Which legal acts regulate the filling out of the account balance sheet

Historically, the term “ turnover balance sheet ” was not fixed in the regulatory legal acts of the Russian Federation - in fact, it is used unofficially.

However, the corresponding document is widely used in practice. The use of balance sheets is indirectly predetermined by the provisions of Art. 10 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ. This regulation provides that:

- information reflected in primary documents must be registered and accumulated in accounting registers (Clause 1, Article 10 of Law No. 402-FZ);

- the structure of the accounting register must contain a grouping of accounting objects, as well as the monetary value of the corresponding objects;

- the forms of the corresponding registers for private economic entities are approved by management, for state ones - by budgetary legal acts.

The fact that the balance sheet is used as an accounting register can be associated, first of all, with the legal tradition that was formed in the Soviet Union.

Thus, in the letter of the Ministry of Finance of the USSR and the Central Statistical Office of the USSR dated February 20, 1981 No. 35, it is recommended to use just the same turnover statements as accounting registers - for main, synthetic accounts, as well as sub-accounts.

Another significant factor predetermining the use of turnover by modern enterprises is the publication by the Ministry of Finance of Russia of Order No. 119n dated December 28, 2001, by which the department approved methodological guidelines regarding the accounting of inventories of Russian enterprises. The provisions of this legal regulation use 2 concepts:

- turnover sheet - a source that records the amounts of income and expenses that correlate with the movement of goods or materials in the warehouse, balances at the beginning and end of the reporting month, as well as the corresponding amounts in synthetic accounts and sub-accounts;

- balance sheet - a document that generally corresponds to the turnover sheet, but it does not record the receipt and consumption of goods or materials.

Due to the availability of these legal regulations, as well as in the course of document management practices in the business and accounting community of the Russian Federation, more or less generally accepted formats of balance sheets gradually became widespread, the structure of which we will consider further.

There is another significant factor for the compilation of turnover by Russian enterprises. The Federal Tax Service quite often requests them during inspections - both during traditional interaction with taxpayers, and as part of innovative methods of communication with companies, such as tax monitoring.

In particular, clause 8 of the order of the Federal Tax Service of Russia dated 05/07/2015 No. ММВ-7-15/184 states that the regulations for information interaction between the taxpayer and the Federal Tax Service should fix the obligation of the former to submit balance sheets to the Federal Tax Service as part of tax monitoring .

Is the fine for failure to submit SALT to the tax authorities legal? The answer to this question, supported by arguments from law enforcement practice, can be found in ConsultantPlus:

If you do not yet have access to the legal system, a trial of full access to the system is available for free.

In accounting, cash transactions are recorded in the Cash Account.

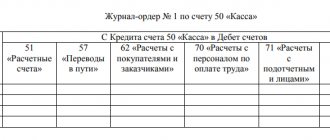

The debit of this account records the receipt of cash at the cash desk, and the credit records its issue. The balance of this account shows the balance, the availability of money in the cash register. In the journal-order form of accounting, the receipt of money is reflected in statement No. 1 on the debit of the Cash Account account, and the issue is reflected in the journal-order No. 1 on the credit of this account. The basis for entries in these registers are the cashier's verified reports, in which the marking of the corresponding accounts for each document is made. The Cash account, like the Current account, corresponds with many balance sheet accounts, the main ones of which are the debit account Current Account, the credit account Settlements with workers and employees and the account Settlements with accountable persons. [p.250] Statement No. 1 - on the debit of the Cash desk account from the credit of accounts for January 2002 [p.329] The second part of the order journals of the first group are auxiliary statements compiled for the purpose of monitoring the flow of funds. For example, for journal order No. 1, which is maintained on the credit of account 50 “Cash,” an auxiliary statement No. 1 is opened on the debit of the “Cash” account. [p.181]

Cash register No. 1 Statement No. 1. By debit of account No. 50 Cash register> - - [p.56]

In addition to the auxiliary (accumulative and grouping) statements, which serve as the basis for recording their results in order journals, statements No. 1 are maintained for the debit of the account /(assh) and No. 2 for the debit of the account. Current account. The data from these statements are not recorded in the order journals. These statements are kept in order not to separate documents on the cash register and the current account, as well as for the purpose of monitoring the flow of funds. [p.133]

Simultaneously with journal order No. 1 for the credit of the Cashier account, to record incoming cash transactions, statement No. 1 is maintained for the debit of the Cashier account, an abbreviated form of which is given in Table. 83. [p.168]

Statement No. 1 for the debit of the Cash account for correspondent accounts is maintained for control purposes, for example, to reconcile amounts returned by accountable persons, unused advances, amounts received from the current account, etc. In this statement, for control purposes, the balance as of the 1st date is entered of the current month (initial balance) and at the end of the month the balance as of the 1st day of the month following the reporting month is displayed. [p.169]

At the same time, Statement No. 2 for the debit of the Current Account account also ends, but its results are not recorded in the General Ledger. It also serves for control purposes, like statement No. 1 for the debit of the Cash Account account. [p.179]

Statement No. 1 on the debit of account 50 for January 1999 [p.580]

Auxiliary statements are the statement (No. 1) on the debit of account 50 Cash register statement (No. 2) on the debit of account 51 Current account statement of the movement of material assets in monetary terms (No. 10) statement of the movement of material assets (at accounting prices) by workshops - workshop storerooms ( No. 11) cumulative statement of synthetic accounting of materials (standard form No. 43) costs for workshops of the main and auxiliary production (statement No. 12) costs of non-industrial production and farms (statement No. 13) costs of capital investments (statement No. 18), etc. [c .46]

Auxiliary statement is an accounting register intended for systematization (accumulation) of data contained in primary documents. These data are recorded as a total of the accounting accounts. V. in. help improve and simplify accounting, reduce the number of accounts. These statements are also called cumulative. V. century are especially widely used. in the journal-order form of accounting, where they are often simultaneously analytical accounting registers. V. in. are the statement (No. 1) on the debit of account No. 50 Cash register statement (No. 2) on the debit of account No. 51 Current account statement of the movement of material assets in monetary terms (No. 10) statement of the movement of material assets (at accounting prices) by workshop - workshop storerooms ( No. 11) cumulative statement of synthetic accounting of materials (standard form No. 43) costs for workshops of the main and auxiliary production (statement No. 12) costs of non-industrial production and farms (statement No. 13) costs of capital investments (statement No. 18), etc. [c .45]

Based on the processed cashier's report, the accounting department keeps records of cash transactions in journal-order 1 for the credit of account 50 Cash and in statement 1 for the debit of account 50 (for control). [p.532]

The amounts of balances held by accountable persons are taken from journal-order 7 for the previous month, the amounts of advances issued are recorded according to the documents reflected in journal-order 1. The amounts of balances of unspent advances handed over to the cash register are recorded on the basis of incoming cash documents reflected in statement 1 on the debit of account 50 Cash, and entries on the credit of account 71 Settlements with accountable persons - based on advance reports. [p.541]

In the journal-order form of accounting, such accumulative statements are also analytical accounting registers. This is statement No. 1 for the debit of account 50 “Cash”, statement No. 2 for the debit of account 51 “Current account”, etc. [p.166]

| Table 5.8 Statement No. 1 for the debit of account No. 50 Cash from the credit of accounts |

To record transactions on the current account, use journal order No. 2 for the credit of the Current Account account and statement No. 2 for the debit of the Current Account account.

These registers are of the same form as journal order No. 1 and statement No. 1 for the Cash account. [p.178] The peculiarity of this form is that the amount of transactions of the same type is recorded only once, but the debit of one account and at the same time the credit of another account receives a double value. If, when compiling a chess turnover sheet, you fill out only the debit of all accounts, then a credit will be obtained automatically; if you fill out only a credit, then a debit will automatically result. For example, the amount of 250 thousand rubles, shown in column 6 on line 1, means the debit of account A and credit [p.37]

Sheet (chess) f. No. B-9. Accounting for business transactions, based on the use of accounting registers for the property of a small enterprise, is completed at the end of the month by calculating the totals of turnover in the applicable statements (from B-1 to B-8 inclusive) and their mandatory transfer to statement No. B-9. It is a synthetic accounting register and is intended to summarize current accounting data and mutual verification of the correctness of the entries made in the accounting accounts. Sheet No. B-9 was called chess because one turn (in one cell) simultaneously reflects the correspondence of two accounts, one for debit, the other for credit, i.e. double entry is used. Statement No. B-9 is opened for each month and serves to record data on the debit and credit of each account separately. In it, accounts are arranged vertically in ascending order, and horizontally in order of increasing statement numbers. In the process of filling out statement No. B-9, turnover on the credit of one account is transferred from the current accounting statements to the debit of the corresponding accounts. In the upper horizontal row (from the credit) there is the required account and from top to bottom (in ascending order of accounts) the turnovers are distributed, i.e. sum. If the amount is equal to the turnover on the credit account in the current accounting statement, then the turnover is posted correctly; if it does not converge, you need to look for an error. This procedure is used throughout the statement and accounts. After posting all the loan turnovers and reconciling them with the current accounting statements, the debit turnovers and their amount are calculated. The amount of turnover on the debit of accounts must be equal to the amount of turnover on the credit of accounts. Based on the chess sheet, a turnover sheet, balance sheet and reporting are compiled (Fig. 8.4). [p.214]

The auditor needs to check, on the basis of journal orders No. 2/1 and statements of debit accounts 52 (transit and current), the correspondence of the entries in them with bank statements and documents attached to them. In addition, it is necessary to check whether separate analytical accounting is maintained for transit and current accounts, since foreign currency earnings coming from non-residents must initially be credited to the transit foreign currency account, and after the mandatory sale of foreign currency earnings, the remainder is credited to the current foreign currency account. [p.125]

When using a journal-order form of accounting, the final data of journal-order No. 2/1 and the debit statements of account 52 Currency accounts (balance at the beginning of the month, debit and credit turnover for the month, balance at the end of the month) must be verified with similar data from the synthetic account 52 in the General Ledger (they must be identical). In case of discrepancies in the indicated indicators, it is necessary to invite the chief accountant to make the necessary corrections in the accounting records of journal order No. 2/1 or the General Ledger. [p.127]

In the accounting department, when accepting a report from the cashier, they are required to check whether all cash orders are included in the report, whether they are drawn up correctly and whether there are receipts for receipt of money on the documents (cash orders, pay slips, etc.), as well as whether the totals and balance (balance) for the next one. day. Corrections in cash receipt and expense documents are not permitted. Only after checking the report and documents, entries are made in the accumulative sheet 1-SN on the receipt of funds at the cash desk (on the debit of account 50 Cash) and in the order journal 1-SN (on the expenditure of funds from the cash register) on the credit of the Cash desk. The cash register account balance can only be debit, which means the balance of cash in the cash register, which is recorded in the statement at the beginning and end of the month. [p.191]

STATEMENT No. 1 FOR DEBIT ACCOUNT No. 50 CASH Turnovers from credit accounts [p.37]

Statement of debit of account 50 (standard form No. B-1) [p.95]

Based on the bank's statement of the current account, two development statements are drawn up: one for the debit of the current account, indicating the accounts being credited, and the other for the loan, indicating the debited accounts. They indicate the serial numbers of documents, the content of transactions, the amount and the corresponding corresponding accounts. Based on the results of the development sheets, entries are made in the journal of form No. K-1 or K-la. For each statement from the current account, one line is allocated in the journal. [p.143]

The cash balance is shown in the statement only at the beginning and end of the month. In this case, the balance at the end of the month is determined by adding the balance at the beginning of the month and the total turnover for the month according to the statement (i.e., according to the debit of the account) and subtracting the amounts of turnover for the month according to journal order No. 1 (i.e., according to the credit of the account) . The account balance at the end of the month is the balance at the beginning of the next month. [p.125]

Amounts of unclaimed wages based on pay slips attached to cash reports are credited to account No. 70.2 Deposited wages and debited to account No. 70.1 Accrued wages. When paying deposited wages, account No. 70.2 is debited and account No. 50 Cash is credited. For deposit amounts not claimed within three years and transferred to the budget, an entry is made in the debit of account No. 70.2 and the credit of account No. 68 Settlements with the budget. According to the bank statement on the transfer of these amounts, account No. 68 is debited and account No. 51 Current account is credited. [p.198]

The bank branch notifies the enterprise about the movement of foreign currency on its personal account with an extract from both transit and current accounts. Based on extracts from current and transit accounts, journal order No. 2/1 is kept for credit turnover and statement No. 2/1 for debit. If necessary, you can maintain analytical accounting cards for the names of currencies in a currency account (see p. 60). [p.52]

In fact, this part of the table allows you to analyze the indicators of account 70 Settlements with personnel for remuneration, draw up deduction certificates for journal orders No. 8, 10/1, statement No. 7 and compare the balances at the end of the month with the General Ledger. So, to the order journal No. 8, a certificate is filled out on the credit of account 68 Calculations with the budget for the amount of taxes withheld from the wages of workers and employees; to the order journal No. 10/1 - on the credit of account 70 to the debit of account 69 Calculations for social insurance and security for the amount of accrued benefits for temporary disability and to the debit of account 88 Retained earnings (uncovered loss), subaccount 88-5 Consumption funds, for the amount of bonuses accrued to all categories of workers according to these funds to statement No. 7 - to the credit of account 73 Settlements with personnel for other transactions for the amount of deductions for goods sold on credit, etc., on the credit of account 76 Settlements with various debtors and creditors - according to writs of execution, etc. [p.139]

Data from statements No. 12, calculated horizontally, show the costs of workshops by debit of accounts, i.e. by directions, and vertically by credit of accounts, i.e. by elements. The total of the debit of account 25-2 General production expenses should be equal to the total of the credit of this account in gr. 19, similar to account 25-1 Expenses for the maintenance and operation of machinery and equipment. [p.337]

According to the release sheet, verified with the calculation of the cost of marketable products, entries are made in the order journal No. 10/1 on the credit of account 20 Main production in correspondence with the debit of account 40 Finished products (430,269 rubles). [p.356]

These expenses are recorded in account 43 Selling expenses. This active balance account is equal to the amount of expenses incurred attributable to products shipped but not paid for at the beginning of the month; debit turnover - costs of the reporting month associated with the shipment of products; credit turnover - amounts written off in the reporting month for sold products. Non-production expenses do not have a separate item in the balance sheet, and therefore, when filling it out, the balance of account 43 at the end of the month is recorded under the item Other inventories and costs. Analytical accounting for account 43 is organized in statement No. 15 according to expense items by debit and credit turnover both for the reporting month and from the beginning of the year, which provides the conditions for analyzing non-production expenses and reporting. The amounts of turnover on the debit of account 43 are reflected in journal orders No. 1, 2, 7, 10/1, and turnover on credit - in journal order No. 11. [p.374]

Statement No. 1 on the debit of the “Cash” account for January 199 [p.181]

Statement No. 1 for the debit of the Cashier account is maintained in the same manner on the basis of the cashier's report as journal order No. 1 for the credit of the Cashier account. To do this, the accountant marks the corresponding accounts on the cash receipts (see Table 54 on page 96), which the cashier enters into the cash book. [p.169]

With the journal-order form of accounting, cash transactions are recorded in journal-order No. 1 (on the credit of the Cashier account and auxiliary statement No. 1 (on the debit of the account). These registers are filled out on the basis of cashier reports with the grouping of amounts by corresponding accounts. With punched cards and other machine-oriented forms of accounting make up machine grams by analogy with machine grams for the account Settlement account. [p.218]

The memorial orders given are filled out based on the data from the considered example for accounting for materials, costs of production and sales of products (see pp. 96-124). Memorial orders are drawn up both on the basis of individual primary documents and on homogeneous groups of documents according to the indicators of the accumulative statements. The use of accumulative statements is preferable. In this case, a permanent number is assigned to the memorial order. For example, memorial order No. 1 for the debit and credit of the Cashier account (or No. 1 for the debit of the Cashier account and No. 2 for the credit of this account, with a large cash turnover), memorial order No. 2 for the debit and credit of the Current account (or No. 3 on the debit of the Current Account and No. 4 on the credit of this account), memorial order No. 3 - on the debit and credit of Settlements with suppliers, memorial order No. 4 - on settlements with the budget, Settlements with various debtors and creditors and other settlements, memorial order No. 5 - for the accounts of production costs, memorial order No. 6 - for the account of Finished Products, Goods shipped, work and services performed, Non-production expenses and Sales, memorial order No. 7 - for the accounts of Diverted funds from profit, Profits and losses. [p.186]

What does a balance sheet look like (structure example)

The Soviet legacy and modern business practices have led to the emergence of 3 main types of balance sheets:

- compiled from a set of values in synthetic accounts;

- compiled according to analytical accounts;

- combined, combining the previous types of whorls.

Statements on a set of synthetic accounts compiled by different enterprises will generally be very similar to each other, since the list of relevant accounts is approved by law.

In turn, filling out SALT for analytical accounts in each organization may differ in very specific nuances. Let's consider what a typical structure of a balance sheet for analytical accounts might look like.

A typical balance sheet for an active or passive account consists of 7 columns:

- name of a specific account (sub-account);

- debit and credit balance at the beginning of the reporting period;

- turnover within the reporting period by debit and credit;

- debit and credit balance at the end of the reporting period.

Depending on which account the balance sheet reflects - active or passive, an increase in assets is recorded in the “Debit” columns and a decrease in them in the “Credit” columns (for active accounts) or, conversely, a decrease in liabilities in the “Debit” and an increase in those in the “Credit” columns (for passive accounts).

You can check whether you are preparing your accounting registers correctly using the Typical Situation from ConsultantPlus. Study the material by getting trial access to the K+ system for free.

Journal-order No. 1

The company must formalize cash transactions using primary documents in accordance with the Procedure for conducting cash transactions.

Previously, to record and group them, special registers were also used - order journals No. 1, as well as statement No. 1 to it.

Currently, these documents are used in specialized programs as one of the types of reports when sampling.

The need to use order journal No. 1

Journal order 1 was previously used in the accounting form of the same name. Accounting programs are currently built on its basis. In them, all order journals are filled in automatically, after completing the primary documentation.

Only small enterprises still retain this form of accounting, in which amounts for primary documents must be posted in special tables. However, even here it is now quite rare to see filling out an order journal manually.

Its main advantage lies in the ability to group documents simultaneously in chronological order and by accounting accounts, that is, by areas of spending funds.

And its construction according to the principle of a checkerboard sheet, the value of the total in the columns is equal to the total total in the rows, provides the opportunity to additionally exercise control over the correct posting of documents in the General Ledger.

Journal order No. 1 and the statement to it are currently not mandatory to fill out. They are compiled as one of the types of summary reports for monitoring and obtaining information in the context of the use of cash.

In addition, there are variations of this register for enterprises in different industries. In construction, a 1c order journal is issued, in sales and supply companies - a 1sn order journal.

How to use the journal

The journal order is drawn up on the basis of data from cash receipts orders, pay slips or cashier reports. It can currently be compiled for any period - day, week, decade, month.

At large enterprises with a large number of documents at the cash register, it is completed in one or several days. Journal order No. 1 serves only to reflect transactions on the account loan.

50 Cash desk, statement No. 1 is used for debit analytics.

The cash document or cashier's report is reflected in the chess sheet. If the register is compiled per day, the number in order is indicated horizontally, otherwise the date of registration of the primary documents. Amounts are distributed in columns in accordance with the accounting accounts indicated in them.

When closing the order journal, the totals for each line and column are calculated. The sum of everything must come together “at an angle.” After this, the cash balance (balance) at the end of the period is displayed.

This register, after registration (printing), is filed together with the primary documents that are reflected in it.

Balances on certain dates in it must coincide with the balance in the cashier’s reports, and in total - with the turnover on the loan account. 50 in the General Ledger for the relevant period.

Sample of filling out journal order No. 1

[ads-pc-2] [ads-mob-2] At the top of the document the name of the company, its registration numbers, and address are indicated.

“Journal order No. 1” is filled in below and if it is generated several days in advance, then the start and end date of the period are indicated.

The name of the columns of the table contains the codes of the accounting accounts, which are debited from the credit account. 50 amounts apply. Using the Chart of Accounts, which gives approximate correspondence for a given account, you can check the correctness of the codes used in the primary documents.

The first column reflects the number in the order of the entry made or the date of cash transactions if the cashier's reports are posted for several days.

In the penultimate column, you need to calculate and enter the totals for the corresponding rows (in chronological order). The table ends with a debit balance column, which reflects the availability of money in the cash register at the reporting date.

The last line of the order journal also contains totals, but for different accounts (by areas of spending).

The report is signed by the director of the company and the chief accountant with a transcript of their personal data.

Nuances

[ads-pc-4] [ads-mob-4]

If journal order No. 1 is issued per day, then it does not have a debit balance column.

In this case, “Balance at the beginning of the day” is written in the first line, and “Balance at the end of the day” is written in the last line and the corresponding amounts are entered.

Journal order No. 1 form

journal order No. 1 in form.

filling out the order journal 1.

Source: https://blankionline.ru/doc/zhurnal-order-1.html

Where are the SALT fills?

You can download a sample of filling out the balance sheet on our website using the link below. Our experts have prepared for you an example of filling out a statement in Word format, reflecting transactions on account 60 (“Settlements with suppliers and contractors”).

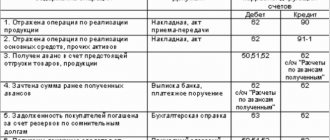

This turnover sheet reflects the following sequence of business transactions:

1. The company transferred to its counterparty an advance payment for goods under a contract in the amount of 100,000 rubles. and reflected this operation as an increase in assets in the debit of active subaccount 60.1. Posting: Dt 60.1 Kt 51 for 100,000 rubles.

2. The counterparty delivered goods to the company under a contract in the amount of 150,000 rubles, and this operation is reflected as an increase in liability in the credit of passive subaccount 60.2. Wiring: Dt 41 Kt 60.2 for RUB 150,000.

3. The company partially pays the counterparty for the goods, and we reflect this transaction as a decrease in liabilities by 100,000 rubles. in the debit of the passive subaccount 60.2 and as a decrease in assets in the credit of subaccount 60.1. Posting: Dt 60.2 Kt 60.1 for 100,000 rubles.

4. As a result, the company owes the counterparty 50,000 rubles, and we record this in the credit of the passive subaccount 60.2, in the credit of the active-passive account 60 as a whole, and also in the final line - as of the end of the reporting period.

Similar statements can be compiled for any accounting account.

Table of accounting entries for account 50

As a rule, cash payments are used in organizations whose activities are related to retail trade. After all, the amount of revenue that the company receives goes to the cash desk in the form of cash. Let's look at typical cash transactions in retail organizations:

| Dt | CT | Description | Document |

| 50.01 | 90.01.1 | Receipt of sales proceeds to the organization's cash desk | Cash register |

| 50.01 | 90.01.1 | Receipt of income from other operations into the organization's cash desk | Cash register |

| 51 | 50.01 | Transfer of cash from the cash desk to the bank for subsequent crediting to the organization’s current account | Account cash warrant |

| 55.01 | 50.01 | Transfer of cash from the cash desk to the bank for subsequent crediting to a special account of the organization | Account cash warrant |

An enterprise can use its own cash to pay contractors (suppliers of goods, contractors, etc.). These transactions are reflected in accounting by the following entries:

| Dt | CT | Description | Document |

| 60 | 50.01 | Payment to the supplier (contractor) for goods received (work performed) | Account cash warrant |

| 62 | 50.01 | Refund of advance payment to the buyer from a special bank account | Account cash warrant |

| 76 | 50.01 | Repayment of debt to other counterparties | Account cash warrant |

| 04 | 50.01 | Acquisition of an intangible asset | Account cash warrant |

An important aspect of using account 50 is the accounting of cash settlements with personnel. Through the cash register, an enterprise can pay:

- employee remuneration (salary, bonuses, allowances, etc.);

- funds to report for business needs;

- travel expenses.

Accounting for these transactions is reflected in the following entries:

| Dt | CT | Description | Document |

| 70 | 50.01 | Payment of salaries to employees in cash through the cash register | Account cash warrant |

| 50.01 | 71 | Return to the cash desk of unused funds issued to an employee for business needs | Receipt cash order |

| 73 | 50 | A loan was issued to an employee of the company | Account cash warrant |

| 71 | 50 | An employee of the company was given an advance for a business trip | Account cash warrant |

| 69 | 50 | Debt on contributions to social funds was repaid in cash through the cash register | Account cash warrant |

In addition, account 50 is used to reflect cash settlements with the company’s shareholders, as well as with the participants of the partnership:

| Dt | CT | Description | Document |

| 75 | 50 | Dividends were paid to shareholders | Receipt cash order |

| 80 | 50 | The debt to the participants of the simple partnership has been repaid | Receipt cash order |

| 81 | 50 | Redemption of the organization's own shares | Receipt cash order |

| 58.4 | 50 | Contribution of cash by a participant as a contribution to the partnership share | Receipt cash order |

An example of reflecting a transaction on account 50 in transactions

Employee of Elita LLC Petrova A.F. an advance was issued for the purchase of paper. Advance amount - 3100 rubles. Petrova purchased paper in the amount of 3215 rubles, VAT 490 rubles. The amount of overexpenditure (115 rubles) was reimbursed to Petrova through the cash register.

The accountant of Elita LLC made the following entries in the accounting:

| Dt | CT | Description | Sum | Document |

| 71 | 50 | Petrova A.F. Elita LLC received an advance payment through the cash desk for the purchase of paper | 3100 rub. | Account cash warrant |

| 10 | 71 | The paper purchased by Petrova arrived (RUB 3,215 - RUB 490) | 2635 rub. | Advance report, sales receipt |

| 19 | 71 | VAT amount included | 490 rub. | Advance report, sales receipt |

| 91.2 | 19 | VAT amount written off | 490 rub. | Advance report, sales receipt |

| 71 | 50 | Petrova A.F. through the cash desk of Elita LLC, a refund amount was issued for overspent funds (RUB 3,215 - RUB 3,100) | 115 rub. | Account cash warrant |

Synthetic account 50 in accounting is used to obtain cash flow data. It is mainly used by trading companies when interacting with buyers and customers; other enterprises need it to carry out internal and external payments for various purposes. Let's figure out what operations accounting account 50 is involved in - you will find the entries below.

Where can I download a blank balance sheet form for free?

The balance sheet form is also available to you on our website. You can download it in Excel format, which allows you to make calculations and apply mathematical formulas.

You can get acquainted with the features of compiling turnover for some common accounts in the articles:

- “Features of the balance sheet for account 60”;

- “Features of the balance sheet for account 01.”

Results

The balance sheet is an accounting register, which is an element of the system for collecting and processing information. As a rule, the form is filled out automatically in accounting systems. Using the statement for tax calculation purposes is possible only in special cases. When carrying out transactions that entail different accounting procedures, there is a need to adjust or prepare a new register for tax purposes.

Sources:

Order of the Ministry of Finance of Russia dated December 28, 2001 N 119n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Operation Log 4

What type of document: Application for cash expense or payment order - should be filed with the transaction journal “Transactions with non-cash funds”?

Answer

The journal of transactions with non-cash funds (f. 0504071) is compiled on the basis of primary, consolidated accounting documents, which serve as the basis for the receipt or debit of funds from the institution’s personal account.

Such documents are:

application for cash expenses (f. 0531801);

application for cash expenses (abbreviated) (f. 0531851);

application for receiving cash (f. 0531802);

application for receiving funds transferred to the card (f. 0531844).

Recommendation: How can a budgetary (autonomous) institution take into account funds received from income-generating activities?

In accounting for budgetary institutions:

Budgetary institutions carry out operations with funds from income-generating activities in the Procedure approved by Order of the Treasury of Russia dated July 19, 2013 No. 11n. To pay monetary obligations using funds from income-generating activities, they submit one of the following documents to the Treasury of Russia:

- application for cash expenses (f. 0531801);

- application for cash expenses (abbreviated) (f. 0531851);

- application for receiving cash (f. 0531802);

- application for receiving funds transferred to the card (f. 0531844).

This is stated in paragraph 4 of the Procedure, approved by order of the Treasury of Russia dated July 19, 2013 No. 11n.

On whether a budgetary institution has the right to use revenue from paid activities received at the cash desk, bypassing a personal account with the Treasury of Russia, see Does an institution have the right to use revenue from paid activities received at the cash desk?

2. Situation: is it necessary to file supporting documents in the folder (file) created for the journal of transactions with non-cash funds (f. 0504071): contracts, bills, invoices, acts, invoices, etc.

No no need.

The journal of transactions with non-cash funds (f. 0504071) is compiled on the basis of primary, consolidated accounting documents, which serve as the basis for the receipt or debit of funds from the institution’s personal account.

Such documents are personal account statements in paper and (or) electronic form with attached copies of payment documents. This conclusion follows from the Guidelines approved by order of the Ministry of Finance of Russia dated December 15, 2010.

No. 173n, and paragraph 159 of the Procedure approved by order of the Treasury of Russia dated December 29, 2012 No. 24n.*

Thus, there is no need to file supporting documents (contracts, bills, invoices, etc.) in a folder created for the journal of transactions with non-cash funds (f. 0504071).

File statements from your personal account along with payment documents that serve as the basis for recording transactions on your personal account.

This conclusion follows from paragraph 11 of the Instructions to the Unified Chart of Accounts No. 157n.

Payment transactions with suppliers and contractors are reflected in the journal of settlement transactions with suppliers and contractors (f. 0504071). Therefore, supporting documents, such as contracts, bills, invoices, acts, invoices, etc.

, should be filed in the folder created for this journal. This conclusion follows from the provisions of the Methodological Guidelines approved by Order of the Ministry of Finance of Russia dated December 15, 2010 No. 173n, and the letter of the Ministry of Finance of Russia dated May 6, 2011.

№ 02-06-10/1910

Article: When primary documents are filed with journals. The official answers

Invoices and acts in the institution are filed with the journal of transactions with non-cash funds. Is it necessary to file documents with the journal of settlements with suppliers and contractors?

At the end of each reporting period, primary (consolidated) accounting documents on paper related to the corresponding transaction logs are chronologically selected and bound (clause 11 of Instruction No. 157n).

Entries in the Journal of transactions with non-cash funds (f. 0504071) are made on the basis of primary (consolidated) accounting documents attached to the daily account statements (personal account).* Entries in the Journal of transactions of settlements with suppliers and contractors (f.

0504071) are entered on the basis of primary (consolidated) accounting documents confirming the institution’s acceptance of monetary obligations to suppliers (contractors, performers), other parties to contracts (agreements), as well as primary (consolidated) accounting documents confirming the fulfillment (repayment) of accepted monetary obligations.

This is stated in the Guidelines for the use of forms of primary accounting documents (Appendix No. 5 to Order No. 173n).

Thus, only attachments to bank documents (or similar ones) should be filed with the journal of transactions with non-cash funds.*

4. ORDER OF THE TREASURY OF RUSSIA DATED 10.10.2008 No. 8N

On the procedure for cash services for the execution of the federal budget, budgets of constituent entities of the Russian Federation and local budgets and the procedure for the implementation of certain functions by territorial bodies of the Federal Treasury... (as amended on September 6, 2013)

2.1. Grounds for conducting operations on cash payments from the federal budget

2.1.1.

To make cash payments, recipients of federal budget funds and administrators of sources of financing the federal budget deficit submit to the Federal Treasury (Federal Treasury bodies) at the place of service in electronic form or on paper the following payment documents (paragraph as amended, entered into force on April 18, 2010 by order of the Treasury of Russia dated December 25, 2009 N 15n, - see the previous edition) Application for cash expenses in accordance with Appendix No. 1 to this Procedure (code according to the departmental classifier of document forms (hereinafter referred to as the form code according to KFD) 0531801);*