By introducing online cash registers into all areas of business, the state seeks to achieve several goals. One of them is the optimization of the number of inspections by tax authorities of representatives of small and medium-sized businesses, accompanied by an increase in the efficiency of activity control. For this purpose, Federal Law No. 54, or the “Law on Online Cash Registers,” was introduced. It obliges business representatives to use the equipment specified in the title.

- Checking the online cash register: legal grounds

- What exactly does the tax inspector check?

- Powers of a tax inspector

- Entrepreneurs' rights

- How is the online cash register checked?

- Grand total

Such devices require monitoring of the performance and correctness of the information provided. The correctness of the generated reports, the compliance of the technical parameters of the cash register (cash register) with established standards, as well as the timely transmission of data to the Federal Tax Service depend on how the tax service checks online cash registers.

Checking the online cash register: legal grounds

The tax inspectorate, like any public service, operates in accordance with the law. Control of the operation of online cash registers by tax inspectors is carried out on the basis of the following documents:

- Order of the Ministry of Finance No. 132n dated October 17, 2011 - defines the regulations for the stages of equipment inspection;

- Law No. 943-1 of March 21, 1991 - limits the powers of tax representatives;

- Federal Law No. 294-FZ of December 26, 2008 - presents a list of rights of business representatives when conducting an inspection of online cash registers.

Control technologies differ in type and form. In appearance they are planned and unscheduled, in form - documentary and on-site. Documentary verification involves identifying compliance of company documentation with established standards. At the same time, representatives of the Federal Tax Service do not visit the company directly, but request documents according to the list. An on-site inspection is an inspector visiting the company’s office.

Expert opinion

Irina Smirnova

Online checkout expert

Ask a Question

Unscheduled inspections are usually carried out based on complaints received from customers. The planned audit is carried out in accordance with the official priority list of enterprises. To do this, the company must be included in the register of scheduled inspections. Most often, such lists are compiled a year in advance.

How often is the check carried out?

The number and frequency of control activities are not limited. That is, the check can be performed on any date. The corresponding instruction is in the Letter of the Federal Tax Service No. AS-4-2/15195 dated September 12, 2012. The average inspection frequency is once a year. The action plan is formed by the Federal Tax Service. If a company is not included in this plan, it may still face inspectors. However, activities not included in the plan are carried out only if there are complaints against the company. Let's consider the reasons for an unscheduled inspection:

- The previously issued order to eliminate violations has expired.

- Complaints came. For example, they may concern the fact that when the buyer purchased a product, he was not given a receipt.

- Complaints about the payment of “black” salaries.

The basis for verification may be losses. Sudden losses in large volumes may raise suspicions that the company is hiding from taxes.

What exactly does the tax inspector check?

Representatives of the tax service monitor the activities of commercial organizations in two areas: they identify compliance of the online cash registers used with the requirements of Federal Law No. 54-FZ and check compliance with the rules for using the equipment. The following indicators are subject to verification:

- accounting of transactions carried out using cash registers;

- technical compliance of the online cash register with current legislation;

- compliance with the rules for working with OFD;

- compliance with the rules for issuing checks.

These are the main topics; they interest the inspection service only superficially. A deeper inspection begins when violations are discovered.

Expert opinion

Kirill

Cashier specialist

Ask a Question

Remote control of the online cash register via the Internet is possible. To do this, the responsible representative of the Federal Tax Service analyzes documents received from the fiscal data operator (FDO). In this way, many suspicious facts from the life of the organization are revealed, and periods of non-use of online equipment are also taken into account.

What they check

The responsibilities of the inspectors include monitoring:

- correct use of cash registers (online cash registers) and compliance with the standards No. 54-FZ;

- procedure for recording revenue.

The procedure for transmitting information when making payments through the online cash register:

- The buyer pays for the goods in cash or by credit card, and the cashier generates a receipt.

- The cash desk submits the generated check online to the OFD (fiscal data operator), which confirms to the cash desk that the check has been registered.

- The cash register prints the receipt, and the seller hands it to the buyer in paper form, SMS, or electronically by email. mail.

- OFD sends the check to the Federal Tax Service website. The buyer can check the received receipt at any time on this website.

During the inspection process, Federal Tax Service inspectors pay attention to the following:

- Do sellers issue checks, strict reporting forms (SSR) and other documents to buyers to confirm the fact of payment for the purchase?

- Are checks filled out correctly?

- Are the data transmitted in full and within the required time frame to the Federal Tax Service?

- Does the CCP comply with the requirements of current legislation?

- Are cash transactions fully taken into account?

The list of questions during the inspection may be expanded if violations are identified.

Powers of a tax inspector

When conducting an audit, the tax authorities must provide the responsible representative of the company with a correctly completed decision to conduct an audit. The document contains a list of issues to be studied.

As part of the inspection, inspectors have the right to:

- provide unhindered access to cash register equipment (CCT);

- study the fiscal data storage;

- check cash documents;

- receive clarifications, reference information and other information related to the operation of the cash register;

- conduct test purchases to check the cashier’s ability to operate equipment;

- involve law enforcement officers in the inspection;

- check contracts with OFD;

- check the correctness of execution and issuance of documents by the online cash register;

- raise the issue of bringing enterprise employees to administrative and criminal liability.

Expert opinion

Irina Smirnova

Online checkout expert

Ask a Question

The management and staff of the company do not have the right to interfere with the inspectors. The best solution during the inspection will be to listen carefully to the representative of the Federal Tax Service and eliminate the shortcomings as quickly as possible. In this case, all procedures will end not only easily, but also without negative consequences.

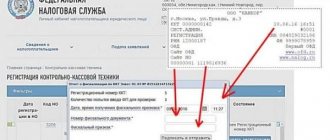

What cash register models can be registered in your personal account?

In your personal account, you can only register new cash register models that transmit data to the Federal Tax Service through the OFD. Old cash register models will not be displayed in your personal account. In your personal account, the date of registration of the cash register, the address of the installation location of the model, the registration number, the model of the cash register, the expiration date of the FN, the name of the official document, and the current status of the cash register are displayed in the form of a table. All cash registers can be seen in the corresponding section. The register of cash registers is updated - new models are added there. For example, on February 19, 2019, an order was issued to include the ATOL 27F and ATOL 50F models in the CCP register. These cash registers can be used in any area without restrictions.

Also, as of January 1, 2021, FFD 1.0 became invalid and was replaced by formats 1.05 and 1.1. Four cash desks from the cash register register support FFD 1.0: “MICRO 35G-F”, “Mercury-MF”, “ars.mobile F” and “ars.vera 01F”. “MICRO 35G-F” and “ars.mobile F”, according to the manufacturers, will support format 1.05 after passing the examination. After the changes, users of “MICRO 35G-F” and “ars.mobile F” need to switch to the new format without changing the fiscal drive. “Mercury-MF” and “ars.vera 01F” are proposed to be replaced with other cash registers with support for FFD 1.05.

How is the online cash register checked?

At the beginning of the audit, the tax inspector conducts two anonymous test purchases: for cash and by bank transfer. In addition, it generates two checks: paper and electronic.

Next, it launches the Federal Tax Service mobile application and checks the received documentation for correctness. Thanks to this, the inspector can quickly verify the financial integrity of the company. If an authorized employee of the Federal Tax Service wants to check the work and qualifications of the cashier, he may ask to issue a refund.

When checking the use of an online cash register, the design of the equipment is carefully studied. They check the presence of the model in the state register, check the presence of seals, the overall integrity of the device, and compliance with technical requirements. Then they check the revenue recorded by the cash register.

Next, the documentation is checked. If tax representatives are on the premises of the company, they confiscate the original documents. If the procedure is carried out at a local branch of the Federal Tax Service, it would be better to provide copies of papers for control.

The following are subject to verification:

- strict reporting forms and checks;

- daily reports;

- invoices;

- cash book.

The inspector may even make a complaint about the quality of document printing. Blurred letters, unclear font, and unnecessary elements on a receipt can confuse not only the tax authorities, but also the company’s clients. Therefore, it is strongly recommended to monitor the condition of the printer, refill cartridges in a timely manner, and carry out maintenance of printing equipment. Paper and electronic checks are checked for the presence of details established by the standards.

These include:

- Business name;

- shift check number;

- Full name of the cashier;

- details of the product or service (name, quantity, cost);

- VAT rate and amount;

- payment method;

- cost of goods with costs and allowances, including discounts and promotions;

- QR code containing information about the document;

- FN serial number;

- CCP number issued upon registration with the Federal Tax Service;

- TIN of the enterprise;

- company tax form;

- address of the retail outlet where the sale was made;

- date and time of the operation;

- shift number;

- fiscal factor and check serial number.

All details must be located strictly in the places designated for them, clearly visible, without any defects or inaccuracies. Otherwise, the inspector has the right to reject the document and fine the company.

If the inspector is going to pick up any documents, this must be done strictly according to the inventory, signed by both parties. At the end of the inspection, an authorized employee of the Federal Tax Service prepares a report in two copies.

Expert opinion

Irina Smirnova

Online checkout expert

Ask a Question

The document contains a list of violations and penalties imposed, facts of disagreement of representatives of the company that was subject to inspection. One copy is sent to the tax office, and the other remains at the disposal of the company. The results of the inspection can be disputed within 10 days from the date of completion.

Checking CCP step by step

Let's consider all stages of the control event:

- Decision of the head of the tax office. A control event is carried out only if there is an appropriate decision from an authorized person.

- Receipt and review of papers. The list of documents that may be requested is set out in paragraphs 29 and 34 of the Regulations. Among these papers one can note the cashier's journal, acts of refund to consumers, and control tapes. These are PKO, registers of documents on cash registers, cash book, reports on advances. Tax representatives can request BSO, BSO acceptance certificates, and write-off certificates. In addition, these are books of income and expenses, paper on determining the cash register limit. The registration card, technical support agreement, and cash register passport are checked. If the organization uses cash receipts, then accompanying documents are requested. Is the list set out in the Regulations exhaustive? No. Specialists may require additional documents. However, they must be relevant to the subject of the audit.

- Examination. Business transactions and money stored in the cash register are checked, inspections and inventories are carried out.

- Registration of inspection results. Based on the results of the control event, a report is drawn up. It records the detected violations or their absence. If violations are found, an administrative violation case is initiated.

When carrying out an audit, tax representatives must adhere to established deadlines. To check the CTT, 5 working days are provided from the date of receipt of the decision from the head of the inspection. If control is carried out over the completeness of revenue accounting, the period is 20 days.

Features of checking the use of cash registers

Checking the use of cash registers involves these actions:

- Verification of receipts and supporting papers. To achieve the set goals, a test purchase is usually carried out. The purchased goods are paid for either in cash or by card. The purchase is needed to verify the issuance of checks. This event must be carried out within a certain time frame. In particular, this is 1 business day. The procedure is regulated by Article 16.1 of Federal Law No. 294 “On the Protection of the Rights of Legal Entities and Individual Entrepreneurs” dated December 26, 2008.

- Studying documents for CTT. Documents are requested after the purchase.

- Monitoring compliance with the rules for using cash registers. The compliance of CTT and checks with existing rules is confirmed.

Documents must be provided on the first working day from the date of initiation of the control event. These can be either copies or originals. If a company does not provide documents within the established time frame, it is held liable for obstructing the work of officials.

IMPORTANT! Tax representatives do not have the right to ask for notarization of copies of papers.

Registration of inspection results

Based on the results of the control event, a report is drawn up. It is compiled in two copies. The act contains information:

- Date of.

- Name of the inspection company, tax identification number, checkpoint, address.

- Full name of the inspectors.

- List of documents that were seized during the event.

- Start and end dates of the review.

- Record of identified violations. It is necessary to make reference to those provisions of the laws that were violated.

The document is signed by representatives of the tax office, as well as by the user of the cash register. The latter may indicate his comments in the act or in a document attached to it.

Communication with the Federal Tax Service through your personal account

In your personal account, you can send a request to the Federal Tax Service about your own violation. This is beneficial because the entrepreneur will not be fined if he admits to the violation through his personal account within three days and eliminates it. To contact the tax authority, there is a “My Mail” section in your personal account, from where you can send a letter.

If a client contacts the Federal Tax Service with a complaint against an entrepreneur, the tax office may request additional information from the entrepreneur through his personal account. The entrepreneur will be able to quickly respond to the request and admit or dispute the accusation.