25.06.2017

The 1C 8.3 Accounting 3.0 program has some functionality for maintaining personnel records and payroll. It is certainly not as advanced as in 1C: Salaries and HR Management, but still, in small organizations it is quite sufficient. Documentation and reporting complies with the law and is constantly maintained and updated. In this article we will look at the main aspects of accounting for insurance premiums in 1C 8.3 and recommendations on what to do if they are not charged.

- “Analysis of contributions to funds”

Pre-setting

Before you start calculating insurance premiums, you need to do a little setup of the program. The correctness of the calculations depends on it. Insurance premiums are a serious matter, so do not neglect the settings and be careful.

If you have not previously indicated the taxation system of your organization, be sure to do so in your accounting policy.

Accounting setup

First of all, let's start setting up accounting for our contributions. They are set up in the same place as the salary. In the “Salary and Personnel” menu, select “Salary Settings”.

Our team provides consulting, configuration and implementation services for 1C. You can contact us by phone +7 499 350 29 00 . Services and prices can be seen at the link. We will be happy to help you!

By clicking on the “Insurance Premiums” hyperlink in the “Classifiers” section, you can view the parameters for calculating premiums. We will not focus on them, since the data in these registers is already filled in in the standard configuration delivery according to current legislation.

Now let's move on to setting up accounting for our contributions. In the salary settings form, select “Salary accounting procedure”.

At the very bottom of the form that opens, follow the link to set up insurance premiums.

In the window that opens, go to the “Insurance Premiums” section and fill in the required fields.

The tariff for NS and PP is set depending on the main type of activity for the previous year. The minimum tariff is 0.2 percent. It is approved by the FSS, to which documents are submitted every year to confirm the main type of activity.

Here you can also set up additional contributions for those professions who are entitled to them, and indicate whether there are employees with hazardous working conditions. At the very bottom you can put a mark on the transfer of additional insurance contributions for a funded pension in accordance with Federal Law No. 56 of April 30, 2008.

Expenditures

To correctly reflect insurance premiums in accounting, you need to make one more setting. In the salary setup form, select “Cost items for insurance premiums.” This is where the procedure for reflecting mandatory contributions from the payroll fund on accounting accounts is set up.

A list already filled in by default will open in front of you. If necessary, it can be supplemented or adjusted.

By default, the debit account will be 26, the credit account will be 69.

Accruals

There are many different types of accruals. This includes salary, sick leave, vacation and others. For each of them, you need to configure whether insurance premiums should be paid from them.

Let's return to the salary settings form. In the “Payroll calculation” section, select the “Accruals” item.

A list of all charges will appear in front of you. They can be edited or new ones added.

Open any accrual. You will see the “Type of Income” field. It is the value indicated in it that will determine whether insurance premiums will be calculated on it or not. In our example, we opened one of the standard accruals, so everything is already filled in here, but when adding new ones, do not forget to indicate the type of income.

Reduced insurance premium rates for small businesses in 1C: ZUP and 1C: Accounting

Published 04/16/2020 09:30 Author: Administrator From April 1, 2020, organizations and individual entrepreneurs who are small and medium-sized businesses have the right to calculate reduced insurance premiums. This procedure was approved by Federal Law No. 102-FZ of April 1, 2020. “On amendments to parts one and two of the Tax Code of the Russian Federation and certain legislative acts of the Russian Federation.” Let's consider how this anti-crisis measure, aimed at reducing the tax burden, was implemented by developers in the 1C programs we are already familiar with: Accounting ed. 3.0 and 1C: Salaries and personnel management ed. 3.1

First, we recommend checking whether your organization is in the register of small and medium-sized businesses. This can be done on the website https://rmsp.nalog.ru/ by entering the TIN.

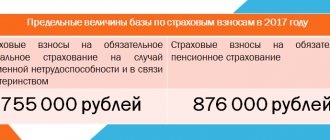

If your company is in this register, then the following tariffs are approved for you:

- for compulsory pension insurance, within and above the established maximum base for calculating insurance premiums for this type of insurance - 10%;

— for compulsory social insurance in case of temporary disability and in connection with maternity – 0%;

— for compulsory health insurance – 5%.

Thus, the total rate of insurance premiums for small and medium-sized businesses is 15%, instead of 30%.

But these rates apply only to the portion of wages exceeding the federal minimum wage. That is, part of the salary is subject to standard tariffs, and if it is exceeded, reduced tariffs apply.

As mentioned earlier, the application of the preferential tariff was introduced on April 1, 2021. At the same time, if, for example, a bonus to employees for March is accrued in accounting in April and later, then such a bonus falls into the base for insurance premiums in April, that is, already subject to a reduced tariff.

Application of reduced insurance premiums in 1C: ZUP ed. 3.1

In the software product 1C: Salary and personnel management, edition 3.1, starting with release 3.1.13.151, a mechanism for applying these changes has been implemented.

So, in the “Organizations” directory, in the “Settings” section on the “Accounting policies and other settings” tab, under the “Accounting policies” link, a new insurance premium rate “For small or medium-sized businesses” has appeared.

You should also indicate the start of application of this tariff from April 2020.

After changing the tariff, you need to save the settings by clicking on the “Save and close” button.

When calculating wages for April in the section “Salary” - “Calculation of salaries and contributions”, insurance premiums will be calculated automatically.

Based on our example, the employee’s salary for April was 65,000 rubles, the minimum wage as of 01/01/2020 was 12,130 rubles.

We calculate insurance premiums:

— for compulsory pension insurance: 12130 * 22% + (65000-12130) * 10% = 7955.60 rubles;

— for compulsory social insurance in case of temporary disability and in connection with maternity: 12130 * 2.9% = 351.77 rubles;

— compulsory health insurance: 12130 * 5.1% + (65000-12130) * 5% = 3262.13 rubles.

It should be noted that contributions must be calculated for each employee separately from the base for each month, and not as a cumulative total from the beginning of the year.

You can check the accuracy of the calculation by generating a report “Analysis of contributions to funds” in the section “Taxes and contributions” - “Reports on taxes and contributions”.

It should be taken into account that there are organizations that already apply reduced insurance premiums, in accordance with Article 427 of the Tax Code of the Russian Federation. For example, accredited Russian companies working in the field of information technology, such as developers of computer programs and databases, have the right to apply a total insurance premium rate of 14%.

In this case, you should be guided by letters of the Ministry of Finance No. 17-4/B-58 dated February 12, 2016. and No. 17-4/B-373 dated July 24, 2015, in which specialists from the Russian Ministry of Labor explained the following: if the payer has the right to apply reduced contribution rates for several reasons, then he must choose only one of them.

Application of reduced insurance premiums in 1C: Accounting 8th ed. 3.0

In this software product, the mechanism for calculating reduced insurance premiums has been implemented starting with release 3.0.77. To use it, you need to go to the “Main” section and select “Taxes and reports”.

In the window that opens, go to the “Insurance Premiums” tab, change the tariff to “For small or medium-sized businesses” and set the application period from “April 2020” and click on “OK”.

When calculating salaries for April in the section “Salaries and Personnel” - “All Accruals”, insurance premiums will be automatically calculated taking into account the application of a reduced tariff for salaries exceeding the minimum wage.

You can view the accrued amounts of insurance premiums broken down by fund by clicking on the link with the total amount.

You can analyze accruals for all employees by generating the “Analysis of Fund Contributions” report in the “Salaries and Personnel” - “Salary Reports” section.

It will have the same appearance as in the 1C program: Salaries and personnel management ed. 3.1.

Changes in the report “Calculation of insurance premiums”

Starting from release 3.0.77.78 in the software product 1C: Enterprise Accounting, edition 3.0 and from release 3.1.13.188 in the program 1C: Salary and Personnel Management, edition 3.1, changes are reflected in the “Calculation of Insurance Premiums” report.

Namely: a new tariff code has been added: 20 - “Payers of insurance premiums recognized as small or medium-sized businesses in accordance with the Federal Law of July 27, 2007. No. 209-FZ, applying reduced rates of insurance contributions for compulsory pension insurance in the amount of 10.0 percent, in relation to the part of payments in favor of insured persons, determined at the end of each calendar month as an excess over the minimum wage established by federal law at the beginning of the billing period" .

To generate a report, you need to go to the “Reports” section in 1C: Enterprise Accounting and select the “Regulated Reports” item. Or go to the “Reporting, certificates” section in 1C: ZUP and select the “1C-Reporting” item.

Then click on the “Create” button and select “Calculation of insurance premiums”. For convenience, in the window with types of reports there is a search line in which you just need to write the word “calculation” and the program will make a selection.

In the report that opens, you must click on the “Fill” button, and then check that the correct payer tariff code is in Appendix 1 to Section 1.

Author of the article: Alina Kalendzhan

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

0 #14 Alina Kalendzhan 07/31/2020 14:22 I quote Marina:

Good afternoon! Tell me why in 1C ZIK the payroll for the 1st quarter of 2020 is divided as in the 2nd quarter?

Good afternoon.

Check your accounting policy settings. Most likely, you have been using the reduced tariff since January, not April. Quote 0 #13 Marina 07/31/2020 14:04 Good afternoon! Tell me why in 1C ZiK the payroll for the 1st quarter of 2020 is divided as in the 2nd quarter?

Quote

0 #12 Alina Kalendzhan 05/08/2020 23:28 I quote Julia:

Good afternoon 1s switched to a reduced tariff in April. In April accruals there is a recalculation for March 2021 due to changes in the time norm. Insurance premiums from these recalculation accruals for March 2021 are included in the base and are charged at a reduced rate. Tell me, how can I correct the recalculation charges for March at the basic tariff?

Good afternoon.

Can you tell me the release number you are working on? Quote 0 #11 Julia 05/08/2020 16:15 Good afternoon! 1s switched to a reduced tariff in April. In April accruals there is a recalculation for March 2021 due to changes in the time norm. Insurance premiums from these recalculation accruals for March 2021 are included in the base and are charged at a reduced rate. Tell me, how can I correct the recalculation charges for March at the basic tariff?

Quote

0 #10 Elena 05/08/2020 14:16 Thank you!!!

Quote

0 Alina Kalendzhan 05/01/2020 04:28 I quote Sergey:

Good afternoon. In BP 2.0 it seems like reduced tariffs are implemented, but for some reason I can’t find it, can you tell me?

Good afternoon.

Go to the “Enterprise” section and select “Accounting Policy”. Copy the existing accounting policy and indicate the start date of April 1 in it and select the tariff you need on the “Insurance premiums” tab. Quote 0 Alina Kalendzhan 04/28/2020 02:13 Quote Oksana:

Alina, good day, could you prepare an article on how to submit an application to the tax office for a wage subsidy for April and May 2021 in the amount of 12,130 for each employee, subject to maintaining 100% employment. And who should be subject to contributions from the payroll for this subsidy (as I understand it, at a rate of 30%) and who should not. In this case, personal income tax is charged. Thank you.

Good afternoon.

This is the first time I have received an order for an article))) we will definitely do a review in the near future. Quote 0 Oksana 04/26/2020 23:21 Alina Good day, could you prepare an article on how to submit an application to the tax office for a wage subsidy for April and May 2021 in the amount of 12,130 for each employee, subject to maintaining 100% employment. And who should be subject to contributions from the payroll for this subsidy (as I understand it, at a rate of 30%) and who should not. In this case, personal income tax is charged. Thank you.

Quote

+2 Sergey 04/26/2020 13:43 Good afternoon. In BP 2.0 it seems like reduced tariffs are implemented, but for some reason I can’t find it, can you tell me?

Quote

0 Galina 04/22/2020 15:47 Thank you for your answer!

Quote

0 Alina Kalendzhan 04/22/2020 14:02 I quote Galina:

Thank you for the article! But tell me, if an IT technology organization already pays reduced rates of insurance premiums (14%), we don’t have any reductions above the minimum wage?

Good afternoon.

The article contains this example. You have the right to choose only one of the benefits. Or 14%, like it. Or 15% above the minimum wage, like SMP. Consider what is more profitable for you. Quote 0 Galina 04/22/2020 11:29 Thank you for the article! But tell me, if an IT technology organization already pays reduced rates of insurance premiums (14%), we don’t have any reductions above the minimum wage?

Quote

0 Karepanova Natalya Vitalievna 04/20/2020 18:48 THANK YOU SO MUCH!!!

Quote

0 Batueva Nadezhda Prinleevna 04/18/2020 04:54 thank you very much!!!

Quote

Update list of comments

JComments

Calculation of insurance premiums in 1C 8.3

Insurance premiums are calculated simultaneously with salary calculations. They are located on the “Contributions” tab of the relevant document. They are calculated automatically and subject to manual adjustment.

Let's see what contribution postings this payroll document generated.

Everything turned out as planned. We left the debit account as 26 by default, but if necessary, it can be changed in the salary settings (item “Salary accounting methods”).

Watch also a short video tutorial about payroll calculation in 1C 8.3:

Reports

All reports discussed below will be generated from the “Salaries and Personnel” menu, “Salary Reports” item.

“Analysis of contributions to funds”

This report provides a detailed and summary summary of data on the amounts of contributions by type, indicating charges. The report generation period is specified by the user.

“Taxes and fees (briefly)”

This report is very convenient for monthly generation. It is displayed by employee.

“Insurance premium accounting card”

This report is recommended by the FIU. It is very convenient for checking the accrual of contributions every year. Contribution amounts are broken down monthly.

Calculation of contributions

This paragraph will discuss how to calculate insurance premiums in 1C. According to the regulations, the accrual of contributions “Accrual of taxes (contributions) from the payroll fund” is launched monthly. This is done in two ways:

- Menu: “Salary” and then “Calculation of taxes (contributions) from the payroll.”

- Tab: “Salary” and after “Calculation of taxes (contributions) from payroll”.

The machine will automatically credit funds to all employees when you post the document, according to the specified parameters in the settings. Accounting entries are created according to Kt of subaccounts 69 and Dt of those accounts where the salaries of subordinates are reflected. Turnovers appear in the accounting registers.

Although the machine automatically calculates everything, you still have the opportunity to make adjustments. The option “Calculation of taxes (contributions) from the payroll fund” will help here, where “Calculation adjustment” is selected. Then, in “Taxes (contributions) from the payroll”, you can actively edit the amount of contributions and the list of people to whom they are charged.

The “Tax Base” tab allows you to adjust the amount of charges and the conditions for collecting deductions. You should open “Payroll taxes (contributions)” and click “Calculate”.

Recalculation of insurance premiums

There are situations when it is necessary to adjust previously accrued insurance premiums. To do this, in the 1C: Accounting program, use the document “Recalculation of insurance premiums”.

In the header of the document, fill in the accrual month and billing period. In the case where additional accrual needs to be made without affecting previous periods, set the flag in the first field (see the figure below). If changes must be made retroactively, then set the flag in the second field (if it is necessary to generate an updated RSV-1 for the previous period).

Next, click on the “Calculate” button and the data will be filled in automatically.