Document year: 2019

Document group: Help

Document type: Help

Download formats: DOC, PDF

One type of confirmation of the solvency of employees is a free-form income certificate. The 2021 sample remains unchanged. There is no single standard for paper confirmation, but there are a number of requirements that apply when drawing up the document.

The paper confirms not only income, but also the frequency of receipt, permanent place of work and period of employment. This document is used for submission to various institutions.

The income certificate is made in the established forms, which are registered by the Resolutions and Orders of the authorities. Also, such a document can be made in free form, taking into account the inclusion of mandatory clauses. Such a certificate has legal force; it simply makes it possible to bring a document if the employer refuses to provide a standard sample, or such certificates are simply not issued.

Let's take a closer look at the type of document flow, where you can get it and under what conditions, as well as instructions for filling out and basic rules.

Get ready for thoughtful reading and read the article to the end: free-form income certificates are offered for free.

Types and features of certificates

To obtain reference information from the employer for submission to various institutions, the employee must write a written application. Also indicate what specific information should be reflected in the document, for what period, and for what purposes the specified information will be used. You don’t have to specify a specific goal, then the performer will simply write “at the place of requirement.”

Important! The sample and information provided will depend on the information requested and the institution to which the certificate is submitted.

In general, certificates from the employer about income from the employer can be divided into two types:

- certifying the citizen’s time of work (in general, and at the current place of employment), his qualifications, and position. Additionally, they may indicate information about the level of education and the institution in which the employee studied;

- certifying his earnings for the last period. Usually this is three or six months.

Regardless of the form and purpose, the paper must contain the company details, general information about the employee and his identity document. Due to the fact that the document contains personal information that cannot be disclosed to outsiders, the employer is required to draw up a written statement.

Information about the employee is filled in based on the company’s primary and accounting documents:

- personal affairs;

- work books;

- pay slips;

- tax returns and others.

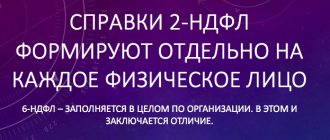

Often, established samples of income certificates 2-NDFL, 3-NDFL, form 182n, certificates in the form of the institutions for which they are drawn up (in the bank form) or in free form are used.

How to confirm the income of a working person

Documents confirming income can be obtained at your place of official employment. The certificate must include the following information:

- The person's position;

- Date of issue of paper;

- Text with approximate content: “The certificate was issued by the company ____ and confirms that the official salary, full name ______, per month is equal to ____ rubles.”

The form of the received document can be free or personal income tax-2. All information provided in it relates to the employee’s last year of work. An additional document that will confirm your earnings can be an income statement or a bank card statement. A certificate confirming income for a pensioner is a certified copy of a pension certificate or a certificate from the nearest territorial body of the Pension Fund, which states that the person receives a pension in the established amount.

If the company of which you were an employee was liquidated, then obtaining a certificate of the amount of earnings will be quite problematic. First of all, you need to find the company’s archives or seek help from its liquidator. In exceptional cases, when searches are unsuccessful, the court will help establish the fact that you received income.

For individual entrepreneurs, documents confirming family income are a tax return for the reporting period. It must have a special mark from the tax office indicating that the document has been accepted by it.

For unemployed people, confirmation is an extract from the social security authority stating that the person has no income. Additionally, you may need a photocopy of the page of the work book with a record of acceptance and dismissal from the place of work. As an option, you can provide a certificate from the Employment Center.

We advise you to read: what documents are needed to register an apartment as an inheritance?

In what case does it apply?

The certificate is requested by various institutions, authorities, courts, bailiffs and others in order to:

- Confirm the officiality of income, its size and stability of income;

- Find out about the citizen’s work experience, position and qualifications.

Most often, help is needed:

- Banks and credit organizations;

- To introduce yourself to a new workplace;

- Social security authorities and others to determine benefits and payments due (sample - certificate of income for 3 months for payment of child benefits);

- To the employment center to determine benefits;

- Judicial authorities;

- Bailiffs when executing a writ of execution;

- Other organizations.

A sample certificate in this form is most often submitted to banks, if the credit program allows this form of presentation, as well as to consulates and visa centers for obtaining a visa.

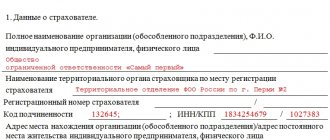

Certificate 2-NDFL from individual entrepreneur

The procedure for issuing a 2-NDFL certificate by an individual entrepreneur employer is no different from that generally accepted for tax agents - legal entities, since an individual entrepreneur, when paying remuneration to an individual, also withholds tax from it and transfers it to the budget. It is this information that is entered into the certificate.

See also the article “Do I need to pay personal income tax on an advance and when?” .

Individual entrepreneurs usually do not provide themselves with a certificate of income in the approved form. This possibility is not mentioned anywhere in the tax legislation. At the same time, filling out such a form and signing it yourself will not be a violation.

The features of the 2-NDFL certificate for individual entrepreneurs are discussed in this article.

But in many situations, an entrepreneur needs only a copy of a declaration that reflects the entrepreneur’s real income (this is not suitable for individual entrepreneurs working on UTII or a patent), an extract from the book of income and expenses, from the cash book, or copies of primary documents confirming the receipt of income.

ATTENTION! Starting from 2021, UTII has been cancelled.

Who issues the certificate

A certificate is requested from the direct employer. To do this, a written application is written addressed to the manager with a request to provide a certificate. You also need to indicate what information should be reflected.

The employer prepares the certificate within three days from the date of receipt of the request.

For persons legally located in the Russian Federation (records of work and residence are kept), the employer also has the right to provide information for reference.

If a citizen has several jobs, and all of them are officially registered, each certificate is requested separately from each employer.

To confirm the income of an individual entrepreneur (individual entrepreneur) for a visa, loan or other things, a free-form certificate is not suitable; a declaration, a sample registration certificate and, if necessary, statutory documents are submitted.

What form of salary certificate is valid in 2020

Many people mistakenly believe that this certificate is in the form of 2-NDFL. However, this is not quite true. Of course, there is data on wages here. Typically, this form is required by financial organizations when a citizen wishes to receive a loan. However, if the organization does not have an approved form, this document is allowed to be drawn up in free form.

The law allows the employee to request this certificate. He is not obliged to ask for it, but must receive it upon request. The data specified in the certificate is protected by law. That is why the document is handed over personally. Upon receiving such a certificate, the employee writes a receipt. This information is also recorded in the appropriate journal of the organization. Naturally, the entry must correspond to the information in the certificate.

When calculating average earnings, accounting takes into account all bonuses and additional remunerations. Former employees can also receive this certificate. They should also write a statement.

( Video : “01 Salary Certificate”)

Procedure and deadline for issuing the form at the place of work

| Writing a written request addressed to the manager that you need a certificate of income. To do this, you need to approach the secretary, a HR specialist, or immediately the responsible accountant. For a civil servant in 2021, the same rules for requesting a certificate of income (available on this page). | If the institution to which the certificate will be submitted has provided an approximate form, attach it to the application. Typically, employees verbally request the document immediately from an accountant or HR specialist. By law, this must happen in writing in order to protect yourself in case the employer refuses to provide a certificate |

| It takes three days to review the application and prepare the initial data. | The time is calculated from the moment the application is received by the employer. Refusal to submit a certificate, delaying deadlines are illegal on the part of the employer |

| A completed certificate can be obtained from the secretary, the human resources department or an accountant. | The document can also be handed over to the applicant’s immediate supervisor. |

| Usually one copy of the paper is prepared, but upon request, the contractor will prepare the quantity that the applicant needs | An employer cannot refuse a certificate even if this is not the first request in a year. |

If an institution or government agency does not establish strict requirements, download the income certificate and enter it into the accounting department.

The document does not have an official validity period; its relevance is determined by the institution for which the certificate is prepared. Since the document certifies recent income, it is considered to be valid for 30 days. Therefore, it is more advisable to take the paper at the beginning of the month, when the accruals are ready and the financial statements are submitted.

Important! If the employer refuses to provide information for any reason or delays the provision, causing the recipient to suffer, the latter has the right to file a complaint with the labor inspectorate and even file a lawsuit in court. But this can only be done if the citizen has documented the application.

Program description

There is one significant difference in the activities of civil servants, for example, from those in the office segment: the wages they receive are not transferred from funds earned by the organization. Financial support for wages comes from the federal or regional budget. In order to prevent officials from abusing their granted powers and to prevent the use of public funds, it was decided to strengthen control over income levels. According to current legislation, civil servants are required to report to the state on income and expenses.

To make it easier to fill out an electronic declaration, a new product called “BK Help” has been developed, which allows you to perform the following functions:

- create printed forms;

- enter the data required by the tax authorities;

- control the correctness of the entered information.

Users note many advantages inherent in this program:

- ease of use;

- availability;

- saving time resources.

In addition, it identifies inaccuracies when filling out the certificate.

The developers provide the opportunity to download “BC Help” for free without prior registration on the website.

This page provides detailed information explaining the legislative mechanism for combating corruption and applying preventive measures, which include providing information on the income and expenses of subjects holding public office.

After reading these materials, you can begin working with the application, which can be launched by clicking on the link located in the lower corner of the right side of the page. In a new window you can see:

- link to download the latest version and its description;

- explanations for filling out the declaration;

- listing the requirements for the procedure for providing a document.

One of the main advantages of this open source software is the preservation of information, which allows, in case of incorrect filling, not to redo the entire document, but only to correct the required column. In addition, to create a reporting document in the next tax period, the user only needs to update the corresponding columns on income and expenses.

The program is equipped with a fairly convenient interface: each field contains hints, indicated by a question mark or an inverted triangle. In addition, the menu is conveniently located in the central part of the screen, which allows you to quickly find the desired help page. When you click the “Print” button, if errors are detected, the system will display a list of sections in which they were made, and will allow you to print the document only after they have been corrected.

The help is divided into 6 parts, occupying 10 pages. If an employee has a spouse or minor children, he is required to provide information about their income in separate documents.

A significant bonus of this program: if, when filling out certificates by hand, there was a constant need to enter personal information into each certificate issued for a relative, then when using the program this process occurs automatically.

The filling date is set by default in accordance with the current date, but if necessary, you can enter the required number in the last section of the document. In the same section you can change the text font.

Rules for issuing a certificate

Even for a free form, certain filling requirements must be met. Otherwise, the certificate may simply not be accepted. Conventionally, the document can be divided into several information blocks:

- Part about the employer. Indication of names (full and abbreviated), legal address and actual location, form of organization, activity codes, registration information, etc. Details may not be indicated if the certificate is drawn up on company letterhead;

- Part about the employee. Standard information is indicated: name, identification document details;

- The main part is the information for which the certificate was taken. Data on income received for the requested period (monthly).

You can also separately highlight the block with certifying signatures and seals. The executor who compiled it and the head of the organization sign for the authenticity of the certificate. The seal is affixed provided that it is available at the enterprise. Although it is not mandatory, it is better to include it if available. An example of a free-form income certificate is available on our page; detailed instructions are discussed in the next section.

Prohibited:

- Corrections, blots, strikeouts;

- Using correction fluid;

- Print on both sides of the sheet;

- A document with obvious printing defects (spots, streaks, faded print).

You can clarify in advance what requirements for the certificate are imposed by the person to whom it is intended. Because there are no uniform standards.

The same rules apply if the employee is employed by an entrepreneur and requests a sample income certificate for a visa.

Instructions for filling out an income certificate

An accountant is responsible for issuing certificates. If the filling procedure and form are clear with the established samples, then when filling out the paper in free form, questions may arise.

First, check with the place of your request whether they have their own reference samples. For example, these are being developed by various banks. Ask for a sample and enter it into the accounting department. The performer will only have to fill it out. This is important because you can only ask for information about income, but in the end it turns out that they also wanted a certificate from you about property and liabilities and expenses for the past 2021.

Secondly, if the place of demand does not have its own form, check the full list of information that the accountant must reflect.

Otherwise, if there are no requirements for the form and mandatory information, the contractor will fill out information about the company, the employee and his recent income.

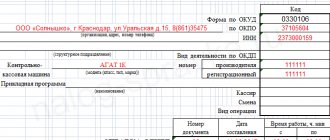

To make it clearer, let’s look at the instructions using an example with screenshots. Here is one of the free form certificate samples (you can download this form from the link).

We are considering the simplest option. At the top is the date of issue and contact phone number, as well as a rectangular stamp with the company details. If the certificate is drawn up on company letterhead, a stamp is not needed. If not, it is additionally better to indicate the TIN, KPP and OGRN.

After the word “Issue”, information about the recipient of the document, the period of work and the position in which he is located is indicated.

Next, the main block of information is written down - about the employee’s income. In our example, income for the last three months is indicated. Since the certificate is given at the beginning of April (in the example), March, February and January become the calculated months for us. Social security or a bank will require a sample certificate of income for 6 months.

The table can be improved by adding more information about calculated taxes and income before taxes.

At the end, the manager and senior accountant sign. The official seal, if available, is placed on the designation of M.P.

Special requirements

As for the informational part, that is, directly the amount of the employee’s income, some social security authorities require this information to be presented in the form of a table. It looks something like this:

| Month | Total amount of payments (RUB) | Withheld (RUB) | Issued by hand (RUB) |

| October | 10 000 | 1 300 | 8 700 |

| november | 10 000 | 1 300 | 8 700 |

| December | 10 000 | 1 300 | 8 700 |

| Total | 30 000 | 3 900 | 2 6100 |

So that the employee does not waste time, and the accountant does not redo the certificate again, it is better to find out in advance in what form the data should be presented.

Attention! One of the purposes of a salary certificate is to receive a subsidy for housing costs. In this case, it should contain data not for 3, but for 6 months . This is the requirement of paragraph 32 of the Rules for the Provision of Subsidies, approved by Decree of the Government of the Russian Federation of December 14, 2005 No. 761.

This is important to know: How to return income tax from salary to a working person

Possible mistakes

Errors that often appear in help are related to:

- with typos;

- spelling errors, errors in names and titles;

- incorrect indication of codes, details and addresses;

- submitting false amounts for wages;

- taking into account the wrong period.

By the way! One of the common mistakes (due to the carelessness of the performer) concerns the indication of the taxpayer number. There are times when the contractor confuses the employer and employee codes.

Responsibility for compiling and providing information on the certificate lies with the executor - an accountant or other responsible person. Certificates with errors or false information will not be accepted at the place of request. Therefore, check the paper first so that there are no typos or obvious errors, make sure that the general information is provided correctly (for example, the work experience is calculated correctly, the position is indicated correctly, etc.).

To make it easier to navigate such a document in the future, download a free sample income certificate in free form. Study the information, ask the person who is requesting it, what exactly he wants to see in the paper, and in what form it is best to compile it. If necessary, consult in advance with the accountant who issues such certificates in your company. By the way, the latter, in addition to the application, may request consent to provide personal information. This is due to the fact that the certificate contains personal data. In this case, consent can be requested each time a new certificate is requested.

The article is over, but you still have questions? Ask them to the duty lawyer on our site.

The specialist will also help you understand the nuances of drawing up certificates of income and expenses for civil and government employees.

Where to get money without proof of income quickly and correctly

Almost always, when applying for a loan from a bank, you must confirm your solvency by providing a certificate of income. But some financial organizations are developing special loan programs with favorable conditions for those who have unstable or unofficial income. It should be remembered that for the provision of such a bonus you will have to pay with an increased interest rate and a limited loan limit. You can get a loan without an income certificate, for example, from Home Credit Bank, OTP Bank, Renaissance Credit, etc.

Now we know where to get a certificate of income (and there is no need to look for guarantors to obtain a loan on favorable terms). An alternative option is to contact private credit organizations (MFOs) - “BystroDengi”, “GreenMoney”, “Denga”, etc., but the interest rate will be much higher and the repayment period will be shorter than that of a bank.

A certificate of income is one of the most popular documents required for many procedures (registration of social benefits, calculation of pensions, applying for a bank loan, when applying for a new job). It can be obtained from the accounting department of the enterprise where the person works, from the Employment Center, and for pensioners from the Pension Fund. The maximum issuance time is 3 days. Knowing where you can get an income certificate quickly and how to fill it out correctly, you will be able to speed up important procedures and avoid wasting time.