How to show compensation from the Social Insurance Fund in the RSV

Starting from 2021, when filling out the DAM, the Form and Procedure approved by Order of the Federal Tax Service of Russia dated October 10, 2016 No. MMV-7-11/ [email protected]

The procedure for filling out the RSV 2021 (reimbursement from the Social Insurance Fund) states that the amounts of insurance premiums for VNiM (insurance in connection with temporary disability and in connection with maternity) are reflected in Appendix 2 to Section 1 of the Calculation.

In accordance with clause 11.14 of the Procedure, in line 080 of Appendix 2, you must indicate the amount of compensation from the Social Insurance Fund in the column corresponding to the month of actual compensation.

Thus, if the Fund reimbursed the employer’s expenses for paying benefits in August 2021, then this should be reflected on line 080 in the column for the 2nd month of the 3rd quarter. We will describe in detail how to do this in an example.

In the final line 090 of Appendix 2, you must indicate the amount calculated using the following formula:

This reflects the difference between accrued contributions and expenses for payment of benefits plus the amount of compensation from the Social Insurance Fund for the reporting period.

Calculating the difference can result in either a negative or a positive number.

IMPORTANT!

There is no need to indicate the amount with a minus sign in front in the calculation! Only the difference is indicated, and you need to show whether it is negative or positive using the numbers 1 or 2, entered in the “sign” columns:

- 1 - premiums are greater than the cost of insurance payments to employees;

- 2 - the cost of insurance payments is greater than the accrued premiums.

So, if you get a negative value, put the number 2 in the “sign” column. This will mean that the amount of benefits you transferred is greater than the amount of insurance premiums.

Please note that at the end of the reporting period, the result will be either an amount payable to the budget (positive) or reimbursement from the budget (negative). They will be indicated with attributes “1” and “2” respectively. In this case, you cannot simultaneously fill in the calculation lines:

- 110 and 120;

- 111 and 121;

- 112 and 122;

- 113 and 128.

When you receive the amount to be paid, fill out line 110, and for reimbursement, fill out line 120, and so on.

Fill in line 090 in the calculation of insurance premiums in 2021

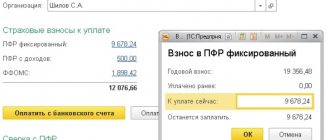

Let’s assume, based on the example above, that the organization received compensation in the amount of 8,564 rubles from the Social Insurance Fund in July 2021. The employer incurred these expenses in May by paying benefits to the employee. Then the indicators of line 090 of the sample take on completely different values.

The value of line 090 of the calculation in 2021

IMPORTANT! On page 070, indicate the amount of expenses that is subject to offset/refund from the budget. Do not include expenses for the first 3 days of illness at the expense of the employer on line 070. Participants in the FSS pilot project do not fill out line 070. Read about the nuances of filling out page 070 here.

- if in section 1, then reflect the amount of contributions for additional social security;

- if in Appendix 2 of Section 1, then indicate the result of reducing the calculated amounts of insurance premiums by the amount of expenses incurred when paying out insurance coverage;

- if in Appendix 3 of Section 1, then enter data on the payment of social benefits for funeral;

- if in Annex 4 of Section 1, then indicate the number of recipients, as well as information on the duration of the paid periods and the amount of additional payments under the BiR to those persons who suffered as a result of the accident at PA Mayak;

- if in Appendix 10 of Section 1, then they reflect information on students from whose income insurance premiums can be calculated at reduced rates;

- if in Appendix 1 of Section 2, then include data on the amount of insurance premiums accrued to a member of a peasant (farm) enterprise;

- if in section 3, then enter the name of the individual who receives income from the employer.

We recommend reading: Law on Silence of the Krasnoyarsk Territory Latest Edition

If the data in the DAM differs from the accounting data

Reflecting the reimbursement of expenses by the Social Insurance Fund when filling out the DAM, accountants notice a discrepancy in the amount of insurance premiums indicated in line 090 of the calculation with the accounting data. This discrepancy raises doubts and a logical question: is the form filled out correctly? For example, in fact, the Social Insurance Fund reimbursed the company’s expenses, but when filling out the calculation, it turns out that the company owes the Fund a larger amount than it actually did. Since the money that the Fund has already reimbursed is added to the contributions accrued for the period.

In fact, there is no mistake in this. And you need to fill out the calculation exactly as indicated in the Procedure.

Despite the fact that a large amount will be indicated in the final line 110 of Section 1, as well as in line 090 of Appendix 2, only the amount of the contributions themselves will need to be paid to the Fund.

After transferring all the information to the budget settlement card, tax authorities will see which amounts are arrears and which are overpaid. And the money reimbursed by the Fund to the policyholder will be indicated as an overpayment. You will not have any debt to the Social Insurance Fund.

If expenses for payment of benefits were taken into account last year, and compensation was received in the current year

In this case, the filling order is also observed and the above formula is used. Regardless of the period for which the Social Insurance Fund reimburses costs, for the previous quarter or for the previous year, this must be reflected in the calculation directly in the month of receipt.

This is stated in the explanatory Letter of the Federal Tax Service of Russia dated 04/09/2018 No. BS-4-11/ [email protected]

In addition, such a conclusion can be drawn from the norms of Chapter 34 of the Tax Code of the Russian Federation, which, starting from January 2021, provides for the offset of expenses spent on VNIM benefits against upcoming payments.

Sample of filling out the DAM with compensation from the Social Insurance Fund

Let's give an example of filling out the RSV when reimbursing the Social Insurance Fund.

Initial conditional data for our example:

Contributions accrued for the half-year:

| Total (RUB) | April | May | June |

| 150 000 | 50 000 | 50 000 | 50 000 |

Benefits paid for the 2nd quarter:

| Total (RUB) | April | May | June |

| 350 000 | 100 000 | 100 000 | 150 000 |

The excess of benefits over contributions was: 350,000 - 150,000 = 200,000 rubles.

The lines of Appendix 2 to Section 1 in the DAM for the 2nd quarter that interest us, when filled out for this example, look like this:

Let's assume that we have reimbursed the payment of benefits to the organization in August 2021.

Let's consider where the DAM reflects compensation from the Social Insurance Fund when filling out Appendix 2 of Section 1 for 9 months, if contributions were accrued for the 3rd quarter:

| Total (RUB) | July | August | September |

| 150 000 | 50 000 | 50 000 | 50 000 |

In total, since the beginning of the billing period, accrued (we consider it as a cumulative total: since the DAM is for 9 months, we add up the amount of contributions for the 1st, 2nd and 3rd quarter): 150,000 + 150,000 = 300,000 rubles.

Benefits paid for the 3rd quarter:

| Total (RUB) | July | August | September |

| 120 000 | 45 000 | 40 000 | 35 000 |

In total, since the beginning of the billing period, accrued (we consider it as a cumulative total: since the DAM is for 9 months, we add up the amount of benefits paid for the 1st, 2nd and 3rd quarter): 350,000 + 120,000 = 470,000 rubles.

In the 3rd quarter there was compensation from the Social Insurance Fund:

| Total (RUB) | July | August | September |

| 100 000 | 0 | 100 000 | 0 |

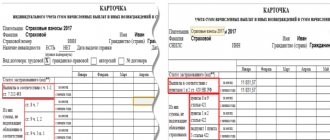

Then the lines of Appendix 2 of Section 1 of the RSV for 9 months of 2021 that interest us will look like this:

Please note that at the end of 9 months, the amount to be reimbursed from the budget was obtained.

When filled out, it is indicated with the sign “2” in column 1. This means that for 9 months the amount of benefits paid to employees exceeded insurance accruals.

And at the end of the third quarter, the amount due was paid to the budget. It is indicated with the sign “1” in column 3. That is, for the 2nd quarter, the amount of insurance accruals exceeded the amount of benefits.

For clarity, we will show in the pictures how the values indicated in lines 090 were calculated.

In just 9 months, benefits exceeded contributions by 170,000 rubles. (300,000 - 470,000 = -170,000). If we add the funds transferred to the FSS in August 2021 in the amount of 100,000 rubles, it turns out that the FSS still owes the organization 70,000 rubles. We indicate this value in line 090 with the sign “2”.

For the third quarter, insurance accruals, taking into account the compensation received from the Social Insurance Fund, exceed the costs of benefits. To be paid to the budget - 130,000 rubles. We enter this value when filling in with the sign “1”.

In July 2021, the Social Insurance Fund has not yet reimbursed the organization’s expenses, so in the calculation of 100,000 rubles. they don't take it. We indicate contributions payable in the amount of 5,000 rubles.

In August 2021, we will add the reimbursed 100,000 rubles. to the difference between lines 060 and 070, since it was in this month that they were listed.

In September we indicate only the difference between lines 060 and 070.

We hope that now filling out the RSV when receiving compensation from the Social Insurance Fund 2020 will be a simple task for you.

Let us remind you that the DAM based on the results of 9 months of 2021 must be submitted no later than October 30.

You can read more about filling out the RSV in this material.

Line 090 in the calculation of insurance premiums

Line 090 in the calculation of insurance premiums is contained in sections 1 and 3, as well as in appendices 2, 3 and 4 to section 1 and appendix 1 to section 2. The information included in line 090 depends on what data needs to be displayed in that or other calculation sheet.

Which sections contain line 090

As you can see, the information in line 090 differs depending on in which section or application it is filled out. At the same time, it can indicate a variety of indicators - amounts, quantities, dates or information indicated by letters.

In fact, a discrepancy does not mean there is an error at all. It arises due to the specifics of the DAM form - it does not contain cells in which the incoming and outgoing balances should be reflected. Therefore, the amount by which benefits paid in 2021 exceed the amount of contributions is not reflected in the DAM for the 1st quarter of 2021. Accordingly, if in the 1st quarter a refund was received from the Social Insurance Fund, then from the calculation it will not be clear that it compensates for the difference between benefits and contributions for the previous year.

You can also check the balance of social insurance settlements using a calculation certificate (Appendix 1 to the letter of the Federal Social Insurance Fund of Russia dated December 7, 2016 No. 02-09-11/04-03-27029). Such a certificate, along with other documents, is submitted to the Fund by those policyholders who want to receive compensation.

How benefits are reflected in the RSV

The problem is that, due to the expenses mentioned above, the indicator for line 090 of Appendix 2 to Section 1 does not reflect the actual state of calculations for social insurance contributions. Let's look at why this happens and what to do.

On line 070, indicate the amount of expenses for the payment of insurance coverage for compulsory social insurance, which is paid at the expense of the Social Insurance Fund. Do not take into account the amounts of hospital benefits for the first three days of incapacity (letter of the Federal Tax Service of Russia dated December 28, 2021 No. PA-4-11 / [email protected] ). And on line 080, indicate the amounts with which the Social Insurance Fund reimbursed expenses for sick leave, maternity benefits, etc.

We recommend reading: How to confirm a residence permit in 2021 in St. Petersburg

On lines 120–123, indicate the amount of excess social insurance expenses incurred by the payer: – on line 120 – for the billing (reporting) period; – on lines 121–123 – for the last three months of the billing (reporting) period.

Question

When filling out the calculation for insurance premiums in section 1. In February, sick leave benefits were accrued in the amount of 13,700.00 and contributions were accrued in the amount of 6,600.00, based on the results payable 0. In March contributions were accrued in the amount of 6,700.00 payable 0, the remainder of the excess goes to April 400 .00. How to reflect in line 110 - 113 and 120 - 123? In line 111 - accrued for January, lines 112 and 113 are empty, value 0. In line 121 - 0, and lines 122 - 123, excess amounts, i.e. 6600.00 and 400.00 balance, correct?

Line 110 indicates the amount of accrued and unpaid benefits, with the exception of those benefits that were accrued for the last month of the reporting period and in respect of which the deadline for payment of benefits established by law was not missed.