Types of bonds in circulation and by form of income

In circulation there are state (federal, regional, municipal) securities and corporate ones - issued by legal entities. The date of transaction with bonds for their acquisition or disposal is the day of transfer of ownership.

According to the categories of income generation, there is a division into 2 types of securities - coupon and zero-coupon. Depending on the type of security, forms of income are established: (click to expand)

- In the form of interest with a specified payment period for coupon bonds. Payment control is carried out using cut-off coupons.

- In the form of a discount - the difference between the face value and the purchase price.

Securities, the market value of which is not determined, must reach the par value of the book value by maturity. The difference is taken into account evenly as part of other income or expenses throughout the entire period of use.

Bonds and types of income on them

One of the stock market instruments is a bond, which expresses a loan relationship between the issuer and the buyer.

Bonds have been on the market for quite a long time; we can say that they were one of the first stock instruments in the history of mankind. Now the bond allows its issuer to attract the missing financial resources for the implementation of investment projects. The buyer gets the opportunity to reliably place his own funds and receive a small income. Profit on bonds can be generated in the following ways:

- The difference between the purchase price and the repurchase price of the bond is formed by discounting the sale price. That is, the bond is sold at a price below par, and repurchased at a price equal to par.

- Interest income or coupon involves calculating the interest rate on a bond depending on its face value.

- Amortization bonds require periodic payments from the seller to the buyer of interest and par, which reduces the final redemption price.

Finished works on a similar topic

- Coursework Accounting for bonds 440 rub.

- Abstract Accounting for bonds 280 rub.

- Test work Accounting for bonds 190 rub.

Get completed work or advice from a specialist on your educational project Find out the cost

Bonds are one of the most reliable ways to invest free funds. Moreover, they are beneficial to both the seller and the buyer. The seller or issuer of a bond can calculate and plan its activities so as to be able to make timely payments to creditors. Buyers of bonds know in advance about the timing of debt repayment, the amount of payment and potential profit.

Bonds in the form of income can be interest-bearing or discount-bearing. According to the time of fulfillment of obligations, urgent, medium-term and long-term instruments are distinguished. They can be convertible or non-convertible. Depending on the currency of circulation, national or foreign exchange. Issuer characteristics divide bonds into public and private, with the latter being able to generate higher income for their buyers. The most reliable type of bonds is secured. As a rule, these can be private or government bonds backed by government property. Such bonds provide guarantees to their owner that in any case he will receive the nominal value of the asset back. Unsecured bonds are not protected from bankruptcy and liquidation of the company. In this case, calculations for them will be made in the general manner. There are also subordinated bonds, the riskiest. Refunds for them occur at the very last moment, after settlements with all creditors.

Do you need proofreading or review of academic work? Ask a question to the teacher and get an answer in 15 minutes! Ask a Question

Documentary form of securities

A security in the form of a bond is a document containing information about the details that allow it to be identified. The data contained on the document ensures the rights of the owner. The bond certifies only the material rights of the investor and does not affect non-property rights, for example, participation in the activities of the enterprise that issued the securities.

The form presented on paper or other media permitted by law is used. The placement of bonds into circulation is carried out through an issue that has a state registration number, and, if there is no need to register the issue, an identification number.

Bonds have pricing characteristics that allow holders to determine the costs and income received. Initially, the bond is assigned a par value - the price indicated on the document. When sold on the secondary circulation market, the bond acquires a market value - a market price that fluctuates during the circulation period.

At maturity, the bond primarily has a value equal to its par value.

Accounting for bonds with coupon income

The cost of bonds with accumulated coupon income differs from the nominal value either down or up. The value of a bond is the sum of the market price and the amount that has changed the value of the security. Bonds with accrued coupon income are purchased on the secondary market.

Example No. 2 for determining the amount to write off the difference in excess of the actual purchase amount over the nominal amount

The LLC Kontakt enterprise purchased a bond of OJSC Kedr with a par value of 50,000 rubles at a price of 55,000 rubles. According to the terms of the agreement, the income from the investment will be 10% of the value of the bond with payment twice a year and maturity 5 years after purchase. The amount of costs exceeding the nominal value must be written off in equal parts over the reporting periods - 500 rubles per six months. In the accounting of Contact LLC, entries are made, accompanied by the following entries:

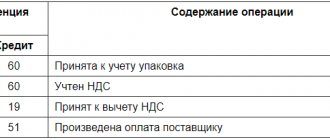

| Operation | Wiring | Amount, rub. |

| Payment has been made for the purchased asset | Dt 76 Kt 51 | 55 000 |

| The bond is taken into account in the amount of actual expenses | Dt 58/2 Kt 76 | 55 000 |

| Part of the excess of actual costs over nominal costs was written off | Dt 91/2 Kt 58/2 | 500 |

| Interest accrued on the bond | Dt 76 Kt 91/1 | 2 500 |

| Interest income received | Dt 51 Kt 76 | 2 500 |

A uniform write-off of the excess amount over the par value of the bonds as part of other expenses will allow you to obtain the par value by the maturity date. If the purchase amount (actual expenses) is less than the nominal value, the difference is accrued in equal parts as part of other income.

Accounting entries in examples

Newsletter description:

- Newsletter for aspiring accountants and more.

- The newsletter contains examples of preparing accounting entries for all sections of accounting.

- The examples are compiled with explanations and taking into account the requirements of regulatory documents.

- By subscribing to this newsletter, you will receive one example of preparing accounting entries every week.

- You will be able to independently analyze the example, familiarize yourself with the regulations, and consolidate your knowledge.

Issue No. 99

Financial investments

2. Debt securities

Example 5

[/td]

| The presence and movement of investments in government and private debt securities (bonds, etc.) are recorded in subaccount 58-2 “Debt securities” (Instructions for using the Chart of Accounts. Account 58 “Financial Investments”). For debt securities for which the current market value is not determined, the organization is allowed to attribute the difference between the initial value and the nominal value during the period of their circulation evenly, as income is due on them in accordance with the terms of issue, to the financial results of the commercial organization (as part of operating income or expenses) or decrease or increase in expenses of a non-profit organization (Clause 22 PBU 19/02). When writing off the excess of the purchase price of bonds and other debt securities acquired by the organization over their nominal value, entries are made in the debit of account 76 “Settlements with various debtors and creditors” (for the amount of income due on securities) and in the credit of account 58 “Financial investments "(for part of the difference between the purchase and nominal value) and 91 "Other income and expenses" (for the difference between the amounts allocated to accounts 76 "Settlements with various debtors and creditors" and 58 "Financial investments") (Instructions for using the Chart of Accounts Account 58 “Financial investments”). | |||

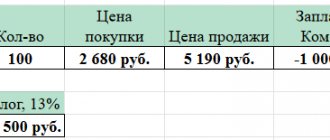

| The organization purchased bonds in the amount of 120,000 rubles. The nominal value of the bonds is 100,000 rubles, the maturity date is 1 year. Interest on bonds is accrued quarterly at a rate of 24% per annum. The accounting policy of the organization establishes that the cost of acquired debt securities is brought to their nominal value evenly over the period of their circulation. When the bonds mature, the organization receives funds in the amount of the bonds' par value. | |||

| Credit | Amount (rub.) | Content | |

| on the date of purchase of bonds | |||

| 120 000 | - amount paid for bonds | ||

| quarterly at the time of payment of interest on bonds | |||

| 5,000 (120,000 -100,000): 4 sq. | — 1/4 of the difference between the purchase price and the face value of the bonds | ||

| 1,000 (100,000 x24%:Q4 -5,000) | - the amount of interest due minus the amount allocated to account 58 | ||

| 6,000 (100,000 x24%:4 sq.) | - amount of interest received | ||

| on the bond maturity date | |||

| 100 000 | - the amount of funds due to be received on redeemed bonds | ||

| 100 000 | — cost of redeemed bonds | ||

| 100 000 | - the amount received on repaid bonds | ||

When additionally accruing the amount of excess of the nominal value of bonds and other debt securities acquired by the organization over their purchase price, entries are made in the debit of accounts 76 “Settlements with various debtors and creditors” (for the amount of income due on securities) and 58 “Financial investments” ( for part of the difference between the purchase and nominal value) and to the credit of account 91 “Other income and expenses” (for the total amount allocated to accounts 76 “Settlements with various debtors and creditors” and 58 “Financial investments”) ( Instructions for using the Chart of Accounts. Account 58 “Financial investments”).

Accounting for transactions on federal loan bonds (OFZ)

The issue and circulation of OFZ are determined by orders of the Ministry of Finance of the Russian Federation. The transfer of a security is carried out in the order of transfer of ownership rights with the conclusion of an agreement and sale at auction. The conditions for treatment are determined:

- Nominal purchase price.

- The value of the bond on each day of circulation. Published monthly on the official website of the Ministry of Finance of the Russian Federation.

- Start, end and maturity dates.

- Release form (documentary).

- Circle of potential owners.

The nominal value of OFZ in circulation is determined taking into account the consumer price index. In addition to the changed value on the maturity date, the owner of the OFZ receives coupon income. Depending on the conditions of issue, a constant or variable coupon income is used in the calculation.

The amount of variable income is added up over individual payment periods. Accounting for OFZs must be taken into account separately from other types of securities. Detailed accounting is maintained for each bond, with data grouped according to the chronology of registration and price.

OFZs are not used to cover the cost of goods, work, services or other types of expenses within the framework of commercial activities.

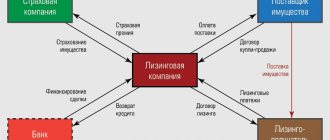

Mortgage coverage with bonds

Property can serve as collateral for the bond. Collateral is provided to reduce the risk of the acquirer (investor). The essence and types of bonds do not change depending on the presence of mortgage collateral. Operations and document flow are similar to the circulation of bonds without collateral. In the event of loss of property serving as collateral, the investor receives the insured amount.

The circulation of covered securities is carried out by credit institutions or mortgage agents. Issuers of bonds must provide detailed information about the securities. Organizations registered as LLC or JSC act as mortgage agents. The enterprise must fulfill the following conditions:

- Clearly state in the Charter the procedure for issuing bonds and follow it throughout the entire period of activity.

- Determine the maximum number of bonds allowed for issue and limit the issue to the constituent documents and is included in the Charter.

- Do not hire employees.

Record keeping is transferred to a specialized organization. Voluntary termination of the existence of an organization is permitted upon full repayment of obligations.

Securities reporting

Issuers issuing bonds are required to disclose information in reports published quarterly. Reporting begins from the first quarter after the issue of bonds and is carried out until the obligations are repaid, the issue is determined to be invalid, and the documents are declared invalid.

The reporting is presented in the form established in the document approved by the Bank of Russia on December 30, 2014 No. 454-P “Regulations on the disclosure of information by issuers of equity securities.” The reporting contains information about the issuer, its activities, liabilities, liquidity of securities, and investments made.

The issuer must submit a complete package of financial statements including all forms. The following information is subject to disclosure in the issuer's financial statements:

- Availability and change in the amount of debt on loans issued by bonds.

- Amounts, maturity dates of bonds.

- The amount of expenses incurred during the issue and circulation of bonds.

Terms and date of repayment

These parameters are specified in the decision to place the next bond.

Most often, there is no reference to a calendar date; the general circulation period is set, for example, in months. The bondholder retains the right to demand the repurchase of assets on any day within the established period, unless otherwise provided by the rules of the issue.

Compliance with the closing date takes into account the profitability of the financial instrument. In practice, it would be logical to initiate a return on investment after the next payment of coupon income. The circulation period usually varies from 1 to 6 months for corporate securities. For federal bonds, the maturity date is longer. Such a period is usually set by organizations of a certain status.