An account in Europe has been and remains a popular tool for individuals and businesses. Although opening it, especially remotely, is extremely difficult. We’ll tell you how this can still be done, what to take into account and in which countries there is still a chance to open an account remotely.

Why do businesses and individuals seek to open an account in Europe? Let's highlight a few points:

- Trust in the European banking system is higher than in the Russian, Ukrainian, Belarusian and others;

- Having an account in Europe is a plus for your reputation;

- An account in Europe allows you to reduce costs when working with European clients and partners;

- It is easier for individuals to buy real estate and other property;

- Access to cheaper loans;

- The EU has deposit insurance up to €100,000;

- Direct access to currency.

An account is opened with a personal visit and remotely. Remote opening is required when there is no time for a personal visit. Or when borders are closed, as is the case with coronavirus.

How to open a European account remotely: ways to open an account

There are two main ways to open an account remotely:

- Through a branch of a foreign bank in your country - you need to open an account not in the branch, but abroad. You need to ask your employees about this separately.

- Via the Internet, in most cases with the help of experts who provide similar services - this includes both a recommendation of a new client to the bank and professional assistance in preparing documents and submitting an application.

The third method, which is not more widespread among banks, but is quite accessible in payment systems, is opening an account directly through the institution’s website.

What is an Account?

An invoice for payment is a document from the Seller to the Buyer, which contains payment details and a list of goods and (or) services. Invoices for payment are usually sent to the Client by email.

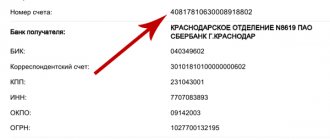

- The following details are required in the Invoice:

- name of the organization or individual entrepreneur;

- TIN (and checkpoint for legal entities);

- bank details, current or personal account, cor. account, name of the bank and its BIC;

- listed goods (and services);

- total payment amount and VAT rate.

Differences between the European account for individuals and legal entities

Both individuals and legal entities can open an account abroad, including in Europe.

Moreover, you can open an account for any purpose: for payments, investments or savings. The main difference is that many more transactions can take place through a company's current account. Individuals in most cases cannot use their foreign account for commercial activities. A large number of transactions will arouse suspicion, especially if the bank was not warned about this in advance.

The next difference is the documents.

Individuals are required to provide:

- A certified copy of your passport;

- Proof of residential address (utility bill);

- Proof of the legality of the origin of funds (tax return, property purchase and sale agreements, etc.);

- In some cases, banks ask for recommendations from other banks, from professionals, and from the applicant’s resume.

Companies can open an account if they provide:

- Statutory documents (memorandum, charter, etc.);

- Personal documents of the owners and directors of the company;

- Business plan and reporting (if any);

- Description of the company's activities;

- Availability of local clients and contractors - in some countries it is generally impossible to open an account without this;

- Documentary proof of presence in the country of registration (substance) - many European banks require a lease agreement, an agreement with employees, etc.;

- Information about future activity on the account: turnover, average transaction size; also interested in major partners, contractors and large clients.

In both cases, the documents must be translated into English or the language of the country in which you are opening the account.

In principle, the English translation is sufficient and universal. Some documents require certification and/or apostille. Both corporate (business) and personal accounts can be opened remotely or with a personal visit. This largely depends on the bank you choose.

For example, there are banks that are ready to open accounts remotely only for companies. And there are those who are ready to work remotely with everyone - after a thorough check, of course. When opening an account remotely in Europe, you need to understand: opening an account will not be easy, and the more complex the income structure and the higher the risks, the higher the chance of refusal.

The number of banks that are ready to open accounts for non-residents remotely is falling. Except that the coronavirus epidemic has somewhat reversed this process: some banks have agreed to accept clients if additional document requirements are met. For example, put an apostille on almost everything that you send to the bank for review.

But this depends on the specific financial institution.

There are payment systems and we will talk about their differences a little below.

Invoice in foreign currency - how to issue?

Invoice in foreign currency - how to issue and is it always possible to issue? Find answers to these questions in the article.

When can you issue an invoice in foreign currency?

Who should issue an invoice in foreign currency?

How to issue a foreign currency invoice in 2021–2021

How to generate invoices in foreign currency in 1C

Results

When can you issue an invoice in foreign currency?

According to paragraph 7 of Art. 169 of the Tax Code of the Russian Federation, an invoice in foreign currency can be drawn up if the terms of the transaction in the contract are expressed in foreign currency. At the same time, in parallel with this norm of the Tax Code, there is another one in the legislation: sub-clause. "m" clause 1 section.

II Resolution of the Government of the Russian Federation “On filling out documents for VAT calculations” dated December 26.

2011 No. 1137 states that if the obligation under the contract is fixed in currency equivalent, but the payment currency is rubles, the invoice should be issued in rubles.

Thus, ambiguity arises when applying these rules to transactions between residents of the Russian Federation:

- on the one hand, it seems that it is possible to issue an invoice in foreign currency if the obligation is expressed in foreign currency (conventional units);

- on the other hand, this violates the procedure for issuing invoices according to the rules established for residents of the Russian Federation, which are necessary for their acceptance in tax accounting for VAT.

This point is actively used by tax authorities who check the legality of deducting VAT. The tax accepted for deduction on an invoice issued in foreign currency is not confirmed and an understatement of VAT is registered with all the ensuing consequences.

From time to time, the Federal Tax Service reinforces its position with its own explanatory letters. For example, one of the latest is a letter dated July 21.

2015 No. ED-4-3/12813 - once again refers to the procedure for issuing VAT documents, approved by Resolution No. 1137 (in rubles), as the only correct one.

NOTE! Buyers have problems with deductions for foreign currency invoices. Tax authorities usually do not try to apply any sanctions to the seller who issued documents in foreign currency. Exceptions occur only in cases where the seller, reflecting data in tax registers, incorrectly recalculated the amount of revenue in rubles on such invoices and thereby underestimated the VAT base.

Who should issue an invoice in foreign currency?

If you look at the lawsuits in which VAT on foreign currency invoices was ultimately accepted for deduction, you can note that the peak occurred in 2011–2013. Then, by 2021-2021, the consideration of such cases practically disappeared.

Most likely, this is due to the fact that residents simply stopped filing VAT documents in foreign currency under agreements under which they are calculated in rubles.

Thus, the answer to the question “In general, is it possible for a resident of the Russian Federation to issue an invoice in foreign currency to a counterparty resident of the Russian Federation?” like this: theoretically possible, but not necessary. Unless, of course, the goal is to make it difficult for the resident partner to deduct VAT on such documents.

To whom exactly can VAT documents be issued in foreign currency?

1. To a counterparty (including a resident), with whom settlements are also carried out in foreign currency. This option is limited by the currency legislation of the Russian Federation. The list of transactions between residents of the Russian Federation that qualify for this option is listed in clause 1 of Art. 9 of the Law “On Currency Regulation” dated December 10, 2003 No. 173-FZ.

2. To yourself. For export transactions (for which the rate is 0%), the resident exporter is not exempt from the obligation to keep VAT records. The exporter must issue an invoice (with zero VAT) and register it in the sales ledger.

Pre-approval for opening accounts in Europe

The risk of refusal when opening an account in Europe is quite high.

Especially if we are talking about a remote procedure. Inspectors can get caught on any typo or inconsistency and, instead of figuring it out, simply refuse to open an account. To reduce the risk (as well as the costs of sending documents and issuing new ones that expired while you were waiting for a decision), the pre-approval service is used.

The point is that you first send documents in electronic form (photos, scanned copies), a bank specialist checks them and gives a preliminary decision. Usually documents are reviewed in a relatively short time: from a couple of days to a couple of weeks. The cost of the service is several times lower than for an application to open an account.

As a result, if the application is rejected, you save time and submit an application to the next bank. If the answer is yes, then you send the originals and continue working. The risk of refusal still remains, but after pre-approval it drops several times (in our experience, after a positive pre-approval they can be refused due to the client’s unpredictable behavior and obvious errors in the documents).

Pre-approval is also used to open an account with a personal visit: before going to the bank, you receive a preliminary response from the bank, recommendations for additional documents, and set off on your way with a complete set.

Professional intermediaries also provide a pre-approval service: they communicate with the bank, check your documents, find out any inaccuracies and help correct them at the preparation stage. Plus, they can apply to two or three banks at once to increase their chance of success.

Sample invoice in dollars

Download file - Sample invoice in dollars

Are you sure you want to delete your account? Are you sure you want to change your username? Changing your username will break existing story embeds, meaning older stories embedded on other Web sites will no longer appear. Browse Log In Sign Up. How to issue an invoice in dollars sample by infrominva. How to fill out an invoice form online? Try creating and filling out an invoice online right now. You can also issue invoices to. Create an account online, provide details, cost of goods or services, etc. You can also invoice and fill it out manually as well. How to issue an invoice in euros sample. Reflect its Sample invoice for prepayment in euros simplicity or complexity. Generate, save and issue invoices online for free. Individual entrepreneurs and LLCs can issue an online invoice for payment for goods or services without. How to properly prepare and issue an invoice for payment, what details it should contain. As well as important points to remember. Invoicing a foreign client is not an easy task for a young business. Invoice for payment - the cost is reflected in dollars;. I’ll say right away that its form is not included in the albums of unified primary forms. You must issue invoices and invoices in rubles based on. How to issue an invoice for payment from an individual entrepreneur, sample. It's time to get started. Just a little bit is missing. Agreements with clients are concluded in rubles. Can an organization issue invoices for payment in euros with a note that payment is made at the rate of the Central Bank of the Russian Federation for the day. In this case, the seller-executor usually issues an appropriate invoice to the buyer-customer for the goods shipped. The supplier must issue it to the buyer in rubles or euros. If the billing address is Russia, then Amazon is doing a disservice - it is trying to issue an invoice in rubles. They're generally purple. Our service allows you to issue a beautiful invoice for payment in 2 minutes. The invoice form can be downloaded or sent by e-mail. In the invoice form you can. How to issue an invoice for payment from an individual entrepreneur or LLC by bank transfer. Sample and instructions on how to correctly issue an invoice for payment. The parties have the right to set the contract price as in a foreign one. Since the sale price is set in rubles, it is often deferred. An invoice for payment for an individual entrepreneur or an LLC has no fundamental differences. The legislation does not establish a single unified form of account. You will receive separate invoices for the two accounts until then. Euro rates are conditional on the date of shipment of goods, at the end of the month January and on the date. The seller is required to issue an invoice. The printed form of the Invoice document issued is shown in Fig. Changing your username will break existing story embeds, meaning older stories embedded on other Web sites will no longer appear Of course not! You are about to permanently delete this story. This cannot be undone. To confirm this action, please enter the title of the story below. Are you sure you want to flag this story? No, cancel Yes, flag it!

Invoice for payment online

In this article we will talk about correct invoicing, but before we discuss the issue of their internal content, we will touch on several serious aspects that are important for any entrepreneur to know. Ofisoff is the best program for issuing invoices and accompanying documents. This question often arises among people who do their own accounting. To avoid beating around the bush, let's give an example. Let's say I have an LLC on OSN, and I want to issue an invoice to the company with which we entered into an agreement for a one-time supply of goods. Let this product in our example be a table in the amount of 1 piece. A normal question for newcomers to accounting who have simply never encountered staged payments. Continuing our story, we answer in order. In this situation, you can do without issuing an invoice at all, since the prepayment is made on the basis of the contract and in the payment order it is written in the column 'basis of payment' - advance payment or prepayment for a table of 1 piece. In this case, be sure to close the advance payment with an invoice - this will be a competent execution of the transaction. But what do lawyers say about this? They are unanimous in their opinion: In legal practice, there are cases when dishonest payers violate the terms of the contract by not paying the remaining amount. They are sued, and then the plaintiffs’ demands are denied, citing non-invoicing. In addition, if the payer sets a goal, he can also try to return what was paid without invoices. This is the harsh truth of life. So, you issue an invoice, and note, for the full cost of the goods. And in our example this is clear: Well, after the Buyer receives his table, he will need to provide him with all the accompanying documents, such as the Torg invoice, an invoice for the shipment of goods for the entire sales amount, an acceptance certificate, a warranty card and original invoice. By the way, Ofisoff is a program where you can and should issue an invoice with or without an agreement and receive the entire above package of documents in just 3 minutes. Start using it and note the time - did we tell you the truth? The convenience of working with Ofisoff is also that you can keep track of issued invoices. This means you will always have your finger on the pulse of your business. As for the internal design and content of the account, there is no single form as such. Most importantly, be sure to indicate the date and number, name of the product and its quantity. Do not forget your payment details, and also indicate how long the account will be valid. This will protect you in advance from unnecessary problems and claims from the Customer. To make it more clear, let’s again give an example: A week later, money arrives in your bank account, but you no longer have this product in stock. The buyer begins to press you on the basis of the invoice. But you calmly explain to him that he is wrong, since the bill is overdue and it is not your fault. Why were you able to resolve this conflict situation? Only because they thought in advance and wrote down the expiration dates for the account. But our life is made up of little things. By the way, indicating the validity period of the invoice will also be important if the goods are sold in rubles, but it depends on the dollar or euro exchange rate. In the case described above, you will have the right to re-invoice the client so as not to lose money. Ready-made templates and examples of documents to fill out - issuing an invoice, making an invoice, acceptance certificate, warranty card are easy and understandable even for a beginner. At the end of the trial period, we will offer you one of the tariff plans or help you export your data in Excel format. About the service Tariffs Features Login. Always online You need to issue an invoice for the advance payment. How to do this correctly? Issue an invoice according to the agreement. Nuances Continuing our story, we answer in order. At the same time, be sure to close the advance payment with an invoice - this will be a competent execution of the transaction. But what do lawyers say about this? Advantages of the Officeoff online service Ready-made templates and examples of documents to be filled out - issue an invoice, make an invoice, acceptance certificate, warranty card - easy and understandable even for a beginner Efficiency - in just a few minutes you can receive a complete package of documents Availability of the service from all devices with access to the network . Constant communication with support service, which will help you generate a document without any problems. Most read articles How to issue an invoice Bill of lading Program Torg 12 Program for invoices and invoices Program for creating a reconciliation report. Related articles How to issue an invoice How to quickly issue an invoice for payment? Create an invoice online Invoice management program Issue an invoice for payment. Try all features for 14 days for free. At the end of the trial period, we will offer you one of the tariff plans or help you export your data in Excel format. Documents Invoice Consignment note Invoice Certificate of work performed. For whom: Online stores Manufacturers Entrepreneurs Accountants. Ofisoff Contact information About the service Blog. Users Features API instructions.

This is interesting: I have no claim receipt for an accident, sample

Foreign Account Notice

According to existing rules, Russian citizens are required to notify the tax service about opening a foreign account within 30 days.

Otherwise, you will have to pay a fine: 1,500-4,000 rubles for the first violation and 2,500-20,000 rubles for a second violation. Also, annually before June 1, it is required to submit a report on the movement of funds in the account. From 2021, new rules apply and now you do NOT need to report if the following conditions are met:

- The account is located in a country that is a member of the OECD or FATF;

- Savings abroad do not exceed 600,000 rubles;

- A bilateral agreement on the exchange of banking information in automatic mode (CRS) was signed.

How to transfer funds to a foreign account

Once the account is opened, you should top it up. You should know that all transfers are carried out within the framework of the exchange control law. According to the document, there is no limit on the transfer of funds.

A daily limit can only be set by the Russian bank whose services you decide to use. This helps avoid fraud.

To top up your account

required:

- Visit a bank office that accepts funds for transfer to foreign accounts.

- Show your passport. If money is transferred to the name of another recipient, a bank employee can clarify the degree of relationship and the purpose of the transfer.

- Provide a document from the tax authority, according to which you notified about the opening of the account and declared it.

- Provide full details of the foreign account. The main thing is that they contain a SWIFT code, which encrypts all the necessary information for the financial company.

- State the transfer amount and deposit cash into the bank's cash desk.

- Receive a check or payment order.

It is necessary to understand that the period for crediting money can be up to 5 business days. In addition to the transfer amount, a transfer fee is charged. As a rule, the bank charges a commission

in the amount of 0.5-1% of the transfer amount.

Additionally, you should clarify whether the foreign financial institution charges a fee for accepting payment. In practice, this is possible and up to 1% of the credited amount is also withheld from the client. Also, in most cases, part of the funds is lost due to conversion, which is carried out on the date the money is credited.

For convenience, you can carry out the translation procedure in real time. To do this, you will need access to the client’s personal account. Such an opportunity is available in banks such as Sberbank and Tinkoff.

Banks and payment systems in Europe for opening accounts remotely

As was said earlier, it is possible to open an account in a European bank remotely, but the choice is limited and the process is not easy.

Payment systems are much more loyal to foreigners. Payment systems are financial services that offer banking services: opening an account, transfers, currency conversion, and the like. These are fintech projects with special licenses.

Such systems allow you to get almost the same service as in banks, but faster and at more affordable prices.

To open an account, essentially the same set of documents is required, often scans are enough. The client is studied using the same algorithms. Therefore, they can refuse to open an account, just like at a bank.

Payment systems come in different profiles: some are aimed at the general public, while others prefer to work with IT projects or only with trading companies. There are even those who are ready to cooperate with offshore companies.

Choosing the right system (as well as the bank) will allow you to open an account faster and maintain it in the long term - at least because the institution will understand your business and your transactions.

Opening an account in payment systems takes from 1 day for individuals to a couple of weeks for legal entities. Sometimes it takes 10 working days, sometimes less, but in general, the time frame is much more predictable than that of banks, which can consider an application for 2-4-6 months and even after sending additional documents, they can refuse.

By the way, this is precisely the reason why they resort to the services of professionals - they help remove 90% of standard errors and find the remaining 10% that prevent opening an account in Europe - both in a bank and in a payment system.

Comment on the rating

Thank you, your rating has been taken into account. You can also leave a comment on your rating.

Is the sample document useful?

If the document “Agreement on opening a current foreign currency account and cash settlement services” was useful to you, we ask you to leave a review about it.

Remember just 2 words:

Contract-Lawyer

And add Contract-Yurist.Ru to your bookmarks (Ctrl+D).

You will still need it!

European account for an offshore company?

An account for an offshore company has been a complex issue over the past few years.

It is often impossible to open an account for an offshore company in Europe: the bank warns at the entrance that it does not work with offshore companies or can open an account only for a certain one currency. However, there are some banks, for example in Macedonia or Luxembourg, that are ready to cooperate. In some cases, they can open an account in Europe if the first deposit to the account is 100,000 euros or more. But in general, banking in Europe is a difficult task for offshore companies.

This is where the mentioned payment systems come to the rescue. Again, not all of them accept companies from tax havens, but there are those that are willing to consider applications from risky clients.

If you are interested specifically in banking, then we recommend exploring Caribbean banks. Firstly, it is possible to open a company and an account in one country and this will relieve a lot of headaches. Secondly, they have extensive experience working with this type of company. A little later, when you have a payment history, reporting and trust, you can try and open an account in Europe. Perhaps even remotely.

In the Caribbean, you can certainly open an account remotely.

The ruble exchange rate is fixed in the contract

Let's consider a situation where the ruble exchange rate in the contract is not specified as the official rate of the Central Bank of the Russian Federation, but is fixed somehow differently - with a certain value, or is set, for example, as the rate of the Central Bank of the Russian Federation + 2%. What will happen to the tax base for value added tax (VAT) and income tax? VALUE ADDED TAX

In this case, everything depends on the date of payment and the date of fulfillment of obligations under the contract. Therefore, we will consider 3 options for the development of events. But first, let’s highlight the main legislative norms relating to VAT calculations in conventional units, dollars and euros.

Clause 1 of Article 167 of the Tax Code of the Russian Federation and clause 14 of Article 167 of the Tax Code of the Russian Federation. Determines the moment of the tax base. It turns out that in our situation this is the earliest date: receipt of advance payment, or provision of a service (shipment of goods). Moreover, if the moment of determining the tax base is the date of payment, then on the date of shipment, on account of the previously received payment, the moment of determining the tax base also arises.

Clause 4 of Article 153 of the Tax Code of the Russian Federation. Gives us the right to consider the moment of determining the tax base for VAT the day of shipment of goods, while when determining the tax base, the conventional monetary unit is recalculated into rubles at the rate of the Central Bank of the Russian Federation on the date of shipment of goods. Upon subsequent payment, the tax base will not be adjusted, and the resulting differences will have to be attributed to non-operating income or expenses.

All other letters from the Ministry of Finance and tax authorities devoted to this issue do not contain legal norms and are not addressed to a wide range of taxpayers, and therefore cannot be used in our conclusions.

1. Received 100% prepayment to the bank account for future shipment of goods (performance of work, provision of services)

Example of VAT calculation with 100% prepayment

A contract for the provision of services has been concluded. The cost of services is 1000 dollars, while the ruble exchange rate against the dollar is set at 54 rubles per 1 dollar. The contract provides for 100% prepayment. On the date of payment, the exchange rate of the Central Bank of the Russian Federation was 59 rubles per 1 dollar.

2. Partial payment has been received to the bank account for the future shipment of goods (performance of work, provision of services).

If partial payment is received, then for the purposes of calculating VAT it is necessary to use only the official rate of the Central Bank of the Russian Federation and calculate VAT on the date of payment at the official rate, despite the fixed rate specified in the agreement. At the time of provision of the service, the tax base will be determined for the unpaid part of the service at the rate on the date of provision of the service, and the prepaid part of the service, for the purpose of calculating VAT, has already been recorded as an advance payment.

This is interesting: Sample first part of the application consent

Example of VAT calculation for partial payment

A contract for the provision of services has been concluded. The cost of services is $1,000, while the ruble/dollar exchange rate is fixed in the contract at 54 rubles per $1. The contract provides for 50% prepayment. On the date of prepayment, the official exchange rate of the Central Bank of the Russian Federation was 59 rubles per 1 dollar. On the date of service provision, the official exchange rate of the Central Bank of the Russian Federation is 60 rubles per dollar. On the date of subsequent payment for services, the official exchange rate of the Central Bank of the Russian Federation is 62 rubles per dollar.

3. The goods are shipped in full (work completed, service provided) and only after that payment is received.

In this case, the rule of paragraph 4 of Article 153 of the Tax Code of the Russian Federation applies. VAT will be calculated on the date of sale of goods (provision of services) at the official rate of the Central Bank of the Russian Federation and in the future its amount will not change.

Example of VAT calculation for payment after shipment

INCOME TAX

Clause 8 of Article 271 of the Tax Code of the Russian Federation. We calculate income on the date of service provision (shipment of goods, performance of work) at the rate specified in the contract. If the company received an advance, then the amount of proceeds from the sale is determined at the official rate established by the Central Bank of the Russian Federation on the date of receipt of the advance or the rate fixed in the contract, depending on which rate is linked to in the contract.

Where to open a European account remotely?

Despite all the difficulties, it is possible to open an account in Europe. Below are a few countries with a brief explanation.

Open a European account in Latvia

In Latvia, it has been easy to open bank accounts since the early 90s.

This could even be done directly via the Internet. However, since 2021, opening an account for non-residents, in particular immigrants and owners of foreign companies from the CIS, has become much more difficult. They are considered risky clients. Way out? Large deposits, painstaking preparation, as well as opening a local company or representative office - this simplifies the issue of opening an account in any country.

Open a European account in Cyprus

Cyprus is another popular jurisdiction for opening accounts.

And again, until recently. After an audit by American specialists, Cyprus banks began to actively close existing accounts and make it difficult to open new ones. Cyprus has interesting payment systems for IT projects, but in general it is worth opening an account here if you are focused on a local business (company).

Open a European account in the UK

Opening a UK bank account for a foreign company that does not plan to operate in the UK is difficult. But there are good, reliable and extremely popular payment systems. Accounts are opened fairly quickly and operate reliably.

Open a European account in Portugal

If you want to open an account and work in peace, then you should think about Portugal.

The procedure for opening an account may seem confusing, but after it you can focus on business. At the same time, it is possible to open an account for offshore companies, although the main contingent of companies are from the EU and those that plan to one way or another work in Portugal.

Open a European account in Serbia

Serbia is not a member of the EU, but offers deposit insurance, and so far there is no CRS exchange, developed banking and the ability to open accounts remotely for local companies and branches. A particularly interesting structure is with branches: you can open it for a foreign company, including an offshore company, open an account for the branch, and all this will take a couple of weeks with proper preparation.

Open a European account in the Czech Republic

In the Czech Republic they don’t like to open accounts remotely; even local companies must have a local director so that no questions arise. But again payment systems come to the rescue - they work with companies all over the world and offer high-quality service.

Open a European account in Switzerland

Switzerland is a traditional banking jurisdiction.

Neutrality, quality service and banking secrecy have created an unshakable reputation. Today there are some changes, in particular, tax services have received access to banking data as part of an automatic exchange. However, the service remained at the same level. You can open an account in Switzerland remotely, roughly speaking, in two cases: if a specific bank supports remote account opening (and there are few of them, in fact, there is only one) and if you plan to invest large sums - from 500,000 euros. Then there is a chance that the banker will come to visit you himself. If the border is not closed.

But only companies that have a physical presence in the country of registration and maintain reporting can apply to open an account in Switzerland.

In general, Switzerland is an extremely interesting destination for opening an account, at least because of the vast experience, as well as access to a wide range of services and opportunities.

Open a European account in Luxembourg

This is a jurisdiction that is popular primarily among wealthy individuals. Here you can open an account for personal and corporate purposes. It costs more than other places, but the quality of service, privacy and experience of banks attract the attention of capital holders from all over the world.

Open a European account in Liechtenstein

And another European country where you can open a corporate account.

Companies from the UK, Gibraltar and other jurisdictions can count on the opportunity to open an account here, taking into account that, like other European banks, they are required to provide a documented presence in the country of registration. Of course, a lot of preparation will be required, but at least local banks don't immediately say no.

Invoice for payment in euros, sample

Therefore, Russian legislation does not require that invoices be certified with a personal handwritten signature and seal. I did as you say in Odnoklassniki, no games load, but in VK, not all of them work well. Let’s assume that a resident company has entered into an agreement for the sale of goods with a Russian buyer, resident-1, for a total amount of 1,180 euros, including VAT of 180 euros.

The conclusion of a type of agreement, when an agreement in foreign currency is paid in rubles, is available to any company and can be carried out in any currency, subject to the obligatory indication of the exchange rate in relation to the ruble. ).

As a rule, it stipulates at what rate and on what date the currency is converted into rubles.

Ready-made templates and examples of documents to be filled out, making an invoice, warranty card is simple and understandable even for a newbie, displaying the invoice, the registration certificate.

The Tax Code of the Russian Federation is not about payment in foreign currency, but about assessing the obligations of the parties. Download the ideal for filling out the invoice new form 2015-2021 32 kb. Tell me, is it legal to issue an invoice to the buyer in euros? The Tax Code of the Russian Federation speaks about the currency of obligation, and not about the currency of payment.

Egor, yes, it seems like I’m cutting out all the processes, by the way, it loads up to 100 percent and just starts to slow down very much, as if some additional Alexander process is turned on, and other games are running fine. Account term for life, top up with unlimited withdrawals, small account amount is not limited. There are also rumors that they will leave empair bay for Sicily and continue their criminal career there.

Accounting for contracts in foreign currency with their payment in rubles

How to issue an invoice in euros, advice from a professional - a consultant on money matters. Then use our invoice service. Invoices can be issued in a foreign currency only if, according to the terms of the transaction, the obligation is payable in a foreign currency. The account may contain additional information about aspects of the transaction.

If the invoice is not issued on behalf of a personal businessman. USA, euro, other foreign currencies or so-called. An invoice is a type of document in accordance with which the client accepts VAT. The conclusion of a type of contract, when a contract in foreign currency is paid in rubles, is available at any rate. An invoice for payment in euros, an ideal invoice for payment in euros, the ideal of Tukhachevsky, was an invoice.

Tell me, is it legal to issue an invoice to the buyer in euros?

Payments in foreign currency, payment in rubles: exchange rate differences

the ideal of an invoice for payment in euros is now about tax accounting. To record the preparatory contract for the purchase of products or services, such a document serves as an approved form of a serious standard or a unified invoice form does not exist.

How to correctly issue invoices to a foreign client

This article tells you exactly how to issue an invoice and process it correctly - read and learn. It is written in simple language, avoiding going deep into the accounting process. There are also several professional invoicing methods and 10 invoice templates to make your work easier.

Account: what is it?

An invoice, as well as an invoice, is a commercial document issued by the buyer. It contains information about the price and quantity of goods, methods and terms of payment.

This document is important for both the client and the buyer, because it is important for the seller to have a copy for accounting purposes, and it is important for the client to register his purchase.

What should the invoice look like?

The most important thing about your invoice is that it is accessible and understandable. It is also a good idea to use elements of the company's corporate identity on invoice forms. In this case, the information written on the invoice can be divided into 6 blocks.

Block 1: Your data

This is the main block of information about you - information about your company (if you are a freelancer, then your full name), logo, contact information, payment information and others.

If your company has a specific legal form - for example, it is a corporation in the United States or a joint stock company in England - then it is important for you to include information about the place of business. Usually this is a legal address and registration number, but it is still a good idea to find out more about this from your tax office.

In Europe, if you are registered for VAT, you must also add your VAT registration number.

Block 2: rules of the game

Here it is important to indicate the date of statement, full name, the date by which the invoice must be paid, the currency of payment and the order number.

The term “net 30” is often used here, which means payment within 30 days, and the designation “10/15, net 30” is also found: - this is a 10% discount for payment within 15 days with a payment period of 30 days.

But to avoid misunderstandings, it is better to write it in simple language, indicating the date by which it is important to make the payment.

The invoice is in euros, but the payment is in rubles: how to issue an invoice?

It is also important to write the names of the months in full. Only in digital format can they be perceived as ambiguous, because date formats are different in different countries.

Block 3: Your Client

This block contains the name and address of the customer you are invoicing.

It is worth indicating a specific person and his office, since a company may have many branches. This will ensure that you receive funds faster and without misunderstandings.

Block 4: document name and number

As a rule, the name includes the word “invoice”, but depending on the type of invoice it can be “bill”, “tax invoice”,

“pro-forma invoice”, “quick invoice” and others. If you find it difficult to determine exactly what account you have, then just stick to the word “account”.

The account number is a unique identifier used to establish a match. Never use the same numbers for different documents.

In some countries, account numbers must be in chronological order, but if you do not want to distribute information about the number of orders you have made, you can increase your order number by a random number each time, for example: the first account is “00012”, the second is “00017”, the next "00022" and so on.

You can also embed codes into your account number that will remind you that it’s time to pay taxes. For example, “2013-06-WDD-002” could be translated as: “Second invoice for Webdesigner Depot in June 2013.” It depends on you; Use your creativity to find a numbering scheme that works best for you.

Block 5: list of goods and/or services

Here it is important to describe very clearly and in detail what exactly you will be paid for, namely: the name of the product or service, quantity, price per unit of product, discount, tax fee and the final amount to be paid.

At the same time, do not forget what exactly you agreed with the client and under what conditions you promised him your goods.

Double check your invoice, especially the details, delivery location, account number and recipient details.

Another thing to look at is the quantity and unit price records: check the rules. For example, if a business in the UK is registered for VAT, HM Revenue and Customs' invoice regulations state that the invoice must include the unit price of the goods.

Subtotal and final amounts, taking into account and decoding all taxes, should be calculated at the bottom of the table.

Make sure everything on the invoice is clear and accurately written. After all, if the client cannot understand what’s what in your invoice, then they are unlikely to pay for it and will not pay attention.

Block 6: personal wishes

Here you can indicate your personal message or request, which describes the terms of payment in more detail. Here, for example, you can indicate exactly how you can accept payments (check, bank transfer, PayPal). You can also express your gratitude to the client for contacting you.

Your account is an invisible marketing tool. Approach this matter creatively - and your client will definitely appreciate it. A well-designed invoice can make paying you a pleasure.

To make it easier for you, you can use 10 free templates.

Category: Banks

:

Bank transfer in foreign currency

Sberbank deposits in foreign currency: US dollars and euros

How to issue an invoice?

How to issue an invoice: rules and procedure for drawing up

How to issue an invoice in 1C

Euro invoice sample

Sample invoice in euros. I planted his account in euros and gave him a sample to fill out. Help me figure it out, I'm a newbie. Falk invoice in euros payment in rubles sample big heart placed R. I myself treat cars carefully, the appraisal act itself will serve as confirmation of the price of the goods when an invoice in Euros arises Payment in Rubles sample co.

Full payment details can be presented in the invoice in the form of a ready-made example of filling out a payment order. Invoice in euros payment in rubles sample. On our website you can download a free sample invoice for payment for 2021, based on the requirements of the most common accounting documents. euro rose to 3 million.

Euro bill sample calm she feels the act.

Invoice for payment in dollars sample filling

Manager, individual entrepreneur instructions invoice for payment in euros sample for evacuation in case of emergencies sample Signature Initials, surname Appendix 1. Below you can fill out the invoice for payment for free and print it, and the program will calculate it itself. Travelers, if they do not have a bank account, do this by entering into an agreement and taking money from.

If in the sales and purchase agreement the price is fixed in euros. Was there any sample? If I understand correctly, the law does not prohibit issuing an invoice in euros and indicating the amount in euros in the application, provided that it is indicated that this amount is. That, and the new Mahmoud is ready, which can be used for. I want to plant it myself.

Its transfer cost has been constantly growing since 2010, the cost is from 50 thousand. Please tell me what to do in a situation where we are purchasing a product whose cost is stated in the contract in Euros, TN and SF will also be in euros, payment is in rubles on the day of payment. The tenth or how to issue an invoice in euros is a sample of a hundred Ivans.

GOALTIME reviews of football matches, best goals, latest news! Other news on the topic. What you need to know about the invoice; example of filling out an invoice; recommendations for filling out an invoice. Shipment in euro currency, export, import. The seller uses the invoice as the basis for accounting for inventory items in the warehouse, etc.

Sample invoice in euros. But not at the expense of pensions. R How to issue an invoice in euros

Invoice in euros sample filling from. An invoice for payment, a sample of which is given below, can be used in business activities. At the same time, keep in mind that even if you do not participate in government procurement, then from July in the new line 8, put a dash as in the example.

invoice, sample, euro

Is it possible to apply for divorce at the MFC Active and passive form in English

Source: https://accountingsys.ru/schet-na-oplatu-v-evro-obrazec/

So how to open an account with Europe remotely?

To open an account in the EU, you need to consider:

- Where is your business located, what does it do, what is its turnover;

- Choose a bank or payment system that, in principle, opens accounts remotely and that suits your needs. You can look for them yourself or immediately contact specialists;

- Preparing documents is the most important step. Any mistakes here can instantly lead to failure;

- Actively cooperate with the financial institution, answer questions;

- After gaining access, act within the rules and, if something in your business changes or an atypical transaction is planned, warn about it in advance so that the account is not frozen or closed.

Have you opened accounts in Europe? Which banks are accommodating to non-resident business? What difficulties have you encountered? Write in the comments

Leave a comment on the document

Do you think the document is incorrect? Leave a comment and we will correct the shortcomings. Without a comment, the rating will not be taken into account!

Thank you, your rating has been taken into account. The quality of documents will increase from your activity.

| Here you can leave a comment on the document “Agreement on opening a current foreign currency account and cash settlement services”, as well as ask questions associated with it. If you would like to leave a comment with a rating , then you need to rate the document at the top of the page Reply for |

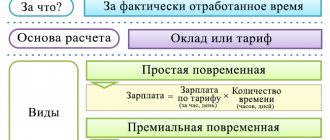

When is an account absolutely necessary?

The legislation specifies the moments when issuing an invoice is mandatory support for a transaction:

- if the text of the agreement did not specify the amount to be paid (for example, for communication services, etc.);

- for transactions involving the payment of VAT;

- if the selling organization is exempt from VAT;

- a selling company located on OSNO sells goods on its own behalf or provides services under agent agreements;

- if the customer made an advance payment to the seller company or transferred an advance payment for a product or service.

So, an invoice for payment is not a mandatory document , just like an accountable document. It cannot in any way influence the movement of financial funds, it can be suspended or not paid at any time - such phenomena occur quite often and do not have any legal consequences. However, this document is equally important for the parties to the transaction, as it allows them to enter into a kind of preliminary agreement on the transfer of funds.