Deadline for payment of UTII in 2021

Transfer the calculated amount of UTII to the budget in 2021 no later than the 25th day of the first month following the expired tax period (quarter). This is provided for in paragraph 1 of Article 346.32 of the Tax Code of the Russian Federation. Therefore, the deadlines for paying UTII in 2021 are as follows:

| Tax period 2021 | Payment deadline |

| 1st quarter | No later than April 25, 2021 |

| 2nd quarter | No later than July 25, 2021 |

| 3rd quarter | No later than October 25, 2021 |

| 4th quarter | No later than January 25, 2021 |

Settlement transactions for payment of UTII

The application of the UTII regime involves the payment of estimated income, the amount of which is established by the state and does not depend in any way on the actual income received by the entrepreneur. The amount of accrued UTII is paid quarterly by the 25th day of the month following the expiring quarter.

Special regime employees of UTII are exempt from paying the main taxes that are inherent in the OSN (clause 4, Article 346.26 of the Tax Code), but no one has exempted them from paying insurance premiums for hired employees.

Correct application of the BCC allows for the correct transfer of contributions to the appropriate budgets:

Features of payment in 2021

In 2021, pay UTII according to the details of the Federal Tax Service, which has jurisdiction over the territory where the “imputed” activity is carried out. In this case, the organization must be registered by the Federal Tax Service as a payer of UTII (clause 2 of Article 346.28, clause 3 of Article 346.32 of the Tax Code of the Russian Federation). However, if there are certain types of business that these rules do not apply to, namely:

- delivery and distribution trade;

- advertising on vehicles;

- provision of services for the transportation of passengers and cargo.

For these types of businesses, organizations do not register as UTII payers at the place where they conduct their activities. Therefore, they pay UTII at the location of the head office. Also see “Insurance premiums of individual entrepreneurs for UTII in 2021: what has changed.”

Sample payment order for UTII in 2019 for individual entrepreneurs

Sample payment order for UTII for individual entrepreneurs

In field 8, the entrepreneur fills in the last name, first name, patronymic and in brackets - “Individual Entrepreneur”, as well as the registration address at the place of residence or the address at the place of residence (if there is no place of residence). Before and after the address information you must put a “//” sign.

In field 101 “Payer status” you must enter the code “09” (Appendix 5 to the order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n). With this status, the TIN or UIN must be filled in (field 22).

For current payments, “0” must be entered in the “Code” detail (field 22), for payments at the request of the inspection - a 20-digit number, if it is in the request. If there is no number in the request, the value is “0”.

Field 110 “Type of payment” does not need to be filled in in payment slips for taxes and contributions from March 28, 2021 (Instruction of the Bank of Russia dated November 6, 2015 No. 3844-U).

When paying tax before filing a return, you must enter “0” in field 109. For current payments, after submitting reports - the date of signing the declaration. When repaying arrears: without an inspection requirement - value “0”, upon request - the date of the requirement.

In field 108, the entrepreneur fills in the document number that is the basis for the payment. For current payments and debt repayment, you must enter “0”. And for payments at the request of the inspection - the requirement number. There are 10 characters in the props, they are separated by dots. The first two are the payment frequency (CP). The next two are the quarter number (01 - 04). The last four are the year for which tax is paid. When paying off the arrears, write down the payment deadline from the request.

In field 106, the entrepreneur writes the value “TP” - for current payments. If he repays the debt, he puts “ZD”, and when making payments at the request of the inspectorate – “TR”.

In field 105 you must fill in the code OKTMO. If the tax is credited to the budget of a subject or municipality, this code is 8-digit. If the tax is distributed among the settlements that are part of the municipality, 11 characters must be entered.

In field 104 you must put the budget classification code, which consists of 20 characters. For UTII this code is 182 1 0500 110 (see KBK UTII 2021 for individual entrepreneurs and legal entities).

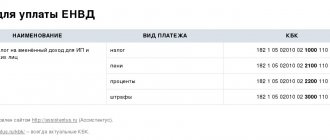

KBC for 2021

In connection with the publication of Order No. 230n of the Ministry of Finance of Russia dated December 7, 2016, some BCCs changed in 2017. So, for example, the BCC for insurance premiums has changed. See “KBK for insurance premiums in 2021: table with explanation.”

However, the budget classification codes (BCC) for UTII for 2021 have not changed. When paying “imputed” tax and related payments, use the BCC indicated in the table below:

| Payment type | KBK for UTII in 2021 |

| Imputed tax | 182 1 0500 110 |

| Penalty | 182 1 0500 110 |

| Fines | 182 1 0500 110 |

If an error is detected when specifying the code

If an error was made when indicating the classification code in the payment order for the payment of UTII, do not worry. It's pretty easy to fix.

To do this, you must submit a clarifying application to the tax office. This statement does not have a legally approved form, so it can be written in any form. A copy of the payment slip in which the error was made should be attached to this application.

If penalties are charged, there is also no need to worry. They will be canceled immediately after tax officials make a positive decision on the clarifying application.

However, it is worth noting that if an error is made not only in the classification code, but also in the recipient’s account number, then a regular clarification statement will not work. It is considered that if these details are written incorrectly, the obligation to pay taxes is not fulfilled.

In such a situation, the amount of UTII tax will need to be transferred again, as well as penalties.

Similar articles

- Changes to the KBK from April 23, 2018

- Used for fixed payments in the Pension Fund of the Russian Federation KBK

- KBC for insurance premiums for 2021

- KBK FFOMS

- Penalties for UTII: KBK in 2021

Sample payment form for UTII in 2017

The BCC for payment of UTII in the payment order must be indicated in field 104.

As for the other fields of the payment order for the payment of current UTII payments in 2021, pay attention to the following:

- in field 105 “OKTMO” - OKTMO of the municipality in which the company or entrepreneur is registered as a payer of “imputed” tax;

- in field 106 “Basis of payment” - for current “imputed” payments - “TP”;

- in field 107 “Tax period indicator” - the number of the quarter for which UTII is transferred. Let’s say “KV.01.2017”;

- in field 108 “Document number” – for current payments “0”;

- in field 109 “Date of payment basis document” - for current payments - the date of signing the UTII declaration;

- Field 22 “UIN” – is filled in if the company (IP) pays imputed tax at the request of the Federal Tax Service. Then this detail will be required by the tax authorities. Otherwise, field 22 is “0”.

- field 110 “Payment type” is not filled in.

Read also

29.11.2016

How to fill out a payment order for the payment of UTII using the Russian Federal Tax Service service

To independently fill out a payment order for the payment of UTII, it is not necessary to spend a lot of time studying its details. It is enough to know what some of them mean. The convenient service of the Federal Tax Service of Russia “Fill out a payment order” will help you cope with the rest. Below is how to use it.

1. Go to the Tax Service website (nalog.ru). Go to the section of electronic services dedicated to the payment of taxes (fees, etc.) “Pay taxes”.

2. Click on the link “Fill out a payment order”.

3. Select the type of taxpayer (i.e., your legal status): individual, legal entity or individual entrepreneur. Set the type of payment document – payment order. Click "Next".

4. Now you need to decide on the type of payment. In the KBK field, enter the code used to pay the single tax. If you do not know it, then fill in the following three fields using the drop-down lists:

- field “Tax group” – select “Taxes on total income”;

- field “Name of payment” – select “Single tax on imputed income for certain types of activities”;

- “Payment Type” group – select “Payment Amount”.

In this case, the service itself will insert the required code into the KBK field. Click "Next".

5. Indicate the details of the payee, i.e. the inspection in whose controlled territory you are carrying out the “imputed” activity. The fields “IFTS Code” and “Municipality” are required. If you have difficulties filling them out, you can indicate the address of the place of business on UTII. Then the service will automatically determine the tax code and OKTMO of the municipality and insert them into the appropriate fields. Click "Next".

6. Fill in the remaining details of the payment order:

- status of the person: “01” – if the tax is paid by an organization, and “09” – if an individual entrepreneur;

- basis of payment: “TP” when making a current tax payment;

- tax period: quarterly payments (quarter number and year);

- date of signing the declaration: in the format “DD.MM.YYYY” - if the declaration is submitted before the day of tax payment, otherwise the field must be skipped;

- order of payment: 5;

- payment amount: the amount of UTII calculated for payment.

Click "Next".

7. Indicate the payer’s details (i.e. yours):

- Name;

- TIN/KPP;

- Name of the bank;

- Bank BIC;

- bank account number.

Do not forget! Organizations enter the “imputed” checkpoint in the appropriate field.

Be careful! Don't make mistakes. The service does not check whether the above details are filled out correctly. Click "Next".

8. Click the “Generate payment order” button. Now the finished document can be opened in Word, edited and printed if necessary.

Note to IP! If an entrepreneur uses the specified service of the Federal Tax Service of Russia to fill out a payment slip for UTII, then the document will still have to be corrected. The fact is that the individual entrepreneur must enter the value “0” in the checkpoint field of the payment order. But the program does not allow you to do this.

Deadline for payment of UTII for the 4th quarter of 2021 and BCC

UTII tax for the 4th quarter of 2021 must be paid by October 25, 2021. The 25th, according to the production calendar for 2021, falls on Friday, which is a working day, which means there is no postponement of the tax payment deadline. As the New Year 2021 approaches, we recommend bookmarking two important pages in advance:

- Production calendar 2021 - contains information about working days, weekends and holidays in 2021, as well as working time standards by month and quarter; necessary for entrepreneurs, accountants, and personnel department employees.

- Tax calendar 2021 - contains deadlines for paying taxes, insurance premiums, and submitting reports for different taxation systems.

Paragraph 2 of Article 346.28 of the Tax Code of the Russian Federation states that individual entrepreneurs, as well as organizations, must pay tax according to the details of the tax inspectorate, in which they are registered as payers of “imputation”.

The BCC for payment of UTII for the 4th quarter of 2021 is as follows: 182 1 0500 110.