Procedure for accounting for expenses for income tax purposes

There is a rule in tax legislation: for those who use the accrual method, expenses for income tax purposes are recognized in the reporting (tax) period to which they relate (clause 1 of Article 272 of the Tax Code of the Russian Federation). At the same time, for a number of expenses the specific moment of their recognition is determined. For example, for expenses for payment to third-party organizations for work performed (services provided), the date of recognition of such expenses is the date of settlement in accordance with the terms of concluded contracts or the date of presentation to the taxpayer of documents serving as the basis for making calculations, or the last date of the reporting (tax) period ( subparagraph 3, paragraph 7, article 272 of the Tax Code of the Russian Federation).

Please note that the provisions of Chapter 25 of the Tax Code of the Russian Federation do not provide for the possibility of arbitrarily choosing the tax period in which these expenses should be reflected. Currently, only for VAT the right of the taxpayer to transfer tax amounts for deduction to future periods within three years is legislated (clause 1.1 of Article 172 of the Tax Code of the Russian Federation).

It turns out that taxpayers are not given the right to take into account expenses in the period in which they wish?

Commentary on Article 272 of the Tax Code of the Russian Federation

Expenses using the accrual method are recognized in the reporting (tax) period to which they relate. It does not matter whether these expenses are paid or not. This is stated in Art. 272 of the Tax Code of the Russian Federation.

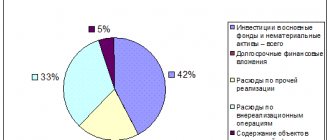

All expenses of the organization are divided into two groups:

— costs associated with production and sales (hereinafter referred to as production costs);

- non-operating expenses.

According to paragraph 2 of Art. 272 of the Tax Code of the Russian Federation, an organization recognizes material expenses when:

— raw materials and supplies related to the goods produced (work, services) are transferred to production;

— an act of acceptance and transfer of production works (services) has been signed.

Depreciation is recognized as an expense on a monthly basis. As for a lump sum of 10 percent of the cost of a new fixed asset, as well as 10 percent of expenses for completion, retrofitting, modernization, technical re-equipment and partial liquidation of fixed assets, they are recognized as an expense on the date of depreciation start (the date of change in the original cost).

Expenses for compulsory and voluntary insurance (non-state pension provision) are recognized in the quarter in which they were paid. At the same time, one-time payments under insurance (pension) contracts that are concluded for a period of more than one year are included in expenses evenly over the term of the contract. In this case, such insurance premiums are written off as expenses in proportion to the number of calendar days during which the insurance contract was valid in the reporting period.

Expenses for the acquisition of the leased asset are written off in those reporting periods in which the agreement provides for leasing payments, in proportion to these payments.

As for other production and non-operating expenses, they should be recognized in the manner established by clause 7 of Art. 272 of the Tax Code of the Russian Federation. The date of these expenses may be, for example:

- for amounts of taxes and fees - the day on which they are accrued;

- for expenses in the form of rental (leasing) payments for rented (leasing) property - the day of settlement or the day when the organization is presented with settlement documents;

- for business trip expenses - the day when the advance report of the posted employee is approved;

— for expenses in the form of interest on loans and borrowings — the day interest is calculated.

For credit and loan agreements concluded for a period of more than one quarter (six months, 9 months or a year), interest for tax purposes is included in expenses at the end of the corresponding reporting period. If, according to the agreement, the borrower pays before the specified period, then - on the date of termination of the agreement (repayment of the debt obligation).

Expenses for the acquisition of the leased asset are written off in those reporting periods in which the agreement provides for leasing payments, in proportion to these payments.

According to paragraph 9 of Art. 271 of the Tax Code of the Russian Federation, income using the accrual method is determined taking into account amount differences. Amount differences arise in cases where payment is made in rubles in an amount equivalent to the amount in foreign currency (conventional monetary units).

But what about Article 54 of the Tax Code of the Russian Federation?

At the same time, there is Article 54 of the Tax Code of the Russian Federation, which is applied in a situation where a company made an error/distortion in calculating the tax base, and this error relates to the previous period. It is this item, according to some accountants, that allows you to “play” with expenses beyond one calendar year. Is this really true?

Based on this article, as a general rule, if an error is discovered, it is necessary to recalculate the tax base and, accordingly, the tax itself in the period in which the error was made (clause 1 of Article 54 of the Tax Code of the Russian Federation). It was admitted, not revealed.

However, there are exceptions to this rule (paragraph 3, paragraph 1, article 54 of the Tax Code of the Russian Federation). In two cases, it is allowed to make adjustments in the current period (during the period when errors/distortions are identified), which will allow you to avoid having to draw up an updated declaration:

- when it is impossible to understand which period the error/distortion belongs to;

- when an error/distortion resulted in excessive payment of tax.

We are interested in the second case – when, due to an error, the organization overpaid the tax. Therefore, if we assume that the “non-accounting” of any expenses last year was caused by an error and because of this “error” the company overpaid the tax, then it can take these expenses into account in the current period.

Thus, the norm seems to be working and, indeed, at first glance, allows companies to take into account expenses whenever they wish (taking into account a three-year period). However, as practice shows, not everything is so smooth. Companies in such situations may face difficulties during tax audits.

Tax authorities are against arbitrarily choosing a period to reflect expenses

Situations where taxpayers arbitrarily choose a tax period to reflect certain expenses are, in practice, perceived negatively by auditors. They see this as not an error/distortion that can be corrected according to the rules of paragraph 1 of Art. 54 of the Tax Code of the Russian Federation, but an intentional action, the purpose of which is to prevent the occurrence of a tax loss. And, as a result, “late” amounts are completely excluded from tax expenses.

They argue their position by the fact that tax legislation does not provide for the possibility of arbitrarily choosing the tax period in which these expenses should be reflected.

The most risky situation is when the period to which the expenses relate does not fall within the three-year tax audit period. In this case, tax authorities may conclude that they do not have the opportunity to verify the fact of excessive tax payment due to an error/distortion.

Also, you should not shift expenses over a long period. It is necessary to ensure that by the time the error is corrected (accounting for “late” expenses), the established art. 78 of the Tax Code of the Russian Federation is a three-year period for the return (offset) of overpayments, taking into account that only during the specified period companies have the right to dispose of the corresponding amount of tax overpaid to the budget.

Article 272. Procedure for recognizing expenses using the accrual method

Article 272. Procedure for recognizing expenses using the accrual method

[Tax Code] [Tax Code of the Russian Federation, Part 2] [Section VIII] [Chapter 25]

. Expenses accepted for tax purposes taking into account the provisions of this chapter are recognized as such in the reporting (tax) period to which they relate, regardless of the time of actual payment of funds and (or) other form of payment, unless otherwise provided in paragraph 1.1 of this articles, and are determined taking into account the provisions of Articles 318 - 320 of this Code.

Expenses are recognized in the reporting (tax) period in which these expenses arise based on the terms of the transactions. If the transaction does not contain such conditions and the relationship between income and expenses cannot be clearly defined or is determined indirectly, the expenses are distributed by the taxpayer independently.

If the terms of the agreement provide for the receipt of income over more than one reporting period and do not provide for the stage-by-stage delivery of goods (work, services), expenses are distributed by the taxpayer independently, taking into account the principle of uniform recognition of income and expenses.

The taxpayer's expenses, which cannot be directly attributed to the costs of a specific type of activity, are distributed in proportion to the share of the corresponding income in the total volume of all income of the taxpayer.

1.1. The taxpayer recognizes expenses from carrying out activities related to the production of hydrocarbons at a new offshore hydrocarbon field in the tax (reporting) period to which they relate, regardless of the time of actual payment of funds and (or) other form of payment, but not earlier than the date of allocation of a new offshore hydrocarbon deposit on a subsoil plot or in the cases provided for in paragraph 8 of Article 261 of this Code, the date of the taxpayer’s decision to complete work on the development of natural resources or part thereof on a specified subsoil plot or to completely stop work on a subsoil plot in due to economic inexpediency, geological futility or other reasons.

If more than one new offshore hydrocarbon deposit is allocated on a subsoil plot, the amount of expenses up to the date of allocation of new offshore hydrocarbon deposits on a subsoil plot related to activities related to the production of hydrocarbon raw materials at a new offshore hydrocarbon deposit carried out at each new offshore hydrocarbon deposit this subsoil plot is determined taking into account the provisions of paragraph 4 of Article 299.4 of this Code.

The expenses specified in this paragraph, expressed in foreign currency, for tax purposes are recalculated into rubles at the official rate established by the Central Bank of the Russian Federation on the dates corresponding to the dates of recognition of similar types of expenses in accordance with paragraphs 2 - 8.1 of this article, without taking into account the provisions of paragraph one of this paragraph, as well as the provisions of paragraphs 7 and 8 of Article 261 of this Code.

. The date of material expenses is recognized as follows:

- date of transfer of raw materials and materials into production - in terms of raw materials and materials attributable to the goods (work, services) produced;

- date of signing by the taxpayer of the certificate of acceptance and transfer of services (works) - for services (works) of a production nature.

. Depreciation is recognized as an expense on a monthly basis based on the amount of accrued depreciation, calculated in accordance with the procedure established by Articles 259, 259.1, 259.2, 322 of this Code.

Expenses in the form of capital investments provided for in paragraph 9 of Article 258 of this Code are recognized as indirect expenses of the reporting (tax) period on which, in accordance with this chapter, the start date of depreciation (date of change in the original cost) of fixed assets in respect of which capital investments have been made.

. Labor costs are recognized as an expense on a monthly basis based on the amount of labor costs accrued in accordance with Article 255 of this Code.

. Expenses for the repair of fixed assets are recognized as an expense in the reporting period in which they were incurred, regardless of their payment, taking into account the specifics provided for in Article 260 of this Code.

5.1. Standardization expenses incurred by the taxpayer independently or jointly with other organizations (in an amount corresponding to its share of expenses) are recognized for tax purposes in the reporting (tax) period following the reporting (tax) period in which the standards were approved as national standards national body of the Russian Federation for standardization or registered as regional standards in the Federal Information Fund of Technical Regulations and Standards in the manner established by the legislation of the Russian Federation on technical regulation.

. Expenses for compulsory and voluntary insurance (non-state pension provision) are recognized as an expense in the reporting (tax) period in which, in accordance with the terms of the agreement, the taxpayer transferred (issued from the cash register) funds to pay insurance (pension) contributions. If the terms of an insurance contract (non-state pension provision) provide for the payment of an insurance (pension) contribution in a one-time payment, then under contracts concluded for more than one reporting period, expenses are recognized evenly over the term of the contract in proportion to the number of calendar days of the contract in the reporting period. If the terms of the insurance contract (non-state pension provision) provide for payment of the insurance premium (pension contribution) in installments, then under contracts concluded for more than one reporting period, expenses for each payment are recognized evenly over the period corresponding to the period for payment of contributions (year, half-year, quarter, month), in proportion to the number of calendar days of the agreement in the reporting period.

. The date of non-operating and other expenses is recognized, unless otherwise established by Articles 261, 262, 266, 267 of this Code:

- 1) date of accrual of taxes (fees, insurance premiums) - for expenses in the form of amounts of taxes (advance payments for taxes), fees, insurance premiums and other obligatory payments;

- 2) the date of accrual in accordance with the requirements of this chapter - for expenses in the form of amounts of contributions to reserves recognized as expenses in accordance with this chapter;

- 3) the date of settlements in accordance with the terms of concluded agreements or the date of presentation to the taxpayer of documents serving as the basis for making settlements, or the last date of the reporting (tax) period - for expenses:

- in the form of commission fees;

- in the form of expenses for payment to third parties for work performed (services provided);

- in the form of rental (leasing) payments for rented (leased) property;

- in the form of other similar expenses;

- in the form of amounts of paid allowances;

- in the form of compensation for the use of personal cars and motorcycles for business trips;

- in the form of interest accrued on the amount of claims of the bankruptcy creditor in accordance with the legislation on insolvency (bankruptcy);

- on business trips;

- for the maintenance of official transport;

- for entertainment expenses;

- for other similar expenses;

the date of recognition by the debtor or the date of entry into legal force of the court decision - for expenses in the form of amounts of fines, penalties and (or) other sanctions for violation of contractual or debt obligations, as well as in the form of amounts of compensation for losses (damage);

the date of recognition by the debtor or the date of entry into legal force of the court decision - for expenses in the form of amounts of fines, penalties and (or) other sanctions for violation of contractual or debt obligations, as well as in the form of amounts of compensation for losses (damage);. Under loan agreements or other similar agreements (including debt obligations issued by securities), the validity of which falls on more than one reporting (tax) period, for the purposes of this chapter, the expense is recognized as incurred and is included in the relevant expenses at the end of each month of the corresponding reporting month. (tax) period, regardless of the date (terms) of such payments provided for by the agreement, with the exception of the expenses specified in subparagraph 12 of paragraph 7 of this article.

If a loan agreement or other similar agreement (including debt obligations issued by securities) stipulates that the fulfillment of an obligation under such an agreement depends on the value (or other value) of the underlying asset with the accrual of a fixed interest rate during the validity period of the agreement, expenses accrued based on this fixed rate, are recognized on the last day of each month of the corresponding reporting (tax) period, and expenses actually incurred based on the current value (or other value) of the underlying asset are recognized on the date of fulfillment of the obligation under this agreement.

In the event of termination of the agreement (repayment of the debt obligation) during a calendar month, the expense is recognized as incurred and is included in the corresponding expenses on the date of termination of the agreement (repayment of the debt obligation).

The provisions of this paragraph do not apply to expenses in the form of interest accrued on the amount of claims of the bankruptcy creditor in accordance with the legislation on insolvency (bankruptcy).

8.1. Expenses for the acquisition of leased property specified in subparagraph 10 of paragraph 1 of Article 264 of this Code are recognized as an expense in those reporting (tax) periods in which, in accordance with the terms of the agreement, rental (leasing) payments are provided. In this case, these expenses are taken into account in an amount proportional to the amount of rental (leasing) payments.

. Lost power. — Federal Law of April 20, 2014 N 81-FZ.

. Expenses expressed in foreign currency are recalculated for tax purposes into rubles at the official rate established by the Central Bank of the Russian Federation on the date of recognition of the relevant expense, unless otherwise established by this paragraph.

Claims (obligations), the value of which is expressed in foreign currency, property in the form of currency values are converted into rubles at the official rate established by the Central Bank of the Russian Federation on the date of transfer of ownership of the specified property, termination (fulfillment) of claims (obligations) and (or) on the last day of the current month, depending on what happened earlier.

If, when recalculating the value of claims (obligations) expressed in foreign currency (conventional monetary units) payable in rubles, a different foreign exchange rate is applied, established by law or by agreement of the parties, the recalculation of expenses, claims (obligations) in accordance with this paragraph is carried out according to this course.

In the case of transfer of an advance or deposit, expenses expressed in foreign currency are converted into rubles at the official rate established by the Central Bank of the Russian Federation on the date of transfer of the advance or deposit (in the part attributable to the advance or deposit).

Claims, the value of which is expressed in foreign currency, under a loan agreement to finance a foreign geological exploration project (including arrears on accrued interest) are converted into rubles at the official rate established by the Central Bank of the Russian Federation on the date of the decision on the foreign geological exploration project, determined in the manner established by paragraph 6 of Article 271 of this Code.

Expenses in the form of negative exchange rate differences arising as a result of recalculation of claims under a loan agreement to finance a foreign geological exploration project on the date of the decision on the foreign geological exploration project are recognized as part of non-operating expenses in one of the following ways:

- in the event of termination of obligations under a loan agreement to finance a foreign geological exploration project in full without satisfying the property claims of the taxpayer in connection with the completion of work on the specified foreign geological exploration project and recognition of such a project as economically inexpedient and (or) geologically unpromising, they are not taken into account for the purposes of taxation;

- in the event that a loan agreement for financing a foreign geological exploration project does not comply with any of the conditions specified in paragraph 11 of Article 261 of this Code, they are taken into account in full on the date when such a condition was violated;

- in other cases, they are taken into account evenly over two years, starting from the month following the month in which the decision was made on a foreign geological exploration project.

Starting from the day following the date of the decision on a foreign geological exploration project, the recalculation of claims, the value of which is expressed in foreign currency, under the corresponding loan agreement for financing a foreign geological exploration project into rubles is carried out in the general manner established by paragraphs one through four of this point.