Do you need an online cash register for individual entrepreneurs without employees?

Recent changes in legislation have established the need to use online cash registers for all categories of business. With the introduction of Federal Law 54, it became clear that everyone was switching to online cash registers. So, online cash registers for individual entrepreneurs without employees, as established by law, are still needed. We'll have to switch to a new system anyway. The law says that individual entrepreneurs without employees need an online cash register, but does everyone need it? As we know, there are different taxation systems: UTII, PSN, OSN, simplified tax system. There is also a division of business into areas: trade, catering, services. Is there a difference for different business categories when it comes to switching to online cash registers? First, let's figure out why the state decided to introduce incomprehensible online cash registers and what consequences this transition has for business.

IP on NPD

Since 2021, an experiment has been carried out in 23 regions of Russia to introduce a new tax regime for self-employed individuals and entrepreneurs. It is based on the payment of professional income tax (PIT). An online cash register for individual entrepreneurs is not needed for NAP. Instead, they generate checks using the special Federal Tax Service application “My Tax”.

An entrepreneur can switch to paying NAP if the experiment is carried out in his region. The following conditions must also be met:

- Individual entrepreneurs have no employees;

- he is not engaged in trade;

- his income does not exceed 2.4 million rubles per year.

Combining NPD with other systems is prohibited. But you don’t need to file reports and calculate taxes yourself—the Federal Tax Service will do that.

Excluded activities

There are areas of business in which cash registers are not used at all. Their list is given in the already mentioned Article 2 of Law 54-FZ. Thus, an online cash register for individual entrepreneurs and organizations is not needed in 2021 if:

- sale of newspapers and magazines at kiosks, provided that their turnover is at least 50% of the total;

- providing meals to students and employees of schools and other educational organizations during their studies;

- trade at exhibitions and fairs in food and non-food products, except those included in a separate list by the Government of the Russian Federation;

- delivery and distribution trade;

- sale of ice cream, milk, soft drinks and water at kiosks;

- sale of some products from tank trucks (kvass, milk);

- seasonal sale of fruits and vegetables;

- rental of residential premises (only for entrepreneurs);

- care for children, disabled people and the elderly;

- gardening work, portering services and some others.

There is also no need to use CCT for the following activities:

- sales through mechanical vending machines (candies, toys and other small items);

- implementation of religious rites and ceremonies, sale of religious objects and literature;

- sale of medicines and medical products by pharmacies located in medical centers in rural areas;

- acceptance of payments by state authorities and local governments for parking;

- acceptance of payments by insurers when making settlements with the participation of agents who are not organizations or individual entrepreneurs;

- acceptance of payments by state and municipal libraries for the provision of services related to librarianship.

Why do you need an online cash register for individual entrepreneurs without employees?

By introducing the sensational 54 Federal Law, the state set very clear and very specific goals. The transition to a new system is intended to help control financial flows and tax concealment, and identify illegal products. Thus, the new system will create a more modern and transparent business in Russia. A system of public control is being introduced. Now the buyer will be able to check receipts and report violations to the Federal Tax Service. Concealing income using online cash registers will be much easier to track than before. Also, the new type of receipts will indicate the product, i.e. It will be clear what, who sold and when. The state will be able to fully control what goods are sold and how they are sold, and control turnover. In addition to the standard paper check, an electronic format has appeared, which every client has the right to receive upon request in the form of an SMS message or an email.

How can an individual entrepreneur organize work without a cash register?

First of all, you need to understand that it is impossible to work at old-style cash registers after 07/01/2017 in the previous mode - the tax office automatically deregisters them. For failure to comply with this requirement, in accordance with paragraph 4 of Art. 14.5 of the Administrative Code, inspectors will issue a warning or impose a fine of 1,500 to 3,000 rubles.

If an individual entrepreneur belongs to categories exempt from the use of cash registers this year, then in order to comply with clause 2.1 of Art. 2 of Law No. 54-FZ, at the client’s request, it is necessary to issue him a sales receipt, receipt or other similar document, which must contain the following details:

- name, number and date;

- FULL NAME. entrepreneur, his TIN;

- the nomenclature of paid goods indicating the quantity;

- sum;

- Full name, position and signature of the official.

The form of such a settlement document has not been approved, i.e. it can be developed and approved independently.

As for individual entrepreneurs working in hard-to-reach areas, the requirements for the procedure for recording and issuing payment documents at the buyer’s request are determined by the rules approved by Order of the Government of the Russian Federation dated March 15, 2017 No. 296. They regulate the need to keep records of the issuance of receipts in a logbook with stitched and numbered sheets with the manager’s signature and seal, if available.

What are online cash registers and what is their difference?

The new type of online cash registers is different from the old cash registers. Now, at the time of selling a product, in addition to a regular paper receipt, the seller can create an electronic receipt. The cashier does not have the right to refuse the client if he asks him to send him an electronic version. To work with electronic checks, the cash register connects to the Internet. But that is not all. The main innovation is the fiscal registrar, into which a fiscal drive is inserted.

It doesn't sound very clear, but it's actually simple. The fiscal registrar receives information about the cash settlement transaction, records the data on the fiscal drive and sends the data to the OFD. OFD is a fiscal data operator who not only receives information, but checks it and then sends it to the tax service.

Another difference between many modern online cash registers is their similarity to tablets, computers and smartphones. What is it? Many cash registers run on modern Android and Windows operating systems, which makes their use more familiar and understandable. Some cash register equipment manufacturers provide cloud information systems for storing and exchanging data. This is very convenient, since all cash registers can be connected to one account, which facilitates analytics and reporting.

So, the distinctive features of online cash registers:

- availability of the Internet (the cash register must be online all working hours),

- fiscal drive (memory chip with encrypted information),

- connection to the OFD and transfer of data to the Tax and other information systems (for example, the Honest Sign marking system),

- two check formats,

- use of modern technologies.

Is acquiring required at an individual entrepreneur's checkout using the simplified tax system in 2021?

The Law “On the Protection of Consumer Rights” states that commercial structures conducting trade or providing services must provide the visitor to an establishment (store) with the opportunity to pay for a purchase in a way convenient for him: in cash or a payment instrument accepted in the Russian Federation. This norm applies to owners of cash registers in any tax regime, including individual entrepreneurs with a simplified tax system of 6 and 15%. The following business entities are exempt from the obligation:

- whose annual turnover was less than five million rubles;

- for which the device operates in offline mode - without online exchange of information with the fiscal data operator and the Federal Tax Service (for businessmen operating away from communication lines).

Exemption from accepting cards within the framework of the NSPK system was granted to commercial structures on the simplified market, whose annual revenue did not exceed 40 million rubles.

Is a cash desk with acquiring required for other individual entrepreneurs under the simplified tax system in 2019? Yes. The exception is for individual entrepreneurs who are listed in the second article 54-FZ.

Advice: regardless of whether a business entity is obliged to accept plastic cards and other payment instruments for payment, it is worth installing a POS terminal and connecting acquiring.

The service for accepting non-cash payments allows you to increase loyalty, increase the average bill and the number of customers, and speed up the service process. To save money, it is enough to provide the cashier’s workplace with a budget card reader (2can P17) or a cash register with a built-in banking terminal (Yarus TF).

How it happened: transition time for individual entrepreneurs without employees

After changes in the legislation on cash registers, the phased introduction of online cash registers began. Individual entrepreneurs without employees in this case were no exception. In 2021, almost everyone uses online cash registers. Let us briefly tell you how the transition took place.

Individual entrepreneurs in trade, services and public catering without hired employees switched to online cash registers from July 1, 2021. Some individual entrepreneurs received a deferment until 2021, at which time the introduction of the “self-employed” category will be fully implemented.

The deferment for individual entrepreneurs without employees affected the trade and services sector, but there are several significant restrictions:

- Individual entrepreneur sells goods of his own making (not resale of other goods)

- Individual entrepreneur provides services or performs work

This category has the right not to use online cash registers until July 1, 2021. Next, you need to use the cash register or switch to the self-employed category.

Individual entrepreneur without a cash register: online stores

Most online stores selling products were required to install cash registers before July 1, 2018. However, some entrepreneurs can continue to work without modern cash register equipment, provided that:

- The online store cooperates only with individual entrepreneurs or LLCs, and receives all funds directly to its own bank account.

- Products are delivered by third party courier services. Payment is accepted by the courier, after which it is transferred to the store's bank account.

- Payment for goods is made upon receipt at Russian Post, first goes to the post office account, and from there to the bank account of the owner of the online store.

In other cases, when an online store operates without a cash register, penalties are imposed, up to and including suspension of the company’s activities.

1. Ask our specialist a question at the end of the article. 2. Get detailed advice and a full description of the nuances! 3. Or find a ready-made answer in the comments of our readers.

Using online cash registers for individual entrepreneurs without employees: pros and cons

The transition to online cash registers is an additional cost for a business, and not all individual entrepreneurs without employees can afford such expenses. Also, for an online cash register you need to connect to the Internet, and this is not always convenient. It is necessary to connect the cash register to the OFD, which is also an expense. But, despite all this, there are legal requirements and significant undeniable advantages.

Advantages of online cash registers for individual entrepreneurs without employees

- Reducing tax audits. Now the Federal Tax Service receives all the necessary data for control through the OFD. The cash desk itself sends information to the OFD for further transmission to control services.

- Convenient revenue control, analytics and reporting thanks to special cash register software.

- Simplification of the cash register registration procedure.

To summarize, we can say that an online cash register for individual entrepreneurs without employees is needed and necessary.

Features of using online cash registers

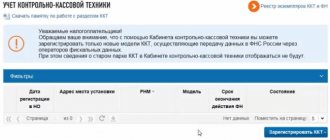

Even before purchasing, be sure to check that your cash register and fiscal drive are in the Federal Tax Service register. What to do after purchasing online? You bought an online cash register - this is only the first step. Next, you need to conclude an agreement with the OFD and register your cash register. Connect to the Internet in a way convenient for you, depending on your conditions and CCP model. Set up your hardware and software. It is important to remember that you need to connect on time and carry out work at the checkout correctly, because for violations there will be fines, and if you violate again, your organization will be suspended.

| Read also: “How to register an online cash register” |

Can an individual entrepreneur work without a cash register in 2021?

An online cash register for individual entrepreneurs without employees is strictly required in 2021. There are no deferments or extensions, much less cancellation of online cash registers. To work legally and not receive fines, you must install equipment in accordance with the requirements of Federal Law 54.

Popular goods

In stock (Art. 100009)

Online cash register Evotor 7.2

- For small and medium businesses

- Touch screen

- Free cash register and app store

- Convenient adding of goods/services at the checkout or in your personal account

15.800 5.0 rating

More details

In stock (Art. 100010)

MTS 5 online cash register

- Up to 24 hours without recharging

- Built-in camera scanner

- 3G, WIFI, Bluetooth

- Fast receipt printing 75 mm/sec.

- Ability to maintain inventory records

14.700 5.0 rating

More details

In stock (Art. 100015)

Online cash register Viki Micro

- Suitable for sales of alcohol and branded goods

- Full functionality for working with EGAIS

- Fiscal registrar to choose from

- Personal management account

9.490 4.0 rating

More details

Need help choosing an online cash register?

Don’t waste time, we will provide a free consultation and select an online cash register that suits you for individual entrepreneurs without employees.