How to apply for sick leave

The certificate of incapacity for work confirms that the person was absent from the workplace for a valid reason.

Based on sick leave, the employer accrues benefits for temporary disability or pregnancy and childbirth. Sick leave certificates are issued by medical institutions that have the appropriate license.

The ballot can be issued in one of two ways:

- On paper.

- Electronically (with the written consent of the insured person, that is, the employee).

When filling out a sick leave certificate on paper, you must follow the rules set out in the Issuance Procedure, approved by Order of the Ministry of Health dated September 1, 2020 No. 925n (hereinafter referred to as Procedure No. 925n). All letters must be capitalized and printed, the pen must be gel, capillary or fountain pen, the ink must be black, etc.

Doctors create an electronic certificate of incapacity for work (ELN) in the unified integrated information system “Social Insurance” online. The person is given not the ballot itself, but a coupon with an ELN number, without a signature or seal.

Next, the employee informs the employer of this number, the accountant finds the electronic newsletter in the system and pays for it.

Work with electronic sick leave according to new rules

IMPORTANT. To work with electronic electronic signature, an organization must complete the following steps: enter into an appropriate agreement with the regional office of the Social Insurance Fund, purchase an enhanced qualified electronic signature and install the necessary software. This is a right, not an obligation of the company. If management refuses to take these actions, there will be no fine. In this case, the medical institution is obliged to cancel the electronic newsletter and replace it with a paper one.

Receive an enhanced qualified electronic signature certificate in an hour

Filling out a sick leave certificate

The sick leave form was approved by order of the Ministry of Health and Social Development dated April 26, 2011 No. 347n. It consists of two sections.

The first section is filled out by the doctor. If he made a mistake on a paper ballot, corrections cannot be made. Instead, you need to issue another copy by checking the “duplicate” box.

The accountant needs to carefully check the certificate of incapacity for work for violations committed by doctors: filling it out in blue ink, missing the doctor’s name, etc. Most often, such flaws serve as a reason for FSS employees to refuse reimbursement of benefits costs. True, arbitration practice is positive for policyholders. Judges usually decide that the fund is obliged to reimburse benefits for shortcomings in the ballot.

REFERENCE. In the electronic LN, the place of work and type of employment (main or part-time) are not indicated. This follows from paragraph 65 of Order No. 925n.

You should also make sure that the paper sick leave certificate is genuine. This can be done using the FSS website, where the list of stolen and lost forms of certificates of incapacity for work is regularly updated.

The second section is filled out by the employer. If he makes a mistake, there is no need to write out a duplicate. It is enough to cross out the incorrect entry and make the correct one on the back, confirming it with the words “Believe the Corrected”, signature and seal. The use of corrective agents is prohibited.

Calculation of average earnings for sick leave in 2021

The rules for calculating sick leave are set out in the Regulations on the specifics of the procedure for calculating benefits for temporary disability and pregnancy and childbirth (approved by Decree of the Government of the Russian Federation dated June 15, 2007 No. 375). To correctly calculate benefits, you first need to calculate the employee's average earnings. To do this you will need to perform a number of actions.

Determine the billing period

As a general rule, the calculation period includes two calendar years preceding the year in which the illness occurred or maternity leave began. For a ballot opened in 2021, the calculation period is 2021 and 2021.

An exception is provided for women who were on maternity leave or maternity leave during the billing period. They are allowed to carry forward one or two years. The basis is a written statement from the employee.

Example 1.

Let's say an employee gets sick in February 2021. The calculation period for it is the period of time from January 1, 2021 to December 31, 2021 inclusive. But since the woman was on maternity leave in 2021, and on maternity leave in 2021, she wrote a request for a transfer. As a result, the new calculation period included the years 2021 and 2021.

Calculate average earnings

It consists of the amounts that the employee received in the billing period and from which contributions to compulsory social insurance were transferred.

Calculate your salary and benefits taking into account the increase in the minimum wage from 2021 Calculate for free

Compare with the maximum permissible base value

The average earnings for calculating benefits cannot be as large as desired. It can be taken into account only in the part that does not exceed the maximum value of the base for contributions in case of temporary disability and in connection with maternity. This value is approved by the Government of the Russian Federation every year.

IMPORTANT. It is necessary to compare the average earnings in the billing period with the base limits in force at that time. It is necessary to compare not the total figure, but data for each year separately (example in Table 1).

Table 1

An example of comparing average earnings with the base limits

| Indicators | Billing period | |

| 2019 | 2020 | |

| Limit value of the base for the corresponding year | 865,000 rub. | 912,000 rub. |

| Average earnings | 900,000 rub. (exceeds) | 880,000 rub. (does not exceed) |

| Amount taken into account when calculating sick leave Total: | 865,000 rub. | 880,000 rub. |

| RUB 1,745,000 (865 000 + 880 000) | ||

Compare with minimum wage

Average earnings must be greater than or equal to the minimum wage that was in effect on the date of the onset of illness or maternity leave. Otherwise, the benefit should be calculated based on the minimum wage.

The FSS, in letter dated 03/01/11 No. 14-03-18/05-2129, recommends comparing two values of average daily earnings: actual and based on the minimum wage. You need to do the following:

- Divide actual average earnings by 730 days.

- The minimum wage on the date of onset of illness or maternity leave is multiplied by 24 months and divided by 730 days.

- If the first value is greater than or equal to the second, calculate sick leave based on the first value. If the first value is less than the second, calculate the benefit based on the second value (example in Table 2).

table 2

An example of comparing two values of average daily earnings (actual and based on the minimum wage)

| Date of onset of illness | January 25, 2021 |

| Average earnings for the billing period (2019 and 2021) | 83,000 rub. |

| Minimum wage for 2021 | RUB 12,792 |

| Actual average daily earnings | RUB 113.7 (RUB 83,000: 730 days) |

| Average daily earnings based on the minimum wage | RUB 420.56 (RUB 12,792 x 24 months: 730 days) |

| Conclusion: | Since the actual average daily earnings are less than this figure calculated based on the minimum wage, the benefit must be calculated according to the minimum wage |

REFERENCE. In some cases, the benefit cannot exceed the minimum wage for a full calendar month, multiplied by the regional coefficient (if any), even if the actual average earnings exceed the minimum wage. This rule applies in the following situations: the employee’s insurance period is less than 6 months; the patient violated the regime prescribed by the doctor, or did not show up for examination, etc.

Find average daily earnings

For temporary disability benefits, in the general case, it is equal to the average earnings for the billing period (taking into account the maximum value of the base), divided by 730 days.

For maternity benefit (BIR) it is generally a fraction. The numerator is the average earnings for the billing period (taking into account the maximum value of the base). The denominator is the number of calendar days in the billing period minus the number of calendar days falling within the excluded period.

The excluded period includes days of illness, maternity leave, maternity leave for children up to one and a half years old, and days when a woman was released from work according to Russian laws with full or partial retention of wages (if contributions were not paid from the payments in case of temporary disability and in connection with motherhood).

Example 2 . The average salary of an employee in the billing period is 950,000 rubles, the base limit has not been exceeded. The number of calendar days of the billing period is 730. Of these, the employee was on sick leave for 20 calendar days (excluded period). The average daily earnings is 1,338.03 rubles (950,000 rubles: (730 days - 20 days)).

If the benefit is calculated based on the minimum wage, then the average daily earnings are equal to the minimum wage (as of the start date of the bulletin), multiplied by 24 months and divided by 730 days. For part-time work, a coefficient corresponding to the length of working time is added to the formula.

Reference data for calculating sick leave in 2021. Table.

| Indicator for calculating sick leave in 2021 | Indicator value in 2021 |

| Billing period | 2016 and 2021 |

| Number of days in the billing period | 730 days |

| Minimum wage | 9489 rub. |

| Limit earnings for calculating sick leave | 2016 – 718,000 rubles. 2021 – RUB 755,000. Amount: 2021 + 2021 = 1,473,000 rubles. |

| Maximum average daily earnings | 2017.81 rub. |

| Minimum average daily earnings | RUR 311.97 |

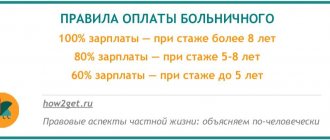

Percentage of length of service when calculating sick leave

When calculating temporary disability benefits, the average daily earnings must be multiplied by the percentage of length of service:

- if the experience is less than 5 years - by 60%;

- if the experience is from 5 to 8 years - by 80%;

- if the experience is 8 years or more - 100%.

REFERENCE. The length of service is determined by the work book (paper or electronic). If it is not there, use employment contracts and certificates from previous places of work. This is stated in paragraph 9 of the Rules for calculating and confirming insurance experience (approved by order of the Ministry of Labor dated 09.09.20 No. 585n).

When paying BIR benefits, the average daily earnings are always multiplied by 100%.

Example 1. Calculation of sick leave in 2021

In January 2021, the sales manager brought sick leave to the company's accounting department. The number of days of her illness = 9 calendar days. Insurance experience = 6 years. Actual earnings of the manager: In 2021 = 400,000 rubles In 2021 = 480,000 rubles. Earnings for 2021 and 2021, that is, for the billing period will be: 880,000 rubles. We compare this amount with the maximum earnings for calculating benefits - 1,473,000 rubles. The manager's earnings of 880,000 rubles do not exceed the maximum limit of 1,473,000 rubles. Let's calculate the amount of daily allowance for a manager: (400,000 rubles + 480,000 rubles): 730 days. × 80% = 964.38 rub. We multiplied by 80%, since the manager’s experience is from 5 to 8 years. This is the case when sick pay should be 80% of total earnings. The manager was sick for 9 days. Let's calculate the amount of benefits for 9 days of illness. To do this, we multiply the manager’s actual daily allowance by the number of sick days: 964.38 rubles. × 9 days = 8,679.42 rub.

Rules and procedure for calculating sick leave in 2021

The amount of the benefit is equal to the average daily earnings (taking into account the percentage of length of service) multiplied by the number of calendar days of illness according to the certificate of incapacity for work. If the bulletin was issued in connection with pregnancy and childbirth, then the number of calendar days of sick leave is generally 140.

From April 2021, an additional restriction applies. It applies to a situation where temporary disability benefits, calculated on the basis of average daily earnings and work experience, calculated for a full calendar month do not reach the minimum wage (in 2021 it is equal to 12,792 rubles). Then sick leave should be paid in the amount of the minimum wage for a full calendar month. In this case, the amount of the daily benefit is equal to the minimum wage divided by the number of calendar days of the month in which the illness occurs. The total benefit is the daily benefit multiplied by the number of calendar days of sickness in each calendar month. If a regional coefficient is introduced, then the minimum wage is determined taking into account this coefficient (for more details, see: “Sick leave in 2021: the temporary procedure for calculating benefits was made permanent”).

By law, the employer is obliged to independently calculate the full amount of benefits and reflect it in the second section of the sick leave.

Then you need to divide the benefit into two parts: at the expense of the employer and at the expense of the Social Insurance Fund. The following rule applies here: in case of illness or injury, the organization pays for the first three days of the newsletter, the remaining days are paid for by the fund. In case of BIR, quarantine and in a number of other cases, the FSS pays for all days (Article 3 of the Federal Law of December 29, 2006 No. 255-FZ).

Both parts of the benefit are reflected in the newsletter.

IMPORTANT. Both parts of the benefit should be entered on the sick leave in full, that is, before deduction of personal income tax. In the same way, you need to fill out the line “TOTAL accrued”.

Calculate your salary and personal income tax with standard deductions for free in the web service

How to calculate sick leave benefits in 2021

After returning to work after illness, the employee presents a sick leave certificate. The organization is obliged to assign him a benefit within 10 calendar days from the date of application and pay it on the next day established for payment of wages. According to Article 15 of Law No. 255-FZ.

The benefit is accrued and paid if the employee applies for it no later than six months from the date of starting work. According to Article 12 of Law No. 255-FZ.

You must pay for the entire period of the employee’s incapacity, including weekends and non-working holidays.

In case of illness or domestic injury, benefits for the first three days of incapacity are paid to the employee at the expense of the company, and from the fourth day - at the expense of the Federal Social Insurance Fund of the Russian Federation (Clause 2, Article 3 of the Federal Law of December 29, 2006 No. 255-FZ).

Minimum and maximum disability benefits in 2021

The maximum average daily earnings is RUB 2,434.25 ((RUB 865,000 + RUB 912,000): 730 days).

The maximum benefit for BIR in the general case is 340,795 rubles ((865,000 rubles + 912,000 rubles): 730 days × 140 days).

Temporary disability benefit, calculated based on the minimum wage (provided that the work experience is more than 8 years) - 420.56 rubles. per day (RUB 12,792 × 24 months: 730 days).

The BIR benefit, calculated based on the minimum wage in the general case, is 58,878.4 rubles (12,792 rubles × 24 months: 730 days × 140 days).

Temporary disability benefit based on the minimum wage for a full month:

in April, June, September, November - 426.4 rubles. per day (RUB 12,792: 30 cal days);

in January, March, May, July, August, October, December - 412.65 rubles. per day (RUB 12,792: 31 cal days);

in February - 456.86 rubles. per day (RUB 12,792: 28 cal days).

Example 4. Calculation of sick leave 2021 from the minimum wage with less than 6 months of experience

If the employee’s insurance period is less than 6 months, the sick leave benefit cannot exceed the minimum wage for a full calendar month, in accordance with Part 6 of Article 7 of Law No. 255-FZ. In this case, to calculate sick leave, you need to calculate and compare: the daily benefit calculated from the employee’s earnings and the maximum daily benefit for a specific month, calculated from the minimum wage. For example, let’s calculate the maximum daily benefit for March and February 2021. In March there are 31 days, in February - 28 days. The maximum daily benefit in February 2021 will be: 9489 rubles. : 28 days = 338.89 rub. The maximum daily benefit in March 2021 will be: RUB 9,489. : 31 days =306.1 rub.

Examples of calculations

Example 3

The employee was sick from November 1 to November 11, 2021, and was in the hospital. On November 6, he violated the regime, and the doctor made a note about this on the sick leave. The period from November 6 to November 11 was paid based on the minimum wage.

The employee's length of service is 13 years, the actual average daily earnings are 1,900 rubles.

The accountant calculated the allowance:

- for the period from November 1 to November 5 - 9,500 rubles (1,900 rubles × 5 days);

- for the period from November 6 to 11 - 2,558.4 rubles (426.4 rubles × 6 days).

The total benefit amounted to 12,058.4 rubles (9,500 + 2,558.4).

Example 4

The woman brought a certificate of incapacity for work according to the BIR to the accounting department. The start of maternity leave is November 18, 2021. As of this date, the insurance period is 5 months.

The accountant calculated the allowance based on the minimum wage in the amount of 58,878.4 rubles.

Calculation of sick leave in 2021 from the minimum wage

When calculating sick pay, the minimum wage must be applied in four cases.

First. If the employee had no earnings during the pay period.

Second. If the average employee’s earnings are below the minimum wage.

Third. If the average earnings are equal to the minimum wage.

Fourth. If the employee's length of service is less than 6 months.

In some regions there are coefficients. If you work in such a region, determine the minimum allowance taking into account the regional coefficient.

Limitation of the paid period

There are exceptions when not all sick days are paid. One of them is provided for people working under a fixed-term employment contract concluded for less than six months. In general, benefits can be accrued to such employees for no more than 75 calendar days under this agreement.

There are exceptions for people who have taken out a ballot to care for relatives. For example, when caring for a child from 7 to 15 years old, one sick leave is paid for no more than 15 calendar days, and in total for a year it is allowed to pay no more than 45 calendar days (Article 6 of Law No. 255-FZ).