How to fill out Form 23 PFR

Form 23 of the Pension Fund of the Russian Federation is now in use; it has been in force since February 2016 and is called “Application for the return of the amount of overpaid insurance premiums, penalties, and fines.” It was approved by resolution of the Pension Fund Board of December 22, 2015 No. 511p.

Funds that were overpaid by an organization (IP) to the Pension Fund of the Russian Federation and the Federal Compulsory Medical Insurance Fund can only be returned upon the payer’s statement about the resulting overpayment. If a fund employee has identified a paid surplus, the Pension Fund must inform the policyholder about this within 10 days. After which a joint reconciliation is carried out, in which each party reflects its data. Based on its results, the overpayment will be confirmed, or an updated calculation will be required.

To return overpaid funds to the Pension Fund, you must prepare an application in paper or electronic form by filling out Form 23 of the Pension Fund (the form can be downloaded below).

An application is submitted to the territorial branch of the Pension Fund of the Russian Federation at the place of registration of the payer of contributions within three years from the date of payment of the amount that resulted in the overpayment. In turn, fund employees make a decision on this application no later than ten working days from the moment they receive an application for the return of the overpaid amount. If the decision is positive, the excess amount will be returned within 1 month. If the Pension Fund fails to comply with the established deadlines, the payer must be returned the amount of the overpayment along with the accrued percentage of the penalty for each day of delay.

Where to go to get a refund of overpaid contributions

Since 2021, the functionality for monitoring the completeness and timing of payment of insurance premiums has been divided between the departments of the Federal Tax Service and insurance funds. The table below provides information on where the payer should contact to return the overpayment that occurred before and after 01/01/2017.

| Type of insurance premiums | Reporting period | |

| Until 01/01/2017 | After 01/01/2017 | |

| Pension insurance | To return an overpayment of pension contributions that arose for reporting periods before 01/01/17, the payer must contact the Pension Fund of Russia | Questions regarding the refund of overpayments on insurance premiums that arose after 01/01/17 must be directed to the territorial body of the Federal Tax Service at the place of registration |

| Temporary disability insurance | The FSS is responsible for the refund of overpayments on disability contributions for reporting periods before 01/01/17 | |

| Compulsory health insurance | An application for a refund of overpayment of health insurance premiums for reporting periods before 01/01/17 should be submitted to the Compulsory Medical Insurance Fund | |

Let's look at an example. On 04/12/2021, the accountant of Frank LLC discovered an error in the DAM for March 2021, as a result of which contributions to the Pension Fund for the specified period were overpaid.

Since the reporting period for the overpayment is before 01/01/2017 (March 2016), to return the overpayment, the accountant of Frank LLC should contact the Pension Fund at the place of registration.

If there is a debt to the Pension Fund

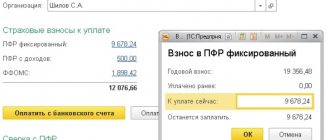

If an organization or individual entrepreneur has a debt to the Pension Fund, it will be repaid from the overpaid amount. That is, the Fund will first reconcile your payments, then the amount of arrears will be deducted from the amount of your overpayment. And the remainder (if anything remains) will be returned to the policyholder.

However, you will not always get your money back. It is impossible to return the surplus if it was deposited and paid in the RSV-1 form and distributed to the individual accounts of employees. In this case, an offset may be made against future payments by the policyholder.

In Form 23 of the Pension Fund of the Russian Federation, the form contains the payer’s data, the name of the overpayment amount and the details for which the refund will be made.

How to submit an application for refund of overpayment of insurance premiums

The basis for the return of an overpayment of insurance premiums is the payer’s application to the regulatory authority (FSS/PFR/MHIF or Federal Tax Service - depending on the period in which the overpayment occurred) with a completed application.

The application form depends on which body the payer applies to. Below we will consider the features of filling out an application when applying for a refund of an overpayment to the Social Insurance Fund, the Pension Fund of the Russian Federation, the Compulsory Medical Insurance Fund and the Federal Tax Service.

Application for refund of overpayment through social insurance authorities

If the overpayment occurred for the period before 01/01/17, then the payer should contact the territorial social insurance authority: (click to expand)

- overpayment of pension contributions - to the Pension Fund;

- overpayment of contributions due to temporary disability and maternity - to the Social Insurance Fund;

- overpayment of contributions for compulsory health insurance - to the Compulsory Medical Insurance Fund.

Each of the above regulatory authorities provides its own application form for completion. The table below provides generalized information about the features of filling out these applications.

| Type of overpayment | Where to apply | Application form | Procedure for filling out an application |

| Overpayment of pension contributions | Pension Fund | 23-PFR (form can be downloaded here ⇒ Form 23-PFR) | When filling out the document, the payer should include the following information in the application:

|

| Overpayment of health insurance premiums | Compulsory Medical Insurance Fund | ||

| Overpayment of contributions to the Social Insurance Fund for injuries | FSS | 23-FSS (form can be downloaded here ⇒ Form 23-FSS (form)) | |

| Overpayment of contributions to the Social Insurance Fund due to temporary disability and maternity | FSS | 22-FSS (form can be downloaded here ⇒ Form 22-FSS (form)) |

The completed document is signed by the chief accountant, affixed with the organization’s seal, and then sent to the regulatory authority for further processing.

Author: Elena Danyakina, independent consultant,

From January 1, 2021, the administrator of insurance premiums is the Federal Tax Service of Russia.

Based on Art. 20 of Federal Law dated 07/03/2016 No. 250-FZ PF RF and FSS RF continue to conduct desk audits of calculations for insurance premiums for 2021, including updated calculations for periods expired before 01/01/2017, and also conduct on-site inspections for periods until 2021.

In accordance with Part 1 of Art. 19 of Federal Law No. 250-FZ, the bodies of the Pension Fund of the Russian Federation and the Social Insurance Fund must transfer the following information to the tax authorities:

— on the amounts of arrears, penalties and fines for insurance contributions to state extra-budgetary funds of the Russian Federation, formed as of January 1, 2017;

- on the amounts of insurance premiums, penalties and fines additionally assessed by the specified bodies based on the results of control measures provided for in Art. 20 of Federal Law No. 250-FZ and carried out for reporting (calculation) periods that expired before January 1, 2017.

Branches of the Pension Fund of Russia and the Federal Tax Service of Russia exchange information electronically at the regional level.

Based on the information received, the tax authorities collect arrears on insurance premiums, corresponding penalties and fines to state extra-budgetary funds that were formed as of January 1, 2021, and insurance premiums, penalties and fines additionally assessed by the Pension Fund of the Russian Federation, the Social Insurance Fund based on the results of control measures carried out for settlement (reporting) periods that expired before January 1, 2021 (if, based on the results of such control measures, there are decisions on prosecution (refusal to prosecute) that have entered into force).

The tax authorities will carry out this collection in the manner and within the time limits established by the Tax Code of the Russian Federation.

This procedure is provided for in Part 2 of Art. 4 of the Federal Law of July 3, 2016 No. 243-FZ “On amendments to parts one and two of the Tax Code of the Russian Federation in connection with the transfer to tax authorities of powers to administer insurance contributions for compulsory pension, social and medical insurance.”

In Letter dated September 28, 2017 No. 03-02-08/63040, the Ministry of Finance indicated that, in accordance with Art. 20 of Federal Law No. 250-FZ, control over the correctness of calculation, completeness and timeliness of payment (transfer) of insurance contributions to state extra-budgetary funds payable for reporting (calculation) periods expired before January 1, 2021 is carried out by the Pension Fund of the Russian Federation and the Social Insurance Fund in the manner in force until the date of entry into force of the said law.

Such clarifications are contained in the Letter of the Federal Tax Service of the Russian Federation dated January 19, 2017 No. BS-4-11/ [email protected] “On conducting an information campaign,” which provides a reminder for insurance premium payers on the administration of insurance premiums by tax authorities. In addition to this document, information and explanatory materials for insurance premium payers were sent [email protected]

As a result of the application by tax authorities of forced collection measures in relation to debts on insurance premiums for periods expired before 01/01/2017, transferred by the Pension Fund of the Russian Federation and the Federal Insurance Fund of the Russian Federation, the formation of excessively collected amounts of insurance premiums is possible if the balance of settlements on insurance premiums transferred by the funds turned out to be incorrect, and also if, during inspections, the funds recalculated insurance premiums to the payer downwards.

During the transfer of data from funds to tax authorities, for various reasons, technical errors occurred, which led to a distortion of the balance of insurance premiums as of 01/01/2017. Since tax inspectorates do not have the right to independently make changes to the composition of information received from extra-budgetary funds, measures were taken debt collection.

The tax inspectorate collected contributions from some payers based on incorrect debt data.

Payers defended their rights in the courts.

In the decision of the Seventh Arbitration Court of Appeal dated September 28, 2017 No. 07AP-6419/17 (the consideration of the case is completed), the judges clarify that the tax authority must be contacted for a credit (refund) on contributions, in particular in case of temporary disability, if the overpayment arose for period after December 31, 2016

The Resolution of the Arbitration Court of the Central District dated December 20, 2021 No. F10-5136/17 in case No. A36-13501/2016 (the case was sent for reconsideration to the Arbitration Court of the Lipetsk Region) states that when establishing the fact of excessive payment (collection) of insurance contributions, penalties, the court should impose an obligation on the authorized body to return (as opposed to collection) the amounts overpaid.

In accordance with Article 21 of Law No. 250-FZ, the decision to return amounts of overpaid (collected) insurance premiums, penalties and fines for reporting (calculation) periods expired before January 1, 2017 is made by the relevant bodies of the Pension Fund of the Russian Federation. However, the powers of the bodies of the Pension Fund of the Russian Federation from 01/01/2017 are limited to making a decision on the return of amounts of overpaid (collected) insurance contributions, penalties for periods before 01/01/2017, while the bodies of the Pension Fund of the Russian Federation do not have the authority to actually return them.

The Ministry of Finance had to regulate the procedure for returning the amount of excessively collected insurance premiums. This procedure is described in letter dated 07/19/2017 No. 03-02-07/2/ [email protected] “On the return of excessively collected amounts of insurance premiums for periods expired before 01/01/2017”, which was communicated to taxpayers by the Federal Tax Service in a letter dated 07/27/2017 No. ED-4-8/14778.

The Ministry of Finance and the Federal Tax Service of Russia propose to demand the return of excessively collected amounts of insurance premiums for periods expired before 01/01/2017, which arose as a result of the application of forced collection measures by tax authorities, from extra-budgetary funds, since the Tax Code of the Russian Federation does not provide for the return of amounts of excessively collected such insurance premiums. Taxpayers in this situation must submit written applications to the Pension Fund of the Russian Federation and (or) the Social Insurance Fund of the Russian Federation in electronic form with an enhanced qualified electronic signature for the return of overpaid amounts of insurance premiums, penalties and fines, and the funds must make a decision within 10 working days on the return of the excess paid insurance premiums for reporting periods expired before January 1, 2021.

The said letter from the Ministry of Finance emphasizes that the Tax Code of the Russian Federation does not regulate relations related to the calculation and payment of insurance premiums calculated before 01/01/2017, as well as relations arising in the process of monitoring the calculation and payment of such insurance premiums. Consequently, the Code does not provide for the return of amounts of such insurance premiums collected in excess. This means that the provisions of Art. 79 of the Tax Code of the Russian Federation on the return of excessively collected contributions does not apply in this situation. That is, interest at the refinancing rate of the Central Bank of the Russian Federation in favor of the taxpayer on the amount of excessively collected tax will not be accrued.

Federal Law No. 250-FZ did not provide for the payment of interest to payers of insurance premiums for violating the established deadline for the return of amounts of overpaid (collected) insurance premiums, although the Federal Law of July 24, 2009 No. 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Fund insurance of the Russian Federation, the Federal Compulsory Medical Insurance Fund" gave such guarantees (Letter of the Ministry of Finance of the Russian Federation dated 01.03.2017 No. 03-02-07/2/11564).

In September 2021, joint letters were issued by the FSS No. 02-11-10/06-02-3959P and the Federal Tax Service No. 3n-4-22/ [email protected] dated 09.15.2017; PF No. NP-30-26/13859 and Federal Tax Service No. 3n-4-22/ [email protected] dated 09/06/2017. The letters clarify that the funds must submit to the tax authorities corrected information on the amounts of insurance contributions for compulsory pension and compulsory health insurance, penalties and fines accrued as of 01/01/2017, as well as primary information on the balance of settlements for insurance premiums as of 01/01/2017, not received by the tax authorities.

The funds must correct the information transmitted by the territorial bodies of the Pension Fund to the tax authorities if the payer does not agree with the balance of payments, as well as if it is necessary to clarify the information transferred to the tax authority, if the territorial bodies of the Pension Fund and (or) the Social Insurance Fund themselves reveal the facts of incorrect transfer of data. RF.

A procedure for correcting information has been prescribed.

If the payer disagrees with the balance of payments, he has the opportunity to contact either the tax office at the place of his registration, or the funds themselves - the pension and/or social insurance fund.

If the payer of contributions applies to the tax inspectorate at the place of registration, the inspectorate must send a request to the funds, attaching a copy of the payer’s application no later than 3 business days from the date of receipt of the payer’s application. Upon receipt of a request, funds are required to verify and correct the data within 20 working days. After this, the tax inspectorate, within 7 working days from the date of receipt of information from the funds, will make changes to the information resources of the Federal Tax Service of Russia.

If the payer of contributions contacts his territorial branch of the FSS of the Russian Federation, then within two working days it must send to the Federal Tax Service of Russia for the constituent entity of the Russian Federation a request about the balance of payments accepted by the inspectorate, as well as about the amounts of overpaid (collected) contributions generated for periods before 01.01 .2017, penalties and fines subject to refund. Upon receipt of a response from the Federal Tax Service of Russia for a constituent entity of the Russian Federation, the FSS branch will check them with its data within two working days. If discrepancies are identified, a decision will be made to adjust the settlement balance. Then this decision will be sent to the Federal Tax Service of Russia for the constituent entity of the Russian Federation, and the fee payer will be sent a response to his appeal with a copy of the decision attached. The inspection will reflect the updated information in the personal account of the payer of contributions no later than seven working days from the date of receipt of information from the Federal Tax Service of the Russian Federation (letter of the Federal Tax Service of Russia dated August 25, 2017 No. ZN-19-22 / [email protected] ).

Please note that a similar procedure is provided for the return of contributions to compulsory pension insurance (letter of the Pension Fund of the Russian Federation dated October 4, 2017 No. NP-30-26/15844).

The recommended form of application to the Pension Fund for the return of amounts of overpaid (collected) insurance premiums, penalties and fines is given in the Information of the Pension Fund of the Russian Federation “On the return of amounts of overpaid (collected) insurance premiums for periods expired before January 1, 2017” (https:// www.pfrf.ru/strahovatelyam/for_employers/rabbot_vozvrat_summ as of 01/12/2018).

An application is submitted to the FSS in form 23-FSS (approved by Order of the FSS of the Russian Federation dated November 17, 2016 No. 457).

The forms of documents used by tax authorities and taxpayers when offsetting and returning amounts of overpaid (collected) taxes, fees, insurance premiums, penalties, and fines are established by Order of the Federal Tax Service of the Russian Federation dated February 14, 2017 No. ММВ-7-8/ [email protected]

Order of the Federal Tax Service of the Russian Federation dated May 23, 2017 No. ММВ-7-8/ [email protected] approved the recommended formats for applications for offset, return of amounts of overpaid, collected or subject to reimbursement of taxes, fees, insurance premiums, penalties, fines, which legal entities will be able to submit in electronic form via TCS through an electronic document management operator.

It should be taken into account that the overpayment of insurance premiums accrued before 01/01/2017 is returned by the pension fund, provided that the organization does not have arrears in payment of insurance premiums, also accrued before 01/01/2017. This rule is established by Part 3 of Art. 21 Federal Law dated July 3, 2016 No. 250-FZ.

An application for the return of overpaid insurance premiums may be submitted within three years from the date of payment of the specified amount. This was established by Federal Law No. 212-FZ of July 24, 2009. This rule applies to settlements with the Pension Fund regarding overpayments of contributions incurred before 01/01/2017.

Please note that if the funds' adjusted debt for insurance premiums for periods up to 2021 exceeds the debt initially transferred to the tax office, the excess amount will be considered an unresolved debt subject to collection. The tax inspectorate will send the insurance premium payer a request for payment of such debt in the form approved by order of the Federal Tax Service of Russia dated February 13, 2017 No. ММВ-7-8/ [email protected]

The same procedures will be carried out when funds clarify information submitted to tax inspectors about additional charges based on the results of audits for periods before 01/01/2017 or about reductions in the amounts of contributions, penalties and fines for them.

Refusal of the regulatory authority to return the overpayment

The supervisory authority has the right to refuse to refund the overpayment of insurance premiums to the payer due to the following grounds:

- The payer has arrears on insurance premiums. The overpayment amount is not refundable if the applicant has arrears in contributions (arrears, penalties, fines). In this case, the overpayment is credited to repay the debt, and the balance of the amount (if any) is credited to the payer’s account.

- The payer contacted the regulatory authority later than the established deadline . According to current legislation, the payer has the right to apply to the Federal Tax Service/Fund for the return of the overpayment within 3 years from the date of occurrence of such an overpayment. If the application occurs after the established period, the issue of refund is resolved in court.

- The organization/individual entrepreneur provided distorted data on the amount of overpayment . If, based on the results of a desk audit, information about an overpayment received from the payer is found to be unreliable, the Federal Tax Service/Fund has the right to refuse to return the funds to the applicant.