What is the reason for introducing encoding?

The changes are related to the entry into force of Law No. 12-FZ dated February 21, 2019, clarifying the procedure for collecting amounts under enforcement documents. The encoding was developed by the Central Bank in order to recognize income from which debt cannot be withheld or partial collection is allowed. The following notations have been introduced:

- “1” - for amounts with restrictions on the amount of recovery (Article of Law No. 229-FZ of October 2, 2007);

- “2” - funds to which recovery does not apply (Article 101 of Law No. 229-FZ);

- “3” - in respect of which restrictions do not apply in accordance with Part 2 of Art. 101 of Law No. 229-FZ.

The assignment of credited funds to one type or another should occur automatically, according to the code entered in field 20.

Income code: sick leave

Benefits for the period of temporary disability are calculated on the basis of a sick leave issued by a medical organization. In general, the first 3 days are paid by the employer, the remaining part is compensated from the Social Insurance Fund, or paid directly by the Fund (in the regions where the pilot project operates).

According to clause 9, part 1, art. 101 of Law No. 229-FZ of October 2, 2007, the penalty applies to disability benefits, the amount of deduction is determined by Art. 99 of the said law:

- up to 70% - for alimony for minor children, for compensation for harm to health, in connection with the death of the breadwinner, or for compensation for damage caused by a crime;

- in other cases – no more than 50%.

The amount of recovery is determined after personal income tax is deducted from the amount of the hospital benefit. The employer assigns the benefit within 10 calendar days after receiving sick leave, and pays it (the benefit in full or its part remaining after deduction according to the claimants) - on the nearest day established for settlement of salaries with employees.

When paying for sick leave non-cash, the income code in the payment order, as well as when transferring salaries, must be entered in field 20 “Name. pl.": the employer must indicate "1" - income for which restrictions on the amount of deductions apply.

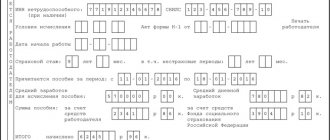

An example of filling out a payment slip for sick leave with income code “1”, when no deductions were made from the employee under writs of execution:

What is the income code for sick leave for 2-NDFL

Annual income tax reporting must include information on all taxable income of an individual. But are sick leave reflected in 2-personal income tax? Yes, include temporary disability benefits in the final calculation along with wages, incentives, compensation and bonus payments. The report should reflect not only the amount of benefits accrued under Federal Law No. 255-FZ. If the employer makes additional payments to subordinates up to the actual average earnings for the period of illness, this income must also be reflected.

For payments calculated according to FSS standards, indicate the sick leave code in the 2-NDFL certificate in 2021 - 2300, and for amounts accrued up to the amount of the actual average earnings - 4800. Explanations are confirmed by Letter of the Federal Tax Service No. BS-4-11/12127 dated 06.07. 2016.

Filling out instructions when withholding debt under a writ of execution

If the employer independently makes deductions according to the writ of execution, then along with the code for the type of sick leave income in the paragraph, field 24 of the document must be correctly filled out - “Purpose of payment”. How to do this is indicated in the information letter of the Central Bank of the Russian Federation dated February 27, 2020 No. IN-05-45/10:

- First, the type of income is indicated, for example, “Payment for sick leave to Vitaly Semenovich Smirnov”;

- then put the symbol “//”, indicate the code “VZS” (short for “collected amount”), again “//”;

- The withheld amount is entered in numbers (after rubles, kopecks are written with a hyphen, for example, 1000-00).

Such a record will allow the financial institution to recognize that the deduction from income has already been made. In such cases, it is not possible to re-collect the transferred amount.

Here is a sample payment slip for hospital payments from which a recovery in the amount of 1210 rubles was made:

Payment of maternity benefits

The sick leave income code in the payment order for the transfer of maternity benefits (maternity benefits) differs from regular disability benefits. This is due to the wording of clause 12, part 1, art. 101 of Federal Law No. 229-FZ, which prohibits the collection of child benefits paid from the budget. Maternity benefits fall into this category of payments. Therefore, when paying for such sick leave, the income code in the payment slip is “2”, that is, the amount from which it is prohibited to withhold debt under writs of execution. Personal income tax is also not withheld from such payments - by virtue of clause 1 of Art. 217 Tax Code of the Russian Federation.

How are maternity benefits calculated?

In this article, “maternity leave” is maternity leave . We will describe the specifics of calculating benefits: to whom, how much and how maternity benefits are calculated, and give an example.

The main thing in the article:

• changes and link to the law (new edition) • formula for calculating maternity leave • example • instructions on how to calculate - 5 simple steps • minimum and maximum maternity leave in 2020-2021 • online calculator

Maternity benefits are paid based on 100% of average earnings. The length of service does not matter, unless it is less than 6 months.

Maternity leave in 2020-2021: changes and new law

Changes in 2021 affected mainly the amount of minimum and maximum benefits (due to indexation and an increase in the minimum wage), the maximum values are discussed below.

In Law No. 255-FZ itself, as of 2021, changes have appeared in two articles:

- Article 16 on the procedure for calculating the insurance period has been supplemented - the periods of service in “... the compulsory enforcement authorities of the Russian Federation” are included in the insurance period;

- Article 2.3 has been clarified. on registration and deregistration of policyholders (more details).

There were no changes to the calculation rules.

Formula for calculating maternity benefits

For working women, maternity benefits are paid in the amount of 100% of average earnings for the previous two years.

The formula is simple, but you need to take into account the features and limitations. We will analyze them at each step of calculating benefits.

How to calculate maternity benefits - 5 simple steps

To calculate the amount of maternity payments you need:

| 1. Calculate the average daily earnings, for this we determine: | |

| • billing period – 2 years, for which we calculate earnings | Step 1 |

| • the amount of earnings in this period | Step 2 |

| • number of days of the billing period | Step 3 |

| Calculation summary: average daily earnings | Step 4 |

| 2. Multiply the average daily earnings by the number of days of maternity leave | Step 5 |

We put all stages of the calculation into 5 steps.

Step 1. Determine the billing period

The billing period is the period for which we calculate earnings to then calculate the amount of maternity payments.

In general, the calculation period is 2 calendar years preceding the year of maternity leave. For maternity leave in 2021, these are 2018 and 2021; in 2021, 2021 and 2021 are taken into account.

Exceptions to the general case: during the previous 2 years (or in one of them) there are periods when the employee was already on maternity or child care leave.

In this case, one or both years can be replaced to calculate maternity leave. The year is replaced by an earlier one, but not any year, but immediately preceding the onset of the previous maternity and/or child care leave.

| Example. The employee is going on maternity leave in 2021. The years 2021 and 2021 should be used for calculations. But from September 2015 to July 2017 she was also on maternity leave and maternity leave. In this case, 2021 can be replaced by 2015. Calculation period: 2021 and 2015. A woman submits an application to her employer to change pay periods. Such a replacement must necessarily increase maternity payments - this is stated in the law (otherwise the calculation year will not be replaced). And this needs to be checked when making calculations. |

Step 2. Determine the amount of earnings for the billing period

What amounts do we take into account and what amounts do we not take into account?

+ We take into account payments from which deductions were made to the social insurance fund: wages, bonuses, bonuses.

– We do not take into account: sick leave, benefits, income under civil contracts, if there were no contributions to the Social Insurance Fund, and other amounts from which they were not paid to the Social Insurance Fund (unofficial salary, financial assistance up to 4,000 rubles).

We compare the amount of earnings for each year with the legal limit: in 2021 it is 815,000 rubles, in 2021 it is 865,000 rubles, in 2021 it is 912,000 rubles. If annual earnings are greater than the specified limit value, then we take the limit value to calculate benefits.

see: how to calculate 2-NDFL certificate

In the 2-NDFL certificate we are interested in clause 3 “Income taxed at the rate”: codes and amounts.

+ We take into account income with code

- 2000 – income under an employment contract

- 2012 – vacation pay

- 2400 – “compensation” for using the car

— We do not take into account income with a code

Other codes

- 2010, 2201-2209 - payments under civil contracts and royalties - we take into account only if they were deductions to the Social Insurance Fund (must be indicated in the contract)

- 2760 – financial assistance – we take into account the amount exceeding 4000 rubles per year.

To simplify the calculation, you can subtract excess amounts from the total amount of income in clause 5 of the certificate.

read more about where the limit values come from

The law establishes maximum amounts of income per year from which contributions to the Social Insurance Fund are made. Contributions are not paid for incomes above these amounts.

In the law, this maximum amount (or limit value) is called “the maximum base for calculating insurance premiums.” It is set every year, the values are given in the table:

| Year | Maximum base for calculating contributions to the Social Insurance Fund, rub. |

| 2020 | 912 000 |

| 2019 | 865 000 |

| 2018 | 815 000 |

| 2017 | 755 000 |

| 2016 | 718 000 |

| 2015 | 670 000 |

| 2014 | 624 000 |

| 2013 | 568 000 |

| 2012 | 512 000 |

| 2011 | 463 000 |

| 2010 | 415 000 |

Since income exceeding the “limit base” does not make contributions to the Social Insurance Fund, these incomes are not taken into account when calculating maternity benefits.

We add up the amounts for 2 years - we received earnings for the billing period, which we will take into account to calculate the benefit.

Step 3. Calculate the number of days in the billing period.

From the number of calendar days in each year (365 or 366) of the billing period, subtract:

– days when the employee was on sick leave, on maternity leave, or on maternity leave.

Periods of unpaid leave are not excluded.

We add up the result obtained over 2 years - we get the number of days in the billing period.

Step 4. Calculate average daily earnings

We divide the earnings for the billing period (see step 2) by the number of days in the billing period (see step 3). The resulting value must be compared with the minimum and maximum values.

Minimum by law

The average daily earnings received cannot be less than the daily earnings based on the minimum wage (minimum wage).

The minimum wage value is taken as of the date of maternity leave. From 01.01.2020 minimum wage = 12,130 rubles, we get:

RUB 12,130 x 24 months / 730 = 398.79 rub.

If the value of the average daily earnings obtained in the calculations is less than based on the minimum wage, then to calculate the benefit we take the value based on the minimum wage.

For a part-time employee, it is important to take into account the following feature:

If the insured person, at the time of the occurrence of the insured event, works part-time (part-time, part-time), the average earnings, on the basis of which benefits are calculated in these cases, are determined in proportion to the duration of the insured person’s working hours.

- clause 1.1 art. 14 of Law No. 255-FZ (garant.ru)

That is, when working half-time, the minimum is calculated from 50% of the minimum wage.

Maximum by law

The average daily earnings received cannot be more than the daily earnings based on the size of the “limit base for calculating insurance premiums.” What kind of limiting base this is is described above.

Please note: even if there was a replacement of years in the calculation period, the limit value is considered for the two years preceding the date of leaving on the current maternity leave.

For maternity leave in 2021, the maximum value of average daily earnings is:

(RUB 815,000 + RUB 865,000) / 730 days = RUB 2,301.37

For maternity leave in 2021, the maximum value of average daily earnings is:

(RUB 865,000 + RUB 912,000) / 730 days = RUB 2,434.25

If during the calculations we received a value of average daily earnings higher than the limit, then to calculate the benefit we take the limit value.

For an employee whose total length of service (all, i.e., throughout her life) is less than 6 months, it is important to take into account the following feature:

An insured woman with an insurance period of less than six months is paid maternity benefits in an amount not exceeding the minimum wage for a full calendar month... taking into account... coefficients [note: we are talking about regional coefficients, if they are established].

- clause 3 of Art. 11 of Law No. 255-FZ (garant.ru)

After checking for the minimum and maximum, we get the average daily earnings, which we will use in calculating the amount of maternity benefits.

Step 5. Calculate maternity benefits

In the general case, everything is simple: we multiply the resulting average daily earnings (see step 4) by the number of days of maternity leave on sick leave.

Exception: the employee did not present a sick leave certificate to the employer and continued to work and receive a salary for some time. After presenting sick leave, maternity leave is issued, and benefits are calculated from the day you go on maternity leave.

In this case, the maternity leave period is reduced by the number of days for which the employee was paid. Accordingly, the benefit will also be reduced. That is, an employee cannot work a little more before the birth of the child in order to receive benefits a little longer after the birth.

Minimum maternity payments in 2020-2021

The minimum amount of maternity benefits is limited to the minimum wage: the benefit will not be less than the minimum wage if the employee goes on maternity leave from full time.

From January 1, 2021, the minimum wage = 12,130 rubles. (the indicator is taken as of the date of maternity leave).

If maternity leave lasts 140 days, the minimum is RUB 55,830.60. = 12,130 rub. x 24 months / 730 days x 140 days (if maternity leave starts after 01/01/2020)

In the draft federal budget, the minimum wage from January 1, 2021 is 12,445 rubles. Based on this value, for 140 days of maternity leave starting in 2021, they will pay at least 57,281 rubles. = 12,445 rub. x 24 months / 730 days x 140 days

For part-time work (partial week, etc.), the minimum benefit must be proportionally reduced.

The maximum benefit amount is limited by the earnings limit, above which social security contributions are not accrued (see above for limit values).

The maximum amount of maternity benefits in 2020 for 140 days will be 322,191.80 rubles. = (RUB 815,000 + RUB 865,000) / 730 days x 140 days

The maximum amount of maternity benefits in 2021 for 140 days will be 340,795 rubles. = (RUB 865,000 + RUB 912,000) / 730 days x 140 days

If the total insurance period is less than 6 months, the maximum amount of maternity benefits for each calendar month is not higher than the minimum wage.

The employee is going on maternity leave in January 2021. Vacation is 140 days. In 2018, she was on sick leave for 150 days; in 2021, the duration of sick leave was 50 calendar days.

Actual earnings (minus disability benefits) for 2021 amounted to 850,000 rubles, for 2021 – 494,000 rubles.

The minimum wage from January 1, 2021 is 12,130 rubles.

The maximum base for insurance premiums in 2021 is 815,000 rubles, in 2021 – 865,000 rubles.

| Step 1. | During the two years preceding the maternity leave (i.e. in 2021 and 2018), the employee did not have maternity or child care leave - we do not replace the period. Calculation period: 2021 and 2019 |

| Step 2. | Earnings already minus sick leave: for 2021 - 850,000 rubles, for 2021 - 494,000 rubles. Compare with limit values. For 2021, we take the maximum size of the base - 815,000 rubles. (since actual earnings for 2021 turned out to be higher than the limit), for 2021 - actual earnings. Total we get 815,000 + 494,000 = 1,309,000 rubles. |

| Step 3. | Number of days in the billing period: 730 – 150 – 50 = 530 days |

| Step 4. | Average daily earnings: RUB 1,309,000 / 530 days = RUB 2,469.81 This is above the minimum (12,130 rubles (minimum wage) x 24 months / 730 = 398.79 rubles), but also exceeds the maximum. For maternity leave in 2021, the maximum average daily earnings is: (815,000 + 865,000) / 730 = 2,301.37 rubles. – we take it into account. |

| Step 5. | Benefit amount: RUB 2,301.37. x 140 days = RUB 322,191.80 |

The amount received is paid to the employee in full at a time; no tax is paid on this amount.