New invoices from January 1, 2021: sample filling >>

There are several changes in the document.

- In column 7 “Tax rate” you need to indicate new values: instead of the usual rate of 18%, indicate 20% - when selling goods, works or services,

- instead of the estimated rate of 18/118, indicate 20/120, for example, when receiving an advance payment for upcoming deliveries.

We will describe in detail below what to write in the fields of the document.

More than 1,500,000 companies already print invoices, invoices and other documents in the MyWarehouse service Start using

Rules for working with invoices: basics

An invoice is a document that serves as a documentary basis for the buyer to accept the VAT amounts presented by the seller for deduction (reimbursement) (Clause 1 of Article 169 of the Tax Code of the Russian Federation). An invoice must be issued every time you sell goods, work, services or property rights. Invoices can be issued on paper or electronically.

From October 1, 2021, a new invoice form will apply. See “New invoice form from 10/01/2017: form and sample filling“.

The paper form of the invoice and the rules for filling it out are approved in Appendix 1 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137.

Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137 approved the current forms and Rules for filling out (maintaining) the following documents used in VAT calculations:

- invoices (Appendix No. 1);

- adjustment invoice (Appendix No. 2);

- log of received and issued invoices (Appendix No. 3);

- purchase books (Appendix No. 4);

- sales books (Appendix No. 5).

If the seller wishes to send invoices to buyers electronically, the buyer must agree to this. At the same time, the means of receiving, exchanging and processing invoices electronically between the seller and the buyer must be compatible. They must comply with the established formats (paragraph 2, paragraph 1, article 169 of the Tax Code of the Russian Federation). Invoices are issued and received electronically in the manner approved by Order of the Ministry of Finance of Russia dated November 10, 2015 No. 174n.

Why are adjustment invoices needed?

The Tax Code of the Russian Federation establishes the obligation to issue adjustment invoices (paragraph 3, clause 3, article 168 of the Tax Code of the Russian Federation). Sellers of goods (work, services) issue such invoices in the event of an adjustment to the cost of goods shipped (work performed, services rendered) or transferred property rights. This can happen when, for example, prices or quantity (volume) of goods (work, services), property rights change.

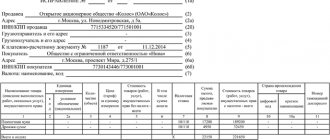

Instructions for filling out an invoice 2021

Filling out the line part

Line 1 Number and date of the invoice. Documents are numbered in order, ascending. Please note that as of October 1, 2021, new rules for storing invoices have been established. Now they should be stored in chronological order - by date of issue or date of receipt. The storage period for invoices and delivery notes has not changed - it is still at least four years from the date of the last entry.

Lines 2, 2a and 2b Name, address, tax identification number and checkpoint of the seller. Be careful! The address from October 1, 2021 is indicated in the invoice according to the Unified State Register of Legal Entities, in detail, without abbreviations (which are acceptable in the constituent documents). Violation of this rule may be grounds for deduction.

Line 3 Information about the sender of the cargo. Indicated only when selling goods. When selling services or performing work, put a dash. If the seller is the sender of the goods, write “He” in this line.

Line 4 Information about the recipient of the cargo. The consignee and his address are indicated in the invoice only when selling goods. If you are submitting a document for services, work, property rights, put a dash.

Line 5 Payment order number - if there was an advance payment (that is, the invoice is drawn up for an advance payment). If not, put a dash. A dash is also placed if prepayment was made on the day of shipment.

Line 6 Name, address (from October 1 - strictly according to the Unified State Register of Legal Entities, without abbreviations), INN and KPP of the buyer.

Line 7 Currency and its code. The invoice is issued in the monetary unit in which prices and payments under the contract are expressed.

Line 8 Government contract number. The government contract identifier has been indicated in invoices since July 1, 2021, and everyone has managed to get used to the innovation. But be careful! Since October 1, 2017, line 8 of the invoice itself has a different name: a clarification has appeared that it is filled out only if data is available. This is what it looks like:

Let us remind you that companies that work with contracts with treasury support are required to indicate in the invoice the number of the government contract (or agreement or agreement on the provision of subsidies, investments, contributions to the authorized capital from the federal budget). They receive a 20-digit code. It is indicated in all contracts drawn up under government orders. You can find this code in the contract or in the Unified Information System. If you do not need to write the IGK on the invoice (that is, you are not working with a contract to which an identifier is assigned), then do not leave the line empty - put a dash in it.

Government Contract ID on Invoices: Sample

Filling out the tabular part of the invoice

Column 1 Name of the product or description of works, services, transferred rights.

Column 1a Here, in the invoice from 10/01/2017, the code of the type of goods is indicated. This applies only to those products that are exported to the EAEU countries.

If you need to indicate a product type code on the invoice, select it from the HS reference book. If not necessary, put a dash.

Column 2 Unit code. The invoice is indicated in accordance with the all-Russian OKEI classifier. The codes in it are in sections 1 and 2.

Column 2a National symbol of the unit of measurement. For example, "pack". You can also check or find out this designation using OKEI.

Column 3 Quantity or volume of goods, works or services. If they cannot be identified, a dash is added.

Column 4 Price per unit of measurement excluding tax. Indicated in the case where it is possible to indicate it, otherwise a dash is placed.

Column 5 Cost of goods, works, services. Indicated excluding tax.

Column 6 Excise tax amount. If you sell non-excisable goods, you cannot put a dash. In this case, write here “No excise duty”.

Column 7 Tax rate.

Column 8 Tax amount in rubles and kopecks - full, without rounding.

Column 9 The cost of the entire quantity or volume of goods, taking into account the amount of tax.

Columns 10 and 10a Country of origin of the goods (in the invoice, both fields are filled in only for imported products). The digital code and short name are indicated here. Both values are given in accordance with the All-Russian Classifier of Countries of the World. Do not write the digital code of Russia in the tenth column of the invoice: filling in is not required for domestically produced goods. In this case, put a dash, as in the next column.

Column 11 Registration number of the customs declaration (indicated in the invoice only for imported goods, in other cases a dash is placed). This column is also new as of October 1, 2021. Previously, the invoice indicated the customs declaration number, but it was serial, but now the registration number is indicated. It looks like this:

What it looks like, what it means and where the service code is reflected

The service code is a three-digit number from the All-Russian Classifier of Units of Measurement OK 015-94 (MK 002-97) (OKEY), approved. Resolution of the State Standard of the Russian Federation dated December 26, 1994 No. 366), allowing:

- measure the service performed;

- fill out primary documents uniformly.

Attention! Recommendation from ConsultantPlus: You need to find the unit of measurement of the product (work, service) that is specified in your contract in section. 1 or in section. 2 OKEY (clause “b”, clause 2 of the Rules for filling out an invoice). To fill out the invoice, take: 1) the code of the unit of measurement, which is indicated in column 1 “Code” of section. 1 or 2 OKEY...(for more details see K+).

In the invoice, column 2 is intended to reflect this code, which is inextricably linked with column 2a. They are filled in (or not filled in) simultaneously according to sections 1 and 2 of the OKEI:

The service provider may have problems with the service code when issuing an invoice. This is due to the tax concept of “service” - according to Art. 38 of the Tax Code of the Russian Federation, a service is understood as an activity whose results do not have material expression. How to measure a service?

Find out how the name of the service is reflected on the cash receipt here .

Invoice deadline

The procedure for issuing a document has not been affected by changes since January 1, 2021. An invoice is issued within 5 days from the moment of: a) shipment of goods, performance of work, provision of services, transfer of rights, or b) receipt of advance payment. Calendar days are counted.

The period is counted from the day following the day of shipment or receipt of advance payment. If the last day of the term falls on a non-working day, the expiration date of the term is considered to be the nearest next working day.

According to the law, there is no penalty for missing the deadline for submitting an invoice. An organization can be fined only for the absence of a document. However, a violated procedure for issuing invoices at the junction of tax periods can still lead to a fine. Thus, late provision of a document may be considered as its absence. For example, when an organization issues an invoice at the beginning of the current tax period that should have been issued at the end of the previous one.

Mandatory invoice details

Let us list an exhaustive list of details that must be filled out in invoices (clauses 5 and 6 of Article 169 of the Tax Code of the Russian Federation):

- serial number and date of compilation;

- name, address and identification numbers of the seller and buyer or contractor and customer;

- name and address of the shipper and consignee - only for shipped goods;

- number of the payment order or other payment and settlement document - if payment took place before shipment;

- the name of the goods shipped or a description of the work performed, services provided and property rights transferred, their units of measurement, when they can be determined;

- the quantity of goods shipped or the volume of work performed and services provided in the specified units of measurement, when they can be determined;

- name of currency;

- price per unit of measurement, if possible, under the contract excluding tax. In case of application of state regulated prices - taking into account the amount of tax;

- the cost of goods shipped, work performed, services provided, transferred property rights without tax;

- the amount of excise duty on excisable goods;

- tax rate;

- the amount of tax based on current tax rates;

- the cost of the total quantity of goods supplied (shipped) according to the invoice (work performed, services rendered), transferred property rights, taking into account the amount of tax;

- country of origin of the goods - only for imported goods;

- customs declaration number - only for imported goods;

- code of the type of goods according to the Commodity Nomenclature of Foreign Economic Activity of the EAEU - when exporting goods to the countries of the Eurasian Economic Union.

Here's what an invoice form looks like in 2021:

You can submit an invoice valid until June 30, 2017.

Fill out an invoice in a few minutes

MyWarehouse is a convenient program for printing invoices and other documents. Thanks to the intuitive interface of MyWarehouse, creating an invoice takes no more than a minute. Each step in drawing up a document is transparent to the user and is accompanied by clear comments.

Advantages of working with documents in the MoySklad service:

- saving 70% of time on preparing an invoice using a new form;

- no errors when entering data;

- automatic generation of an archive of printed documents;

- automatic continuous numbering of documents;

- output forms to Excel and PDF format.

New invoice format from July 1, 2017

From July 1, 2021, it is allowed to generate invoices in electronic form exclusively according to the new format approved by Order of the Federal Tax Service dated March 24, 2016 No. ММВ-7-15/155.

An adjustment invoice from July 1, 2021 can also be submitted only in a new format, which was approved by Order of the Federal Tax Service dated April 13, 2016 No. ММВ-7-15/189.

Please note that the formats of electronic invoices are approved by orders of the Federal Tax Service of Russia dated March 24, 2016 No. MMV-7-15/155 and dated March 4, 2015 No. MMV-7-6/93. Until July 1, 2021, both formats are valid simultaneously. And during the period from May 7, 2021 to June 30, 2021, it is allowed to generate invoices in any format: both old and new. However, from July 1, 2021, the “old” electronic format of invoices cannot be used (clauses 2 and 3 of the order of the Federal Tax Service of Russia dated March 24, 2016 No. ММВ-7-15/155).

What has changed in the format

There are no changes to the invoice metrics, form or data structure in the new format. The reason for the appearance of the new format was the introduced ability to indicate additional information in invoices, including details of the primary document. In fact, the new invoice format has also become the format of a universal transfer document (UD).

Also, the new invoice format from July 1, 2021 may include not one file, as before, but two, which at the same time have multidirectional movement: from seller to buyer and from buyer to seller.

Read also

24.08.2017

Transaction codes in the sales book

Until 2021, the seller had to indicate the type of transaction for VAT 26 in the sales books when reflecting data from primary accounting documents when shipping goods to persons who are not payers of the value added tax, for example, persons on the simplified tax system, as well as those who are exempt from payment. It turns out that the code was used in cases where the SF is not set.

From 2021, after the new values were introduced, the seller is required to display “26” in sales records if invoices, primary accounting documents and other data are issued that contain summary information on actions for a month or quarter when selling goods to non-paying parties fee and persons who are exempt from paying the fee.

VAT transaction codes with explanation for the sales book

There are many types of indicators that are displayed in the purchase accounting and sales ledger.

If the seller has shipped the products, carried out the work, the company has transferred the products and work, construction and installation works for its consumption, designation 1 is written.

The same value is indicated if the seller received an amount related to payment for goods or work, the tax is calculated on the difference between prices when selling objects that were taken into account with the tax.

This figure is relevant when selling products for export, the buyer returning to the OCH goods that were taken into account, if the price of the goods is set at SF, the buyer received an adjustment SF by reducing the cost of shipment, the seller drew up an adjustment SF with an increase in the price of shipments.

When receiving an advance or prepayment through an agent, “2” is entered. If the company calculated VAT as an agent and transferred payment for the purchase of goods within Russia from a foreign counterparty, “6” is entered. When selling free of charge, the number 10 is written. When construction or reconstruction of real estate is carried out, the number “13” is written.

When a company transfers property rights under an assignment agreement, “14” is entered. If the commission agent issues the consumer one SF for the principal’s products and his own, the number is 15. If the buyer receives an adjustment SF for a tariff reduction, the number is 18. If the company restores the tax, the value is 21.

Operation type code 26 is set for the sale of goods and works to buyers under special regimes and to individuals. It is also placed if the seller has received an advance from buyers under a special regime or from individuals. The data obtained is reflected in the declaration.

When a commission agent sells the principal’s goods, the value 27 is used. If the commission agent receives advance payment from buyers and issues several invoices, “28” is entered. If the company independently adjusts the tax base when a transaction with a counterparty does not correspond to the market value, the value 29 is displayed.

Operation codes 26: order and nuances of filling

The sales book displays the date and number of the invoice indicating the sale, the value with and without added value, the tax indicator. The buyer’s TIN and KPP column remains untouched. The counter display of the SF in the purchase book is encrypted with the numbers 16, 17 or 22.

In contrast to transactions encrypted with code 26, when recording other sales transactions, registration of data with INN and KPP is mandatory, since such a defect will be revealed during the process of organizing control.

Invoice journal and transaction code 26

In the invoice journal, the number 26 is used. There are opinions that it is used when the seller draws up summary documents, and when issuing an invoice to a tax defaulter for a single transaction, the number 1 is used.

According to the order of the Federal Tax Service, “26” is used when indicating in the book of purchases, sales, additional sheets, in the register of the Federation Council when preparing documentation for persons who do not pay tax, as well as for those who are exempt from paying the fee, when receiving an advance from these persons, and registering documents.

The documents include the SF, primary documentation, and other papers that contain summary information on actions for the year or quarter when selling goods or services. Taking this into account, when registering in the purchase book an invoice for an advance payment received from a person who does not pay tax when shipping goods, the transaction indicator 26 is written

The procedure for registering an entry with KVO 26 in the sales book

The book of purchases and sales is filled out by companies and individual entrepreneurs who are payers on the OSN on the basis of issued invoices. These documents reflect almost all the data that is required to maintain tax accounting forms and are reflected in the VAT return.

In the purchase book, the value of the type of transaction is written in column 2. This rule also applies to accounting for sales. The list was approved by order of the Federal Tax Service.

There are 24 numbers in total, but they are not numbered in continuous order. The last one on the list is “32”. Each of the values reflects a separate situation that is related to the calculation of the payment.

Some figures can be used for a ledger of purchases and sales.

Indicator 26 in sales accounting is used to indicate the preparation of a consolidated tax return, which contains data on the sale of goods, works and services for persons who are not payers of the fee. The same number is used when receiving advance payment from these persons.

It is important to correctly display the figures for the type of transactions in VAT accounting forms. This is due to the fact that the Federal Tax Service analyzes the data provided by payers, including by numbers. To reduce the number of errors, the Federal Tax Service has issued clarifications regarding existing QUOs

Source: https://expert-nds.ru/kod-vida-operatsii-o-nds-26-v-knige-prodazh/

What you need to know ↑

All individual entrepreneurs, as well as other legal entities, regardless of their form of ownership, should definitely understand the most important points regarding the invoice itself, as well as the procedure for its formation.

Since the presence of errors can lead to quite serious problems with the tax office. It is necessary to familiarize yourself with the following questions in as much detail as possible:

- definitions;

- nuances when forming a document;

- legal grounds.

Definitions

An invoice (for construction work, goods, etc.) must be issued by the seller to the buyer. On the territory of the Russian Federation, the main purpose of an invoice is to record value added tax.

Moreover, the format of this document, as well as the procedure for its execution and other operations performed with it, are enshrined directly in the Tax Code of the Russian Federation.

The invoice also has a second function. With its help, the formation of an accepted VAT deduction is carried out.

The document under consideration must necessarily contain the following information:

- details of the seller/buyer;

- full list of products;

- cost and tax rates.

Subsequently, based on the data present in the invoices, a “Purchase Book” and a “Sales Book” are formed. The seller must apply invoice codes accordingly.

They are necessary in order to correctly display all the actions by which these documents are generated. For example, code 796 on a service invoice represents the number of pieces. Literally it is designated as “piece.”

Nuances when creating a document

The creation and use of an invoice has many different nuances. First of all, this concerns the date of compilation.

It happens that for some reason the buyer receives this document with a fairly serious delay.

In this case, the company or individual entrepreneur still has the right to accept the document for deduction. But it's worth remembering:

| Date of receipt | It is necessary to confirm |

| Application of deduction | Only possible during the invoice period |

Starting from 2021, organizations exempt from VAT are not required to draw up a document of this type.

Those enterprises to which this rule does not apply must remember the following important points:

| All invoices | Must be numbered in chronological order |

| Upon return of goods or refusal | It is necessary to generate a new document from services already provided |

| If for some reason the price has been changed | You should not make corrections to the old invoice; you must generate a new one with corrected data |

| When drawing up a document by a commission agent (intermediary) | The real seller of the product must be indicated |

You should not allow any inaccuracies or other errors in the document of the type in question. Since this may lead to excessive attention from the tax service.

Especially when it comes to all kinds of deductions and similar benefits related to value added tax.

Legal grounds

The basis for the formation and use of an invoice is:

| Article No. 164 of the Tax Code of the Russian Federation | Tax rates for VAT are indicated |

| Article No. 176 of the Tax Code of the Russian Federation | Tax Refund Process |

| Article No. 169 of the Tax Code of the Russian Federation | Using an invoice |

The most important is Article No. 169 of the Tax Code of the Russian Federation. Clause 5 of this article discusses the entire contents of this document in as much detail as possible.

The invoice contains the following items:

- number, as well as date of formation;

- TIN, buyer/taxpayer address;

- full name, address of the recipient of the cargo;

- numbers of all payment documents;

- names of goods and services;

- quantity of goods and services received.

How to fill out an invoice online

Filling out online forms is the easiest way to prepare standard documents. You just need to make sure that you are not asking to fill out an outdated or inactive form, but the most recent one, taking into account all the latest changes.

To avoid misunderstandings and possible troubles, it is necessary to use online services only from trusted sites that monitor all legislative changes. If there is no confidence that the current version of the document has been proposed for use, then you need to pay attention to the following:

- Is the site professional (in this case, accounting-oriented);

- whether regulatory documents or links to their latest editions are published on the website, whether there are thematic articles or consultations;

- Is the specialist available online?

Usually, on the page where it is proposed to write out a document online or download a document template, there is also an explanation of what should be written in a particular line or column. If all this is missing, then it is better to look for a more reliable accounting portal.

The best option would be a portal where any controversial issues are explained in detail. This should be done with reference to the clauses and articles of the relevant legislative and regulatory documents. After all, there are many controversial issues between taxpayers and inspectors regarding the correctness of filling out columns and lines that need to be clarified.

Code 796 on the invoice

We will separately consider the features of filling out columns 2 and 2a of the tabular part of the invoice. They must indicate not only the name of the unit of measurement, but also its code value.

According to Resolution No. 1137, codes from OKEI should be used, but many accountants note that this all-Russian classifier does not take into account all units of measurement used in the regions. For example, there is no code for units such as a solder or a bucket (in this case, a dash is placed in column 2 of the invoice).

However, when filling out invoices, the most commonly used unit of measurement is “piece” (abbreviated as “piece”). It is marked in the classifier under code 796. Therefore, quite often piece units of measurement are replaced with just this alphanumeric designation: code 796 is indicated in column 2, and the abbreviation “piece” is indicated in column 2A.