How the Federal Tax Service corrected the control ratios for the DAM

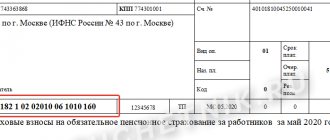

The current control ratios of the calculation form for insurance premiums were approved by letter of the Federal Tax Service of Russia dated 02/07/2020 No. BS-4-11/2002.

Letter dated May 29, 2020 No. BS-4-11/8821 tax authorities:

- clarified control ratios of 1.84, 1.138 and 1.140;

- introduced new KS 1.193 - 1.199 and 2.8 - 2.10.

For the first time, these KS must be taken into account when submitting the calculation of contributions for the half-year (6 months) of 2021.

SZV-M: calculation of contributions

The RSV-1 form was approved by Order of the Federal Tax Service of the Russian Federation No. ММВ-7-11 / [email protected] dated 10.10.2016. In 2021, certain changes were made to it. Therefore, starting with reporting for the first quarter of 2020, policyholders must use the form approved by Order of the Federal Tax Service No. ММВ-7-11 / [email protected] dated September 18, 2019.

Form changes:

- Added "Payer Type" cell. Code 1 is entered in it if payments to individuals have been accrued. Or code 2 if there were no payments in the reporting period.

- In Appendix 2, the line “Number of individuals from whose payments insurance premiums are calculated” has been added.

- Separate appendices to the first section have been excluded from the report (in accordance with changes to Article 427 of the Tax Code of the Russian Federation).

- Added and deleted certain lines from the third section.

The list of codes for payers of insurance premiums at reduced rates has also been updated.

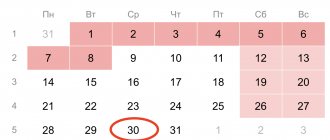

RSV-1 is submitted quarterly:

- For the first quarter of 2021 - until April 30, 2020.

- For 6 months of 2021 - until July 30, 2020.

- For 9 months of 2021 - until 10/30/2020

- For 12 months of 2021 - until 01/30/2021

For violation of the deadlines for submitting the report, penalties are provided in the amount of 5% of the amount of contributions, which is reflected in the report, but not less than 1000.00 rubles and no more than 30% of the amount of contributions.

As of January 1, 2020, the changes made to Art. 431 of the Tax Code of the Russian Federation (Federal Law No. 325-FZ of September 29, 2019). In accordance with them, policyholders who report to the Pension Fund about the insurance experience of employees and provide information about them are required to submit a report in two ways:

- in electronic form with a staff of more than 10 people;

- on paper if the number of employees is less than 10 people.

The contribution calculation form consists of 24 sheets. It includes a title page, three sections and appendices.

In accordance with Letter No. BS-4-11/4859 dated March 17, 2017, Ministry of Finance No. 03-15-07/17273 dated March 24, 2017, DAM-1 zero must be submitted within the deadlines established by law.

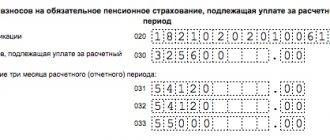

At the same time, in the zero report (when there were no payments to employees - payer type code “2”) the following sheets are filled out:

- Title page;

- Section 1 (without applications with zero values in lines 031-033, 051-053, 071-073, 091-093);

- Section 3 (subsection 3.1).

The rules for filling out the sections are specified in the Letter of the Federal Tax Service of the Russian Federation No. BS-4-11 / [email protected] dated April 12, 2017.

All insurers, which are legal entities and individual entrepreneurs who use hired labor in their activities, must fill out the following sheets:

- Title page;

- Section 1;

- Subsections 1.1 and 1.2 of Appendix 1 to Section 1;

- Appendix 2 to Section 1;

- Section 3.

Other sheets are filled out depending on need.

If the policyholder is entitled to reduced or additional rates of social payments, he additionally needs to fill out the following sections:

- Subsections 1.3.1, 1.3.2, 1.3.3, 1.4 of Appendix 1 to Section 1;

- Appendix 2 to Section 1;

- Appendices 5-10 to Section 1;

- Section 3.

If during the reporting period the employer paid individuals security for compulsory social insurance in case of temporary disability and in connection with maternity, he fills out the following sections:

- Appendix 3 to Section 1;

- Appendix 4 to Section 1.

If the employer has hired foreign citizens who are temporarily staying in the territory of the Russian Federation, he fills out Appendix 9 to Section 1.

Appendix 1.1 is filled out by policyholders who paid wages to pilots or workers employed in the coal industry. Section 1 and Schedule 3 - policyholders who paid employee benefits. Section 1 and Appendix 4 - employers paying benefits to victims of the Chernobyl nuclear power plant (at the expense of the federal budget). Section 1 and Appendix 5 - IT companies (with reduced tariffs). Section 1 and Appendix 6 - NPOs using the simplified taxation system (STS). Section 1 and Schedule 7 - employers who engage in animation. Section 1 and Appendix 8 - insurers who pay compensation to foreign citizens. Section 1 and Schedule 9 are employers who pay income to student groups or individual students. Section 2 and Appendix 1 - heads of peasant and farm enterprises (peasant farms).

Why do we need new KS on contributions?

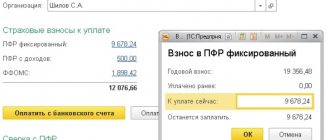

New control ratios are needed by small and medium-sized businesses (SMEs) to check the correctness of filling out the DAM regarding payments to individuals over 1 minimum wage, which are subject to reduced insurance premiums from April 1, 2021.

Earlier, in a letter dated 04/07/2020 No. BS-4-11/5850, the Federal Tax Service provided temporary tariff codes and categories of the insured person. It is for these codes that new control relations have been introduced.

For reduced contributions from the part of payments that is above 1 minimum wage, the tariff code is 20.

For insured persons, for part of payments from 1 minimum wage, the category codes are as follows:

- MS - individual;

- VZHMS - foreigners and stateless persons insured in the OPS system who temporarily reside in Russia, as well as foreigners or stateless persons temporarily residing in the Russian Federation who have been granted temporary asylum;

- VPMS - foreigners and stateless persons who temporarily stay in the Russian Federation (with the exception of highly qualified specialists).

Please note that all listed codes may become permanent.

For these codes, additional formulas have been added to the control ratios for contributions:

FOR PAYER RATE CODE

FOR INSURED PERSON CATEGORY CODE

If there are other 1.1 adj. 1 rub. 1 SV according to field value 001 adj. 1 rub. 1 SV = 20 obligation to find information about the payer in the SME register at the beginning of each month in which gr. 2, 3, 4 along lines etc. 1.1 adj. 1 rub. 1 CB > 0

If in other 3.2.1 rub. 3 SV according to FL (according to SNILS full name indicators) field value 130 = MS, then in other. 3.2.1 rub. 3 SV for this FL with a value in field 130 = NR line 150 for each field value 120 = minimum wage