Child deduction codes in 2021

Codes for types of deductions were approved by Order of the Federal Tax Service dated September 10, 2015 No. ММВ-7-11/387.

It is worth saying that the child tax deduction code in 2021 depends not only on which child is counted, whether the child is disabled, but also on who the deduction is provided to (for example, a parent or guardian). For example: the deduction code for the first child, when the deduction is provided to the parent, is 126, and the deduction codes for two children in 2021 for guardians are 130 (first child) and 131 (second child).

Thus, pay attention to several conditions under which child tax credits for children are provided in 2021.

Table. Deduction codes for children in 2021 (single deduction):

| To whom is the single deduction granted? | Condition of provision | Who is entitled to the deduction / Deduction code | |

| Parent, spouse of a parent, adoptive parent who cares for the child | Guardian, trustee, adoptive parent, spouse of the adoptive parent who is providing for the child | ||

| First child | Age up to 18 years or full-time student, graduate student, resident, intern, student, cadet under the age of 24 | 126 | 130 |

| Second child | 127 | 131 | |

| Third and each subsequent child | 128 | 132 | |

| Disabled child | Age up to 18 years | 129 | 133 |

| Disabled child of group I or II | Full-time student, graduate student, resident, intern, student under the age of 24 | ||

Types of standard tax deductions

The Tax Code defines categories of individuals who have the right to a special calculation of income tax:

- 3,000 rubles are deducted from monthly income; in the personal income tax certificate, code 105 is entered next to this amount for the following citizens: disabled liquidators at the Chernobyl nuclear power plant, Mayak PA;

- those who received disabilities due to living in contaminated areas in the Chernobyl area and the Chelyabinsk region;

- civilian and military liquidators at the Chernobyl nuclear power plant in 1986-1987;

- military personnel from 1988 to 1990, participants in the Shelter project;

- participants in the creation, testing, and disposal of radioactive residues of nuclear weapons before 1961;

- disabled people of the Great Patriotic War;

- disabled people of all groups due to the consequences of injury during military operations or while performing official duties;

- other categories of disabled people receiving pensions on the same basis as military disabled people.

- Knights of 3 degrees of the Order of Glory, Heroes of the Soviet Union, Russian Federation;

In the video - what tax deductions are there:

Deduction in the amount of 1400 rubles. is due for 1 or 2 children under 18 years of age. The encoding depends on who is raising the children:

- First child: parents – 126;

- adoptive parents – 126;

- guardians – 130.

- parents – 127;

For the 3rd child and subsequent ones, the preferential reduction in income is 3,000 rubles.

Codes in 2 personal income tax:

- parents – 128;

- adoptive parents – 128;

- guardians – 132.

If there is a disabled child in the family, then the benefit is 12,000 rubles, while code 129 will be indicated for parents and adoptive parents, and code 133 for guardians.

Education of disabled children of groups 1 and 2 in day care until the age of 24 by parents and adoptive parents will provide the opportunity to have, in addition to the social disability pension, a monthly deduction in the amount of 12,000 rubles. For guardians, this amount will be 6,000 rubles.

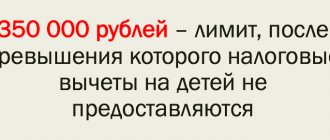

For citizens raising children, a reduction in the tax base is effective if the income summed up from the beginning of the year does not exceed 350,000 rubles. (on average 29,167 rubles per month, dividends are not taken into account). When changing jobs in the current year, the cumulative total is calculated taking into account previous income. Read about the types of personal income tax deductions here.

The benefit ceases to apply if the established income level is exceeded.

When older children reach 18 years of age, retention remains at the same level: for 2, 3, subsequent children.

Child tax withholding is provided without taking into account the receipt of other standard tax deductions, such as child care benefits for a disabled child.

Child tax deduction: double deduction code

Below is a table with deduction codes for children, if deductions in 2021 are provided in double size. This is possible, for example, when the only parent or one of the adoptive parents wrote an application for refusal to receive a tax deduction for the child.

| Who is eligible for double deduction? | Condition of provision | Who is entitled to the deduction / Deduction code | |||

| Sole parent, adoptive parent | Sole guardian, trustee, foster parent | One of the parents of their choice based on an application for refusal of one of the parents to receive a tax deduction | One of the adoptive parents of their choice based on an application for refusal of one of the adoptive parents to receive a tax deduction | ||

| First child | Age up to 18 years or full-time student, graduate student, resident, intern, student, cadet under the age of 24 | 134 | 135 | 142 | 143 |

| Second child | 136 | 137 | 144 | 145 | |

| Third and each subsequent child | 138 | 139 | 146 | 147 | |

| Disabled child | Age up to 18 years | 140 | 141 | 148 | 149 |

| Disabled child of group I or II | Full-time student, graduate student, resident, intern, student under the age of 24 | ||||

Read also

16.03.2020

Tax deductions and reporting

All deductions from the tax base must be regularly reflected in the enterprise’s reporting. They are included in the 2-NDFL certificate, which is necessary for the taxpayer to provide a report on his income and deductions made from it. The certificate is also presented when entering a new workplace, to banks and other authorities. Many issues cannot be resolved without providing this document.

In 2015, many codes underwent changes, which happened due to adjustments to the legislative tax base of the state. However, codes 104 and 105, like most codes from the standard category, were not affected by the changes.

If for any reason the tax has already been paid by the taxpayer without deducting the code, the due amount is returned to him, according to the document provided by the taxpayer.

There are deadlines for return: after submitting the application, the procedure must be carried out within three months, and no later. If the refund is carried out by the tax office, three months are allotted to verify all documents, plus another month to transfer the amount to the taxpayer’s account.

Even deduction codes not taken into account when filing an application by the taxpayer serve as a guarantee of personal income tax refund.

Top

Write your question in the form below

Deduction code 126 in the 2-NDFL certificate

Help 2-personal income tax: deduction 126

An employee, having requested a 2-personal income tax certificate from his employer, in paragraph 4 can find the tax deduction code - 126.

According to ed. Order of the Federal Tax Service of Russia dated November 22, 2016 N ММВ-7-11/ [email protected] “On approval of codes for types of income and deductions”, code 126 is deciphered as follows:

Standard tax deductions provided for in Article 218 of the Tax Code of the Russian Federation For the first child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student, cadet under the age of 24 to a parent, spouse of a parent , the adoptive parent who is providing for the child.

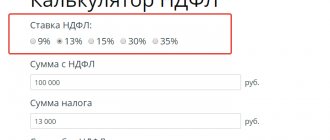

In practice, this means that you, as an employee, receive from your employer a standard tax deduction monthly in the amount of 1,400 rubles (until the amount of your income exceeds 350,000 rubles on an accrual basis from January) based on your previously completed application for child deductions .

In other words, if your monthly salary is 25,000 rubles, the employer calculates personal income tax in the amount of 13% on the amount (25,000 - 1,400) = 23,600, withholds it and transfers it to the budget.

Therefore, if you need a 2-personal income tax certificate to fill out a 3-personal income tax return (for example, for a tax refund - receiving social or property deductions), it is also important to take into account this deduction code in it. In the declaration, paragraph 1.3 is filled out on Sheet E1 (relevant for the declaration for 2021 or earlier). In the declaration for 2021 or later – Appendix 5, paragraph 1.3.

If the employee’s 2nd personal income tax certificate contains this deduction code, as well as any others in paragraph 3 or 4, and he does not indicate them in the declaration, such a declaration will be filled out incorrectly, the amount of tax refund will be calculated in a smaller amount than the employee could get.

| On the website you can fill out the 3-NDFL declaration online; we have fully automated all deduction codes from the 2-NDFL certificate (including code 126). You indicate them, they are automatically reflected in the declaration along the required lines. Our specialist will check the finished declaration. Fill out the 3-personal income tax declaration online |

For example, according to the 2-personal income tax certificate in paragraph 4, the employee filled out deduction code 126 in the amount of 5,600 rubles. The declaration is filled out to refund training taxes; the amount of expenses for these purposes amounted to 38,000 rubles. The employee, therefore, claims a refund of 13%, that is, 4,940. But if he forgets to reflect the deduction in the amount of 5,600 in the declaration, then the amount of tax refund will be calculated as follows: 38,000 * 0.13 - 5,600 * 0.13 = 4,212.

Thus, it is very important to reflect all deduction codes from the 2-personal income tax certificate in the declaration.

You can see the current tax deduction codes HERE >>>

When filling out the 3rd personal income tax declaration on our website, you do not need to know how certain income or deduction codes are deciphered. We have automated the data from the 2-personal income tax certificate. You just need to indicate the codes that are present in your 2-personal income tax certificate, and our online program will automatically reflect them on the necessary declaration sheets.

Amount of deductions provided for children

To determine the amount of deduction due to the employee, along with the application, the employee brings to the accounting department documents confirming the right to deduction . The application is written once , and if the conditions for granting deductions have changed, a new one is written with the necessary documents attached.

| Deduction amount | To whom is it granted? | Supporting documents |

| 1400 | First child | Birth (adoption) certificate, certificate from an educational institution (if a student) |

| 1400 | Second child | |

| 3000 | Third child and each subsequent child | |

| 6000 | A disabled child, disabled group 1-2, up to 24 years old - a full-time student, if raised by adoptive parents | Certificate of disability, birth certificate, certificate from an educational institution (if a student) |

| 12000 | Disabled child, disabled group 1-2, up to 24 years old – full-time student |

In 2021, the Ministry of Finance clarified that the parent of a disabled child has the right to receive two deductions at the same time - 1400 (3000) and 12000, or 1400 (3000) and 6000 if raised in a foster family.