Who should use forms KM-7 and KM-6

Form KM-7 is a document that is directly related to the use of a cash register system that has an ECLZ.

The obligation to use it has been abolished since July 2016 with amendments to the Law “On the Application of CCP” dated May 22, 2003 No. 54-FZ. And from July 2021, this form becomes unnecessary altogether due to the cessation of the use of cash registers equipped with ECLZ. However, this does not prevent the continued use of the KM-7 form only insofar as it concerns information about the amount of revenue received per shift. Read about what equipment has replaced cash registers with EKLZ in the article “Procedure for switching to online cash registers since 2016” .

At the time of the use of cash registers equipped with EKLZ, the KM-7 form was a mandatory attachment to another unified form - KM-6, which the cashier-operator had to draw up. But with the introduction of amendments to the law “On the Application of Cash Register Machines”, form KM-6 is filled out only at the request of the business entity.

See here for details.

The report on form KM-7 contains columns for indicating the factory and registration numbers of all used cash registers. Moreover, it was required to create it for any number of available cash registers, including for a single cash register.

The KM-7 form was approved by Decree of the State Statistics Committee of the Russian Federation dated December 25, 1998 No. 132. You can download it on our website.

Certificate-report of the cashier-operator (form KM-6)

Home / Cash register

| Table of contents: 1. Innovations from 2017-2021 2. Instructions for filling out the KM-6 form 3. No cash transactions | Document: Download the certificate form KM-6 View sample filling KM-6 |

A cashier-operator's certificate-report is a primary document that displays the results of the company's work and is intended to account for the organization's revenue received for a working day (shift).

The certificate-report is drawn up based on the information in the cashier-operator’s journal (KM-4) filled out for a given day (shift) or according to the X- and Z-reports.

The Z-report refers to the report that the cashier takes from the cash register at the end of the shift (working day). It provides data on cash transactions performed. Based on the balance indicated in the Z-report, the cashier checks the cash and transfers it to the administrator.

The X-report refers to the report that the cashier takes from the cash register to determine the amount of cash processed during the day (shift). It can be withdrawn an unlimited number of times at any time, the information will not be displayed anywhere, and the revenue will not be reset.

Indicators contained in the certificate report: data on payments in cash and payment bank cards (non-cash transfers of funds to the company's current account are not taken into account), refunds made to customers.

Storage: since the certificate refers to the primary documents confirming the implementation of cash payments via cash register, the storage period is 5 years.

Innovations from 2017-2021

According to the explanations of the tax inspectorate (letter of the Federal Tax Service of the Russian Federation dated September 26, 2016 No. ED-4-20 / [email protected] and the Ministry of Finance of the Russian Federation No. 03-01-15/19821 dated April 4, 2017), the transition to online cash registers is made by filling out a cashier’s certificate report -operator optional (all information about ongoing cash register transactions is stored in your personal account on the Federal Tax Service Inspectorate website).

Instructions for filling out the KM-6 form

The cashier-operator's certificate-report is filled out daily in a single copy. A legally developed form - form KM-6, approved by Decree of the State Statistics Committee of Russia dated December 25, 1998 No. 132

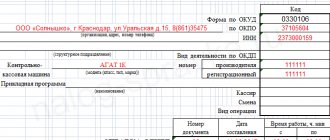

Cap part

Information about the organization or individual entrepreneur

- Name - must correspond to that specified in the constituent documents (in practice, an abbreviated name is most often used, but only if it is specified in the documentation). An individual entrepreneur indicates his full last name, first name, and patronymic (in accordance with registration documents with the Federal Tax Service).

- Address: as a rule, the legal address is indicated for organizations and the address of residence for individual entrepreneurs; telephone.

- Structural unit (if available)

OKPO code

This is the main code of organizations and individual entrepreneurs in statistical bodies (can be found by TIN on the official website of Rosstat). An empty field will not be a blunder.

OKDP code

OKDP is a classifier of products by type of economic activity. Lost force, OKPD 2 is used instead.

Codes can be determined depending on the type of product: on the websites of the Ministry of Economic Development of the Russian Federation, Rosstat (https://www.gks.ru/metod/classifiers.html) or do not fill in this field.

Cash register

Here you can find information about the cash register model, the manufacturer's number (serial number of the cash register indicated in the documentation) and the registration number indicated in the registration card of the cash register with the Federal Tax Service.

Attention! The list of cash registers approved for use from 2021 is presented on the official website of the tax service (https://www.nalog.ru/rn77/related_activities/registries/reestrkkt/).

Cashier field, etc.

Enter the cashier's last name and initials. If the certificate is compiled in sections with different cashiers, the field may remain empty.

Below is the number and date of the document, working hours

Tabular part

1 column

The number of the Z-report taken for the current day (shift) is entered - displayed on the report itself. This column coincides with column 4 of the cashier-operator’s journal.

2nd and 3rd column

If KKM provides for the division of Z-reports into various departments, these columns display the numbers of departments and sections (optional). If division by department is not provided, then a dash is added.

4 column

The report form is outdated; there is no need to fill out this column (a dash is placed).

5 column

The sum of all punched cash register checks for the entire period of its operation is displayed (cumulative result of activity). In the X- and Z-report, the cumulative total can be displayed with the following names:

- GROSS TOTAL;

- CUMULATIVE SALES TOTAL;

- NI.

Something to keep in mind! The amount can be taken from column 6 of the cashier-operator's journal, the X-report of the current day's cash register or the Z-report of the previous day's cash register.

6th column

Results of activity at the end of the current day (shift): data from the Z-report of the current day or column 9 of the cashier-operator’s journal (cumulative total).

7 column

The revenue received for the shift is displayed (the sum of all punched checks minus any refunds made). The data in the column coincides with column 10 of the cashier-operator's journal.

8 column

The total result of refunds made to customers and erroneously issued checks. The information is displayed in the KM-3 act. All receipts for which the refund was made are attached to the act. The data in the column coincides with column 15 of the KM-4 journal

9th and 10th column

Last name and initials of the head of the department. If there is no position of manager, the full name of the cashier is given. And also the signature of the specified person.

Data after the table

After filling out all the columns of the table, the total amount of revenue received (minus returns) in rubles and kopecks is entered in words.

Based on the completed journal of the cashier-operator, the cashier draws up a certificate-report KM-6, transfers this form to the senior cashier (chief accountant, manager) simultaneously with the proceeds from the cash receipt order (the report includes the PKO number and the date of preparation).

In small companies, a cashier-operator or an individual entrepreneur who combines all positions independently transfers the received proceeds to collectors at the bank. In the certificate-report, a note is made about the transfer of funds (bank account details, date, receipt number).

Reverse side of the report: accepting the cash received for the shift (day) according to the PQS and posting the cash received for the shift (day), the responsible persons sign on the reverse side of the certificate: senior cashier, cashier-operator, company management or individual entrepreneur (if combining positions, the same signature is placed several times) .

The prepared certificate-report of the cashier-operator is the basis for filling out a general statement of cash register counter readings and company revenue (according to the KM-7 form).

No cash transactions

If no cash transactions were carried out during the working day (shift), then a certificate-report of the cashier-operator is not drawn up.

Read in more detail: Certificate-report of cashier-operator

Did you like the article? Share on social media networks:

- Related Posts

- Cashier-operator's journal (form KM-4)

- Online cash registers in 2021

- Sample of filling out the KM-4 form

- Cash register for individual entrepreneurs and LLCs in 2021

- Sample of filling out the KM-6 form

Leave a comment Cancel reply

What are the features of filling out a report on form KM-7

Form KM-7 had to be generated daily in 1 copy and submitted to the accounting department before the start of the next work shift together:

- with form KM-6;

- PKO, RKO;

- acts in the KM-3 form (for the return of funds to customers).

The table, which is the main element of the KM-7 form, indicated and summarized the indicators for all fiscal counters of cash register systems, as well as for cash revenue for the trading entity as a whole or broken down by department (in this case, the figures were certified by the signatures of the heads of the relevant departments).

The amounts reflected in the acts in the KM-3 form, that is, returned to the company’s buyers, were indicated in words in a special column located under the table.

The information recorded in the KM-7 form was certified by the head of the trading entity, as well as by the senior cashier.

Read about the KUM-3 form in the material “Unified form No. KM-3 - form and sample” .

Rules for the formation of KM-7

Until 2021, the following rules for compiling KM-7 were legally established:

- It was filled out by hand or using computer programs daily based on KM-6 forms handed in by cashiers.

- It was sent to the enterprise’s accounting department no later than the next business day.

- The data obtained after the Z-report was taken was entered into it.

- The information was printed on two sides of one A4 sheet.

- The information specified in the report was certified by the signatures of the responsible persons: the senior cashier and a representative of the company administration.

During the period when firms and individual entrepreneurs used cash registers equipped with EKLZ, drawing up KM-7 was a mandatory procedure. It could be requested by tax authorities who came to the organization to conduct an audit. The absence of completed reports resulted in the imposition of penalties on the legal entity.

In 2021, the KM-7 form lost its mandatory status, because control of cash transactions carried out by business entities is possible online. Companies and individual entrepreneurs have the right to continue to fill out the report on a voluntary basis. They can develop a different form of it, for example, compiling only revenue figures.

Journal form KM-4: filling procedure