary and personnel – Salary – Calculation of dividends;

- Operations – Accounting – Calculation of dividends.

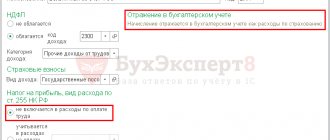

The personal income tax rate on dividends is determined automatically, based on the status and type of founder .

Dividend Accrual document form does not contain a field for the dividend settlement account; the user does not have the opportunity to set or change it. The 1C 8.3 Accounting program automatically generates transactions involving account 75.02 “Calculations for the payment of income.”

Let's take a closer look at the calculation of dividends for each type of founder using an example.

On March 28, the general meeting of the founders of the Organization decided to distribute the profit received for 2021 in the amount of 2,000,000 rubles. in favor of the following founders:

- Russian legal entity Karandash LLC, which owns a 50% share of the Authorized Capital (AC) 6 months - 1,000,000 rubles;

- an individual (resident of the Russian Federation) Alexander Pavlovich Ivanov, an employee of an organization owning a 35% share of the management company - 700,000 rubles.

- individual (non-resident of the Russian Federation) Kutuzov Alexander Pavlovich, who owns a 15% share of the management company - 300,000 rubles.

Calculation of dividends to an individual resident of the Russian Federation

Please indicate:

- Recipient - type of founder: Individual .

For a resident of the Russian Federation, the personal income tax amount is calculated at a rate of 13% ; it cannot .

Postings according to the document

Calculation of dividends to an individual non-resident of the Russian Federation

Check that the Non-Resident in the individual’s card in the section Salaries and Personnel – Directories and Settings – Individuals via the Income Tax .

Calculate dividends:

Please indicate:

- Recipient - type of founder: Individual .

For a non-resident of the Russian Federation, the personal income tax amount is calculated at a rate of 15% cannot be changed .

Postings according to the document

Calculation of dividends to a Russian legal entity

Please indicate:

- Recipient - type of founder Legal entity .

By default for legal entities. persons, the amount of income tax on dividends is calculated automatically at a rate of 13% . But unlike an individual, it can be edited by indicating the required amount in the Income Tax .

This is necessary if a different rate is used to calculate dividend tax. For example, when the tax is calculated at a rate of 0% if the organization holds at least 50% of the shares for 365 days or more.

Postings according to the document

This article will show how to calculate and pay dividends in the 1C: Enterprise Accounting version 3.0 configuration. In the example under consideration, the release configuration was 3.0.69.35

Let's start by first understanding what is meant by the term dividends. Translated from Latin dividendum is something that is subject to division.

According to Article 43 of the Tax Code of the Russian Federation, a dividend is understood as any income received by a shareholder (participant) from an organization during the distribution of profits remaining after taxation on shares (shares) owned by the shareholder (participant) in proportion to the shares of shareholders (participants) in the authorized (joint) capital of this organizations.

In simple words, dividends are the net profit of an organization (or part of it), which is distributed among its participants (shareholders) in proportion to their shares in the authorized capital.

The amount of net profit that can be distributed for the payment of dividends (the amount of dividends is determined by the decision of participants/shareholders) is reflected in the credit of account 84.01. To see it in the program, go to the “Reports” subsystem and select “Account balance sheet”.

In the form that opens, select the period for which we want to see the amount, indicate account 84.01 and click “Create”, the balance at the end of the period on the credit of this account will be the amount of profit that can be distributed to pay dividends and paid.

Please note that when paying dividends to individuals, personal income tax (hereinafter referred to as personal income tax) will need to be charged and withheld from this amount, the amount of which has been 13% since 2015. The procedure for paying income tax when paying dividends to legal entities is regulated by Article 284 of the Tax Code of the Russian Federation.

To calculate dividends in the program, there is a document “Accrual of dividends”, which is located in the “Salaries and Personnel” subsystem, “Salaries” menu.

By going to the document data log, clicking on the “Create” button, we create a new document.

In which we fill in the dividend recipient, select the period for which we are accruing dividends, manually enter the amount that we want to accrue and click “Pass”. In our case, there is only one participant (shareholder) and he is an individual, we will accrue dividends for 2021. Please note that when filling out the amount, the program will automatically calculate the amount of personal income tax and the amount of dividends to be paid.

You can see what transactions are generated when dividends are calculated in the movements of this document; to do this, you need to click on the DtKt icon in the command panel.

We see that the entire amount from loan 84.01 corresponds to account 75.02 - Calculations for the payment of income, where our participant is in the analytics and then the amount of personal income tax is withheld from it to account 68.01.

Once dividends have been accrued, we can proceed to their payment. We can pay both through a bank and through a cash desk. In our case, dividends will be paid through the bank; to do this, based on the document we entered, you need to create a “Payment Order” document, which will then need to be sent to the bank.

In case of payment of dividends through the cash register, you need to create a “Cash Issue” document and issue dividends to the participant from the cash register using a cash receipt order. It is imperative, as in the first and second cases, no later than the next business day after the payment of dividends, that personal income tax must be transferred to the tax office at the place of registration of the organization.

That's all, we hope that this material will be useful to you. If you have questions about the calculation, distribution and payment of dividends in the 1C: Enterprise Accounting version 3.0 configuration, or other configurations, write to us in the comments to the publication or through the feedback form on the website, we will be happy to answer you.

New publications

- Loading the FIAS address classifier into 1C: Accounting 3.0

- Preparation and sending of SZV-M from 1C: Accounting 3.0

- Hiring an employee in accounting 2.0

- Submitting an application to renew a license and/or certificate for the 1C:Reporting service

Most read

- Clearing 1C Cache

- Updating 1C configuration via the configurator

- Setting up a salary project in 1C: Accounting 3.0

- Updating the 1C platform through the 1C:ITS portal

- Hiring an employee in ZUP 3.1

Payment of dividends: postings in 1C 8.3

1C provides an assistant for the payment of dividends, personal income tax and income tax on dividends.

The assistant is launched by clicking the Pay .

The result of his work will be the creation of Payment order :

- for the payment of dividends;

- for the payment of personal income tax (for the payment of income tax on dividends).

Check the fields:

- Type of operation - Transfer of dividends ;

- Recipient - Individual ;

- Expense item - Payment of dividends with the established type of movement Payment of dividends and other payments in favor of owners .

a debit from your current account using the link Enter a debit document from your current account in the Payment order .

Check the fields:

- Type of operation - Transfer of dividends ;

- Expense item - Payment of dividends .

Postings according to the document

Payment of dividends to other participants is processed in the same way. the Recipient field will be set to Legal Entity .

A little about the legislative framework

Dividends are a portion of profits that owners can distribute to themselves as a reward for profitable operation based on the performance of their enterprise. At the same time, it is important to understand that the presence of money in the current account is not an indicator of the profitability of the activity; accordingly, this is not enough to transfer dividends.

According to paragraph 1 of Art. 28 No. 14-FZ, as well as clause 1 of Art. 42 the company has the right to distribute profits once a quarter, half a year or once a year. The entire process of distributing funds must be prescribed in the company's charter so that each distribution procedure is legal and justified. If the profit has not been distributed among the owners, it is recorded in the retained earnings account.

According to the financial statements, net profit is determined, which is the source of funds for paying income to the founders.

At the same time, it is completely unclear where to look, if not at the balance in the current account. But often the opposite situation arises: there is profit, but there is no money in the current account to make payments for the distribution of profit. Therefore, later we will look at how to determine the amount of dividends in the program.

The amount of dividends is subject to personal income tax, as well as to any type of income of an individual, if the founder of the company is an individual, and income tax, if an organization. In this case, the payer organization will be a tax agent for personal income tax for income recipients, in simple words - you will pay the tax amount to the budget on part of the profit paid, and transfer the rest to the founders. You must pay the tax on the day or the next business day you receive income (take into account weekends and holidays). These are all the tax obligations that you will have when distributing your company's profits.

The general meeting of founders (or shareholders) makes a decision on the payment of dividends; its decision based on the results of the meeting must be formalized in the minutes of the meeting. It specifies the amount and timing of payments, dates and form of payments, as well as a list of founders and shareholders who are entitled to a portion of the company’s profits.

There are cases when a company does not have the right to distribute the income of an enterprise among the founders, these include:

— not all participants contributed their shares to the authorized capital in full and on time;

— at the time of distribution of dividends, the organization is in a state of bankruptcy, or will be in bankruptcy after payment;

- if it turns out that the value of net assets is lower than the authorized capital of the enterprise (we will show their calculation below in the article);

- before the repurchase of shares of the joint-stock company, which are subject to repurchase in accordance with the law, etc.

The procedure for distributing net profit in relation to legal entities does not have any distinctive features and is subject to the general procedure prescribed in legislative acts. There is a peculiarity with the taxes paid. For legal entities, a profit tax is also established, which is paid by the tax agent when transferring income to the founders-legal entities on the day of transfer or on the next business day. Income tax is 13%, and is reflected in the tax return of the quarter in which the income was paid.

So, let's summarize. What to do when a company plans to distribute its profits:

— We determine the amount of profit on the date specified in the charter (based on the results of the quarter, half a year, year);

— We hold a meeting of participants, draw up a protocol with the recommended amount of dividends, the timing and method of payment, as well as a list of income recipients;

— We calculate them in the program, pay them, and transfer the tax to the budget.

— Don’t forget to include all amounts accrued to the owners in the 6-NDFL and 2-NDFL certificate, as well as in the income tax return for legal entity founders.

Fill out the declaration

We are required to report to the regulatory authorities that the company has paid income to its founders, calculated tax on them and transferred it to the budget. As already mentioned in the first section of the article, in the reporting quarter they fill out a report on Form 6-NDFL to reflect payments to individuals, and an income tax return for legal entities.

Regulated reports are located in the “Reports” section.

Using the “Create” command, select the 6-NDFL report from the list and fill it out.

In the first section, the amount of dividends is included in line 020, like other payments on an accrual basis, and is separately included in line 025. Similar to personal income tax, which is filled out in lines 040 and 045. Withheld tax is reflected in the general order in line 070.

Let's move on to the second section.

The date of actual receipt of income and the date of deduction of income are equal to the date of accrual and payment, and the transfer period is the next business day. The amount of income received is indicated in full, taking into account personal income tax.

Then we will fill out a 2-NDFL certificate for the individual who received the income.

Now let's create an income tax return. The path to it lies there.

Fill out Sheet 03. Section A. In the header you must select the category of the tax agent, the type of dividends, indicate the period and year for which the payment is made. Next, in line 001, fill in the amount of income paid to the legal entity. It is automatically copied to line 010. And we enter the amount in line 022 as income taxed at a rate of 13%. The income of organizations that own 50% or more of the authorized capital for more than 365 days is taxed at a rate of 0%. The exercise of this right is confirmed by a notification from the tax authority.

Next, in section B of sheet A, information is filled in about the legal entities that are named in the register of participants and to whom the dividends were transferred. The type line is entered as 00, which corresponds to the primary report; it characterizes the order of the corresponding adjustments to the declaration.

The director of the organization, the date it received income and the amount of income and tax related specifically to this legal entity are indicated. It is clear that the total amounts of accrued dividends were listed above on an accrual basis; in section B they are detailed by recipient. In our example, there is only one recipient, so the amounts will be the same.

Note. If the owners include both individuals and legal entities to whom dividend payments are made, then it is necessary to fill out separate pages in the income tax return for payments to individuals in Sheet 03 of Section A, and for legal entities. If the participants include only individuals, then there is no need to fill out an income tax return. For them, only 6-NDFL and 2-NDFL certificate for the year are submitted.

We recommend reading the article: “1C Cloud - what is it? In simple words"

Dividends in other versions of 1C in 2021

General rules

Version 6.0 is currently practically not used.

In order to correctly reflect the accrual of dividends in 1C 7.7, the document “Accrual of dividends” is used. It is suitable for both employees and outsiders to the company.

You need to click on “Enter accruals” in the “Documents” menu and enter into the form:

- total amount;

- list of shareholders (interest holders);

- the number of shares (shares) owned by each of them.

Then click the “Calculate” button.

The accrual is carried out depending on how dividends are distributed: per total amount or per share (share). The payment amount and tax for each shareholder are calculated automatically. The resulting list can be edited if necessary.

The document is posted to the “Salary” journal and distributed into two lists:

- "Dividends to shareholders";

- "Employee dividends."

Dividends in 1C Accounting 8 - topic of the video below: