What is a pilot project

A pilot project is an experiment in which the Russian Social Insurance Fund directly pays social benefits without the participation of employers. Also, as part of the pilot project, the foundation, at its own expense, finances expenses for the prevention of injuries and occupational diseases. Contributions for “injuries” are not included in the financing.

For 2021, the experiment of the social insurance fund is being tested on itself (see table).

| Type of region of the Russian Federation | Participants in the FSS experiment |

| Republic | Crimea |

| Karachay-Cherkessia | |

| Tatarstan | |

| edge | Khabarovsk |

| Regions | Astrakhan |

| Belgorodskaya | |

| Kurganskaya | |

| Nizhny Novgorod | |

| Novgorodskaya | |

| Novosibirsk | |

| Rostov | |

| Samara | |

| Tambovskaya | |

| Sevastopol | |

| From July 1, 2021 | |

| Republic | Mordovia |

| Regions | Bryansk |

| Kaliningradskaya | |

| Kaluzhskaya | |

| Lipetskaya | |

| Ulyanovskaya | |

How sick leave is assigned as part of a pilot project

In order for an employee to receive the sick leave benefits due to him as part of the pilot project, he still submits all the necessary documents to his employer. If the employee’s disability is not related to an industrial accident, he submits to the employer:

Articles on the topic (click to view)

- Is sick leave considered income?

- What to do if you have extended sick leave for pregnancy and childbirth

- What to do if your employer does not accept electronic sick leave

- What to do if you are not given sick leave

- How many days does it take for sick leave to arrive from the Social Insurance Fund?

- What to do if the place of work is not indicated on the sick leave

- Are sick leave taken into account when calculating maternity leave?

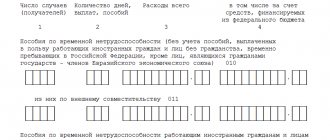

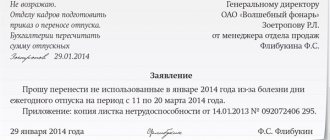

- application for payment of benefits in the form approved by order of the Federal Social Insurance Fund of Russia dated September 17, 2012 No. 335;

- certificate of incapacity for work;

- certificates of earnings from previous places of work for the pay period, if they have not been submitted previously.

The employer must submit the received documents within five calendar days to the branch of the Federal Social Insurance Fund of Russia at the place of his registration. Attached to them is an inventory of the documents being transferred in accordance with the form from the order of the Federal Social Insurance Fund of Russia dated September 17, 2012 No. 335.

The FSS branch of Russia reviews the documents within 10 calendar days and makes a decision on payment of benefits or refusal. If the decision has a “plus” sign, then the money is sent to the employee’s bank account using the details that he noted in his application.

It is worth keeping in mind that the Social Insurance Fund pays disability benefits in the usual manner. That is, starting from the fourth day of sick leave, benefits are paid to the employee for the period of his temporary illness not by the employer, but directly by the Social Insurance Fund. In this case, the employer must pay the subordinate for the first three days at his own expense.

How the pilot project works

Since 2012, the FSS project “Direct Payments” has been operating on the territory of the Russian Federation, which by the end of 2021 will unite 78 subjects. Based on government decree No. 294 of April 21, 2011, regions where the pilot project on sick leave begins to operate are joining it gradually, depending on readiness and need. Among those who joined this year:

- Komi and Yakutia, Udmurtia, Irkutsk, Kirov, Kemerovo, Orenburg, Saratov and Tver regions, Yamalo-Nenets Autonomous Okrug - from January;

- Bashkortostan, Dagestan, Krasnoyarsk and Stavropol territories, Volgograd, Leningrad, Tyumen and Yaroslavl regions - from July.

IMPORTANT!

St. Petersburg, Moscow and the Moscow region are planned to be connected to the project on January 1, 2021.

Read more: 9 more regions will be included in the Direct Payments project

The bottom line is that the social insurance fund independently pays benefits for temporary disability, but sick leave is not paid directly from the Social Insurance Fund if it is opened due to an accident at work or an occupational disease. In addition, “Direct payments” do not affect the transfer of funeral benefits and payment of 4 additional days off to one of the parents caring for a disabled minor. The Social Insurance Fund reimburses these funds to employers on the basis of mutual settlements.

IMPORTANT!

Although the pilot project clarifies how to receive sick leave directly from the Social Insurance Fund and involves direct payments of temporary disability benefits to insured persons, employers are required to pay for the first 3 days of illness at their own expense. In addition, their responsibilities include calculating amounts and submitting all documents confirming the correctness of the calculation.

How to fill out sick leave for a pilot project

The organization whose employee received sick leave fills out only the continuation of the form - its second part. Registration of the first is the responsibility of the specialist of the medical institution that issued the document.

This is important to know: How to extend sick leave if you have recovered

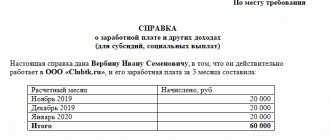

Also see “How to fill out sick leave for an employer: sample.” So, first, the form contains information about the company - its name. Then they note whether this is the person’s main place of work or whether he is employed here part-time. Below on the form of the certificate of incapacity for work indicate the tax registration number and subordination code. After this comes information about the employee such as TIN and SNILS.

Next, you will need to indicate the person’s work experience. Below are the start and end dates of the employee’s period of disability. To calculate the amount of benefits, his average and daily earnings are also indicated.

Expert opinion

Lebedev Sergey Fedorovich

Practitioner lawyer with 7 years of experience. Specialization: civil law. Extensive experience in defense in court.

After this, the amounts that should be accrued to the sick person by his employer and the Social Insurance Fund are given. Below they are summed up and the total amount of benefits that will be paid to the person for the period of his illness is displayed.

Be sure to indicate the surnames and initials of the head of the company, as well as the accountant or HR employee who filled out the sick leave. These persons put their signatures in the lower right corner.

Application for the allocation of necessary funds to pay insurance coverage

Additionally,

sick leave for an employee can be paid in two ways: either fully compensated by the Social Insurance Fund, or partially at the expense of the Social Insurance Fund and partially at the expense of the employer. When an employer must pay for sick leave, find out in the article https://otdelkadrov.online/7179-sluchai-kogda-rabotodatel-dolzhen-oplatit-bolnichnyi-list-kogda-eto-obyazannost-fss.

This is the main document sent to the FSS. You must use the form approved by the FSS letter N 02-09-11/04-03-27029 dated December 7, 2016. When filling it out, you must indicate the following information:

- in the upper right corner the name of the recipient of the application is indicated (if we are talking about payments for periods starting from 2021, then it will be the territorial tax office, and compensation for earlier periods is carried out by the corresponding division of the Social Insurance Fund);

- in the main part of the document, fill in the general details of the enterprise (TIN, KPP, address), as well as the subordination code and registration number of the applicant in the Social Insurance Fund;

- Next, you must indicate the requested amount and the applicant’s bank details.

The document must be signed by the manager and chief accountant, and also sealed. The application is submitted in 2 copies.

Nuances of entering data

As has already become clear from the above, the pilot project does not affect the filling out of sick leave by the employer . However, it will be useful for employees who are delegated to issue temporary disability certificates in the organization to refresh their memory of some of the nuances associated with this professional task.

Pen and ink

According to paragraph 65 of the Procedure, approved by order of the Ministry of Health and Social Development of Russia No. 624n, filling must be done exclusively with a gel, fountain or capillary pen. It is prohibited to use ballpoint pens for these purposes. Ink can only be black.

High tech

Letters

Information about the organization and the employee is entered into the sick leave form exclusively in capital Russian letters. If the company name contains foreign elements, their combinations, as well as abbreviations, they should not be changed into Russian.

Cells

Filling should occur exclusively where the appropriate fields and cells are allocated for this. It is prohibited to go beyond their limits.

Seal

It is important to note that a seal is affixed to a sick leave certificate only if it is provided for in the company’s charter. There is a place on the right for her. You can go beyond its limits, but the print should not overlap part of the data in the cells.

How to fill out sick leave for direct payments

The period within which sick leave can be filed is limited to 6 months from the date of termination of illness. If the deadlines are not violated, the employer is obliged to pay temporary disability benefits. There is no need to write any special statements.

The basis for calculating benefits will be a certificate of incapacity for work. If the policyholder refuses to accept the document for payment, it makes sense to write a statement in any form demanding payment of benefits. This must be done within the period established by law. As a sample, you can take a form for direct payment to the Social Insurance Fund or use the example below. The last point is to indicate the requirement to issue a written reasoned refusal in case of an unsatisfactory decision. In order to reduce waiting times, you can specify in the document that the employer issues a document related to the work process.

This is important to know: Sample of filling out the register of sick leave for the Social Insurance Fund

The policyholder does not fill in the total accrued. Rationale: In accordance with clause 3 of the Regulations on the specifics of the appointment and payment in 2012, 2013 and 2014 to insured persons of compulsory social insurance in case of temporary disability and in connection with maternity and other payments in the constituent entities of the Russian Federation participating in the implementation of the pilot project approved by Decree of the Government of the Russian Federation dated April 21, 2011 N 294 (hereinafter referred to as the Regulation), the policyholder, no later than five calendar days from the date of submission by the insured person (his authorized representative) of applications and documents, submits the applications received to him to the territorial body of the Fund at the place of registration and documents necessary for the appointment and payment of the relevant types of benefits, as well as a list of submitted applications and documents, drawn up in a form approved by the Fund. If a sheet is issued for part-time work, then the sheet number issued for the main job is indicated - the name of the place of work. Be sure to ask the employer what name of the company is recorded in the Federal Social Insurance Fund of the Russian Federation. This is the name that should be indicated on the sheet. If the patient does not know the full name of the employer, in this case the doctor leaves an empty field that the employer must fill in 6. Next, in the “Exemption from work” table, indicate the start and end dates of sick leave. The doctor's details are entered and his signature is added. When filling out the name of the institution or doctor's specialization, writing an abbreviation is allowed. 7. Under the table, the doctor writes from what date the patient can start working. If the sick leave is extended, then the corresponding code is entered in the “Other” column. And below is written the sick leave number, which is issued in continuation. 8.

Why does the HR manager need to follow the rules for filling out sick leave?

Issuing sick leave is a procedure strictly regulated by the legislator. This follows from the fact that sick leave must be issued exclusively on a secure form. Its form was approved by order of the Ministry of Health and Social Development of Russia dated April 26, 2011 No. 347n.

In addition, it is important to follow the rules for filling out sick leave in 2021 by the employer, established for him by order of the Ministry of Health and Social Development of the Russian Federation dated June 29, 2011 No. 624n. The document contains a list of general requirements for filling out sick leave, which are still relevant today.

The employer enters information only into some of the items on the sick leave form, which are combined into the “To be completed by the employer” block.

IMPORTANT! The sick leave certificate must correctly indicate the data filled in by both the doctor and the employer.

If the responsible person of the employer, before filling out the sick leave certificate, discovers errors in the block drawn up by the doctor, it makes no sense for the employer to fill out the part. Most likely, the Social Insurance Fund will refuse to reimburse the organization for expenses. It is necessary to request a new document from the medical organization.

Expert opinion

Lebedev Sergey Fedorovich

Practitioner lawyer with 7 years of experience. Specialization: civil law. Extensive experience in defense in court.

The FSS sanction can be just as severe for mistakes made due to ignorance of how the employer fills out sick leave. Let's look at how they can be avoided.

This is important to know: How to get an electronic sick leave certificate via VLSI

Basic principles for sending data

In order for the project of using a gateway to send data on employee sick leave to the Social Insurance Fund to be fully implemented, the following principles for sending data must be strictly observed:

- the employer must be registered with the Social Insurance Fund as a participant in the mutual electronic document management system;

- to send sick leave electronically through the gateway, the employer must have an electronic digital signature , the certificate of which meets the requirements established for such signatures by the Social Insurance Fund;

- when sending data on sick leave, the requirements for the timing of sending such data must be met , which means the need to send a sick leave within no more than five days from the date of receipt of such a certificate of incapacity from the employee.

If these principles are followed, interaction with the FSS will be carried out quite quickly.