I General provisions

When making cash payments to buyers (clients), two types of cash registers are used: electromechanical cash registers and electronic control and recording machines (ECRM). A cash register is a counting, summing, computing and receipt printing device. Enterprises are allowed to operate only those types of cash registers whose serial samples have been tested in the prescribed manner and entered into the State Register. Commissioning, maintenance, repair and decommissioning of cash registers must be carried out by manufacturing plants or specialized enterprises, technical centers endowed with the appropriate rights for this type of activity. Cash register machines used for cash settlements with the population are subject to registration with the tax authorities at the location of the enterprise. Monitoring compliance with the rules for the use of cash registers and the completeness of accounting for cash proceeds at enterprises is carried out by tax services.

Canceled documents

The Federal Tax Service letter No. ED-4-20/18059 and the Ministry of Finance letter No. 03-01-15/54413 indicate that companies that accept cash and online payments using modern cash registers may refuse to complete a number of documents

with code KM. They represent primary accounting documents that were previously used to account for funds received from individuals and transactions associated with these activities.

So, now all forms with numbers from KM-1 to KM-9 have been canceled

, as well as

form KM-56

, which is a certificate-report prepared by the cashier-operator.

However, payment aggregators and other companies have the right to maintain these forms on their own initiative

if they are convenient for their work. But there is definitely no need to fill out strict reporting forms manually: the online cash register automatically prints them or sends them to the buyer using electronic communication channels - via SMS or email.

II. Operating rules

2.1. Persons who have mastered the rules for operating cash registers to the technical minimum and have studied these “Model Rules” are allowed to operate a cash register. An agreement on financial liability is concluded with persons admitted to work. 2.2. Each cash register machine has its own serial number (on the marking plate), which must be indicated in all documents related to this machine (cash receipt, reporting sheet, passport, “Cashier-Operator Book”, etc.), as well as documents reflecting moving the cash register (sending it for repair, transferring it to another company, etc.). 2.3. The cash register must have a passport of the established form, in which information about the commissioning of the machine, medium and major repairs is entered. The passport contains the details of this cliche indicating the name of the enterprise and the cash register number. 2.4. The transfer of the readings of summing money meters to zeros (cancellation) can be done when putting a new machine into operation and during inventory, and, if necessary, in case of repair of money meters in workshops, only in agreement with the controlling organization with the obligatory participation of its representative. The controlling organization refers to the bodies of the State Tax Service of the Russian Federation. 2.5. The translation of the readings of summing money meters, the control of meters before and after their transfer to zero is formalized by an act in Form No. 26 (Appendix No. 1) in two copies, one of which, as a control one, is transferred to the accounting department of the controlling organization, and the second remains in the given enterprise ( store, cafe, etc.). 2.6. The transfer of a machine to another enterprise or workshop for repair and back is carried out using a consignment note and is documented in an act in Form No. 27 (Appendix No. 2), which records the readings of sectional and control counters (registers). The invoice and the act are submitted to the accounting department of the enterprise no later than the next day. A corresponding note about this is made in the “Cashier-Operator Book” at the end of the entry for the day. Along with the car, its passport is also given, in which the corresponding entry is given. 2.7. When repairing cash meters directly at enterprises, a report is also drawn up in Form No. 27, recording the readings of cash and control meters before and after the repair. 2.8. Before they are put into operation, spare machines are stored well lubricated to protect against corrosion, covered with covers on shelves or racks. The climatic parameters of the room must correspond to those specified in the operating manual.

III. Preparing cash registers for operation

3.1. Commissioning of new machines is carried out by a mechanic from an organization that provides warranty, maintenance and repair of this type of machine. When commissioning electronic control and recording machines and cash terminals, the presence of an electronics programmer is required. A mechanic (programmer) must have a certificate for the right to maintain and repair machines of this type and present it to the management of the enterprise or institution. 3.1.1. When putting machines into operation, cashiers must be present as financially responsible persons. 3.2. A mechanic for repairing cash registers (if necessary, an electronics programmer) checks the serviceability, tests the cash register in operation and formalizes its transfer to operation, filling out all the data in the factory passport. The mechanic is obliged to seal the machine after installing a company plate with the name of the enterprise and the number of the calculation unit or enter it into the machine program. 3.3. Before the cash registers are put into operation, the lock must be closed, and the key (except for the keys for setting sectional cash counters to zero) must be kept by the director of the enterprise. The keys for transferring cash counters to zero are transferred by the director (manager) of the enterprise to the controlling organization - the tax inspectorate, where they are stored in safes and issued by written order of the head and chief accountant of this organization to a specialist authorized to conduct an audit. 3.4. For the cash register, the administration creates a “Cashier-Operator Book” in Form No. 24 (Appendix 3), which must be laced, numbered and sealed with the signatures of the tax inspector, director and chief (senior) accountant of the enterprise. However, the “Cashier-Operator Book” does not replace the cash report (Form No. 25). 3.5. When installing cash registers on store shelves or for waiter work, the “Cashier-Operator Book” is kept in the abbreviated form N 24-a (Appendix 4). 3.6. It is allowed to maintain a common ledger for all machines. In this case, entries must be made in the order of numbering of all cash registers (NN 1, 2, 3, etc.) with the serial number of the cash register indicated in the numerator; the counter readings of inoperative cash registers are repeated daily, indicating the reasons for inactivity (in stock, in repairs, etc.) and are certified by the signature of a representative of the enterprise administration. All entries in the book are made in chronological order in ink, without blots. When making corrections to the book, they must be specified and certified by the signatures of the cashier - operator, director (manager) and chief (senior) accountant. 3.7. The cash register passport, the Cashier-Operator Book, acts and other documents are kept by the director (manager) of the enterprise, his deputy or the chief (senior) accountant. 3.8. Before starting work on a cash register: the cashier receives from the director (manager) of the enterprise, his deputy or chief (senior) cashier everything necessary for work (keys to the cash register, keys to the cash register drive and to the cash drawer, small change coins and bills in the amount , necessary for settlements with customers, accessories for operating and servicing the machine for signature). 3.8.1. The director (manager) of the enterprise or his deputy, the administrator on duty is obliged to: - open the lock of the drive and meters of the machine and, together with the cashier, take readings (receive a reporting sheet) of sectional and control meters and compare them with the readings recorded in the “Cashier-Operator Book” for previous day; – make sure that the readings match and enter them into the book for the current day at the start of work and certify them with your signatures; – draw up the beginning of the control tape, indicating on it the type and serial number of the machine, the date and time of the start of work, the readings of sectional and control counters (registers), verify the data on the control tape with signatures and close the lock for the readings of cash counters; – give cashiers (controllers - cashiers, salespeople, waiters) keys to the machine drive lock; – instruct the cashier on measures to prevent check forgery (encryption of checks, a certain color of the check tape used, maximum check amount, etc.); – provide the cashier with small change coins and bills within the amount of cash balance at the cash register in the amount necessary for settlements with customers, as well as receipt tapes of appropriate sizes, ink ribbon and other consumables provided for this type of machine; – give instructions to the cashier (controller - cashier, salesperson, waiter, etc.) to start work, making sure that the machine is in good working order and the workplace is ready to start work. 3.8.2. The cashier (controller - cashier, salesperson, waiter, etc.) is obliged to: - check the serviceability of the blocking devices, fill the receipt and control tape, set the dater to the current date, set the numerator to zeros; – turn on the machine to the electrical network and, by receiving a zero check, check its operation from the electric drive; – print two or three checks without indicating the amount (zero) in order to check the clarity of printing of the details on the receipt and control tapes and the correct installation of the dater and numerator; – attach zero checks to the cash report at the end of the day; – wipe the casing with a dry cloth and install a sign with your name on the buyer’s (client’s) side; – place the necessary equipment for work (micro calculator).

What documents need to be completed when operating a CCP?

The use of cash registers is associated with the preparation of various primary documents.

Start of work shift

Before starting work, the cashier-operator from the main cash desk of the organization is given small change coins and bills in the quantity necessary for settlements with customers (clause 3.8, 3.8.1 of the Model Rules, approved by letter of the Ministry of Finance of Russia dated August 30, 1993 No. 104).

The obligation to provide the cashier with change money is assigned to the director or his deputies, administrators (clause 3.8.1 of the Model Rules, approved by letter of the Ministry of Finance of Russia dated August 30, 1993 No. 104). The procedure for the circulation of change cash (change fund) shall be approved by order of the manager. This follows from paragraph 7 of the Bank of Russia instruction dated March 11, 2014 No. 3210-U.

The issuance of change money from the main cash desk should be reflected in the book of accounting of funds accepted and issued by the cashier in Form No. KO-5, approved by Resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88 (clauses 4, 4.5 of the Bank of Russia instructions dated March 11, 2014 No. 3210-U, instructions approved by Resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88). To confirm the receipt of small change coins and banknotes, the cashier-operator signs in column 4 of the book of accounting for funds accepted and issued by the cashier.

In addition, column 6 of the cashier-operator's journal reflects the readings of the summing counter at the beginning of the working day (shift). This value must be certified by the cashier-operator and the senior cashier (the head of the organization, his deputy, the head of the section, etc.) (letter of the Federal Tax Service of Russia for Moscow dated July 9, 2008 No. 22-12/066519).

If change coins and banknotes are transferred from the main cash desk of the organization to the cash desks of separate divisions, then when transferring money it is necessary:

— issue a cash receipt order; - make an entry in the cash book.

This conclusion follows from paragraphs 4.1, 6.4 of the Bank of Russia Directive No. 3210-U dated March 11, 2014 and the instructions approved by Resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88.

When you receive change money at the cash desk of a separate division of the organization, draw up a cash receipt order in form No. KO-1, approved by Decree of the State Statistics Committee of Russia dated August 18, 1998 No. 88 (clause 5 of the Bank of Russia Directive No. 3210-U dated March 11, 2014) . Issue change money from the cash desk of a separate division to cashiers-operators of the same division in accordance with the general procedure.

Operation of CCP during a shift

During the shift, the cashier-operator:

— accepts cash proceeds received as payment for goods (work, services) sold;

— issues cash from the cash register when goods are returned to customers (customers refuse work or services).

Return of goods by the buyer

Situation: what documents need to be completed when returning goods by the buyer? The citizen buyer paid for the goods in cash

The answer to this question depends on when the buyer returns the item: on the day of purchase or later.

The selling organization is obliged to replace the goods or return money to the buyer upon presentation of at least one of the following documents:

- cash receipt; - sales receipt; — another document confirming payment.

In the event that the buyer cannot present any of these documents, he can refer to witness testimony confirming the fact of purchasing the goods from the seller.

If using any of these methods the buyer can prove that the product was purchased from this seller, the organization will have to fulfill his requirements (to replace the product or return the money).

This procedure follows from Article 493 of the Civil Code of the Russian Federation and paragraph 3 of paragraph 1 of Article 25 of the Law of February 7, 1992 No. 2300-1.

If the product is returned on the day of purchase, then, as a rule, a refund is made using a cash receipt received from the buyer and signed by the head of the organization or his deputy (clause 4.2 of the Model Rules, approved by letter of the Ministry of Finance of Russia dated August 30, 1993 No. 104). At the same time, an act on the return of funds to customers using unused cash receipts is drawn up. The act is drawn up in one copy and signed by the head of the organization, the head of the department (section), the senior cashier and the cashier-operator. Cash receipts returned during the shift are pasted onto a sheet of paper and, together with the reports, are submitted to the accounting department.

This procedure follows from the instructions approved by Resolution of the State Statistics Committee of Russia dated December 25, 1998 No. 132.

The amount returned to the buyer is issued from the operating cash register using the same cash register with which the money was received (letter of the Federal Tax Service of Russia dated April 11, 2013 No. AS-4-2/6710). Indicate the amount issued under the act in column 15 of the cashier-operator's journal.

If the buyer returns the goods not on the day of purchase, but later, then pay the money to the buyer as follows.

Request from the buyer:

— application for return of goods; - passport or identification document.

In this case, money is issued not from the operating room, but from the main cash register. This is explained by the fact that the proceeds from the sale of this product have already been reflected in the cash book (and in accounting). When issuing a cash receipt, indicate in it the details of your passport or other document identifying the buyer.

When issuing money from the main cash register, the senior cashier (cashier):

— checks the cash receipt order;

- issues money to the buyer indicated in the cash receipt order upon presentation of his passport or identification document (letter of the Federal Tax Service of Russia dated December 3, 2012 No. AS-4-2/20379);

— makes an entry in the cash book (clause 4.6 of the Bank of Russia Directive No. 3210-U dated March 11, 2014).

This procedure is established by clause 6.1 of the Bank of Russia Directive No. 3210-U dated March 11, 2014.

Attention: for violation of the rules for processing the return of goods, the organization bears administrative responsibility.

Violation of the rules for processing the return of goods entails a fine for failure to receive cash in the amount of:

— from 4000 to 5000 rub. – for officials of the organization (for example, a manager); — from 40,000 to 50,000 rubles. – for an organization (Article 15.1 of the Code of Administrative Offenses of the Russian Federation).

Incorrect same-day returns are mostly returns without a receipt. In this case, the tax service qualifies the money issued to the client from the operating cash desk as unrecorded revenue (see, for example, letters of the Federal Tax Service of Russia for Moscow dated July 30, 2007 No. 34-25/072141, Department of the Federal Tax Service of Russia for Moscow dated April 2, 2003 No. 29-12/17931).

However, some courts are of the opinion that processing the return of goods on the day of purchase not using a cash receipt (but using a sales or, for example, warranty card) is not a violation under Article 15.1 of the Code of Administrative Offenses of the Russian Federation (see, for example, the decisions of the FAS North Western District dated July 12, 2007 No. A56-51595/2006, dated March 15, 2006 No. A56-20348/2005, East Siberian District dated August 13, 2007 No. A33-6945/07-F02-5130/07 ). This is due to the fact that the obligation to return the buyer’s money for the goods, even in the absence of a cash receipt, is established, in particular, by the legislation on the protection of consumer rights (paragraph 3, paragraph 1, article 25 of the Law of February 7, 1992 No. 2300-1 ). Consequently, the inspection cannot hold the organization liable under Article 15.1 of the Code of the Russian Federation on Administrative Offenses when returning money on the day of purchase not using a cash receipt, but using another document.

The main violation for returns not on the day of purchase is the issuance of money from the operating cash register. In such situations, the organization mistakenly reduces the revenue in the cashier-operator’s journal instead of issuing an expense cash order (see, for example, Resolution of the Supreme Court of the Russian Federation dated January 28, 2011 No. 5-AD11-1).

Error in cash receipt

Situation: what to do if the cashier-operator punches a cash receipt with an error in the payment amount?

The answer to this question depends on two factors:

- what amount is written on the check: more than the purchase price, or less;

— whether the cashier-operator can replace an erroneous check with a correct one or not.

If the cash receipt indicates an amount greater than the purchase price, two options are possible.

If the error is discovered immediately (for example, if the customer has not yet left the cash register), the customer should be issued a new check with the correct payment amount. The erroneous check must be cleared. At the end of the shift, draw up a statement for the entire amount of payment on the erroneous check in form No. KM-3. Stick the canceled check on a piece of paper and attach it to the deed. In addition, indicate the erroneous amount in column 15 of the cashier-operator’s journal.

This procedure follows from paragraph 4.3 of the Model Rules, approved by letter of the Ministry of Finance of Russia dated August 30, 1993 No. 104, and instructions approved by Resolution of the State Statistics Committee of Russia dated December 25, 1998 No. 132.

The procedure for action when an error is detected at the end of a shift (when it is impossible to replace the issued check) is not regulated by law. Nevertheless, in practice you can do the same as in the first case. Draw up a report in form No. KM-3 and indicate in it the difference between the correct and erroneous payment amount. Reflect the same difference in column 15 of the cashier-operator’s journal.

In this case, it will not be possible to attach an incorrect check to the deed. Therefore, during an audit, the tax inspectorate may accuse the organization of not posting cash proceeds. Responsibility for such a violation is provided for in Article 15.1 of the Code of the Russian Federation on Administrative Offenses. The dispute will have to be resolved in arbitration. Some judges believe that correcting such errors in the absence of cash receipts is lawful (see, for example, decisions of the Federal Antimonopoly Service of the West Siberian District dated May 25, 2006 No. F04-2909/2006(22691-A70-7), Northwestern District dated March 15, 2006 No. A56-20348/2005, dated September 7, 2004 No. A56-14926/04, dated September 29, 2004 No. A52/1052/2004/2, East Siberian District dated February 25, 2004 No. А33-15332/03-С6-Ф02-468/04-С1).

If the cash receipt indicates an amount less than the purchase price, the cashier-operator only needs to punch an additional receipt for the difference. This can be done immediately after excess funds have been discovered in the cash register. Otherwise, during an audit, the tax inspectorate may hold the organization liable for committing an administrative offense.

According to Article 14.5 of the Code of the Russian Federation on Administrative Offences, in particular, punching a check indicating an amount less than that paid by the buyer is equated to non-use of cash registers (clause 1 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 31, 2003 No. 16, determination of the Supreme Arbitration Court of the Russian Federation RF dated March 18, 2009 No. VAS-2583/09, resolution of the Federal Antimonopoly Service of the East Siberian District dated September 25, 2008 No. A10-763/08-F02-3901/08, Ural District dated January 16, 2007 No. F09- 11858/06-S1, Moscow District dated July 24, 2006 No. KA-A41/6587-06-P).

End of work shift

At the end of the work shift, the cashier-operator:

— based on the Z-report, makes entries in the cashier-operator’s journal according to form No. KM-4. In this case, column 9 reflects the readings of the summing counters taken in the presence of the cashier-operator by the senior cashier (the head of the organization, his deputy, the head of the section) at the end of the shift. The amount of revenue received per shift is reflected in column 10. Columns 11–14 indicate the amounts of revenue handed over, and column 15 indicates the amounts issued to customers when returning goods. The register must be signed by the cashier-operator, the senior cashier (the head of the organization, his deputy, the head of the section, etc.);

— draws up a certificate-report of the cashier-operator in form No. KM-6. This document also reflects the readings of control and summing meters, the amount of revenue per shift and the amount of money returned to customers. The report is drawn up in one copy and, together with the proceeds, is transferred to the main cash desk.

— returns to the senior cashier of the main cash register the amount of money received at the beginning of the shift for change and initial settlements with customers. This return is recorded in the book of accounting of funds accepted and issued by the cashier in form No. KO-5. To confirm the return of this amount, the senior cashier signs in column 9.

This procedure is provided for in clause 6.1 of the Model Rules, approved by letter of the Ministry of Finance of Russia dated August 30, 1993 No. 104, clauses 4, 4.5 of the Bank of Russia instructions dated March 11, 2014 No. 3210-U, instructions for filling out forms No. KM-4 and No. KM -6, approved by Resolution of the State Statistics Committee of Russia dated December 25, 1998 No. 132, instructions for filling out form No. KO-5, approved by Resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88.

Based on the certificates-reports of cashiers-operators, the cashier (senior cashier) draws up a summary report for all cash registers (form No. KM-7 “Information on meter readings of cash register machines and the organization’s revenue”). It is compiled in one copy. Columns 5–7 of the summary report reflect the meter readings of each cash register, and column 8 – the amount of revenue. It is separately indicated how much money was given to customers when returning goods and what amounts were entered erroneously. The summary report is signed by the senior cashier and the head of the organization. It is transferred to the accounting department along with incoming and outgoing orders and certificates and reports from cashiers-operators. This procedure is provided for by instructions approved by Resolution of the State Statistics Committee of Russia dated December 25, 1998 No. 132.

If change coins and banknotes are returned from the cash desks of separate divisions to the main cash office of the organization, then when transferring money it is necessary:

— issue a cash receipt order;

— make an entry in the cash book of a separate division.

This procedure follows from the provisions of paragraphs 4.1, 4.6 of the Bank of Russia Directive No. 3210-U dated March 11, 2014 and the instructions approved by the State Statistics Committee of Russia Resolution No. 88 dated August 18, 1998.

If a cash balance limit is set for a separate division of an organization, then the received change coins and bills can be left at the department’s cash desk for subsequent distribution to cashiers-operators, but within the limit (clauses 2, 7 of the Bank of Russia instructions dated March 11, 2014 No. 3210- U).

Situation: is it necessary to take out cash register fiscal memory reports (Z-reports) if during the work shift no revenue was received at the operating cash desk (either by payment cards or in cash)?

Answer: yes, it is necessary.

Every day at the end of the work shift, the cashier-operator is required to fill out a log in form No. KM-4. The journal is filled out in chronological order. This follows from the instructions approved by Decree of the State Statistics Committee of Russia dated December 25, 1998 No. 132. The basis for entries in the journal are Z-reports taken from the cash register at the end of each shift. Thus, daily receipt of Z-reports is the responsibility of the cashier-operator, which he must fulfill regardless of the presence or absence of revenue. If no revenue was received by the operating cash desk during the work shift, then dashes must be entered in the appropriate columns in the cashier-operator’s journal (based on the Z-report taken).

The Russian Ministry of Finance adheres to a similar position in letter dated June 11, 2009 No. 03-01-15/6-311.

Situation: on what day do you need to make an entry in the cashier-operator’s journal and capitalize the proceeds if the cashier’s shift lasts from 11 a.m. of the current day to 6 a.m. the next day?

In this case, the organization has the right to independently establish the procedure for recognizing revenue. This is explained as follows.

The cashier-operator is obliged to fill out the cashier-operator logbook in form No. KM-4 every day at the end of the work shift. The journal is filled out in chronological order. The basis for the entries in it are Z-reports taken from the cash register at the end of each shift. This follows from the instructions approved by Resolution of the State Statistics Committee of Russia dated December 25, 1998 No. 132.

Based on the control tape removed from the cash register, a cash receipt order is issued for the total amount of cash received (clause 5.2 of Bank of Russia Directive No. 3210-U dated March 11, 2014).

The cashier records information about the movement of cash and cash payments in the cash book using form No. KO-4. Every day, the accountant confirms the amount of cash revenue capitalized for the day and reflected by the cashier in the cash book (based on incoming and outgoing cash orders). This follows from paragraph 4.6 of the Bank of Russia instruction dated March 11, 2014 No. 3210-U.

At the same time, the start and end times of work of various departments of the organization may not coincide (for example, a cashier’s shift may not coincide with the work hours of the accounting department). In addition, the beginning (end) of a work shift may not coincide with the beginning (end) of a calendar day. The work schedule of personnel must be prescribed in the Labor Regulations (Articles 91, 100 of the Labor Code of the Russian Federation).

In this case, you can capitalize the revenue for the shift as follows:

1. The cashier-operator takes two Z-reports: one at the end of the current day, the other at the end of the work shift. Entries in the cashier-operator's journal and cash book are made for the corresponding days. Revenue is accounted for in the amount indicated in each of the Z-statements.

2. The cashier-operator takes out one Z-report at the end of the shift and the entire amount of revenue is received on the day the shift ends (this is reflected in the cashier-operator’s journal and the cash book on the same day).

For example, if a cashier-operator’s shift lasts from 11 a.m. of the current day to 6 a.m. the next day, then the proceeds can be capitalized:

- in the corresponding amounts in the current and next days (based on Z-reports taken at 00 o'clock on the current day and at the end of the shift (6 o'clock in the morning) falling on the next day);

- in full amount on the next working day (based on the Z-report taken at the end of the shift (6 a.m.) falling on the next day).

The chosen option must be approved by order of the head of the organization.

The legitimacy of this position is confirmed by the tax department (see, for example, letters from the Federal Tax Service of Russia for Moscow dated May 3, 2005 No. 09-24/31061, UMTS of Russia for Moscow dated February 3, 2003 No. 29-12/6552 ).

Advice: there are arguments that allow an organization to capitalize all revenue received for a shift (based on the Z-report taken at the end of the shift) the previous day. They are as follows.

Every day, the accountant records the cash proceeds received by the organization in the cash book (clause 4.6 of the Bank of Russia Directive No. 3210-U dated March 11, 2014). This data is the basis for recording entries in accounting. In accordance with the principle of rational accounting, making these entries the next day (or distributing revenue for shifts between different days) is inconvenient, this leads to an increase in labor costs (clause 6 of PBU 1/2008). Reflection of revenue received per shift on the previous day meets the needs of the organization to determine inventory balances at the beginning of the next day. Since the use of this option does not lead to distortion of accounting data and violation of cash discipline, the head of the organization has the right to approve it by order of the organization.

IV. Cashier work during the shift

4.1. The cashier-operator or other financially responsible person (controller-cashier, waiter, seller, bartender, order taker, etc.) is obliged to: – ensure careful care and careful handling of the machine, keep it clean and tidy; – carry out operations of entering amounts in accordance with the operating instructions for this type of cash register; – for one buyer (client), determine the total amount of the purchase, service according to the cash register indicator or using counting devices and tell it to the buyer (client); – to receive money from buyers (clients) for goods or services provided according to the amount called the buyer (client), indicated in the price list for the services provided, the price list for the goods sold, in public catering establishments indicated in the menu, or price tags in the following order: a) clearly state the amount of money received and place this money separately in full view of the buyer (client); b) print a receipt - when making payments using a cash register; c) name the amount of change due and give it to the buyer (client) along with the check (in this case, hand out paper bills and small change at the same time). 4.2. Checks from cash registers for the purchase of goods are valid only on the day they are issued to the buyer (client). The cashier-operator can issue money on checks returned by buyers (clients) only if the check has the signature of the director (manager) or his deputy and only on a check issued at this cash desk. 4.3. In the event of a cashier-operator error: – when entering the amount and it is impossible to redeem the check during the shift, the unused check is activated at the end of the shift; – in issuing change to the buyer (client), if a dispute arises, the buyer has the right to demand that the administration withdraw the cash register; – draw up and draw up, together with the administration of the enterprise, an act in Form No. 54 (Appendix No. 5) on the return of money to buyers (clients) for unused cash receipts, cancel them, stick them on a sheet of paper and, together with the act, submit them to the accounting department (where they are stored under text documents for a given date); – record in the “Cashier-Operator Book” the amounts paid on checks returned by buyers (clients) and the number of zero checks printed on the day; – the cashier-operator has no right to: remove the cash register without the permission of the administration; – do not issue a cash receipt to the buyer (client). 4.4. If a cash register is installed at the workplace of the seller or order taker, they are subject to the duties of a cashier/operator. 4.5. The cashier has the right: - during the shift, at the direction of the director (deputy director), change the code, apply stamps and imprints “redeemed”, “account”, “control”, etc.; – receive printouts from the cash register; – change the code in the cash register together with the programmer (operator). 4.6. If a malfunction occurs, the cashier is obliged to: – turn off the cash register; – call an administration representative using the alarm system installed in the cabin; – together with a representative of the administration, determine the nature of the malfunction; – in case of unclear printing of details on a check, non-exit of a check or breakage of the control tape, together with representatives of the administration, check the prints of the check on the control tape, sign the check (if the check did not come out, get a zero one instead), indicating the correct amount on the back (rubles in words, kopecks numbers) and after checking the absence of numbering gaps, sign where the control tape breaks; – if further work is impossible due to a malfunction of the cash machine, the cashier, together with a representative of the administration, formalizes the end of work on this cash machine in the same way as at the end of a shift, with a note in the “Cashier-Operator Book” for this cash machine, the time and reason for the end of work . If the cashier cannot eliminate the malfunction, the administration calls a technical specialist (mechanicist, programmer, electronics specialist, control systems, communications specialist), making an appropriate entry in the log of calling the technical specialist and recording the work performed (Appendix No. 6, Form No. 30). 4.7. The cashier is prohibited from: – working without control tape or gluing in places where it is broken; – allow unauthorized persons into the cash register premises to the cash machine, except for the director (manager) of the enterprise, his deputy, accountant, duty administrator and, with their permission, a technical specialist or supervisory person to check the cash register; – leave the cash register without notifying the administration and without turning off the cash machine, without locking the cash register or cash register. If it is necessary to leave the cash register, all keys (for the booth, working key for the cash register and cash drawer) must be kept by the cashier; – independently make changes to the operating program of the cash terminal (for which the latter must be protected from unauthorized access); – must not have personal money in the cash register and money not accounted for through the cash register (except for money issued before starting work).

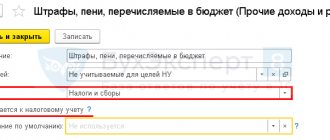

Documents to be filled out

These include:

- cash book - an accounting document in which cash transactions are recorded, filled out in writing or electronically;

- cash receipt order - issued when funds are received at the cash desk, filled out based on data from the check and the strict reporting form;

- expense cash order - issued when cash is issued from the cash register, can be filled out on the basis of fiscal documents.

- BSO - after changes, 54-FZ can be issued electronically.

In addition, a correction check and a form with the “receipt return” sign appeared. The first one must be generated and printed if the revenue was not taken into account at the checkout. For example, in the event of a power outage, when a cashier is forced to trade without using a cash register. The second document is required when returning money for a product or service. The cashier must issue it and give it to the client for both cash and non-cash payments.

In addition, the user of the online cash register must keep reports on the opening and closing of the shift, as well as the closing of the fiscal drive.

Astral

January 20, 2021 2052

Was the article helpful?

67% of readers find the article useful

Thanks for your feedback!

Comments for the site

Cackl e

Products by direction

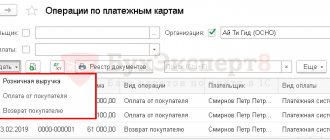

V. Features of non-cash payments with customers

5.1. Calculation through settlement checks of Sberbank institutions. The settlement check has a series and number and is a standard form. It indicates the amount for which the check was issued (in numbers and in words), the last name, first name and patronymic of the owner of the check, details of the bank institution that issued the check, and the validity period of the check. The settlement check is certified by the signatures of employees of the banking institution and an official seal indicating the date of issue. When presenting a settlement check in payment for goods, the cashier checks that the check form corresponds to the established template, that there are no erasures or corrections to the text and the amount of the check, that the check digits correspond to the amount written on the check, the validity period of the check, the presence of a clear stamp of the official seal and the signatures of employees of the banking institution , after which he verifies the identity of the bearer of the check using a passport or a document replacing a passport. The trading enterprise bears financial responsibility for accepting and paying for the goods a settlement check filled out in violation of the “Instructions on the procedure for using settlement checks”. After checking and accepting the settlement check as payment for the goods, the cashier puts a stamp on the back with the text “Check accepted as payment for the goods,” indicating the number and name of the store and the date the check was accepted, signs on the stamp, and also notes the data in a special statement about the passport presented by the buyer or a document replacing it. Then he punches the amount indicated in the check through the cash register to the second section (password), through which only non-cash payments are made, and issues a cash receipt. Payment checks (this also applies to checkbooks), accepted as payment for goods, are handed over by the store to the bank's servicing institution along with cash proceeds through the bank's collector. 5.2. Payment using check books. A checkbook is issued for any amount within the limits of the depositor's available funds in an account at a banking institution. A checkbook is a personal document. It indicates the last name, first name and patronymic of the owner, the number of the bank branch issuing the book, the number of checks in the book, their series and their own numbers. The account number on the basis of which the checkbook was issued and the amount for which it was issued are also indicated. The date and validity period of the book are certified by the signatures of employees of the banking institution and the seal of this institution. The checkbook has a set validity period, which can be extended, about which a corresponding entry is made, which is certified by the signature of an employee of the banking institution and the seal. Each check contains the serial number, series and its own check number, and on the reverse side - the number of the banking institution, its location, deposit account number and other data related to the banking institution. Each check has a counterfoil with the same number in the book. When purchasing goods, the owner of the checkbook fills out the check and its counterfoil. A completed check, not separated from the checkbook, is presented to the cashier along with your passport as payment for the goods. When accepting a check, the cashier verifies the identity of the owner of the checkbook and checks the data with the corresponding entry on the back of the check and certifies this signature with his signature. Checks the validity period of the checkbook, as well as the correctness of filling in the same way as described when working with checks. The cashier accepts the correctly completed check as payment for the goods, separating it from the checkbook. Makes a mark (puts an imprint of the store stamp) on the back of the check indicating the date of its receipt (month in words) and signs. When preparing proceeds for delivery to the bank, on the reverse side of the transmittal sheet and invoice for the amount of cash proceeds in the column “List of presented checks” indicate the numbers and series of checks, the account number and name of the drawers, the amount of each check and the total amount of all checks. 5.3. Payment via credit cards. A credit card is a plastic rectangle with a magnetic strip that contains the data necessary to pay for goods. When purchasing a product, a system cash terminal connected to the bank is inserted into the cash register slot, the account number of the credit card owner is communicated via the communication channel, his solvency is confirmed and a command is given to debit the specified amount (the cost of the purchase or service) from the account. After which the card is returned to the owner. When you enter a credit card into the machine, a personal code is entered, known only to the owner.

VI. Finishing work on the cash register

6.1. When the business closes or upon the arrival of the cash collector, if he is scheduled to arrive before the business closes, the cashier must: – prepare cash receipts and other payment documents; – draw up a cash report and submit the proceeds together with the cash report on the receipt order to the senior (chief) cashier (in small enterprises with one or two cash desks, the cashier hands over the money directly to the bank's collector). A representative of the administration, in the presence of the cashier, takes readings of sectional and control counters (registers), receives a printout or removes the control tape used during the day from the cash register. The administration representative signs the end of the control tape (printout), indicating on it the type and number of the machine, the readings of sectional and control counters (registers), daily revenue, the date and time of completion of work. Reporting statements of testimony at the end of the working day are entered into the “Cashier-Operator Book”. Based on the readings of sectional counters (registers) at the beginning and at the end, the amount of revenue is determined. The amount of revenue must correspond to the readings of cash totaling counters and the control tape. It must coincide with the amount handed over by the cashier-operator to the senior cashier and placed in the collection bag with the final check of the cash register machine. After reading counters (registers) or printing, determining and checking the actual amount of revenue, an entry is made in the “Cashier-Operator Book” and signed by the cashier and the administration representative. 6.2. If there is a discrepancy, the actual amount of revenue is determined by adding the amounts printed on the control tape. If there is a discrepancy between the results of adding the amounts on the control tape and the revenue determined by the counters (registers), the administration representative and the cashier must find out the reason for the discrepancies. Identified shortages or surpluses are entered in the appropriate columns of the “Cashier-Operator Book”. Based on the results of the audit, the administration of the enterprise, in the event of a shortage of funds, must take measures to recover it from the guilty persons in the prescribed manner, and if there is a surplus of funds, enter them into accounting and attribute them to the results of economic activities. 6.3. Having completed the registration of cash register documents, the cashier performs: - inter-repair maintenance of the machine and prepares it for the next day in accordance with the requirements of the operating manual for this type of cash register equipment. Cashiers (controllers - cashiers, salespeople, waiters, etc.) working on cash registers must be equipped with the following accessories to care for them: - brushes for cleaning the fonts of the receipt printing mechanism; – brushes for painting cushions and rollers of the check printing mechanism; – tweezers for removing stuck receipt tapes; – formalin or other means for periodic disinfection of cash drawers of cash registers; – corresponding keys to cash registers. The key for clearing technical runs must be kept by the senior cashier. After carrying out maintenance, the cashier: – closes the cash register with a cover, having previously disconnected it from the power supply; – hands over the keys to the cash machine, cash register to the director (manager) of the enterprise, duty administrator or senior (chief) cashier for safekeeping against receipt. The senior (chief) cashier, after receiving all the necessary documents, draws up a summary report in Form No. 25 (Appendix 7) for the current day. The summary report, along with acts, receipts, and expenditure orders, is transferred to the accounting department before the start of the next shift. 6.4. Used cash receipts and copies of sales receipts are kept by financially responsible persons for at least 10 days from the date of sale of goods on them and verification of the sales report by the accounting department. Used control tapes are stored in packaged or sealed form in the accounting department of the enterprise for 15 days after the results of the last inventory have been carried out and signed, and in case of a shortage - until the end of the consideration of the case. Data in the computer's memory is destroyed within a period of time (3 years) no less than the above for electromechanical cash registers. Directors (managers) and owners of enterprises are responsible for storing cash receipts, copies of sales receipts, control tapes and maintaining machine memory information for a specified period. After the end of the established storage period, used cash register receipts, copies of sales receipts, control tapes, printouts are handed over to organizations for the procurement of secondary raw materials according to the act of their write-off (destruction).

VII. Responsibilities of service organizations and mechanics

(operator) for the repair and maintenance of cash registers In cities with a developed network of trading enterprises equipped with a large number of cash registers, it is necessary to organize and ensure the activities of republican (republics within the Russian Federation) and regional (territorial, regional, interregional, district, city) technical centers for their repair and maintenance. 7.1. The technical center is obliged to: – send a representative to the enterprise (at his request) to open the factory packaging and re-open the purchased cash register; – provide incoming control of new cash registers arriving from manufacturing plants; carry out the necessary work on re-preservation, adjustment and technical examination, diagnostics; – ensure that the marking plate with the serial number of the machine is securely attached, preventing its replacement; – seal cash registers together with the tax office; – make and install a company cliche with the name of the trading enterprise and the number of the payment center (cash desk) or enter it using the software method; – commission machines and accept them for maintenance; – carry out annual maintenance, technical inspections and all types of repairs; – write off worn-out and obsolete cash registers, dismantle them and dispose of them. Maintenance of machines is carried out to maintain constant serviceability, prevent failure during operation and extend service life. When organizing maintenance, they are guided by the relevant GOSTs. Maintenance means strict adherence to the structure of scheduled preventive maintenance (PPR) and interrepair periods provided for each type of machine and includes: interrepair maintenance, machine inspection, current and major repairs. Between repairs maintenance is carried out by cashiers daily. 7.2. Responsibilities of a mechanic for the repair and maintenance of cash register machines. The mechanic carries out routine technical inspections, including checking the condition of the machine’s mechanisms and eliminating minor faults. 7.2.1. The mechanic is obliged to: - present to the director or representative of the administration or the chief cashier of the enterprise an official identification card with a photo card and, with the permission of the enterprise administration, inspect and repair the cash machine in the presence of the cashier (controller - cashier, salesman, waiter, etc.) and the chief (senior) cashier; – periodically inspect and carry out preventive maintenance of the cash register in accordance with the structure of the maintenance work of this model, lubricate all rubbing parts and check the operation of the receipt printing mechanism (feeding of receipt and control tape), the operation of the numbering machine, inking devices, locks and other mechanisms of the cash register; – check the machine locks; – fill out the log of calling technical specialists and recording the work performed, making entries about the work performed in the log and the machine passport; – upon completion of the repair, seal it (if the seal is removed) with your own seal and inform the tax office about the need to seal this machine (working on a cash register machine until a new tax office seal is installed); – install and connect (if necessary) a spare cash register; – if it is necessary to repair cash and control meters, indicate to the management of the trading enterprise about the need to send the machine for repair to a technical center (or other service organization). 7.2.2. Repairs and maintenance by private individuals are prohibited. 7.2.3. Repair of cash registers should be carried out only after readings from cash summing and control counters have been taken and the seal has been removed from the casing of the device (if necessary). 7.2.4. At the end of the repair, the readings of the cash and control counters are checked, and the casing of the cash register is sealed. A report on the results of checking the machine and sealing the casing is drawn up with the participation of a mechanic in Form No. 27 (Appendix 2). 7.3. Responsibilities of the operator for the repair and maintenance of electronic cash terminals and control and recording machines. 7.3.1. Maintenance and repair specialists present the director (manager) of the enterprise, the duty officer or the chief (senior) cashier with an official identification card with a photo card and, with the permission of the enterprise administration, carry out an inspection in the presence of the cashier (controller - cashier, waiter) and the chief (senior) cashier, maintenance of electronic cash register. Commissioning is carried out by a specialized contractor under a separate contract according to the form for the cash register. 7.3.2. Changes to the operating program of the electronic cash register must be agreed upon with the controlling organization. Machine repairs are carried out only after readings from cash summing and control counters are taken and, if necessary, the seal is removed from the machine casing. Upon completion of the repair, the readings of the cash and control counters are checked, and the casing of the cash register is sealed. A report on the results of checking and sealing the cash register casing is drawn up in Form N 27 with the participation of the director, the cashier-operator, a technical center specialist and a representative of the tax office. 7.3.3. Documents about the faulty operation of cash or control counters and a conclusion about the suitability of the electronic cash register for further work or sending it to the technical center for repair are prepared by the programmer, filling out the passport for the machine and the log of calling technical specialists and recording the work performed with the corresponding entries. 7.3.4. Setting up the printing mechanism is carried out by persons with a safety qualification group of at least third. When setting up, use the instructions for setting up and acceptance, the operating manual, and, if necessary, carry out individual work on the technological run in workshops with testing on benches. 7.3.5. Maintenance and repair work is carried out by a specialized organization on a contractual basis with the consumer. Warranty repairs of a cash register are carried out by the manufacturer or a specialized organization that has an agreement with the manufacturer at the expense of the manufacturer. 7.3.6. Maintenance (service) services must issue the consumer a technical passport of the machine, and persons servicing cash registers must enter the following data into the passport: 1) date and time of receipt of the user’s request for repair; 2) date and time of the start of repairs; 3) a general description of the results of inspection of external damage to the machine (presence or absence of a seal on the machine casing tape, etc.); description of manifestations (signs) of failures, failures, etc.; 4) a description of the actions for repair or maintenance of the machine, with or without removal of the machine from its place of installation; 5) number of the last check issued; 6) date and time of completion of work and signature of the person performing the maintenance; 7) date and time of return delivery of the machine if the work was not carried out at the place where the machine was installed.

VIII. Safety regulations

8.1. When operating and maintaining a cash register, it is necessary for the cashier - operator and technical specialists to comply with the safety requirements set out in the PTB, PTE, PUE, as well as in the operating manual for this type of cash register, including: - the cashier’s workplace must be equipped in such a way as to prevent the possibility of contact between a worker and live devices, grounding bars, heating radiators, and water pipes; – the machine must be connected to the network through a special socket that must be grounded; – it is not allowed to use fuses that are not designed for the current provided for by the technical characteristics of this machine, and to connect the machine to the network without a fuse (replace the fuse with a “bug”); – before connecting the electromechanical machine to the network, it is necessary to check the rotation of the hand drive handle counterclockwise; – before connecting the machine to the electrical network, you must inspect the plug, cord, socket and make sure that they are in good condition (there are no breaks, exposures, etc.); – it should be remembered that for machines with automatic opening of the cash drawer, during the issuance of the first check, the cash drawer is pushed out under the action of springs by at least 1/3 of its length; – interference with the operation of the machine after it has been started until the end of the working cycle is not allowed; – when stopping the machine for an unknown reason, as well as in case of sudden stopping (stopping the machine during an unfinished work cycle), it is necessary to disconnect it from the power supply. All work on checking an electromechanical machine should be carried out using a manual drive. However, you should not use excessive force to check the mechanisms of a machine that has stopped for an unknown reason; – it is prohibited to carry out maintenance on the machine connected to the power supply; – after finishing work on the machine, you must turn off the power supply by removing the plug from the socket; – persons unfamiliar with the operating and safety rules should not be allowed to operate the machine. 8.2. In order to ensure the safety of the cashier's work, it is necessary to equip the cashier's cabin with a device for calling security and administration, and also provide emergency lighting for the cash register cabin.

How to operate a cash register: step-by-step steps

Every cashier at their workplace should have a step-by-step instruction or guide on how to operate an online cash register, because a cashier must perform the following actions daily:

- at the beginning of the working day, check the serviceability of the cash register;

- turn on the cash register;

- check the presence of a receipt printing tape (if it is missing, install a new one);

- register a cashier (possibility of some cash register models);

- display test reports (current and for the previous shift);

- meet the buyer;

- punch the receipt of the purchased product or service;

- carry out the plan for the break (check the actual amount of money in the safe and in the machine’s memory, add new product items or other actions as necessary);

- at the end of the shift, recalculate the revenue received and compare it with the value in the memory of the cash register equipment.

Arriving at the workplace, the cashier must make sure that there is no damage to the body of the cash register equipment and information input/output wires, as well as the presence of the necessary seals on the device (if any). You also need to clean the product from dust and dirt. At the end of the preparation, the cashier checks the reliability of the cash register’s connection to a 220 Volt household network (if the equipment is stationary) and the connection to the Internet.

You need to pay attention to the correct installation of the receipt tape. Quite often, the roll is installed upside down, and then they are surprised at the incorrect printing and blame the supposedly faulty printer. The correct position of the roll in the printing device is clearly indicated in the equipment instructions. It is due to the presence of only one layer for printing on thermal tape. Check the ribbon installation when printing the report.

Next, the cashier prints a report for the previous shift. If the amounts are visible in the previously printed report, the employee of the previous shift forgot to reset. If this was not corrected in time and noticed by the inspection authorities, the institution is subject to penalties.

For this reason, how to operate a cash register is a must-have skill even for a junior cashier just starting out in their career. The way out of this situation is to urgently print the report before 24 hours have passed from the date of the first printing of the previous shift's check. If necessary, you need to correct the date and time of the transaction, count the money in the appropriate compartment and reconcile it with the report of the previous shift.

When recalculating the amount, you need to keep in mind non-cash payments to customers. It is reflected on the check as a separate line. Such money is stored in the company’s personal account, and not in a cash safe. It is also recommended to be prepared for the fact that the accountant or owner of the enterprise may ask the cashier to provide an official issue during the working day. This is completely normal. The proceeds must be transferred to collectors, to the specified account or personally to the owner of the institution.

At the end of the work shift, a final report is performed. To do this, you need to have a sufficient balance of the cash register tape. About the successful completion of zeroing, the printed paper will contain the phrases “Registers cleared,” “Report is valid,” and so on. The report is assigned an individual number and stamped with a date and time. These parameters are also subject to mandatory verification by the cashier.

The control tape (if any) should be carefully rolled up and stored at the place of calculation for 3 days and 3 years within the enterprise. If you want the amount of non-cash payments to be transferred to the specified bank account, the shift must be closed at the bank payment terminal. The cashier must wait for a report on the correct sending of transaction information to the tax service in the case of an online cash register or take such documents directly to the federal tax service building. The end of the shift is marked by turning off the cash register.

Agreed

Deputy Chairman of the Russian Federation Committee on Trade N.A.LUPEI Deputy Head of the State Tax Service of Russia N.V.IVANOV Deputy Chairman of the Russian Federation Committee on Mechanical Engineering A.N.VOLDORIN First Deputy Chairman of the State Standard of Russia S.I.AVERIN Appendix 1 to the Model Rules operation of cash register machines when making cash settlements with the population

Rate how useful the information in the article was? ( 1 ratings, average: 5.00 out of 5)

What documents are needed to register an online cash register?

To register an online cash register, you need to send an application to the tax authorities. According to Law 54-FZ, the application for registration of a cash register must contain the following details:

- user name (full name of the organization or full last name, first name, patronymic (if any) of an individual entrepreneur);

- TIN;

- address and location of installation of the cash register;

- serial number and model of the cash register;

- serial number and model of the fiscal drive.

Depending on the planned direction of use of the online cash register, additional data is entered into the application, for example, if online payments will be made, then the website address must be indicated in the “Address” line. The corresponding lines are filled in:

- when used as part of an automatic device;

- when used by a paying agent;

- when making payments on the Internet;

- during peddling and delivery sales;

- when used only for printing strict reporting forms.

The application form is given in Appendix No. 1 to the Order of the Federal Tax Service of the Russian Federation dated May 29, 2017 No. ММВ-7-20 / [email protected] (as amended on September 7, 2018). You can download the form on our website .

And one more thing: before contacting the tax authority with an application to register an online cash register, you need to decide on the OFD, since its data is also entered into it.

The application form completed on paper is submitted to the tax office. You can register an online cash register at any tax office, not only at the one where the organization itself is registered.

In addition to the application, the inspection will require the presentation of originals of the certificate of state registration of a legal entity or entrepreneur (OGRN or OGRNIP), certificate of registration with the tax authority (TIN), documents for a cash register, a seal (if the organization has not refused to use it), and also not do not forget to issue a power of attorney for the representative of the organization performing the registration procedure.